Why Full Coverage Car Insurance Quotes Matter for New England Drivers

Full coverage car insurance quotes help you find comprehensive protection for your vehicle at a competitive price. Here’s what you need to know:

Quick Answer: Getting Full Coverage Quotes

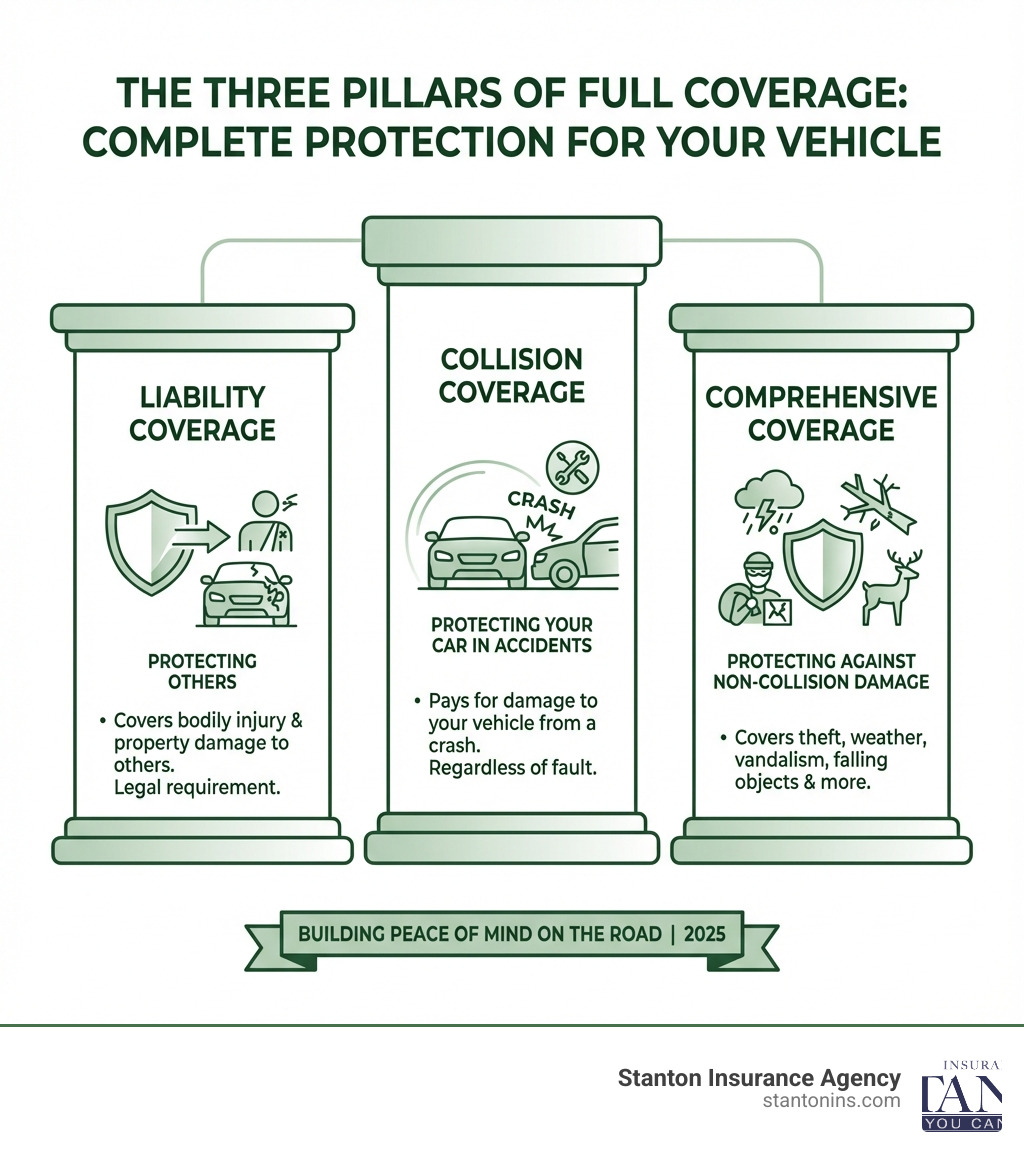

- What It Is: A combination of liability, collision, and comprehensive coverage

- Average Cost: Averages around $1,172/year in MA and $1,345/year in NH

- What To Do: Gather your driver’s license, VIN, and driving history, then compare quotes from multiple insurers

- Key Tip: Make sure you’re comparing identical coverage limits and deductibles across all quotes

Finding the right car insurance can feel like navigating a maze. You want solid protection for your vehicle, but you don’t want to overpay. That’s where understanding full coverage comes in.

“Full coverage” is the gold standard for peace of mind on the road. It safeguards you from a wide range of potential incidents—from fender benders to theft to storm damage. While the average cost of full coverage varies by state—around $1,172 per year in Massachusetts and $1,345 in New Hampshire—your actual rate depends on factors like your driving record, where you live, and what kind of car you drive.

In Massachusetts and New Hampshire, drivers face unique insurance requirements and market conditions. Massachusetts requires specific coverages by law, while New Hampshire takes a different approach to insurance mandates. Both states see significant variation in rates based on location—drivers in urban areas like Newton or Waltham typically pay more than those in rural communities.

The good news? With the right approach, you can find a policy that delivers comprehensive protection without breaking your budget. This guide walks you through exactly what full coverage entails, how to compare quotes effectively, and how to make smart decisions about your coverage.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping New England drivers steer full coverage car insurance quotes to find the right balance of protection and value. My team and I specialize in working with individuals and families across Massachusetts and New Hampshire to secure comprehensive auto coverage that fits their specific needs and budgets.

Decoding “Full Coverage” Car Insurance

“Full coverage” isn’t a single type of insurance, but rather a combination of coverages that provide a robust safety net for you and your vehicle. While state-mandated liability insurance only covers damages you cause to others, a full coverage policy protects your own car as well. This bundle is designed to handle the financial impact of accidents, theft, and other unexpected events.

What’s Included in a Full Coverage Policy?

When we talk about “full coverage,” we’re generally referring to a policy that combines several key types of protection. These work together to cover a wide array of potential scenarios on the road.

- Liability Coverage: This is the foundation of almost every auto insurance policy and is legally required in Massachusetts. It protects you financially if you’re at fault for an accident, covering bodily injuries and property damage to other people. For example, if you accidentally hit another car, your liability coverage would pay for the other driver’s medical bills and vehicle repairs.

- Collision Coverage: This coverage helps pay for damage to your own vehicle if you hit another car, an object (like a tree or a pole), or if your car rolls over, regardless of who is at fault. It’s designed to get your car repaired or replaced after an accident.

- Comprehensive Coverage: Often called “other than collision,” comprehensive coverage protects your vehicle from non-collision events. This includes things like theft, vandalism, fire, natural disasters (like hail or floods), and even damage from hitting an animal. If a tree branch falls on your car while it’s parked, or if your car is stolen, comprehensive coverage steps in.

- Uninsured/Underinsured Motorist Coverage: This is a crucial addition, especially in states like Massachusetts where it’s required. It protects you if you’re involved in an accident with a driver who either has no insurance or not enough insurance to cover your damages and medical bills. It can also cover hit-and-run incidents.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): These coverages help pay for medical expenses for you and your passengers after an accident, regardless of who was at fault. In Massachusetts, PIP is mandatory and covers medical expenses, lost wages, and other related costs up to a certain limit. New Hampshire drivers might opt for MedPay to cover similar costs.

For more detailed information, check out our guide on comprehensive and collision coverage.

The Key Benefits of Full Coverage

Opting for a full coverage policy provides numerous advantages beyond just meeting legal requirements.

- Financial Protection for Your Asset: Your car is a significant investment. Full coverage protects that investment, ensuring you won’t be left with massive repair bills or the burden of replacing a totaled vehicle out-of-pocket after an accident or other covered event.

- Fulfills Lender Requirements: If you have a car loan or lease, your lender will almost certainly require you to carry full coverage. This protects their financial interest in the vehicle. For more information, read about car insurance requirements for financed cars.

- Peace of Mind: Knowing that you’re protected against a wide array of potential incidents—from collisions to theft to natural disasters—offers invaluable peace of mind every time you get behind the wheel. You can drive confidently, knowing unexpected costs won’t derail your finances.

- Covers Non-Collision Incidents: Unlike basic liability, comprehensive coverage ensures you’re covered for events outside of a typical car crash, such as falling objects, severe weather, or vandalism, which can be particularly relevant in New England’s diverse climate.

Full Coverage vs. State Minimums: A Clear Comparison

Every state requires a minimum level of liability insurance to legally drive. However, this basic coverage leaves a significant gap: it does nothing to pay for damage to your own vehicle if you are at fault. Full coverage bridges this gap, offering far more comprehensive protection. On average, full coverage tends to be more expensive than minimum liability coverage, but for good reason—it covers significantly more.

Massachusetts & New Hampshire Minimum Requirements

It’s important to understand the legal landscape in our region.

- In Massachusetts: Drivers must carry specific mandatory minimums, as outlined by state law: Bodily Injury to Others ($20,000 per person / $40,000 per accident), Personal Injury Protection (PIP) ($8,000), Bodily Injury Caused by an Uninsured Auto ($20,000 per person / $40,000 per accident), and Damage to Someone Else’s Property ($5,000). For more details, see what is the minimum car insurance coverage in massachusetts.

- New Hampshire: Uniquely, New Hampshire does not mandate car insurance. However, drivers are required to prove financial responsibility if they are in an at-fault accident. This means if you cause a crash, you must be able to pay for the damages and injuries you inflict. For most drivers, purchasing insurance is the only practical way to meet this requirement and avoid severe financial penalties. Our guide on are you required to have auto insurance in new hampshire provides more context.

Here’s a quick comparison of what each type of coverage typically handles:

| Coverage Aspect | Minimum Liability | Full Coverage |

|---|---|---|

| Damage to Other Person’s Car | ||

| Injuries to Other People | ||

| Damage to Your Car in an At-Fault Accident | ||

| Damage to Your Car from Collision (Not At-Fault) | ||

| Theft of Your Car | ||

| Damage to Your Car from Weather/Vandalism | ||

| Injuries to You/Passengers (No-Fault) | Sometimes (PIP) | |

| Damage from Uninsured Driver |

What Drives the Cost of Full Coverage Car Insurance?

The price of a full coverage policy is highly personalized, calculated from a wide range of risk factors. For instance, while full coverage in Massachusetts averages around $1,172 per year and about $1,345 per year in New Hampshire, your specific rate will depend on your unique profile. Understanding these factors is the first step toward finding savings.

Personal and Vehicle Factors

Insurance companies use a sophisticated algorithm to assess risk, and your premium reflects that assessment.

- Driving Record: This is arguably the biggest factor. A clean record with no accidents or tickets will earn you lower rates. Conversely, speeding tickets, at-fault accidents, or DUIs will significantly increase your premiums. Safe drivers can save up to 35% with claims-free rewards.

- Age and Experience: Younger, less experienced drivers typically pay more due to higher statistical likelihood of accidents. Rates tend to decrease as drivers gain more experience and reach their mid-20s.

- Location: Where you live, and even where you park your car, plays a big role. Urban areas with higher traffic density, theft rates, and vandalism often have higher premiums. For example, auto insurance in Newton MA might be different from a more rural part of New Hampshire. Insurers consider claim frequency, claim cost, and theft/vandalism rates in an area when setting rates.

- Vehicle Make, Model, and Year: The type of car you drive impacts cost. More expensive cars, luxury vehicles, sports cars, and those with higher repair costs or higher theft rates will generally cost more to insure. It’s advisable to opt for full coverage car insurance for new cars from the year 2020 or later.

- Annual Mileage: The more you drive, the higher your risk of an accident, which can lead to higher premiums.

- Credit-Based Insurance Score: In most states, insurers use a credit-based insurance score to help determine rates, as it’s correlated with the likelihood of filing claims. However, it’s important to note that Massachusetts is one of the states where insurers cannot use credit history to determine car insurance rates.

Understanding these variables can shed light on why car insurance is so expensive in massachusetts.

Policy Customization and Deductibles

Your deductible—the amount you pay out-of-pocket before insurance kicks in for collision and comprehensive claims—has a direct impact on your premium. A higher deductible typically means a lower monthly payment, because you’re taking on more of the initial risk. Likewise, the coverage limits you select for liability and other protections will influence your final cost. Choosing higher limits provides more protection but also increases the premium. It’s a balance between affordability and the financial risk you’re willing to bear. For more on how these choices interact, explore collision vs limited collision.

How to Get Accurate Full Coverage Car Insurance Quotes

Getting a quote is the most crucial step in finding the right price. The key is to provide accurate information to receive a quote that reflects your true cost and to compare policies with identical coverage levels.

Step 1: Gather Your Information

Before you start, have all your essential details ready. This will make the quoting process much smoother and ensure accuracy.

- Driver’s License Number(s) for all drivers on the policy

- Vehicle Identification Number (VIN) for all cars you want to insure

- Home Address

- Driving History (any accidents, tickets, or claims in the past 3-5 years)

- Current or Prior Insurance Information (provider, policy number, expiration date)

- Make, model, year, and trim level of your vehicle(s)

- Estimated annual mileage for each vehicle

Step 2: Understanding Your Full Coverage Car Insurance Quotes

When you receive a quote, look beyond the final price. It’s easy to get swayed by the lowest number, but we encourage you to dig deeper. Verify that the coverage types (collision, comprehensive, liability), limits (e.g., 100/300/50, meaning $100,000 bodily injury per person, $300,000 bodily injury per accident, $50,000 property damage), and deductibles ($500, $1,000) are identical across all quotes you compare. This ensures you’re making an apples-to-apples comparison and truly evaluating value. Our guide on comparing car insurance companies which one is right for you can help you with this process.

Step 3: Finding Discounts and Savings

Always ask about potential discounts. Many insurers offer a variety of ways to save, and these can significantly reduce the cost of your full coverage car insurance quotes.

- Bundling: Combining your auto policy with home, renters, or even umbrella insurance can lead to substantial savings.

- Multi-Car Discount: Insuring more than one vehicle on the same policy.

- Good Driver/Claims-Free Discount: For maintaining a clean driving record over a specified period. Safe drivers can save up to 35% with a claims-free reward.

- Good Student Discount: For young drivers who maintain a certain GPA.

- Anti-Theft Device Discount: If your vehicle has approved, factory-installed anti-theft devices.

- Safety Features Discount: For cars with advanced safety features like adaptive cruise control or automatic emergency braking.

- Paid-in-Full Discount: Paying your annual premium upfront instead of monthly installments.

- Defensive Driving Course Discount: Completing an approved defensive driving course.

When Do You Really Need Full Coverage?

While full coverage offers superior protection, it isn’t always a financial necessity for every driver and every vehicle. The decision depends on your car’s value, your financial situation, and any contractual obligations you may have.

When Full Coverage is Required or Recommended

There are several scenarios where obtaining full coverage car insurance quotes is not just a good idea, but often a requirement or a strongly recommended choice.

- Financed or Leased Vehicles: This is the most common scenario. Lenders and leasing companies require full coverage to protect their investment. They want to ensure their asset is covered against damage, theft, or total loss. See our guide on car insurance requirements for financed cars for more.

- High-Value or New Cars: If your vehicle is new (e.g., from the year 2020 or later, as statistics suggest), or if it holds significant market value, full coverage is highly recommended. The cost of repairing or replacing a newer, more expensive car can be substantial, and full coverage protects you from these potentially devastating out-of-pocket expenses.

- Inability to Afford Replacement/Repairs: If you wouldn’t be able to easily afford to repair or replace your vehicle after a major accident, theft, or other damage, full coverage provides a critical financial safety net. It transfers that significant financial risk to your insurance provider.

Is It Worth Paying for Full Coverage Car Insurance Quotes on an Older Car?

This is a common question, and the answer often comes down to simple math and your personal financial situation. While full coverage offers peace of mind, for older vehicles, the cost of the premium might outweigh the potential payout.

A common rule of thumb is to reconsider full coverage if your annual premium (for collision and comprehensive) is 10% or more of your car’s actual cash value (what it’s worth today, considering depreciation). For example, if your car is only worth $4,000, and your full coverage adds $500 per year to your premium, you might be paying too much relative to its value.

Another consideration is your deductible. If your car’s market value is less than your deductible (e.g., your car is worth $1,000, but your collision deductible is $1,000), then collision and comprehensive coverage won’t provide much financial benefit. In such cases, you might consider dropping collision and comprehensive to save money, provided you can afford to repair or replace the car on your own. For a deeper dive into this decision, read when to drop collision insurance coverage.

The decision rests on your comfort level with risk and your financial capacity. If losing your older car would present a significant financial hardship, even if it’s not worth much, keeping full coverage might still be the right choice for your peace of mind.

Frequently Asked Questions about Full Coverage Car Insurance

We often hear similar questions from drivers in Massachusetts and New Hampshire when they’re exploring full coverage car insurance quotes. Here are some of the most common ones:

What is the main difference between full coverage and liability-only insurance?

The main difference lies in what gets covered. Liability-only insurance covers bodily injury and property damage you cause to others in an at-fault accident. It does not cover any damage to your own vehicle, nor does it cover your medical expenses. Full coverage, on the other hand, includes liability plus collision and comprehensive coverages, which pay for repairs to your car regardless of who caused the accident (for collision) or from non-accident events (for comprehensive). It provides a much broader safety net for your own vehicle and often your medical costs.

Can I customize my full coverage policy?

Absolutely! The term “full coverage” is really just an umbrella for a group of coverages, making it highly customizable. You can adjust your liability limits to provide more protection than the state minimums, choose your collision and comprehensive deductibles to balance premium cost with out-of-pocket expense, and add optional coverages. These optional additions can include rental car reimbursement (to cover a rental while your car is repaired), roadside assistance (for breakdowns or flat tires), or gap insurance (for financed cars that are totaled). We work with you to build a policy that fits your specific budget and protection needs.

Does a full coverage claim always increase my premium?

Not necessarily. While an at-fault accident claim can certainly lead to a premium increase, it’s not a universal rule for all claims under a full coverage policy. Many insurers offer “accident forgiveness” programs, which might prevent your rates from going up after your first at-fault accident. Furthermore, claims made under your comprehensive coverage (like for a cracked windshield, storm damage, hitting an animal, or theft) typically do not impact your rates in the same way an at-fault collision claim does, as these are often considered “no-fault” incidents.

Your Trusted Partner for Car Insurance

Navigating full coverage car insurance quotes is much simpler with an expert guide. From understanding your needs in Wellesley to finding the best rates in Waltham, having the right protection brings invaluable peace of mind. The team at Stanton Insurance Agency is dedicated to helping you find a policy that perfectly balances comprehensive protection with a price that fits your budget. We’re here to answer your questions, explain your options, and provide custom solutions for your unique situation in Massachusetts and New Hampshire. Ready to drive with confidence? Contact us today to explore your auto insurance options.