Collision vs Limited Collision: #1 Crucial Guide

Understanding Your Auto Insurance Options in Massachusetts & New Hampshire

Collision vs Limited Collision coverage options in Massachusetts and New Hampshire often confuse drivers, but the difference is straightforward and critical to understand. Here’s what you need to know:

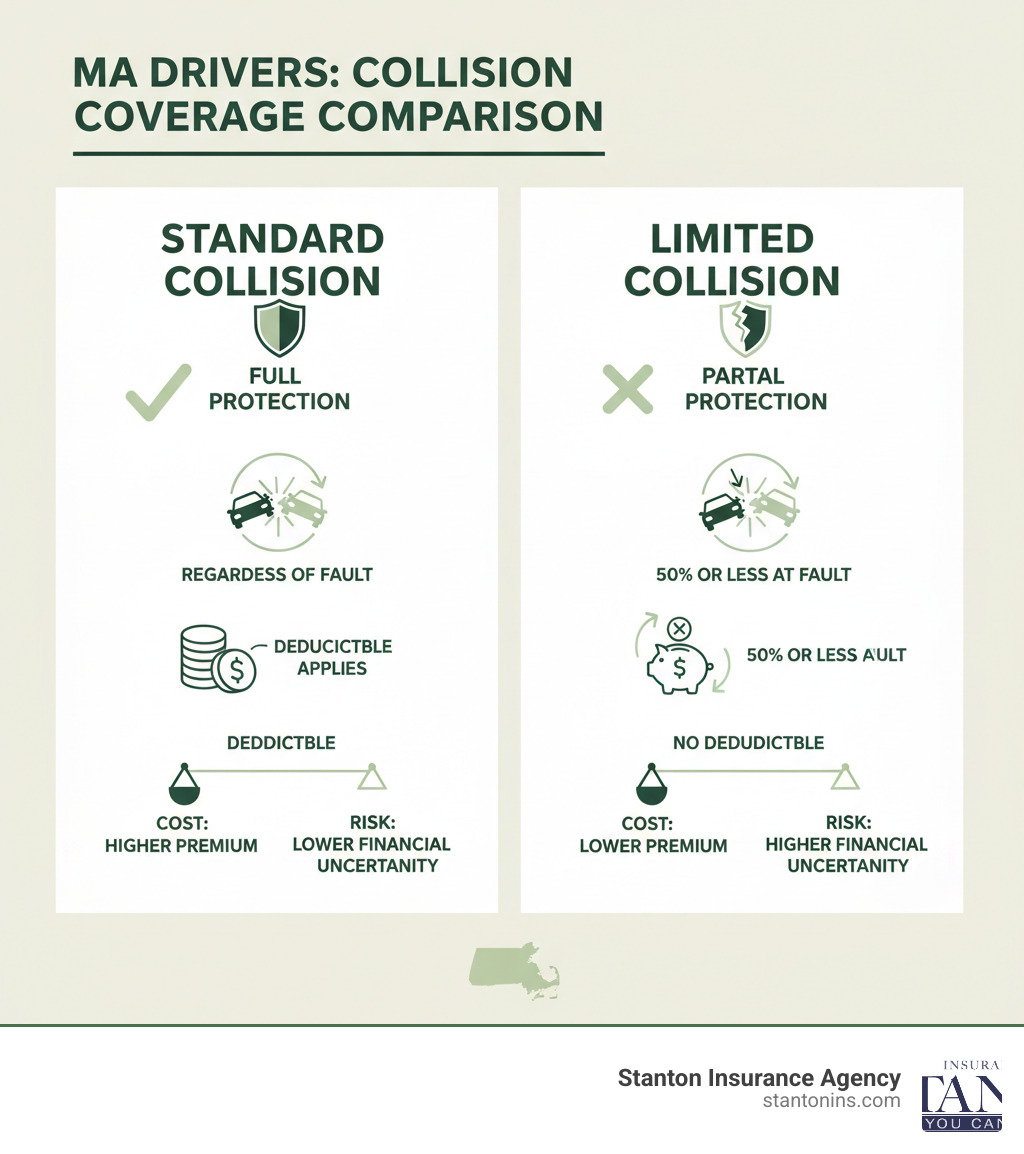

Standard Collision Coverage:

- Covers your vehicle damage regardless of who caused the accident

- Requires you to pay a deductible (typically $500-$1,000)

- Higher premium but broader protection

- Required for leased or financed vehicles

Limited Collision Coverage:

- Only covers damage if you are 50% or less at fault

- No deductible when coverage applies

- Lower premium but significant coverage gaps

- Provides no benefits if you’re more than 50% at fault

The choice between these coverages directly impacts your financial protection after an accident. Standard collision offers peace of mind regardless of fault, while limited collision saves money but leaves you exposed in at-fault accidents.

Auto insurance can feel like navigating a maze of policy options and confusing terms. Many drivers in Massachusetts and New Hampshire don’t realize they have choices within their collision coverage, or understand how dramatically these choices can affect their protection and costs after an accident.

I’m Geoff Stanton, a fourth-generation insurance professional and President of Stanton Insurance Agency in Waltham, Massachusetts. Over my 25+ years in the industry, I’ve helped countless families in Massachusetts and New Hampshire steer the Collision vs Limited Collision decision to find the right balance of protection and affordability for their specific needs.

What is Standard Collision Coverage?

Standard Collision coverage is an optional part of a car insurance policy in Massachusetts and New Hampshire that helps pay to repair or replace your car if it’s damaged in a collision with another vehicle or object (like a fence or a tree), or if it rolls over. Think of it as your vehicle’s personal bodyguard—ready to step in when things get bumpy, regardless of who is at fault for the accident.

This coverage provides financial protection for your own vehicle, which becomes especially important when you consider that accidents happen to even the most careful drivers. Whether you slide into a guardrail on an icy morning or someone runs a red light and hits you, standard collision has your back.

How Standard Collision Coverage Works

When you need to use your collision coverage, the process is straightforward. After an accident, you file a claim with your insurance company. You’ll pay your chosen deductible amount, and your insurer covers the remaining repair costs up to your vehicle’s actual cash value (ACV).

The ACV represents what your car was worth right before the collision, accounting for factors like age, mileage, and condition. For example, if your car is valued at $15,000 and suffers $8,000 in damage with a $500 deductible, you’d pay $500 and your insurance would cover the remaining $7,500.

Fault Determination in Standard Collision

Here’s where standard collision really shines in the Collision vs Limited Collision comparison. This coverage protects you whether you’re 0% or 100% at fault. Got distracted and rear-ended someone? Your car’s damage is still covered. Someone else caused a multi-car pileup that damaged your vehicle? Also covered.

When you’re found to be more than 50% at fault, you’ll pay your deductible and your insurance handles the rest. However, if another driver is determined to be primarily responsible for the accident, your insurance company will often seek reimbursement from their insurer through a process called subrogation. This sometimes means you’ll get your deductible back, though it’s not guaranteed and can take time.

Deductibles: Choosing What Works for Your Budget

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Drivers in Massachusetts and New Hampshire typically choose from deductible options like $500 or $1,000, though other amounts are available.

The relationship between deductibles and premiums follows a simple pattern: higher deductibles mean lower premiums, while lower deductibles result in higher premiums. If you choose a $1,000 deductible instead of $500, you’ll save money on your monthly premium but pay more when filing a claim. It’s about finding the sweet spot between what you can afford monthly versus what you could handle in an emergency.

Who Needs Standard Collision Coverage?

Standard collision coverage is almost always required by lenders if you’re financing or leasing your vehicle. Lenders want to protect their investment, and frankly, you should want to protect yours too.

Even if you own your car outright, this coverage is highly recommended for newer or more valuable vehicles. If the thought of paying thousands of dollars out-of-pocket for repairs after an accident makes you uncomfortable, standard collision coverage provides essential peace of mind.

For owners of older vehicles with lower values, this is where the Collision vs Limited Collision decision becomes more complex, as the cost-benefit equation changes significantly.

To dive deeper into this essential protection, check out our comprehensive guide: What is Collision Insurance?.

What is Limited Collision Coverage?

Limited Collision coverage is a more restrictive and less expensive alternative to standard collision. As the name implies, its coverage is limited to very specific circumstances. In Massachusetts, it only pays for damage to your vehicle if you are found to be no more than 50% at fault for the accident. It is important to note this specific coverage type is not offered in New Hampshire.

Think of limited collision as the budget-conscious cousin of standard collision coverage. It offers some protection, but comes with strings attached that can leave you holding the repair bill when you need help most.

Strict Fault Requirement: The 50% Rule (Massachusetts)

The 50% fault rule is what makes limited collision coverage so restrictive. If you are determined to be more than 50% at fault for the collision, this coverage provides no payment for your vehicle’s damages. You would be responsible for the entire cost of repairs out of pocket.

Let’s say you’re rushing to work and rear-end someone at a red light. Or maybe you misjudge a turn and clip another car. In scenarios like these where you’re clearly more than half responsible, limited collision won’t help you. The coverage simply disappears when you need it most – during at-fault accidents.

This is where the Collision vs Limited Collision decision becomes critical. Standard collision would cover these situations, but limited collision leaves you completely exposed.

No Deductible (When it Applies)

Here’s the silver lining of limited collision: there’s no deductible to pay when you make a successful claim. If you meet the “not-at-fault” criteria and are 50% or less at fault, the policy pays for the repairs in full, up to your car’s actual cash value.

This can be genuinely helpful when someone else causes the accident. You won’t have to come up with $500 or $1,000 upfront for repairs like you would with standard collision. The insurance company handles everything once fault is determined in your favor.

Identifying the Other Party is Key

Limited collision has another catch: the other driver must be identified for your coverage to work. If someone damages your car and speeds away, leaving you staring at a hit-and-run scene with no license plate or witness information, limited collision won’t help you.

Unfortunately, hit-and-run incidents happen more often than we’d like. Without being able to identify the responsible party, your limited collision coverage becomes useless, and you’re back to paying for repairs yourself.

State-Specific Rules and Context

The specifics of limited collision coverage are defined by Massachusetts state law, and there are clear guidelines about when this coverage applies. According to the Basics of Auto Insurance in Massachusetts, Limited Collision pays for damages only under these certain circumstances related to fault. New Hampshire does not have an equivalent limited option; drivers there rely on standard collision coverage.

The reduced coverage comes with a reduced price tag in Massachusetts. Insurance companies can offer lower premiums for limited collision precisely because they’re taking on much less risk. They only pay when you’re not primarily at fault and when the other driver can be identified and held responsible.

Key Differences: Collision vs. Limited Collision

When it comes to Collision vs. Limited Collision coverage, the differences go far beyond just the price on your insurance bill. These two options represent fundamentally different approaches to protecting your vehicle, and understanding their distinctions could save you thousands of dollars down the road.

| Feature | Standard Collision Coverage | Limited Collision Coverage |

|---|---|---|

| Fault Requirement | Covers damage regardless of who is at fault. | Only covers damage if you are 50% or less at fault. |

| Deductible | You must pay your chosen deductible. | No deductible is paid if the claim is covered. |

| At-Fault Accident | Your vehicle’s damage is covered (minus deductible). | Your vehicle’s damage is not covered. |

| Cost | Higher premium. | Lower premium. |

| Best For | Newer, valuable, leased, or financed cars. | Older, low-value cars that are owned outright (in Massachusetts). |

Understanding the Fault Factor in Collision vs. Limited Collision

The biggest game-changer in the Collision vs. Limited Collision decision comes down to one word: fault. With standard collision coverage, fault becomes almost irrelevant to your immediate financial situation. Your insurance company will repair your car whether you accidentally backed into your neighbor’s mailbox, misjudged a turn into a guardrail, or found yourself in a complex multi-car accident where blame gets spread around.

Limited collision coverage, an option in Massachusetts, turns every accident into a high-stakes blame game. You’re essentially making a bet that you’ll never be found more than 50% responsible for damaging your own vehicle. Even the most careful drivers can have momentary lapses – maybe you’re rushing to an important meeting and don’t see that concrete barrier, or perhaps black ice catches you off guard. With limited collision, these “oops” moments could cost you the full value of your car.

The harsh reality is that fault determination isn’t always black and white. Insurance adjusters and police reports sometimes assign percentages that might surprise you. What feels like a minor mistake on your part could push your fault percentage over that critical 50% threshold, leaving you completely without coverage.

Cost and Deductible Implications of Collision vs. Limited Collision

The lower premium of limited collision coverage certainly looks attractive on paper, but it’s important to understand what you’re really trading away. Think of it this way: with standard collision, you’re paying a predictable premium for predictable protection. Your deductible might be $500 or $1,000 – an amount you can plan for and budget around.

The core trade-off in Collision vs. Limited Collision comes down to this: paying a higher premium for comprehensive protection versus saving money upfront but risking a massive financial hit later.

With limited collision, you might save several hundred dollars per year on your premium. But if you cause an accident, your “deductible” suddenly becomes the entire cost of replacing your vehicle. That $800 annual savings doesn’t look so great when you’re facing a $15,000 repair bill.

Standard collision offers the comfort of knowing exactly what you’ll pay if something goes wrong. Limited collision might save you money today, but it could leave you scrambling to cover repair costs that far exceed what most families have readily available in their emergency funds.

The no-deductible feature of limited collision sounds appealing, but remember – it only applies when you’re not primarily at fault and the other driver can be identified. When those conditions aren’t met, you’re not just paying a deductible; you’re paying everything.

Making the Right Choice for Your Vehicle

Choosing between Collision vs Limited Collision coverage isn’t a decision to make lightly, especially since Limited Collision is an option specific to Massachusetts. It’s deeply personal, tied to your vehicle’s value, your financial situation, and how much risk you’re comfortable carrying. Think of it like choosing between a safety net and a tightrope – both can work, but one gives you a lot more room for error.

When Limited Collision Makes Sense (in Massachusetts)

Limited collision can be a smart financial move, but only under specific circumstances where you can handle the potential downside. Your car’s age and value play a huge role here. If you’re driving a 2010 sedan that’s worth maybe $4,000, paying $500-600 annually for standard collision coverage might feel like throwing money away. The math just doesn’t add up when your premium approaches a significant percentage of your car’s value.

Owning your car outright gives you the freedom to make this choice. Without a lender breathing down your neck, you can weigh the risks yourself. But here’s the critical question: do you have enough savings to cover a major repair or replacement if you cause an accident? If a $5,000 repair bill would mean eating ramen for months, limited collision isn’t for you.

Excellent driving records make limited collision more appealing. If you’ve been accident-free for years and feel confident about staying that way, the premium savings can be substantial. However, even the most careful drivers can have an “oops” moment – backing into a pole, misjudging a tight parking spot, or simply having a momentary lapse in attention.

When Standard Collision is Your Best Bet

For most drivers, standard collision coverage provides essential peace of mind. Newer or high-value vehicles practically demand this protection. If your car is worth $20,000 or more, the potential repair costs after an accident can be staggering. Modern vehicles are complex machines with expensive parts and sophisticated safety systems that cost serious money to fix properly.

Leased or financed vehicles require standard collision – there’s no choice here. Your lender wants to protect their investment, and frankly, so should you. Financial vulnerability is the biggest factor to consider. If you couldn’t easily write a check for $10,000 tomorrow to replace your damaged car, standard collision is non-negotiable.

The real value of standard collision is peace of mind regardless of fault. Life happens. You might be the safest driver in Massachusetts, but one moment of distraction or a simple mistake can lead to thousands in damage. Standard collision means you’re covered no matter what.

The Risky Road of No Collision Coverage

Going without any collision coverage is like driving without a seatbelt – you might be fine, but why take the chance? This approach saves the most money upfront but leaves you completely exposed financially. Even if another driver hits you, recovering money from their insurance can be a slow, frustrating process. You’d be responsible for repairs immediately, then hope to get reimbursed later.

In Massachusetts, the no-fault system (PIP) covers initial medical expenses, but your vehicle damage is handled separately. New Hampshire, an at-fault state, works differently; the at-fault driver’s insurance is responsible for damages from the start, but having your own collision coverage is crucial for getting your car fixed promptly without waiting for fault to be determined. If you’re considering dropping collision entirely, our guide on when to drop collision insurance coverage can help you make that decision carefully.

The bottom line? Your vehicle’s value, your savings account, and your sleep-at-night factor should guide your decision. Limited collision works for some drivers with older, lower-value cars and solid financial cushions. Standard collision makes sense for everyone else who wants comprehensive protection without worrying about fault determination.

Frequently Asked Questions about Collision Coverage

When helping families in Massachusetts and New Hampshire steer the Collision vs Limited Collision decision, we encounter many of the same thoughtful questions. Let me address the ones that come up most often in our conversations.

What happens if I have Limited Collision and am the victim of a hit-and-run?

This scenario perfectly illustrates one of limited collision’s biggest blind spots in Massachusetts. Unfortunately, if someone hits your car and speeds away, your limited collision coverage won’t help because it requires the other driver to be identified. No identification means no coverage, even if you were completely innocent.

In a hit-and-run in either state, you would rely on your standard collision coverage to pay for repairs (after your deductible). Alternatively, Uninsured Motorist Property Damage coverage, if you’ve purchased it, could also apply. This is a key reason many drivers prefer the broader protection of standard collision.

Is Limited Collision the same as Comprehensive coverage?

Not even close! I see this confusion often, and it’s totally understandable since both coverages protect your own vehicle. But they’re like two different superheroes with completely different powers.

Limited collision, a Massachusetts-specific option, only kicks in when you’re in a collision with another vehicle or object, and you’re 50% or less at fault. Comprehensive coverage, on the other hand, handles all the non-collision drama life can throw at your car. We’re talking about theft, vandalism, fire, hail storms, falling tree branches, or that deer that decides to play chicken with your morning commute. They cover completely separate types of risks, so having one doesn’t replace the need for the other.

Can I have both Standard and Limited Collision coverage?

Nope, it’s an either-or situation in Massachusetts, where both are offered. You can’t have both scoops when it comes to collision coverage on the same vehicle. Your policy will have either standard collision or limited collision, but never both simultaneously. You pick the option that best matches your risk appetite and budget.

What if I’m less than 50% at fault, but the other driver’s insurance won’t pay?

Ah, this is where things can get frustrating, and it happens more often than you’d think. Even when you’re clearly not at fault, the other driver’s insurance company might drag their feet, dispute the claim, or the other driver might be uninsured entirely.

With standard collision coverage, you have a safety net in both states. You can file a claim with your own insurance company, pay your deductible, get your car fixed, and let your insurer fight to recover costs. With limited collision in Massachusetts, if the other driver’s insurance won’t cooperate, you could find yourself stuck in insurance limbo, as your coverage depends on the other party.

Why is limited collision cheaper than standard collision?

The price difference for this Massachusetts-specific option comes down to basic insurance math. Limited collision is cheaper because it has much stricter conditions for when it actually pays out. Insurance companies love certainty, and with limited collision, they know they’ll only pay claims when you’re 50% or less at fault and the other driver is identified.

This dramatically reduces the situations where they have to open their checkbook, so they can offer you lower premiums. It’s the classic risk-reward trade-off: you save money upfront on your premium, but you’re taking on significantly more financial risk if you ever cause an accident. The insurance company is essentially saying, “We’ll give you a discount because we probably won’t have to pay as many claims.”

The key is understanding that this lower premium comes with strings attached – big ones that could leave you holding a very expensive repair bill if things go wrong.

Get the Right Protection for Your Ride

The Collision vs Limited Collision decision isn’t just about choosing an insurance option – it’s about choosing peace of mind that matches your lifestyle and budget, and it’s a choice unique to Massachusetts.

Standard collision coverage is like having a reliable friend who’s always got your back, no matter what happens. Whether you accidentally slide into a guardrail on an icy morning or misjudge that tight parking space, your coverage steps in to handle the repair costs. You’ll pay your deductible, but you won’t face the devastating expense of a total vehicle replacement.

Limited collision coverage, available in Massachusetts, works more like a fair-weather friend. When everything goes smoothly and other drivers are at fault, it’s fantastic – no deductible to pay and your repairs are covered completely. But the moment you’re primarily responsible for an accident, even by just 51%, you’re on your own financially. That fender-bender could suddenly cost you thousands out of pocket.

The math is straightforward but the emotions run deeper. If you’re driving a newer vehicle or one that you couldn’t easily replace tomorrow, standard collision provides that essential safety net. Your monthly premium might be higher, but you’re protecting yourself from potentially catastrophic repair bills that could derail your budget for months.

For drivers with older, paid-off vehicles who have substantial savings set aside, limited collision can make financial sense. You’re essentially self-insuring for at-fault accidents while still maintaining some protection when others cause damage to your car.

Understanding these differences is the first step to building the right auto insurance policy for your specific needs. Every driver’s situation is unique—whether you’re navigating the specific options in Massachusetts or the at-fault system in New Hampshire—and what works for your neighbor might leave you exposed or over-insured.

At Stanton Insurance Agency, we take the time to understand your vehicle’s value, your driving patterns, and your financial comfort zone. For our Massachusetts clients, we’ll walk through the Collision vs Limited Collision decision together, helping you weigh the premium savings against the potential risks. For our New Hampshire clients, we’ll focus on the right deductible and coverage strategy for your needs. Our goal isn’t just to sell you a policy – it’s to ensure you have the trusted protection that lets you drive with confidence, knowing you’ve made the right choice for your situation.