Dental Insurance: 7 Powerful Affordable Plans in 2025

Finding Affordable Dental Coverage That Actually Works

Dental insurance is a specialized healthcare plan that helps offset the costs of dental procedures through regular premium payments. Unlike medical insurance, dental plans typically emphasize preventive care while providing partial coverage for basic and major services.

| Dental Insurance Quick Facts |

|---|

| Average Monthly Cost: $15-$50 |

| Typical Annual Maximum: $1,000-$1,500 |

| Preventive Coverage: 80-100% |

| Basic Services Coverage: 50-80% |

| Major Services Coverage: 0-50% |

| Common Waiting Periods: 0 months for preventive, 6 months for basic, 12 months for major services |

Finding affordable dental insurance can feel overwhelming. With monthly premiums, annual maximums, waiting periods, and coverage percentages, it’s easy to get lost in the fine print. But securing the right dental plan is essential for both your oral health and financial wellbeing.

Most dental insurance plans cover 80-100% of preventive care such as regular cleanings and exams. This focus on prevention helps catch problems early before they require more expensive treatments. Basic services like fillings typically receive 50-80% coverage, while major services like crowns may be covered at just 0-50%, often with waiting periods.

When comparing plans, look beyond just the monthly premium. Consider annual maximums (usually $1,000-$1,500), waiting periods for different service categories, and whether your preferred dentist is in-network. Dental insurance isn’t designed to cover everything—it’s primarily a tool to make routine care affordable and provide a safety net for unexpected issues.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve helped countless families and individuals find dental insurance plans that balance comprehensive coverage with affordable premiums. Our agency specializes in guiding clients through the complexities of insurance options to find solutions that protect both their health and their finances.

Dental insurance terms made easy:

How Dental Insurance Works & Why You Need It

Dental insurance is basically a partnership between you and the insurance company. You pay a little each month, and they help cover your dental bills when you need care. It’s like having a friend who chips in for your dental work – a friend who helps keep your smile bright and your wallet happy.

Most people pay between $15 and $50 monthly for dental insurance – about the cost of a few coffee shop visits. That might seem like an extra expense, but when you consider that two regular cleanings and check-ups can run $300-400 without insurance, the math starts making sense pretty quickly. Throw in a filling at $100-250, and you’re already potentially saving money.

Your dental insurance plan typically includes several key parts:

Your premium is what you pay monthly to keep your coverage active. Think of it as your dental care subscription. Your deductible (usually $50-$150 per year) is what you pay out-of-pocket before your insurance kicks in. The annual maximum is the total amount your plan will pay in a year – typically between $1,000-$1,500. And yes, waiting periods might apply for certain services, especially the more expensive ones.

One of the best things about having dental insurance? It encourages you to actually go to the dentist for preventive care. When cleanings and check-ups are covered at 80-100%, you’re much more likely to schedule those appointments. And catching problems early can save you from much bigger bills down the road.

What is dental insurance and how does it work?

Most dental insurance plans use a tiered system that’s pretty straightforward once you understand it. Think of it as a “100-80-50” structure:

The preventive stuff – your regular cleanings, exams, and x-rays – typically gets covered at 80-100%. Basic procedures like fillings and simple extractions usually get 50-80% coverage. And the major work – things like crowns, bridges, and root canals – typically gets covered at 0-50%.

When you visit your dentist, the claims process is usually hassle-free. You get your dental work done, your dentist sends the bill to your insurance company, they figure out what’s covered, and then you pay your portion while the insurance company pays theirs. Your portion is called coinsurance – the percentage you pay after meeting your deductible. If your plan covers fillings at 80%, for example, you’d pay the remaining 20%.

In-network vs. out-of-network benefits

Here’s where choosing the right dentist can really impact your wallet. The difference between in-network and out-of-network can be substantial!

In-network dentists have special agreements with your insurance company. They’ve agreed to accept lower, negotiated fees for their services. The best part? They can’t “balance bill” you for the difference between their regular price and this negotiated rate.

Let me give you a real-world example: Imagine a crown normally costs $1,200. If the in-network negotiated rate is $800, your dentist accepts that $800 as payment in full. If your plan covers major services at 50%, you’d pay $400, and your insurance covers the other $400. Pretty straightforward.

Out-of-network dentists haven’t made these agreements. While your insurance still pays their portion based on what they consider “reasonable fees,” the dentist can bill you for any difference. Using our crown example, if your insurance company’s “reasonable fee” is $800, but your dentist charges $1,200, you could end up paying your coinsurance plus that extra $400 difference.

The savings can be significant. Delta Dental reports that their network dentists offer average savings of 30-35% compared to out-of-network fees. That’s real money staying in your pocket!

At Stanton Insurance Agency, we help our clients steer these choices to find the perfect balance between coverage, cost, and convenience. We believe everyone deserves a healthy smile without breaking the bank.

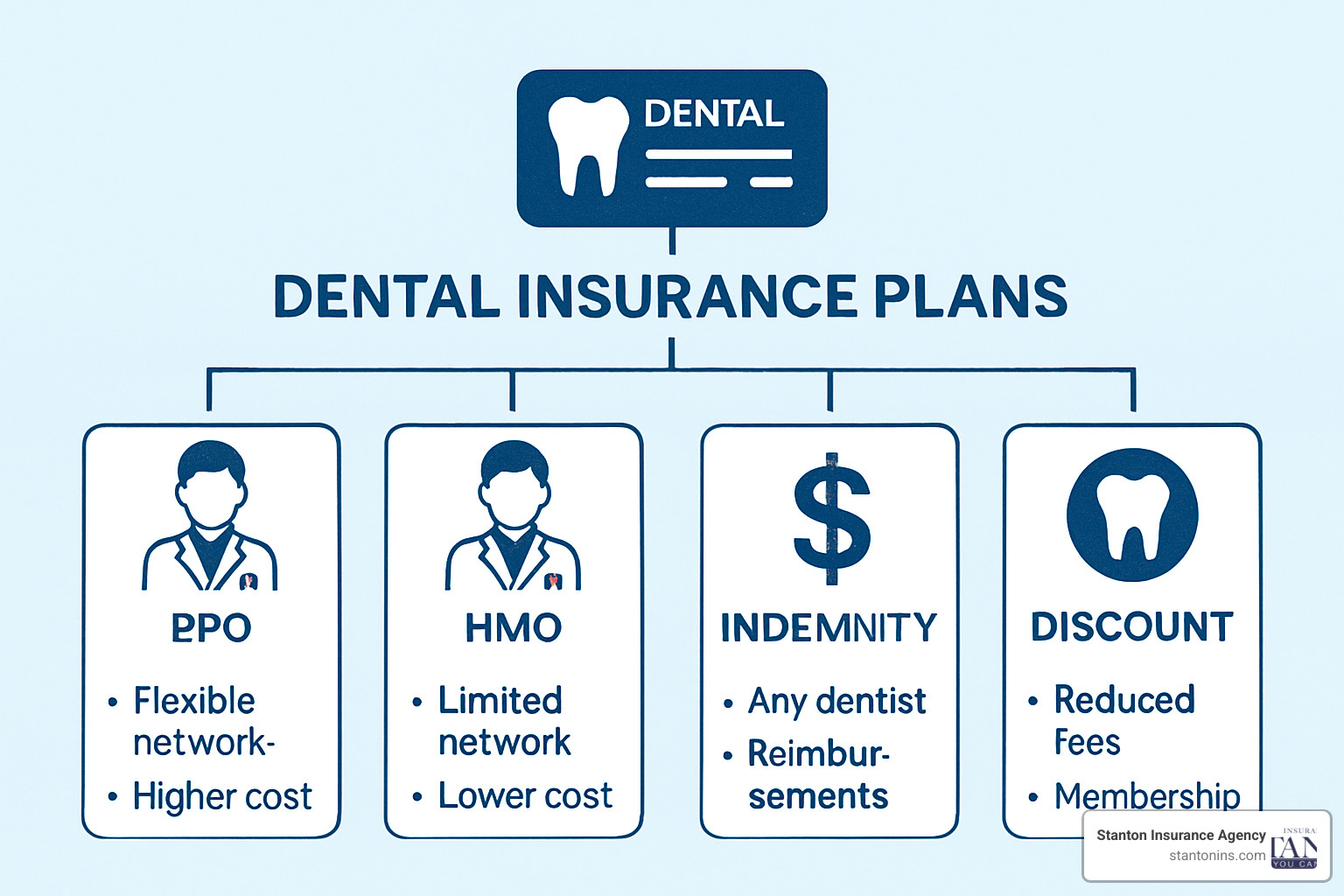

Types of Affordable Dental Insurance Plans

Shopping for dental insurance shouldn’t give you a toothache! Let’s break down your options in plain English so you can find a plan that keeps both your smile and wallet happy.

Dental insurance PPO plans

Think of PPO plans as the “Goldilocks” option of dental insurance – not too restrictive, not too expensive, but just right for many families. These popular plans strike a nice balance between freedom and affordability.

With a PPO, you’ll typically pay around $30-50 monthly for an individual plan. The real beauty is flexibility – you can visit any dentist you like, though you’ll save significantly more when staying in-network. This is perfect if you already have a dentist you love and don’t want to switch.

PPO networks tend to be quite extensive, so finding a participating dentist is usually straightforward. Coverage typically follows that 100-80-50 pattern we mentioned earlier – full coverage for preventive care, good coverage for basic procedures, and partial coverage for the big stuff.

Take Delta Dental’s PPO plans as an example – they generally cover 60-100% of your cleanings right away, 50-80% of fillings after a short 6-month waiting period, and 0-50% of crowns after waiting a year. Just remember that PPOs do come with annual maximums, usually between $1,000-$2,000, after which you’re responsible for the full cost of care.

Dental insurance HMO & EPO options

If budget is your primary concern, HMO and EPO plans deserve a closer look. These dental insurance options trade some flexibility for better affordability.

HMO plans typically cost just $15-25 monthly – significantly less than PPOs. The main trade-off? You’ll need to choose a primary dentist who coordinates all your care, and you must stay within the plan’s network except in emergencies.

One major advantage of HMO plans is they often have no annual maximum, meaning the benefits keep flowing all year long. Instead of percentage-based coverage, you’ll pay fixed copayments for services, making costs very predictable.

DeltaCare USA offers a popular HMO option with no waiting periods or deductibles for preventive care. Many of my clients find HMOs perfect for families who mainly need checkups, cleanings, and occasional fillings. Just be aware that provider networks are smaller, and some offices can get busy – scheduling might require a bit more advance planning.

Discount & savings programs

Not technically dental insurance, but definitely worth considering, discount programs offer a straightforward alternative that many of my clients love.

With these programs, you pay an annual membership fee (usually $100-200) in exchange for significant discounts on dental services. The benefits start immediately – no waiting periods – and there are no annual maximums to worry about.

The pricing is refreshingly transparent. You simply pay the discounted rate directly to your dentist, with no claims to file or reimbursements to track. Aetna’s Vital Savings program, for example, can save members up to 45% on dental services.

These plans shine for people who need immediate care, have already maxed out their insurance benefits, or want coverage for services their primary insurance excludes. Patient Direct® from Delta Dental offers similar savings of up to 45% on out-of-pocket costs, providing valuable relief for those caught in insurance waiting periods or without traditional coverage.

At Stanton Insurance Agency, we help you steer these options to find the right fit for your family’s unique needs. There’s no one-size-fits-all solution when it comes to dental insurance – the best plan is the one that matches your budget, preferred dentists, and expected dental needs.

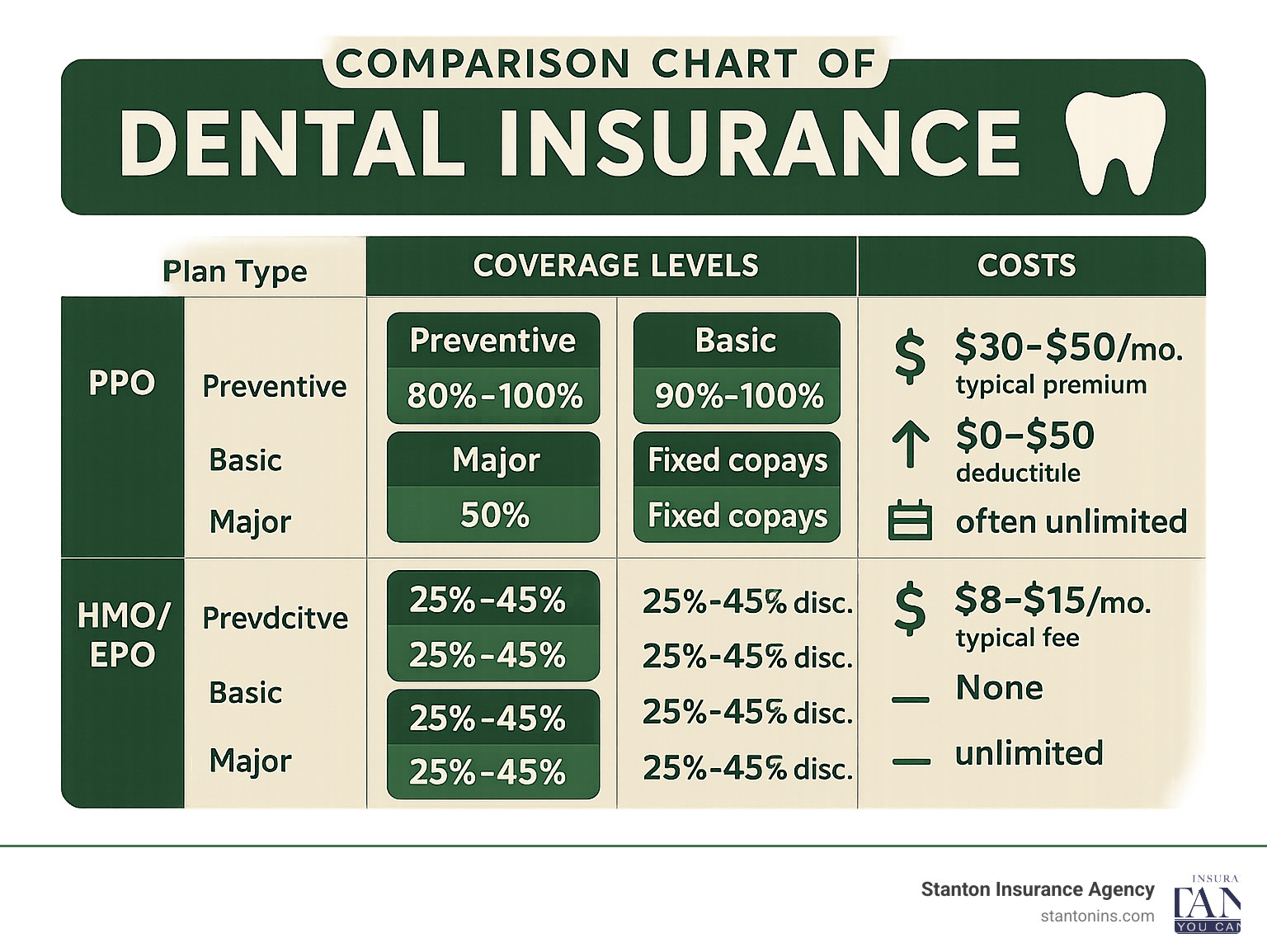

Comparing Costs & Coverage at a Glance

Let’s talk dollars and sense when it comes to dental insurance. I know comparing plans can feel like trying to solve a puzzle, but understanding what you’ll pay—and what you’ll get—is simpler than it seems.

Most individual dental insurance plans cost between $15-$50 per month, depending on the type and level of coverage you choose. Deductibles typically range from $50-$150 annually, though some plans waive this for preventive care (smart move, if you ask me!).

Here’s what you might expect from different plan types:

PPO plans tend to be the middle ground, with monthly premiums around $30-50 and annual maximums of $1,000-$2,000. They typically cover 80-100% of preventive care, 50-80% of basic procedures, and about 50% of major work.

HMO and EPO plans are usually more budget-friendly upfront, with premiums of $15-25 monthly. The trade-off? You’ll need to stay in-network, but many offer unlimited annual benefits and use fixed copays instead of percentages for basic and major services.

Discount plans aren’t technically insurance but offer an alternative approach. With membership fees of just $8-15 monthly, they provide 25-45% discounts on all services with no annual limits. They’re straightforward—what you see is what you get.

NCD dental plans, for example, offer a tiered approach with 100% coverage for preventive care, 80% for basic services, and 50% for major procedures. Their annual maximums reach $3,000 or $5,000 depending on which plan level you choose—quite generous compared to industry standards.

Delta Dental’s PPO ‘Gold’ plan includes a $50 annual deductible with a $1,000 annual maximum, while their premium ‘Diamond’ plan offers a $0 deductible with a $2,000 annual maximum and includes a $1,500 lifetime maximum for certain specialized services.

Hidden costs to watch for

Before you sign on the dotted line, let’s talk about the less obvious expenses that might surprise you later.

Waiting periods are perhaps the most frustrating hidden cost. While preventive care is usually covered immediately (thankfully!), basic services often come with 3-6 month waiting periods, and major services might make you wait a full year. Orthodontics can require patience—up to 24 months in some cases before coverage kicks in.

Cigna’s plans, like many others, typically impose waiting periods for their Class 2 and 3 services. There’s a silver lining, though: these waiting periods can sometimes be waived if you had prior dental insurance with no more than a 63-day lapse. Just note that orthodontia and implant waiting periods are usually set in stone.

Frequency limitations can also catch you off guard. Most plans limit cleanings to twice yearly and restrict how often you can get certain x-rays (full mouth every 3-5 years, bitewings annually). Need a crown replacement? Most plans will only cover that once every 5-10 years.

Lifetime maximums are separate caps for specific services. Implants often come with lifetime maximums of $1,500-$2,000, as does orthodontic work. Once you’ve used up these benefits, they’re gone for good—even if you switch plans.

Exclusions are the fine print worth reading. Nearly all dental insurance plans exclude cosmetic procedures like teeth whitening and purely aesthetic veneers. Pre-existing conditions—like teeth missing before you enrolled—typically aren’t covered. And if you started dental work before your coverage began, don’t expect the insurance to pick up the tab.

For a broader perspective on how dental costs fit into your overall healthcare budget, you might want to check out our page on how much is personal health insurance. Having a complete picture helps you make smarter decisions for both your smile and your wallet.

How to Pick the Best Dental Insurance for Your Smile and Budget

Finding the perfect dental insurance plan doesn’t have to be complicated. At Stanton Insurance Agency, we’ve helped countless families steer these waters, and we’ve found that a thoughtful approach makes all the difference in finding coverage that keeps both your smile and wallet healthy.

Start by taking an honest look at your dental health needs. Are you mainly interested in those twice-yearly cleanings? Or do you know you’ll need some fillings or perhaps even a crown in the near future? Maybe your teenager needs braces soon? Your specific needs will guide your coverage choices.

Your relationship with your dentist matters too. If you love your current provider and don’t want to switch, check whether they’re in-network with the plans you’re considering. Sometimes the comfort and trust you’ve built with a dentist is worth paying a bit more in premiums.

When it comes to budgeting, be realistic about what you can afford. Some folks prefer higher monthly premiums in exchange for lower out-of-pocket costs when they actually need care. Others would rather pay less each month and save up for potential dental expenses. There’s no wrong answer—it’s about what works for your financial situation.

Dental insurance options vary depending on your circumstances. Individual plans work well if you’re on your own, while family plans cover multiple people. If your employer offers dental benefits, that’s often the most cost-effective route. For those purchasing through the health insurance marketplace, dental coverage is typically available as an add-on.

Here in Massachusetts, New Hampshire, and Maine—where Stanton Insurance Agency proudly serves—dental coverage isn’t mandatory for adults. However, pediatric dental benefits are considered essential health benefits for children under the Affordable Care Act, so make sure the little ones are covered.

Before you sign on the dotted line, verify your benefits thoroughly. According to HIPAA guidelines, your personal information should be transmitted securely during this process. Most insurers now offer secure online portals or encrypted communication methods to protect your privacy while checking coverage details.

Questions to ask before enrolling

Smart shoppers know that asking the right questions before choosing dental insurance can save headaches later. If anyone in your family might need braces or clear aligners, find out if orthodontic coverage is included and what the lifetime maximum benefit is—it’s often separate from your annual maximum.

Thinking about dental implants? They’re a significant investment, so confirm whether they’re covered and if there’s a separate lifetime maximum for implant procedures. Many plans limit coverage or exclude implants entirely.

Emergency tele-dentistry can be a lifesaver. Some carriers like Delta Dental offer virtual dental visits available 24/7, 365 days a year—perfect for those middle-of-the-night toothaches or weekend emergencies.

Ask about annual rollover options too. Some forward-thinking plans let you carry over unused portions of your annual maximum to the next year if you’ve kept up with preventive care. This feature can be incredibly helpful if you anticipate needing major work in the future.

Don’t forget to inquire about pre-existing conditions and waiting periods. Most plans have limitations on conditions that existed before enrollment, especially for missing teeth. And if you had previous coverage without a significant gap (usually less than 63 days), some insurers will waive those frustrating waiting periods.

Tips to stretch your benefits

Getting the most from your dental insurance is a bit of an art form. Here’s how the pros do it:

Be an early bird with preventive visits. Schedule those bi-annual cleanings and exams early in the year. This strategy gives you time to address any issues found before your annual maximum is reached.

When possible, bundle your dental services. If you need multiple procedures, ask your dentist if they can be done in a single visit (when medically appropriate). This approach can reduce the number of copays or coinsurance payments you’ll make.

Coordinate your dental care with your tax-advantaged accounts. Using FSA or HSA funds to pay for out-of-pocket dental costs means you’re effectively paying with pre-tax dollars—a smart financial move that stretches your hard-earned money further.

Take time to review your Explanation of Benefits (EOB) statements throughout the year. These documents help you track usage and ensure you’re receiving all the benefits you’re entitled to. Think of it as balancing your dental checkbook!

Don’t be shy about asking your dentist for treatment alternatives. Often there are multiple approaches to address a dental issue, each with different costs. A good dentist will be happy to discuss all your options.

If you’re approaching your annual maximum but need major work, discuss with your dentist whether treatment can be safely split between calendar years. This timing strategy lets you use two years of benefits instead of maxing out in a single year.

At Stanton Insurance Agency, we believe everyone deserves a healthy smile without financial stress. We’re here to help you steer the sometimes confusing world of dental insurance with personalized guidance custom to your unique situation.

Frequently Asked Questions about Dental Insurance

Are there waiting periods and can they be waived?

When you’re eager to use your new dental insurance, waiting periods can feel frustrating. Most plans do include these cooling-off periods before certain services become available:

For routine check-ups and cleanings, you’re usually covered right away—insurers want you to get preventive care immediately. But for other services, you’ll typically need to wait: 3-6 months for basic services like fillings, and often a full year for major work like crowns or root canals. Orthodontics and implants might require patience, with waiting periods extending up to 24 months.

The good news? These waiting periods aren’t always set in stone. If you’re switching from another dental plan, many insurers will waive waiting periods if you had comparable coverage and didn’t have a significant gap (usually less than 63 days). Cigna, for example, typically waives waiting periods for Class 2 and 3 services if you had at least 12 months of prior coverage with no more than a 63-day lapse—though orthodontia and implants usually remain subject to the standard waiting period.

Looking for immediate coverage? Consider HMO plans or dental discount programs, which generally don’t impose waiting periods. These can be lifesavers when you need treatment right away.

What procedures are usually not covered?

Even the most comprehensive dental insurance plans have their limitations. Understanding what’s typically excluded can help prevent surprise bills down the road.

Cosmetic procedures almost never make the cut. That dazzling teeth-whitening procedure or those perfect veneers you’ve been eyeing? If they’re purely for appearance rather than medical necessity, you’ll likely be paying out-of-pocket.

Pre-existing conditions also present challenges. If you had missing teeth before enrolling, many plans won’t cover their replacement. Similarly, treatment already in progress when your coverage begins typically remains your financial responsibility.

Experimental procedures fall outside standard coverage, as do certain major services like TMJ treatments or some implant procedures (though implant coverage is becoming more common). And those “upgrades” like tooth-colored fillings on back teeth? Your plan might only cover the basic silver amalgam version.

The details vary significantly between plans. For instance, some Delta Dental PPO plans cover tooth-colored composite fillings for front teeth while only covering amalgam for back teeth, whereas their premium plans might offer composite coverage throughout your mouth.

Reading the fine print before signing up can save you from unexpected expenses later. When in doubt, ask for a detailed benefits breakdown—it’s your right as a consumer.

What should I do if I need dental care but don’t have insurance?

Finding yourself in need of dental care without insurance can be stressful, but you have more options than you might think.

Dental savings plans offer an immediate solution with no waiting periods. While not insurance, these membership programs provide discounts of 25-45% on most procedures right away. With annual fees typically between $100-200, they can be more affordable than traditional insurance for immediate needs.

Dental schools represent an excellent value option. Yes, students will be performing your treatment, but they’re supervised closely by experienced faculty. While appointments may take longer, the 30-50% savings compared to private practice fees can make the extra time worthwhile.

Many communities have Federally Qualified Health Centers offering dental services on sliding fee scales based on your ability to pay. These centers provide quality care while making services accessible to those with limited financial resources.

Most dentists understand that dental care can strain budgets and offer payment plans or work with financing companies like CareCredit. These options let you spread payments over time, often with low or zero interest if paid within a promotional period.

Even without insurance, don’t skip those regular cleanings and exams. They’re your best defense against developing more serious—and expensive—problems. A $150 filling today could save you from a $1,000+ root canal tomorrow.

Many dentists also offer discounts for payment at the time of service, so don’t be afraid to ask about cash prices. And if you anticipate needing care soon, some carriers offer short-term dental insurance with minimal waiting periods for basic services.

For more information about dental care options without insurance, the American Dental Association provides helpful resources at ADA.org.

At Stanton Insurance Agency, we understand that navigating dental care costs can be challenging. We’re happy to discuss affordable dental insurance options that might work for your situation. Delaying necessary dental care often leads to more extensive problems—and higher bills—down the road.

Conclusion

Finding affordable dental insurance that actually works shouldn’t leave you with a toothache. With the right knowledge and a trusted guide, you can secure coverage that protects both your smile and your savings account. At Stanton Insurance Agency, we’ve helped countless families throughout Massachusetts, New Hampshire, and Maine steer the sometimes-confusing world of dental benefits to find plans that truly fit their lives.

As you consider your options, remember what matters most: dental insurance is designed primarily to make preventive care accessible while providing that crucial safety net for unexpected issues. The peace of mind that comes from knowing a sudden toothache won’t derail your budget is invaluable.

The perfect plan for you isn’t necessarily the one with the lowest premium or the highest annual maximum. It’s the one that aligns with your family’s specific oral health needs, works with your preferred dentists, and fits comfortably within your monthly budget. Look beyond just the premium to understand the complete picture—deductibles, waiting periods, and coverage percentages all play important roles in determining the true value of a plan.

Don’t forget to consider alternatives like dental savings plans if traditional insurance doesn’t quite meet your needs. These membership-based programs can offer immediate savings without the waiting periods that often come with insurance.

Most importantly, whatever coverage you choose, be sure to actually use those preventive benefits! Regular cleanings and check-ups are your best defense against developing more serious (and expensive) problems down the road.

Whether you’re an individual seeking basic coverage, a growing family needing comprehensive benefits including orthodontics, or a senior looking to supplement Medicare, we’re here to help you steer your options. Our team at Stanton Insurance Agency takes pride in finding solutions that protect what matters most—your health and your financial wellbeing.

For more information about how dental insurance fits into your overall protection strategy, visit our Personal Insurance page. We’re ready to guide you toward the right dental plan that gives you confidence without taking a big bite out of your budget.

Don’t wait for a dental emergency to think about coverage. Contact us today to discuss your options and take that first step toward a healthier smile and a well-protected wallet. After all, the best time to get dental insurance is before you need it!