Why Condo HO6 Insurance Is Essential for Unit Owners

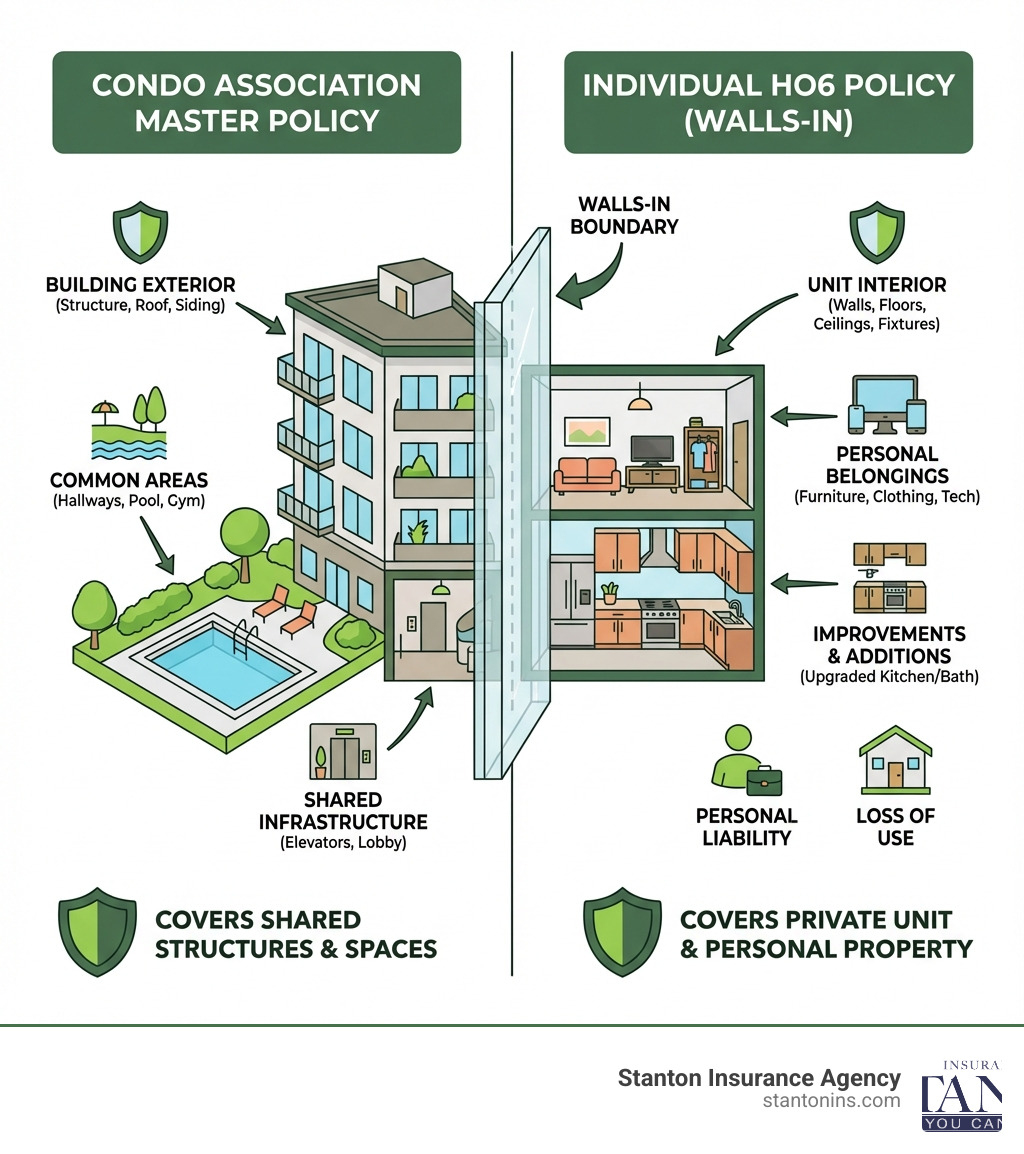

Condo HO6 insurance is a specialized property insurance policy designed specifically for condominium and co-op unit owners. Unlike standard homeowners insurance, it protects the interior of your unit, your personal belongings, and provides liability coverage—essentially everything from the “walls-in.”

Quick Answer: What Condo HO6 Insurance Covers

- Your Unit’s Interior: Walls, floors, ceilings, cabinets, fixtures, and built-in appliances (depending on your association’s master policy)

- Personal Property: Furniture, electronics, clothing, and other belongings

- Personal Liability: Legal fees and damages if someone is injured in your unit or you damage someone else’s property

- Loss of Use: Temporary living expenses if your unit becomes uninhabitable due to a covered loss

- Loss Assessment: Your share of costs when the association’s master policy doesn’t fully cover common area damage

Why You Need It: Your condo association’s master policy covers the building’s exterior and common areas, but it doesn’t protect your personal space or belongings. Most mortgage lenders require HO6 insurance, and many condo associations mandate it in their bylaws.

Owning a condominium offers a unique blend of private ownership and shared community living. But this arrangement also creates unique insurance needs that differ significantly from traditional homeownership. Your condo association maintains a master insurance policy for the building structure and shared spaces like hallways, pools, and gyms. However, that coverage stops at your unit’s threshold. Everything inside—your renovated kitchen, your furniture, your personal liability—is your responsibility to insure.

This is where condo insurance, formally known as an HO-6 policy, becomes critical. It’s your financial safety net against theft, fire, water damage, and liability claims. Without it, you could face devastating out-of-pocket costs to replace your belongings or defend yourself in a lawsuit.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, where I’ve spent over two decades helping condo owners in Massachusetts and New Hampshire understand and secure the right condo HO6 insurance coverage. At Stanton Insurance, we specialize in working with individuals and families to protect their homes and valuables with personalized service and local expertise.

Basic condo HO6 insurance glossary:

- Condo Insurance Coverage for Water Damage

- condominium insurance coverage

- what is loss assessment coverage

What is Condo (HO-6) Insurance and Why Is It Essential?

An HO-6 policy is a type of property insurance custom for condominium and co-op owners. Think of it as “walls-in” coverage. While a standard homeowners (HO-3) policy covers an entire freestanding house and the land it sits on, a condo HO6 insurance policy is designed to protect the part of the property you are directly responsible for: the interior of your unit. This includes everything from the paint on your walls to your personal belongings. While not always required by state law, most mortgage lenders will not issue a loan without proof of an HO-6 policy. Furthermore, your condo association’s bylaws will almost certainly require you to carry individual insurance to cover your unit and personal liability, protecting both your investment and the community as a whole.

How HO-6 Differs from Homeowners (HO-3) Insurance

The world of property insurance can feel like an alphabet soup, with HO-3, HO-4, and HO-6 policies floating around. Let’s clear up the main distinction between an HO-3 and an HO-6 policy.

- HO-6 Policy: This policy is specifically for condominium and co-op unit owners. It provides “walls-in” coverage, meaning it protects the interior of your unit, your personal belongings, and your liability. The key here is its interaction with your condo association’s master policy, which covers the exterior and common areas. An HO-6 policy is typically a “named peril” policy, meaning it only covers damages caused by perils specifically listed in the policy, such as fire, theft, or vandalism.

- HO-3 Policy: This is the most common type of homeowners insurance, designed for owners of single-family homes. An HO-3 policy covers the entire structure of the house, any detached structures (like a garage or shed), and the land it sits on. It also protects your personal property and provides liability coverage. Unlike most HO-6 policies, HO-3 policies are often “open peril” or “all-risk,” meaning they cover all causes of loss unless specifically excluded in the policy. This broader coverage reflects the homeowner’s full responsibility for the entire property.

With an HO-6, you’re insuring your personal domain within a larger structure. With an HO-3, you’re insuring the entire structure and land as your sole domain.

Is Condo Insurance Required?

The short answer is: almost always, yes. While it might not be a state law requirement everywhere, several factors make condo HO6 insurance a practical necessity:

- Mortgage Lender Requirement: If you have a mortgage on your condo, your lender will almost certainly require you to carry an HO-6 policy. This protects their financial interest in your unit. Without adequate insurance, they risk losing their investment if your unit is damaged or destroyed.

- Condo Association Bylaws: Your condo association’s governing documents (bylaws, declaration) will typically mandate that unit owners purchase individual HO-6 policies. This is crucial for the entire community, as it ensures that if one unit is damaged, the responsibility for repairs or replacement falls to the individual owner’s policy, not the association’s master policy or other unit owners.

- Financial Protection: Even without external requirements, HO-6 insurance is a wise financial decision. It protects your significant investment in your condo unit and all your personal belongings. Imagine a fire or major water leak—the costs to repair your unit and replace everything inside could be astronomical without insurance.

- Liability Shield: What if a guest slips and falls in your unit, or your pet accidentally bites someone? Your HO-6 policy provides personal liability coverage, protecting you from potentially ruinous legal fees and settlement costs. It can even cover medical payments to others who are injured on your property, regardless of fault, up to a certain limit.

- Asset Protection: Your condo is likely one of your most valuable assets. An HO-6 policy safeguards that asset, along with your personal property and financial well-being, against unforeseen events.

A Deep Dive into Your Condo HO6 Insurance Coverage

An HO-6 policy is a package of several distinct coverages designed to provide comprehensive protection. Understanding what each part does is key to ensuring you’re not left with unexpected gaps or expenses after a loss. From fires to theft to liability claims, your policy is your financial safety net.

Core Protections in a Standard HO-6 Policy

Let’s break down the main components you’ll find in a standard condo HO6 insurance policy:

- Dwelling Coverage (Coverage A): This is the “walls-in” part of your coverage. It protects the interior structures of your unit, including permanent fixtures like flooring, walls, ceilings, cabinets, and built-in appliances (such as your dishwasher or water heater). The extent of this coverage depends heavily on your condo association’s master policy, a topic we’ll dive into shortly. For instance, if a fire damages your kitchen, your dwelling coverage would help pay to repair or replace the damaged cabinets and walls.

- Personal Property (Coverage C): This covers your personal belongings inside your unit and, often, anywhere else in the world. Think of everything you’d take with you if you moved: furniture, clothing, electronics, jewelry, artwork, and more. This coverage protects against specified perils like theft, fire, and vandalism. If your beloved collection of vintage vinyl records is stolen, your personal property coverage would help you replace it.

- Personal Liability: This is a crucial protection. If someone is injured in your unit or you accidentally cause damage to someone else’s property, and you are found legally responsible, this coverage steps in. It can cover legal fees, medical bills for the injured party, and any judgments or settlements against you. For example, if a guest slips on a wet floor in your condo and breaks their wrist, your liability coverage would help with their medical expenses and any potential lawsuit.

- Loss of Use / Additional Living Expenses (ALE): Should your condo unit become uninhabitable due to a covered loss (like a fire or extensive water damage), this coverage helps pay for your temporary living expenses. This includes things like hotel stays, temporary rental costs, restaurant meals, and even laundry services while your unit is being repaired.

- Medical Payments to Others: This coverage pays for medical expenses for guests who are accidentally injured on your property, regardless of who is at fault. It’s usually a smaller amount (e.g., $1,000 to $5,000) and is designed to cover minor injuries without the need for a liability claim. If a friend accidentally cuts their hand on a sharp counter edge in your kitchen, this coverage could help pay for their emergency room visit.

Understanding Loss Assessment Coverage

Loss assessment coverage is a vital and unique component of condo HO6 insurance. It’s designed to protect you from unexpected financial hits. Here’s how it works:

Your condo association has a master policy that covers common areas and the building structure. However, if a major covered event—like a fire in the lobby, extensive damage to the roof from a hailstorm, or even a liability claim in a shared amenity—causes damage that exceeds the master policy’s coverage limit, or if the master policy has a high deductible, the condo association may issue a “special assessment” to all unit owners to cover the shortfall.

This assessment means each unit owner is responsible for a portion of the repair costs. Without loss assessment coverage, you would have to pay your share out-of-pocket, which can sometimes amount to thousands of dollars. Loss assessment coverage helps pay your share of this bill, protecting you from a sudden, and often substantial, out-of-pocket expense.

Common Exclusions: What Your Policy Won’t Cover

Just as important as knowing what your HO-6 policy covers is understanding what it typically doesn’t cover. These are standard exclusions across most policies, and being aware of them helps you identify potential gaps you might need to address with additional coverage.

- Common Areas: Your personal HO-6 policy is for your unit. Common areas like hallways, shared roofs, building exteriors, and amenities (pools, gyms) are covered by your condo association’s master policy.

- Flooding: Standard condo HO6 insurance policies, like most homeowners policies, do not cover damage caused by external flooding (e.g., rising rivers, storm surge, or heavy rainfall inundating your property). If your condo is in a flood-prone area in Massachusetts or New Hampshire, you’ll need to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer. Learn more about flood insurance here.

- Earthquakes: While less common in Massachusetts and New Hampshire, earthquake damage is generally excluded from standard policies. If you live in an area with seismic activity concerns, you might consider adding an earthquake endorsement.

- Wear and Tear: Insurance covers sudden, accidental damage, not gradual deterioration. Your policy won’t pay to fix a leaky faucet that’s been dripping for months or to replace old carpeting that’s simply worn out. Routine maintenance and upkeep are your responsibility as a homeowner.

- Pest Infestations: Damage from termites, rodents, or other pests is typically not covered. This falls under maintenance issues.

- Neglect: If damage occurs because you failed to maintain your unit or take reasonable steps to prevent a loss, your claim could be denied. For example, if you leave your unit vacant for an extended period without proper care and a pipe bursts due to freezing temperatures, it might be considered neglect.

- Sewer Backup: Damage caused by water backing up through sewers or drains is also typically excluded from standard policies. This is a common and often costly issue, especially in older buildings or during heavy rain. We highly recommend adding a water backup endorsement to your HO-6 policy to cover this risk.

- Intentional Acts: Damages or injuries caused by intentional acts are never covered. Insurance is designed for unforeseen accidents.

Understanding these exclusions allows us to discuss custom solutions and additional endorsements that might be right for you.

The Master Policy: Your HO-6 Policy’s Other Half

You can’t choose the right HO-6 policy without first understanding your condo association’s master policy. This is the insurance that covers the entire condominium complex, including the physical structure and shared spaces. The type of master policy your association has directly determines how much dwelling coverage you need for your own unit. Think of it as a puzzle: your HO-6 policy fills in the pieces that the master policy leaves out.

The Three Types of Master Policies

Condo master policies generally come in three flavors, each with different implications for your individual condo HO6 insurance:

| Policy Type | What It Covers | Your HO-6 Responsibility |

|---|---|---|

| Bare Walls | The basic structure of the building, including exterior walls, roofing, and framing. It does not cover anything inside your unit (not even the drywall). | You must insure the entire interior of your unit: walls, floors, fixtures, cabinets, appliances, and all personal property. This is the most comprehensive dwelling coverage you’ll need. |

| Single Entity | The building structure plus the standard fixtures inside each unit as they were originally built (e.g., standard cabinets, plumbing, wiring, basic flooring). | You must insure your personal belongings and any upgrades or improvements you or a previous owner made (e.g., custom flooring, high-end appliances, renovated bathrooms). |

| All-In | The most comprehensive type, covering the building, standard fixtures, and any improvements or additions made to the unit. | You primarily need to insure your personal belongings and cover your personal liability. Dwelling coverage needs are minimal, often just covering paint, wallpaper, or minor alterations. |

How the Master Policy Dictates Your Condo HO6 Insurance Needs

The type of master policy your condo association holds is the single most important factor in determining how much dwelling coverage you need on your personal condo HO6 insurance policy.

- Reviewing Association Documents: To avoid coverage gaps (or paying for coverage you don’t need!), it’s crucial to obtain and review a copy of your condo association’s master insurance policy and declarations. This document will explicitly state what the association’s policy covers and where your responsibility begins. We can help you decipher these documents if they look like ancient hieroglyphs!

- Adjusting Dwelling Coverage:

- If your association has a “bare walls” master policy, you’ll need significant dwelling coverage on your HO-6 policy to cover everything from the studs inward, including drywall, insulation, flooring, cabinetry, and built-in appliances.

- With a “single entity” policy, your HO-6 dwelling coverage will focus on any improvements or upgrades you’ve made to the original unit. If you upgraded your kitchen or installed hardwood floors, your HO-6 needs to protect those investments.

- An “all-in” policy means your dwelling coverage needs are minimal, as the master policy covers most of your unit’s interior structure and improvements. You’ll still want some dwelling coverage for minor items or cosmetic finishes.

- Master Policy Deductible: It’s also important to know the deductible on the master policy. If there’s a large deductible for a common area claim, and your association assesses unit owners for their share, your loss assessment coverage on your HO-6 policy will be invaluable.

- Coverage Gaps: The goal is to ensure seamless coverage between the master policy and your individual HO-6. Without this coordination, you could find yourself responsible for damages you thought were covered. For a broader understanding of how condo insurance works, you can refer to the NAIC consumer guide on condo insurance. We’re here to help you steer these complexities.

Calculating Costs and Finding Savings on Your Policy

The cost of condo HO6 insurance is influenced by a variety of factors, but it’s generally more affordable than a traditional homeowners policy because you aren’t insuring the entire building. According to the National Association of Insurance Commissioners (NAIC), the nationwide average cost is about $506 per year. However, local factors play a huge role. For our clients in Massachusetts, the average cost is around $444 annually, while in New Hampshire, it’s typically closer to $332 per year. These are just averages, of course, and your specific premium will depend on several variables.

What Factors Influence the Cost of Condo Insurance?

Several elements come into play when calculating your condo HO6 insurance premium:

- Location: Where your condo is located in Massachusetts or New Hampshire significantly impacts cost. Factors like local crime rates, proximity to a fire department, and susceptibility to natural disasters (e.g., coastal areas prone to hurricanes or winter storms) all influence premiums.

- Construction Materials: The age and type of construction materials used in your building can affect rates. Newer buildings with modern fire suppression systems or materials resistant to certain perils might have lower premiums.

- Claims History: Your personal claims history, as well as the claims history of the condo association, can impact your rates. More frequent claims often lead to higher premiums.

- Coverage Limits: The higher your chosen coverage amounts for dwelling, personal property, and liability, the higher your premium will be.

- Deductible Amount: This is the amount you agree to pay out-of-pocket before your insurance kicks in. Choosing a higher deductible typically lowers your premium, but make sure it’s an amount you can comfortably afford in an emergency.

- Protective Devices: Having safety and security features like smoke detectors, fire alarms, sprinkler systems, burglar alarms, and even smart home devices can often qualify you for discounts.

- Credit Score: In many states, including Massachusetts and New Hampshire, your credit-based insurance score can influence your premium. A higher score often indicates a lower risk to insurers, leading to better rates.

Smart Ways to Save Money

We’re always looking for ways to help our clients get the best coverage at the most competitive price. Here are some smart strategies to save money on your condo HO6 insurance:

- Bundle Your Policies: This is one of the easiest and most significant ways to save. Many insurance providers offer discounts if you combine your condo HO6 insurance with other policies, like your auto insurance. We can help you explore bundling options that make sense for you. Check out our car insurance options here.

- Raise Your Deductible: As mentioned, opting for a higher deductible will lower your annual premium. Just be sure you have enough in your emergency fund to cover that higher deductible should you need to file a claim.

- Install Safety Devices: Make your condo safer and potentially save money! Installing centrally monitored fire alarms, burglar alarms, and sprinkler systems can often lead to discounts on your policy. Even basic smoke detectors are a must-have.

- Review Annually: Don’t just “set it and forget it.” Your insurance needs change over time, and so do market rates. We recommend reviewing your policy with us annually to ensure your coverage still meets your needs and to check if you qualify for new discounts. Shopping around periodically can also help you find better rates.

- Maintain a Good Credit Score: While not directly insurance-related, a strong credit history can positively impact your insurance score, potentially leading to lower premiums.

Frequently Asked Questions about Condo HO-6 Insurance

We understand you likely have many questions about protecting your condo. Here are some of the most common ones we hear:

What’s the difference between an HO-6 and an HO-4 (renters) policy?

This is a great question that highlights the different ownership structures in multi-unit dwellings.

- An HO-6 policy is specifically for condo owners. It includes dwelling coverage for the interior structure of the unit (the “walls-in”), personal property coverage for your belongings, and personal liability protection. As an owner, you have an insurable interest in the physical unit itself.

- An HO-4 policy, also known as renters insurance, is for tenants who rent a home or apartment. It covers only their personal belongings and provides personal liability coverage. Renters have no ownership interest in the structure they live in, so their policy doesn’t include any dwelling coverage. Essentially, an HO-4 policy protects what you own and your actions, while an HO-6 protects what you own (the unit and your stuff) and your actions.

Do I need extra coverage for valuables like jewelry or art?

Yes, most likely. A standard condo HO6 insurance policy has specific, limited coverage amounts for high-value items like jewelry, fine art, furs, firearms, and silverware. These “sub-limits” are often quite low, typically ranging from $1,000 to $2,500 per category, regardless of your overall personal property limit.

If you own valuable items that exceed these sub-limits, you will need to add a “scheduled personal property” endorsement (also known as a floater or rider) to your policy. This endorsement allows you to list specific high-value items and insure them for their appraised value, providing broader coverage than your standard policy. We always recommend getting an appraisal for truly valuable items to ensure they are properly insured.

Does condo insurance cover water damage?

It’s complicated, and this is where many condo owners get caught off guard.

- Covered Water Damage: A standard condo HO6 insurance policy typically covers damage from sudden and accidental water discharge from within your unit. This includes things like a burst pipe, an overflowing washing machine, a leaky hot water heater, or a sudden leak from a dishwasher. These are generally considered “specified perils” covered by your policy.

- Excluded Water Damage: However, it does not cover water damage from several common sources:

- External Flooding: This includes water from rising rivers, storm surges, or heavy rainfall that enters your unit from the outside. This requires a separate flood insurance policy.

- Water Backup from Sewers or Drains: This is a common and often costly issue, particularly in urban areas of Massachusetts and New Hampshire. If water backs up through your sewer lines, drains, or sump pump, the resulting damage is typically excluded from a standard HO-6 policy. We strongly recommend adding a “water backup and sump pump overflow” endorsement to your policy for this crucial protection.

- Gradual Leaks or Seepage: Damage from slow, ongoing leaks or water seeping through foundations is usually considered a maintenance issue and is not covered.

- Mold: While mold that results directly from a covered water damage event might have limited coverage, mold that develops due to neglect, humidity, or unaddressed leaks is typically excluded.

Understanding the nuances of water damage coverage is vital, as it’s one of the most frequent types of claims. We can help you identify your specific risks and recommend the appropriate endorsements.

Conclusion: Securing Your Condo and Your Peace of Mind

Navigating condo HO6 insurance doesn’t have to be complex. The key is to remember that your personal HO-6 policy and your association’s master policy are two halves of a whole, designed to work together to provide complete protection. By understanding what your master policy covers, you can tailor your HO-6 policy to fill the gaps, ensuring your home, your belongings, and your finances are secure.

At Stanton Insurance Agency, we pride ourselves on being local experts in Massachusetts and New Hampshire. We understand the unique insurance landscape of our communities and are dedicated to helping you find the precise coverage you need without paying for what you don’t. We believe in building relationships and offering personalized advice, ensuring that your valuable assets are protected with trusted insurance solutions.