Understanding the True Cost of Protecting Your Business Vehicles

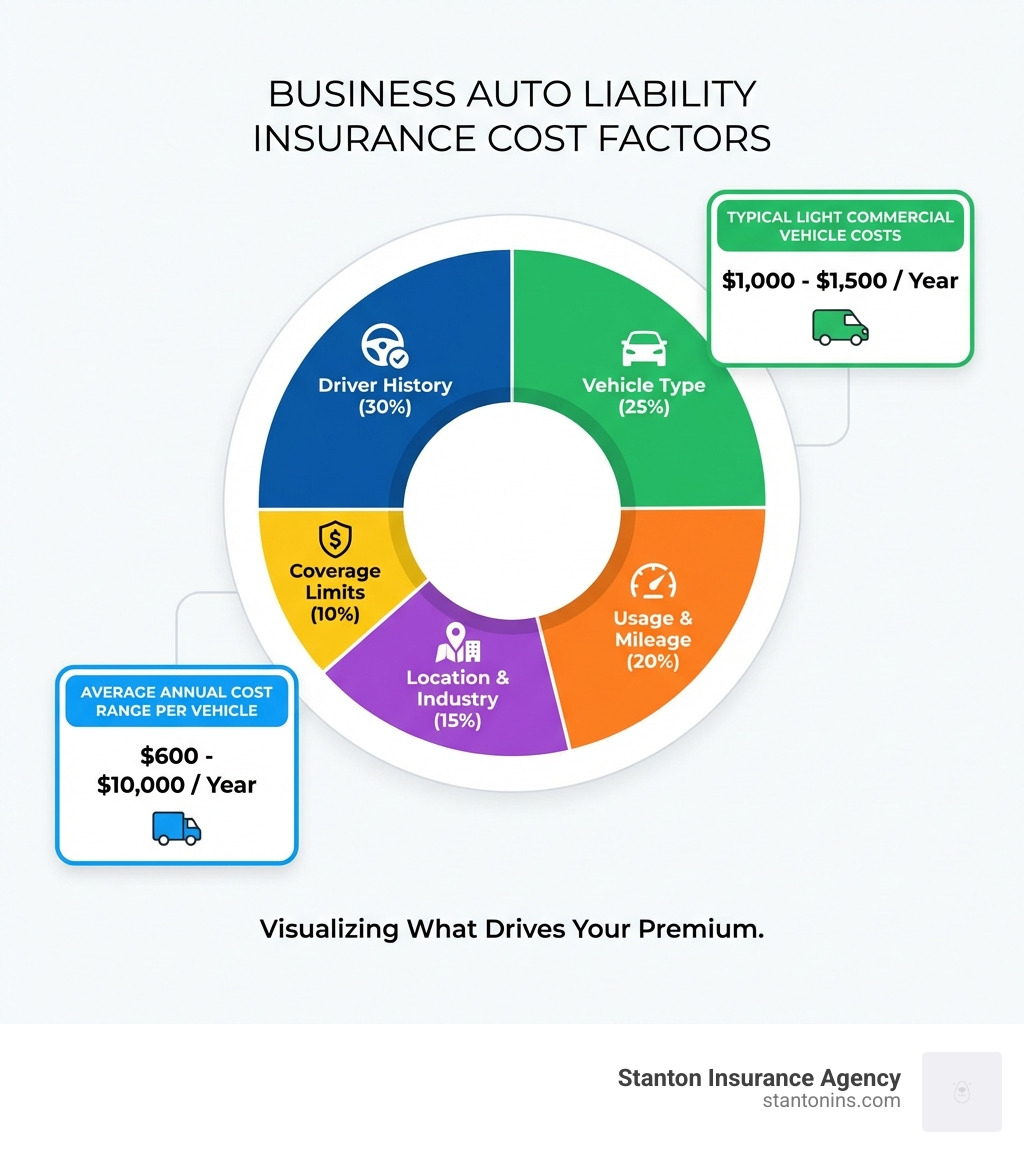

Business auto liability insurance cost can vary dramatically—from as little as $600 to over $10,000 annually per vehicle—depending on your specific circumstances. Here’s what you need to know:

Quick Cost Overview:

- Average Range: $1,000 to $1,500 per year for light commercial vehicles

- Monthly Cost: Typically $220 to $1,200 depending on coverage and risk factors

- Massachusetts: $180 to $990 per month on average

- New Hampshire: $120 to $630 per month on average

Key Cost Factors:

- Type and value of vehicle

- How the vehicle is used (mileage, purpose, cargo)

- Driver history and experience

- Your industry and location

- Coverage limits and deductibles chosen

As a business owner, you’re no stranger to juggling expenses and making strategic decisions about where to invest your money. But when it comes to protecting the vehicles that keep your business moving, understanding the cost of commercial auto insurance can feel like cracking a code.

The reality is that business auto liability insurance cost isn’t a one-size-fits-all number. A florist using a single van for local deliveries will pay vastly different premiums than a construction company operating a fleet of heavy trucks across multiple states. The average auto liability claim for bodily injury was $28,278 in 2024—a figure that underscores why adequate coverage isn’t optional, it’s essential.

This guide breaks down exactly what drives your premium, what you can expect to pay in Massachusetts and New Hampshire, and most importantly, how to manage these costs without sacrificing the protection your business needs.

I’m Geoff Stanton, and as a 4th generation owner and President of Stanton Insurance, I’ve helped hundreds of local businesses steer business auto liability insurance cost decisions over my 25+ years in the industry. Through my work as a Certified Insurance Counselor specializing in commercial coverage, I’ve seen how the right policy—at the right price—can make all the difference when the unexpected happens.

Quick business auto liability insurance cost definitions:

The Fundamental Difference: Commercial vs. Personal Auto Insurance

Many small business owners wonder if they can simply use their personal auto insurance for a vehicle that’s also used for work. The answer is almost always no. Insurance providers draw a clear line between personal and commercial use, and attempting to cover business activities with a personal policy can lead to a denied claim when you need it most.

Commercial auto insurance is specifically designed to handle the higher risks associated with business operations. Here’s why it’s different and necessary:

- Higher Liability Limits: Business vehicles often carry valuable equipment or transport clients, increasing the potential for costly damages in an accident. Auto liability insurance for commercial use offers much higher coverage limits to protect your business from substantial lawsuits. The average auto liability claim for bodily injury was $28,278 in 2024, a figure that can cripple a small business without adequate coverage.

- Coverage for Employees: Unlike personal policies, commercial auto insurance can cover any employee who is permitted to drive your company vehicles, not just family members listed on the policy. This is a critical distinction; if an employee uses their personal vehicle for business purposes and is involved in an accident, their personal policy may deny the claim if the business use was not disclosed or covered, leaving your business exposed.

- Broader Vehicle and Use Coverage: Whether you operate a heavy-duty commercial insurance for trucks or a simple sedan for sales calls, a commercial policy covers the vehicle for its specific business purpose, including transporting goods, tools, or paying passengers. For instance, a coffee shop customer getting burned by a hot cup of coffee delivered by your employee in a company car could lead to a claim that only commercial auto insurance would properly address.

- Protection for Business Assets: A claim against your business could target all your company’s assets. A robust business liability insurance policy, including auto liability, is designed to shield your business from these threats. This means protecting not just your vehicles, but also your property, equipment, and financial stability.

Key Factors That Influence Your Business Auto Liability Insurance Cost

There is no one-size-fits-all price for commercial auto insurance. Insurers perform a detailed risk assessment, and your final premium is a unique reflection of your business’s specific operational profile. Understanding these factors empowers you to make informed decisions and identify areas where you can manage your costs.

Vehicle Type, Size, and Value

The kind of vehicle you need to insure is a primary cost driver. A large, heavy dump truck has the potential to cause significantly more property damage liability in an accident than a small sedan used for client visits.

- Heavy Vehicles: Trucks, tractor-trailers, and construction vehicles are more expensive to insure due to their weight, size, and higher repair costs. Their potential to cause greater damage in an accident means higher liability limits are needed, driving up the premium.

- Passenger Transport: Vans and buses used to transport people carry a higher risk of bodily injury claims, increasing premiums. The risk associated with carrying human cargo is much higher than inanimate objects.

- Vehicle Age and Model: Newer, more expensive vehicles cost more to repair or replace, which is reflected in the cost of physical damage coverage (Collision and Comprehensive), though it has less impact on the liability portion. However, high-performance or luxury vehicles, regardless of age, can still contribute to higher liability costs due to their potential for higher speed and associated risk.

How the Vehicle is Used

How your vehicles are used daily directly correlates with risk exposure.

- Purpose of Use: A vehicle used to haul hazardous materials will have a much higher premium than one used for local flower deliveries. Similarly, vehicles used for emergency services, towing, or public transport face higher risks and thus higher premiums.

- Annual Mileage: The more time a vehicle spends on the road, the higher the probability of an accident. Long-haul trucking operations will naturally face higher costs than a local contractor who uses a vehicle sparingly. More miles driven means more exposure to potential incidents.

- Radius of Operation: Vehicles that operate within a small, local radius are typically cheaper to insure than those that travel long distances or cross state lines. Traveling across state lines can also introduce varying state regulations and liability requirements, which can affect costs.

Driver History and Experience

The people behind the wheel are one of the most significant factors in your insurance rate. We’ve all heard the saying, “It’s not the car, it’s the driver,” and in insurance, that rings especially true.

- Driving Records: A history of accidents, traffic violations, or DUIs for any employee driver will dramatically increase your premium. Insurers see this as a strong indicator of future risk. A business with a clean driving record across its fleet can expect to pay significantly less than one with a history of claims or infractions.

- Age and Experience: Younger, less experienced drivers are statistically more likely to be involved in accidents, leading to higher rates. Conversely, a team of seasoned drivers with years of experience and clean records can help keep your business auto liability insurance cost down.

- Commercial Driver’s License (CDL): For roles requiring it, ensuring drivers have a valid CDL and proper training can sometimes help manage costs, as it demonstrates a higher level of professional qualification. Insurers often view CDL-certified drivers as more qualified and less risky, potentially leading to lower rates.

Industry and Location Risks

Your industry and where you operate play a crucial role.

- High-Risk Industries: Industries like construction, trucking, and taxi services inherently involve more driving and higher-risk scenarios, leading to higher premiums than a tech company with a single car for errands. For instance, a construction company using heavy trucks is seen as riskier than a florist using passenger vans for local deliveries.

- Geographic Location: Operating in a dense urban area with heavy traffic and higher accident rates will cost more than in a rural setting. According to the Insurance Information Institute, factors like weather conditions, road quality, and local litigation trends all impact rates. For example, average premiums in Massachusetts and New Hampshire will differ based on these local factors. States with higher populations, more congested roads, and higher average claim costs typically have higher premiums.

What is the Average Cost of Commercial Auto Insurance?

While the specific cost is highly individualized, it’s helpful to understand the general price range. According to industry data, business auto liability insurance cost can range from $600 to as much as $10,000 annually per vehicle. On average, for private passenger or light commercial vehicles, costs tend to hover around $1,000 to $1,500 per year. For some businesses, especially those with higher risk factors or extensive coverage needs, these costs can escalate significantly. The average monthly cost of commercial auto insurance can range between $220 and $1,200.

Decoding the Average Business Auto Liability Insurance Cost in MA and NH

Location is a major factor. For businesses in our local area, costs can vary significantly due to traffic density, accident rates, legal environments, and even road conditions.

- Massachusetts: On the commercial side, average monthly costs for car insurance in MA can range from $180 to $990. The higher end of this range often applies to businesses in the greater Boston area due to higher traffic density, increased accident frequency, and potentially higher repair and medical costs.

- New Hampshire: With a more rural landscape and generally lower population density, NH auto insurance costs for commercial vehicles are often lower, with average monthly premiums ranging from $120 to $630. While New Hampshire is known for its “Live Free or Die” motto, we still recommend adequate coverage!

Let’s look at an estimated breakdown:

| Vehicle Type | Industry | Estimated Monthly Premium |

|---|---|---|

| Cargo Van | Florist (Local Delivery) | $90 – $150 |

| Pickup Truck | Landscaping | $120 – $200 |

| Dump Truck | Construction | $400 – $800+ |

| Box Truck | Long-Haul Trucking | $600 – $1,200+ |

This table illustrates how dramatically industry and vehicle type influence the business auto liability insurance cost.

How Coverage Options and Deductibles Shape Your Premium

Your business insurance policy is a collection of different coverages, each with its own cost. Customizing these options allows you to balance protection with your budget.

Mandatory and Optional Coverages

While requirements vary by state, a typical commercial vehicle insurance policy includes:

- Liability Coverage (Mandatory): This is the core of your policy. It covers bodily injury and property damage to others if you or your employee is at fault in an accident. State minimums are often insufficient for businesses, with many opting for $1,000,000 in coverage for adequate protection. This is crucial as the average auto liability claim for property damage was $6,770 in 2024, while bodily injury claims averaged $28,278, which can escalate quickly.

- Uninsured/Underinsured Motorist Coverage (Often Mandatory): Protects you if you’re hit by a driver with little or no insurance. This coverage is particularly important in states like Massachusetts and New Hampshire, where not all drivers carry sufficient coverage.

- Personal Injury Protection (PIP) / Medical Payments (Varies by State): Covers medical expenses for you and your passengers, regardless of fault. Massachusetts is a no-fault state, requiring PIP coverage. New Hampshire typically offers Medical Payments coverage.

- Collision Coverage (Optional): Pays to repair or replace your vehicle if it’s damaged in a collision with another object or if it overturns. This is vital if your business relies on its vehicles and cannot afford significant out-of-pocket repair costs.

- Comprehensive Coverage (Optional): Covers damage to your vehicle from non-collision events like theft, vandalism, fire, or hitting an animal. If your vehicles are expensive or crucial to your operations, this coverage provides essential protection.

- Other Optional Coverages: Depending on your business, you might consider:

- Hired and Non-Owned Auto Liability: Covers liability for vehicles you rent or for employees using their personal vehicles for business.

- Cargo Coverage: Protects the goods you transport.

- Towing and Roadside Assistance: Essential for businesses with vehicles frequently on the road.

The Deductible vs. Premium Trade-Off

Your deductible is the amount you pay out-of-pocket for a claim before your insurance kicks in. There is an inverse relationship between your deductible and your premium:

- Higher Deductible = Lower Premium: By agreeing to take on more financial risk yourself, the insurance company rewards you with a lower annual insurance premiums. This can be a smart move if your business has sufficient reserves to cover a higher deductible.

- Lower Deductible = Higher Premium: If you prefer to pay less out-of-pocket during a claim, you will pay more for your policy upfront. This offers greater immediate protection but comes at a higher ongoing cost.

Choosing the right deductible is a key part of your liability car insurance cost guide. You must balance the potential for premium savings against your company’s ability to comfortably pay the deductible if an incident occurs. While a higher deductible lowers your premium, it means more out-of-pocket expense if you have a claim.

Smart Strategies to Lower Your Commercial Auto Insurance Premiums

While some cost factors are fixed, there are several proactive steps you can take to manage and reduce your business auto liability insurance cost. We’re here to help you steer these options.

Strategies to Reduce Your Business Auto Liability Insurance Cost

- Bundle Your Policies: One of the easiest ways to save is by bundling your commercial auto policy with other policies, such as commercial general liability or commercial property insurance, with the same provider. This can often lead to a multi-policy discount of 5% to 15% per policy.

- Implement a Driver Safety Program: Formally train your employees on safe driving practices, conduct regular vehicle maintenance, and maintain clean driving records. Some insurers offer discounts for businesses with established safety protocols, potentially saving you 20% to 33%. This includes creating written safety policies, quarterly driver training, and proper vehicle maintenance.

- Hire Drivers with Clean Records: Make a thorough check of a potential employee’s driving history a standard part of your hiring process. Fewer accidents and violations directly translate to lower premiums. A single at-fault accident can significantly impact your rates.

- Choose the Right Vehicles: When adding to your fleet, consider the insurance cost implications. Opt for vehicles with high safety ratings and avoid modifications that could increase risk. Standard business vehicles are significantly cheaper to insure than specialized or for-hire vehicles.

- Increase Your Deductible: As discussed, if your business has a healthy cash flow, choosing a higher deductible on your physical damage coverages (collision and comprehensive) can provide significant premium savings, sometimes 15% to 30% on those portions of your policy.

- Install Telematics Devices: Many insurers offer usage-based insurance programs that use a telematics device (a plug-in or app) to monitor driving habits like speed, braking, and mileage. Safe driving can earn you substantial discounts, typically 5% to 20%. These devices can also provide valuable data for fleet management and safety improvement.

- Compare Quotes Regularly: Don’t settle for the first quote you receive. We recommend comparing quotes from multiple insurers annually to ensure you’re getting the best coverage at a competitive price. Comparing multiple insurers can save up to 33%.

Frequently Asked Questions about Business Auto Liability Insurance Cost

Is commercial auto insurance a worthwhile investment for my business?

Absolutely. The potential financial consequences of a single at-fault accident—including legal fees, medical bills, and vehicle repair costs—can easily bankrupt a business without adequate protection. Consider the average auto liability claim for bodily injury at $28,278 in 2024; imagine multiple injuries, extensive property damage, and legal fees. Without proper insurance, these costs could far outweigh your annual premiums. The cost of a policy is a predictable expense that safeguards you from unpredictable and potentially catastrophic losses, offering peace of mind. For more details, see our guide on why auto insurance is important.

What are the potential financial consequences of not having adequate commercial auto insurance?

The financial repercussions of not having sufficient commercial auto insurance can be devastating. If your business or an employee is at fault in an accident, you could face:

- High Out-of-Pocket Costs: Paying for vehicle repairs, medical bills for injured parties, and property damage out of your business’s pocket.

- Lawsuits and Legal Fees: Being sued for damages, which can incur significant legal expenses even if you win, and potentially massive settlements or judgments if you lose.

- Business Interruption: Legal battles and financial strain can divert resources and attention away from your core operations, leading to lost revenue and productivity.

- Damage to Reputation: Accidents and lawsuits can harm your business’s standing and trustworthiness.

- Bankruptcy: In severe cases, particularly with large bodily injury claims, a business could be forced into bankruptcy.

What is the difference in cost between insuring a single commercial vehicle versus a fleet?

Insuring a single vehicle is straightforward, with the premium based on the factors discussed above. For a fleet (typically 5 or more vehicles), insurers often offer a “fleet rating.” While the total premium will be higher, the per-vehicle cost is often lower than if each vehicle were insured individually. Fleet policies also simplify administration with a single policy and renewal date, making management more efficient. When you have a fleet, insurers can spread the risk across multiple vehicles and drivers, which can result in more favorable rates per unit.

How can bundling policies affect the cost of commercial auto insurance?

Bundling policies is one of the most effective ways to reduce your business auto liability insurance cost. When you purchase multiple types of insurance (e.g., commercial auto, general liability, property insurance) from the same provider, you often qualify for a multi-policy discount. These discounts can range from 5% to 15% per policy, leading to significant overall savings. It also simplifies your insurance management, as you deal with a single provider for all your business’s needs.

Are there specific industries that face higher commercial auto insurance costs?

Yes, absolutely. Industries that inherently involve more driving, specialized vehicles, or higher risks tend to face higher commercial auto insurance costs. Examples include:

- Transportation and Trucking: Moving goods over long distances, especially hazardous materials, exposes vehicles and drivers to higher risks of accidents and liability.

- Construction: Operating heavy machinery, transporting materials, and working on active job sites increases the likelihood of incidents and the severity of potential damages.

- Passenger Transport: Taxis, ride-sharing services, and bus companies carry the high risk associated with transporting people.

- Delivery Services: Businesses with frequent local deliveries, especially in dense urban areas, have higher exposure due to increased time on the road and stop-and-go traffic.

These industries often require higher coverage limits and may have a higher frequency of claims, which is reflected in their premiums.

Secure Your Business with the Right Coverage

Understanding your business auto liability insurance cost is the first step toward making a smart, protective investment in your company’s future. By carefully considering your vehicles, drivers, and operational risks, you can work with an expert to tailor a policy that provides robust protection without breaking your budget. The right coverage offers more than just financial security; it provides the peace of mind to focus on what you do best—running your business.

At Stanton Insurance Agency, our team of experienced professionals can help you steer the complexities of commercial insurance and find a policy that fits your unique needs. We serve businesses across Massachusetts and New Hampshire, understanding the local nuances that impact your insurance. To get a personalized assessment and explore your options, contact us today or learn more in our complete Auto Liability Insurance Cost Guide.