What is comprehensive and collision coverage: 1 Key

Understanding Your Auto Insurance: More Than Just “Full Coverage”

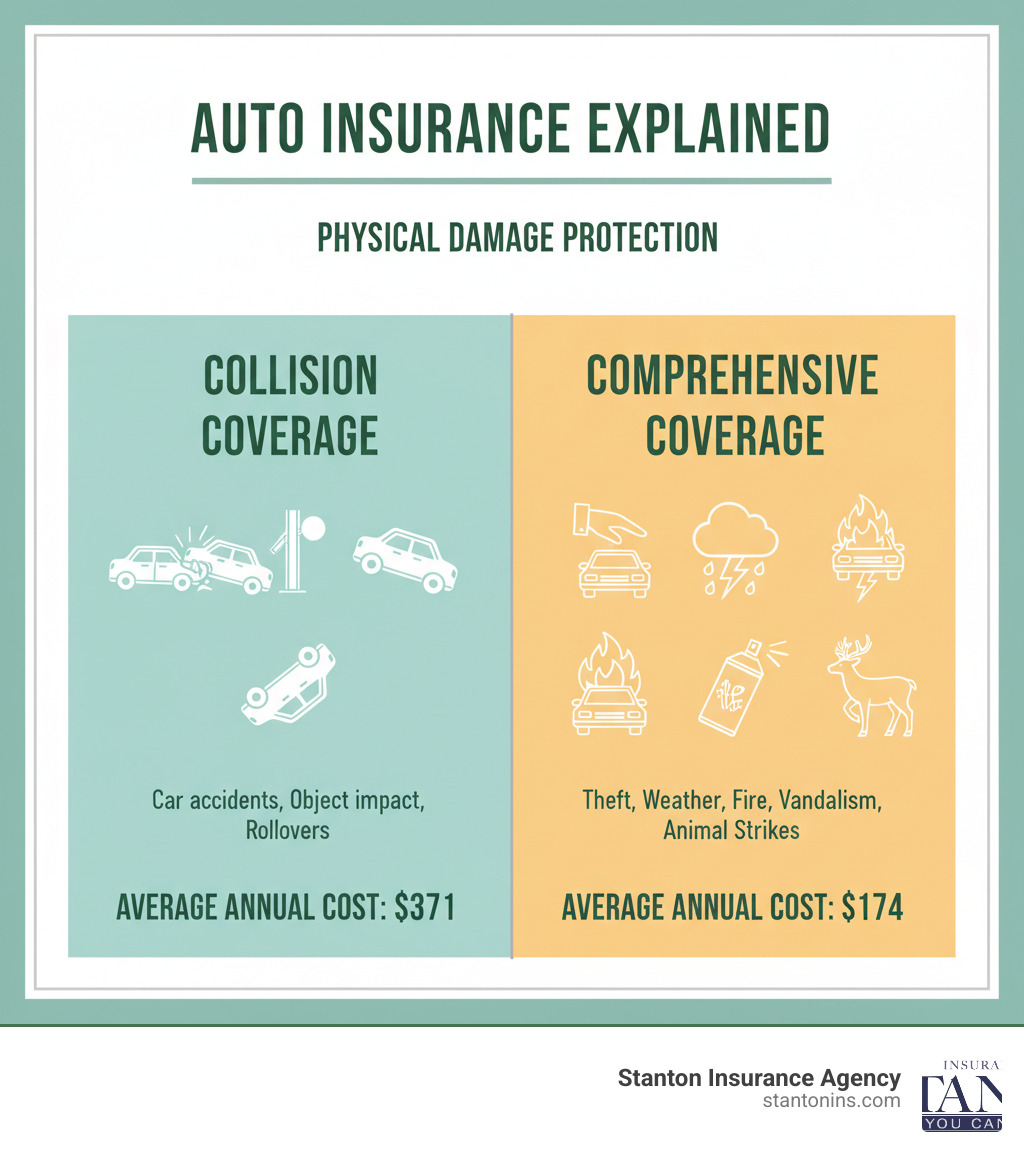

What is comprehensive and collision coverage? These are two distinct types of auto insurance that protect your vehicle from physical damage:

- Collision coverage pays to repair or replace your car when it’s damaged in an accident with another vehicle or object, regardless of who is at fault

- Comprehensive coverage pays for damage to your car from non-collision events like theft, vandalism, fire, weather, or hitting an animal

- Key difference: Collision covers crashes; comprehensive covers almost everything else

- Neither is required by law in Massachusetts or New Hampshire, but lenders typically require both if you finance or lease your vehicle

- Average costs: Collision runs about $371/year nationally, while comprehensive averages $174/year

You’ve likely heard the term “full coverage,” but it isn’t an actual policy type. It’s industry shorthand for a policy bundling liability, collision, and comprehensive coverage. This misconception can lead drivers to believe they have complete protection when they might have gaps—or be paying for coverage they don’t need.

The reality is more nuanced. About 80% of U.S. drivers buy comprehensive coverage, and 76% purchase collision, according to the Insurance Information Institute. But whether you need both, one, or neither depends on your car’s value, your financial cushion, and your risk factors.

I’m Geoff Stanton, President at Stanton Insurance Agency. For over two decades, I’ve helped Massachusetts and New Hampshire drivers build policies that match their needs. In this guide, we’ll break down what comprehensive and collision coverage protect, when you need them, and how to make the smart choice for your situation.

What is comprehensive and collision coverage terms simplified:

- what is collision insurance

- what does comprehensive insurance cover

- does hitting a deer fall under collision coverage

Decoding Collision Coverage: Protecting Your Car in an Accident

Collision insurance is the workhorse of your auto policy when it comes to crashes. It pays for repairs to your vehicle when it’s damaged in a collision, whether you’re at fault or not. The key thing to remember is this: collision coverage kicks in when your car makes contact with another object.

According to the National Association of Insurance Commissioners, the average annual cost for collision coverage was about $371 in 2020. That makes it more expensive than comprehensive coverage, but for good reason. Collision-related incidents happen more frequently and often come with heftier repair bills. Think about it—fender benders in parking lots, multi-car pile-ups on the highway, or that one time you misjudged the distance to your garage door (we’ve all been there).

The beauty of collision coverage is that it protects you regardless of fault. If you’re responsible for the accident, your collision coverage handles the repairs to your car. If someone else is at fault, their liability insurance should cover your damages—but if they’re uninsured or underinsured, your collision coverage becomes your safety net.

What does collision insurance cover?

Colliding with another vehicle is the most obvious scenario. Whether it’s a minor parking lot scrape or a serious highway accident, collision coverage pays for damage to your car. This is especially valuable when you’re at fault, since you can’t rely on the other driver’s insurance to help you.

Hitting a stationary object is another common claim. Maybe you backed into a pole, swerved to avoid an animal and hit a guardrail, or clipped a mailbox while turning. Your collision coverage handles repairs for impacts with telephone poles, fences, trees, and yes, even your own garage door.

Pothole damage might seem like it should fall under a different category, but it’s covered by collision insurance. If you hit a severe pothole that damages your tires, wheels, or suspension, your collision coverage can help with those repair costs.

Your car rolling or flipping over in a serious accident results in extensive damage, and collision insurance covers these catastrophic scenarios. Even if no other vehicle is involved, you’re protected.

Hit-and-run incidents are frustrating because there’s no identifiable driver to hold responsible. But if you have collision coverage, your policy will cover the repairs minus your deductible. Without it, you’d be paying for those damages entirely out of pocket.

The real value of understanding what is comprehensive and collision coverage becomes clear when you realize how collision protects you in everyday driving situations. It’s not just for major accidents—it’s for all those moments when things don’t go quite as planned. Learn more about the specifics of collision versus comprehensive coverage here.

Understanding Comprehensive Coverage: Protection Beyond the Crash

Comprehensive insurance is sometimes called “other than collision” coverage, which really tells you everything you need to know. While collision coverage handles the crashes, comprehensive steps in for just about everything else that can damage your car. Think of it as your protection against life’s unpredictable moments—the ones you can’t always see coming.

The good news? This broad protection doesn’t break the bank. According to the Insurance Information Institute, about 80% of U.S. drivers purchase comprehensive coverage. That high adoption rate makes sense when you consider the average cost was around $174 per year nationally in 2020, though more recent data shows it averaging about $263 annually. That’s still significantly less expensive than collision coverage, even though it protects against a surprisingly wide range of incidents.

What is comprehensive and collision coverage really comes down to control. Collision deals with things you might control—how you drive, where you park. Comprehensive handles the things you can’t—a hailstorm at 2 AM, a deer that jumps out of nowhere, or someone deciding your car looks like a good target for vandalism.

What does comprehensive insurance cover?

Picture this: you walk out to your car in the morning and find someone smashed your window overnight. Or you’re driving home and a rock flies up from the road ahead, cracking your windshield. Maybe a severe thunderstorm rolls through and leaves your car covered in golf-ball-sized hail dents. These are exactly the moments when comprehensive coverage becomes invaluable.

Theft and vandalism are among the most common comprehensive claims. If your entire vehicle is stolen, comprehensive coverage reimburses you for its actual cash value. If thieves break in and steal parts like airbags or catalytic converters, that’s covered too. Vandalism—whether it’s keyed paint, broken windows, or slashed tires—also falls under this coverage.

When fire, explosions, or riots damage your vehicle, comprehensive insurance handles the repairs. This includes fires that start in your car’s engine and fires that spread from nearby sources.

Natural disasters can strike anywhere, and comprehensive coverage protects you from them all. Hail damage is particularly common and can be incredibly expensive to repair. Floods can total a vehicle in minutes if water reaches the engine or interior. Windstorms, hurricanes, tornadoes, and even less common events like earthquakes and volcanic eruptions are all covered. If you live in an area prone to severe weather, this coverage can save you tens of thousands of dollars.

Falling objects cause more damage than you might think. A tree branch breaking off during a storm, ice sliding off a building roof, or debris from a nearby construction site—comprehensive coverage pays for all of it.

Here’s one that surprises many drivers: hitting an animal is covered under comprehensive, not collision. If you strike a deer, moose, or any other animal, the damage falls under your comprehensive policy. This is one of the most misunderstood aspects of auto insurance, and it’s especially important for those of us in Massachusetts and New Hampshire where deer populations are significant. Learn more about this common question here.

Windshield damage from flying rocks, temperature changes, or other causes is typically covered by comprehensive insurance. Many policies even allow windshield chip repairs without requiring you to pay your deductible, making it easy to fix small damage before it spreads.

One reassuring detail: comprehensive claims generally don’t increase your insurance rates the way at-fault collision claims might. That said, filing multiple claims of any type within a short period could eventually affect your rates or risk non-renewal, so it’s still worth considering whether smaller claims are worth filing.

The bottom line is that comprehensive coverage protects your vehicle from the unexpected. While you can control how carefully you drive, you can’t control the weather, wildlife, or other people’s actions. For most drivers, especially those with newer vehicles or cars in areas with severe weather or high theft rates, comprehensive coverage offers peace of mind at a reasonable price.

What is the Difference Between Comprehensive and Collision Coverage?

Here’s the simplest way to remember the difference: collision covers damage from crashing, while comprehensive covers damage from almost everything else. It’s really that straightforward.

Think of it this way: if your car hits something or something hits your car, that’s collision territory. But if a tree falls on your parked car, a thief breaks in, or hail damages your hood, that’s where comprehensive steps in. They’re two separate coverages with their own deductibles, but they work together like a tag team to protect your vehicle from different types of damage.

It’s also crucial to understand how what is comprehensive and collision coverage differs from liability insurance. Liability insurance covers damages you cause to other people’s property and their bodily injuries—it does not cover your own car at all. That’s an entirely different animal. When people talk about having a “full coverage” policy, they’re referring to a bundle that includes all three: liability, collision, and comprehensive.

Here’s a quick comparison to help clarify the distinction:

| Feature | Collision Coverage | Comprehensive Coverage |

|---|---|---|

| Primary Purpose | Covers damage to your car from a collision with an object or another vehicle. | Covers damage to your car from non-collision events. |

| Example Scenarios | Hitting a car, backing into a pole, pothole damage, rolling your vehicle, hitting a guardrail. | Theft, vandalism, fire, hail, flood, hitting an animal, falling tree branch, broken windshield. |

| Fault | Covers damage regardless of who is at fault. | Fault is not a factor, as it covers events outside of a typical accident. |

| Average Cost | Higher premium (Avg. $371-$723/year) | Lower premium (Avg. $134-$263/year) |

What is the difference between comprehensive/collision and ‘full coverage’?

Let’s clear up one of the biggest misconceptions in auto insurance: full coverage is not actually a policy type. It’s industry shorthand, a convenient phrase that insurance folks use, but it doesn’t appear on any actual policy document.

When someone says they have “full coverage,” what they typically mean is that their policy includes the legally required liability insurance along with both collision and comprehensive coverage. It’s a package deal that protects you in three essential ways.

First, there’s liability coverage—the mandatory part in most states that covers damages you cause to other people or their property. Second, collision coverage protects your own vehicle if it’s damaged in a crash with another vehicle or object. And third, comprehensive coverage protects your own vehicle from non-collision events like theft, vandalism, or natural disasters.

So when you hear “full coverage,” think of it as a robust policy that protects both you from liability claims and your vehicle from various types of damage. It’s a convenient phrase, but it’s crucial to understand the specific components it refers to. And here’s the kicker: it doesn’t mean you’re covered for every single eventuality—things like mechanical breakdowns or normal wear and tear aren’t included, no matter how “full” your coverage is.

What is the difference between comprehensive/collision and liability insurance?

This is a fundamental distinction that every driver should understand, because these coverages serve completely different purposes.

Liability insurance is primarily designed to protect other people and their property if you’re at fault in an accident. It has two main components: bodily injury liability, which covers medical expenses, lost wages, and pain and suffering for others injured in an accident you cause, and property damage liability, which covers the cost to repair or replace property—like another car, a fence, or a building—that you damage in an accident.

Liability insurance is legally required in almost every U.S. state because it ensures that victims of accidents you cause can be compensated. It’s about your financial responsibility to others on the road.

Comprehensive and collision coverage, on the other hand, are all about protecting your own car. They cover the costs to repair or replace your vehicle, regardless of fault (for collision) or cause (for comprehensive, as long as it’s a non-collision event). Neither of these coverages will help pay for damage you cause to someone else’s property—that’s liability’s job.

The key takeaway? Liability insurance is about your financial responsibility to others, while comprehensive and collision coverage protect your personal asset—your vehicle. They serve very different, but equally important, purposes in a complete auto insurance policy. Understanding why auto insurance is important for protecting yourself and others on the road helps you see how all these pieces fit together to give you real peace of mind.

Making the Right Choice: Do You Need Both Coverages?

Here’s a fact that surprises many drivers: neither comprehensive nor collision coverage is required by state law in Massachusetts or New Hampshire. But before you think about dropping them, there’s an important caveat.

If you’re financing or leasing your vehicle, your lender will almost certainly require you to carry both coverages. They have a financial stake in your car, and they want to make sure their investment is protected—whether you back into a pole or a hailstorm dents your hood. This requirement typically stays in place until you’ve paid off the loan completely.

For drivers who own their car outright, the decision becomes more personal. It comes down to your risk tolerance and your vehicle’s value. Can you afford to replace your car tomorrow if it’s totaled? Would a $3,000 repair bill strain your budget? These are the questions that should guide your choice.

One crucial factor in this decision is your deductible—the amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically means a lower premium, which sounds great until you actually need to file a claim. Most deductibles range from $250 to $1,000, though some insurers offer higher options. If your car is leased or financed, your contract will normally cap your deductible at $500 or lower.

Massachusetts drivers have a unique advantage: insurers cannot use your credit score to determine your rates, unlike in most other states. However, your driving record, vehicle type, and location still significantly impact what you pay. If you park on the street in a high-theft area, or if you live in a region prone to severe weather, you’ll likely see that reflected in your comprehensive premium. Learn more about the basics of auto insurance in Massachusetts.

When should you have both coverages?

Understanding what is comprehensive and collision coverage helps, but knowing when you need both is equally important. We generally recommend keeping both coverages when your car is new or valuable. The average cost of a new passenger vehicle topped $44,000 in January 2024, and replacing that out-of-pocket would be devastating for most families.

Having a car loan or lease makes this decision easy—your lender requires it. But even beyond that requirement, if you couldn’t comfortably write a check to repair or replace your car tomorrow, these coverages provide essential financial protection. They’re your safety net against the unexpected.

Your location matters more than you might think. Living in an area with high theft rates makes comprehensive coverage invaluable for protecting against stolen vehicles and vandalism. If you’re in a region that experiences severe weather—think hailstorms, floods, or hurricanes—comprehensive becomes even more critical. And for our rural neighbors who frequently encounter deer and other animals on the road, comprehensive coverage is practically essential.

When might you drop coverage?

There are situations where dropping one or both coverages makes financial sense, particularly as your car ages. If your car’s value has dropped significantly, you might be paying premiums that exceed what you’d receive in a claim. A common rule of thumb suggests considering dropping both coverages when your car’s market value dips below about $3,000.

Another practical guideline is the 10% rule: if the annual cost of coverage exceeds 10% of your car’s value, it may no longer be cost-effective. For example, if your car is worth $2,000 and your collision premium is $400 annually with a $500 deductible, you’d pay $400 per year for coverage that would only pay out $1,500 maximum (the car’s value minus your deductible).

If you’ve built up a robust emergency fund that could easily cover major repairs or a replacement vehicle, you might choose to self-insure and save on premiums. This approach works best for financially secure drivers with older, lower-value vehicles. Learn more about when to drop collision insurance coverage.

The decision to drop coverage should never be rushed. It requires weighing the potential financial risk against the savings in premiums. We encourage you to talk with us about your specific situation—your car’s value, your financial cushion, and your daily driving patterns all play a role in making the right choice.

Frequently Asked Questions about Comprehensive and Collision Coverage

Even after breaking down the details, we know that what is comprehensive and collision coverage can still leave you with questions. These are the ones we hear most often from our clients in Massachusetts and New Hampshire:

Does hitting a deer fall under collision or comprehensive coverage?

This surprises many people. Hitting a deer—or any other animal—is covered under your comprehensive insurance policy, not collision. Insurers categorize hitting an animal as an unpredictable, non-collision incident because it’s an uncontrollable element entering your path. This is why comprehensive coverage is crucial in areas with heavy wildlife populations. If a deer jumps in front of your car, your comprehensive policy pays for the damage, minus your deductible. You can read more about this common scenario here.

What is a deductible and how does it work?

Your deductible is the amount you agree to pay out of your own pocket before your insurance kicks in to cover the rest of a claim. Think of it as your share of the repair bill.

Here’s how it works: Let’s say you have a $500 deductible on your comprehensive coverage, and a hailstorm causes $3,000 worth of damage to your car. You would pay the first $500, and your insurance company would cover the remaining $2,500. You choose your deductible amount when you purchase your policy, and both comprehensive and collision coverage have their own separate deductibles.

The deductible you choose directly affects your premium. A higher deductible—say, $1,000 instead of $500—means you’re taking on more of the initial risk, so your premium will be lower. A lower deductible means you pay less out-of-pocket on a claim, but your premiums will be higher. It’s about finding the sweet spot that matches your budget and financial risk tolerance.

Is it worth having collision coverage on an old car?

The answer depends on your car’s current value and your financial cushion. A common rule of thumb is to consider dropping collision if the annual premium costs more than 10% of the vehicle’s actual cash value. For example, if your car is worth $2,000, your premium is $400 per year, and your deductible is $500, the maximum payout is only $1,500 ($2,000 value minus the $500 deductible). In this case, the premium may no longer be cost-effective.

The decision comes down to whether you could afford to repair or replace the car from your savings. If your car has minimal value and you have an emergency fund, dropping collision might be a sound financial choice. You can find more guidance on when to drop collision insurance coverage here.

We’re always happy to walk through these numbers with you and help you make the choice that fits your situation best.

Secure the Right Protection for Your Vehicle

You’ve made it through the details, and now you understand that what is comprehensive and collision coverage really comes down to two distinct tools working together to protect your vehicle. Collision coverage is there when you crash into something—another car, a pole, or even when your vehicle rolls over. Comprehensive coverage picks up the slack for everything else—the theft, the hailstorm, the deer that jumps in front of you on a country road, the tree branch that falls during a storm.

The distinction between these two coverages is crucial to building a policy that actually fits your life, not just checking the “full coverage” box and hoping for the best. Full coverage isn’t a magic policy that protects you from everything—it’s simply a term for bundling liability, collision, and comprehensive together.

Here’s the reality: every driver’s situation is different. The coverage that makes perfect sense for someone with a brand-new SUV and a car loan might be overkill for someone driving a 15-year-old sedan they own outright. Your vehicle’s value, your savings cushion, where you live, and how you use your car all play into this decision.

That’s where an independent agent becomes invaluable. We can sit down with you and look at your specific situation—your vehicle’s actual cash value, your budget, your deductible options, and your risk factors. Do you park on the street in a high-theft area? Comprehensive coverage suddenly becomes more important. Is your car worth less than a few thousand dollars? Maybe it’s time to reconsider collision coverage and bank those premium savings instead.

The team at Stanton Insurance Agency is here to help you steer these choices with clarity and confidence. We want to make sure you’re not paying for coverage you don’t need, or worse, finding you’re missing coverage you do need when it’s too late. We’ve been helping Massachusetts and New Hampshire drivers make these decisions for years, and we understand the local factors that affect your rates and risks.

Ready to review your policy and make sure it’s working as hard as you do? Contact us today for a personalized car insurance quote that’s built around your actual needs, not industry assumptions.