Directors and Officers Liability Insurance Explained Top 1

What is Directors and Officers (D&O) Liability Insurance?

Understanding directors and officers liability insurance explained is crucial for any business leader. This specialized insurance protects company leaders from personal financial loss if they are sued for decisions made in their role. In simple terms, D&O insurance covers legal defense costs, settlements, and judgments, shielding the personal assets of those who manage a company.

Company leaders make high-stakes decisions daily that can lead to lawsuits from employees, customers, or investors. Defending against these claims is expensive, even if they are baseless. For example, a 2023 risk survey from a leading insurer found that over a quarter of private companies experienced a D&O loss in the prior three years, with the vast majority suffering a significant financial impact.

D&O insurance protects the personal assets of leaders, from their homes to their savings, giving them the confidence to make tough choices without fear of personal financial ruin. As Adam Rauscher, Vice President of Insurance Services at Merit Financial Advisors, noted, “Lawsuits happen even in some cases which are questionable.”

I’m Geoff Stanton, President at Stanton Insurance. With over two decades of experience in commercial liability, I’ve seen how vital D&O insurance is for businesses of all sizes. My goal is to help you understand this essential protection.

Simple guide to directors and officers liability insurance explained terms:

- director and officer liability insurance cost

- d&o insurance coverage

- is director and officer’s insurance included in general liability

What is Directors and Officers (D&O) Liability Insurance?

Stepping into a leadership role means accepting significant personal risk. Directors and officers liability insurance explained simply is a safety net for your personal assets. When leaders make decisions that result in lawsuits, D&O insurance is designed to protect the personal finances of directors, officers, and board members against claims of wrongful acts.

This comprehensive coverage includes legal defense costs, settlements, and judgments. It’s also essential for attracting and retaining top talent, as few would serve on a board if their personal savings were at risk. At its core, D&O insurance is a financial shield. Even if you are cleared of wrongdoing, the legal fees can be astronomical. D&O coverage shoulders these burdens, ensuring your personal finances are not wiped out by a professional dispute.

Learn more about comprehensive management liability insurance.

For an independent overview of this protection, see Investopedias explanation of D&O liability insurance.

Why D&O Insurance is Crucial for Every Company

It’s a common misconception that only large public corporations need D&O insurance. The reality is that D&O claims can have a significant financial impact on businesses of all sizes, including private companies and nonprofits. Whether you’re a startup in New Hampshire, a family business in Massachusetts, or a nonprofit in Maine, your leaders face real exposure.

Today’s business environment is complex. Cyber incidents, changing regulations, and social tensions create new liabilities. Any of these can trigger allegations of mismanagement or poor oversight—all potential grounds for a D&O lawsuit. For smaller businesses, a single D&O lawsuit could be devastating, affecting the entire organization’s future.

Beyond financial protection, D&O insurance is crucial for attracting and retaining qualified leadership. Top talent seeks assurance that their personal assets are not on the line for business decisions. This coverage provides that peace of mind, making it easier to recruit experienced leaders.

More information about directors and officers liability insurance coverage.

Who is at Risk? The Scope of D&O Liability

The reach of D&O liability is broad, extending to directors, officers, board members, executives, and sometimes their spouses and estates. This protection covers past, present, and future leaders, meaning they could face lawsuits related to their tenure even after leaving the company.

The exposure affects organizations across all sectors, including public and private companies, nonprofits, and startups. Claims can come from many sources:

- Shareholders and investors might allege financial misrepresentation.

- Employees could file claims related to wrongful termination or discrimination.

- Customers and business partners might sue over contractual disputes.

- Competitors can allege unfair competition.

- Regulatory bodies may investigate and penalize for non-compliance.

- The company itself can sue its directors, especially in bankruptcy scenarios.

The evolving landscape of risks, from cybersecurity to global events, underscores why robust D&O protection is essential for all organizations.

For nonprofit organizations specifically, learn more about D&O insurance for nonprofits.

Directors and Officers Liability Insurance Explained: What’s Covered

Understanding what directors and officers liability insurance explained actually covers is simple: it protects against financial losses from management decisions. While general liability covers physical incidents like a slip-and-fall, D&O covers claims that leadership made a poor decision that cost someone money. It’s essentially “management errors and omissions” coverage.

Details: https://stantonins.com/director-and-officer-liability-insurance-coverage/

The policy provides four main financial protections. Defense costs are often the largest expense, as even baseless lawsuits are expensive to fight. Settlements are also covered, as many D&O cases are resolved out of court. If a case goes to trial and results in a judgment, the policy covers that as well. Finally, certain fines and penalties may be covered where legally permissible.

Specific Claims Covered by D&O Policies

D&O coverage is broad and can be triggered by various claims:

- Misrepresentation to investors: Especially common for companies seeking funding, but private companies also face this risk.

- Failure to comply with regulations: Directors can be personally liable for failures to comply with securities, environmental, or data privacy laws.

- Employment practices and HR issues: Claims of wrongful termination or discrimination against senior leadership can trigger D&O policies.

- Customer and business partner disputes: Lawsuits alleging misrepresentation or breach of fiduciary duty by leadership.

- Oversight failures, including cybersecurity: Directors face liability for failing to implement adequate cybersecurity measures.

- Disputes from mergers and acquisitions (M&A): M&A activity is a high-risk period, generating claims of inadequate due diligence or mismanagement.

See more: https://stantonins.com/directors-and-officers-liability-insurance-explained/

Common D&O Policy Exclusions

While comprehensive, D&O policies have standard exclusions. Understanding what is not covered is crucial.

- Fraudulent or criminal acts: Insurance does not protect against deliberate illegal behavior.

- Illegal personal profit: Excludes coverage when leaders improperly enrich themselves.

- Bodily injury and property damage: These are covered by general liability insurance.

- Prior and pending litigation: Claims you knew about before the policy began are not covered.

- Insured vs. Insured claims: Excludes coverage for internal disputes between members of the management team.

- Pollution and environmental damage: These require separate, specialized environmental liability policies.

These exclusions keep D&O insurance focused on its core purpose: protecting leadership from the financial consequences of alleged wrongful acts committed in good faith.

Understanding the Three Pillars of D&O: Side A, Side B, and Side C Coverage

Think of D&O insurance as a shield with three parts, known as “sides.” Understanding these sides is key to grasping the full scope of directors and officers liability insurance explained, as they clarify who is protected and under what circumstances.

Side A: Protecting Directors and Officers Directly

Side A coverage safeguards the personal assets of individual directors and officers. It applies when the company cannot legally or financially indemnify them for their legal costs, settlements, or judgments. This can happen if the company is insolvent, or if laws or company bylaws prohibit indemnification (often the case in shareholder derivative suits). Side A coverage pays the individual leader directly, acting as a personal financial shield. This dedicated protection is a primary reason D&O insurance is vital for attracting top talent.

Side B: Reimbursing the Company

Side B is often called “company reimbursement” coverage. In most D&O claims, the company first pays the legal defense costs and any settlements for its directors and officers, as it is usually obligated to do. Side B of the D&O policy then reimburses the company for those payments. This is the most frequently used part of a D&O policy, as it protects the company’s balance sheet from the significant financial burden of defending its leaders.

Side C: Protecting the Company Itself (Entity Coverage)

Side C, or “entity coverage,” provides direct protection to the company itself when it is named as a defendant in a lawsuit alongside its directors. This is particularly important for publicly traded companies facing securities-related lawsuits. For example, if shareholders sue a public company for misleading statements, Side C would cover the company’s legal defense and settlement costs. Many private companies also purchase entity coverage for other types of claims.

Together, Side A, Side B, and Side C create a comprehensive safety net, protecting individual leaders, reimbursing the company, and directly shielding the corporate entity.

How D&O Insurance Works and What It Costs

Now that you know what D&O insurance is, let’s explore how it works and what it costs. D&O policies have unique features that set them apart from other types of business insurance.

Want to dive deeper into the financial side? Learn more: https://stantonins.com/directors-and-officers-insurance-cost/

Key Operational Features of a D&O Policy

D&O policies have several distinct characteristics:

- Claims-Made Coverage: The policy covers claims that are made against you and reported to the insurer during the policy period. This differs from “occurrence-based” policies. If you cancel your D&O policy, you are generally not covered for future claims related to past actions unless you purchase an extension.

- Reimbursement Model: Many D&O policies require you to hire your own legal team and manage your defense. The insurer then reimburses you for approved legal costs, rather than managing the defense for you.

- Shrinking Limits: This is a critical feature. The money spent on legal defense reduces the total policy limit available for settlements or judgments. For example, a $1 million policy with $300,000 in legal fees leaves only $700,000 for a potential settlement.

- Prior Acts Coverage: Most policies cover “wrongful acts” that occurred before your policy began, as long as you were unaware of any potential claim at the time.

- Extended Reporting Period (ERP): Also known as “tail coverage,” an ERP can be purchased when a policy is canceled. It extends the time you have to report claims for wrongful acts that occurred before the policy expired.

Curious about other types of business protection? Explore other liability insurance types: https://stantonins.com/business-liability-insurance/

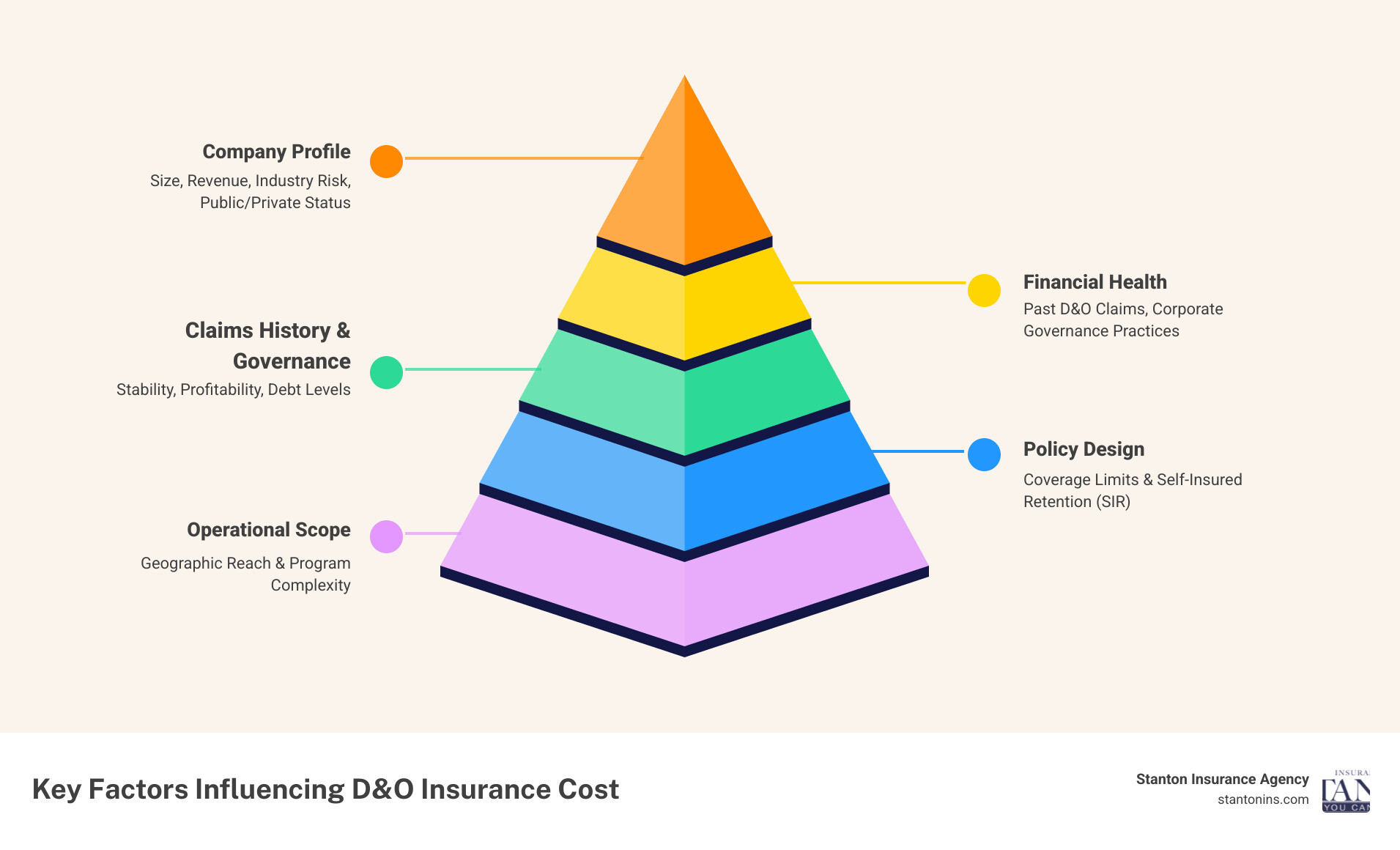

Factors That Influence the Cost of D&O Insurance

The cost of directors and officers liability insurance explained varies significantly. While the median cost for small businesses is often around $1,240 annually, this is just an average. Your premium depends on several risk factors:

- Company Size and Revenue: Larger companies with higher revenue generally have more exposure and pay higher premiums.

- Industry Risk Profile: Highly regulated or litigious industries, like biotech or financial services, typically face higher costs.

- Public vs. Private Status: Public companies pay more due to the risk of securities litigation, though private companies still face significant D&O exposures.

- Financial Health: A strong, stable financial position can signal lower risk and lead to better rates.

- Claims History: A history of D&O claims will likely increase your premium.

- Corporate Governance: Strong internal controls and board practices can be viewed favorably by insurers.

- Coverage Limits and Deductible: Higher limits increase the premium. D&O policies use a Self-Insured Retention (SIR), which is the amount you pay before insurance kicks in. A higher SIR can lower your premium.

- Geographic Reach: Operating internationally, especially in complex legal environments, can increase risk and cost.

Frequently Asked Questions about D&O Insurance

We often get questions from our clients in Massachusetts, New Hampshire, and Maine about D&O insurance. Here are answers to some of the most common questions we hear to make directors and officers liability insurance explained easy to understand.

Is D&O insurance the same as general liability insurance?

No, they are very different. They protect against distinct risks and are not interchangeable.

- General Liability (GL) insurance covers physical risks, such as bodily injury to a customer or property damage caused by your business operations.

- Directors & Officers (D&O) insurance covers financial losses resulting from managerial decisions and alleged “wrongful acts” by company leaders. It protects their personal assets from claims of negligence, breach of duty, or misstatements.

While both are vital, they cover completely separate types of claims. You need both for comprehensive protection.

Learn more about why they’re distinct: https://stantonins.com/is-director-and-officers-insurance-included-in-general-liability/

Do non-profits need D&O insurance?

Yes, absolutely. It’s a common misconception that non-profits are immune to lawsuits. Their board members are held to similar legal standards as for-profit directors and can be sued for mismanagement of funds, failure to oversee programs, or employment-related issues.

D&O insurance is crucial for non-profits to protect the personal assets of board members who volunteer their time and expertise. It also makes it much easier to attract and retain qualified people to serve on your board, as they won’t have to risk their personal savings to support a good cause.

Dive deeper into insurance for non-profits here: https://stantonins.com/insurance-for-nonprofit-organizations/

What is the difference between D&O and Employment Practices Liability Insurance (EPLI)?

These are both management liability policies, but they cover different risks.

- D&O insurance primarily covers claims related to the overall management decisions and fiduciary duties of leaders, often brought by external parties like investors or regulators.

- EPLI is laser-focused on claims from employees (past, present, or potential) regarding employment issues. This includes wrongful termination, discrimination, sexual harassment, and other workplace disputes.

While there can be some overlap, EPLI is the dedicated policy for employment-related risks. It is best practice to have both D&O and EPLI policies to ensure robust protection.

Get more details on EPLI: https://stantonins.com/what-is-employment-practices-liability-insurance/

Secure Your Leadership and Your Company’s Future

After exploring what directors and officers liability insurance explained truly means, it’s clear that protecting your leaders is essential for stable growth and good governance. D&O coverage is a strategic tool that safeguards the personal assets of your directors and officers, empowers them to make confident decisions, and shields your company’s finances from potentially devastating lawsuits. In today’s business environment, it is a fundamental part of any robust risk management program.

We know D&O insurance can feel overwhelming. At Stanton Insurance Agency, we are dedicated to simplifying this process for our clients across Massachusetts, New Hampshire, and Maine. We provide trusted protection for your most valuable assets: your people and your business.

Partnering with an experienced advisor makes all the difference. The expert team at Stanton Insurance Agency is ready to help you assess your unique risks and tailor a D&O policy that provides the security your leadership team deserves. Whether you’re a small business, a growing startup, or an established organization, we can find a policy that fits your specific needs.

Ready to secure your leadership and fortify your company’s future? Contact us today to learn more about our Business Liability Insurance solutions.