Difference between uninsured and underinsured: 1st Secure Move

Why Understanding UM and UIM Coverage Could Save You Thousands

Getting behind the wheel in Massachusetts or New Hampshire means navigating a unique mix of city streets, winding country roads, and busy highways. While you can control your own driving habits, you can’t control the choices of every other driver on the road. Unfortunately, a significant number of those drivers are operating without any auto insurance, or with coverage so minimal it’s practically useless in a serious accident. This is where the difference between uninsured and underinsured motorist coverage becomes one of the most important, yet often misunderstood, aspects of your auto policy.

The statistics are sobering. According to the Insurance Information Institute, nearly 13% of drivers nationwide are uninsured. While Massachusetts has a lower rate at 6.2%, that still means more than 1 in 20 drivers on the road with you can’t pay for the damages they might cause. In New Hampshire, the rate is a more concerning 10.4%. An accident with one of these drivers could leave you facing tens, or even hundreds, of thousands of dollars in medical bills and lost income with no one to hold accountable.

This is precisely why Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverages exist. They act as a shield, protecting you and your family from the financial fallout of an accident caused by an irresponsible driver.

| Coverage Type | When It Applies | What It Covers |

|---|---|---|

| Uninsured Motorist (UM) | At-fault driver has NO insurance | Your medical bills, lost wages, and sometimes vehicle damage |

| Underinsured Motorist (UIM) | At-fault driver has insurance but NOT ENOUGH to cover your costs | The gap between their coverage and your actual expenses |

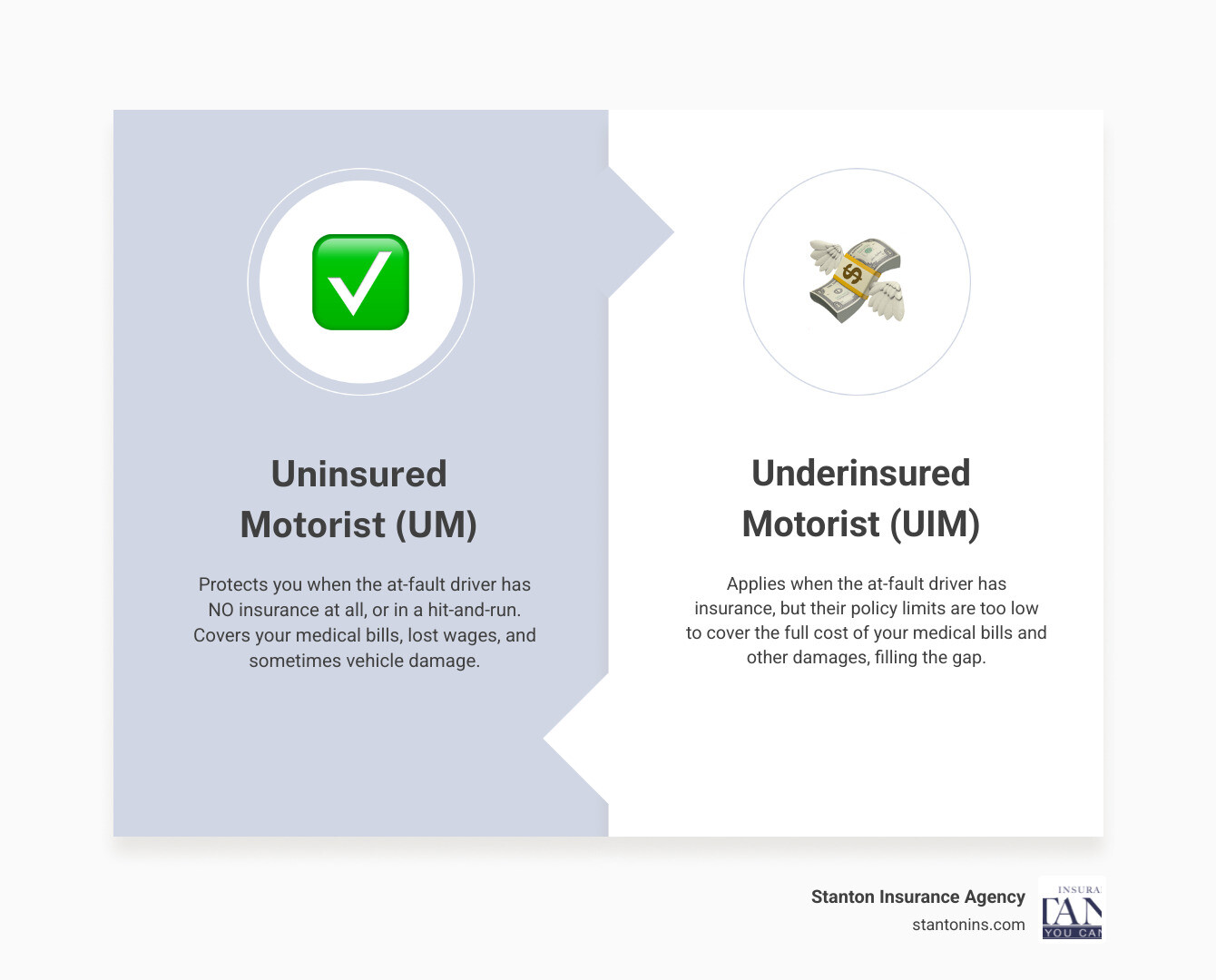

In simple terms, UM coverage is your protection against a driver with zero insurance, including hit-and-run scenarios where the driver is never identified. UIM coverage is your backup when the at-fault driver did the bare minimum, buying a policy whose limits are quickly exhausted by the costs of a real-world accident. Think of it this way: UM protects you from drivers who chose not to buy insurance, while UIM protects you from drivers who bought too little insurance.

Even if you have excellent health insurance, UM and UIM fill critical gaps. Health insurance does not compensate you for lost wages or pain and suffering, and it still leaves you with deductibles and co-pays. UM/UIM can address those non-medical losses and the medical costs that health insurance doesn’t cover, helping you avoid draining savings or taking on debt after a serious crash.

I’m Geoff Stanton, a fourth-generation owner at Stanton Insurance Agency in Waltham, Massachusetts. With over 20 years of experience helping families steer the complexities of auto insurance claims, I’ve seen the devastating consequences of being unprepared. I recall a client, a diligent professional and careful driver, who was struck by a driver who ran a red light. The at-fault driver had no insurance. Our client’s injuries required surgery and months of physical therapy, preventing them from working. Their Uninsured Motorist coverage was the crucial lifeline that covered their medical bills and compensated for their lost income, preventing a medical crisis from becoming a financial catastrophe. Its these real-life situations that prove understanding the difference between uninsured and underinsured coverage is not just an academic exerciseit’s essential financial planning.

One more tip as you evaluate your protection: increasing UM/UIM limits is often surprisingly affordable compared to other parts of your auto policy. A common best practice is to match your UM/UIM limits to your own bodily injury liability limits so you protect yourself as well as you protect others. If you havent reviewed those limits recently, its worth a quick conversation with your agent.

The Primary Difference Between Uninsured and Underinsured Motorist Coverage

Understanding the difference between uninsured and underinsured motorist coverage can save you from serious financial headaches down the road. While these two types of coverage are often bundled together in your policy and sound similar, they serve distinctly different purposes and are triggered by different circumstances. Getting them straight is key to building a truly protective auto insurance policy.

| Feature | Uninsured Motorist (UM) | Underinsured Motorist (UIM) |

|---|---|---|

| Definition | Protects you when the at-fault driver has no insurance at all. | Protects you when the at-fault driver has insurance, but not enough to cover your damages. |

| When It Applies | No insurance, hit-and-run accidents, or if the at-fault driver’s insurer denies the claim. | The at-fault driver’s policy limits are exhausted and are too low for your medical bills and damages. |

| Primary Purpose | Fills the complete absence of coverage from the at-fault party. | Bridges the financial gap between the at-fault driver’s inadequate coverage and your actual costs. |

The fundamental distinction lies in the insurance status of the driver who caused your accident. Uninsured Motorist (UM) coverage steps in when you’re hit by someone with absolutely no liability insurance. Underinsured Motorist (UIM) coverage comes to your rescue when the at-fault driver has insurance, but their policy limits fall short of covering your medical bills, lost wages, and other damages.

What is Uninsured Motorist (UM) Coverage?

Uninsured Motorist coverage is your financial safety net when you’re in an accident caused by a driver who is illegally operating without insurance or a hit-and-run driver who flees the scene. A key benefit of UM coverage is that it is a “first-party” claim. This means you file the claim directly with your own insurance company. You can work with your agent at Stanton Insurance to coordinate the claim and documentation from start to finish.

Your Uninsured Motorist Coverage is typically broken down into two main parts:

-

Uninsured Motorist Bodily Injury (UMBI): This is the most critical component. It is designed to pay for the human cost of an accident. This includes a wide range of expenses for you and any passengers in your vehicle, such as:

- Medical Bills: Emergency room visits, hospital stays, surgeries, follow-up doctor appointments, and prescription medications.

- Rehabilitation Costs: Physical therapy, occupational therapy, and any necessary medical equipment.

- Lost Wages: Compensation for the income you lose while you are unable to work during your recovery. If your injuries are permanent, this can even cover diminished future earning capacity.

- Pain and Suffering: Compensation for non-economic damages like physical pain, emotional distress, and loss of enjoyment of life.

In Massachusetts, Personal Injury Protection (PIP) typically pays first (up to statutory limits), and then UM can address bodily injury losses not covered by PIP or health insurance when the at-fault driver is uninsured or cannot be identified in a qualifying hit-and-run.

-

Uninsured Motorist Property Damage (UMPD): This coverage is designed to pay for repairs to your vehicle. However, its availability varies by state.

- In Massachusetts, UMPD is not offered. Instead, you must use your collision coverage to repair your car after being hit by an uninsured driver. Many policies in MA also offer a Collision Deductible Waiver option that can waive your collision deductible when you are not at fault and the responsible driver is identified (note that this generally does not apply to most hit-and-run claims where the driver cannot be identified).

- In New Hampshire, UMPD is available as an optional coverage. If you purchase it, it will help pay for your car repairs, though it usually comes with a small deductible (e.g., $250).

What is Underinsured Motorist (UIM) Coverage?

Underinsured Motorist coverage becomes your financial lifeline when you’re hit by a driver who has insurance, but not enough. Many drivers only purchase the state-required minimum Liability Car Insurance Coverage, which can be exhausted very quickly in a moderate to severe accident.

Let’s walk through a realistic example:

Imagine you are seriously injured in an accident in New Hampshire. Your total damages add up to $150,000, which includes $80,000 in medical bills, $50,000 in lost wages from being out of work, and $20,000 for ongoing physical therapy. The at-fault driver only has the New Hampshire minimum bodily injury liability limit of $25,000 per person. Their insurance will pay you that $25,000, but you are still left with a staggering $125,000 in uncovered costs. This is where your UIM coverage steps in. If you have a UIM limit of $250,000, your own policy would pay that remaining $125,000, making you whole. Without UIM, you would be personally responsible for that massive shortfall.

A quick Massachusetts example:

Suppose your injuries total $100,000 and the at-fault driver carries only the MA minimum of $20,000 per person for bodily injury. After their insurer pays $20,000, your UIM coverage can respond for the remaining $80,000, up to your UIM limits. In many policies, you can select UM/UIM limits up to (but not higher than) the bodily injury liability limits you purchase for yourself—another reason to choose robust limits. Your agent can confirm the options available on your policy.

Stacking Rules Differ by State

Stacking refers to combining UM or UIM limits from multiple vehicles to increase the available protection after a single accident. Rules vary:

- Massachusetts: Stacking is generally not permitted under the standard auto policy. Typically, the highest single applicable limit applies.

- New Hampshire: Stacking may be available if your policy allows it; some policies include anti-stacking provisions. Where permitted by your policy, combining limits from multiple vehicles on the same policy can increase your protection.

Your policy language controls whether stacking is allowed, so review your declarations and endorsements or ask your agent to explain your specific coverage.

The difference between uninsured and underinsured coverage highlights two distinct but equally serious risks on the road. Having robust protection for both scenarios is a cornerstone of a smart auto insurance strategy.