Cyber insurance carriers: 10 Top-Rated & Trusted in 2025

Understanding the Cyber Insurance Landscape

Cyber insurance carriers are companies that provide financial protection against digital threats and data breaches. Based on market share data, the top cyber insurance carriers in the United States include:

- Leading National Carrier A – $573.6M in premiums (7.9% market share)

- Major Insurance Group B – $487.2M in premiums

- Global Insurance Provider C – Leading provider of standalone cyber policies

- National Insurance Group D – Experienced 22% growth in cyber premiums (2022-2023)

- International Insurance Group E – Comprehensive cyber risk management solutions

The need for cyber insurance has never been more critical. With the average cost of a data breach continuing to rise and ransomware attacks becoming increasingly sophisticated, businesses of all sizes face significant financial exposure from cyber threats. Small and medium businesses are particularly vulnerable, often lacking the robust security infrastructure of larger enterprises while still being attractive targets for cybercriminals.

What makes cyber insurance unique is that carriers don’t just provide financial compensation after an incident—many now offer proactive security services, continuous monitoring, and incident response support as part of their policies.

I’m Geoff Stanton, President at Stanton Insurance Agency, and I’ve helped numerous businesses steer the complex landscape of cyber insurance carriers to find coverage that matches their specific risk profiles and budgetary constraints. My experience with commercial property and liability insurance extends to helping clients understand how cyber policies complement their existing coverage.

Cyber insurance carriers terms explained:

What Are Cyber Insurance Carriers?

Cyber insurance carriers are much more than just insurance companies—they’re your partners in navigating the complex digital threat landscape. These specialized insurers have built their business around understanding, measuring, and managing the unique risks that come with our increasingly connected world.

Think of these carriers as financial safety nets designed specifically for the digital age. While traditional insurers might offer cyber coverage as a side dish, dedicated cyber insurance carriers make it their main course, developing deep expertise that general insurers simply can’t match.

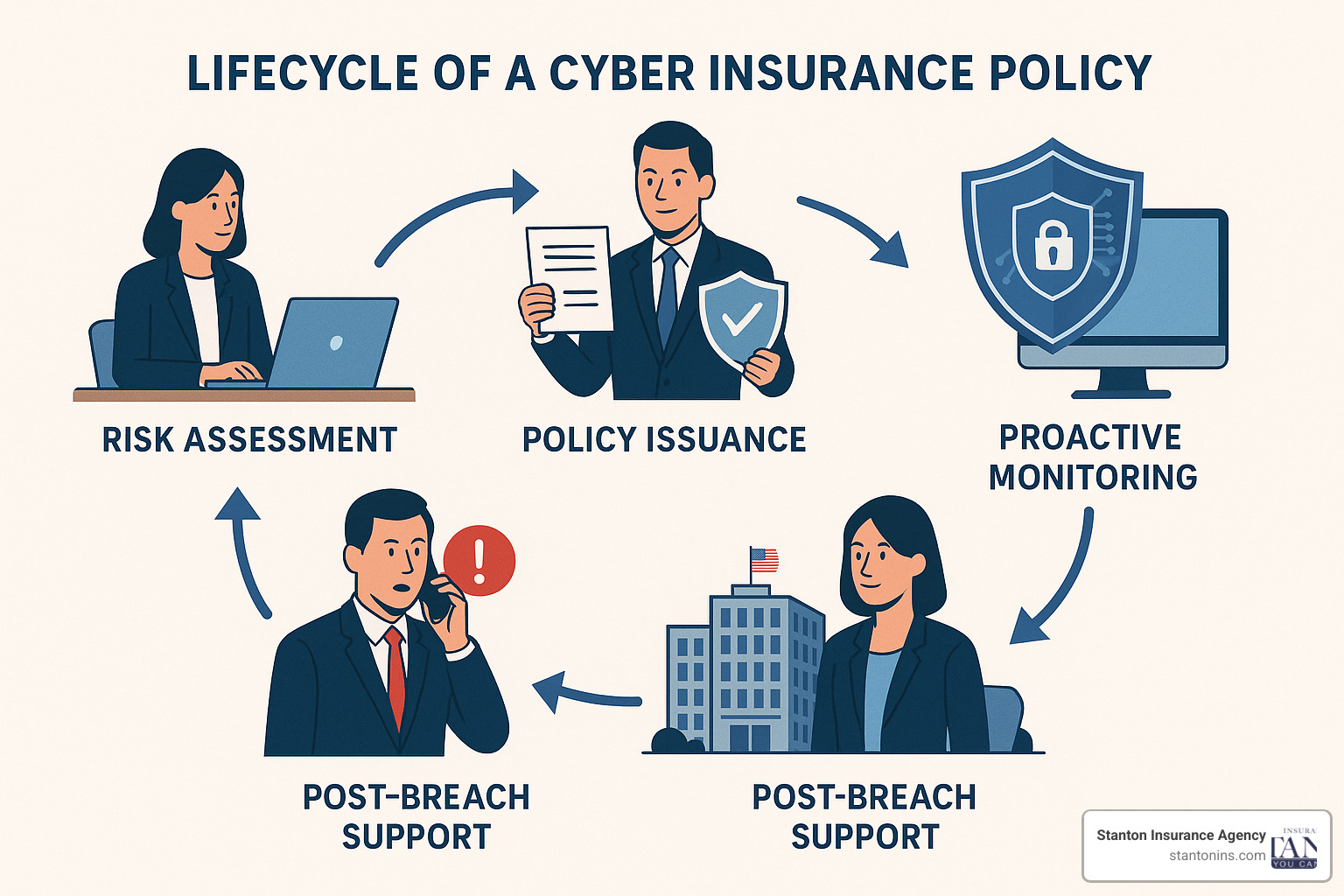

What makes today’s cyber carriers special is that they’ve evolved beyond the traditional “pay when something bad happens” model. Modern cyber insurance carriers offer comprehensive ecosystems that support your business before, during, and after a cyber incident. This includes pre-breach planning to strengthen your defenses, real-time security monitoring to catch issues early, coordinated incident response when attacks happen, and guidance through the recovery process afterward.

The numbers tell an interesting story about how important this market has become. In 2023, the U.S. property & casualty insurance industry wrote approximately $7.24 billion in cyber insurance premiums. Even more telling is that the top 20 carriers accounted for more than $5.4 billion of that total—showing just how specialized this field has become and why working with experienced carriers matters so much.

Why Carrier Choice Matters

When you’re shopping for a cyber insurance carrier, not all options are created equal. Here’s what you should be looking at:

Financial Strength: Can your carrier weather a storm if multiple clients face attacks simultaneously? This is where ratings from organizations like AM Best become crucial. Many leading carriers maintain A or A+ ratings—giving you confidence they’ll be there when you need them most.

Risk Appetite: Every carrier has different comfort zones. Some focus on businesses with up to $250 million in revenue, while others can accommodate companies up to $5 billion. Finding a carrier whose sweet spot matches your business profile means better coverage and often better pricing.

Claims Network: When you’re facing a cyber crisis, having access to the right experts can make all the difference. Top cyber insurance carriers maintain global networks of forensic specialists, legal experts, and IT remediation professionals who can spring into action immediately.

Service Quality: The human element still matters enormously. As one broker said about a leading cyber carrier: “One of my favorite things about working with them is the continued service throughout the policy year.” That kind of responsiveness can be invaluable when you’re dealing with the stress and uncertainty of a cyber incident.

At Stanton Insurance Agency, we’ve helped countless businesses find the right match among the leading cyber insurance carriers. We understand that this choice isn’t just about getting a policy—it’s about finding a true risk management partner for your digital journey.

How Cyber Insurance Carriers Support Your Business

Gone are the days when cyber insurance carriers simply collected premiums and cut checks after disasters. Today’s leading cyber insurers have transformed into true risk management partners who stand beside you before, during, and after cyber incidents.

These modern carriers bring a wealth of support services that make them invaluable allies in your cybersecurity journey. When you work with top cyber insurance carriers, you’re gaining access to sophisticated risk assessment tools that evaluate your security posture in real time. Take Corvus by Travelers, for example – they can provide quotes in under two hours for most businesses, and eligible companies can receive an autoquote in less than a minute. This rapid response means you’re never left waiting when you need protection quickly.

The support you’ll receive from quality cyber insurance carriers extends far beyond just paperwork. You’ll benefit from real-time risk scanning that continuously monitors your external-facing digital assets, helping spot vulnerabilities before hackers can exploit them. You’ll receive personalized security alerts custom specifically to your industry and technology stack, ensuring you’re informed about threats that matter most to your business.

When trouble strikes, you’ll have access to 24/7 incident response teams – skilled experts ready to jump into action at the first sign of a breach. Your insurance agent can track your risk profile through broker dashboards, suggesting improvements that might strengthen your security posture or even lower your premiums. Many carriers also provide security vendor marketplaces with pre-vetted security providers offering special policyholder discounts.

Signature Services

What truly sets the best cyber insurance carriers apart are their signature services – the special touches that make their coverage uniquely valuable.

Many modern carriers accept collaborative underwriting, working directly with your business to understand your specific risks rather than applying generic formulas. This partnership approach typically results in coverage that better fits your needs and pricing that reflects your actual risk profile.

“After struggling to find affordable cyber coverage for weeks,” one customer told us, “our agent connected us with a carrier that not only provided a competitive quote but also included quarterly security scans and a dedicated risk engineer who helped us implement basic security controls that actually reduced our premium at renewal.”

Some carriers include unlimited risk advisor calls with their policies – giving you on-demand access to experts who can guide you through security best practices, help with incident response planning, and steer regulatory compliance requirements. This ongoing consultation can be worth its weight in gold, especially for businesses without dedicated security staff.

The risk engineering services provided by top carriers bring technical experts to your aid who can assess your current security controls and recommend practical improvements to reduce exposure. And when incidents occur, having direct access to an incident response hotline connects you immediately with breach coaches and forensic partners who can guide you through those critical first hours when every minute counts.

At Stanton Insurance Agency, we carefully evaluate these support services when recommending cyber insurance carriers to our clients, ensuring you get not just a policy, but a true security partner.

Innovations in Cyber Insurance

The cyber insurance world is changing fast, and it’s exciting to see how cyber insurance carriers are stepping up their game. Gone are the days when insurance just meant paying claims after something bad happened. Today’s innovative carriers are rolling up their sleeves and getting involved in preventing cyber disasters before they strike.

One of the coolest developments I’ve seen is the “Active Insurance” model that leading carriers have introduced. This approach is like having both an insurance policy and a security partner wrapped into one package. Instead of the old “wait and see” approach, these carriers actively work alongside you to keep threats at bay.

Some of the most impressive innovations include:

- AI-powered risk assessment that analyzes millions of data points about your security setup to spot weak points before hackers do

- Automated protection mechanisms that kick in automatically when threats appear on the horizon

- Managed Detection & Response (MDR) services that provide round-the-clock monitoring as part of your policy

Many innovative carriers use something called “Active Risk Assessment” that taps into their massive data graph. This technology constantly collects and analyzes information from across the internet—even the dark web—to identify potential risks to their policyholders before trouble strikes.

Want to see real-world examples of these innovations in action? Check out the latest Download Report Cyber Claims Report for eye-opening statistics and trends.

What Sets Modern Carriers Apart

What really makes today’s cyber insurance carriers different is their shift from being passive check-writers to active security partners. This isn’t just a small adjustment—it’s a complete reimagining of how cyber insurance works.

Modern carriers bring valuable tools to the table that traditional insurers simply don’t offer. They provide continuous monitoring of your digital footprint, constantly scanning for new vulnerabilities as they pop up. Many offer premium incentives for security improvements, giving you real financial benefits for strengthening your defenses.

I’ve seen carriers develop impressive breach scenario libraries that show you exactly how similar businesses have been attacked, making abstract risks feel much more concrete and actionable. Perhaps most valuable is the closed-loop risk management approach, where your security posture is constantly improving based on new threats and incidents.

As one of our clients recently told me, “Our carrier’s monthly security scan caught an exposed RDP port that our IT team completely missed. They alerted us right away and walked us through fixing it step by step. That simple heads-up probably saved us from a ransomware nightmare.”

These innovations aren’t just nice-to-have features—they’re changing how businesses think about cyber risk. The best carriers now function as extensions of your security team, providing expertise and resources that would be prohibitively expensive to build in-house. This collaborative approach creates a win-win situation: you get better protection, and the carrier faces fewer claims.

Cyber Insurance for Small and Midsize Businesses

Small and midsize businesses (SMBs) face unique challenges when it comes to cybersecurity. They often lack the resources of larger enterprises but face many of the same threats. Recognizing this reality, several cyber insurance carriers have developed specialized offerings for the SMB market.

These carriers understand that SMBs need affordable coverage that addresses their specific risk profiles without requiring enterprise-level security investments. For example, AmTrust emphasizes that “you don’t need to be a Fortune 500 company to afford protection against cyber risk,” highlighting their focus on making cyber insurance accessible to smaller businesses.

Key features of SMB-focused cyber policies include:

- Adaptive coverage: Protection that scales with your business size and evolves as your technology footprint changes

- Proprietary risk scoring: Simplified assessment methods that don’t require extensive security documentation

- Quick bind options: Streamlined application processes that can provide coverage in as little as 24 hours

- Access to multiple reinsurers: Backing from major global reinsurance companies ensures claims-paying ability

Carrier Advantages for SMBs

Working with specialized cyber insurance carriers offers several advantages for small and midsize businesses:

Premium incentives: Many carriers offer discounts for implementing basic security controls like multi-factor authentication, endpoint protection, and regular backups. These incentives can make robust cyber coverage more affordable while improving your security posture.

Industry-specific endorsements: Carriers often develop specialized coverage extensions for particular industries. For example, healthcare organizations might receive improved coverage for HIPAA-related exposures, while retailers might benefit from specific PCI-DSS violation protection.

Value-added services: SMB-focused carriers typically include services that would otherwise be cost-prohibitive for smaller businesses, such as:

- Security awareness training for employees

- Vulnerability scanning and monitoring

- Incident response planning assistance

- Regulatory compliance guidance

As one small business owner shared: “After a competitor was hit with ransomware, we realized we needed cyber insurance but worried about the cost. We were surprised to find a policy that not only fit our budget but included security tools that would have cost more than the premium if purchased separately.”

Streamlined Underwriting & Claims

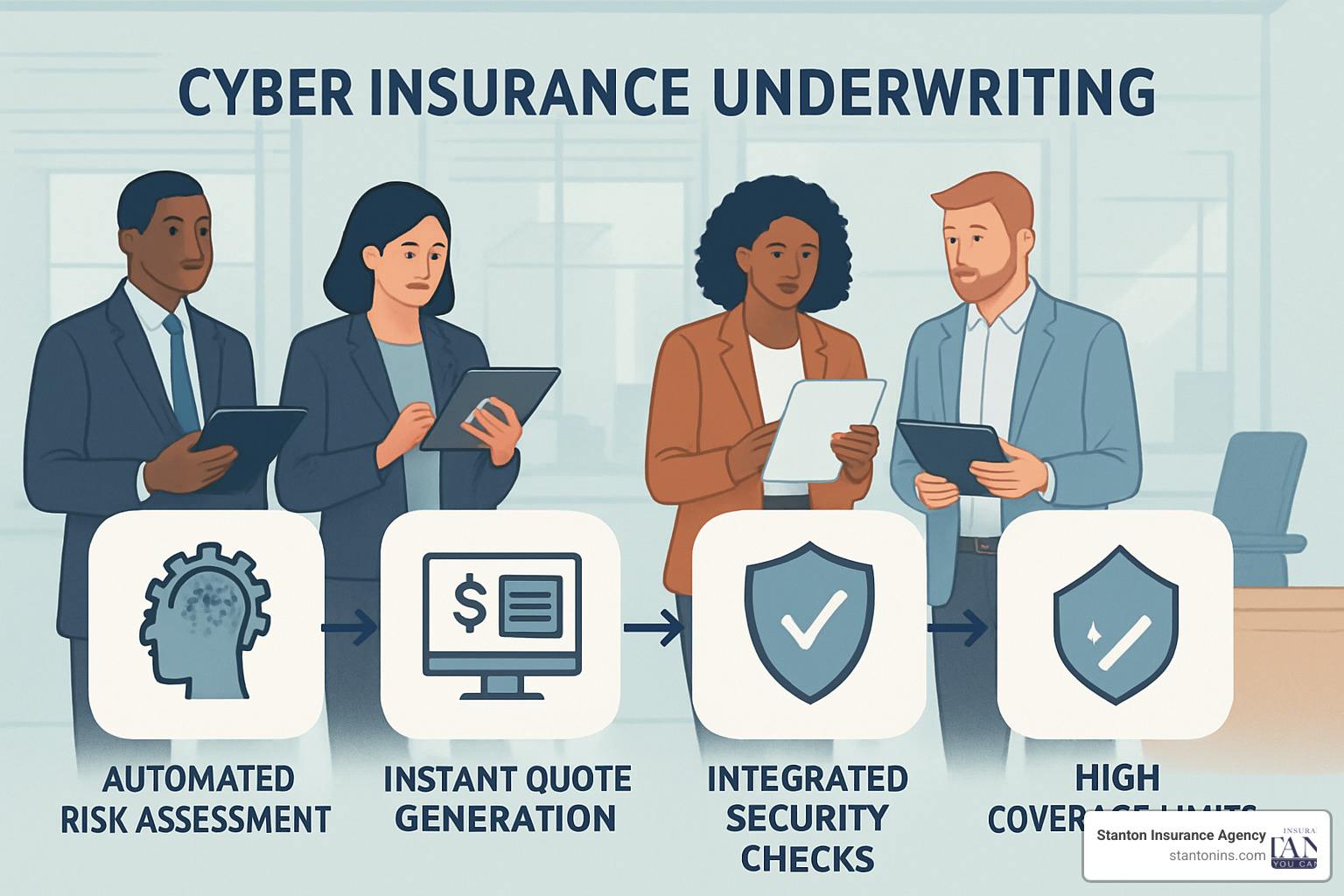

Gone are the days of lengthy paperwork and weeks of waiting for cyber insurance quotes. Today’s cyber insurance carriers have completely transformed how businesses get covered for digital risks, making the whole process remarkably smoother for everyone involved.

The technology revolution has finally reached insurance underwriting. Many carriers now leverage sophisticated systems that can analyze your business’s risk profile in minutes rather than days. For example, At-Bay proudly offers “fully automated underwriting” that delivers “bindable quotes in seconds” while also providing valuable security insights. This means you can get protected quickly while also learning more about your specific cyber vulnerabilities.

What makes modern cyber insurance carriers truly stand out is their tech-forward approach. Most now offer:

Automated underwriting that uses AI and data analytics to evaluate your business quickly and accurately. No more endless questionnaires or confusing technical assessments.

Bindable quotes in seconds for eligible businesses – perfect when you need coverage immediately for a new contract or project.

Integrated security technology that directly connects with assessment tools to provide a real-time snapshot of your digital risk profile.

High coverage limits up to $10 million, giving businesses of all sizes the protection they need against today’s sophisticated threats.

Bundled options that let you combine cyber coverage with related protections like technology errors & omissions insurance, creating a more comprehensive safety net for your business.

Prevention + Protection

What I love about today’s leading cyber insurance carriers is how they’ve evolved beyond just paying claims. They’re now true partners in helping prevent incidents in the first place – because as we all know, the best claim is one that never happens!

This prevention-focused approach includes valuable features like actionable security insights that give you specific recommendations based on your underwriting assessment. It’s like getting a mini security consultation along with your insurance quote.

Many carriers also provide loss frequency analytics that show you exactly what types of incidents are most common in your industry. This information is gold for prioritizing your security investments where they’ll have the biggest impact.

For businesses with unique needs, carriers often offer excess capacity options that provide higher limits for specific exposures based on your particular risk profile. This customization ensures you’re not paying for coverage you don’t need while still protecting against your biggest threats.

When incidents do happen (and unfortunately, they sometimes will), the claims process has been dramatically streamlined. Most cyber insurance carriers now offer 24/7 incident response hotlines, dedicated claims handlers who understand cyber events, and relationships with pre-vetted forensic and legal experts who can spring into action immediately.

This comprehensive approach – combining prevention with protection – gives businesses both the tools to avoid incidents and the financial safety net if something does slip through. It’s insurance that actually works to make claims less likely, which is a win for everyone involved.

Looking for the right cyber insurance for your business? At Stanton Insurance Agency, we can help you steer the options and find a carrier that matches your specific needs and budget. We understand that every business faces unique cyber risks, and we’re here to help you find the perfect coverage solution.

Key Factors That Affect the Cost of Cyber Insurance

The pricing of cyber insurance policies is influenced by numerous factors, as cyber insurance carriers attempt to accurately assess the risk associated with each potential policyholder. Understanding these factors can help businesses anticipate costs and potentially implement measures to reduce their premiums.

The most significant pricing factors include:

Industry class: Certain industries face higher risk due to the nature of their data or their attractiveness as targets. Healthcare, financial services, and retail typically pay higher premiums due to their valuable data assets.

Revenue & records: The size of your business and the volume of sensitive records you maintain directly impact your exposure. More records mean greater potential liability in the event of a breach.

Security controls: The robustness of your cybersecurity measures significantly influences pricing. Basic controls like multi-factor authentication, endpoint protection, regular patching, and secure backups can substantially reduce premiums.

Claims history: Previous cyber incidents, especially if they resulted in claims, will affect your premium. Carriers view past incidents as potential indicators of future risk.

Limits & retentions: Higher coverage limits naturally result in higher premiums, while higher deductibles (retentions) can lower your costs.

Regulatory environment: Businesses operating in heavily regulated industries or regions with strict privacy laws (like GDPR in Europe or CCPA in California) may face higher premiums due to increased compliance requirements and potential penalties.

For more detailed information on pricing factors, visit our guide on the Cost of Cyber Liability Insurance.

How Cyber Insurance Carriers Price Risk

Cyber insurance carriers employ sophisticated methods to assess and price risk:

Multifactor algorithms: Advanced models that consider dozens or even hundreds of variables to determine appropriate premiums.

Security scan scores: Many carriers conduct external vulnerability scans as part of the underwriting process, with the results directly influencing pricing.

Ransomware controls checklist: Due to the prevalence and severity of ransomware attacks, carriers often have specific checklists of controls they expect to see in place, such as:

- Offline/segregated backups

- Email filtering and security awareness training

- Endpoint detection and response (EDR) solutions

- Privileged access management

- Regular patching of critical vulnerabilities

One underwriter explained, “We’ve moved from simply asking if you have a firewall to understanding exactly how your backup strategy is implemented, whether you’re using EDR tools, and how you’re controlling remote access. These details directly impact the likelihood and potential severity of a ransomware event.”

Comparing Cyber Insurance Carriers: Key Takeaways

When shopping for cyber insurance, looking only at premium costs is like buying a car based solely on price – you might miss what really matters. The cyber insurance market has grown up fast, with the top 20 carriers writing over $5.4 billion in direct premiums in 2023 alone.

What should you look at when comparing cyber insurance carriers? First, check the coverage breadth. Some policies focus mainly on protecting you from lawsuits (third-party liability), while others also cover your own costs from an attack, like business downtime, recovering your data, and ransomware payments. The best policies give you both types of protection.

The risk-management tools included with your policy can be gold, especially for smaller businesses. I’ve seen clients receive security services worth more than their premium – like having a security consultant on retainer without the extra bill.

Don’t overlook service quality. When you’re in the middle of a cyber crisis, the expertise and responsiveness of your claims handler can make all the difference between a smooth recovery and a prolonged nightmare.

Always check financial ratings too. An AM Best rating shows if your carrier has the financial muscle to pay claims when needed. Stick with carriers rated A- or better for peace of mind.

Watching market share trends can reveal which carriers are innovating or offering better value. For example, some insurance groups grew their direct premiums by over 40% from 2022 to 2023, while others jumped by more than 25% in the same period. That kind of growth usually means they’re doing something right.

Why “Cyber Insurance Carriers” Matter to Your Balance Sheet

Your choice of cyber insurance carrier directly impacts your company’s financial health in ways you might not expect.

Capital protection is the obvious benefit – the right coverage prevents a cyber attack from draining your bank account or forcing you to seek emergency financing. As one of my clients put it after surviving a ransomware attack: “That policy was the difference between a bad month and going out of business.”

The vendor access that comes with quality carriers is often overlooked but incredibly valuable. Leading carriers give you pre-negotiated rates with top security firms, specialized attorneys, and crisis PR teams – relationships that would cost a fortune to build on your own.

Compliance support has become increasingly important as privacy regulations multiply. Many policies now cover regulatory defense costs and penalties, helping you steer the complex web of privacy laws without breaking the bank.

I recently spoke with a CFO who told me, “After evaluating several carriers, we chose one that offered not just financial protection but also pre-breach planning services that helped us identify and address several security gaps. The value extended far beyond the policy itself.”

Questions to Ask “Cyber Insurance Carriers” Before Buying

Before signing on the dotted line, make sure you ask these critical questions:

What are the coverage triggers? You need to know exactly what constitutes a covered event. Some policies require specific types of breaches or damages to activate coverage, and these details matter enormously when you’re filing a claim.

Are there sub-limits for certain types of coverage? Many policies have lower limits for specific threats like ransomware or social engineering fraud. Make sure these sub-limits align with your actual risks.

Which panel vendors are pre-approved for incident response? And importantly, do you have flexibility to use your own vendors if needed? Some carriers are strict about using only their approved providers.

What’s the typical claims timeline? Ask about the usual resolution time for claims and what support you’ll receive during the process. A carrier that abandons you to figure things out alone isn’t worth the paper your policy is printed on.

At Stanton Insurance Agency, we’ve helped countless businesses steer these questions to find the cyber insurance carrier that truly fits their needs – not just on price, but on the protection that matters most to their specific situation.

How Cyber Insurance Carriers Assess & Underwrite Risk

Ever wonder how cyber insurance carriers figure out if your business is a good risk? The days of simply filling out a paper form are long gone. Today’s underwriting process is a sophisticated blend of human expertise and cutting-edge technology.

When you apply for cyber coverage, carriers use several methods to evaluate your digital risk profile:

AI-driven external scans examine your organization’s digital presence from the outside in. These automated tools look for vulnerabilities like open ports, unpatched software, and weak encryption that hackers could exploit. It’s like a digital health check-up that happens behind the scenes while you’re completing your application.

“We’re essentially looking at your business the same way a hacker would,” explained one underwriter I spoke with recently. “If we can spot vulnerabilities during our scan, so can the bad guys.”

Penetration of dark-web data is another critical piece of the puzzle. Carriers check whether your company’s credentials or information have already been compromised and are being traded in shadowy corners of the internet. Finding your company’s data on the dark web is a red flag that you might be at higher risk for future attacks.

Most cyber insurance carriers have developed their own proprietary scoring systems. These combine technical findings with industry data and claims experience to generate a risk score unique to your business. This score helps determine not just if you qualify for coverage, but also what your premium might be.

Some carriers now offer continuous monitoring endorsements as part of their policies. Rather than just assessing your risk at the time of application or renewal, they keep an eye on your security posture throughout the policy period. The good news? If you make security improvements, you might see premium reductions. Of course, the flip side is also true – if your security deteriorates, your rates could increase.

Despite all this technology, security questionnaires remain an essential part of the process. These detailed forms help carriers understand your internal controls and security practices that can’t be detected through external scans. Questions typically cover topics like:

- How you manage access to sensitive systems

- Your backup and recovery procedures

- Employee security awareness training

- Incident response planning

- Patch management processes

I recently helped a manufacturing client through this process, and they were surprised by how thorough the questionnaire was. “It felt more like a security audit than an insurance application,” the IT director told me. But that thoroughness ultimately worked in their favor – the carrier identified several simple security measures they could implement that reduced their premium by nearly 15%.

The combination of these assessment methods gives cyber insurance carriers a comprehensive view of your risk profile. As one underwriter put it to me: “We combine external scanning technology that gives us an outside-in view of vulnerability with questionnaires that help us understand internal controls like access management and employee training. Together, these provide a comprehensive picture of an organization’s cyber risk posture.”

At Stanton Insurance Agency, we help guide our clients through this sometimes complex process, explaining what carriers are looking for and how you can put your best foot forward when applying for cyber coverage.

Threats & Incidents Most Often Covered

When shopping for cyber protection, it helps to understand exactly what cyber insurance carriers typically cover. Think of cyber insurance as a safety net designed to catch the most common digital disasters that businesses face today.

Ransomware attacks have become alarmingly common, with ransomware leak site activity hitting a new quarterly record of 1,663 victims in Q4 2024. Cyber insurance carriers recognize this growing threat by offering coverage for ransom payments (where legally allowed), professional negotiation assistance, and the often substantial costs of restoring your systems afterward.

Data breaches remain a primary concern for businesses of all sizes. When customer information gets exposed, policies typically cover the full response lifecycle—from investigating how the breach happened to notifying affected individuals, providing credit monitoring services, and managing the public relations fallout that often follows.

When your systems go down due to a cyber attack, the business interruption coverage kicks in. This protection helps replace lost income and covers extra expenses you might incur while getting back on your feet—a lifeline for businesses where downtime means lost revenue.

“We’re seeing ransomware claims evolve from simple encryption events to complex extortion scenarios involving data theft and threatened publication,” explains one claims specialist I work with regularly. “Modern policies need to address both the technical recovery and the potential business impact of these sophisticated attacks.”

Social engineering fraud—where attackers use deception rather than technical hacking—has become increasingly sophisticated. Cyber insurance carriers often cover financial losses from these schemes, though you’ll want to carefully review any sub-limits or specific conditions that might apply.

For businesses that handle payment information, coverage for PCI fines provides crucial protection against the potentially devastating financial penalties imposed by the payment card industry following a data breach.

Beyond traditional ransomware, broader cyber extortion coverage protects against other digital threats—like demands for payment to prevent the release of sensitive information or to stop attacks that could disable your systems.

Many policies now include system failure coverage, which extends protection to outages caused by operational or technical failures, not just malicious attacks—a recognition that not all costly digital disruptions come from hackers.

Some forward-thinking cyber insurance carriers even offer reputational harm coverage, helping replace income lost due to damage to your company’s reputation following a cyber incident. This acknowledges that sometimes the biggest cost of a breach isn’t the technical response but the lost customer trust that follows.

At Stanton Insurance Agency, we’ve seen how the right cyber coverage can mean the difference between a manageable incident and a business-threatening disaster. We work with top cyber insurance carriers to ensure your coverage addresses the specific threats most relevant to your industry and business model.

Claims & Incident Response: What to Expect

When disaster strikes, the way your cyber insurance carrier responds can make all the difference between a quick recovery and a prolonged nightmare. I’ve seen how understanding the claims process before an incident occurs helps businesses take the right steps when every minute counts.

Think of the claims process as your roadmap through the chaos. It typically begins with the first-notice process – most carriers maintain 24/7 hotlines specifically for reporting incidents. I can’t stress enough how important immediate reporting is. Delays can compromise vital evidence and potentially affect your coverage. One business owner told me, “I waited just 48 hours to report a suspicious email, and by then the attackers had already moved laterally through our network.”

Once you’ve made that crucial first call, your carrier’s forensics engagement kicks into high gear. The best carriers have pre-approved forensic partners ready to begin investigating immediately, often deploying experts within hours of notification. These digital detectives work to contain the threat and preserve evidence.

Simultaneously, your carrier will coordinate legal counsel through breach coaches who help steer the complex web of disclosure requirements while maintaining legal privilege to protect your interests. This legal guidance is invaluable, especially when you’re dealing with multiple state and international privacy laws.

Your carrier will also provide guidance on regulator notifications – helping you understand when and how to notify relevant regulatory bodies about the incident. Missing these notification deadlines can result in significant penalties, so having expert guidance here is crucial.

The technical aspects of recovery include data recovery assistance – helping you restore compromised systems and recover lost data. This is where the quality of your carrier’s partner network really shines through. As one IT director shared with me, “Our carrier’s recovery team had us back online three days faster than our initial estimates.”

For business interruption claims, carriers have specific business income reimbursement processes, including documentation requirements and timelines. Be prepared to provide detailed records of lost income and extra expenses incurred during your downtime.

Perhaps most valuable is the post-incident hardening phase, where your carrier provides recommendations to strengthen your security and prevent similar incidents in the future. This feedback loop turns an unfortunate event into a learning opportunity that makes your business more resilient.

For more comprehensive information about what cyber policies typically cover, I recommend visiting our guide on What Does Cyber Liability Insurance Cover?

As one claims manager recently told me, “The first 72 hours after finding a breach are critical. Cyber insurance carriers that provide immediate access to forensic experts, legal counsel, and crisis management resources can dramatically improve outcomes. This is why we emphasize the importance of selecting a carrier with a robust incident response network.”

When you’re selecting a policy, don’t just focus on the premium – ask detailed questions about the carrier’s claims process, their average response times, and the quality of their incident response partners. The difference between a good and great claims experience often comes down to these details that aren’t visible on the declaration page.

How to Choose the Right Policy and Carrier

Finding the perfect cyber insurance carrier is a bit like dating – you need someone who understands your specific needs, fits your budget, and will be there when things get tough. As I’ve helped businesses steer these decisions, I’ve found that taking a methodical approach helps cut through the complexity.

Start by taking a hard look at your potential financial exposure. How many customer records do you maintain? How dependent is your revenue on digital systems? What regulations apply to your industry? Your answers will help determine appropriate coverage limits that truly protect your business without overinsuring.

Policy exclusions deserve your careful attention. I’ve seen too many businesses find coverage gaps only after an incident occurs. Pay particular attention to exclusions around unencrypted devices, failure to maintain security controls, and prior known conditions. These common exclusions can invalidate coverage when you need it most.

Compare optional coverages based on your unique risk profile. If your business regularly transfers funds electronically, social engineering fraud protection becomes essential. Similarly, system failure coverage might be critical if your revenue depends heavily on technology uptime. Many businesses also benefit from reputational harm protection, which can help recover from the brand damage that often follows a public breach.

The value-added services included with your policy can sometimes be worth more than the premium itself. When evaluating cyber insurance carriers, look beyond just the coverage terms to consider:

- Quality of vulnerability scanning and monitoring

- Employee security awareness training programs

- Incident response planning assistance

- Access to security experts for consultation

Financial stability matters tremendously when selecting a carrier. A policy is only as good as the company’s ability to pay claims, especially during widespread cyber events that might affect multiple policyholders simultaneously. I always recommend verifying a carrier’s AM Best rating – look for A- or better for peace of mind that they’ll be there when you need them.

| Feature | Carrier A | Carrier B | Carrier C |

|---|---|---|---|

| First-party coverage limit | $1M | $2M | $1M |

| Third-party coverage limit | $1M | $1M | $2M |

| Business interruption waiting period | 8 hours | 12 hours | 6 hours |

| Ransomware sub-limit | Full limit | $500K | Full limit |

| Security services included | Basic scan | Full suite | Monitoring only |

| Incident response team | Global | US only | Global |

| AM Best rating | A | A+ | A- |

One of our clients recently shared their experience: “Working with Stanton Insurance Agency, we were able to compare five different cyber carriers side by side. This comparison helped us identify a policy that not only met our coverage needs but also included security services that would have cost thousands of dollars if purchased separately.”

The right cyber insurance carrier does more than just provide a policy – they become a partner in your overall risk management strategy. By carefully evaluating these key factors, you’ll find coverage that not only protects your balance sheet but actually helps prevent incidents before they occur.

Frequently Asked Questions about Cyber Insurance

What is the difference between standalone and packaged cyber insurance?

When shopping for cyber protection, you’ll likely encounter two main options: standalone policies and packaged coverage. Understanding the difference can save you money and ensure you’re properly protected.

Standalone cyber insurance is exactly what it sounds like – a dedicated policy that focuses exclusively on digital risks. These policies are the premium option, offering broader coverage, higher limits, and specialized services custom specifically to cyber threats. Because they’re built from the ground up to address digital risks, standalone policies can be customized to your unique situation.

Packaged cyber insurance, on the other hand, gets added to another policy like your Business Owner’s Policy (BOP) or professional liability coverage. While this approach is convenient and sometimes more affordable upfront, it typically comes with more limited protection and lower coverage limits. Think of it as the difference between a specialized tool and a multi-tool – one is designed to do a specific job extremely well, while the other offers convenience but may compromise on effectiveness.

The market clearly shows a preference for specialized protection – standalone policies represented the majority of the $7.24 billion in cyber premiums underwritten in 2023.

As one insurance professional at a leading cyber insurance carrier told me recently: “Standalone policies can be more comprehensive because they’re designed specifically for cyber risk, while packaged coverages are often added as an afterthought to a policy designed for other purposes. For businesses with significant digital assets or operations, standalone coverage usually provides better protection.”

How much coverage does a small business actually need?

This is perhaps the most common question I hear from business owners, and the honest answer is: it depends. The right coverage amount isn’t one-size-fits-all, but rather should be custom to your specific situation.

Several key factors will influence how much coverage you need:

First, your industry matters enormously. If you’re in healthcare, financial services, or another highly regulated field, you’ll likely need higher limits to protect against potential regulatory penalties after a breach.

The volume and sensitivity of data you handle is another crucial consideration. A company with thousands of customer credit card numbers faces greater exposure than one primarily handling basic contact information.

How much your revenue depends on technology should also guide your decision. If a system outage would immediately halt your ability to generate income, robust business interruption coverage becomes essential.

Finally, don’t overlook third-party contractual requirements. Many client and vendor agreements now specifically require certain levels of cyber coverage.

As a general guideline, small businesses (under $10M in revenue) typically carry $500,000 to $2 million in coverage. Mid-sized companies often need $2-5 million, while larger enterprises might require $5-10 million or more.

I remember one accounting firm client who initially thought $1 million would suffice. After we walked through their specific risks – client financial data, regulatory requirements, and potential business interruption – they realized their actual exposure was closer to $3 million. The good news? The premium difference for that additional coverage was surprisingly affordable.

Can cyber insurance carriers help prevent attacks before they happen?

Absolutely! This is one of the most valuable and often overlooked benefits of working with modern cyber insurance carriers. Today’s cyber insurers have evolved far beyond the traditional “pay claims after something bad happens” model.

Many leading carriers now function more like security partners, offering a suite of preventive services as part of their policies. These might include:

Regular vulnerability scanning that automatically checks your external-facing systems for security gaps that hackers could exploit

Security awareness training programs that teach your employees how to recognize phishing attempts and other social engineering tactics (human error remains the leading cause of breaches!)

Comprehensive risk assessments that evaluate your security controls and provide specific recommendations for improvement

Breach planning assistance to help you develop and test incident response plans before you need them

These proactive services create a win-win situation. You get valuable security tools that might otherwise be expensive to purchase separately, and the carrier reduces their own risk by helping prevent claims before they happen.

One of our manufacturing clients shared a perfect example of this partnership in action. Their cyber insurance carrier’s quarterly security scan identified an unpatched vulnerability their IT team had missed. The carrier immediately alerted them and provided step-by-step remediation guidance. Just three weeks later, that exact vulnerability was exploited in a major ransomware campaign that hit several other companies in their industry – but not them.

This preventive approach represents the future of cyber insurance – a true partnership focused on stopping attacks before they happen rather than just cleaning up afterward.

Conclusion

The landscape of cyber insurance carriers continues to evolve rapidly as digital threats become more sophisticated and prevalent. What once was a simple financial product has transformed into something much more comprehensive. Today’s top carriers don’t just offer policies – they’ve become true risk management partners, providing financial protection alongside proactive security services, continuous monitoring, and expert incident response.

When you’re looking for the right cyber insurance partner, value extends far beyond the dollar amount of your policy limits. Think about the carrier’s financial strength – can they weather a major cyber event affecting multiple clients? Consider their claims handling reputation – will they be there when you need them most? Look at the security services included in your premium – are they offering tools that will actually help protect your business? And perhaps most importantly, do they understand the specific challenges facing your industry?

The right carrier should feel like an extension of your own risk management team. They should help you prevent incidents when possible and respond quickly and effectively when necessary. They should speak your language and understand your concerns.

At Stanton Insurance Agency, we work closely with businesses throughout Massachusetts, New Hampshire, and Maine to steer the complex cyber insurance market. Our team stays up-to-date on the latest carrier offerings, coverage innovations, and emerging threats. This allows us to ensure our clients receive the protection they need without breaking the bank.

We understand that every business has its own unique risk profile and budget constraints. Whether you run a small retail shop, a healthcare practice, or a technology firm, we can help you find a cyber insurance solution that addresses your specific concerns while providing real value beyond basic coverage.

For more information about protecting your business – including cyber insurance and other essential coverages – visit our Business Insurance page or reach out to our team through the contact form on our website. We’re here to help you build strong defenses against today’s evolving cyber threats, giving you the peace of mind to focus on what you do best: running your business.