Condominium Insurance Coverage: Essential 2025 Guide

Why Your Condominium Insurance Coverage Matters More Than You Think

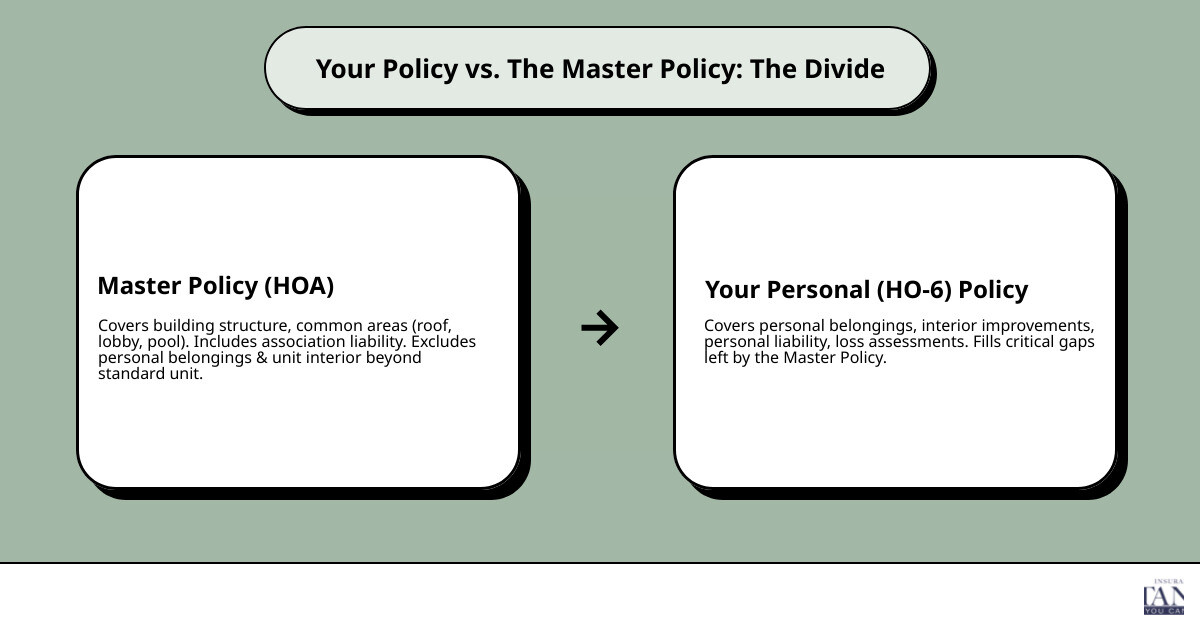

Condominium insurance coverage is a specialized type of home insurance that protects your personal belongings, liability, and interior unit improvements, filling critical gaps left by your condo association’s master policy. Here’s what you need to know:

- Your association’s master policy covers the building structure and common areas, but not your personal property or interior upgrades

- Your personal HO-6 policy protects your belongings, liability, improvements/betterments, and covers loss assessments

- Key coverages include: personal property (replacement cost recommended), liability ($300K-$500K+), loss assessment, improvements/betterments, and additional living expenses

- Optional but crucial add-ons: water backup, sewer backup, and overland water coverage

- Cost factors: location, building age/construction, coverage limits, deductible, and claims history

It feels good to know you’re covered, but many condo owners find too late that they’re not fully protected. When buying or owning a condominium, you’re stepping into a unique insurance situation. You own your unit, but you also share ownership of common areas with your neighbors. This creates a complex web of insurance responsibilities that can leave you financially exposed if you don’t understand the divide between your personal policy and the condo corporation’s master policy.

The most common and costly mistake? Assuming the association’s insurance covers everything. It doesn’t. Your personal belongings, interior upgrades, liability for accidents in your unit, and your share of the master policy’s often-massive deductible are all your responsibility to insure. Without the right coverage, a burst pipe, fire, or lawsuit could cost you tens of thousands of dollars out of pocket.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over two decades helping condo owners in Massachusetts steer the complexities of condominium insurance coverage to ensure they have complete protection. Let’s break down exactly what you need to know to avoid getting caught without coverage when you need it most.

Your Policy vs. The Master Policy: Understanding the Divide

Here’s where many condo owners get tripped up: they assume that the insurance policy held by their condominium corporation or homeowners association (HOA) covers everything. It doesn’t. In reality, you’re dealing with two separate insurance policies that are designed to work together like puzzle pieces, with each covering different parts of your condo life.

Think of it this way: the master policy protects the “we,” while your personal policy protects the “me.”

The Condo Corporation’s Master Policy is the big umbrella. Your HOA is legally required to maintain this policy, and its job is to protect the physical structure of the building and all the common areas everyone shares. We’re talking about the roof over your head, the exterior walls, the elevators that carry you to your floor, the lobby where you greet guests, the swimming pool where you cool off in summer, and the hallways you walk through every day. The master policy also provides liability coverage for the association itself, so if someone slips and falls in the lobby, the association is protected.

But here’s the catch: the master policy stops at your front door. It does not cover your personal belongings or the interior of your unit beyond what your condo documents define as the “standard unit.” That bare-bones definition matters more than you might think.

Your Personal Condo (HO-6) Policy is where your protection begins. This is your personal safety net, designed to protect your financial interests within your “four walls.” It covers your furniture, clothing, electronics, and provides liability coverage for accidents that happen inside your unit. It also covers the parts of the unit you’re responsible for maintaining, like those gorgeous hardwood floors you installed or the custom kitchen cabinets you love.

To make this crystal clear, here’s how the coverage breaks down:

| Coverage Area | Master Policy | HO-6 Policy |

|---|---|---|

| Building Exterior/Roof | Covered | Not covered |

| Common Areas (Lobby, Pool) | Covered | Not covered |

| Your Personal Belongings | Not covered | Covered |

| Interior Finishes (Flooring, Cabinets) | Only “standard unit” | Your upgrades covered |

| Personal Liability (Inside Unit) | Not covered | Covered |

| Additional Living Expenses | Not covered | Covered |

What the Master Policy Leaves Behind

The master policy is built to protect the collective: the building and shared spaces. That’s important, but it leaves some significant gaps that only your personal MA condo insurance policy can fill.

Your personal belongings are completely on you. That couch you saved up for? Your laptop? Your entire wardrobe? The master policy won’t pay a dime if they’re damaged or stolen. You need your own coverage for everything you own inside your unit.

Interior upgrades and improvements aren’t covered either. Most master policies only cover the unit as it was originally built (think bare walls, basic flooring, and standard fixtures). Did you renovate your bathroom with high-end tile? Install hardwood floors throughout? Upgrade to granite countertops? Those improvements are your responsibility to insure, because the master policy treats your unit as if it’s still in its original, basic condition.

Personal liability is entirely your problem. If a guest trips over your rug and breaks their wrist, or if you accidentally start a fire that damages your neighbor’s unit, the master policy won’t protect you. You’re personally on the hook for damages, medical bills, and legal fees. That’s a risk you don’t want to take.

The master policy deductible can be shockingly high; we’re talking $25,000, $50,000, or even more. Here’s what many condo owners don’t realize: if a covered event originates in your unit (like a burst pipe that floods multiple floors), the association may hold you responsible for paying that entire deductible. Without your own condominium insurance coverage, you could be writing a check for tens of thousands of dollars.

Temporary housing costs aren’t covered by the master policy. If a fire or major water leak makes your unit uninhabitable for weeks or months, you’ll need somewhere to stay. The master policy won’t pay for your hotel bills, restaurant meals, or the cost of renting a temporary apartment. That coverage only comes from your personal policy’s Additional Living Expenses provision.

The bottom line? Your condo association’s master policy is important, but it’s designed to protect the building and the association, not you personally. To truly protect yourself, your belongings, and your financial future, you need your own condominium insurance coverage that picks up where the master policy leaves off.

Core Components of Your Personal Condominium Insurance Coverage

A standard HO-6 policy is like a safety net made up of several interwoven strands, each one designed to catch you if something goes wrong. Understanding what each part does helps you build coverage that actually fits your life, not just a cookie-cutter policy that leaves gaps.

Personal Property Coverage

This is where your condominium insurance coverage really shines. It protects everything you own inside your four walls: your furniture, electronics, clothing, kitchen gadgets, and even the stuff tucked away in a personal storage locker within the building. If fire, theft, or vandalism strikes, this coverage has your back.

Here’s the thing: not all personal property coverage is created equal. You’ll want to choose Replacement Cost coverage instead of Actual Cash Value. Why? Because Replacement Cost pays to replace your damaged items with new ones. If your five-year-old couch gets ruined when your neighbor’s pipes burst, you get enough money to buy a comparable new couch, not the depreciated value of your old one. That difference can be hundreds or even thousands of dollars.

Take the time to create a home inventory. Walk through your condo with your phone and snap photos of your belongings. You’ll be amazed at how much stuff you actually own, and it makes filing a claim so much easier if disaster strikes.

Personal Liability Coverage

Think of personal liability coverage as your financial bodyguard. It steps in when you’re found legally responsible for accidentally injuring someone or damaging their property. This protection follows you whether the incident happens in your condo or elsewhere.

Let’s say a guest slips on your freshly mopped floor and breaks their wrist. Or imagine you accidentally start a kitchen fire that damages your neighbor’s unit. Your liability coverage helps pay for medical expenses, legal fees, and damages, protecting your savings, your home equity, and your future earnings from being wiped out by a lawsuit.

Most policies start with limits between $300,000 and $500,000, but we often recommend higher limits, such as $1,000,000 or even $2,000,000. Legal costs can skyrocket quickly, and the peace of mind is worth it. For even more protection, consider adding a personal umbrella policy, which kicks in when your standard liability limits are exhausted.

Additional Living Expenses (ALE) / Loss of Use

Here’s a scenario nobody wants to face: a fire or major water leak makes your condo uninhabitable for weeks or months while repairs are underway. Where will you stay? How will you afford hotel bills and restaurant meals?

That’s where Additional Living Expenses coverage becomes a lifesaver. It reimburses you for the extra costs of maintaining your normal standard of living while you’re displaced. Hotel rooms, takeout meals, laundry services, even pet boarding; ALE covers the difference between what you’d normally spend and what you’re forced to spend during this difficult time. This coverage ensures that a disaster doesn’t derail your finances on top of everything else you’re dealing with.

‘All-Risk’ vs. ‘Specified Perils’

When shopping for condominium insurance coverage, you’ll need to choose between two approaches. Specified Perils coverage protects you only against a list of named risks, such as fire, lightning, theft, and vandalism. If something happens that’s not on the list, you’re out of luck.

All-Risk (also called Comprehensive) coverage flips this around. It protects you against everything except what’s specifically excluded in your policy. Common exclusions include floods, earthquakes, and intentional damage. This broader approach means you’re covered for unexpected scenarios you might never have thought to worry about.

We generally recommend All-Risk coverage. Yes, it costs a bit more, but the extra protection is worth it. Life has a way of throwing curveballs, and All-Risk coverage means you’re ready for most of them.

Crucial Coverages Unique to Condo Life

Beyond the basics, condominium insurance coverage includes special provisions designed to address the unique risks of community living. These are often the most misunderstood and most important parts of your policy. Let’s break down what makes condo insurance different from other types of coverage.

Improvements and Betterments

Did you renovate your kitchen with granite countertops or install new hardwood floors? Maybe you upgraded to custom cabinetry or added beautiful ceramic tile in your bathroom? These upgrades are considered “improvements and betterments,” and here’s the thing: the condo corporation’s master policy won’t cover them.

The master policy is only responsible for the unit’s original “standard” finishes; basically, what the builder installed when the unit was first constructed. Everything you’ve done to make your condo uniquely yours falls on your shoulders to insure. This includes new cupboards, upgraded carpet, modern fixtures, and any other improvements you or a previous owner made.

Your HO-6 policy can provide coverage to repair or replace these valuable upgrades after a loss. Without this coverage, you’d be paying out of pocket to restore your condo to its pre-loss condition, potentially costing tens of thousands of dollars. Owners are generally responsible for insuring fixtures, furnishings, equipment, and personal property within their unit, as these are not considered part of a standard unit.

Loss Assessment Coverage

This is arguably the most critical and unique aspect of condominium insurance coverage. Let me paint you a picture: imagine a fire damages the building’s roof, and the total repair cost is $500,000. The master policy has a coverage limit of $400,000, leaving the association short $100,000. Now what?

To cover this shortfall, the HOA can levy a “special assessment” against all unit owners. If there are 50 units in your building, each owner would be billed $2,000. Suddenly, you’re facing an unexpected expense that could seriously impact your finances.

Loss Assessment coverage is designed to pay this bill for you, protecting you from sudden, unexpected expenses related to common property damage. This coverage becomes even more critical when you consider that condo corporation master policy deductibles can be enormous, often ranging from $10,000 to $50,000 or even higher.

If a shared common area in your condo building, like the lobby or parking garage, is damaged and the cost of repairs exceeds the condo association’s coverage limit, the balance owing may be split amongst the condo unit owners. Your Loss Assessment coverage protects you from these out-of-pocket expenses. It can also cover your share of the master policy deductible, which alone could be financially devastating.

We can also provide Deductible Protection Coverage, which offers up to $25,000 in coverage if the type of loss is covered by your policy. This helps cover a portion of the condominium corporation’s insurance deductible, a benefit that can save you thousands when a claim occurs.

Water Damage, Sewer Backup, and Overland Water

Does condo insurance cover water damage? The answer is: it depends on the source. A standard policy typically covers sudden and accidental water damage from within your unit, like a burst pipe or overflowing appliance. If your upstairs neighbor’s pipes burst and flood your living room, your insurance will cover the damage to your belongings and interior finishes.

However, standard policies usually exclude damage from sewer backup (water backing up through sewers or drains) and overland water (water entering your unit from heavy rain, snowmelt, or overflowing rivers). These exclusions exist because these types of water damage are predictable risks in certain areas and can result in catastrophic losses.

Here’s the problem: these are two of the most common and costly types of claims. A typical condo insurance policy does not cover flooding, but an improved water damage endorsement can cover accidental sewer backup and overflow of a body of water.

Given the increasing frequency of severe weather events in Massachusetts and New Hampshire (from intense rainstorms to rapid snowmelt), these add-ons are highly recommended. Without this protection, you could face tens of thousands of dollars in damage that your insurance won’t cover. Adding these endorsements provides comprehensive protection against water-related perils that are becoming more common every year.

Optional Add-Ons and Endorsements

Beyond the core coverages, several optional add-ons, or endorsements, can further improve your condominium insurance coverage. Legal Expense Insurance (LEI) is an available endorsement that can be added to many condo policies in Massachusetts and New Hampshire, providing coverage for legal fees related to specified situations like property disputes.

Earthquake coverage is another important consideration. Standard home insurance policies, including condo policies, typically do not automatically include earthquake coverage, but it can be purchased for an additional premium. If you add Deductible Protection Coverage, it can even help with up to $2,500 for earthquake damage deductibles.

Identity theft protection is increasingly valuable in our digital world, providing access to expert advice and personalized legal support for identity theft, cyber-attacks, and cyber extortion expenses. If you own high-value items like jewelry, fine art, or collectibles, your standard personal property limits might not be enough. You can schedule these items separately for broader coverage and higher limits.

Finally, umbrella liability insurance provides an extra layer of liability protection above the limits of your standard policies, offering additional peace of mind for a relatively low cost.

Choosing Your Policy: Cost Factors and Smart Steps

Getting the right coverage doesn’t have to feel overwhelming. Once you understand what influences your premium and follow a few straightforward steps, you’ll be well on your way to securing a policy that truly protects you.

What Factors Influence the Cost of Condo Insurance?

The cost of your condo insurance isn’t random; it’s based on real factors that reflect your unique situation. Your location plays a significant role. If your building is close to a fire station or in an area with lower risk for natural disasters, you’ll likely pay less. Where you live in Massachusetts or New Hampshire can definitely impact your rate, though there’s no one-size-fits-all rule.

The construction of your building matters, too. Newer buildings or those made with masonry tend to cost less to insure than older wood-frame structures. The coverage limits you choose (how much personal property protection and liability coverage you want) directly affect your premium. Higher limits mean more protection, but also a higher cost.

Your deductible is another key factor. Choosing a higher deductible lowers your premium, but remember, that’s the amount you’ll pay out-of-pocket before your insurance kicks in. Deductibles can range from a few hundred dollars to tens of thousands, so pick one that fits your budget and comfort level.

Your claims history also influences your rate. If you’ve filed multiple claims in the past, insurers may see you as a higher risk. On the flip side, you might qualify for discounts that bring your premium down. Bundling your condo insurance with your auto insurance is a great way to save. Having a security system or being claims-free for several years can also earn you discounts. Every little bit helps.

Steps to Purchase or Review Your Policy

Start by reviewing your condo documents. Before you do anything else, get a copy of your condo corporation’s master policy and bylaws. You need to understand how they define a “standard unit” and exactly what your responsibilities are versus the association’s. This is the foundation of choosing the right condominium insurance coverage. Your governing documents will clarify what elements of your unit you’re responsible for insuring on your own.

Next, inventory your belongings. Walk through your condo and create a detailed list of everything you own—furniture, electronics, clothing, kitchenware, everything. Take pictures or videos. Estimate the replacement cost of each item. This exercise helps you determine how much personal property coverage you actually need. Make sure your contents coverage requirements are accurate and reflect reality, not guesswork.

Assess your specific needs. Think about the value of any improvements you’ve made to your unit. Have you installed custom cabinets, new flooring, or upgraded fixtures? Consider your comfort level with liability exposure and whether you need optional coverages like water backup protection or earthquake coverage. If you’ve made significant renovations recently, it’s crucial to update your insurance policy to reflect these changes.

Compare quotes from multiple carriers. This is where working with an independent insurance agent really pays off. We can help you compare options from different insurers to find the best combination of coverage and price for your situation. You can also start the process online with a Condo Insurance Quote to get a detailed estimate. We’ll make sure you have the right coverage, not just the cheapest policy.

Review your policy annually. Life doesn’t stand still, and neither should your insurance. Set a reminder to revisit your policy every year. Make sure your coverage limits still match the value of your belongings and any new improvements you’ve made. Bought a new laptop? Renovated your bathroom? Those changes warrant a review. Keeping your policy current means you won’t be caught short when you need it most.

At Stanton Insurance Agency, we’re here to guide you through every step of this process. We’ll help you understand your condo documents, assess your needs, and find a policy that gives you complete peace of mind. You don’t have to steer this alone.

Frequently Asked Questions about Condo Insurance

What is the difference between condo insurance and tenant insurance or standard homeowner’s insurance?

This is a great question! Condo insurance is a home insurance product that provides coverage for your personal belongings, as well as any improvements or betterments made to the unit you own.

- Condo insurance (HO-6) is specifically designed for unit owners. It covers your personal belongings, liability within your unit, and the interior structure of your unit from the “studs in,” including any improvements you’ve made.

- Tenant insurance (HO-4) covers a renter’s personal property and liability, but it does not cover any part of the building structure because the tenant doesn’t own it.

- Standard homeowner’s insurance (HO-3) is for single-family home owners. It covers the entire dwelling structure (exterior and interior), personal belongings, and liability. The key difference is that a single-family homeowner owns the entire structure and land, whereas a condo owner only owns their unit’s interior and a share of common elements.

Am I required to have condo insurance?

While Massachusetts or New Hampshire state law may not mandate it for every condo owner, your mortgage lender almost certainly will require it to protect their investment. Furthermore, your condo association’s bylaws will likely require you to carry a personal policy with a minimum amount of liability coverage to protect the entire community. Even if not legally required by the state, going without it is a significant financial risk. For more details, see our guide on Do I Need Home Insurance for a Condo?.

Does condo insurance cover my appliances?

Yes, generally! Your personal condominium insurance coverage can protect appliances you own, such as your refrigerator, washer, dryer, and dishwasher. These items are typically covered under your personal property coverage if they are damaged by a covered peril like a fire, theft, or certain types of water damage. It’s important to ensure your personal property limits are high enough to replace all your appliances, electronics, and other belongings at current market prices. For more specific scenarios and a deeper dive, check out our article: Does Condo Insurance Cover Appliances?.

Secure Your Condo, Secure Your Peace of Mind

Understanding your condominium insurance coverage is not just about fulfilling a requirement; it’s about protecting your home, your assets, and your financial stability. By recognizing the critical gaps left by your association’s master policy and securing a robust HO-6 policy, you ensure that you won’t be left financially stranded when disaster strikes.

The world of condo insurance can seem complex, but you don’t have to steer it alone. The experienced professionals at Stanton Insurance Agency are here to help you review your condo documents, assess your unique needs, and find a policy that provides complete peace of mind. Contact us today to get a personalized quote and ensure your condo is properly protected.