Cheap apartment insurance rates: Smart Savings 2025

Why Cheap Apartment Insurance Rates Are Easier to Find Than You Think

Cheap apartment insurance rates are surprisingly accessible, with most renters finding quality coverage for less than the cost of a few coffees each month. According to national data, the average renters insurance policy costs just $15 per month (about $179 per year). In New Hampshire, rates are even lower at around $12 per month, while Massachusetts renters typically pay about $16 per month. Here’s what you need to know to find the best rates:

Top 5 Ways to Get the Cheapest Apartment Insurance:

- Compare quotes from multiple companies – Rates vary significantly between insurers, so shopping around is key

- Bundle with auto insurance – Save 5-25% by combining policies

- Raise your deductible – Increasing from $500 to $1,000 can reduce premiums by 10-25%

- Install safety devices – Smoke detectors, deadbolts, and security systems earn discounts of 2-20%

- Pay annually – Save 2-10% by paying the full year upfront instead of monthly

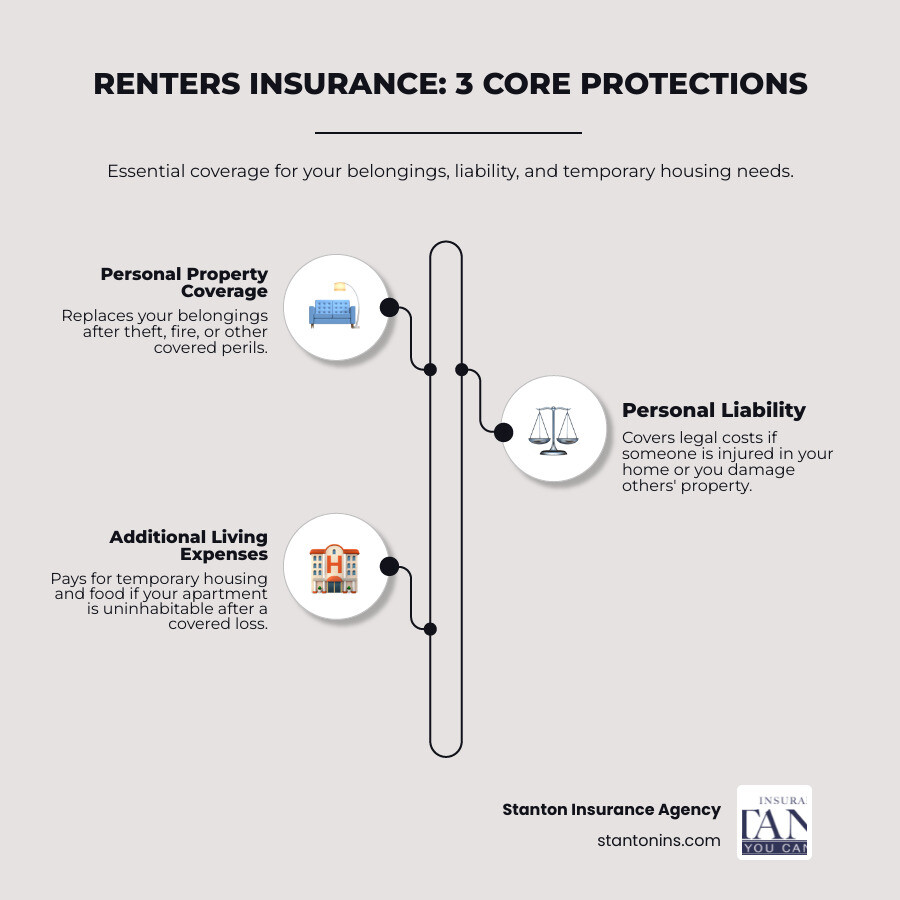

Despite these low costs, renters insurance provides comprehensive protection for your belongings, shields you from liability if someone is injured in your home, and covers temporary housing if your apartment becomes uninhabitable. The reason apartment insurance is so affordable compared to homeowners insurance is simple: your landlord’s policy covers the building structure, while your policy only needs to protect your personal property and liability exposure.

What does a typical low-cost policy include? Most affordable renters policies cover personal property (your belongings), personal liability (if you’re sued), medical payments to guests who are injured, and additional living expenses if you can’t stay in your apartment due to a covered event like a fire. Many policies start at less than $5 per month for basic coverage, though most renters find that $15-20 per month provides solid, comprehensive protection.

I’m Geoff Stanton, President at Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping renters in Massachusetts and New Hampshire find cheap apartment insurance rates that deliver real value. Working with an independent agent like our team means you’ll see quotes from multiple carriers, ensuring you get the best possible price without sacrificing coverage quality.

Understanding the Cost: What’s the Average Price for Apartment Insurance?

The national average cost for renters insurance is surprisingly low, hovering around $15 per month, or about $179 per year. However, this price can vary significantly. In Massachusetts, the average is slightly higher at about $16 per month, while renters in New Hampshire enjoy some of the lowest rates in the country, averaging around $12 per month. This affordability is a key difference from homeowners insurance, which is more expensive because it must also cover the physical structure of the building—a cost your landlord’s policy handles.

Many people are surprised to learn just how little renters insurance costs. Often, it’s less than your monthly streaming service subscription! This makes finding cheap apartment insurance rates not just a possibility, but a reality for nearly everyone.

Why is Renters Insurance So Affordable?

The reason renters insurance is so affordable is simple: it covers different things than homeowners insurance. Your landlord’s policy protects the physical building—the walls, roof, and foundation. If a fire damages the structure, their insurance handles the repairs.

A renters policy, on the other hand, focuses only on what belongs to you: your personal property and your liability. This significantly reduces the insurer’s risk, which translates into lower premiums. You’re protecting your clothes and furniture, not the multi-million dollar building. This lower risk is the key driver behind the incredibly affordable cheap apartment insurance rates we often see. You can learn more about this essential coverage by visiting our page on More info about Renters Insurance (https://stantonins.com/renters-insurance/).

What Does a Basic, Cheap Policy Include?

Even at its most affordable, a standard renters insurance policy offers robust protection. A basic, cheap apartment insurance rates policy typically includes four core components:

- Personal Property Coverage: Protects your belongings (clothes, furniture, electronics, etc.) from covered events like theft, fire, and vandalism. This coverage helps you replace your possessions without paying entirely out-of-pocket.

- Personal Liability Protection: This crucial component helps pay for legal fees and damages if you’re found responsible for injuring someone or damaging their property. It can prevent a minor accident from becoming a major financial disaster.

- Medical Payments to Others: This helps pay for minor medical expenses if a guest is accidentally injured in your apartment, regardless of fault. It can help resolve small incidents before they become large claims.

- Loss-of-Use Coverage (Additional Living Expenses): If a covered event like a fire makes your apartment uninhabitable, this helps pay for temporary living expenses, such as hotel stays and meals, while your home is repaired.

Even with cheap apartment insurance rates, these fundamental coverages provide a comprehensive safety net. For a deeper dive into what’s covered, check out our guide: What Does Renters Insurance Cover? (https://stantonins.com/what-does-renters-insurance-cover/)

Key Factors That Influence Your Apartment Insurance Rates

Several factors determine your final premium. Insurers assess your risk based on your location, the coverage you select, and your personal history. Understanding these elements is the first step toward lowering your bill. We want to empower you to understand how these pieces fit together, so you can confidently seek out the best cheap apartment insurance rates available.

Location, Location, Location

Just like in real estate, your location plays a significant role in determining your renters insurance rates. Where your apartment is situated, even down to the specific ZIP code, can influence how much you pay. Here’s why:

- ZIP Code: Different neighborhoods have varying risk profiles. Areas with higher crime rates, for instance, might see slightly higher premiums due to an increased risk of theft.

- Crime Statistics: If your neighborhood has a history of burglaries or vandalism, insurers may factor this into your rate.

- Weather Risk: Areas prone to severe weather events, like heavy snowstorms or flooding (though flood damage is typically excluded, the general risk can influence rates), might have different pricing structures. While Massachusetts and New Hampshire aren’t typically known for hurricanes, winter storms can certainly pose risks.

- Proximity to Fire Department: Living closer to a fire station can sometimes lead to lower rates because emergency services can respond more quickly to incidents, potentially reducing the extent of damage.

- State-Specific Rates: As we’ve seen, average rates vary significantly by state. New Hampshire enjoys some of the most affordable rates nationally, while Massachusetts is slightly higher but still very competitive. This is due to a variety of factors, including state regulations, local risks, and the competitive landscape of insurers in the region.

Your Coverage Choices and Deductible

The choices you make about how much coverage you want directly impact your premium. It’s a balance between comprehensive protection and finding cheap apartment insurance rates.

- Personal Property Limit: This is the maximum amount your insurer will pay to replace your belongings. We recommend taking an inventory of your possessions to get an accurate estimate of their value. While a policy starting at $20,000 in personal property coverage might cost $8-$10 per month, increasing that to $50,000 might only add $4-$6 to your monthly premium. For every additional $10,000 in personal property coverage, you might expect to pay roughly $1 to $3 more per month. It’s a small increase for significant added peace of mind.

- Liability Coverage Amount: This protects you if you’re found responsible for someone’s injury or property damage. Most landlords require at least $100,000 in liability coverage, and the Insurance Information Institute (III) often recommends $100,000 to $300,000. Increasing your liability coverage from $100,000 to $300,000 might not drastically change your premium but offers much greater protection.

- Deductible’s Role: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible typically results in lower monthly premiums. It’s a trade-off: you save money each month, but you’ll pay more upfront if you file a claim.

- Raising Deductible Savings: This is one of the most effective ways to lower your rates. Raising your renters policy deductible from $500 to $1,000 can reduce your costs by 10% to 25%. We often advise our clients to consider a deductible they are comfortable paying in an emergency.

Here’s a quick look at how coverage choices can impact your monthly premium, keeping in mind these are illustrative examples for Massachusetts or New Hampshire:

| Policy Type | Personal Property | Liability | Deductible | Estimated Monthly Premium (MA/NH) |

|---|---|---|---|---|

| Budget-Friendly Basic | $20,000 | $100,000 | $1,000 | $10 – $14 |

| Improved Protection | $50,000 | $300,000 | $500 | $18 – $25 |

For more details on protecting yourself, explore What is Personal Liability Insurance for Renters? (https://stantonins.com/what-is-personal-liability-insurance-for-renters/).

Your Personal Profile

Insurers look at your individual history to assess risk, which in turn affects your rates.

- Credit Score Impact: In MA and NH, your credit-based insurance score can influence your premiums. A higher score often means lower rates, while a poor score can lead to higher premiums. The cost difference can be substantial. Maintaining a good credit score is a smart financial move that can help lower your insurance costs. According to Experian (https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/), a good score is generally considered to be 670 or higher.

- Claims History: A history of claims, especially for theft or water damage, can increase your premiums at renewal. Insurers see past claims as an indicator of future risk. However, some companies are more forgiving, so it’s still possible to find affordable rates.

- High-Risk Profile: If you have a high-risk profile (e.g., poor credit, multiple past claims), finding affordable insurance may take more effort, but it’s not impossible. Shopping around and being upfront about your history is the best strategy.

- Pet Ownership: Your pets can affect your rates, particularly certain dog breeds considered “high-risk” for liability. Some insurers focus more on an individual dog’s history than its breed. Always disclose pet ownership when getting a quote for accurate coverage.

Smart Strategies for Finding Cheap Apartment Insurance Rates

Securing the most affordable rates is about more than just picking the lowest number. It involves a strategic approach to discounts, policy structure, and comparison shopping. By actively managing your policy choices, you can significantly reduce your monthly premium without sacrificing essential protection. We’re here to show you how to steer these options to find the best cheap apartment insurance rates for your needs in Massachusetts or New Hampshire.

Open up Savings with Discounts and Bundling

Insurance companies love to reward customers who reduce their risk or simplify their business. This translates into a variety of discounts that can make your cheap apartment insurance rates even cheaper!

Here are some common discounts we help our clients explore:

- Multi-Policy Discount (Bundling): This is one of the most significant ways to save, often ranging from 5% to 25%. When you bundle your renters insurance with another policy, like your auto insurance, you typically get a discount on both. It’s a win-win: less paperwork for you, and more savings! We find this is a very popular option for our clients in MA and NH.

- Safety and Security Device Discounts: Installing certain safety features in your apartment can lead to discounts of 2% to 5%. This includes:

- Smoke detectors and carbon monoxide detectors

- Fire extinguishers

- Deadbolt locks

- Monitored security systems (these can sometimes offer even higher discounts, up to 20%)

- Water leak detectors

- Claims-Free History: If you haven’t filed any insurance claims for a certain period (e.g., three to five years), many insurers will reward you with a discount. This shows you’re a lower risk to them.

- Pay-in-Full Discount: Paying your entire renters insurance cost upfront annually rather than in monthly installments can save you an additional 2% to 10%. This is a simple way to shave a few extra dollars off your premium.

- Automatic Payments: Setting up automatic payments from your bank account can sometimes earn a small discount.

- Early Quoting: Some companies offer a discount if you get a quote a certain number of days before your policy’s effective date.

These discounts can really add up, changing already affordable rates into truly cheap apartment insurance rates.

Comparing Quotes: The Surest Path to Cheap Apartment Insurance Rates

While discounts are great, the single most effective strategy to find the lowest premium is to compare quotes from multiple providers. No two insurance companies calculate risk or offer rates in exactly the same way, so what’s cheap for one person might not be for another.

- Getting Multiple Quotes: We always recommend getting at least three to five quotes from different insurance providers. This allows you to see a range of prices for similar coverage.

- Comparing Coverage Apples-to-Apples: When comparing, make sure you’re looking at policies with the same coverage limits (personal property, liability, etc.) and the same deductible amount. This ensures an accurate comparison.

- Using an Independent Agent: This is where we shine! As an independent insurance agency, we work with a variety of top-rated insurers. This means we can do the shopping for you, comparing different policies and discounts to find the best cheap apartment insurance rates custom to your specific needs in Massachusetts and New Hampshire. You get multiple quotes without having to fill out multiple forms.

- Online Quote Process: Many companies offer quick online quotes, but the most comprehensive way to compare is often through an agent who understands the nuances of each policy.

Ready to see how much you can save? Visit our page to Get Renters Insurance Quotes in Massachusetts (https://stantonins.com/renters-insurance-quotes-massachusetts/) or contact us directly if you’re in New Hampshire.

Choosing Your Coverage Type: Actual Cash Value (ACV) vs. Replacement Cost Value (RCV)

When insuring your personal property, you’ll typically have two main options: Actual Cash Value (ACV) and Replacement Cost Value (RCV). Understanding the difference is crucial for both your coverage and your premium.

- Actual Cash Value (ACV) Definition: An ACV policy pays you the depreciated value of your belongings. This means it factors in wear and tear, age, and obsolescence. For example, if your five-year-old laptop is stolen, an ACV policy would pay out what that five-year-old laptop was worth at the time of the theft, not the cost of a brand-new one.

- Replacement Cost Value (RCV) Definition: An RCV policy pays you the amount it would cost to replace your damaged or stolen item with a brand-new one of similar kind and quality, without deduction for depreciation. If that same five-year-old laptop is stolen, an RCV policy would provide enough money to buy a new, comparable laptop.

- Cost Impact: Generally, policies with ACV coverage will have lower premiums (contributing to cheap apartment insurance rates) because the insurer pays out less in the event of a claim. RCV policies, while more expensive, offer superior protection and can save you a lot of money out-of-pocket if you need to replace items.

- Long-Term Value: While an ACV policy might seem appealing for its lower upfront cost, consider the long-term implications. If a major loss occurs, an RCV policy will put you in a much better financial position to replace your belongings without having to dip deep into your savings. We often recommend RCV for most clients unless budgetary constraints are extremely tight.

Navigating Your Policy: What’s Covered and What’s Not

A standard renters insurance policy (often called an HO-4 policy) is a package of several essential coverages. Knowing what is typically included—and more importantly, what is excluded—is crucial for ensuring you have no gaps in your financial protection. Even with cheap apartment insurance rates, understanding your policy means you won’t be caught off guard when you need it most.

Core Coverages in a Standard Policy

These are the pillars of your renters insurance policy, designed to protect you from the most common risks.

- Personal Property: As discussed, this covers your possessions against named perils. This includes items that are stolen from your car or damaged by fire in a storage unit, not just those inside your apartment. It’s also important to note that your valuable items like jewelry, furs, or fine art often have sub-limits in standard policies (e.g., $1,500). If you have expensive items, you might need to schedule them separately or add an endorsement to ensure they are fully covered.

- Personal Liability: This is the bedrock of financial protection. It covers legal fees, medical bills, and damages if you’re found responsible for someone else’s injury or property damage. Your landlord may require a minimum of $100,000 in liability coverage, and the Insurance Information Institute (III) recommends considering $100,000 to $300,000. This is a crucial defense against unexpected lawsuits. For further insights, refer to recommendations from the Insurance Information Institute (https://www.iii.org/article/renters-insurance).

- Additional Living Expenses (Loss of Use): If your apartment becomes uninhabitable due to a covered event, this coverage steps in to pay for your temporary living expenses. This could include hotel stays, restaurant meals, and other increased costs you face while you’re displaced. This coverage typically lasts for a specified period, often three to six months of rent.

- Medical Payments to Others: This provides a smaller amount of coverage (typically $1,000 to $5,000) to pay for medical expenses if a guest is injured on your property, regardless of fault. It helps resolve minor incidents quickly without escalating into a liability claim.

Common Exclusions to Be Aware Of

While renters insurance is comprehensive, there are certain events and items that are typically not covered by a standard policy. Knowing these exclusions helps you understand the limitations of your coverage and decide if you need additional protection.

- Floods: Standard renters insurance policies do not cover damage caused by floods. If you live in a flood-prone area in Massachusetts or New Hampshire, you would need to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP).

- Earthquakes: Similar to floods, earthquake damage is generally excluded from standard renters policies. Specialized earthquake coverage can be purchased as an add-on or a separate policy.

- Bed Bugs and Pests: Damage or issues related to pests, including bed bugs, rodents, or termites, are usually not covered. This often falls under maintenance responsibilities or specific pest control services.

- Intentional Acts: Any damage or injury caused by intentional acts on your part will not be covered.

- Business-Related Claims: If you run a business out of your apartment, your renters policy typically won’t cover business equipment, inventory, or liability related to your business operations. You would need a separate business insurance policy for that.

- Roommate’s Property (Unless Named): If you have roommates, their personal belongings are generally not covered under your policy unless they are specifically named on your policy. It’s often recommended that roommates get their own separate policies. Sharing a policy can lead to shared coverage limits, meaning there might not be enough coverage for everyone in the event of a total loss.

- Policy Endorsements: For items or risks not covered by a standard policy, you can often add “endorsements” or “riders” for an additional premium. This is common for valuable items like jewelry, collectibles, or for specific perils like sewer backup.

We’re here to help you understand these nuances and ensure you have the right protection, even when seeking cheap apartment insurance rates.

Frequently Asked Questions about Cheap Apartment Insurance Rates

We hear a lot of questions about renters insurance, especially when it comes to balancing cost and coverage. Here are some of the most common ones we address for our clients in Massachusetts and New Hampshire:

Can my landlord require me to have renters insurance?

Yes, landlords can and often do require tenants to carry renters insurance as a condition of the lease. They typically do this to reduce their own liability risk. Your lease may specify a minimum amount of liability coverage, often $100,000 or more. They may also ask to be listed as an “interested party” so they are notified if your policy is canceled. This requirement protects both parties: the landlord from potential lawsuits and you from financial losses.

How quickly can I get renters insurance coverage?

In most cases, you can get renters insurance coverage almost instantly. Many providers allow you to get a quote and purchase a policy online or over the phone in just a few minutes. We can often help our clients secure coverage within 24 hours, and sometimes even immediately. Your proof of insurance can often be emailed to you and your landlord right away, satisfying your lease requirements without any delay.

Is it worth getting renters insurance if I don’t own much?

Absolutely. Even if you believe your belongings aren’t worth much, the cost to replace everything at once after a fire or theft can be surprisingly high. Imagine having to buy all new furniture, clothes, and electronics out of pocket – it adds up quickly! More importantly, the liability coverage is invaluable. If a guest is injured in your apartment and sues you, the legal and medical costs could be financially devastating without the protection of a renters policy. For just a few dollars a month, it provides essential financial protection and peace of mind, regardless of the perceived value of your possessions.

Secure Your Peace of Mind Affordably

Finding cheap apartment insurance rates is an achievable goal for any renter. By understanding the factors that affect your premium, actively seeking discounts, and comparing your options, you can secure robust protection for just a few dollars a month. This small investment safeguards your belongings and financial future, offering peace of mind that is truly priceless. At Stanton Insurance Agency, our experienced team is dedicated to helping you find a policy that provides the right coverage at the best possible price. Contact us today to see how affordable protecting your apartment can be.