Comprehensive vs Full Coverage: 2025 Essential Guide

Why Understanding Comprehensive vs Full Coverage Matters

Comprehensive vs Full Coverage is one of the most common sources of confusion when shopping for car insurance. Here’s the quick answer:

Key Difference:

- Comprehensive Insurance = A specific coverage type that protects your car from non-collision damage (theft, vandalism, weather, animals)

- Full Coverage = An informal term for a policy bundle that includes liability + collision + comprehensive insurance

What Each Covers:

| Coverage Type | What It Protects |

|---|---|

| Comprehensive | Theft, vandalism, fire, hail, flooding, hitting an animal |

| Collision | Damage from hitting another vehicle or object, rollovers |

| Liability | Injuries and property damage you cause to others |

| “Full Coverage” | All of the above combined |

The confusion happens because people often use “full coverage” to mean comprehensive, but they’re not the same thing. Comprehensive is just one piece of what most people call full coverage.

Navigating car insurance terminology doesn’t have to be overwhelming. Whether you’re shopping for your first policy, refinancing a vehicle, or wondering if you’re paying for coverage you don’t need, understanding these distinctions can save you money and stress. Full coverage policies cost significantly more than minimum liability-only coverage—a significant difference that deserves careful consideration.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and a Certified Insurance Counselor. Over my 25+ years in the industry, I’ve helped countless Massachusetts and New Hampshire drivers understand the nuances of Comprehensive vs Full Coverage to build policies that truly protect their assets without breaking the bank.

Deconstructing Car Insurance: The Core Components

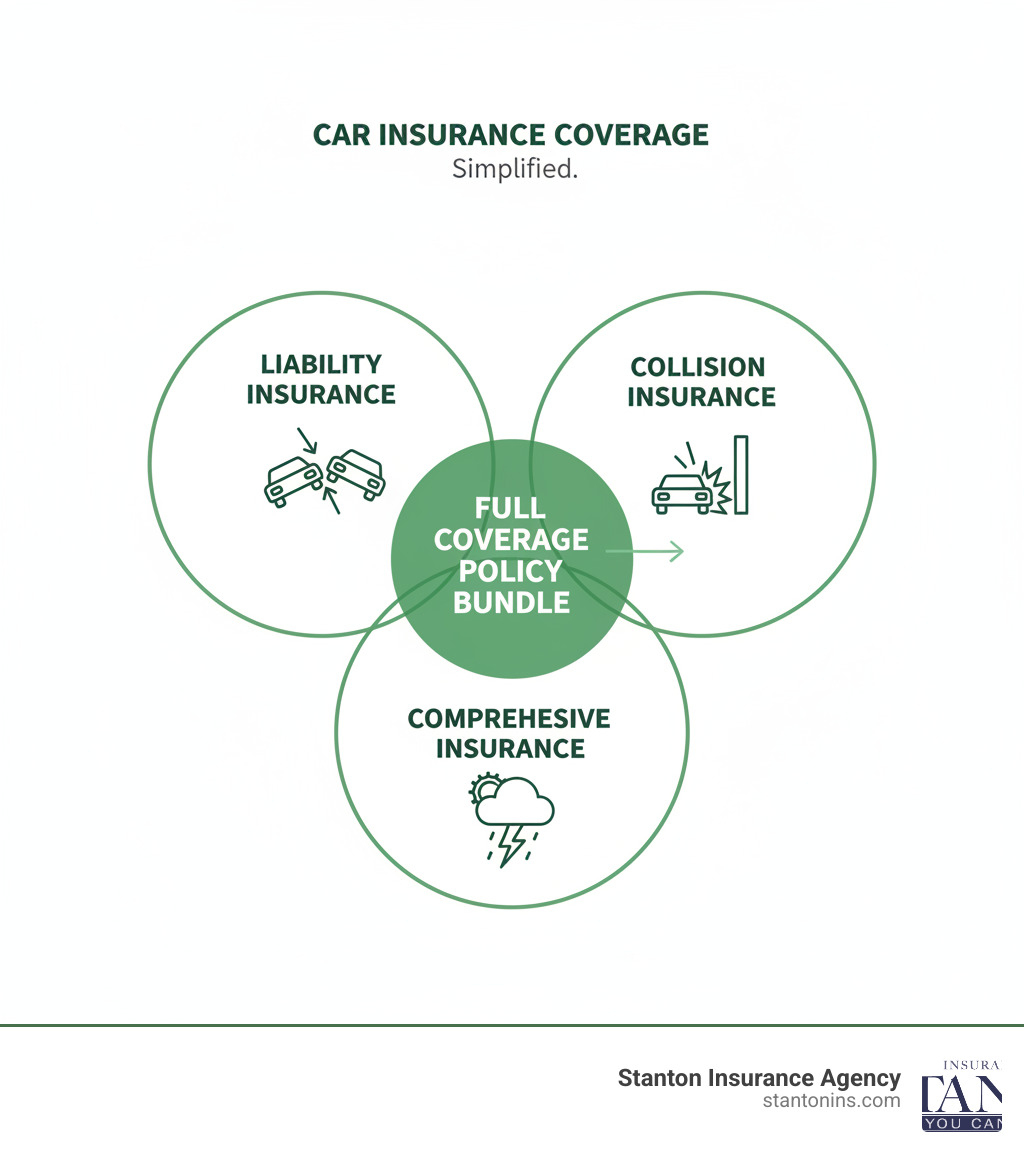

To truly understand the Comprehensive vs Full Coverage debate, you first need to know the building blocks of a typical auto policy. Think of “full coverage” as a recipe rather than a single ingredient—it’s a combination of three key parts: liability, collision, and comprehensive. Each one protects you from different types of financial risk, and together they create a safety net that covers most driving scenarios.

What is Liability Insurance?

Liability insurance is the foundation of any auto policy and is required by law in nearly every state, including Massachusetts and New Hampshire. Here’s what makes it different from other coverages: it doesn’t cover your own car or injuries. Instead, it covers costs for injuries and property damage you cause to others in an accident where you are found at fault.

Think of it as your financial shield against lawsuits and devastating out-of-pocket expenses. If you rear-end someone at a stoplight and cause damage to their vehicle or injuries to their passengers, your bodily injury coverage handles their medical bills, while your property damage coverage pays for their vehicle repairs—up to your policy limits.

Without adequate liability coverage, you could be personally on the hook for these expenses, which can easily reach tens or even hundreds of thousands of dollars. That’s why understanding your state’s minimum requirements is just the first step. Most insurance professionals, myself included, recommend carrying limits well above the state minimums to truly protect your financial future. To learn more about how liability fits into the bigger picture, check out our guide on Full Coverage vs. Liability Car Insurance.

What is Collision Insurance?

Collision coverage is where your own vehicle finally gets some love. This coverage pays to repair or replace your car after it’s damaged in a collision with another vehicle or an object—think fences, trees, guardrails, or that concrete pole you didn’t see while backing up.

Here’s the important part: collision insurance applies regardless of who is at fault. If you slide into a ditch on an icy New Hampshire back road or get sideswiped by another driver, collision coverage handles your vehicle’s damage. You’ll pay your deductible first (typically $500 or $1,000), and then insurance covers the rest.

If you finance or lease your car, your lender will almost certainly require you to carry collision coverage. They’re protecting their investment—after all, they technically own the vehicle until you’ve made that final payment. Even if your car is paid off, collision coverage is worth considering if you can’t easily afford to repair or replace your vehicle out of pocket. For more details on how this coverage works, visit our resource: What is Collision Insurance?.

What is Comprehensive Insurance?

Comprehensive coverage, sometimes called “other than collision,” protects your car from damage not caused by a crash. This is where things get interesting, because comprehensive covers a surprisingly wide range of scenarios—many of which are completely beyond your control.

This coverage kicks in for theft, vandalism, fire, falling objects (like tree branches during a New England storm), and natural disasters like hail or flooding. If you hit a deer on Route 2 or wake up to find your car missing from your driveway, comprehensive coverage is what saves you financially.

The statistics make a compelling case for this coverage. According to the National Insurance Crime Bureau, over one million vehicles were stolen in 2022—that’s almost two cars stolen every minute across the country. Animal collisions are also remarkably common in Massachusetts and New Hampshire, especially during dawn and dusk hours.

Like collision coverage, comprehensive typically comes with a deductible, and lenders usually require it for financed or leased vehicles. But unlike collision, comprehensive tends to be more affordable because the covered events, while varied, are often less frequent than collision claims. To explore everything this coverage protects against, visit What Does Comprehensive Insurance Cover?.

Comprehensive vs Full Coverage: The Main Event

Now that we’ve broken down the individual pieces, let’s bring them together to clear up the confusion. The central misunderstanding in the Comprehensive vs Full Coverage debate is this: comprehensive is part of full coverage, not a synonym for it. Think of it like comparing a single ingredient to the entire recipe. You can purchase comprehensive coverage alongside your required liability insurance, but you won’t find a policy labeled “full coverage” on any insurance company’s official menu.

What is ‘Full Coverage’ Insurance?

Here’s the truth: “full coverage” is insurance industry shorthand, not an actual policy you can buy. It’s a nickname that agents and customers use to describe a combination of coverages that work together to create a broad safety net for both you and your vehicle.

When someone in Massachusetts or New Hampshire says they have “full coverage,” they typically mean their policy includes liability insurance to meet state requirements and protect them from costs they cause to others, collision insurance to protect their own car in accidents regardless of fault, and comprehensive insurance to safeguard against theft, weather damage, and other non-collision events. It’s essentially the trifecta of protection.

But the bundle doesn’t always stop there. Depending on your state’s requirements and your personal needs, a robust “full coverage” package might also include Personal Injury Protection (PIP) to cover your medical expenses after an accident, Medical Payments coverage (MedPay), or Uninsured/Underinsured Motorist coverage to protect you when the at-fault driver doesn’t have adequate insurance. For a deeper look at how all these pieces fit together, check out our guide on Full Coverage vs. Comprehensive and Collision.

Key Differences in Protection: Comprehensive vs Full Coverage

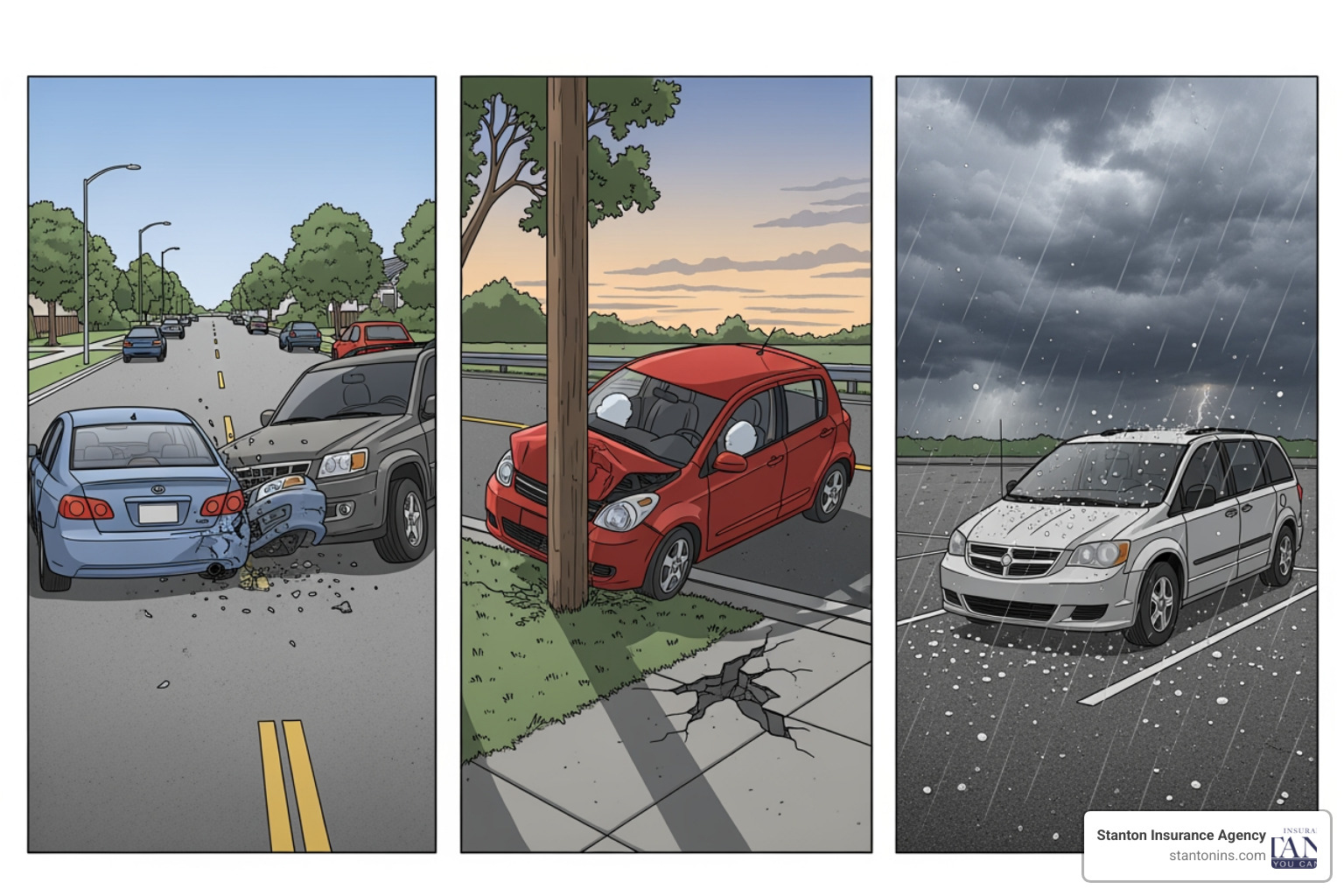

The best way to understand the difference between comprehensive coverage alone and a “full coverage” policy is to look at real-world scenarios. While comprehensive insurance handles a specific category of risks, it leaves significant gaps that collision and liability coverages fill.

Imagine your car is stolen from your driveway overnight. Comprehensive insurance would cover that loss. If a deer darts across Route 2 and you hit it, comprehensive has you covered. When a summer hailstorm leaves your roof looking like a golf ball, that’s comprehensive territory too.

But what happens when you cause an accident and damage your own car? Comprehensive won’t help—that’s where collision insurance steps in. If you injure another driver in that same accident, you’ll need liability coverage to protect yourself from their medical bills and lost wages. And if someone hits your parked car outside the grocery store, you’re relying on collision coverage again, not comprehensive.

| Scenario | Covered by Comprehensive Only? | Covered by ‘Full Coverage’? |

|---|---|---|

| Your car is stolen from your driveway. | Yes | Yes |

| You hit a deer on the highway. | Yes | Yes |

| A hailstorm dents your car’s roof. | Yes | Yes |

| You cause an accident and damage your car. | No | Yes (via Collision) |

| You cause an accident and injure another driver. | No | Yes (via Liability) |

| Another driver hits your parked car. | No | Yes (via Collision) |

This table makes it clear: comprehensive insurance is valuable for specific non-collision events, but “full coverage” provides a much wider shield by combining comprehensive with collision and liability protection. It’s the difference between wearing a raincoat and being fully dressed for a New England winter.

Does ‘Full Coverage’ Truly Cover Everything?

Despite its reassuring name, “full coverage” doesn’t mean you’re protected against every possible scenario. It’s a bit like having a fully stocked toolbox—you have what you need for most jobs, but you won’t find a ladder or a power washer in there. Understanding what’s not covered is just as important as knowing what is.

Your policy won’t cover normal wear and tear or mechanical breakdowns. If your transmission fails after 150,000 miles, that’s a maintenance issue, not an insurable event. Similarly, personal items stolen from your car—like your laptop, phone, or that expensive camera equipment—typically aren’t covered by auto insurance. Those belongings usually fall under your homeowners or renters insurance policy instead.

If you intentionally damage your own vehicle, don’t expect a payout. Insurance is designed to protect against unexpected events, not deliberate destruction. And here’s one that surprises many people: rental car costs while your car is being repaired aren’t automatically included. You’ll need to add rental reimbursement coverage to your policy if you want that protection.

Towing and labor costs also require their own add-on, typically called roadside assistance coverage. Without it, that tow from the breakdown lane on I-95 comes out of your pocket. And if you’ve added custom parts or aftermarket equipment to your vehicle—think upgraded sound systems, lift kits, or specialty wheels—these modifications might not be fully covered unless you’ve specifically endorsed them on your policy.

The bottom line? Even “full coverage” has its limits and exclusions. At Stanton Insurance Agency, we make it our business to walk you through your policy’s fine print, identify any gaps that concern you, and recommend additional coverages that might give you true peace of mind. After all, the best insurance is coverage that actually protects what matters most to you.

Making the Right Choice: Cost, Requirements, and Value

Deciding on your level of coverage involves balancing cost, legal and lender requirements, and your personal financial situation. While more coverage provides more peace of mind, it also comes at a higher price. It’s about finding that sweet spot where you’re adequately protected without overspending, much like finding the perfect lobster roll in New England – you want value and quality!

Legal and Lender Requirements

Here in Massachusetts and New Hampshire, the law only requires you to carry liability coverage. In Massachusetts, you’ll also need Personal Injury Protection (PIP) as a mandatory add-on. This minimum coverage ensures that if you cause an accident, the other party’s damages and injuries are addressed. However, this leaves your own vehicle completely vulnerable.

If you have a loan or lease on your vehicle, though, the rules change. Your lender is technically the legal owner of your car until you make that final payment. To protect their investment, they will almost always require you to maintain both comprehensive and collision coverage as part of your loan or lease agreement. This isn’t a suggestion or a recommendation—it’s a contractual obligation.

Think of it from their perspective: they’ve loaned you tens of thousands of dollars to purchase a vehicle. Without comprehensive and collision coverage, a single accident or theft could leave them holding a loan for a car that no longer exists or has significantly diminished value. This requirement typically stays in place until you own the car outright. For more details on Massachusetts requirements specifically, you can refer to the Basics of Auto Insurance | Mass.gov.

The Cost Factor: Liability-Only vs. Full Coverage

The financial difference between liability-only and full coverage is often the elephant in the room when Massachusetts and New Hampshire drivers are shopping for insurance. A full coverage policy costs significantly more than state-minimum liability coverage, a difference that adds up over the year.

That’s not pocket change, but here’s what you’re getting for that additional investment: protection for your own vehicle, not just for others. With liability only, if you cause an accident, your car repairs come entirely out of your own pocket. With full coverage, your collision insurance steps in to help.

Both comprehensive and collision coverages come with a deductible—the amount you agree to pay out of pocket before your insurance coverage kicks in. This is where you have some control over your costs. Choosing a higher deductible like $1,000 will generally lower your monthly premium, making your insurance more affordable upfront. On the flip side, a lower deductible of $500 means you’ll pay less out of pocket if you file a claim, but your monthly premium will be higher.

It’s a balancing act between what you can afford monthly and what you’re comfortable paying in an emergency. If you have a healthy emergency fund, a higher deductible can save you significant money over time. For a detailed breakdown of how these deductibles work with each coverage type, check out our article on the Difference Between Collision and Comprehensive Insurance Coverage.

When to Keep or Drop Full Coverage

The decision to drop full coverage—specifically, the comprehensive and collision parts—usually comes down to your car’s actual cash value. If your vehicle is older, paid off, and has a low market value, you might find yourself paying more in premiums than your car is actually worth.

A common rule of thumb is to consider dropping these coverages when the annual premium exceeds 10% of your car’s value. Let’s say your 2012 sedan is worth about $3,000. If you’re paying $350 a year for comprehensive and collision combined, that’s nearly 12% of the car’s value. After you factor in your deductible (let’s say $500), a total loss claim would only net you $2,500. Over just two years of premiums, you’ve already paid $700—nearly a third of what you’d receive.

However, here’s the critical question: could you afford to repair or replace your car out of pocket tomorrow? If the answer is no, keeping full coverage is the safer financial choice. This is especially true if you live in an area prone to harsh weather (and we know New England winters can be brutal), or if you’re concerned about theft or vandalism in your neighborhood.

Comprehensive insurance tends to be relatively affordable compared to collision. If your car still has decent value, comprehensive might be “worth it” even if you decide to drop collision. It protects against those unpredictable events like theft, vandalism, or a tree falling on your car during a storm—incidents that happen regardless of your driving skills.

Collision insurance, on the other hand, remains highly beneficial for newer cars, those still under a loan or lease, or for drivers who are accident-prone or frequently drive in heavy traffic. Our guide on When to Drop Collision Insurance Coverage offers more insights into this critical decision and can help you evaluate whether it’s time to adjust your coverage.

The bottom line? There’s no one-size-fits-all answer to the Comprehensive vs Full Coverage question. It depends on your vehicle’s value, your financial situation, and your comfort level with risk. We’re here at Stanton Insurance Agency to help you work through these decisions and find the coverage level that makes sense for your unique circumstances.

Frequently Asked Questions about Comprehensive vs. Full Coverage

Is comprehensive insurance the same as full coverage?

No, these terms are not interchangeable, and understanding the difference can save you from some serious headaches down the road. Comprehensive insurance is a specific type of coverage that protects your car from non-collision damage—think theft, vandalism, fire, natural disasters (like those infamous New England blizzards or the occasional hurricane), and animal collisions. We’ve all heard stories of hitting a deer on a dark country road, right?

“Full coverage,” on the other hand, is a common industry term (not an official policy name) referring to a policy that bundles comprehensive, collision, and liability insurance together. It’s the whole package, designed to provide broad protection for both you and your vehicle. So while comprehensive is an important piece of the puzzle, it’s just one piece. Comprehensive vs Full Coverage isn’t really a competition—it’s more like comparing a single ingredient to the entire recipe.

Is it better to have a $500 or $1,000 deductible?

This is one of those questions where the answer is genuinely, “It depends on you.” Choosing between a $500 and $1,000 deductible comes down to your financial situation and how you handle risk.

Here’s how it works: A $1,000 deductible will give you a lower monthly or annual premium, which means more money in your pocket right now. But if you need to file a claim after backing into your mailbox or getting caught in a hailstorm, you’ll pay that first $1,000 out of pocket before your insurance kicks in. A $500 deductible means higher premiums but less financial stress when something goes wrong.

My advice? If you have a healthy emergency fund—at least $1,000 that you can access without breaking a sweat—the higher deductible can save you money over time through lower premiums. If that $1,000 would be a real stretch for your budget, stick with the $500 deductible for more immediate relief when you need it most. Think of it as paying a little more for peace of mind.

Do I need both comprehensive and collision insurance?

If your car is leased or financed, the answer is almost always yes, and it’s not really up for debate. Lenders and leasing companies in Massachusetts and New Hampshire require these coverages to protect their financial interest in your vehicle. After all, they technically own it until you make that final payment.

If you own your car outright, though, it becomes a personal choice based on your vehicle’s value and your financial comfort level. If your car is valuable—say, worth over $3,000 to $5,000—and you couldn’t easily afford to repair or replace it after an accident, theft, or natural disaster, having both comprehensive and collision coverage is a wise investment for financial security and peace of mind. You’re protecting yourself from potentially devastating out-of-pocket expenses.

For older, lower-value vehicles, you might consider dropping one or both coverages to save on premiums. Just ask yourself this simple question: If my car was totaled tomorrow, could I afford to replace it without insurance help? If the answer is no, keep the coverage. If you’d shrug and buy another used car without too much financial pain, you might be ready to drop it.

Conclusion: Securing the Right Protection for Your Vehicle

You’ve made it to the finish line, and hopefully, the fog around Comprehensive vs Full Coverage has lifted. The key takeaway? “Full coverage” isn’t a single product you can order off a menu—it’s more like a carefully crafted recipe. It combines liability, collision, and comprehensive insurance into one robust policy that shields you from a wide range of financial risks. Comprehensive coverage handles the unexpected non-collision events—theft, vandalism, hail damage, that deer that jumped out of nowhere on Route 2. But a full coverage package goes further, protecting your vehicle when accidents happen and covering the costs you might cause to others.

Think of it this way: comprehensive insurance is like having a good umbrella. It protects you from specific weather events. Full coverage is like having that umbrella, a raincoat, waterproof boots, and a backup plan if you slip and fall. It’s the complete package.

So which one is right for you? That depends on your vehicle’s value, your budget, and how much financial risk you’re comfortable shouldering. If you’re driving a newer car or one that’s financed, full coverage is almost always the smart move—and often required. If your car is older and paid off, you might save money by scaling back. But if replacing your car out of pocket would strain your finances, keeping that comprehensive protection is worth every penny.

The beauty of working with a local agency like Stanton Insurance Agency is that we understand the unique challenges of driving in Massachusetts and New Hampshire—from brutal winter weather to unpredictable wildlife on rural roads. We’re here to help you steer these options and build a policy that truly fits your life, not just check boxes on a form.

Ready to find the perfect balance of protection and price for your situation? Let’s talk. Get a personalized auto insurance quote today and drive with confidence, knowing you’ve made the right choice for you and your vehicle.