Does Car Insurance Cost More for Financed Cars: 3 Crucial

Understanding the Real Cost of Insuring a Financed Vehicle

Does car insurance cost more for financed cars? Yes, it typically does. The reason isn’t that insurers charge higher rates for financed vehicles, but that lenders require more comprehensive coverage to protect their financial interest in the car.

Quick Answer:

- Financing itself doesn’t increase your insurance rate.

- Lenders require “full coverage” (collision and comprehensive).

- Full coverage can cost $600-$1,000+ more per year than liability-only.

- GAP insurance can add another $30-$66 per month if required.

- You can adjust coverage after paying off the loan.

When buying a new car, insurance costs are often an afterthought. Understanding how financing affects your insurance can prevent sticker shock and help you budget accurately. While drivers who own their cars can opt for state-minimum liability coverage, financed car owners must maintain collision and comprehensive coverage for the loan’s duration. This protection is a non-negotiable part of your loan agreement.

I’m Geoff Stanton, President of Stanton Insurance Agency. With over two decades as a Certified Insurance Counselor, I’ve helped many Massachusetts and New Hampshire residents understand why car insurance costs more for financed cars and how to manage these necessary costs. My goal is to help you make informed decisions.

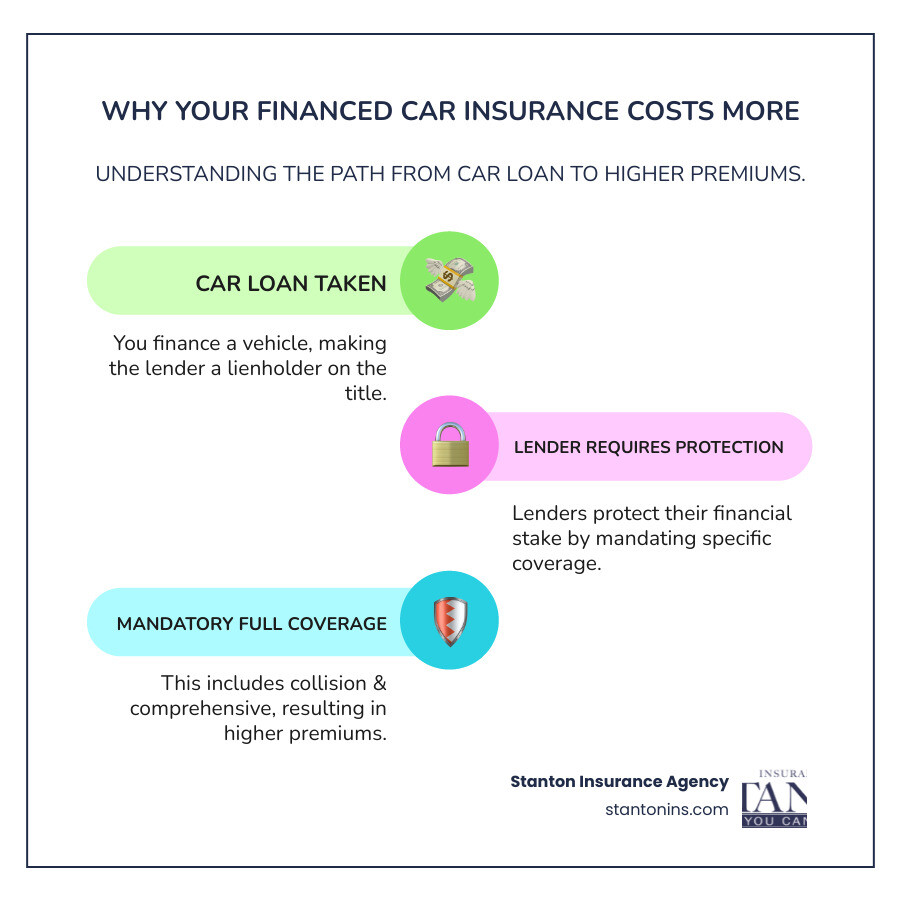

Why Does Car Insurance Cost More for Financed Cars?

Many car buyers are surprised to learn that insurance companies don’t charge more just because you have a loan. The real reason car insurance costs more for financed cars is about protecting the lender’s investment. Until you make that final payment, the bank or credit union is the lienholder on your car’s title. They have invested thousands in your vehicle and need to ensure that investment is protected.

If you only carried basic liability car insurance coverage, it would pay for damages to others but wouldn’t cover your own car. If your financed car were stolen or totaled, you’d still owe the loan amount on a vehicle you couldn’t drive. To prevent this, lenders require you to carry “full coverage” insurance, which is where the higher costs originate.

The Lienholder’s Role and Requirements

A “lienholder” is the financial institution that loaned you money for your car. They are listed on your insurance policy as a “loss payee,” which gives them certain rights over how the vehicle is insured.

They require specific coverage. For the entire loan, you must maintain both collision and comprehensive insurance. This isn’t optional; your loan agreement mandates it to ensure the car can be repaired or replaced. Financial experts agree that this requirement to carry full coverage is the primary way an auto loan impacts your insurance rate.

Your insurer must keep them informed. If you cancel your policy or reduce coverage below the required limits, your insurer is legally obligated to notify the lienholder.

They get paid first in a total loss. If your car is totaled, the insurance settlement check will be made out to both you and the lienholder. This ensures the loan is paid off before you receive any remaining money.

Before driving off the lot, you’ll need to provide proof of insurance that lists the lender as a loss payee. Always tell your agent you have a lienholder to ensure you get the right coverage and documentation from the start.

What Happens if You Don’t Comply?

Letting your required insurance lapse has serious consequences. Your lender will be notified and will likely give you a short window to reinstate coverage. If you don’t, they will purchase “force-placed insurance” on your behalf.

Force-placed insurance is extremely expensive, protects only the lender’s interest, and the cost is added to your loan payment. If your car is damaged, the payout goes straight to the bank, leaving you with a damaged vehicle and a larger loan. In the worst-case scenario, failing to maintain proper insurance can lead to repossession.

Maintaining the required insurance is a legal obligation that protects both you and your lender. Understanding this helps you budget appropriately and avoid costly mistakes.

Understanding “Full Coverage” and Its Costs

“Full coverage” isn’t an official policy type but shorthand for a combination of coverages that protect you and your lender. When you finance a car, this is the level of protection your lender will require, which is a major reason why car insurance costs more for financed cars.

Here’s what you’re paying for:

Liability insurance is required by law in Massachusetts and New Hampshire. It protects other people if you cause an accident, paying for their medical bills and property damage. It does not cover your own vehicle. For more details, you can explore how liability car insurance works and learn about car insurance liability.

Collision coverage repairs or replaces your car if it hits another vehicle or object, like a guardrail or pole, regardless of who was at fault.

Comprehensive coverage handles non-collision events. This includes theft, vandalism, fire, falling objects, and weather damage like hail. It’s sometimes called “other than collision” coverage.

Adding collision and comprehensive to your policy can increase your annual premium by $600 to $1,000 or more, depending on your vehicle, location, and deductibles. This is a significant jump from a liability-only policy, but it’s required when you have a loan.

What is GAP Insurance and Why is it Important?

GAP (Guaranteed Asset Protection) insurance is another important coverage for financed vehicles. New cars depreciate quickly—sometimes losing 20% of their value in the first year. If your car is totaled, your collision or comprehensive coverage pays its current market value, which might be less than what you still owe on your loan.

This difference is the “gap.” Without GAP insurance, you are responsible for paying it, meaning you could be making payments on a car that no longer exists.

Many lenders require GAP insurance, especially with a small down payment or long loan term. It typically adds $30 to $66 per month to your costs but provides crucial peace of mind. If your financed car is totaled or stolen, GAP insurance ensures you can walk away from the loan without owing thousands of dollars.

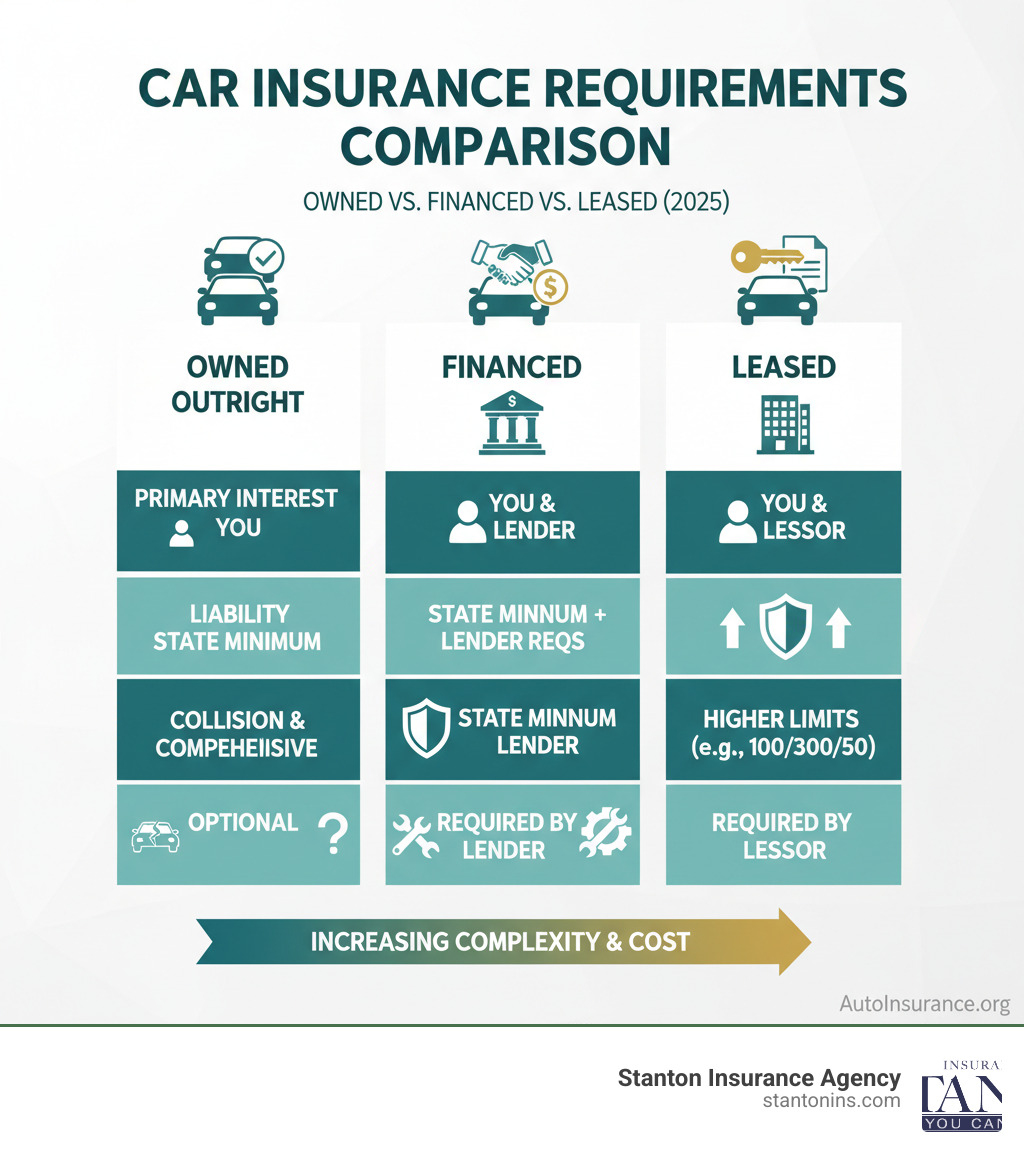

Financed vs. Leased vs. Owned: A Car Insurance Comparison

How you acquire your vehicle—financing, leasing, or buying it outright—directly impacts your insurance requirements and costs. This comparison helps clarify why car insurance costs more for financed cars compared to other methods.

| Feature | Owned Outright | Financed | Leased |

|---|---|---|---|

| Primary Interest | You | You & the Lienholder | You & the Leasing Co. |

| Liability Coverage | State Minimum Required | State Minimum Required | Higher Limits Often Required (e.g., 100/300/50) |

| Collision Coverage | Optional | Required by Lender | Required by Lessor |

| Comprehensive | Optional | Required by Lender | Required by Lessor |

| GAP Insurance | Not Needed | Often Required/Recommended | Almost Always Required |

| Typical Cost | Lowest | Higher | Highest |

When you own your car outright, you have full control. As long as you meet the state-required liability minimums for Massachusetts or New Hampshire, you can skip collision and comprehensive coverage to save money. This freedom typically leads to the lowest auto insurance costs.

With a financed car, you share control with your lender. They require full coverage (collision and comprehensive) to protect their investment, which significantly increases your premium compared to a liability-only policy.

Leased vehicles usually have the strictest requirements and are the most expensive to insure. The leasing company, which owns the car, often mandates higher liability limits (e.g., $100,000/$300,000/$50,000) well above state minimums. Full coverage and GAP insurance are almost always required.

The cost difference can be substantial. A liability-only policy on an owned car might cost $800 a year, while full coverage for a financed car could be $1,600 or more. A leased vehicle with higher limits could push the premium even higher. Understanding these differences helps you budget accurately when deciding how to acquire your next vehicle.

How to Lower Your Car Insurance Premiums on a Financed Vehicle

Even with the requirement to carry full coverage, you can still find ways to reduce your car insurance costs on a financed vehicle.

Shop around. This is the most effective way to save. Rates for identical coverage can vary by hundreds of dollars between insurers in Massachusetts and New Hampshire. Get quotes from multiple providers to find the best value.

Increase your deductible. Your deductible is what you pay out-of-pocket on a claim. Raising it from $500 to $1,000 can lower your premium. First, confirm your lender allows it and that you can comfortably afford the higher amount if you need to file a claim.

Bundle your policies. Insurers offer significant discounts (10-25% or more) when you bundle your auto insurance with your home, renters, or condo insurance.

Ask about all available discounts. Proactively inquire about discounts for being a good student, having a safe driving record, anti-theft devices, paying your premium in full, or completing a defensive driving course.

Protect your driving record. A clean driving record without accidents or violations is crucial for keeping rates low and qualifying for good driver discounts.

Choose your vehicle wisely. Before you buy, get an insurance quote. Cars that are expensive to repair, targeted by thieves, or have high-performance engines cost more to insure.

Look into telematics programs. Many insurers offer usage-based programs that monitor your driving via a mobile app. Safe driving habits can earn you discounts of up to 30% or more.

For more ideas, explore options for low cost liability car insurance and see how providers of cheap liability auto insurance might also offer competitive rates for the full coverage you need.

While car insurance does cost more for financed cars, you don’t have to overpay. A little effort can help you find quality coverage that fits your budget.

The Light at the End of the Loan: Insurance After You Pay Off Your Car

Making your final car payment is a milestone. You’ve paid off the loan, the lienholder is removed from your title, and you now own the car outright. This gives you complete control over your car insurance policy and the opportunity to lower your premiums.

You are no longer bound by your lender’s requirement to carry collision and comprehensive coverage. But before you drop them to save money, you should carefully consider your situation.

Start by asking yourself two questions:

-

What is the car’s current value? If your car has depreciated significantly, full coverage might not be cost-effective. A helpful guideline is the “10 times rule”: if your car’s value is less than 10 times the annual premium for physical damage coverage, consider dropping it. For example, paying $1,000 per year to cover a car worth $5,000 may not be a wise financial decision.

-

Could you afford to repair or replace it? If your car were totaled tomorrow, would you have the savings to buy a replacement without financial hardship? If the answer is no, keeping full coverage might be the better choice. The peace of mind can be worth the premium, especially if the car is essential for work or family.

Paying off your loan is also the perfect time to review your entire policy. Even if you drop collision and comprehensive, you should reassess how much liability insurance you need for your car. As your assets grow, you may need higher liability limits to protect your financial future.

Once your car is paid off, you gain the flexibility to tailor your policy to your needs and risk tolerance. Some drivers keep full coverage for the protection, while others drop it and save the money. The key is that the choice is finally yours.

Frequently Asked Questions about Insurance for Financed Cars

Does financing a used car still mean higher insurance costs?

Yes. When you finance a used car, the lender is the lienholder and will require you to carry collision and comprehensive coverage to protect their investment. While used cars are often cheaper to insure than new ones, this full coverage requirement means your premium will be higher than if you bought the car with cash and only carried liability insurance.

What is the difference in the claims process for a financed car?

For minor repairs, the process is the same. For a total loss, however, the lender is involved. The insurance settlement check is typically made out to both you and your lienholder. This ensures the loan is paid off before you receive any remaining funds. This extra step protects the lender but can make the claims process take longer than it would for a car you own outright.

Can I get just liability insurance on a financed car?

No. Your loan agreement contractually requires you to maintain collision and comprehensive coverage. Attempting to drop these coverages would violate your agreement and could lead to serious consequences, such as the lender purchasing expensive “force-placed insurance” on your behalf or even repossessing your vehicle. You can only request a liability insurance quote and switch to liability-only coverage after the loan is fully paid off.

Get the Right Protection for Your Financed Vehicle

So, does car insurance cost more for financed cars? Yes, but it’s because you’re carrying a higher level of protection for a valuable asset. The key is to ensure you’re not overpaying for this necessary coverage. By understanding your lender’s requirements, shopping around for the best rates, and using all available discounts, you can secure the right policy at a competitive price.

At Stanton Insurance Agency, we help drivers throughout Massachusetts and New Hampshire steer their insurance options with confidence. Our goal is to provide trusted protection for your valuable assets, helping you find coverage that satisfies your lender, protects you, and fits your budget.

Insurance can be complicated, especially with a financed vehicle. We’re here to explain your options in plain English and help you make informed decisions. Don’t let the higher cost of insuring a financed car keep you from exploring your options.

We are here to help you find the right balance of comprehensive protection and affordability. Contact us today to learn more about your auto insurance options or visit our main page for car insurance solutions. For a personalized quote, reach out to us at Stanton Insurance Agency or through our contact page.