Why Timing Matters When Canceling Your Auto Insurance

When to cancel insurance is a question that requires careful consideration, not a spur-of-the-moment decision. Cancel too early, and you could face fines, license suspension, or sky-high premiums the next time you need coverage. Cancel at the wrong time, and you might leave yourself financially exposed or create a coverage gap that follows you for years.

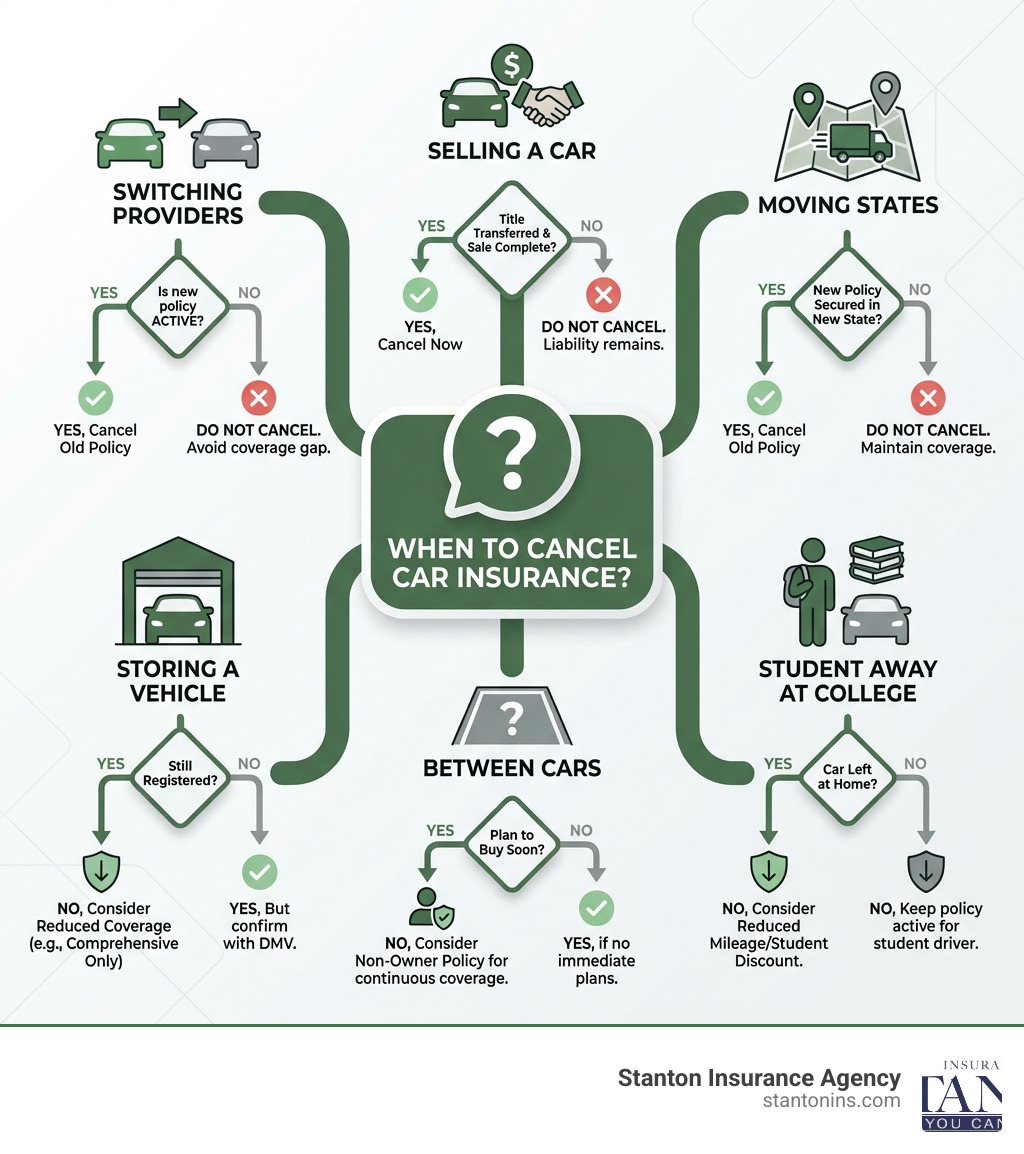

The best times to cancel your car insurance are:

- When switching to a new provider – but only after your new policy is active

- When selling your car permanently – but only after the title is transferred and the sale is 100% complete

- When moving to a state your insurer doesn’t cover – but only after securing a new policy in your new location

You should NOT cancel if:

- You still own a registered vehicle (even if it’s parked)

- You’re between cars and plan to buy another soon

- Your car is temporarily in storage

- Your college student left their car at home

Even one day without insurance counts as a coverage lapse. That lapse can mark you as a high-risk driver, increase your future premiums, and in some cases, result in fines or license suspension. In Massachusetts, the penalties are particularly strict—you must cancel your registration plates before you can cancel your insurance, or you risk significant legal trouble.

The good news? When to cancel insurance has clear-cut answers. In most cases, the issue isn’t whether to cancel, but when and how to do it correctly. This guide will walk you through the exact scenarios where canceling makes sense, the alternatives you should consider first, and the step-by-step process to cancel without creating problems down the road.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping drivers in Massachusetts and New Hampshire steer these exact situations, including understanding when to cancel insurance without creating financial or legal headaches. Whether you’re switching carriers, selling a car, or just trying to lower your costs, I’ll show you the right way to make these decisions.

Similar topics to When to cancel insurance:

When You SHOULD Cancel Your Car Insurance

Canceling your auto insurance is a valid step in several specific situations. Acting at the right moment ensures a smooth transition without financial or legal penalties. Here are the primary scenarios where canceling your policy is the correct move.

You’re Switching to a New Insurance Provider

Found a better rate? Better coverage? Switching carriers? These are all excellent reasons to consider a change. However, the golden rule of when to cancel insurance when switching providers is to never cancel your old policy until your new one is officially active. A lapse in coverage, even for a single day, can flag you as a high-risk driver, potentially increasing your future premiums significantly.

To ensure a smooth transition, we always recommend setting up your new policy and making the first payment before you even think about canceling your old one. Coordinate with your new provider to have your new policy start on the same day you plan to cancel your car insurance renewal with your current insurer. This eliminates any gap in coverage and helps you avoid potential penalty fees that some insurers might charge for early cancellation. Your new agent can often help you with this coordination, making the process seamless.

You’re Selling Your Car (and Not Replacing It)

If you’re permanently getting rid of your vehicle and won’t be driving anymore, or will be relying solely on public transportation, you can certainly cancel the policy associated with that vehicle. However, it is crucial to wait until the sale is 100% complete and all ownership transfers are finalized. This means you have:

- Transferred the title document to the new owner so they can get a new title in their name.

- Completed and signed a bill of sale, which lays out all the details, like who’s buying it, how much they paid, and the odometer reading.

- Submitted a Notice of Release of Liability to your state’s DMV or RMV, if your state requires one. This form protects you from liability for accidents or tickets that occur after the sale.

- Returned your license plates. In Massachusetts, you must cancel your MA plates before you can cancel your insurance. Failing to do so can lead to fines and a suspended driver’s license and registration.

Only after these steps are complete can you safely cancel the policy associated with that vehicle. Until the vehicle is no longer registered in your name, most states, including Massachusetts and New Hampshire, require you to maintain at least minimum liability coverage. Canceling too soon means you could be held legally and financially responsible for any incidents involving the car while it’s still technically yours, even if you’re not driving it.

You’re Moving to a State Your Insurer Doesn’t Cover

While many large insurance providers operate across most of the U.S., it’s possible your current insurer doesn’t offer coverage in your new state, or perhaps their rates aren’t competitive there. When you move, you will need to register your vehicle in your new state of residence and purchase a policy that aligns with that state’s auto insurance laws.

In this scenario, understanding when to cancel insurance means securing a new policy that meets your new state’s requirements before canceling your old one. This ensures you maintain continuous coverage and avoid any lapses. Once your new policy is active and you’ve registered your vehicle in the new state, you can then proceed to cancel your previous coverage. Even if your current carrier does operate in your new state, your rates and coverage needs will likely change, so it’s always wise to shop around and compare quotes.

When to Re-Evaluate, Not Cancel: Alternatives to Cancellation

In many situations, canceling your policy outright is the wrong move and can create significant problems. Before you make the call, consider if one of these alternatives is a better fit for your situation. This is a key part of understanding when to cancel insurance.

You Still Own the Car, But Aren’t Driving It

Perhaps your classic car is tucked away for the winter, or you’re taking an extended vacation and leaving your daily driver at home. You might think, “Why pay for insurance if I’m not driving?” However, most states, including Massachusetts, require any vehicle with an active registration to be insured. Even if your car is parked in a garage for the season, you are legally required to maintain at least the state’s minimum liability coverage. Canceling your policy could result in fines, a suspended license, and a registration suspension.

Instead of canceling, consider reducing your coverage. You could switch to a “storage” or “comprehensive-only” policy, which would protect against risks like theft, vandalism, fire, or storm damage while the car is not being driven. You would still maintain the state-mandated liability coverage to avoid legal penalties for having an uninsured, registered vehicle. This way, you save money without risking a lapse or legal trouble.

You’re Between Cars

We’ve all been there: you’ve sold your trusty old car, but your new ride isn’t arriving for a few weeks or even a month. If you cancel your policy entirely during this interim, you create a coverage gap. This lapse, even if short, will likely cause your rates to be higher when you eventually purchase your new policy. Insurers view a history of continuous coverage favorably, and a gap signals higher risk.

- Alternative: Non-Owner Car Insurance. This handy policy provides you with liability coverage when you’re driving a car you don’t own (like a rental, a borrowed car from a friend, or a test drive). It’s a fantastic way to maintain your status as a continuously insured driver, preventing a lapse and keeping your future premiums down. It doesn’t cover damage to the car you’re driving, but it protects you financially if you cause an accident.

Your College Student Left Their Car at Home

If your child is moving to college more than 100 miles away without their car, don’t rush to cancel their insurance. They’ll still need coverage when they’re home for breaks, and keeping them on your policy can maintain their continuous coverage record, which benefits their future rates. Instead, ask your insurer about a “student away at school” or “distant student” discount. Many insurance companies offer significant discounts for students who attend school 100 miles or more from home, as they’re driving less frequently. This is a clever way to save money without sacrificing coverage or creating a problematic lapse.

| Action | Best For | Key Benefit | Potential Downside |

|---|---|---|---|

| Cancel Policy | Permanently no longer owning or driving a car. | Stops all premium payments. | Creates a coverage gap if you drive again. |

| Reduce Coverage | Storing a registered vehicle for an extended period. | Lowers premium while protecting the asset and meeting legal requirements. | No collision coverage if you decide to drive it. |

| Non-Owner Policy | In between cars or frequently borrow/rent vehicles. | Avoids coverage lapse; provides liability protection. | Doesn’t cover damage to the car you’re driving. |

The Step-by-Step Guide to Canceling Your Policy

Once you’ve determined that canceling is the right move, follow these steps to do it correctly and avoid any negative consequences. This methodical approach ensures you’re protected throughout the process.

1. Secure New Coverage (If Applicable)

As we’ve emphasized, this is the most important step if you plan to continue driving or need new insurance. Before you touch your current policy, make sure your new policy is active, paid for, and ready to go. Have your new policy number and its official start date on hand before you proceed with canceling your old one. This single action prevents a coverage gap, which is the biggest pitfall when navigating when to cancel insurance.

2. Contact Your Insurance Provider

Do not, we repeat, do not just stop making payments. That’s a recipe for disaster, as we’ll explain shortly. You must formally notify your current insurer of your intent to cancel. Call your agent or the company’s customer service line. While a phone call is often sufficient, some insurers may require a written request, such as a signed cancellation letter, for their records. Be prepared to provide the following crucial information:

- Your full name and current address

- Your policy number

- The vehicle information (VIN) for the car you’re canceling coverage for

- The desired effective date of cancellation (ideally, the same day your new policy begins)

- The reason for cancellation (e.g., selling vehicle, switching providers)

This information helps your insurer process your request accurately and efficiently.

3. Notify the DMV/RMV

While your insurance company is generally required to notify the state when your policy is canceled, it’s always a good idea to double-check state requirements and take proactive steps yourself. To avoid any issues, you should also ensure your registration and plates are properly handled. For instance, in Massachusetts, you must cancel your MA plates with the Registry of Motor Vehicles (RMV) before the insurance can be officially canceled for a registered vehicle. In other states, you may need to surrender your plates if you no longer have insurance for a registered vehicle to prevent fines. Always confirm the specific requirements with your local DMV or RMV.

4. Request Written Confirmation

After you’ve initiated the cancellation process, ask your insurer to send you a formal notice of cancellation in writing or via email. This document is your official proof that the policy has been terminated and serves as an invaluable record in case of any future disputes or inquiries. This notice will also typically outline any potential refund you may be owed for prepaid premiums, ensuring transparency and accountability. Keep this confirmation safe!

The Financial & Legal Risks of a Coverage Lapse

Understanding when to cancel insurance is mostly about avoiding the serious consequences of a coverage lapse. A lapse occurs any time you own a registered vehicle but do not have insurance. This seemingly minor oversight can lead to major headaches, both financially and legally.

Higher Future Premiums

Perhaps the most common consequence of a lapse in coverage is the impact on your future insurance rates. Even a one-day lapse can cause future insurers to view you as a higher risk, resulting in more expensive premiums when you apply for a new policy. Why? Because continuous coverage demonstrates responsibility to insurers. If you’ve been without insurance long enough, some providers may even consider you a high-risk driver, making it more difficult to find affordable coverage. Furthermore, you may lose valuable loyalty or continuous coverage discounts you’ve earned over the years with your previous insurer, adding to the cost.

Cancellation Fees

While many insurers don’t charge a fee for canceling your policy, some do, especially if you’re canceling mid-term. This can be a flat fee (e.g., $50) or a “short-rate” fee, which is typically a percentage of your remaining premium for the policy period. These fees are designed to cover the administrative costs of early termination and compensate the insurer for the lost premium. Always ask about potential cancellation fees before you finalize your decision to avoid any surprises.

Legal Penalties

Driving without insurance is illegal in nearly every state, including Massachusetts. While New Hampshire technically doesn’t mandate car insurance, if you have active registration tags on your vehicle, you are generally expected to have proof of financial responsibility. The penalties for driving uninsured in Massachusetts can be severe and may include:

- Heavy fines

- Suspension of your driver’s license and vehicle registration

- Vehicle impoundment

- In some extreme cases, even jail time

If you’re caught driving without insurance, it can be difficult to find a new insurer since you will be placed in the high-risk category, leading to even higher rates. For a detailed look at the consequences in Massachusetts, you can review what happens if my car insurance is cancelled in Massachusetts. Even if you’re not driving the car, if it’s registered in your name, you are likely required to have at least minimum liability coverage to avoid these penalties.

Frequently Asked Questions about Canceling Car Insurance

Can I get a refund after canceling my car insurance?

Yes, in most cases, you can get a refund. If you paid your premium in advance for a six-month or annual term, you are typically entitled to a prorated refund for the unused portion of your policy. For example, if you paid for a full year and cancel halfway through, you should receive approximately half of your premium back, minus any cancellation fees. State laws regulate this process, often specifying how quickly insurers must process refunds. For instance, while not applicable to Massachusetts or New Hampshire, some states like Nebraska mandate that auto insurers must contact you within 15 business days of cancellation regarding eligible refunds, and some states require them to return the unused premium within a certain timeframe. Your insurer will subtract any applicable cancellation fees from your refund.

Can I reinstate a canceled car insurance policy?

It depends on your insurer and the reason for the cancellation. If your policy was canceled for non-payment, some companies offer a grace period during which you can pay the past-due amount to reinstate it. This might involve a small fee, but it’s generally better than having a lapse on your record. However, if it has been too long since the cancellation, or if the cancellation was for other reasons (like fraud or license suspension), you will likely need to apply for a completely new policy. This new policy could come at a higher rate due to the lapse in coverage. It’s always best to contact your insurer directly as soon as possible to explore your options for reinstatement.

What happens if I just stop paying my car insurance premiums?

This is, hands down, the worst way to cancel your car insurance. While it might seem like the easiest path, it comes with significant negative consequences. Your insurer will provide a grace period after a missed payment, but if you don’t pay within that time, they will eventually cancel your policy for non-payment. This cancellation goes on your insurance record and is a red flag to future insurers.

Such a cancellation can make it much harder and more expensive to get insurance in the future, as you’ll be viewed as a high-risk client. You will also likely be billed for the coverage you had during the grace period, meaning you’ll owe money even though your policy was canceled. Avoid this method at all costs; always formally cancel your policy when you’ve decided it’s time.

Stay on the Road with Confidence

Canceling your car insurance isn’t just about ending a service—it’s a legal and financial decision that requires careful timing. The key is to always avoid a lapse in coverage. Whether you’re switching providers, selling your car, or just storing it for the winter, make sure you have the right protection in place for your specific situation.

If you have questions about your policy or need help navigating the process in Massachusetts or New Hampshire, an independent agent can provide the expert guidance you need. We’re here to help you understand when to cancel insurance and when to explore other options. For a complete review of your coverage options, explore our MA Car Insurance resources or contact the team at Stanton Insurance Agency today. We’re committed to providing trusted protection for your valuable assets and exceeding your expectations.