Does renters insurance cover personal injury 7 key facts 2025

Understanding Personal Injury Protection in Renters Insurance

Does renters insurance cover personal injury – yes, most renters insurance policies include personal liability coverage that protects you when guests are injured on your rental property. This coverage typically includes $100,000 to $300,000 in liability protection plus medical payments to others coverage for immediate medical expenses.

Quick Answer:

- Personal Liability Coverage: Pays legal fees and damages when you’re at fault for someone’s injury

- Medical Payments Coverage: Covers guest medical bills up to $1,000-$5,000 regardless of fault

- Who’s Covered: Visitors, guests, service workers, and delivery personnel

- Who’s NOT Covered: You, roommates, family members living with you

- Common Scenarios: Slip and falls, dog bites, water damage to neighbors, fire injuries

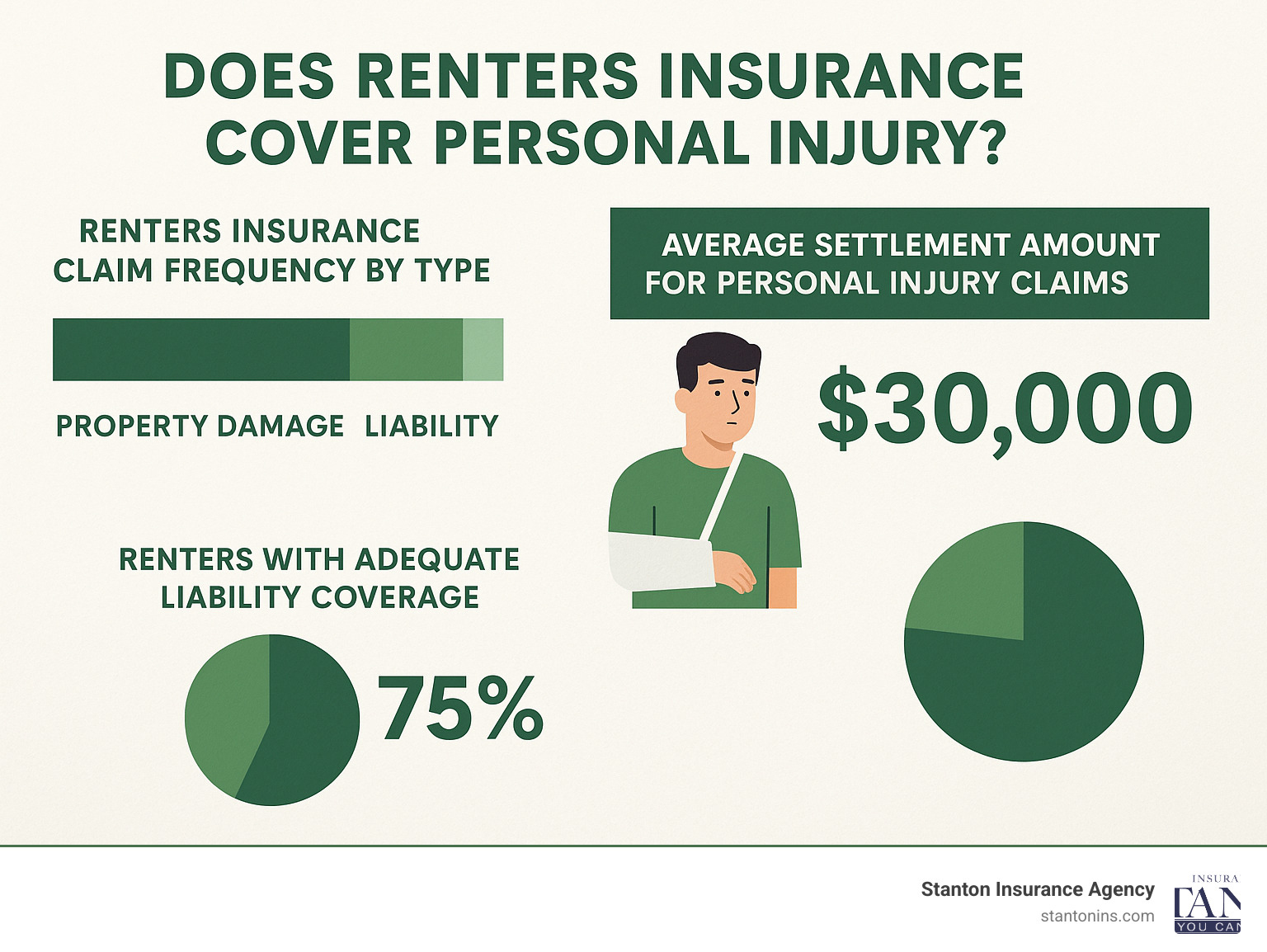

With up to 70% of renters lacking insurance coverage, many people don’t realize their financial vulnerability when accidents happen. At just $12-15 per month on average, renters insurance provides crucial protection against costly personal injury lawsuits.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over two decades helping Massachusetts residents steer insurance claims and coverage decisions. My experience has shown me how proper liability coverage can protect renters from devastating financial consequences when accidents occur on their property.

Does renters insurance cover personal injury glossary:

- personal accident insurance

- what is personal liability insurance for renters

- what is personal umbrella insurance

Does Renters Insurance Cover Personal Injury Claims?

When someone gets hurt on your rental property, does renters insurance cover personal injury claims? Absolutely – and it’s one of the most valuable parts of your policy.

Your renters insurance tackles personal injury situations through two key coverages. Personal liability coverage handles the big stuff – like when someone decides to sue you after getting injured. Medical payments to others coverage takes care of immediate medical bills without legal drama.

If your neighbor slips on ice outside your apartment door, your policy steps in to protect you. Personal liability coverage kicks in if they hire a lawyer for their broken wrist and missed work days. We’re talking about protection that can reach $100,000 to $300,000 or more.

Medical payments coverage handles things before they escalate. If that same neighbor just needs urgent care for scrapes and bruises, this coverage pays their medical bills right away – no fault-finding, no lawyers. It typically covers $1,000 to $5,000 per person.

More info about Personal Liability Insurance for Renters

Understanding Personal Liability Coverage in Renters Insurance

Personal liability coverage is your financial bodyguard when accidents happen and you’re legally responsible. Most policies start with $100,000 in coverage, but we recommend bumping it up to at least $300,000 based on real claims we’ve seen.

Let’s say you’re hosting a dinner party and a guest slips in your kitchen, breaking their ankle. The emergency room visit costs $8,000, they miss three weeks of work losing $4,500 in wages, and their lawyer adds another $12,000 in legal fees. Your liability coverage handles all of it – the medical bills, lost wages, pain and suffering, and your legal defense costs.

This protection follows you beyond your rental property. Accidentally knock someone over while jogging? Cause a fender-bender with your bicycle? Your renters liability coverage often applies to these everyday situations too.

The legal defense part is huge – even if you win the case, defending yourself can cost $30,000 to $50,000. Your liability coverage pays these legal expenses on top of any damages.

Medical Payments to Others Coverage

Medical payments to others coverage (“MedPay”) is the peacekeeper of insurance coverages. It pays medical expenses regardless of who’s at fault – no finger-pointing, no waiting for lawyers.

Most policies offer $1,000 to $5,000 per person in MedPay coverage. It’s designed for those “oops” moments in everyday life. Your friend burns their hand on your oven? MedPay covers their urgent care visit. Someone trips over your dog’s toy? MedPay handles the emergency room bill.

The beauty of MedPay is speed and simplicity. Instead of your injured guest dealing with health insurance deductibles, MedPay steps in immediately. It keeps friendships intact and shows you care about making things right quickly.

MedPay is perfect for urgent care visits and minor emergency room trips, but for serious injuries requiring surgery and weeks of therapy, you’ll need that liability coverage for major protection.

What Types of Personal Injuries Does Renters Insurance Cover?

When people ask does renters insurance cover personal injury, they’re usually thinking about everyday accidents that can happen when hosting friends or going about daily life. Renters insurance covers a surprisingly wide range of personal injury scenarios.

The most frequent claims involve slip and fall accidents. You’ve just mopped your kitchen floor before guests arrive but forgot to put up a wet floor sign. When your friend slips and breaks their ankle, your liability coverage handles their medical bills and legal costs. These accidents might seem minor, but emergency room visits and orthopedic treatment can easily cost thousands.

Dog bite incidents represent another major category. If your usually friendly golden retriever gets startled and bites the mail carrier, your renters insurance typically covers the victim’s medical treatment, including emergency care and potential plastic surgery. Dog bite claims are among the most expensive, often reaching $30,000 or more.

Water damage liability is particularly common in apartment buildings. When your bathtub overflows and water seeps through to damage your downstairs neighbor’s ceiling and furniture, your liability coverage pays for repairs and replacements. These claims range from a few thousand for minor ceiling repairs to tens of thousands when expensive electronics are ruined.

Fire injuries can occur when your cooking mishap causes a fire that spreads beyond your unit. If a neighbor is injured while evacuating, your renters insurance may cover their medical expenses.

Covered Injury Scenarios

Your renters insurance protects you when third parties – anyone who doesn’t live in your household – get injured due to your actions or negligence. This includes friends and family who visit, contractors, delivery drivers, and neighbors.

Guest accidents during social gatherings are common. Whether someone trips over your coffee table during game night, burns themselves on your outdoor grill, or gets injured using recreational equipment, your liability coverage handles their medical expenses. A broken bone from a trampoline accident can easily result in $25,000 in medical bills.

Worker and contractor injuries present a complex scenario. If you hire a handyman and they’re injured due to a hazard you failed to warn them about, your renters insurance may cover their medical costs. However, professional contractors typically carry their own insurance.

Does Renters Insurance Cover Personal Injury Outside Your Rental?

Does renters insurance cover personal injury extends beyond your rental property. Your policy often includes off-premises liability coverage, which protects you for accidents you cause while away from home during personal activities.

This coverage applies to everyday activities and recreational pursuits. If you’re playing pickup basketball and accidentally collide with another player, causing them to break their wrist, your renters liability coverage may handle their medical expenses. The same protection applies if you’re riding your bicycle and accidentally cause a pedestrian to fall.

The important distinction is that off-premises coverage applies to personal activities, not business activities or motor vehicle incidents. Your renters insurance won’t help with car accidents – that’s what auto insurance covers.

Extended coverage even applies to temporary locations. If you’re house-sitting and accidentally start a kitchen fire that damages property or injures someone, your renters liability coverage may respond. This umbrella of protection follows you around, covering personal recreational activities, sports, and everyday mishaps away from home.

Who Is Protected Under Renters Insurance Personal Injury Coverage?

When people ask does renters insurance cover personal injury, they’re wondering who exactly benefits from this protection. Your renters insurance covers third parties – essentially anyone who doesn’t live in your household but gets injured due to your actions or negligence.

Your policy creates a protective umbrella for people who visit your rental property or encounter you in daily life. Guests dropping by for dinner are covered if they slip on your freshly mopped floor. Visitors attending your weekend barbecue are protected if they’re injured by your grill malfunction. Even service workers like your internet installer have coverage if they’re hurt due to a hazard you created.

Delivery personnel represent another important covered group. When your Amazon driver trips over that garden hose you left across the walkway, or when the pizza delivery person slips on your icy steps, your renters insurance handles their medical expenses and potential lawsuits.

Neighbors are also protected, which is particularly valuable in apartment buildings. If your bathtub overflow causes your downstairs neighbor to slip and fall on their water-damaged floor, your liability coverage handles their injury claim.

More info about Renters Insurance Coverage

Coverage for Different Types of People

Non-residents form the core group protected by your renters insurance. This includes your college friend visiting for the weekend, your parents stopping by for dinner (assuming they don’t live with you), or your romantic partner who maintains their own apartment. Once someone becomes a household resident, they lose this third-party protection.

Third parties conducting business at your rental property fall under your coverage in most situations. When you hire a handyman to fix your leaky faucet and they’re injured due to a hazard in your apartment, your policy typically responds. However, professional contractors who carry their own liability insurance might have their coverage as primary.

Your coverage extends to people you encounter during personal activities away from home. If you’re playing frisbee at the local park and accidentally knock someone down, your renters liability coverage may apply. This off-premises protection makes your policy valuable even when you’re not at home.

Does Renters Insurance Cover Personal Injury to Roommates and Family?

Renters insurance specifically excludes coverage for injuries to household members. This means your roommates, family members living with you, and anyone else who calls your rental home aren’t covered under your personal injury protection.

Household exclusions exist to prevent fraudulent claims. If your roommate could file a claim against your renters insurance every time they stubbed their toe on your furniture, the system would become unworkable.

Family members living in your household face the same exclusion, regardless of whether they’re on the lease. Your spouse, children, parents, or siblings who live with you must rely on their own health insurance if they’re injured due to your negligence.

The practical impact is significant for roommate situations. If you share an apartment and your roommate slips on water you spilled, breaking their wrist, your renters insurance won’t cover their medical bills or lost wages. They’d need to pursue compensation through their health insurance or potentially take legal action against you personally.

Common Exclusions and Limitations in Personal Injury Coverage

While does renters insurance cover personal injury in many day-to-day accidents, certain situations fall outside the policy. Knowing these gaps keeps you from expecting help that won’t arrive.

The biggest exclusions involve intentional harm, business activities, motor vehicles, and criminal acts. If you deliberately injure someone, conduct business in your apartment, or cause an auto accident—even in your own parking spot—your renters policy steps aside. These claims must be handled by separate business or auto insurance, or you pay out of pocket.

What Personal Injuries Are NOT Covered

- Your own injuries or those of people who live with you (roommates, spouses, children)

- Accidents tied to a side hustle or home-based business

- Injuries involving cars, motorcycles, boats, or other motor vehicles

- Any loss occurring while illegal activity is underway

These exclusions are industry-standard and appear in virtually every Massachusetts and New England renters policy.

Breed Restrictions and Pet Liability

Most insurers still apply breed restrictions for dogs deemed “high risk,” such as pit bulls, Rottweilers, and Doberman Pinschers. Others look at an individual dog’s history instead of its breed, so shopping around can pay off. Exotic pets—snakes, large birds, ferrets—are usually excluded altogether.

Always disclose pets when you apply for coverage. Omitting them can void the entire policy if a bite or scratch leads to a claim.

For more information about renters insurance statistics and industry data, visit the Insurance Information Institute’s website at iii.org.

How Much Personal Injury Coverage Do You Need?

Figuring out coverage amounts isn’t about picking random numbers – it’s about protecting your financial future. While most renters insurance policies start with $100,000 in liability coverage, this amount might leave you vulnerable in today’s world of expensive medical care and legal fees.

A simple slip-and-fall accident can easily result in $75,000 in medical bills when surgery and physical therapy are involved. That’s already pushing your coverage limits before considering lost wages, pain and suffering, or legal defense costs. This is why understanding does renters insurance cover personal injury situations properly means looking beyond minimum coverage amounts.

Your lifestyle plays a huge role in determining adequate coverage. Dog owners face significantly higher risks, especially since the average dog bite claim exceeds $50,000 nationally. If you love hosting parties, you’re regularly exposing yourself to slip-and-fall risks.

Asset protection is equally important. If you have savings accounts, investment portfolios, or other valuable assets, inadequate insurance coverage puts these at risk. Court judgments don’t disappear – they can follow you for years.

More info about What Does Renters Insurance Cover

Determining Adequate Coverage Limits

$100,000 minimum coverage sounds substantial until you face a serious injury claim. Emergency room visits alone can cost $15,000-$30,000, before considering surgery, rehabilitation, or ongoing medical care. We’ve seen clients whose guests required multiple surgeries, with total costs exceeding $200,000.

$300,000 recommended coverage provides much better protection without breaking your budget. The additional premium typically costs just $20-$40 annually for this extra protection. This amount handles most typical injury claims while leaving room for legal defense costs.

High-risk factors warrant even higher consideration. Swimming pools create attractive nuisance liability, while trampolines are involved in thousands of injury claims annually. If you own these items or frequently entertain large groups, $500,000 in coverage makes financial sense.

Additional Protection Options

Umbrella insurance acts like a safety net above your regular renters insurance, typically starting at $1 million in additional coverage for just $200-$400 annually. This coverage kicks in when your regular policy limits are exhausted.

Excess liability coverage simply increases your existing coverage limits without adding new types of protection. While less comprehensive than umbrella policies, excess coverage can be perfect if you want higher limits for potential claims.

Asset protection strategies work hand-in-hand with adequate insurance coverage. While insurance is your first line of defense against liability claims, proper financial planning can provide additional layers of protection for your long-term financial security.

Filing a Personal Injury Claim Under Renters Insurance

When someone is hurt, get them medical help first. Once they’re safe, follow these streamlined steps to protect everyone’s interests and keep the claim moving.

Steps to File a Claim

- Report the incident to your insurer—ideally within 24 hours—using the 24/7 claims line.

- Document the scene: photos of hazards, the injury location, and any property damage.

- Gather statements: names and phone numbers of witnesses; their short written account if possible.

- Collect paperwork: police or medical reports once available. Forward copies to your adjuster.

- Preserve evidence: don’t repair or discard anything until the adjuster authorizes it.

Staying organized and responsive helps the carrier settle legitimate claims quickly—and limits the chance of disputes later.

When Landlord Insurance vs Tenant Insurance Applies

- Common areas & exterior hazards (icy walkways, broken steps) generally fall on the landlord’s policy.

- Inside your unit or hazards you create (spilled water, loose rugs) trigger your renters liability coverage.

- Your lease may shift minor maintenance duties—like replacing smoke-detector batteries—to you. If neglect of those duties causes an injury, expect the claim to land with your policy.

Clear photos, prompt reporting, and knowing these boundaries keep the process simple for everyone involved.

Frequently Asked Questions about Renters Insurance Personal Injury Coverage

Does renters insurance cover personal injury if I’m sued by a guest?

Does renters insurance cover personal injury lawsuits? Absolutely – this is exactly why personal liability coverage exists. When a guest takes legal action after being injured on your rental property, your insurance company handles both the legal defense and any damages you’re found responsible for paying.

Your liability coverage kicks in for common scenarios like guests slipping on wet floors, tripping over loose carpets, or being injured by hazards you should have addressed. The insurance company assigns you an attorney, pays all legal fees, and covers settlements or court judgments up to your policy limits.

Legal defense costs alone can reach $40,000 or more, even if you’re ultimately not found liable. Your policy covers these expenses in addition to any damages awarded, not as part of your coverage limit.

Will my renters insurance cover medical bills if someone gets hurt in my apartment?

Your renters insurance provides two different types of medical coverage for injured guests.

Medical payments to others coverage handles immediate medical expenses regardless of who’s at fault. This no-fault coverage typically pays $1,000 to $5,000 per person for necessary medical care right after an accident. If your dinner guest burns their hand on your oven and needs urgent care, this coverage pays their medical bills without any investigation.

For more serious injuries, your personal liability coverage becomes crucial. When someone requires surgery, extended treatment, or has significant medical bills due to an injury you’re responsible for, liability coverage handles these larger expenses, including medical bills, lost wages, and pain and suffering up to your policy limits.

Does renters insurance cover personal injury claims for dog bites?

Dog bite coverage under renters insurance is generally excellent news for pet owners, but there are important restrictions. Most renters policies do cover dog bite liability, treating these incidents like any other personal injury claim where you’re found responsible.

Your coverage applies whether the bite happens inside your apartment, in common areas, or even during neighborhood walks. If your dog bites a neighbor, mail carrier, or visitor, your personal liability coverage typically handles their medical expenses and legal costs if they sue.

However, breed restrictions can significantly impact your coverage. Many insurance companies exclude certain breeds they consider high-risk, including pit bulls, Rottweilers, German Shepherds, and Doberman Pinschers.

Dog bite claims are among the most expensive personal injury claims, often involving not just immediate medical care but also reconstructive surgery, psychological counseling, and significant pain and suffering damages.

Conclusion

Understanding does renters insurance cover personal injury is essential for protecting yourself from financial disaster when someone gets hurt on your rental property. Your personal liability coverage and medical payments work together like a safety net, catching you when accidents happen and guests need medical care or decide to sue.

Without proper protection, a single slip-and-fall accident could wipe out your savings, garnish your wages, and follow you for years. With renters insurance, these same incidents become manageable claims handled by your insurance company.

Key points to remember: maintain at least $300,000 in liability coverage, understand that your roommates and family members aren’t covered, and be aware of any breed restrictions if you own pets. At just $12-15 per month, renters insurance delivers incredible value compared to the tens of thousands you could face in a personal injury lawsuit.

We’ve walked countless clients through injury claims over the years – from dog bites requiring reconstructive surgery to kitchen fires that spread to neighboring units. The clients with adequate coverage sleep well at night while their insurance company handles the legal details and medical bills. Those without coverage often face years of financial stress and legal complications.

Don’t gamble with your financial future. Review your current renters insurance policy today to ensure you have appropriate personal injury protection. If you’re not sure what coverage you have or whether it’s adequate for your lifestyle, we’re here to help you understand your options.

Your renters insurance works best as part of a complete protection strategy. Consider umbrella insurance for extra liability coverage, keep your personal property coverage up to date, and make sure you understand when your policy applies versus when your landlord’s insurance takes over.

The question isn’t whether you can afford renters insurance – it’s whether you can afford to be without it when someone gets hurt and looks to you for compensation. Contact us at Stanton Insurance Agency to review your coverage and ensure you’re properly protected.

More info about Personal Insurance

Like us on Facebook!