Difference between stacked and unstacked insurance: 3 Key

Understanding Your UM/UIM Coverage Options

The difference between stacked and unstacked insurance affects how much financial protection you have after an accident with an uninsured or underinsured driver. Here’s what you need to know:

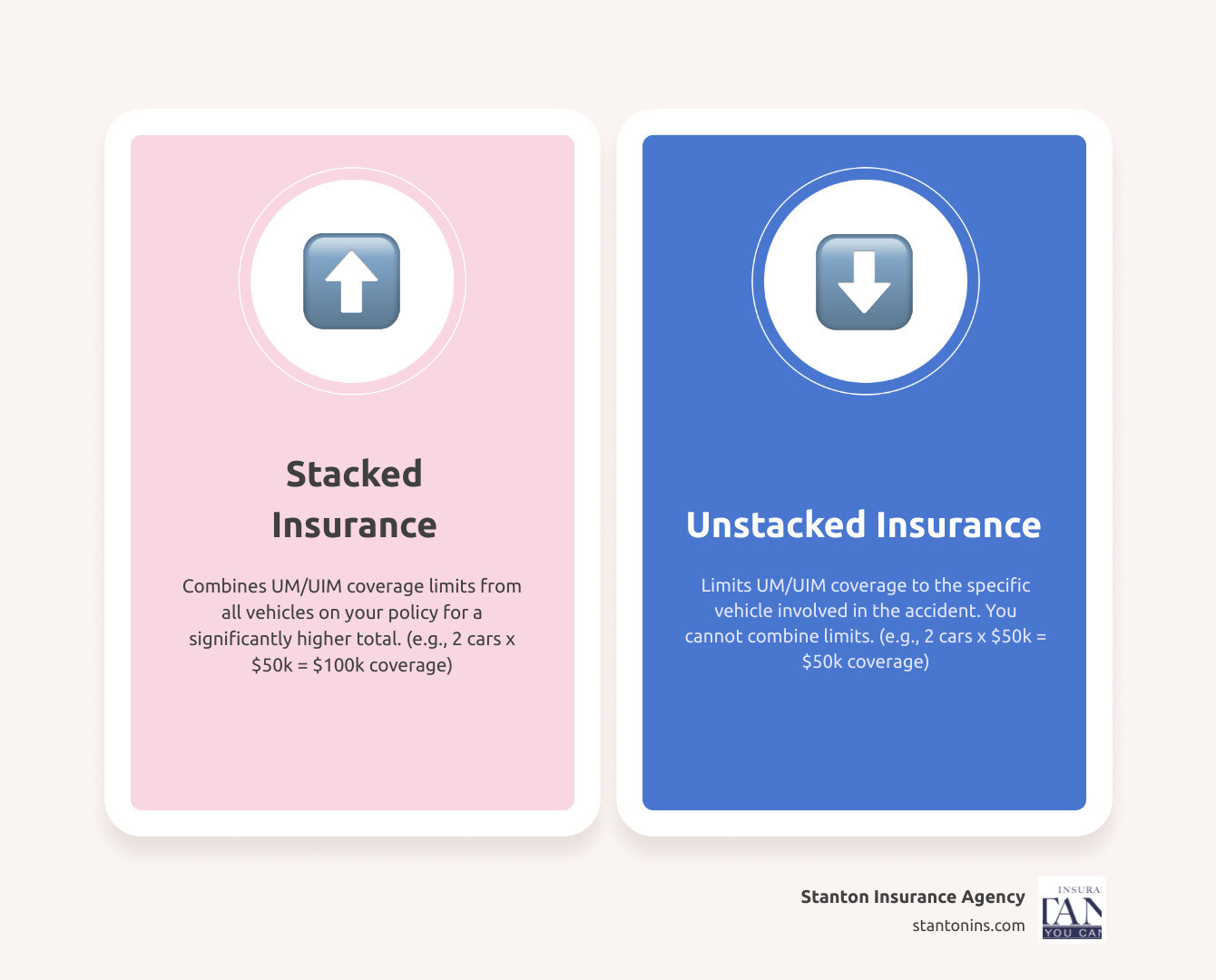

Key Differences:

- Stacked Insurance: Combines UM/UIM coverage limits from multiple vehicles for higher total protection

- Unstacked Insurance: Limits coverage to the specific vehicle involved in the accident

- Availability: Stacked coverage is only available in certain states and requires multiple vehicles

- Cost: Stacked coverage costs more but provides significantly higher protection limits

When you’re hit by a driver with little or no insurance, your Uninsured/Underinsured Motorist (UM/UIM) coverage is your financial lifeline. The choice between stacking and unstacking determines if you can combine coverage limits from all your vehicles or are limited to just one. With about 12.6% of U.S. drivers uninsured, according to the Insurance Research Council, this decision is critical, especially for families with multiple vehicles who could multiply their protection through stacking.

I’m Geoff Stanton, President of Stanton Insurance Agency. For over two decades, I’ve helped Massachusetts and New Hampshire families steer complex insurance choices like stacked vs. unstacked coverage. Understanding these options is crucial for your family’s financial security on the road.

Simple difference between stacked and unstacked insurance glossary:

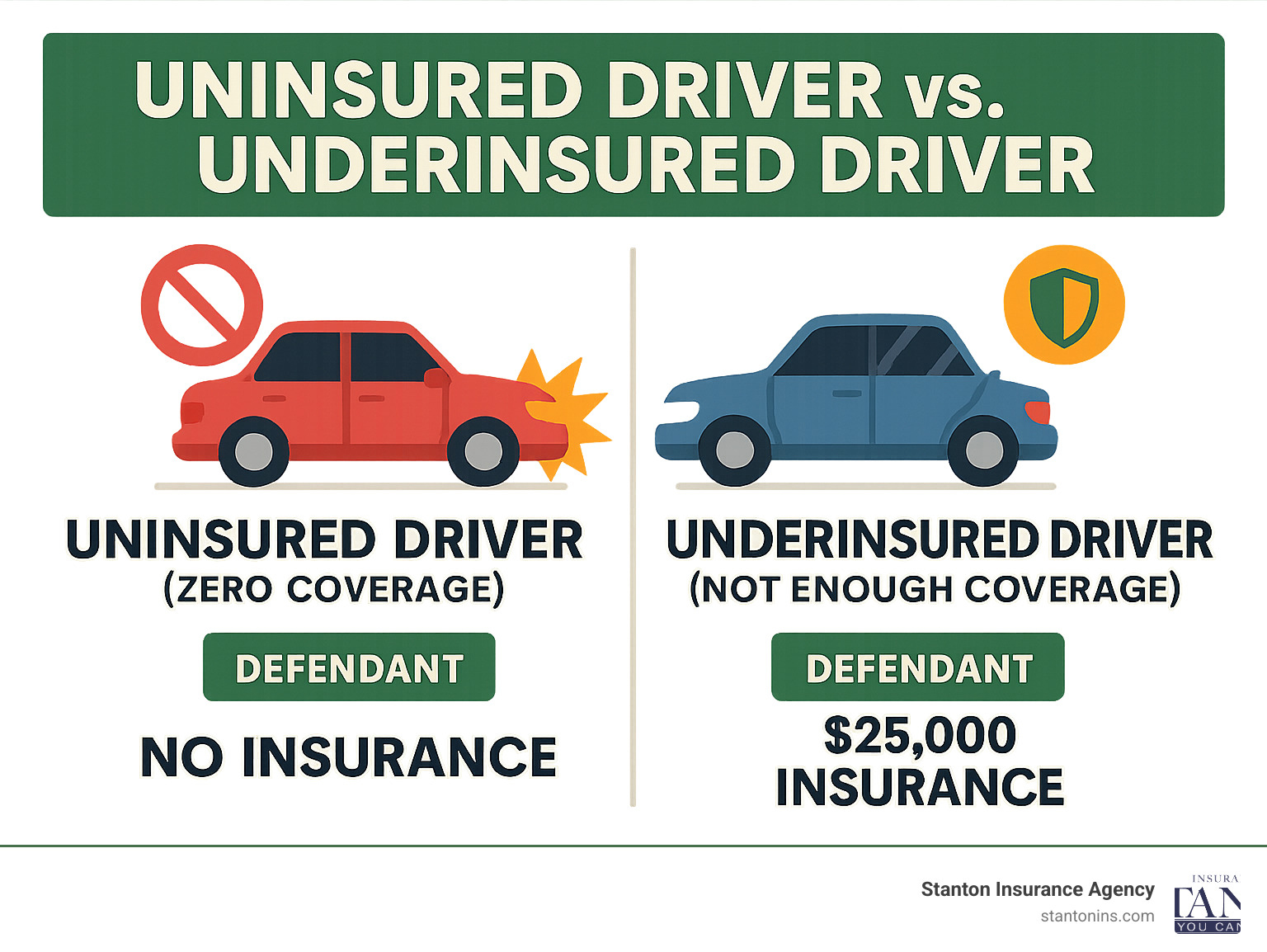

The Core Concept: Uninsured/Underinsured Motorist (UM/UIM) Coverage

Imagine another driver runs a red light and hits you. You’re injured, your car is wrecked, and medical bills are mounting. To make matters worse, the at-fault driver has little or no insurance to cover your costs.

This nightmare scenario is why understanding the difference between stacked and unstacked insurance matters. Before we dive into stacking, let’s discuss the coverage that makes it possible: Uninsured/Underinsured Motorist (UM/UIM) coverage.

Think of UM/UIM coverage as your financial safety net when other drivers can’t or won’t take responsibility for the damage they cause. It’s a crucial part of your auto insurance policy that steps in to protect you when the at-fault driver’s insurance falls short.

Uninsured Motorist (UM) Coverage protects you when the at-fault driver has no car insurance. Without it, you could be stuck paying for your own medical bills and lost wages, even though the accident wasn’t your fault.

Underinsured Motorist (UIM) Coverage applies when the at-fault driver has insurance, but their bodily injury liability limits are too low to cover your damages. For example, if your medical bills are $75,000 and the other driver only has $25,000 in coverage, UIM helps cover the remaining $50,000.

Here’s a sobering reality check: the Insurance Research Council estimated 12.6% of U.S. drivers were uninsured in 2021. While the national average is concerning, the rate in New Hampshire was 9.3% in 2021. Even in Massachusetts, with one of the nation’s lowest rates at 3.5%, thousands of drivers are still on the road without coverage, making robust UM/UIM coverage essential.

Even in states with lower uninsured driver rates, you never know when you’ll cross paths with someone driving without coverage. Having strong UM/UIM protection ensures you’re not left holding the bag for someone else’s poor decisions.

The Key Difference Between Stacked and Unstacked Insurance

If you own multiple vehicles, you must decide between stacked and unstacked insurance. This choice determines if you can combine your Uninsured/Underinsured Motorist (UM/UIM) coverage limits from all your cars or if you’re limited to one vehicle’s coverage. Stacking is like combining several emergency funds, while unstacking limits you to a single fund. This decision dictates your financial protection when you need it most.

What is Stacked Car Insurance?

Stacked car insurance lets you combine the UM/UIM coverage limits for each vehicle on your policy, creating a much higher total limit. Essentially, you multiply your protection by the number of vehicles you insure.

For example, if you own two cars, each with $50,000 in UM/UIM bodily injury coverage, stacking gives you a total of $100,000 in protection. This increased limit applies to bodily injury costs like medical expenses and lost wages, providing a crucial safety net for serious accidents.

What is Unstacked Car Insurance?

With unstacked insurance, your UM/UIM coverage is limited to the specific vehicle involved in the accident. You cannot access the coverage from other vehicles on your policy.

Using the same example, if you have two cars with $50,000 in UM/UIM coverage each and are hit while driving one, your maximum protection is $50,000. This is the standard, more affordable option for most auto policies, but it offers less protection if you own multiple vehicles.

The Difference Between Stacked and Unstacked Insurance: A Side-by-Side Comparison

Understanding these key distinctions will help you make the right choice for your family’s protection:

| Feature | Stacked Insurance | Unstacked Insurance |

|---|---|---|

| Coverage Limit | Combines limits from all insured vehicles for a higher total. | Limited to the coverage amount of the single vehicle in the accident. |

| Premium Cost | Higher premium due to increased coverage. | Lower premium; more budget-friendly. |

| Best For | Families with multiple vehicles seeking maximum protection against uninsured/underinsured drivers. | Single-vehicle owners, those on a strict budget, or those in states where stacking is not allowed. |

| Availability | Only available in certain states and for policies with multiple vehicles. | The standard option in all states, and often the only option for single-vehicle policies. |

The choice between stacked and unstacked insurance is about real-world financial protection. Stacked coverage costs more, but the higher protection can be invaluable after a serious accident with an uninsured driver. Is the extra premium worth the peace of mind?

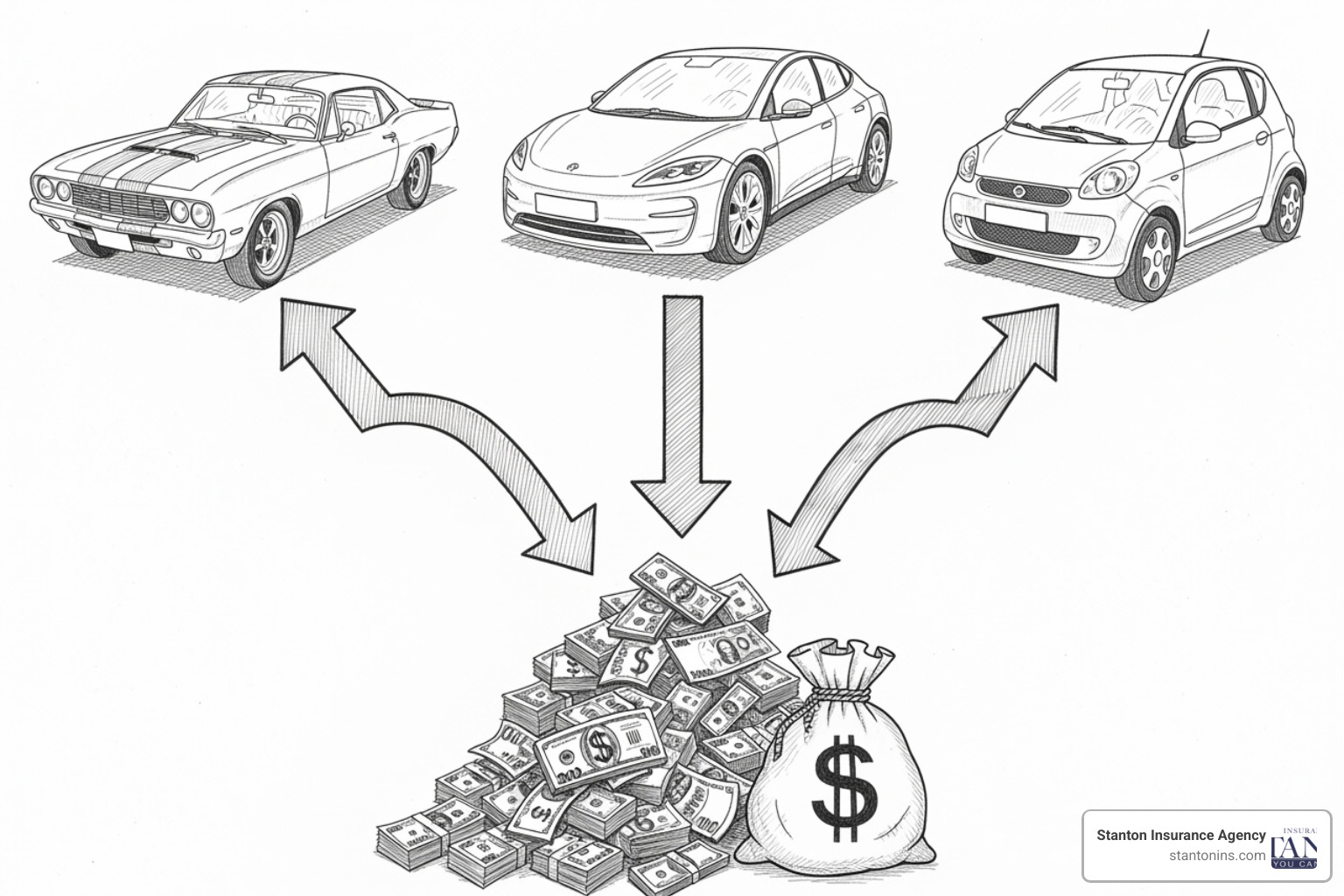

How Stacking Works: Vertical vs. Horizontal

When stacking is permitted, it typically happens in one of two ways. Understanding the mechanics helps clarify how your coverage multiplies and helps you grasp the full difference between stacked and unstacked insurance.

Vertical Stacking: Combining Coverage on a Single Policy

Vertical stacking is the most common form you’ll encounter, and thankfully, it’s pretty straightforward to understand. Think of it like stacking blocks – you’re taking all the UM/UIM coverage from each vehicle on your single policy and stacking them on top of each other to create one towering pile of protection.

Here’s how it works in real life: Let’s say you’re a busy parent with three vehicles on one policy – maybe a sedan for commuting, an SUV for family trips, and a pickup truck for weekend projects. Each vehicle has $100,000 in UM/UIM bodily injury coverage. With vertical stacking, if you’re hit by an uninsured driver while driving any of these vehicles, you don’t just get $100,000 in coverage. Instead, you get the combined total of all three vehicles: $300,000 in protection.

The math is simple: (UM/UIM Limit per Vehicle) x (Number of Vehicles on Policy) = Total Stacked Coverage. It’s like having a financial safety net that grows stronger with every vehicle you add to your policy. This is the type of stacking most commonly available to New Hampshire drivers with multiple vehicles on one policy.

Horizontal Stacking: Combining Coverage Across Multiple Policies

Horizontal stacking is the less common cousin of vertical stacking, and it’s only allowed in a handful of states. While vertical stacking combines coverage within one policy, horizontal stacking lets you reach across multiple separate policies to combine coverage.

Picture this scenario: You and your spouse each maintain separate auto insurance policies. Maybe you started with different insurers before you got married, or perhaps you keep separate policies for business reasons. In states that allow horizontal stacking, if you’re injured in an accident with an uninsured driver, you might be able to combine the UM/UIM coverage from both your policy and your spouse’s policy.

This type of stacking recognizes that household members often share financial responsibilities, even when their insurance policies are separate. However, horizontal stacking comes with more restrictions than vertical stacking. Many states and insurers have specific rules about when and how you can combine coverage across policies, so it’s not as simple or widely available as vertical stacking.

The key takeaway? Most New Hampshire drivers will encounter vertical stacking when they have multiple vehicles on one policy. Horizontal stacking is a more specialized option, also permitted in New Hampshire, but it is subject to more complex rules and specific policy language.

Stacking Laws in Massachusetts and New Hampshire

Whether you can stack your insurance depends entirely on state law. The rules in Massachusetts and New Hampshire are very different, making it crucial for local drivers to understand their specific options. Knowing these state-specific nuances is a huge part of understanding the practical difference between stacked and unstacked insurance.

Can You Stack Insurance in Massachusetts?

No. Massachusetts law prohibits stacking Uninsured and Underinsured Motorist coverage. On a standard Massachusetts auto policy, your UM/UIM limits are unstacked by default, and there is no option to combine them.

This means the coverage limit listed on your policy is the maximum you can receive per accident, regardless of how many vehicles you own. If you have $50,000 in UM/UIM coverage, that’s your ceiling for any single accident.

Because stacking isn’t an option in Massachusetts, it’s vital for drivers to select sufficiently high UM/UIM limits from the start. Since you cannot multiply your coverage, your initial choice is critical. Understanding the minimum car insurance coverage in Massachusetts is just a starting point; you should consider higher limits for adequate protection.

Understanding Your Options in New Hampshire

New Hampshire is a state that allows drivers to stack their UM/UIM coverage, giving you more flexibility in building your financial protection. When you purchase a policy in New Hampshire, you have the choice to stack the limits for the vehicles you insure.

This means if you have multiple vehicles, you can combine their UM/UIM coverage limits, significantly increasing your potential payout if you’re hit by an uninsured or underinsured driver.

However, there’s an important catch: if you decide you don’t want this additional protection and its associated cost, you must formally reject it in writing. New Hampshire takes this requirement seriously. If you don’t explicitly reject stacking, your policy might include it by default, which could mean higher premiums than you expected.

For families with multiple vehicles, this stacking option provides a valuable opportunity to significantly increase protection. Given that about 9.3% of drivers in New Hampshire are uninsured, having this option can be a real game-changer for your financial security on the state’s roads. For more details on how this works with local policies, explore our comprehensive resources on auto insurance in New Hampshire.

Making the Right Choice for Your Family

Choosing between stacked and unstacked insurance is a significant decision for your family’s financial security, especially when facing medical bills after an accident with an uninsured driver. Your personal situation, budget, and location are key factors in finding the right balance between protection and cost.

When to Consider Stacked Insurance (If Available)

If you live in New Hampshire where stacking is allowed, it’s often worth the extra cost, especially if you own multiple vehicles. Each car you add to your policy multiplies your UM/UIM coverage. For example, a family with three cars could turn $50,000 in coverage per car into $150,000 of total protection.

This extra protection becomes especially valuable if you frequently have passengers, as your stacked coverage extends to everyone riding with you.

For families seeking maximum financial protection, stacked insurance offers the highest possible coverage limits against uninsured and underinsured drivers. When you consider that serious accidents can easily generate six-figure medical bills, the higher limit could mean the difference between financial recovery and devastation.

While stacked coverage comes with a higher premium, the increase is often modest relative to the significant boost in protection. If you can afford the higher premium and have assets to protect, it’s usually a wise investment.

When Unstacked Insurance Is the Right (or Only) Choice

Unstacked insurance is sometimes the only option. For Massachusetts drivers, state law prohibits stacking, so the focus must be on selecting the highest possible unstacked UM/UIM limits from the start.

If you only own one vehicle, the concept of stacking is irrelevant. You can’t combine coverage limits when there’s only one limit to work with, so your coverage is automatically unstacked.

Tight finances might make the lower premium of unstacked coverage more appealing. It’s better to have some UM/UIM protection than none at all.

Families with comprehensive health insurance that includes low deductibles might feel more comfortable with unstacked coverage. While UM/UIM covers more than just medical bills—including lost wages and pain and suffering—excellent health coverage does reduce some of the immediate financial pressure.

The key is understanding what you’re choosing and why. The difference between stacked and unstacked insurance is about the real-world financial protection your family will have when you need it most.

Frequently Asked Questions about Stacked and Unstacked Insurance

We get a lot of questions about the difference between stacked and unstacked insurance, so let’s tackle some of the most common ones.

Can I stack other types of coverage like collision or liability?

No. Stacking is exclusively for Uninsured Motorist (UM) and Underinsured Motorist (UIM) bodily injury coverage. You cannot stack other coverages like liability or collision. Stacking is designed to protect you from other underinsured drivers, not to increase your own liability limits or coverage for vehicle repairs.

How much more does stacked insurance cost?

The cost varies based on your insurer, state (NH), number of vehicles, driving record, and coverage limits. While stacked coverage costs more, the increase is often modest for the significant boost in protection it provides. The best way to know the exact cost is to get a personalized quote from Stanton Insurance Agency for your specific situation in New Hampshire.

What happens if I only own one car?

If you only own one car, stacking does not apply. Your UM/UIM coverage is automatically unstacked as there are no other vehicle limits to combine. This makes your initial choice of coverage limits very important, as you’ll need to ensure that single policy provides robust protection.

What is the role of uninsured/underinsured motorist coverage (UM/UIM) in stacking?

UM/UIM coverage is the foundation of stacking. The entire purpose of stacking is to increase the limits of your UM/UIM coverage. Without UM/UIM coverage, there is nothing to stack. Your UM/UIM limits determine your base protection and how much it can be multiplied through stacking.

How do coverage limits differ between stacked and unstacked policies?

With an unstacked policy, your UM/UIM limit applies only to the vehicle in the accident. If you have three cars with $50,000 of coverage each, your limit is $50,000 per accident. With a stacked policy, the limits combine. Those same three cars would give you a total of $150,000 in coverage for a single accident, offering significantly more financial protection for serious injuries.

What are the legal implications of rejecting stacked car insurance?

In New Hampshire, you can reject stacked coverage, but it must be done formally in writing. This is a legal waiver of your right to combine UM/UIM limits from multiple vehicles and cannot be reversed after an accident. Rejecting stacking lowers your premium but also significantly reduces your potential financial protection in an accident with an uninsured driver. This trade-off requires careful consideration, and the rejection must be properly documented as required by state law.

Conclusion: Secure the Right Protection for the Road Ahead

Understanding the difference between stacked and unstacked insurance empowers you to build a policy that truly protects your family. In states like New Hampshire, stacking offers a powerful way to multiply your financial safety net. In Massachusetts, where stacking isn’t an option, drivers must focus on securing high-limit unstacked coverage to ensure their policy is strong enough on its own.

The most important step is to review your current UM/UIM limits and honestly assess whether they’re sufficient for your needs. With medical costs rising and a significant number of uninsured drivers on the roads in both New Hampshire (9.3%) and Massachusetts (3.5%), adequate coverage isn’t just smart—it’s essential for protecting your family’s financial future.

The goal isn’t just to meet minimum requirements. It’s about finding the sweet spot where you have robust protection without breaking your budget. Whether you’re combining limits through stacking in New Hampshire or maximizing your unstacked coverage in Massachusetts, the key is making sure you’re prepared for whatever the road throws your way.

Navigating insurance options can feel overwhelming, but you don’t have to do it alone. The experienced professionals at Stanton Insurance Agency are here to help you understand your choices and find that perfect balance of coverage and cost. We’ve been helping families in Massachusetts and New Hampshire make these important decisions for over two decades, and we pride ourselves on providing trusted protection for your valuable assets.

Your peace of mind on the road is worth a conversation. To ensure your assets are protected, contact us today to review your policy or get a personalized quote that reflects your specific needs.

Protect your journey. Explore your car insurance options with us today.