Comprehensive Business Insurance: Ultimate 2025 Guide

Why Every Business Needs a Financial Safety Net

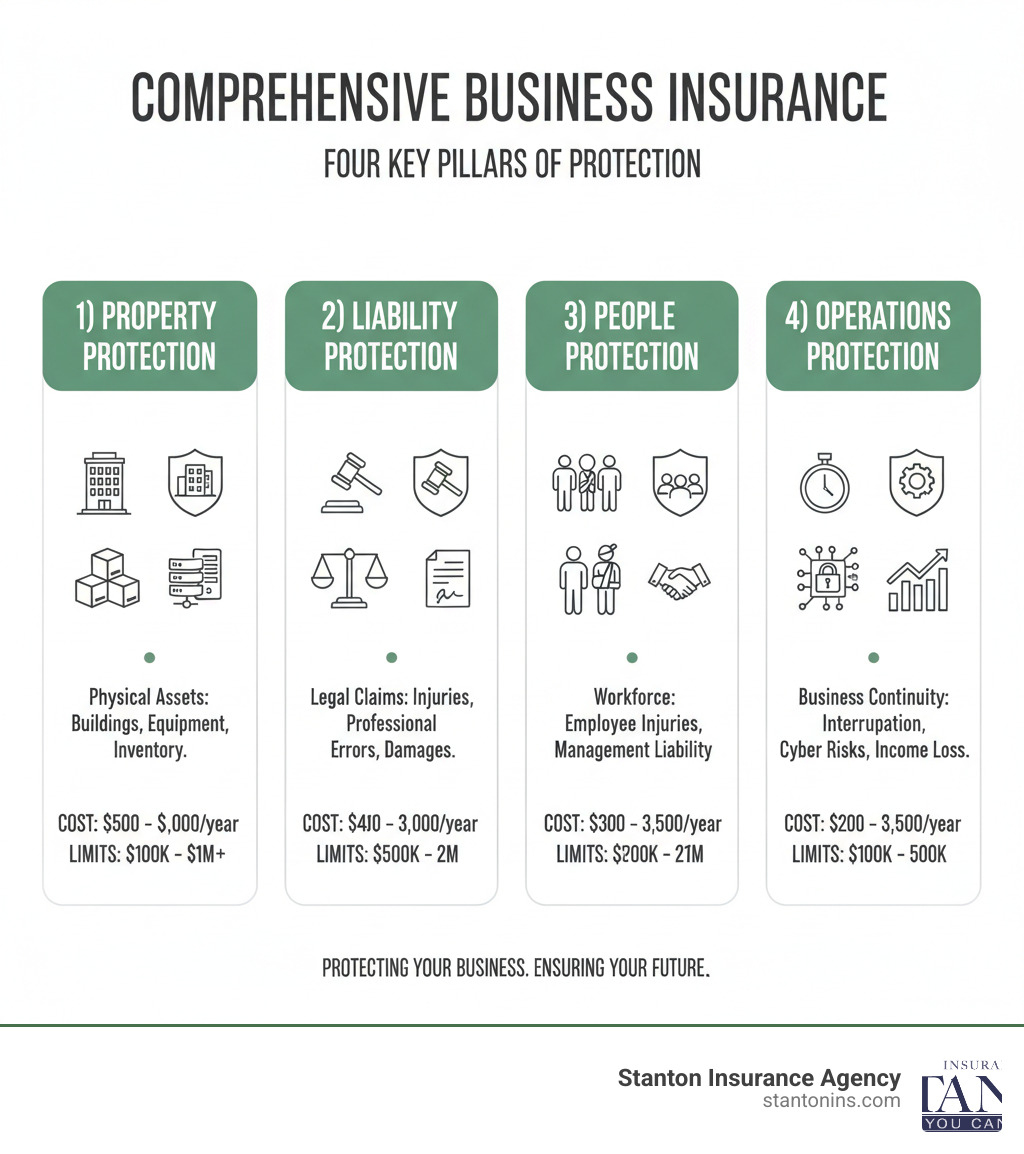

Comprehensive business insurance is not a single product but a strategic package of policies customized to protect your company from financial risks like property damage, liability claims, and cyber threats. It combines essential coverages into one cohesive protection plan designed for your specific needs.

Key components typically include:

- General Liability Insurance – Protects against third-party injury and property damage claims

- Commercial Property Insurance – Covers buildings, equipment, and inventory from damage or loss

- Business Income Insurance – Replaces lost revenue if operations are interrupted

- Workers’ Compensation – Required by law for businesses with employees in Massachusetts and New Hampshire

- Cyber Liability Insurance – Shields against data breaches and cyberattacks

- Commercial Auto Insurance – Covers business vehicles and employee-driven vehicles for work

Without a proper safety net, a single unexpected event—a fire, a customer injury, or a cyberattack—can threaten everything you’ve worked to build. A robust insurance plan does more than check a box; it protects your assets, ensures business continuity, meets contractual requirements, and gives you peace of mind to focus on growth.

While laws require coverages like workers’ compensation for businesses with employees, true protection goes far beyond legal minimums by addressing all the unique risks your business faces.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts. With over two decades of experience helping businesses build comprehensive business insurance plans, I’ve seen how the right coverage can mean the difference between a business closing after a loss or recovering with minimal interruption. This guide will walk you through what you need to know to fully protect your company.

What is Comprehensive Business Insurance and Why is it Essential?

Imagine a customer lawsuit demanding $200,000 after a fall in your office, or a storm destroying $150,000 worth of inventory. These aren’t scare tactics; they’re real scenarios that can wipe out a business without the right protection.

The importance of a safety net for your business

Most small businesses are just one major incident away from financial disaster. Business insurance is about survival, not just meeting legal requirements. Yes, Massachusetts and New Hampshire require workers’ compensation if you have employees, and commercial auto insurance is mandatory for business vehicles. But as the Insurance Information Institute makes clear, the real risks extend far beyond what the law requires.

Without proper insurance, you’re gambling with your livelihood. A lawsuit could drain personal savings, while operational disruptions could halt your ability to pay bills and employees. The right insurance provides operational stability, protects both business and personal assets, and gives you peace of mind to focus on growth.

What is a comprehensive business insurance policy?

Comprehensive business insurance isn’t a single, off-the-shelf policy. It’s a custom-built protection plan that combines different insurance coverages to address your specific risks. A restaurant in Boston faces different threats than a software company in Nashua, so a one-size-fits-all approach simply doesn’t work.

For many small businesses, a Business Owner’s Policy (BOP) is an excellent foundation. This bundled package combines general liability, commercial property, and business income insurance into an affordable plan. Our guide on What is Business Owners Insurance and When Do You Need It? can help you determine if a BOP is right for you.

For growing or higher-risk businesses, a Commercial Package Policy (CPP) offers more flexibility. This approach lets you pick and choose from a wider menu of coverages—like commercial auto, cyber liability, and professional liability—to create a truly customized policy. This scalability ensures your protection can evolve with your business, so you’re not locked into a rigid package that no longer fits.

Deconstructing the Policy: Core Components of Comprehensive Business Insurance

A comprehensive business insurance plan is a package of individual coverages designed for your specific operation. Understanding these core components is key to building the right protection.

Foundational Liability Coverages

General Liability Insurance is the foundation, protecting you from claims of third-party injury, property damage, or advertising injury (like libel or slander). If a customer is injured at your location or your operations damage a client’s property, this policy covers medical bills, repair costs, and legal fees. Learn more about this essential coverage on our Public Liability Insurance page.

Professional Liability Insurance, or Errors and Omissions (E&O), is crucial for businesses providing expert advice or services. It protects you from claims of negligence, mistakes, or failure to perform as promised. If a client loses money due to your advice, E&O covers your legal defense and damages. We explore its relationship with cyber coverage in our article: Does Professional Liability Insurance Cover Cyber?

Protecting Your Physical Assets and Operations

Commercial Property Insurance protects your physical assets—buildings, equipment, inventory, and supplies—from risks like fire, theft, and vandalism. Whether you own or rent, this coverage helps you repair or replace what’s damaged to get back to business. See our guide on Commercial Property Insurance for details.

Business Income Insurance (or business interruption insurance) is a financial lifeline. It replaces lost revenue and covers ongoing expenses like rent and payroll if a covered event forces a temporary closure. Protect your revenue stream with details from our Business Income Insurance page.

Commercial Auto Insurance is essential for any business using vehicles, as personal auto policies exclude business use. It covers liability from accidents and physical damage to your vehicles. Our Commercial Auto Insurance resource has more information.

Modern Risks and Specialized Protections

Cyber Liability Insurance is vital in the digital age. If you store customer data or process payments, you’re at risk for data breaches and ransomware attacks. This policy covers investigation, recovery, notification, and legal costs. Learn more on our Cyber Liability Insurance page.

Directors and Officers (D&O) Insurance shields the personal assets of your company’s leaders from lawsuits alleging wrongful acts in managing the company, such as employment disputes or financial mismanagement. Our Directors and Officers Insurance page explains this in detail.

Workers’ Compensation is legally required in Massachusetts and New Hampshire for businesses with employees. It provides medical care and wage replacement for job-related injuries or illnesses and protects your business from employee lawsuits. We explain its value on our Workers Compensation Insurance Importance page.

Tailoring Your Shield: How to Determine the Right Coverage

Because no two businesses are identical, your insurance must be customized for effective and cost-efficient protection. A comprehensive business insurance plan is built for your specific world, not a generic template.

Assessing Your Business’s Unique Risks

Building the right plan starts with a risk assessment. Key factors include:

- Your Industry: A restaurant’s risks (fires, slip-and-falls) differ from a tech startup’s (data breaches, E&O claims).

- Business Size and Revenue: Larger operations have greater liability exposures.

- Number of Employees: More staff increases the potential for workplace incidents and is a factor in workers’ compensation.

- Physical Location: A downtown Boston location has different risks (heavy foot traffic) than a coastal business (flooding) in Massachusetts or New Hampshire.

- Contractual Requirements: Landlords, clients, or lenders often mandate specific insurance minimums. The Small Business Administration offers guidance on these obligations.

For a deeper dive, our guide on The Definitive Guide to Finding Suitable Business Insurance Coverage walks you through the process.

Building your comprehensive business insurance plan for specific industries

Comprehensive coverage varies by industry. Here are a few examples:

- Construction: A plan often centers on a Builders Risk Insurance Policy, general liability, commercial auto, and workers’ compensation.

- Technology: Protection prioritizes cyber liability and professional liability (E&O). Our Technology Insurance Company page explores these needs.

- Real Estate: Apartment Building Insurance is the core, protecting structures and covering liability from tenant claims.

- Non-Profits: Coverage often includes general liability, property, and Directors and Officers (D&O) insurance to protect board members. Learn more about Insurance for Nonprofit Organizations.

The Role of an Independent Insurance Agent

Navigating comprehensive business insurance alone can be complex. An Independent Commercial Insurance Agent works for you, not an insurance company. Our job is to understand your business, conduct a thorough risk analysis, and identify potential coverage gaps.

Unlike captive agents, we shop the market on your behalf, comparing policies from multiple carriers to find the best fit and value. We also act as your advocate during the claims process, guiding you through the paperwork to ensure a fair outcome. Because business isn’t static, we conduct annual reviews to adjust your coverage as you grow. As a Business Insurance Broker serving Massachusetts and New Hampshire, we understand the local challenges and are committed to building a relationship that protects what you’ve built.

Understanding the Investment: Costs, Management, and Reviews

While comprehensive business insurance is a critical investment, cost is a practical consideration. Understanding what drives your premiums and how to manage them can help you secure excellent protection at a fair price.

What Factors Influence the Cost of Insurance?

There is no single price for comprehensive business insurance. While a small business might pay around $450 annually for a basic general liability policy, your final premium depends on your unique risk profile. Insurers consider:

- Industry and risk level

- Coverage types and limits selected

- Claims history

- Business location in Massachusetts or New Hampshire

- Number of employees

- Annual revenue

- Deductible amount chosen

For specialized coverage, costs vary. Our guide on the Cost of Cyber Liability Insurance breaks down what to expect in that area.

Strategies for Managing Insurance Costs

You can proactively manage your insurance costs with several strategies:

- Implement risk management: Insurers often reward businesses with strong safety programs and secure IT systems. Simple steps like maintaining a safe workplace and documenting safety procedures can make a difference.

- Bundle policies: Combining coverages into a Business Owner’s Policy or Commercial Package Policy is almost always more affordable.

- Choose higher deductibles: If you have sufficient cash flow, a higher deductible can lower your premium.

- Shop around: Working with an independent agent allows you to compare quotes from multiple carriers, which can lead to significant savings.

The Importance of Regular Policy Reviews

Your insurance policy is not a “set it and forget it” document. It needs regular attention as your business evolves. We recommend an annual review, especially if you have:

- Hired new employees

- Acquired new equipment or property

- Changed your operations or services

The insurance market also changes, with new options and pricing. Regular reviews prevent coverage gaps and ensure you’re not overpaying. As your local Massachusetts Business Insurance Agency, we conduct these crucial reviews to keep your protection relevant and cost-effective.

Frequently Asked Questions about Comprehensive Business Insurance

Is business insurance legally required in Massachusetts and New Hampshire?

Yes, for certain coverages. In both Massachusetts and New Hampshire, businesses with employees are legally required to have workers’ compensation insurance. Commercial auto insurance is also mandatory for any business-owned vehicles. While general liability insurance may not be required by state law, it is a business necessity and often a contractual requirement from landlords or clients.

What is the difference between a Business Owner’s Policy (BOP) and a Commercial Package Policy (CPP)?

A Business Owner’s Policy (BOP) is a pre-packaged bundle combining general liability, commercial property, and business income insurance. It’s ideal for small, low-risk businesses due to its convenience and affordability. A Commercial Package Policy (CPP) is more flexible and customizable. It allows you to select from a wider menu of coverages to build a custom plan, making it a better fit for larger or higher-risk businesses that need a more robust comprehensive business insurance solution.

What happens if I don’t have adequate business insurance?

The consequences are severe. Without adequate insurance, a single lawsuit, fire, or data breach could force you to pay for all damages and legal fees out-of-pocket. These costs can easily run into hundreds of thousands of dollars, leading to debt, the loss of personal assets, and business failure. Comprehensive business insurance is your defense against this, ensuring that one unexpected event doesn’t end everything you’ve worked to build.

Conclusion: Secure Your Future with Proactive Protection

Protecting the business you’ve built requires smart, proactive planning. A well-crafted comprehensive business insurance plan is the heart of that strategy, acting as a shield against the unpredictable. Your insurance plan stands between a temporary setback and a business-ending catastrophe, whether it’s a lawsuit, fire, or cyber breach.

You don’t have to steer this alone. By understanding your risks and working with a trusted, independent advisor, you can ensure your coverage adapts as your business grows. The team at Stanton Insurance Agency has spent decades helping business owners in Massachusetts and New Hampshire build insurance plans that provide real peace of mind. Our goal is to craft a strategic plan that protects your livelihood, allowing you to focus on growth.

Waiting for a crisis to find a gap in your coverage is a gamble you can’t afford to take. The time to act is now. Your business is your legacy and deserves comprehensive protection.

Let’s work together to secure your company’s future. Ready to build the safety net your business needs? Visit our Business Insurance page to get started.