Cyber Liability Insurance Policy: 7 Essential 2025 Success Tips

Why Every Business Needs Protection From Growing Cyber Threats

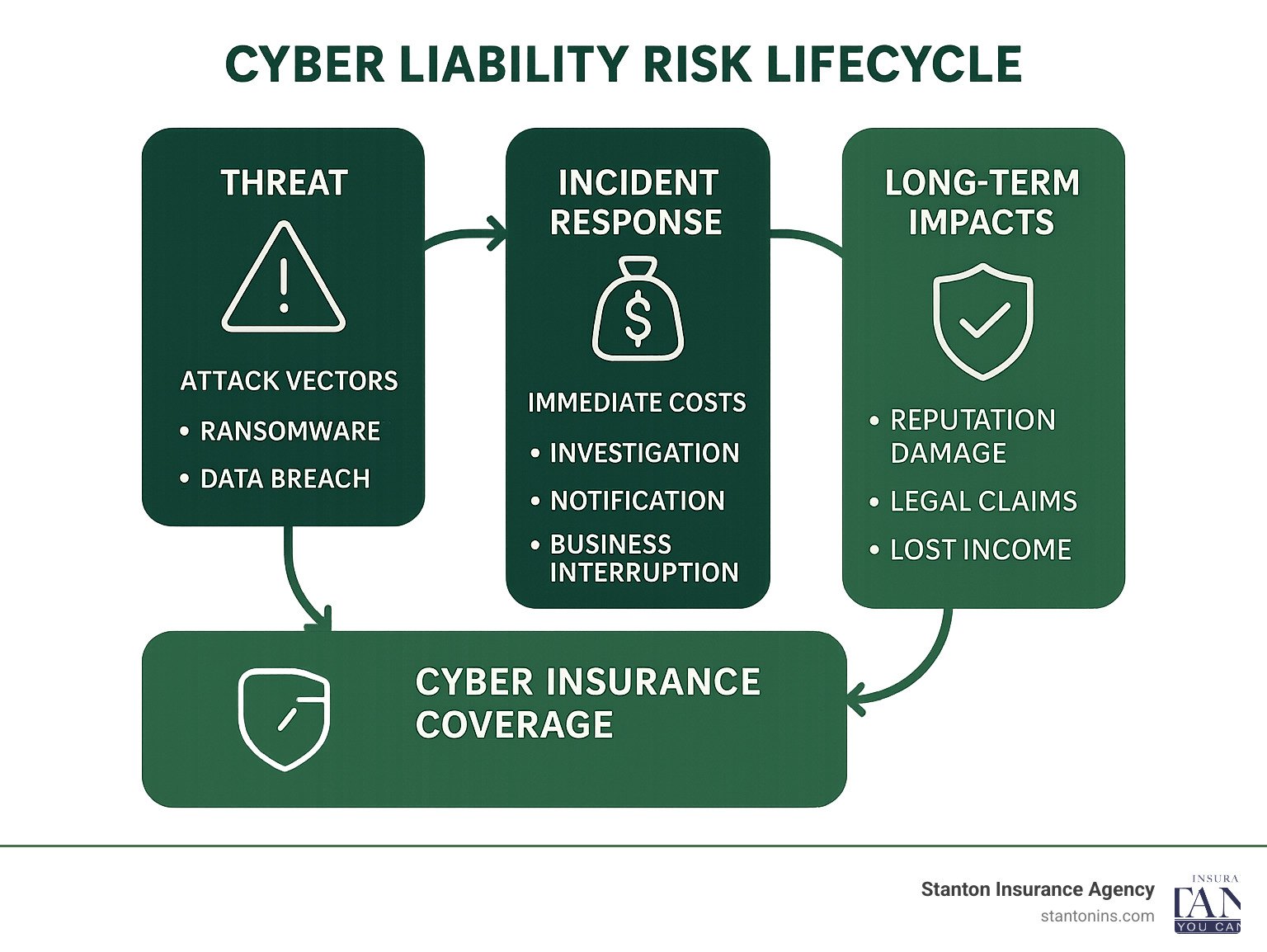

A cyber liability insurance policy is specialized insurance coverage that protects businesses from financial losses related to data breaches, cyberattacks, and other digital security incidents. Here’s what you need to know:

Key Components of Cyber Liability Insurance:

- First-party coverage – Covers your direct costs (data recovery, business interruption, ransom payments)

- Third-party coverage – Protects against lawsuits from affected customers or partners

- Breach response services – Includes legal counsel, forensic investigation, and customer notification

- Regulatory defense – Covers fines and penalties from compliance violations

The numbers tell a sobering story about today’s cyber threat landscape. According to recent studies, 55% of small businesses have experienced a data breach and 53% have had multiple breaches. The average cost of a worldwide data breach reached $4.24 million in 2021, while 60% of small businesses go out of business within six months of experiencing a breach.

Unlike traditional business insurance policies, cyber liability coverage specifically addresses digital risks that general liability and professional liability policies typically exclude.

I’m Geoff Stanton, a Certified Insurance Counselor and 4th generation owner of Stanton Insurance Agency. With over two decades of experience helping businesses steer complex insurance needs, I’ve seen how a properly structured cyber liability insurance policy can mean the difference between a manageable incident and a business-ending catastrophe.

Quick cyber liability insurance policy terms:

- what does cyber insurance not cover

- do therapist need cyber liability insurance

- does professional liability insurance cover cyber

What Is a Cyber Liability Insurance Policy?

Think of a cyber liability insurance policy as your digital safety net. While your traditional business insurance protects your physical building and equipment, cyber liability insurance steps in when hackers target your computers, steal your customer data, or hold your files for ransom.

This specialized coverage is designed for our digital world, where your most valuable assets might be stored on servers instead of in filing cabinets. Your customer database, financial records, and proprietary business information all need protection – and that’s exactly what a cyber liability insurance policy provides.

When cybercriminals strike, the costs add up fast. You’ll need forensic experts to figure out what happened, lawyers to handle the legal maze, and potentially thousands of dollars to notify affected customers. Many states have strict breach notification laws that require businesses to inform customers within a specific timeframe when their personal information is compromised.

Why Businesses Need One

Here’s the uncomfortable truth: cyber attacks don’t care about the size of your business. I’ve seen small accounting firms hit with the same sophisticated ransomware that targets major corporations. The difference is that large companies have entire IT security teams and deep pockets – most small businesses don’t.

The financial protection aspect is probably the most obvious benefit. When the average data breach costs over $4 million, even a “small” cyber incident can threaten your business’s survival. Reputation management often becomes the bigger long-term challenge, as customers lose trust quickly when their personal information is compromised.

Don’t forget about regulatory fines either. Government agencies are getting more aggressive about penalizing businesses that don’t properly protect customer data. These fines can reach into the hundreds of thousands or even millions of dollars.

First-Party vs Third-Party Coverage

Understanding the difference between first-party and third-party coverage is crucial when shopping for a cyber liability insurance policy. First-party coverage pays for your direct costs, while third-party coverage protects you when others make claims against your business.

First-party coverage handles your immediate needs after a cyber incident. This includes getting your systems back online, recovering lost data, and managing the crisis. You’ll also get coverage for business interruption when cyber attacks force you to shut down temporarily.

Third-party coverage protects you from lawsuits and regulatory actions. When customers sue because their data was stolen from your systems, or when government agencies investigate your data protection practices, third-party coverage steps in.

| Coverage Type | What It Covers | Example Scenario |

|---|---|---|

| First-Party | Your direct costs and losses | Ransomware attack requires $50,000 to restore systems |

| Third-Party | Claims made against you by others | Customer sues for $100,000 after their data is stolen |

Core Coverages and Typical Exclusions

When you’re shopping for a cyber liability insurance policy, think of it like building a security system for your business – you need multiple layers of protection working together. Understanding both what’s covered and what’s not covered is essential for making smart choices about your cyber liability insurance coverage.

Five Key Coverage Areas

Privacy liability coverage forms the backbone of most policies. When sensitive customer information gets exposed – whether it’s credit card numbers, medical records, or personal details – this coverage handles the legal defense costs and potential settlements.

Network security coverage kicks in when hackers break through your digital defenses. This covers the costs of investigating how the attack happened, fixing the vulnerabilities, and dealing with the aftermath.

Business interruption coverage might be the most underestimated protection in any cyber liability insurance policy. When your systems go down, you’re still paying rent, salaries, and other expenses while losing revenue.

Cyber extortion coverage has become critically important as ransomware attacks surge. This coverage handles both the investigation costs and, where legally appropriate, ransom payments. More importantly, it provides access to specialized negotiators.

Media liability coverage protects against claims related to your online content, social media posts, or website materials. In our connected world, a single social media misstep can trigger lawsuits for defamation or copyright infringement.

The data restoration component deserves special attention. Rebuilding corrupted databases and recreating lost digital assets often costs far more than businesses expect. Public relations costs and credit monitoring services round out the essential coverage areas.

What a Policy Will Not Cover

Understanding what your cyber liability insurance policy won’t cover can save you from nasty surprises during a claim. For a comprehensive look at these limitations, check out our detailed guide on what cyber insurance doesn’t cover.

Hardware upgrades and improvements represent a major exclusion area. If a cyber attack damages your systems, the policy will restore them to their previous condition but won’t pay for upgrades.

Future profit losses beyond the policy’s specified time frame won’t be covered. Most policies limit business interruption coverage to 12-24 months.

Insider fraud and employee dishonesty typically fall outside cyber liability coverage. If your trusted bookkeeper steals customer data, you’ll need separate crime coverage.

Pre-existing breaches create another significant gap. If you know about a security incident before purchasing coverage, that incident won’t be covered.

Acts of war or terrorism remain excluded from most policies, though some insurers now offer cyber terrorism coverage as an option.

Requirements, Eligibility & Cost of a Cyber Liability Insurance Policy

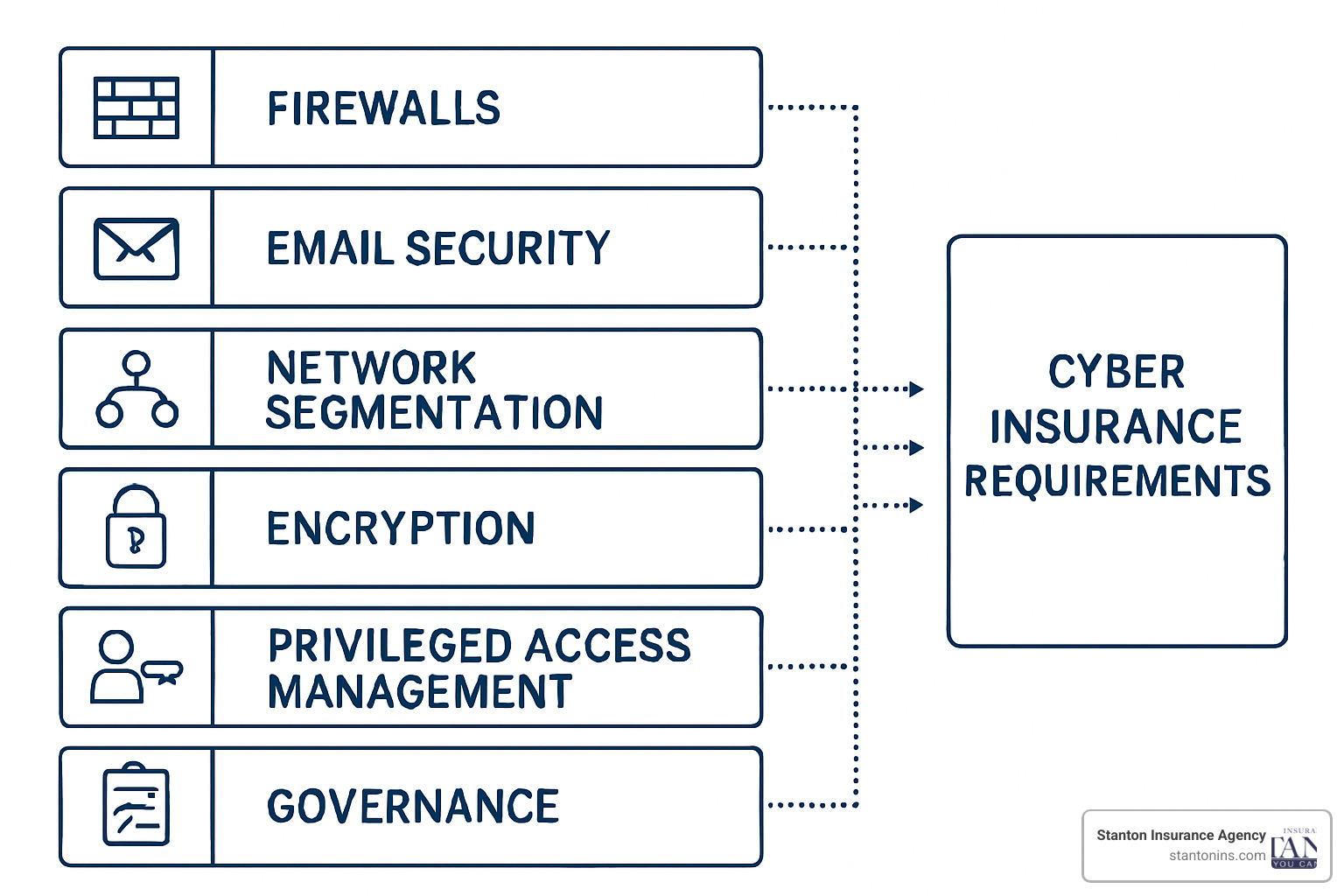

The cyber insurance landscape has transformed dramatically over the past few years. What used to be a relatively straightforward application process has evolved into a comprehensive evaluation of your business’s cybersecurity posture. Understanding these current cyber insurance requirements is your first step toward securing affordable protection.

Underwriting Checklist

Today’s cyber liability insurance policy underwriting process resembles a cybersecurity audit more than a traditional insurance application. Insurers want proof that you’re taking reasonable steps to protect your systems and data.

The security audit component has become non-negotiable for most carriers. You’ll need to demonstrate that you have multifactor authentication enabled on all administrative accounts. Your backup strategy receives intense scrutiny – insurers expect to see regular, tested backups with offline storage capabilities.

Employee training programs are another critical checkbox. Insurers know that human error causes the majority of successful cyberattacks, so they want evidence of ongoing cybersecurity awareness training.

Your breach history plays a huge role in both eligibility and pricing. If you’ve experienced previous incidents, be prepared to provide detailed documentation about what happened and what improvements you’ve implemented.

The compliance posture evaluation examines how well you meet industry-specific requirements. Healthcare organizations need HIPAA compliance documentation, while businesses handling credit card data must demonstrate PCI-DSS adherence.

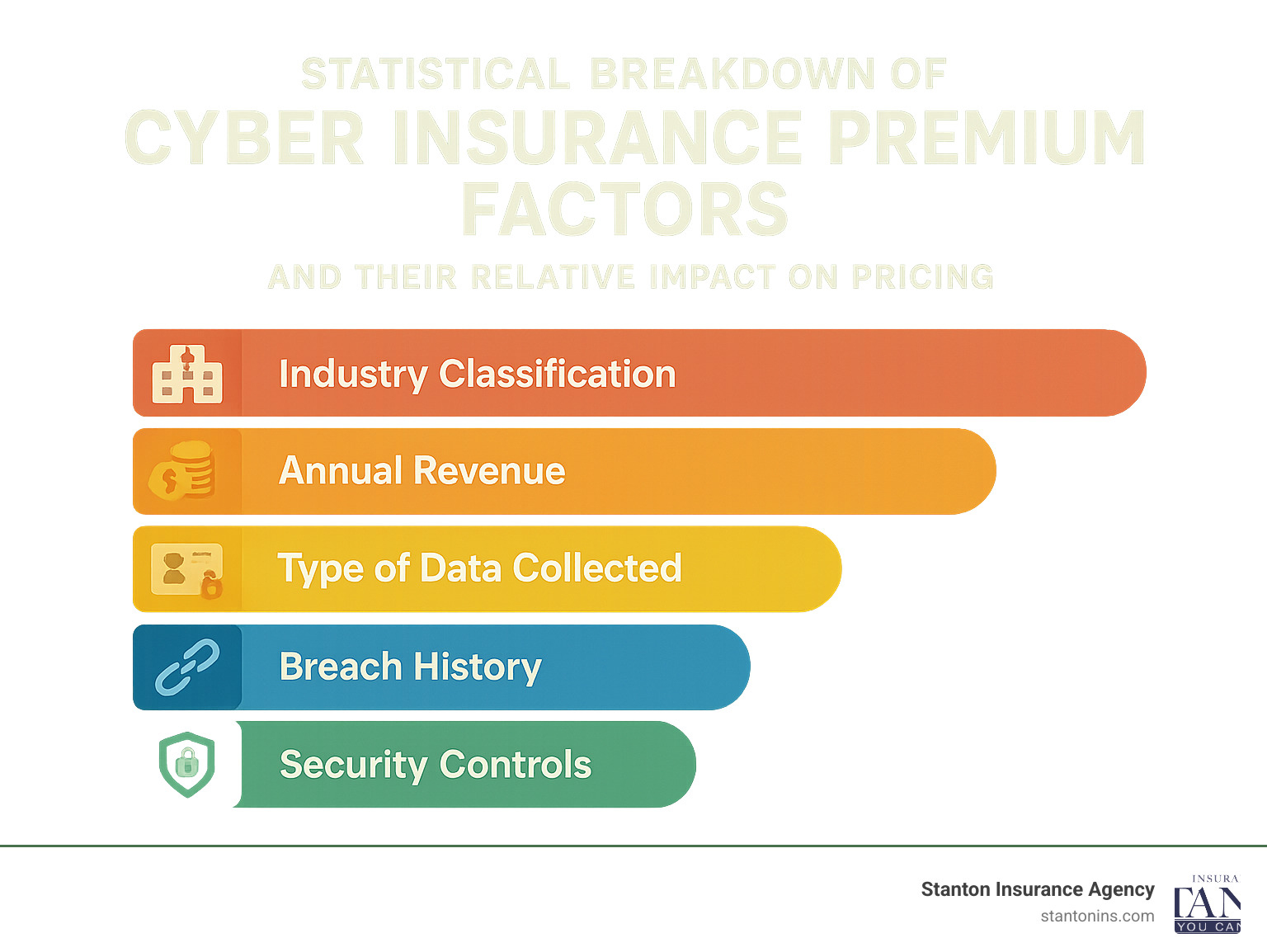

Premium Pricing Drivers

The cost of a cyber liability insurance policy varies enormously based on your specific risk profile. I’ve seen premiums range from a few hundred dollars annually for small service businesses to tens of thousands for organizations with extensive data exposure.

Your industry class significantly impacts pricing. Healthcare providers and financial services companies typically face higher premiums due to the sensitive nature of their data. Revenue and record count create the foundation for premium calculations.

Your claims history extends beyond cyber incidents to include any technology-related claims under other policies. The policy limits and deductibles you select directly impact your premium.

For detailed cost analysis and current market rates, review our comprehensive guide on how much cyber liability insurance costs. The IBM Cost of Data Breach Study provides additional context on incident costs that insurers use for pricing models.

Managing Cyber Risk & Lowering Premiums

The best cyber liability insurance policy is one you never actually need to file a claim on. Taking steps to strengthen your cybersecurity doesn’t just protect your business – it can also slash your insurance premiums. For small businesses looking to get the most value, our guide on cyber insurance for small businesses walks through specific strategies that work.

Technical Controls That Matter to Insurers

When insurance underwriters review your application, they’re looking for evidence that you’ve built real barriers against cyber threats. These technical controls represent your first line of defense.

Next-generation firewalls have become table stakes in today’s threat environment. Endpoint detection and response (EDR) software takes protection a step further by monitoring every device on your network for suspicious activity.

Email security solutions deserve special attention because email remains the primary attack vector for cybercriminals. A good email security system will catch phishing attempts before they reach your employees’ inboxes.

The 3-2-1 backup rule has become a standard requirement that insurers now expect to see. Keep three copies of your critical data, store them on two different types of media, and maintain one copy completely offline.

Patch management might sound boring, but it’s absolutely critical. Many cyber incidents exploit vulnerabilities that already have available fixes. Network segmentation is becoming increasingly important for limiting how far attackers can move through your network.

Governance & Training Essentials

All the technical controls in the world won’t help if your employees accidentally open the door for cybercriminals. Governance and training are essential parts of any risk management strategy.

Written cybersecurity policies provide the foundation for everything else. Regular security awareness training must go beyond the traditional annual compliance session. We recommend monthly phishing simulations and quarterly security updates.

Incident response procedures with clearly defined roles can mean the difference between a minor incident and a major crisis. Password hygiene remains a fundamental challenge, but implementing password managers can significantly reduce this risk.

Vendor due diligence has become increasingly important as supply chain attacks grow more common. Your cyber liability insurance policy may not cover incidents that originate from third-party vendors.

Claims Process & Real-World Examples

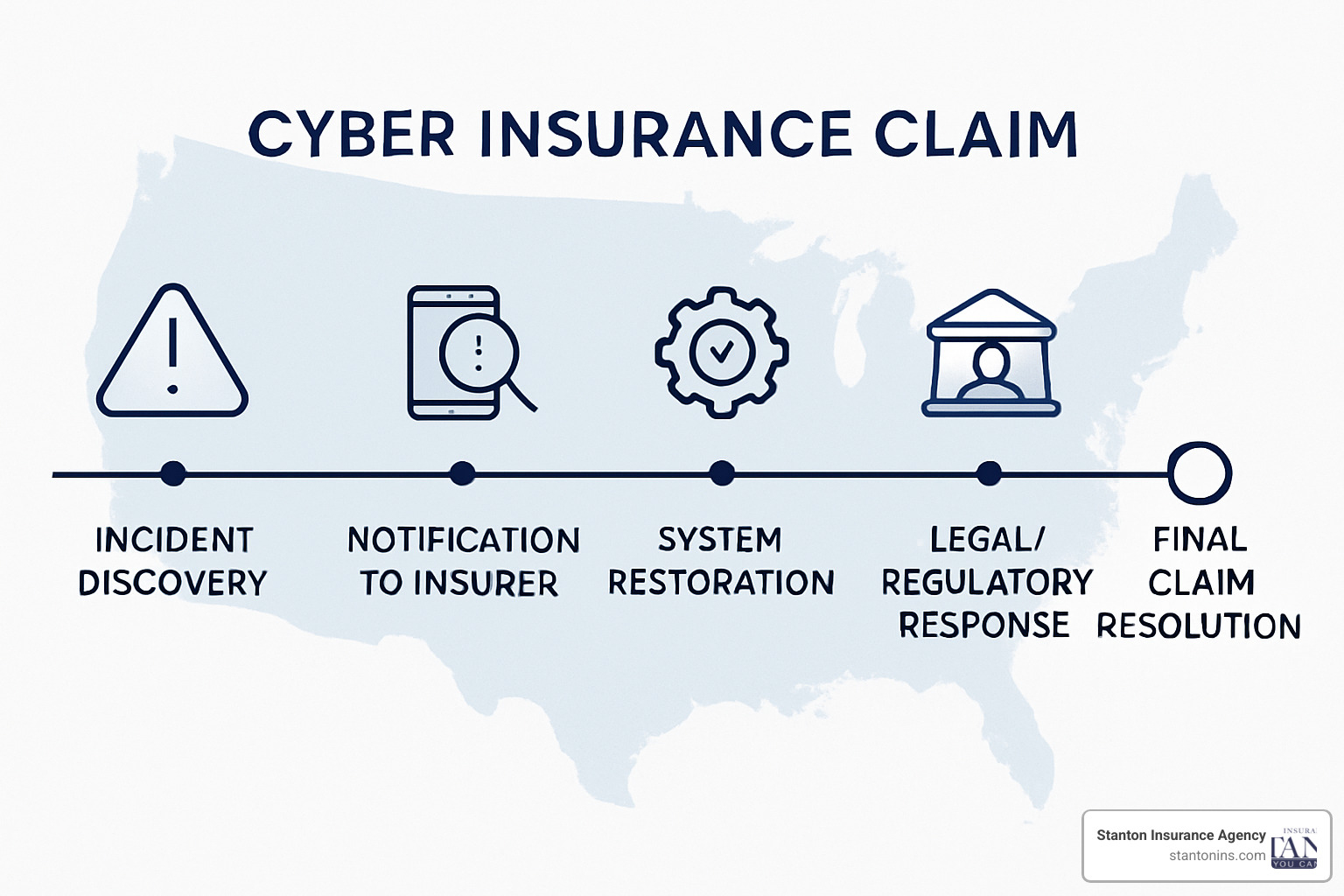

When a cyber incident strikes your business, knowing what to expect from the claims process can make the difference between a smooth recovery and a chaotic nightmare. The success of your claim often depends on how quickly and properly you respond in those first critical hours.

Timeline From Incident to Payout

The first 24 hours are absolutely crucial. You need to notify your insurance carrier immediately. Most policies require “prompt” notification, which insurers interpret as within 24 to 48 hours maximum.

During this initial phase, your insurer will connect you with a breach coach – typically a specialized attorney who coordinates your entire response. The investigation phase typically takes one to thirty days, depending on how complex your incident is. Forensic experts will dig through your systems like digital detectives.

System restoration and containment happens alongside the investigation. Your IT team will work to plug security holes, rebuild compromised systems, and get your business running again.

Customer and regulatory notifications must happen within specific timeframes – usually 30 to 90 days, depending on your state’s laws. The final settlement phase can stretch from three months to over a year.

Lessons From High-Profile Incidents

The 2011 Sony PlayStation Network breach remains one of the most instructive cases for understanding how cyber incidents unfold.

Sony’s nightmare lasted 77 million compromised accounts, 23 days of complete service outage, and over $171 million in total costs. The actual technical costs were just a fraction of that massive bill. Customer notifications alone cost over $10 million, while legal fees and settlements added tens of millions more.

I’ve worked with a regional healthcare provider hit by ransomware. The attack encrypted their patient records and billing systems, forcing them to operate on paper for several weeks. Their total claim exceeded $2 million, breaking down into forensic investigation ($400,000), ransom payment ($150,000), business interruption losses ($300,000), regulatory fines and legal fees ($800,000), and customer notification services ($350,000).

Without cyber insurance, this healthcare provider would have closed their doors. Instead, their cyber liability insurance policy covered the costs and allowed them to recover stronger than before.

How to Choose the Right Cyber Liability Insurance Policy & Provider

Choosing the right cyber liability insurance policy can feel overwhelming, but it doesn’t have to be. Coverage breadth matters more than a low premium if the policy won’t actually protect you when disaster strikes. Financial strength ratings tell you whether your insurer will still be around to pay claims in five years.

Key Questions to Ask Brokers

Start with claims support – ask how quickly the insurer responds to initial notifications and whether they provide dedicated cyber claims teams. The retroactive date question is critical if you’re switching carriers. This date determines how far back the policy covers incidents finded during your policy period.

Ask about the betterment clause – this determines whether the policy covers system upgrades during recovery or just restores you to your previous state. Breach response partners can make or break your incident response. Some insurers maintain panels of pre-approved vendors, while others let you choose your own experts.

Policy sublimits deserve careful attention. Some policies split coverage into separate buckets, while others provide a single aggregate limit you can use however needed.

Policy Comparison Checklist

Every cyber liability insurance policy should include business interruption coverage, cyber extortion protection, regulatory defense, and comprehensive breach response services.

The internal breach coach provision varies significantly between insurers. Some policies include immediate access to specialized attorneys who coordinate your entire response. Panel vendors represent another key differentiator. Leading insurers maintain networks of vetted forensic investigators and technical experts.

For detailed analysis of different insurance companies, check out our guide on cyber insurance carriers. We regularly evaluate carrier performance based on claims handling, financial strength, and service quality.

Optional coverage like cyber terrorism protection might seem unnecessary until you need them. The key is finding the right balance between comprehensive coverage and reasonable cost.

Frequently Asked Questions About Cyber Liability Insurance Policies

What’s the difference between cyber liability and general/professional liability?

General liability insurance covers bodily injury and property damage – the traditional “brick and mortar” risks. Professional liability protects you when you make mistakes in your professional services. But both of these policies typically exclude cyber-related incidents.

A cyber liability insurance policy fills that gap by specifically addressing digital risks. If the problem involves data, networks, or digital systems, you probably need cyber coverage. If a hacker steals your customer database, cyber insurance responds. If your systems get infected with ransomware, cyber insurance helps with those losses.

Do startups and micro-businesses really need cyber insurance?

The reality is that cybercriminals often prefer targeting smaller businesses because they typically have weaker security defenses than large corporations. Even if you think you don’t handle much sensitive information, you might be surprised. Do you accept credit cards? Store employee social security numbers? Keep customer email addresses? All of that represents potential cyber exposure.

I’ve worked with small businesses that thought they were safe until they had an incident. One local restaurant had their point-of-sale system compromised, exposing hundreds of customer credit card numbers. The notification costs alone were over $15,000.

The good news is that cyber liability insurance policy coverage for small businesses is quite affordable – often just a few hundred dollars per year. When you consider that 60% of small businesses close within six months of a major cyber incident, it’s one of the smartest investments you can make.

How can I estimate the right coverage limit for my company?

Start by thinking about your potential data breach costs. A general rule of thumb is $150 to $300 per record for customer notification and credit monitoring services. If you have 1,000 customer records, that’s potentially $150,000 to $300,000. Then add legal fees, forensic investigation costs, and regulatory response expenses.

Business interruption losses are often overlooked but can be substantial. Calculate your daily revenue and fixed costs, then estimate recovery time. Most small businesses need 2-8 weeks to fully recover.

For most small businesses, I typically recommend starting with $1 to $2 million in coverage. Mid-size businesses often need $5 to $10 million, while larger organizations may require $15 million or more.

Conclusion

Protecting your business from cyber threats doesn’t have to feel overwhelming. A thoughtfully chosen cyber liability insurance policy acts as your safety net in an increasingly dangerous digital world – giving you peace of mind while you focus on what you do best.

The reality is crystal clear: cyber attacks aren’t slowing down, and they’re not getting any less expensive. With 55% of small businesses experiencing breaches and average costs reaching over $4 million, the question isn’t whether you need protection – it’s whether you can afford to go without it.

The companies that bounce back strongest from cyber incidents are those who combine solid insurance coverage with smart security practices. Traditional insurance simply won’t cover these digital risks, making specialized cyber coverage as essential as locking your doors at night.

I’ve seen how the right coverage can save a business. One client’s ransomware attack could have cost them $300,000 out of pocket. Instead, their comprehensive policy covered everything from forensic investigation to customer notifications. They were back up and running within weeks, not months.

Ready to take action? Start with an honest look at your current cyber risk exposure. Check whether your existing insurance leaves dangerous gaps. Then let’s work together to design coverage that actually fits your business.

For detailed coverage information, explore our comprehensive guide on cyber liability and data breach insurance. Our team brings decades of experience helping businesses find the right protection at the right price.

The smartest time to buy a cyber liability insurance policy is before you need one. Waiting until after an attack is like shopping for a fire extinguisher while your kitchen burns. Contact Stanton Insurance Agency today – let’s get your business the trusted protection it deserves.