Condo Insurance Coverage for Water Damage: Avoid 2025 Nightmares

Why Understanding Condo Insurance Coverage for Water Damage Is Critical

Condo Insurance Coverage for Water Damage is one of the most misunderstood aspects of protecting your home. A leak from a neighbor, a roof failure, or a burst pipe can create a confusing and costly puzzle involving your policy, your neighbor’s, and the HOA’s master coverage. With repair costs ranging from $300 to over $100,000, knowing what your policy covers isn’t just smart—it’s essential.

Quick Answer: What’s Covered vs. What’s Not

| Typically Covered | Typically NOT Covered |

|---|---|

| Burst pipes inside your unit | Flooding from outside sources |

| Leaking appliances (dishwasher, washing machine) | Sewer or drain backups (without endorsement) |

| HVAC system malfunctions | Gradual leaks from poor maintenance |

| Damage to your personal property | Damage originating from common areas (HOA’s responsibility) |

| Temporary housing if unit is uninhabitable | Wear and tear or neglect |

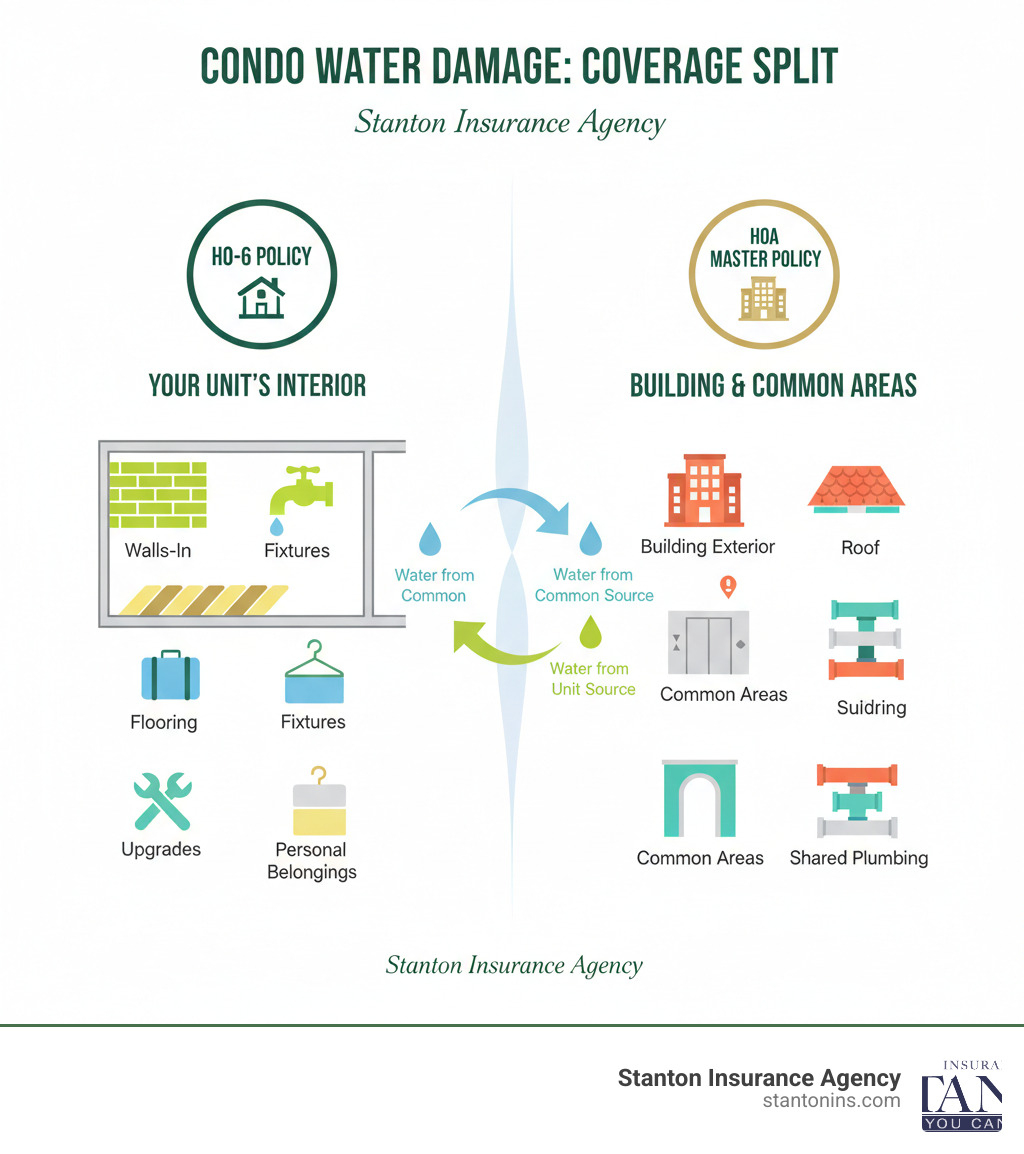

Who Pays for What?

- Your HO-6 Policy: Covers damage inside your unit walls, your personal belongings, and improvements you’ve made.

- HOA Master Policy: Covers the building structure, roof, common areas, and shared plumbing.

- Neighbor’s Policy: May cover damage if their negligence caused the problem.

The confusion comes from the fact that water doesn’t respect boundaries. A leak from a neighbor’s unit, a roof failure, or a burst pipe in a common wall can all affect your condo differently. The wrong assumption can leave you facing thousands in out-of-pocket expenses.

Why Trust This Guide

I’m Geoff Stanton, President of Stanton Insurance Agency. As a fourth-generation insurance professional and Certified Insurance Counselor, I’ve spent over two decades helping condo owners in Massachusetts and New Hampshire steer the complexities of water damage claims. I’ve seen how the right knowledge and coverage can save condo owners from financial disaster.

What Your Condo Insurance Covers (And What It Doesn’t)

Your condo insurance—known as an HO-6 policy—is designed to cover sudden and accidental water damage that originates inside your unit. The key word is “sudden.” However, many common water-related problems are specifically excluded, leading to costly surprises.

Types of Water Damage Typically Covered

Your Condo Insurance Coverage for Water Damage is designed for abrupt incidents you couldn’t reasonably foresee.

- Burst Pipes and Plumbing Failures: This is the classic covered scenario. If a pipe suddenly ruptures, a toilet overflows due to mechanical failure, or a water heater gives way, your policy should cover the resulting damage to your property, walls, flooring, and fixtures.

- Leaking Appliances: A dishwasher hose that bursts, a washing machine that malfunctions, or a refrigerator water line that suddenly breaks are all events your HO-6 policy is built to handle.

- HVAC System Overflow: If your air conditioning or heating system malfunctions and sends water into your unit, the damage is typically covered.

- Fire Sprinkler Activation: If a sprinkler system accidentally goes off or is triggered by a covered event, the resulting water damage is covered.

This protection extends beyond the structure. Your policy helps replace damaged furniture and electronics, provides loss of use coverage for temporary living expenses, and includes personal liability protection if you accidentally damage a neighbor’s unit. For a comprehensive look, explore our guide on What Does Condo Insurance Cover.

Types of Water Damage Generally NOT Covered

Standard policies have significant gaps, particularly for issues that develop slowly or come from external sources.

- Gradual Leaks and Poor Maintenance: A slow drip behind a wall or damage from failing to fix a known problem is considered a maintenance issue, not a sudden accident, and is not covered.

- Natural Floods: Damage from heavy rainfall, overflowing rivers, or storm surges is never covered by a standard condo policy. You need a separate flood insurance policy. Learn more at our page on Why is Flood Insurance Important.

- Sewer and Drain Backups: This is almost always excluded from standard policies, but you can typically add this protection through a low-cost endorsement.

- Ground Seepage: Water seeping into your unit from the ground through the foundation or walls is not a covered peril.

- Ice Dams: While some policies may cover sudden damage from ice dams, recurring issues from a failure to prevent them can lead to denied claims.

These exclusions exist because insurance is meant for unexpected accidents, not predictable events or maintenance. For a complete picture, check out What is Not Covered by Condo Insurance.

The Great Divide: Your HO-6 Policy vs. The HOA Master Policy

The most confusing part of a condo water damage claim is determining where one policy ends and another begins. Your personal HO-6 policy covers your individual unit from the “walls-in,” while the HOA’s master policy covers the building’s structure and common areas. Understanding this division is key.

When You Are Responsible: Your HO-6 Policy

Your personal condo policy is your first line of defense, covering everything from the paint inward, plus your liability.

- Dwelling Coverage: Protects the interior structure of your unit, including drywall, ceilings, floors, and built-in fixtures.

- Personal Property Coverage: Protects your belongings, such as furniture, electronics, and clothing.

- Improvements and Betterments: Covers upgrades you’ve made beyond the standard builder-grade finishes, like custom floors or countertops.

- Personal Liability Coverage: Protects you financially if you accidentally cause damage to someone else’s property or if a guest is injured in your unit.

- Loss of Use Coverage: Helps pay for hotel stays and other additional living expenses if water damage makes your condo uninhabitable.

Determining the right amount of coverage is crucial. Our guide on How Much Condo Insurance Do I Need offers valuable insights.

When the HOA is Responsible: The Master Policy

The HOA is responsible for insuring the shared parts of the building. If water damage originates from a common element, the master policy should respond. This policy generally covers common areas (roof, hallways, elevators), the building exterior, and shared utilities like plumbing within common walls. In both Massachusetts and New Hampshire, when a pipe in a shared wall bursts, the HOA’s master policy is generally responsible for repairing the pipe and wall, while your HO-6 policy would cover the damage inside your unit.

Not all master policies are the same. It’s critical to know which type your HOA has:

| Master Policy Type | What the HOA Covers | What You Must Cover |

|---|---|---|

| Bare Walls-In | Building structure, common areas, shared utilities (pipes in common walls) | Everything inside your unit: drywall, flooring, fixtures, appliances, all improvements |

| Single Entity | Everything in Bare Walls-In, plus original builder-grade fixtures and finishes | Any upgrades beyond original finishes, personal property |

| All-In | Everything in Single Entity, plus all unit owner improvements and additions | Personal property and personal liability |

Your HOA’s master policy type directly impacts how much dwelling coverage you need on your HO-6 policy. If your HOA has a bare walls-in policy, you’ll need significantly more coverage than if they have an all-in policy.

Navigating Your Condo Insurance Coverage for Water Damage

Complex water damage scenarios are common in condo living. Whether the water comes from a neighbor, a storm, or a backed-up drain, knowing the rules of engagement for your insurance is critical. Understanding these nuances before disaster strikes makes all the difference.

Your Guide to Condo Insurance Coverage for Water Damage from a Neighbor

If water from an upstairs unit floods your condo, don’t assume their insurance will automatically pay. The claims process follows a specific order.

Your own policy responds first. It may seem counterintuitive, but you should file a claim with your own MA Condo Insurance policy to get repairs started quickly. This covers your dwelling (walls, floors) and personal property. Waiting for your neighbor’s insurance can cause long delays.

After paying your claim, your insurer will pursue your neighbor’s insurance company for reimbursement through a process called subrogation. This happens behind the scenes. Your neighbor’s liability coverage may apply if they were clearly negligent—for example, if they ignored a known leak. However, if the event was a sudden accident, their policy might not cover your damages directly.

Understanding Your Condo Insurance Coverage for Water Damage vs. Flooding

This distinction is critical and often misunderstood. Standard Condo Insurance Coverage for Water Damage covers damage from internal sources like burst pipes. It does not cover flooding from outside sources.

In insurance terms, “flooding” is water from overflowing rivers, storm surges, or heavy rainfall that overwhelms drainage systems. For condo owners in Massachusetts and New Hampshire, this means nor’easters, coastal flooding, or rising rivers are not covered by a standard HO-6 policy.

For these events, you need a separate flood insurance policy, typically purchased through the National Flood Insurance Program (NFIP) or a private insurer. Flood insurance usually takes 30 days to take effect, so you can’t wait until a storm is approaching. For more information, see our article on Why is Flood Insurance Important or visit state resources for Massachusetts and New Hampshire.

Sewer Backups: An Often-Overlooked Exclusion

Coming home to find water backing up through your drains is a costly and hazardous mess. Unfortunately, damage from a sewer or drain backup is almost always excluded from a standard HO-6 policy.

Insurers consider this a different peril from clean water damage due to contamination and cleanup costs. Backups can be caused by tree roots, grease buildup, or overwhelmed municipal sewer systems.

The good news is that you can add this coverage through a low-cost endorsement known as “water backup and sump pump overflow” coverage. This small investment provides enormous peace of mind and can save you thousands in cleanup costs. For related prevention strategies, see our guide on how to Protect Basement From Flooding.

Your Action Plan: From Prevention to Filing a Claim

When you find water damage, a fast and informed response can save you thousands. Knowing the immediate steps to take, the potential costs, and how to prevent future incidents puts you in control.

Immediate Steps After Finding Water Damage

- Stop the Water: If you can do so safely, shut off the main water valve to your unit or the specific appliance that’s leaking.

- Notify Your HOA: Inform your property manager immediately. The issue could be coming from a common area or affect other units.

- Document Everything: Before moving anything, take extensive photos and videos of the source, the damage, and all affected property.

- Protect Your Belongings: Move undamaged items to a dry, safe area to prevent further harm.

- Call Your Insurance Agent: Start the claims process as soon as the immediate situation is secure. An independent agent is your advocate.

- Make Temporary Repairs: Take reasonable steps to prevent more damage, like placing buckets or using fans. Keep all receipts, but do not make permanent repairs until an adjuster has inspected the damage.

The Financial Impact: Costs and How Insurance Helps

Water damage restoration is expensive. A burst pipe can cost $300 to $5,000 or more, while a leaking appliance can easily exceed $5,000. Just one to two inches of water can lead to over $10,000 in cleanup and repair costs, with major incidents running from $20,000 to $100,000. This is where your Condo Insurance becomes a financial lifeline. Your dwelling coverage pays to repair your unit’s interior, personal property coverage helps replace your belongings, and loss of use coverage pays for temporary housing. While you’ll pay a deductible, your policy protects you from devastating out-of-pocket expenses.

Prevention is the Best Policy

The best insurance claim is the one you never have to file. Proactive steps can dramatically reduce your risk.

For Condo Owners:

- Inspect appliance hoses (washing machine, dishwasher) every few months for cracks or wear. Replace standard rubber hoses every 3-5 years.

- Know where your water shut-off valve is and test it annually.

- Check plumbing under sinks and behind toilets for any signs of moisture.

- Consider replacing your water heater proactively if it’s over 10 years old.

- Keep drains clear and consider installing smart water leak detectors.

For HOAs:

- Perform regular maintenance on the roof, gutters, and common-area plumbing.

- Proactively replace aging pipes in older buildings to prevent catastrophic failures.

- Stay vigilant about ice dam prevention with proper insulation and ventilation. See our Ice Dam Prevention Tips.

- Act quickly when unit owners report leaks in common areas.

Frequently Asked Questions about Condo Water Damage Insurance

We hear these questions all the time from condo owners in Massachusetts and New Hampshire. Here are clear, concise answers based on our decades of experience.

Who pays the insurance deductible for water damage in a condo?

The answer depends on the water’s source and your HOA’s bylaws:

- If the damage starts in your unit (e.g., your dishwasher leaks), you file a claim on your HO-6 policy and pay your deductible.

- If the damage starts in a common area (e.g., the roof leaks), the HOA files a claim on its master policy and is responsible for its deductible.

- The big surprise: Many HOA bylaws allow the association to charge you for their master policy deductible (which can be $25,000, $50,000, or more) if the damage originated in your unit, even if you weren’t negligent. This is why loss assessment coverage is so important.

Is mold from water damage covered by my condo insurance?

Sometimes, but coverage is limited. Most policies include a small amount of mold coverage (typically $1,000 to $10,000), but only if the mold resulted from a covered, sudden water damage event, like a burst pipe. Mold from gradual leaks, poor maintenance, high humidity, or an uncovered event like a flood is generally not covered. The best way to ensure coverage is to act immediately to dry out any water damage.

What is loss assessment coverage and why do I need it?

Loss assessment coverage is a critical endorsement for every condo owner. If a major event damages common areas and the cost exceeds the HOA’s insurance limits, or if the HOA needs to cover its large deductible, it can levy a special assessment on all unit owners to cover the shortfall. This bill can be for thousands or even tens of thousands of dollars.

Loss assessment coverage is part of your HO-6 policy that pays your share of this assessment, up to your policy’s limit. With HOA deductibles for water damage climbing, it’s crucial to ensure your loss assessment coverage limit is high enough to protect you from this significant financial risk. We recommend reviewing your limit and comparing it to your HOA’s master policy deductible.

Secure Your Peace of Mind

Navigating Condo Insurance Coverage for Water Damage is complex, but you don’t have to do it alone. Understanding the relationship between your HO-6 policy and the HOA’s master policy is the key to ensuring you are not left with unexpected gaps in coverage. Regular maintenance and a clear action plan can protect your investment and peace of mind.

For a thorough review of your current policy to ensure you have the right protection for your Massachusetts or New Hampshire condo, it’s wise to speak with a trusted expert. The team at Stanton Insurance Agency can help you understand your risks and tailor a policy that fits your needs. Don’t wait for water to show up uninvited; get expert guidance today. Get a Condo Insurance Quote from us now!