Directors and Officers Liability Insurance: 2025 Ultimate Guide

Why Every Organization with a Board Needs Protection

Directors and Officers Liability Insurance protects the personal assets of corporate leaders when they face lawsuits for their management decisions. This coverage shields both individuals and organizations from potentially devastating financial losses.

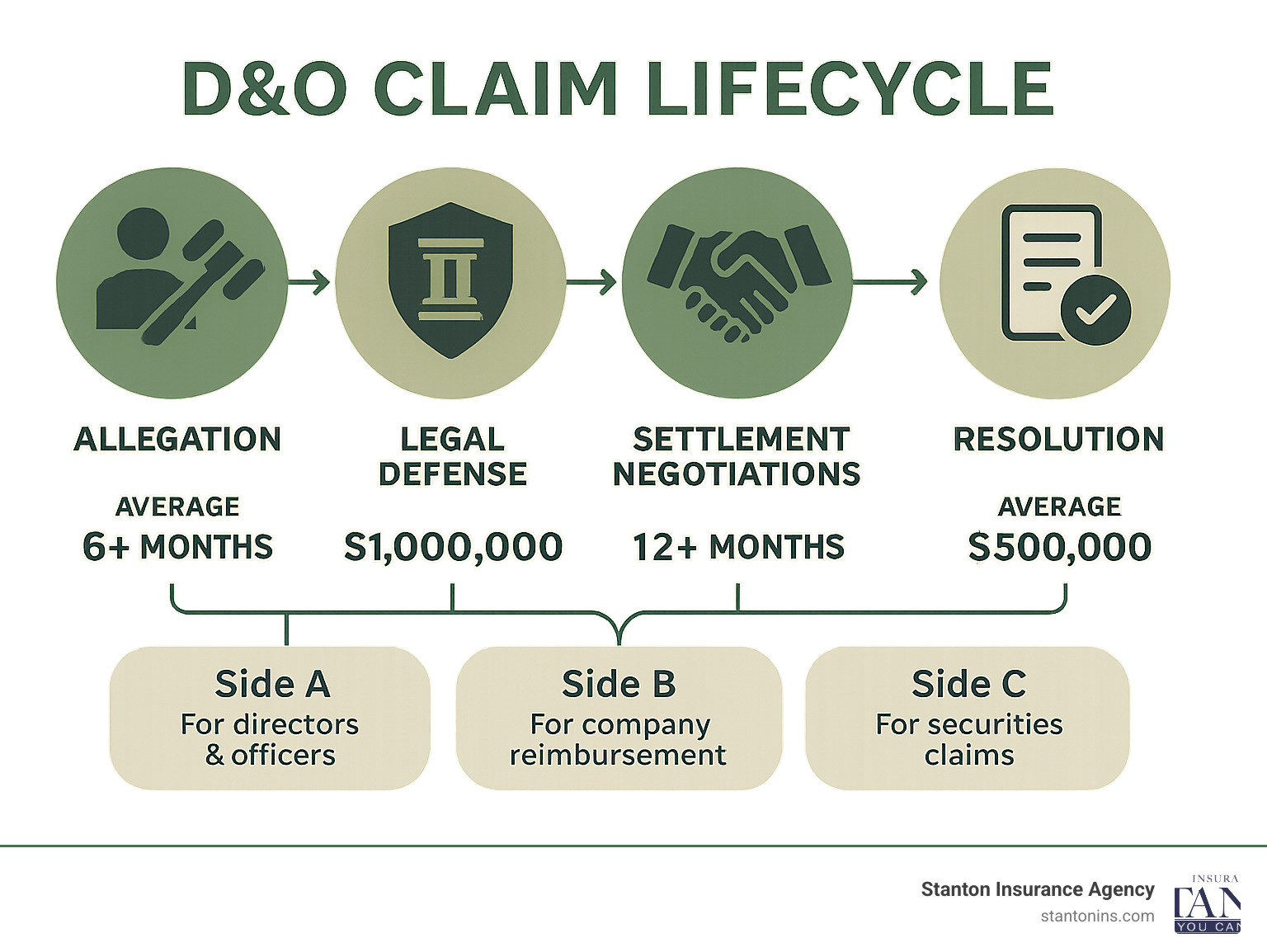

Key Coverage Areas:

- Side A: Direct protection for directors and officers when the company cannot indemnify

- Side B: Reimbursement to the company when it indemnifies its leaders

- Side C: Coverage for the organization itself in securities claims

- Common Claims: Employment practices violations, breach of fiduciary duty, mismanagement allegations

- Average Costs: Median annual premium of $1,240, with claims averaging $35,000 to settle

The statistics are sobering. Research shows that more than 25% of private companies reported a D&O loss over three years, with 96% experiencing negative financial impacts. Perhaps most surprising: nonprofit organizations file twice as many D&O claims as public and private companies combined.

Consider this real-world example: A museum faced over $260,000 in defense costs and damages after incorrectly advertising artists’ work without permission. Meanwhile, a nonprofit president’s alleged misuse of grant funds led to more than $300,000 in defense costs alone.

“You can’t afford not to have D&O coverage,” as industry experts frequently warn. Without proper protection, directors and officers risk their personal assets – including homes, savings, and retirement funds – to cover legal defense costs that can easily reach six figures.

Learn more about Directors and Officers Liability Insurance:

- management liability insurance

- insurance for nonprofit organizations

- is director and officer’s insurance included in general liability

What Is Directors and Officers Liability Insurance?

Picture this: You’re serving on a nonprofit board, making decisions you believe are in the organization’s best interest. Then a lawsuit lands on your doorstep, claiming your decisions caused financial harm. Without Directors and Officers Liability Insurance, your personal savings, your home, and your retirement funds could all be at risk.

Directors and Officers Liability Insurance is specialized coverage that steps in when corporate leaders face lawsuits for their management decisions. Think of it as a financial shield that covers legal defense costs, settlements, and judgments when someone claims you made a “wrongful act” while serving in a leadership role.

What exactly counts as a wrongful act? Breach of fiduciary duty tops the list – this happens when someone claims you didn’t act in the organization’s best interest. Misrepresentation of company assets is another common allegation, along with failure to comply with workplace laws and misuse of company funds.

Even seemingly minor decisions can trigger major lawsuits. Poor corporate governance choices, regulatory violations, and employment-related disputes all fall under the D&O umbrella. The scary part? You don’t have to be guilty of anything to face these claims.

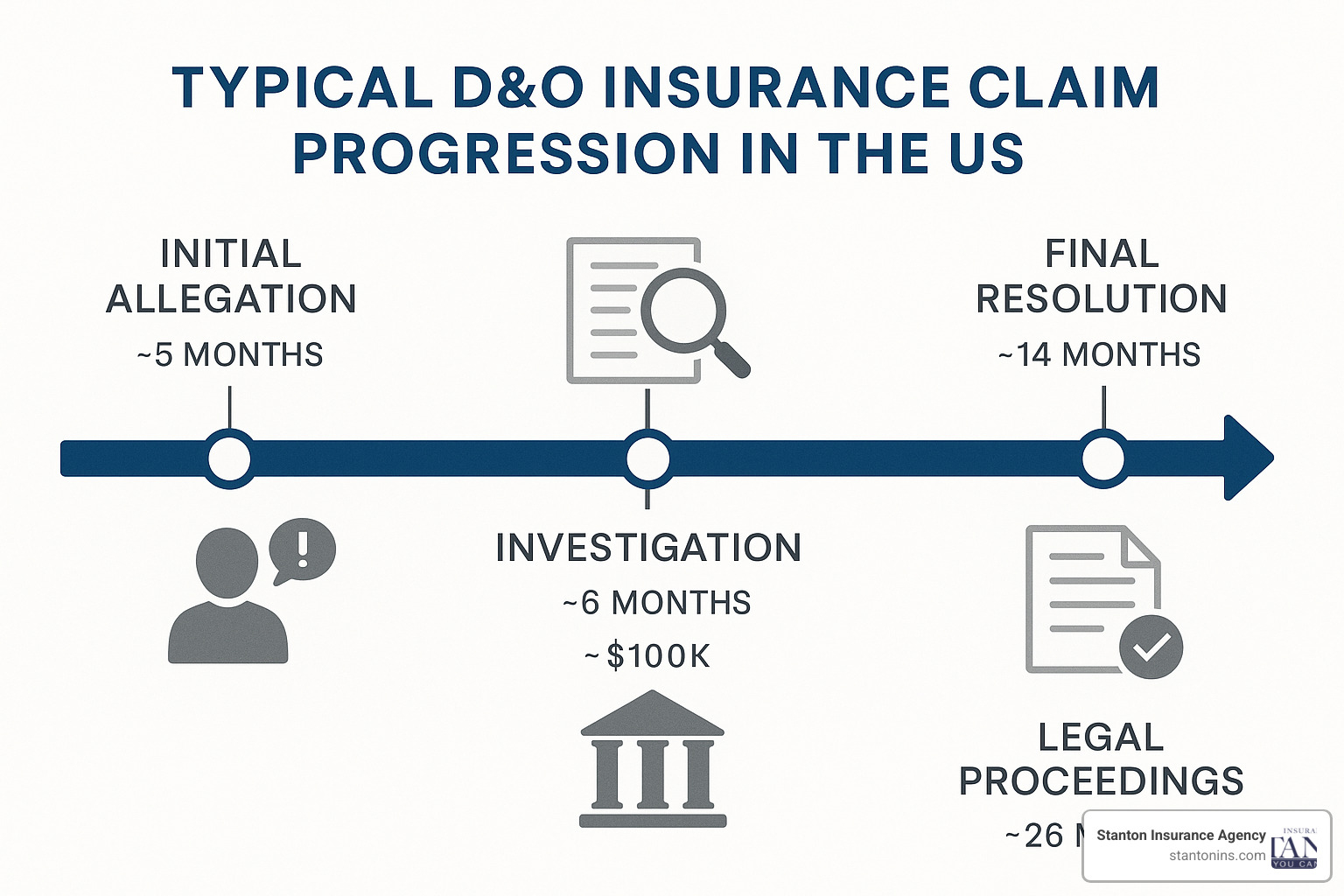

Here’s where the math gets frightening. Defense costs alone can destroy your financial future. Attorney rates typically run $200 to $1,000 per hour, and civil trials often take 12-18 months just to get scheduled. A single lawsuit can rack up hundreds of thousands in legal fees before you even reach a settlement.

For a deeper dive into the technical aspects, check out this Investopedia primer on D&O coverage for additional details.

Key Functions of a D&O Policy

Asset protection is the big one. Without coverage, directors and officers risk everything they’ve worked for – their homes, savings, investments, even their spouse’s assets. D&O insurance creates a wall between these claims and your personal wealth.

Balance sheet protection keeps your organization healthy too. When companies pay legal costs for their leaders, that money comes straight from operating funds. D&O insurance reimburses these payments, keeping cash flow stable during legal battles.

The recruitment advantage might surprise you. Quality board members and executives increasingly refuse to serve without D&O protection. Having coverage signals that your organization is serious about governance and won’t abandon its leaders when trouble hits.

How D&O Differs from Other Executive Policies

Employment Practices Liability Insurance (EPLI) handles employee complaints about discrimination, harassment, or wrongful termination. While some D&O policies include EPLI coverage, the core D&O protection focuses on management decisions rather than day-to-day employment issues.

Fiduciary liability insurance deals specifically with pension plan problems and ERISA violations. Cyber liability insurance responds to data breaches and technology incidents.

Many organizations find that bundling these coverages together makes both financial and practical sense. Our management liability insurance solutions can help you explore comprehensive protection options.

Who Needs Coverage? Nonprofits, Private & Public Firms Alike

Here’s a common myth that costs organizations dearly: thinking Directors and Officers Liability Insurance is only for Fortune 500 companies. The reality? Any organization with a board of directors faces potential lawsuits that could devastate both the organization and its leaders personally.

Private companies face diverse threats. Lawsuits can come from shareholders, employees claiming discrimination, vendors disputing contracts, customers alleging harm, competitors claiming unfair practices, and regulators investigating compliance issues. Small businesses often need this protection most because they lack the deep pockets to weather significant legal storms. The numbers don’t lie – over 25% of private companies reported a D&O loss over just three years.

Public companies deal with all those same risks plus additional securities-related exposures under federal law. Shareholder derivative suits and SEC investigations come with the territory when you’re publicly traded.

Nonprofit organizations present perhaps the most interesting risk profile. Many nonprofit leaders operate under dangerous misconceptions about their protection. They assume charitable immunity shields them from lawsuits, but that’s rarely the case in practice.

Board composition plays a huge role in determining risk levels. Organizations with inexperienced directors, passionate mission-driven leaders who may overlook governance details, or boards with constant turnover face heightened exposures.

Why Nonprofits File Twice as Many Claims

The statistics might surprise you: nonprofits file D&O claims at twice the rate of public and private companies. This isn’t because nonprofit leaders are less capable – it’s because they face unique challenges that create perfect storms for litigation.

Mission-focused leadership can be both a strength and a vulnerability. Nonprofit directors often prioritize achieving their mission over governance formalities. While this passion drives incredible social impact, it can lead to oversight gaps and compliance issues that trigger expensive claims.

Inexperienced boards compound the problem. Many nonprofit directors are volunteers who bring tremendous heart but limited business training. They may not fully understand their fiduciary duties or recognize the legal implications of seemingly routine decisions.

The employment practices numbers are staggering: 94% of D&O claim dollars for nonprofits stem from employment practices allegations. These include discrimination claims, harassment allegations, wrongful termination suits, and wage-and-hour violations.

Grant misuse allegations represent another major risk area. Federal and state agencies closely monitor how organizations use grant funds. Even allegations of improper use can trigger investigations that cost hundreds of thousands in defense expenses.

Many nonprofit leaders cling to charitable immunity myths that provide false security. While some charitable immunity laws exist, they offer limited protection and typically don’t cover defense costs. The federal Volunteer Protection Act provides some immunity for uncompensated volunteers, but significant coverage gaps remain.

Community Associations & Foundations: Niche Exposures

Community associations frequently deal with third-party discrimination claims from residents and vendors. Disputes over architectural standards, amenity access restrictions, and selective enforcement actions can trigger costly litigation.

Foundations managing fiscal sponsorship relationships face unique oversight challenges. When sponsored projects go wrong, foundations can face allegations of inadequate supervision or misuse of funds intended for specific purposes.

Museums and cultural organizations confront provenance liability when artwork ownership comes into question. Defense costs alone can exceed $85,000, with damages reaching $175,000 or more based on actual cases.

Specialized policy endorsements address these sector-specific risks, providing targeted protection for organizations who understand their unique challenges.

Anatomy of a D&O Policy: Sides A, B & C, Coverage vs. Exclusions

Think of Directors and Officers Liability Insurance like a three-layer cake – each layer serves a specific purpose, but they all work together to create comprehensive protection.

Side A Coverage acts like your personal bodyguard. It jumps in to protect individual directors and officers when their company can’t or won’t help them out. This happens when a company goes bankrupt, faces legal restrictions on helping its leaders, or simply refuses to provide support because of the claim’s nature.

Side B Coverage protects your organization’s wallet. When your company covers legal costs for its directors and officers, Side B reimburses those expenses. Without this coverage, hefty legal bills could seriously damage your organization’s financial health.

Side C Coverage shields the organization itself, particularly in securities-related lawsuits. While this was originally designed for public companies dealing with angry shareholders, private companies increasingly need this protection as investor disputes become more common.

Most policies use shared limits, meaning all three sides draw from the same pot of money. Some insurers offer dedicated Side A limits that can’t be touched by other claims, providing extra security for individuals.

Side A Focus: Ultimate Personal Asset Shield

Side A coverage is where the rubber meets the road for personal protection. When everything else fails, this coverage stands between you and financial disaster.

Picture this scenario: your nonprofit suddenly faces bankruptcy while you’re dealing with a lawsuit from your time as board president. The organization has no money to help with your legal defense, and you’re staring at attorney bills that could easily reach $200,000 or more. Side A coverage becomes your lifeline, protecting your home, retirement savings, and everything else you’ve worked to build.

Bankruptcy scenarios represent the classic moment when Side A coverage proves its worth. Non-indemnifiable losses create another crucial need for Side A protection. State laws sometimes prohibit companies from helping their leaders, particularly with regulatory penalties or conflicts of interest.

Directors and Officers Liability Insurance Exclusions You Can’t Ignore

Every D&O policy contains exclusions – situations where the insurance company won’t provide coverage. Understanding these exclusions helps you avoid nasty surprises when you need protection most.

Fraud and criminal acts represent the most significant exclusion category. Insurers won’t cover deliberately fraudulent behavior or criminal conduct. However, coverage typically applies until fraud is actually proven in court, meaning the policy will help with defense costs during investigations.

Personal profit exclusions eliminate coverage when directors or officers allegedly improperly benefited from their positions. Prior acts exclusions can create coverage gaps if you’re not careful. Most policies won’t cover claims arising from actions taken before your policy started, unless you maintained continuous coverage.

ERISA violations require separate fiduciary liability insurance rather than D&O coverage. Bodily injury and property damage belong under general liability policies.

For comprehensive information about D&O exclusions and coverage limitations, explore our detailed guide on how to define liability insurance directors and officers.

Real-World Claim Scenarios, Risks & Best-Practice Mitigation

When I talk with clients about Directors and Officers Liability Insurance, I often share real stories because the statistics alone don’t capture the human impact. Good people making reasonable decisions can still face devastating lawsuits that threaten their personal financial security.

Shareholder suits remain a constant threat, especially when companies face financial challenges. Creditor actions often target individual directors and officers when companies struggle financially. Regulatory investigations have become increasingly aggressive, with government agencies pursuing individual accountability.

Employment disputes represent the biggest category of nonprofit D&O claims, accounting for 94% of all claim dollars. Discrimination allegations, harassment claims, wrongful termination suits, and wage-and-hour violations can devastate an organization’s budget and reputation.

The financial impact is sobering. More than one in four private companies reported a D&O loss over three years, with the average claim settling for approximately $35,000. However, complex cases can easily reach $100,000 or more, and 96% of organizations report negative financial impacts from these claims.

Lessons from Notable Nonprofit Cases

A museum advertising lawsuit started with what seemed like a simple promotional campaign. The museum incorrectly advertised artists’ work without obtaining proper permissions from the artists’ estates. What began as a marketing oversight escalated into a complex legal battle costing over $85,000 in defense expenses alone, plus $175,000 in damages. The total bill exceeded $260,000.

A grant misappropriation case involved a nonprofit president who faced federal allegations of misusing grant funds. The investigation lasted over two years, during which the organization’s reputation suffered significantly. Even though the investigation ultimately cleared the individual of any wrongdoing, defense costs exceeded $300,000.

In a wage-and-hour defense case, a social services nonprofit faced employee claims alleging unpaid overtime and meal break violations. Defense costs reached $500,000 before settlement negotiations even began, with total exposure eventually exceeding $1 million.

These cases demonstrate that even well-intentioned organizations with dedicated leadership can face devastating financial consequences.

Reducing D&O Exposure Before You Buy Insurance

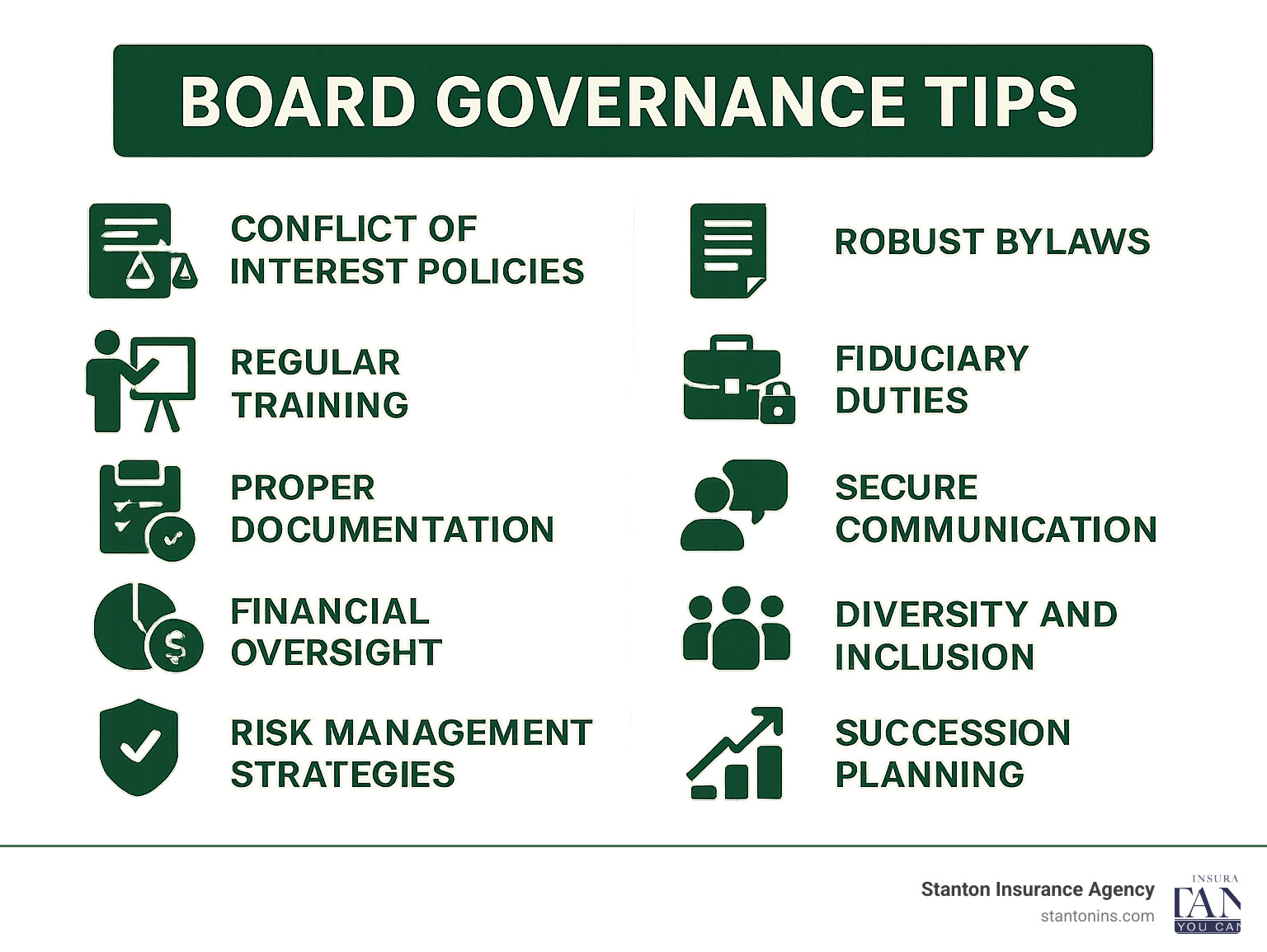

While Directors and Officers Liability Insurance provides essential financial protection, smart organizations also implement strong governance practices to reduce their risk exposure.

Robust bylaws serve as your organization’s foundation. These documents should clearly define director and officer duties, establish proper indemnification provisions, and outline decision-making processes.

Conflict-of-interest policies must go beyond simple disclosure requirements. Establish clear procedures for identifying conflicts, removing conflicted individuals from decision-making, and documenting the process.

Board training should be ongoing, not just a one-time orientation. Directors need regular education about their fiduciary duties, legal compliance requirements, and emerging risk areas.

Good governance practices and proper insurance coverage work together. You can’t eliminate D&O risk entirely through governance alone, but you can significantly reduce your exposure while demonstrating to insurers that your organization takes risk management seriously.

Buying & Maintaining the Right D&O Program

Choosing the right Directors and Officers Liability Insurance can feel overwhelming, but breaking it down into manageable steps makes the process much clearer.

Insurance companies look at several key factors when pricing your coverage. Your annual revenues and total assets give them a sense of your organization’s size and potential exposure. They’ll also want to know how many employees and board members you have, since more people often means more potential for claims.

Your industry classification matters tremendously. A tech startup faces different risks than a community food bank. Insurers also dig into your claims history and evaluate your financial stability and governance practices.

The median annual premium for D&O coverage sits around $1,240, but your actual cost depends on these factors. Coverage limits typically start at $1 million for smaller organizations and can reach $100 million or more for large companies. Defense costs alone often hit six figures, so don’t skimp on limits to save a few hundred dollars in premium.

Retention levels work like deductibles – higher amounts reduce your premium but increase your out-of-pocket costs when claims arise. Most organizations choose retentions between $5,000 and $25,000.

For detailed guidance on coverage options and pricing, check out our comprehensive guide on what is director and officer liability insurance.

Step-by-Step to Secure Directors and Officers Liability Insurance

Start with a thorough risk assessment of your organization. Look at your board composition, consider your industry’s typical risks and the regulatory environment you operate in. Document the types of claims that could realistically hit your organization and estimate what they might cost.

When completing your insurance application, accuracy is absolutely critical. Insurance companies can deny coverage entirely if they find material misrepresentations later. If you’ve had any prior claims, investigations, or even situations that made you nervous, disclose them.

Comparing quotes means looking beyond just the premium numbers. Get proposals from multiple insurers who understand your sector. Compare policy terms, exclusions, coverage limits, and the insurer’s reputation for handling claims fairly and quickly.

Once you’ve agreed on terms, bind coverage immediately. Don’t let gaps develop between your old and new policies. Even a single day without coverage could leave you exposed.

Ongoing Policy Management & Compliance

Buying the policy is just the beginning – proper management ensures you’ll actually have coverage when you need it.

Notice requirements trip up many organizations. Most policies require you to report potential claims or even circumstances that might lead to claims. Establish clear procedures so board members and staff know when and how to report potential problems.

Annual policy reviews keep your coverage current as your organization evolves. Your nonprofit that started with a $500,000 budget and grew to $5 million needs different coverage limits.

For current market information, visit our resource on directors and officers insurance cost.

Frequently Asked Questions about Directors and Officers Liability Insurance

How much coverage should our organization buy?

The right amount of Directors and Officers Liability Insurance depends on several key factors that vary significantly from one organization to another.

Organization size plays a major role in determining appropriate limits. A small nonprofit with ten employees and a $500,000 annual budget faces different exposures than a private company with 200 employees and $50 million in revenue. Larger organizations typically need higher limits because they have more complex operations, more stakeholders, and potentially larger claim settlements.

Industry risk levels vary dramatically. A technology company faces different exposures than a social services nonprofit or a manufacturing business. Some sectors historically see higher claim frequency and severity, which should influence your coverage decisions.

Consider your stakeholder base carefully. Organizations with diverse groups of investors, donors, members, or beneficiaries face liftd exposure because more parties can potentially bring claims.

As a starting point, many organizations begin with $1-3 million in coverage. However, don’t let this general guideline replace a thorough risk assessment. Some high-risk entities need $10 million or more, while others might find $1 million adequate.

Defense costs alone can easily reach hundreds of thousands of dollars before any settlement discussions begin. Attorney fees of $400-600 per hour add up quickly when dealing with complex litigation that can stretch over months or years.

Does D&O protect past directors and spouses?

Most Directors and Officers Liability Insurance policies provide coverage for past, present, and future directors and officers. The key requirement is that claims must be made during the policy period and relate to acts performed while serving in their official capacity. This “runoff” coverage proves crucial because claims often surface years after the alleged wrongful act occurred.

Spouse protection has become increasingly important and more common in D&O policies. Some policies automatically extend coverage to protect spouses’ assets, recognizing that married couples often hold property jointly. Other policies require specific endorsements for spouse coverage.

This spouse protection matters because personal assets like homes, savings accounts, and retirement funds are frequently held in both names. Without proper coverage, a claim against one spouse could threaten the family’s entire financial security.

How does D&O interact with corporate indemnification agreements?

Corporate indemnification represents the organization’s promise to protect its directors and officers from personal financial loss. Most organizations include strong indemnification provisions in their bylaws, essentially saying “we’ll cover your legal costs and any damages if you get sued for doing your job.”

This sounds great in theory, but indemnification has significant practical limitations. What happens if your organization goes bankrupt? How can an insolvent company fulfill its indemnification promises? This is where Side A coverage becomes essential, providing direct protection when indemnification fails.

Side B coverage works hand-in-hand with indemnification by reimbursing the organization when it does indemnify directors and officers. This protects the company’s balance sheet and preserves cash flow for mission-critical activities rather than legal expenses.

The interaction creates multiple layers of protection. First, the organization attempts to indemnify through its bylaws and available resources. If indemnification is insufficient, prohibited, or impossible, D&O insurance steps in to provide direct protection to individuals.

Conclusion

Directors and Officers Liability Insurance isn’t just another line item on your insurance budget – it’s the safety net that protects the people who dedicate their time and expertise to leading your organization.

The numbers don’t lie. More than 25% of private companies face D&O losses over three years, while nonprofits file claims at twice the rate of other organizations. That’s not a distant possibility – it’s a clear and present reality for organizations just like yours.

Think about what happens when your organization can’t attract quality board members because they’re worried about personal liability. Or when your current directors start resigning because they feel exposed. The ripple effects go far beyond insurance – they threaten your organization’s ability to fulfill its mission.

The financial stakes are real. Defense costs routinely climb into six figures before any settlement discussions even begin. The average D&O claim settles for $35,000, but one in ten reaches $100,000 or more. Without coverage, those costs come directly from personal assets – homes, savings accounts, retirement funds.

The median annual premium of $1,240 suddenly looks pretty reasonable when you consider these potential costs. It’s less than most organizations spend on office supplies, yet it protects against financial catastrophe that could destroy both the organization and its leaders’ personal financial security.

Proper governance practices matter, but they don’t eliminate risk. Robust bylaws, board training, and strong financial controls reduce your exposure – they don’t make it disappear. Even the most careful organizations can face employment practice claims, regulatory investigations, or stakeholder disputes that trigger D&O coverage.

Your organization’s mission is too important to risk on the hope that nothing will go wrong. Your leaders’ personal financial security is too valuable to leave unprotected. The question really isn’t whether you can afford D&O coverage – it’s whether you can afford to operate without it.

For comprehensive business insurance solutions that protect your organization’s most valuable assets – including the dedicated people who lead it – explore our business insurance offerings designed specifically for organizations like yours.