Does homeowners insurance cover personal injury to the homeowner? 5 Crucial Truths for 2025

The Coverage Surprise: Does Homeowners Insurance Cover You?

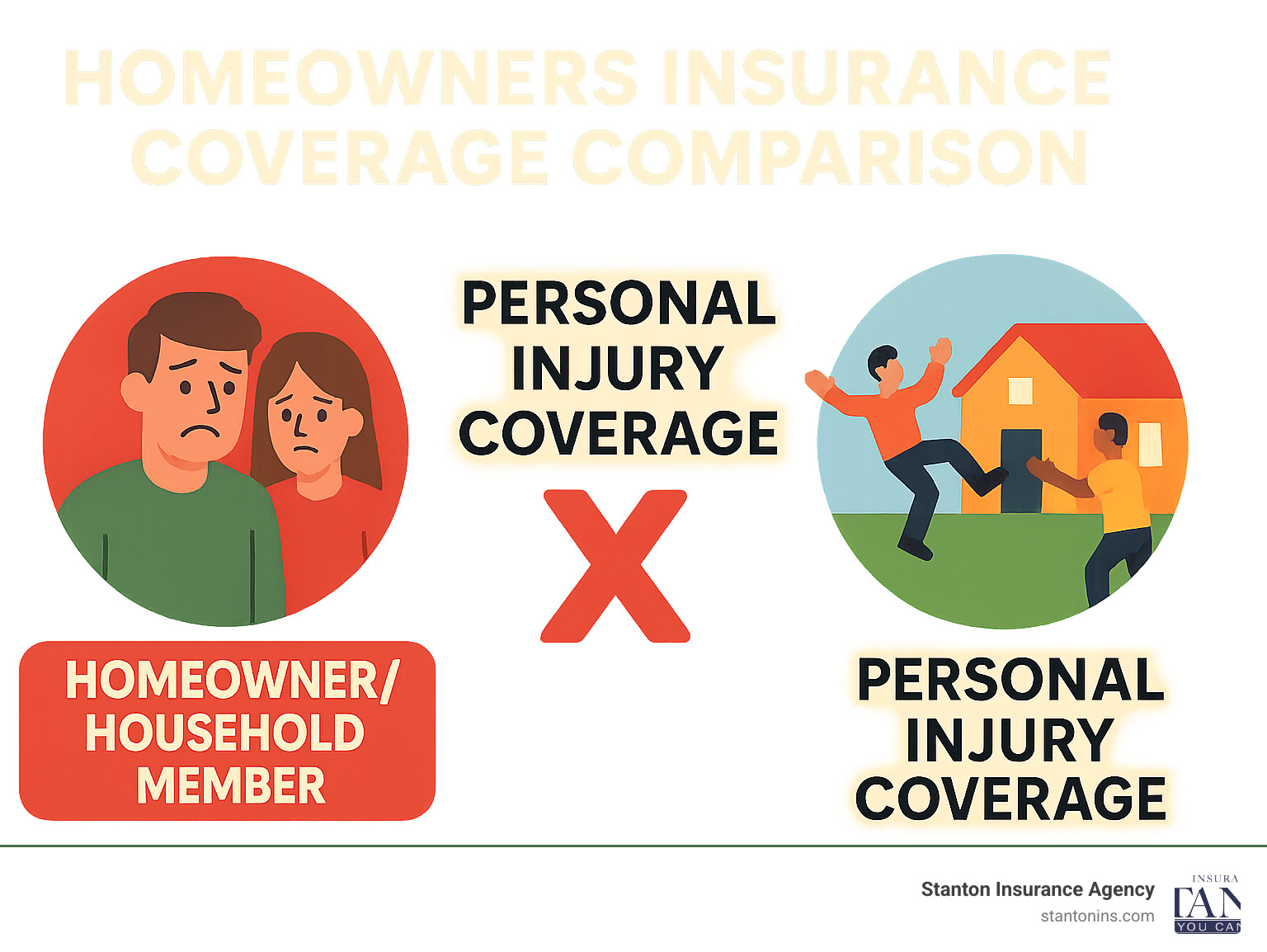

Does homeowners insurance cover personal injury to the homeowner? No, it does not. Standard homeowners insurance policies do not cover injuries to the policyholder or household members. Instead, homeowners insurance is designed to protect you financially when others are injured on your property.

Here’s what you need to know at a glance:

| Who Gets Injured | Covered by Homeowners Insurance? | What Covers It Instead |

|---|---|---|

| Homeowner/Family | ❌ No | Health insurance |

| Guests/Visitors | ✅ Yes (under liability/med-pay) | N/A |

| Service Workers | ✅ Yes (with some exceptions) | Their workers’ comp |

This coverage gap surprises many homeowners who assume their policy protects them comprehensively. While your homeowners insurance includes personal liability coverage that pays for injuries to guests, neighbors, and other visitors, it specifically excludes coverage for you and your family members.

When you’re injured in your own home, your health insurance is your primary protection. The medical payments portion of your homeowners policy—which typically ranges from $1,000 to $5,000—only applies to injuries sustained by others on your property, not to you or household members.

As President of Stanton Insurance in Waltham, Massachusetts, I’ve helped countless homeowners understand the limitations of their policies regarding does homeowners insurance cover personal injury to the homeowner questions, ensuring they have appropriate health insurance coverage to fill this critical gap.

Relevant articles related to does homeowners insurance cover personal injury to the homeowner:

- what is personal liability in home insurance

- what is personal umbrella insurance

- what is personal property insurance

Does Homeowners Insurance Cover Personal Injury to the Homeowner?

Let’s tackle the big question head-on: Does homeowners insurance cover personal injury to the homeowner? Unfortunately, the answer is no. This often comes as a surprise to many of our clients throughout Massachusetts, New Hampshire, and Maine who assume their policy protects them completely.

Your homeowners insurance makes an important distinction between who’s covered for injuries on your property:

When it comes to injuries, your policy distinguishes between first-party and third-party claims. First-party claims involve damage to your own property or belongings, while third-party claims involve injuries or damages to others. For personal injuries specifically, your homeowners insurance only covers third parties—people who don’t live in your home.

This means if your neighbor slips on your icy steps, they’re covered. But if you take the same tumble? You’re not. The same goes for family members living with you—they fall under what insurance companies call the “household member exclusion.”

Why this gap? It’s simple economics. Insurance companies design homeowners policies to protect you from liability claims from others, not to function as health insurance. If they covered the policyholder’s injuries too, your premiums would skyrocket, and the distinction between health insurance and property insurance would disappear.

Personal Liability vs. Personal Injury—Know the Legal Lingo

Insurance terminology can be confusing, especially when terms sound similar but mean very different things. Let’s clear up two commonly confused coverages:

Personal Liability Coverage is the standard protection in your homeowners policy that kicks in when someone else gets physically hurt on your property due to your negligence. Picture this: a delivery person slips on your icy walkway and breaks their arm. Your personal liability coverage would pay for their medical bills, lost wages, and potentially pain and suffering—up to your policy limits.

Personal Injury Coverage, despite its name, typically refers to non-physical injuries like libel, slander, defamation, false arrest, or wrongful eviction. It’s usually an optional add-on to your policy. For example, if someone sues you for making allegedly defamatory comments on social media, this coverage could help with your legal defense costs.

Here’s the crucial part—neither of these coverages applies when you or household members get hurt at home. Your health insurance is what protects you in those situations.

The Fine Print: “Does homeowners insurance cover personal injury to the homeowner” in Plain English

Let’s break down the policy exclusions in everyday language:

The Household Member Exclusion specifically states that bodily injury to you or regular residents of your household isn’t covered. The only exception might be for residence employees like live-in nannies or housekeepers.

Your policy also excludes Intentional Acts—injuries resulting from deliberate actions aren’t covered, whether they happen to you or others. Similarly, any Self-Inflicted Injury, whether intentional or accidental, falls outside your coverage.

Even in the unlikely scenario where there might be some gray area, you’d still need to pay your Policy Deductible before seeing any benefits. And ultimately, if you file a claim for your own injury, you’ll receive a Claim Denial citing these specific exclusions in your policy language.

We’ve seen many clients throughout New England misunderstand these exclusions, only to face disappointment when their claims are denied. That’s why at Stanton Insurance Agency, we always emphasize having robust health insurance alongside your homeowners policy. Your homeowners insurance provides excellent protection against liability for others’ injuries—but when it comes to your own wellbeing, health insurance is your essential safety net.

Who Pays When YOU Get Hurt at Home?

So you’ve taken a tumble down your own stairs or sliced your finger while preparing dinner. Now what? When injuries happen at home, many homeowners are surprised to find they’re on their own financially.

Your health insurance—not your homeowners policy—becomes your financial lifeline in these situations. This distinction matters tremendously, as home accidents aren’t rare occurrences. According to the National Safety Council, Americans suffer approximately 25 million home injuries each year, making this coverage gap something every homeowner should understand.

When you’re injured at home, your health insurance typically covers doctor visits, emergency care, hospital stays, surgeries, medications, and rehabilitation services. However, unlike a guest who might receive compensation from your homeowners policy with few questions asked, you’ll face your health insurance’s usual financial problems: deductibles, copays, coinsurance, and out-of-pocket maximums.

Here’s where things get particularly challenging. Unlike workers’ compensation, which provides wage replacement when you’re injured on the job, your health insurance won’t pay a dime toward your lost income if you can’t work while recovering. That broken ankle from slipping on your kitchen floor? Your health insurance might cover the medical bills (minus your deductible and copays), but you’re on your own for any missed paychecks.

This same reality extends to all household members. If your teenager breaks an arm falling off the backyard trampoline, their health insurance—not your homeowners policy—will be responsible for the medical costs. This holds true even if the exact same accident would have been covered had it been a neighbor’s child instead of your own.

Medical Payments Coverage: Small Bills, Big Confusion

“But what about that Medical Payments coverage on my homeowners policy?” It’s a question we hear often at Stanton Insurance, and it reveals one of the most misunderstood aspects of homeowners insurance.

Medical Payments coverage (often called Med-Pay) seems straightforward: it pays smaller medical bills when someone gets hurt on your property, regardless of fault. It covers immediate needs like ambulance rides, ER visits, and diagnostic tests, typically with limits between $1,000 and $5,000.

The critical detail many homeowners miss? Med-Pay explicitly excludes the policyholder and household members. It’s designed exclusively for guests and visitors to your home.

This exclusion creates situations that can feel deeply unfair. If your neighbor trips on your loose porch step and needs an ambulance, your Med-Pay coverage might handle those costs smoothly. But if you trip on that exact same step? You’ll be paying your health insurance deductible and copays out of pocket.

Can I File Against My Own Policy?—”Does homeowners insurance cover personal injury to the homeowner” revisited

“There must be some exception,” clients often tell us. “What if my water heater explodes and burns me? What if my ceiling collapses on me? Surely my homeowners policy would cover me then?”

The answer remains stubbornly consistent: No, your homeowners insurance will not cover your own injuries at home—even in scenarios involving malfunctioning appliances or structural failures. Your policy might cover the property damage from that burst water heater or collapsed ceiling, but your medical expenses still fall to your health insurance.

In cases involving defective products, you might have a product liability claim against the manufacturer, but that’s separate from your homeowners coverage. And while health insurers sometimes seek reimbursement (subrogation) from responsible parties after paying for your care, they generally cannot subrogate against your own homeowners policy because of those same household member exclusions.

The financial impact of this coverage gap shouldn’t be underestimated. Even with solid health insurance, a serious home injury can be expensive. Emergency room visits average over $1,000, while treating a broken bone can cost anywhere from $2,500 to $15,000 depending on severity and complications, according to healthcare cost studies. Add potential lost wages to that equation, and a home accident can quickly become a financial crisis.

This reality underscores why understanding the question “does homeowners insurance cover personal injury to the homeowner” is so important—and why having comprehensive health insurance is an essential companion to your homeowners policy.

For more detailed scientific research on home injuries and their impacts, you can review the National Library of Medicine’s comprehensive study on home injuries.

Coverage Gaps, Exclusions & Common Misconceptions

Your homeowners insurance has more holes than Swiss cheese when it comes to certain situations—and understanding these gaps might save you from a financial disaster down the road.

Let’s talk about those four-legged family members first. Many homeowners are shocked to find that certain dog breeds might be completely excluded from their policy. If you own a Rottweiler, pit bull, or German shepherd, your insurer might refuse to cover any injuries they cause—leaving you personally responsible for medical bills that could easily reach tens of thousands of dollars. Each company has different rules about this, which is why we always discuss pet ownership during our policy reviews.

Running a side business from your dining room table? That creates another potential coverage gap. If a client visits your home office and trips over your computer cord, your standard homeowners policy likely won’t help. The insurance company will point to the business exclusion and deny the claim. You’d need either a home business endorsement or a separate business policy to close this gap.

Those backyard fun zones can become insurance nightmares too. Trampolines and swimming pools—what insurance folks call “attractive nuisances”—often trigger special exclusions or requirements. Some policies flat-out refuse to cover trampoline injuries, while others require specific safety measures like nets or fences. I’ve seen families devastated when they find too late that their backyard toys aren’t covered.

And don’t forget about contractors! If you hire someone to fix your roof or remodel your bathroom and they don’t have their own insurance, guess who might be responsible if they fall? That’s right—you. Always verify that any worker on your property has appropriate coverage before they start.

You can learn more about these liability concerns on our detailed page about personal liability in home insurance.

Typical Injuries That ARE Covered—for Guests, Not You

The irony of homeowners insurance is that it covers almost any accidental injury to your guests while covering virtually none of your own. This is where the answer to “does homeowners insurance cover personal injury to the homeowner” becomes painfully clear.

When your neighbor slips on your freshly mopped kitchen floor and fractures their wrist, your liability coverage springs into action—covering their medical bills, lost wages, and even pain and suffering if you’re found negligent. But if you slip on that same floor ten minutes later? You’re on your own.

The same applies to other common household accidents. A bookshelf tips over onto your dinner guest? Covered. That same bookshelf falls on you while you’re dusting? Not covered. Your friend’s child nearly drowns in your pool? Your policy responds. Your own child has the same accident? That’s what your health insurance is for.

Even something as simple as a kitchen accident follows this pattern. If a guest cuts their hand on a broken glass or burns themselves on your stove, their injuries would typically be covered. But identical injuries to you or your family members won’t trigger a dime of homeowners coverage.

This stark contrast highlights why having robust health insurance alongside your homeowners policy is absolutely essential for comprehensive protection.

Exceptions That Can Sink a Claim

Even when your policy should theoretically cover an injury to someone else, certain circumstances can leave you holding the bill. These exceptions affect third-party claims and are worth understanding before an accident happens.

Criminal activity is a universal deal-breaker. If someone gets hurt during or because of illegal activity on your property, don’t expect your insurance to help. This applies whether the criminal act was committed by you, your guest, or anyone else involved.

Time matters too. I’ve seen valid claims denied simply because the homeowner waited too long to report the incident. Most policies require notification “as soon as practicable”—insurance-speak for “right away.” If you wait weeks or months to report an injury, the company may legally refuse coverage.

Policy lapses create another dangerous gap. If you missed a payment and your coverage was suspended, any incidents during that period are completely unprotected. I’ve had the heartbreaking conversation with homeowners who were just three days late on their payment when a major accident occurred.

And remember those breed restrictions we mentioned? They’re not just fine print—they’re enforced. If your German shepherd bites the mail carrier and your policy excludes that breed, you could be personally liable for the entire claim.

Finally, intentional harm is never covered. Insurance is designed for accidents, not deliberate actions. If you intentionally cause injury to another person, you’re on your own legally and financially.

At Stanton Insurance Agency, we’ve guided countless clients through these complex exclusions across Massachusetts, New Hampshire, and Maine. We believe that knowing what isn’t covered is just as crucial as understanding what is. After all, surprises are great for birthday parties—not for insurance claims.

Boosting Your Protection Beyond Standard Limits

So we’ve established that does homeowners insurance cover personal injury to the homeowner? No, it doesn’t. But that doesn’t mean you should ignore your liability coverage limits—quite the opposite, actually.

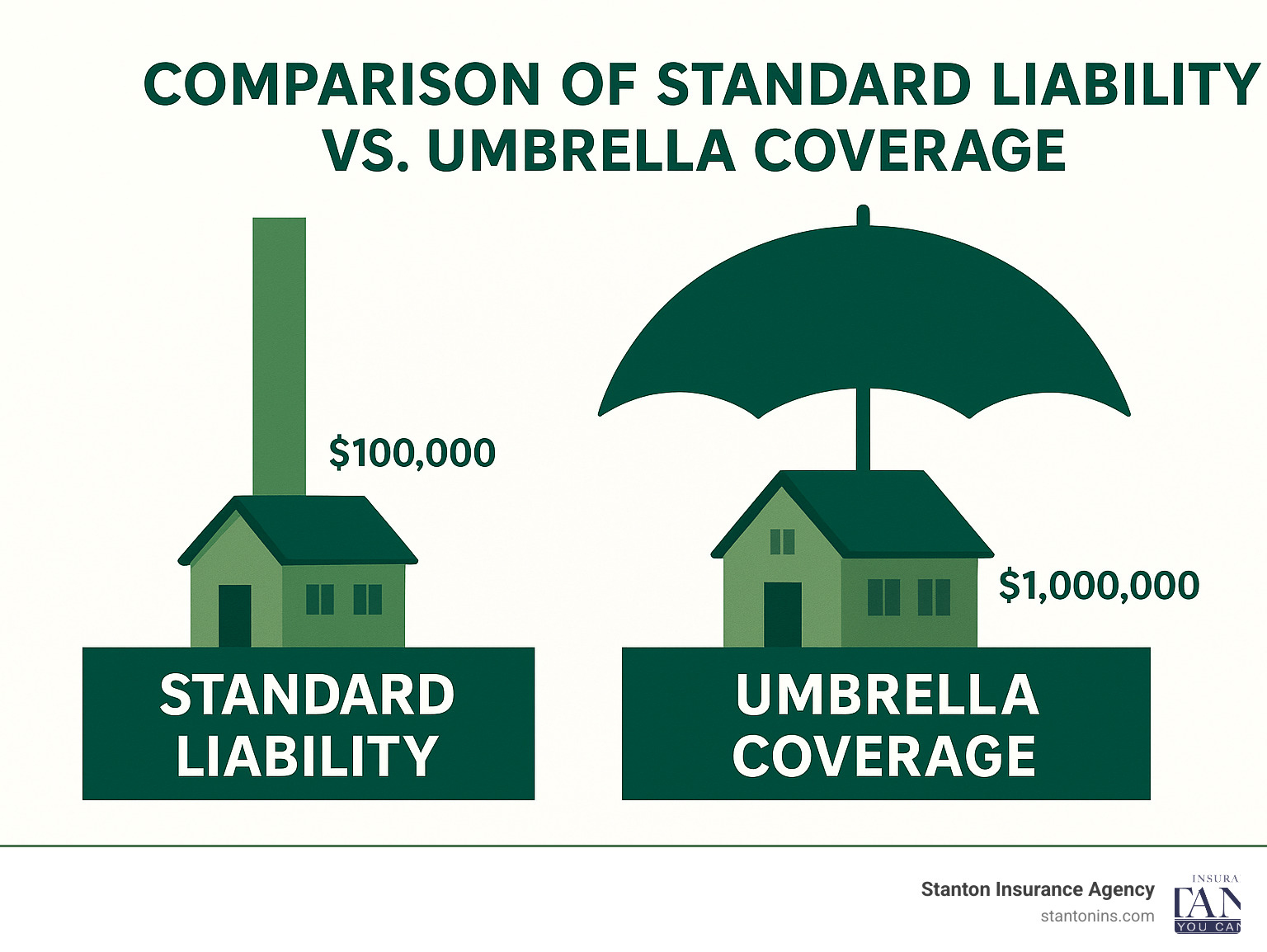

Most standard homeowners policies come with about $100,000 in personal liability protection. That might sound like a lot until you consider today’s medical costs and our increasingly lawsuit-happy society. A serious injury on your property could easily exceed that amount, leaving your personal assets exposed.

Here at Stanton Insurance, we typically recommend our New England homeowners carry at least $300,000 to $500,000 in liability coverage. And for clients with substantial assets to protect? We often suggest bumping that protection to $1 million or more. Think of it as a financial shield around your home and future.

You have two main options to beef up your protection:

First, you can simply increase your base homeowners liability limits. Moving from $100,000 to $300,000 or $500,000 often costs surprisingly little—maybe just $20-40 more per year. That’s less than a fancy coffee each month for significantly better protection.

Second, you might consider adding a personal umbrella policy. These policies provide extra liability coverage that kicks in after your homeowners policy reaches its limits. They typically start at $1 million in coverage and can be remarkably affordable for the protection they offer.

Here’s how base liability and umbrella coverage stack up:

| Feature | Base Liability Coverage | Umbrella Coverage |

|---|---|---|

| Starting limits | $100,000 | $1,000,000 |

| Cost per $100,000 | ~$10-20 annually | ~$15-30 annually for first $1M |

| Coverage scope | Limited to policy perils | Broader coverage |

| Defense costs | Included within limits | Often separate from limits |

| Off-premises coverage | Limited | More comprehensive |

While liability claims aren’t the most common type—making up less than 3% of all homeowners claims—they can be financially devastating when they do occur. The average liability claim runs over $22,000, and serious cases can easily reach six or seven figures.

Smart Upgrades & Endorsements

Beyond simply increasing your liability limits, there are some clever ways to improve your protection with targeted policy endorsements.

A personal offense endorsement is one of my favorites to recommend. For just a few dollars per year, it covers non-physical injuries like libel, slander, and defamation. In our social media-obsessed world, where a thoughtless post can lead to serious legal trouble, this protection is more valuable than ever.

You might also consider higher medical payments coverage. Standard Med-Pay limits of $1,000 to $5,000 can be increased to $10,000 or more. This coverage is fantastic because it allows you to quickly take care of a guest’s medical bills without triggering a liability claim or determining fault—potentially avoiding a lawsuit altogether.

For homeowners with specific risk factors like pools, trampolines, or certain dog breeds, ask us about scheduled risk coverage. These endorsements can specifically address high-risk features of your property rather than excluding them entirely from your policy.

While we can’t change the fundamental fact that homeowners insurance doesn’t cover personal injury to the homeowner, we at Stanton Insurance Agency can make sure you have optimal protection for everything your policy does cover. After all, smart coverage isn’t just about what happens to you—it’s about protecting your financial future from what might happen to others on your property.

For more detailed information about umbrella coverage, check out our guide on what is umbrella insurance.

How to Respond & File a Claim After Any Injury at Home

The moments after an injury at home can be chaotic and stressful. Whether it’s you nursing a sprained ankle or a guest who took an unfortunate tumble down your stairs, knowing exactly what to do can make all the difference—both for recovery and financial protection.

When you or a family member gets hurt at home, your health insurance—not homeowners insurance—will be your financial safety net. Start by getting appropriate medical care right away. Once the immediate medical needs are addressed, take some time to document what happened with photos and notes. These records may prove valuable when dealing with your health insurance company later.

Keep track of all your medical bills, treatment plans, and communications with healthcare providers. These detailed records will help ensure you receive all the benefits you’re entitled to under your health policy.

For guest injuries, the process looks quite different, as your homeowners insurance does come into play:

First, help the injured person and call emergency services if needed—safety always comes first. While waiting for help to arrive, discreetly document the scene with photos if possible. This isn’t about avoiding responsibility; it’s about having an accurate record of conditions at the time of the accident.

Notify your homeowners insurance company promptly—ideally within 24-48 hours. Insurance policies require timely notification, and delays can jeopardize coverage. When describing what happened, stick to the facts without admitting fault or making promises about compensation.

For serious incidents, consider sending your claim notification via certified mail. This creates a paper trail proving you reported the incident in a timely manner, which can be crucial if disputes arise later.

Your homeowners policy typically provides two important protections when guests are injured: Medical Payments coverage for immediate medical expenses regardless of fault, and Liability coverage plus legal defense if you’re sued—even if the lawsuit turns out to be groundless.

Step-by-Step Claim Checklist

When someone else gets hurt on your property and you need to file a homeowners insurance claim, follow these essential steps:

- Seek immediate medical care for the injured person

- Document everything about the accident scene with photos and notes

- Contact your insurance agent or company to report what happened

- Complete all required claim forms thoroughly and submit them promptly

- Keep copies of all documents and maintain a log of every conversation related to the claim

Throughout the process, cooperate fully with your insurance company’s investigation while protecting your interests. If at any point you receive legal papers or the claim is denied, consider consulting an attorney right away.

At Stanton Insurance Agency, we’ve guided countless homeowners through this exact process across Massachusetts, New Hampshire, and Maine. We believe in being there for our clients during these stressful situations, serving as advocates to ensure claims are handled fairly and efficiently.

What to Do If Someone Else Is Hurt—Protecting Yourself Legally

As a homeowner, you have what the legal world calls a “duty of care” to maintain reasonably safe conditions for visitors. This doesn’t mean your home must be perfectly hazard-free, but you should address known dangers and warn guests about risks that aren’t obvious.

If someone is injured on your property, resist the natural urge to apologize profusely or promise to pay for everything. While kindness is important, statements like “It’s all my fault” or “I’ll cover all your bills” could be interpreted as admissions of liability later.

Contact your insurance company immediately, even if the injury seems minor. Small issues can sometimes develop into more serious conditions days or weeks later. Your insurance provider needs to know about potential claims as soon as possible.

Be careful about giving recorded statements without guidance, and consider consulting an attorney if the injury is serious or if you receive legal threats. Document everything about your property’s condition at the time of the incident—this information could be crucial for your defense.

If a claim moves to settlement negotiations, let your insurance company handle the process—that’s what you pay them for. Settlements typically include a release of liability, protecting you from future claims related to the same incident. The process can take time, especially for serious injuries, so patience is important.

According to research published in the National Library of Medicine, home injuries account for millions of emergency room visits each year. Understanding the proper response to these incidents isn’t just about insurance—it’s about protecting your financial future. A judgment lien resulting from an inadequately insured home injury can affect your property and assets for years.

For more information about judgment liens and their potential impact on homeowners, you can visit Nolo’s legal encyclopedia on judgment liens.

At Stanton Insurance Agency, we don’t just sell policies—we help you steer the complexities of what happens after an injury occurs. Our team is committed to ensuring you have both the coverage you need before an accident and the support you deserve afterward.

Frequently Asked Questions about Personal Injury & Homeowners Insurance

Does homeowners insurance ever pay my own medical bills?

The short answer? No. Standard homeowners insurance policies simply don’t cover medical bills for you or your family members living in the home. This isn’t a quirk of certain policies—it’s an industry-wide standard that applies even when your injury results from something typically covered, like a house fire or storm damage.

Your health insurance is your financial lifeline when you’re injured at home. I’ve had clients express genuine surprise at this gap, especially after diligently paying homeowners premiums for years.

There is one tiny exception worth mentioning: if you employ full-time residential staff like a live-in nanny who doesn’t qualify as a “household member,” they might be covered for work-related injuries in your home. That said, workers’ compensation insurance is usually the more appropriate coverage for domestic employees. When in doubt, it’s always best to ask us directly about your specific situation.

What injuries to guests are almost always excluded?

While your homeowners policy offers substantial protection when guests get hurt on your property, certain scenarios fall outside that safety net. Understanding these exclusions helps prevent unpleasant surprises when you need coverage most.

Intentional acts aren’t covered—if you deliberately cause harm to someone, don’t expect your insurance to bail you out. Similarly, injuries connected to business activities in your home typically fall outside standard coverage. That pottery studio in your basement where customers visit? Those risks require business insurance.

Certain pets can create coverage issues too. Many policies exclude specific dog breeds or animals with a history of aggression. I’ve seen heartbreaking situations where homeowners finded this exclusion only after an incident occurred.

Other common exclusions include injuries during illegal activities, harm from high-risk features like trampolines or pools (unless specifically endorsed), communicable disease transmission, and damage from certain natural disasters like floods or earthquakes unless you’ve purchased specific coverage.

Each of these exclusions represents a potential gap in your liability protection. At Stanton Insurance, we help you identify these vulnerabilities and find solutions before problems arise.

How much liability coverage should a typical homeowner carry?

I generally recommend carrying liability limits at least equal to your net worth, with a minimum of $300,000 to $500,000 even if your assets are modest. For many of our clients across Massachusetts, New Hampshire, and Maine, adding a $1 million umbrella policy provides the right level of protection.

When determining your ideal liability coverage, consider what you have to lose. Your home equity, retirement accounts, investments, and even future earnings could be at risk in a serious liability claim. Think about:

Your total assets – everything you’ve worked hard to build and could potentially lose in a lawsuit.

Property features that increase risk – pools, trampolines, fire pits, and other attractions that might lead to injuries.

Your social patterns – frequent entertaining, large gatherings, or regular visitors increase your exposure.

Pets – dogs in particular can increase liability risk, regardless of how well-behaved they are.

Teenage drivers in your household benefit from umbrella policies, which extend to auto liability as well.

Here’s the good news: increasing your liability protection is surprisingly affordable. Adding $100,000 in coverage to your base policy typically costs just $10-20 per year. A $1 million umbrella policy usually runs about $150-300 annually—that’s less than a dollar a day for significant peace of mind.

I’ve seen how proper liability coverage has protected families from financial devastation after unexpected accidents. While we can’t prevent life’s mishaps, we can certainly help you prepare for them. Does homeowners insurance cover personal injury to the homeowner? No—but we can help ensure you’re protected in virtually every other scenario.

Conclusion

Let’s face it—finding that homeowners insurance does not cover personal injury to the homeowner can feel like finding a hole in your safety net. But knowledge is power, and understanding this limitation is your first step toward creating truly comprehensive protection for your family and everything you’ve worked for.

Your homeowners policy shines when it comes to protecting you from liability when guests get injured on your property. That neighbor who slipped on your icy steps? Covered. The delivery person who tripped over your garden hose? Protected. But when it comes to your own tumbles and mishaps, your health insurance must step in to save the day.

At Stanton Insurance Agency, we’ve guided countless homeowners throughout Massachusetts, New Hampshire, and Maine through this exact realization. We believe in building protection that works in layers—like a well-designed winter outfit in New England—with each piece serving its purpose.

The most effective protection strategy combines several key elements:

First, maintain robust health insurance with manageable deductibles and out-of-pocket maximums. When you take that unexpected tumble down your own stairs, this is your financial first line of defense.

Second, ensure your homeowners policy includes adequate liability limits—we typically recommend at least $300,000 to $500,000, depending on your specific situation. This protects your assets if someone else gets hurt on your property.

Third, consider an umbrella policy that extends your protection to $1 million or more. For about the cost of a monthly pizza night, you can dramatically increase your safety margin against major liability claims.

Finally, be prepared to act quickly and document thoroughly if any injury occurs, whether to you or a visitor. Those first hours matter tremendously for both medical outcomes and claim processes.

We understand that insurance isn’t exactly the most thrilling topic around the dinner table. But at Stanton Insurance, we work hard to make protecting your home and family as straightforward as possible. When life throws its inevitable curveballs—whether they hit you or your guests—having the right protection in place brings invaluable peace of mind.

We’re here to help you steer the sometimes confusing world of insurance coverage and ensure that when home sweet home occasionally turns into home ouch home, you’re prepared for whatever comes next.

For more information about our complete range of personal insurance options, visit our personal insurance page.