Car insurance requirements for financed cars: 3 Essential

Understanding the Fine Print of Financing

Car insurance requirements for financed cars go well beyond what your state mandates. When you finance a vehicle, you’re not just dealing with state minimums—you’re also meeting your lender’s protection standards.

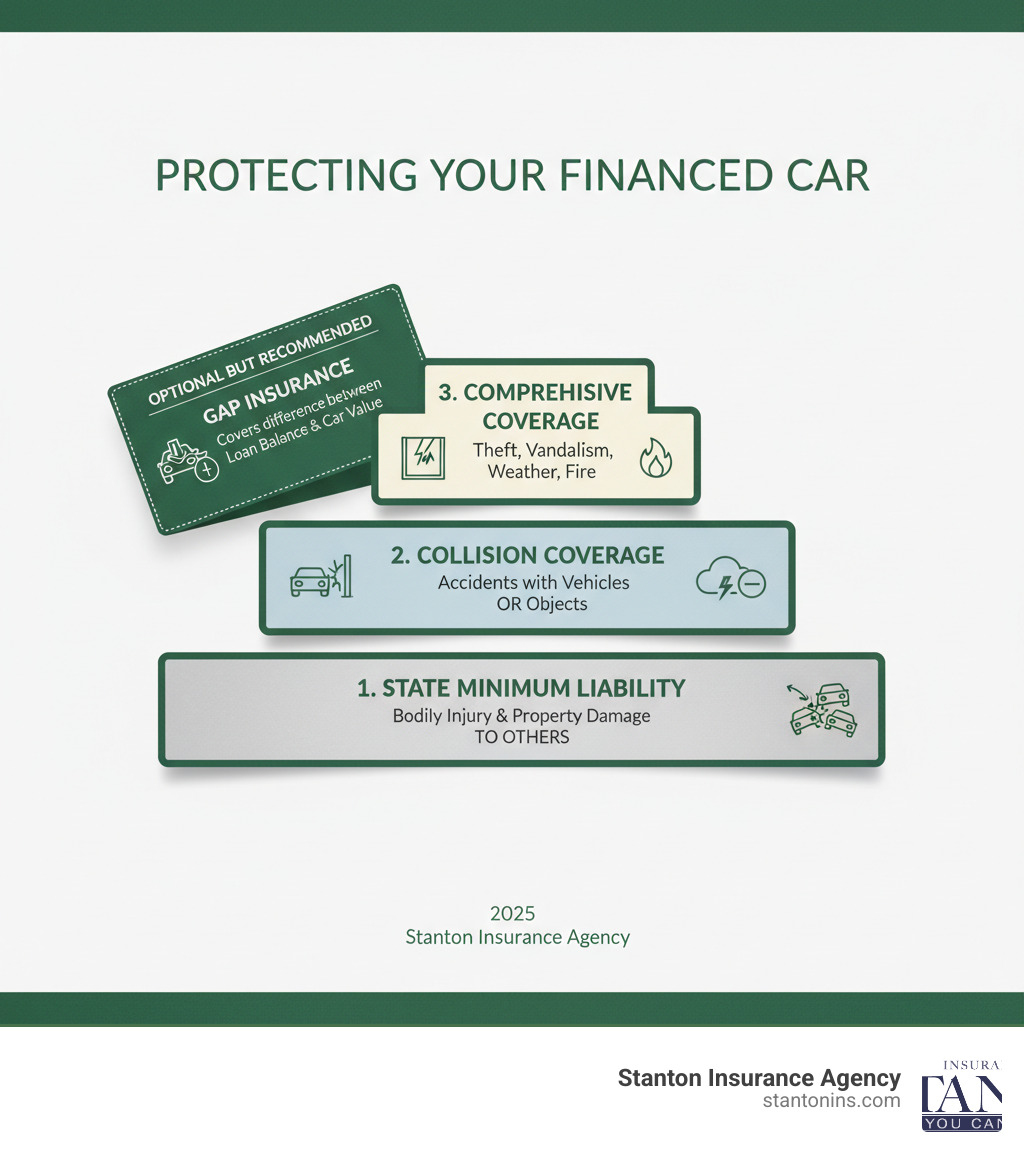

Here’s what lenders typically require for financed vehicles:

- State-Mandated Liability Coverage – Covers injuries and property damage you cause to others

- Collision Coverage – Pays for damage to your car from accidents with other vehicles or objects

- Comprehensive Coverage – Covers theft, vandalism, fire, weather damage, and other non-collision events

- Loss Payee Designation – Your lender must be listed on the policy to receive claim payments

- Deductible Limits – Usually capped at $500-$1,000 maximum

- GAP Insurance – Often required or strongly recommended to cover the difference between your loan balance and the car’s actual value

There’s no getting around it: if you own a car through financing, you need robust insurance coverage. Though it adds to your monthly expenses, most people don’t realize that this requirement protects you just as much as it protects your lender. Your loan balance doesn’t disappear if your car is totaled—without proper coverage, you could be making payments on a vehicle you can no longer drive.

I’m Geoff Stanton, President at Stanton Insurance Agency, and I’ve been helping Massachusetts and New Hampshire drivers steer car insurance requirements for financed cars since 1999. Understanding these requirements isn’t just about compliance—it’s about protecting your investment and your financial future.

Why Lenders Require More Than Basic Insurance

Here’s a reality check: when you finance a car, you don’t technically own it yet. The bank or credit union does. You’re making payments toward ownership, but until that final payment clears, the vehicle serves as collateral for your loan.

Think of it this way—your lender just handed you tens of thousands of dollars to buy a car. They’re trusting you’ll pay it back, but they’re not taking any chances. If your car gets stolen, totaled in an accident, or destroyed by a fire or flood, they want to make sure they’re not left holding the bag.

Without adequate insurance, everyone loses. You’d be stuck making payments on a car you can’t drive, and the lender would be out the money they loaned you. That’s exactly why your financing agreement spells out—in no uncertain terms—the specific types and amounts of coverage you must carry throughout the entire loan period.

This isn’t the lender being difficult. It’s just good business sense. And honestly? These car insurance requirements for financed cars protect you just as much as they protect them.

The Lender’s Stake: Protecting the Asset

Your financing paperwork makes the lender what’s called a “lienholder.” That’s a fancy legal term meaning they have a claim to your vehicle until you’ve paid off every penny you owe.

To protect that claim, lenders require you to list them on your insurance policy as a “loss payee.” This isn’t just bureaucratic red tape—it’s a critical safeguard. If your car is totaled, the insurance check won’t just be made out to you. It’ll be made out to both you and the lender, ensuring they get their money back first.

This designation guarantees that if the worst happens, the lender recoups their investment before you see a dime. It might sound harsh, but remember—they technically own more of that car than you do until the loan is paid off.

Full Coverage vs. Liability-Only

Here’s where many new car buyers get tripped up. Your state requires liability insurance—coverage that pays for damage you cause to other people and their property. But liability coverage does absolutely nothing to protect the value of your own vehicle.

That’s a problem for your lender. If you only carry the state minimum and your car gets totaled, they’re left with no way to recover their loan balance.

This is why lenders mandate what the industry calls “full coverage.” Despite the name, “full coverage” isn’t actually a specific type of insurance policy. It’s shorthand for a combination of coverages: your state-required liability plus physical damage protection for the vehicle itself—namely collision and comprehensive coverage.

I can’t tell you how many times clients have asked me, “Can I just get liability insurance on a financed car?” The answer is always no. Not only will your lender reject a liability-only policy, but dropping down to liability after you’ve financed breaks your loan agreement entirely.

If you’re curious about the differences between these coverage types and why they matter, our guide on Full Coverage vs. Liability Car Insurance breaks it all down in plain English.

Decoding “Full Coverage”: The Key Car Insurance Requirements for Financed Cars

When people talk about “full coverage,” they’re really describing a policy that bundles together three essential types of insurance: liability, collision, and comprehensive. It’s not an official insurance term, but it’s the industry shorthand for what lenders require to protect their investment in your financed vehicle.

Here’s something many people don’t realize until they see their first premium: your lender doesn’t just care that you have these coverages—they also care about your deductible. Most financing agreements specify a maximum deductible, typically no more than $500 or $1,000. This might seem like an arbitrary rule, but there’s logic behind it. A lower deductible means less out-of-pocket expense when you file a claim, which means you’re more likely to actually repair the vehicle rather than letting it sit damaged. Of course, lower deductibles come with higher premiums, but lenders want to ensure a potential claim isn’t derailed because you can’t afford a $2,000 or $3,000 deductible.

State-Mandated Minimums vs. Lender Requirements

The car insurance requirements for financed cars exist on two separate levels, and this confuses a lot of people. Your state says you need certain minimums to legally drive. Your lender says you need additional coverages to protect the car itself. Both requirements must be met simultaneously.

In Massachusetts, state law requires specific minimums for bodily injury to others, property damage, and personal injury protection. You can learn more about what is the minimum car insurance coverage in Massachusetts and review the official Basics of Auto Insurance | Mass.gov guidelines. New Hampshire operates under different rules, which we cover in detail in our article on Auto Insurance Requirements in New Hampshire.

The state requirements focus on protecting other people from your potential negligence on the road. Your lender’s requirements focus on protecting the physical asset they’ve financed. It’s a two-tiered system, and you’re responsible for satisfying both. The state minimums alone will never be enough when you’re financing a vehicle.

The Core Components: Collision and Comprehensive Coverage

These two coverages form the heart of what lenders require, and they work as a team to protect your vehicle from just about any physical damage scenario.

Collision Insurance covers damage to your vehicle when you hit something—or something hits you. This includes accidents with other cars, backing into a pole, sliding into a guardrail, or even if your car flips over. If you’re asking yourself do you need collision coverage, the answer is yes when you finance. It’s not optional. For a deeper dive into how this works, check out what is Collision Insurance and what does Collision Insurance cover.

Comprehensive Insurance handles everything else—the “other than collision” scenarios. This includes theft, vandalism, fire, falling objects, storm damage from hail or wind, and hitting an animal. Here’s an easy way to remember the difference: if you hit a deer, that’s comprehensive. If you swerve to avoid the deer and hit a tree, that’s collision. Most lenders require both coverages with reasonable deductible limits because they want complete protection for their asset.

Don’t Forget GAP Insurance

Guaranteed Auto Protection, or GAP insurance, is one of those coverages that doesn’t sound important until you need it—and then it becomes the most important coverage you have. Here’s why: a new car loses value the second you drive it off the lot. Depreciation is immediate and relentless.

If your car is totaled six months after purchase, your collision or comprehensive coverage pays out the Actual Cash Value of the vehicle at the time of the loss. But you still owe whatever remains on your loan. If you put little or nothing down, or if you rolled negative equity from a trade-in into the new loan, you could easily owe $5,000, $8,000, or even more than the insurance payout. This situation is called being “upside down” or having negative equity.

GAP insurance covers this difference, potentially saving you thousands of dollars out of pocket. Some lenders require it, and even when they don’t, it’s one of the smartest protections you can buy for a financed vehicle. We break down all the details in our guide on what is GAP insurance.

What Happens If You Don’t Comply with Insurance Requirements?

Let’s be honest: nobody wants to think about the “what ifs” when they’re enjoying their new car. But here’s the reality—breaching the insurance clause in your loan agreement isn’t like forgetting to pay a library fine. It’s a serious issue with consequences that can spiral quickly.

Your lender isn’t just sitting back hoping you’re keeping up with your insurance. They’re actively monitoring your coverage status. The moment your policy lapses or gets cancelled, they know about it. And they will take action to protect their investment.

The High Cost of Force-Placed Insurance

Picture this: your insurance lapses because you forgot to pay the bill or switched carriers and there was a gap in coverage. Within days or weeks, you’ll likely receive a notice from your lender. If you don’t remedy the situation quickly, they have the legal right to purchase insurance for the vehicle on your behalf.

This is called “force-placed” or “lender-placed” insurance, and it’s about as pleasant as it sounds. While it technically keeps you in compliance with the loan agreement, this type of policy comes with a massive catch—actually, several catches.

First, it’s extremely expensive. We’re talking often two to three times what you’d pay for coverage on your own. Second, it only protects the lender’s interest in the vehicle itself. You get no liability protection whatsoever. If you cause an accident and injure someone, you’re completely exposed. Third, the lender adds the high cost of this policy directly to your monthly loan payment, which can make your car payments suddenly unaffordable.

Imagine paying triple for insurance that doesn’t even protect you from lawsuits. That’s the reality of force-placed coverage.

The Ultimate Consequence: Default and Repossession

Here’s where things get really serious. Failing to maintain the required insurance violates your financing contract. It’s a breach of the agreement you signed when you drove off the lot. This breach can put your entire loan into default.

When a loan goes into default, your lender has options—and none of them are good for you. They could demand the full remaining balance of the loan immediately, which most people simply can’t pay. Or they could move to repossess the vehicle. Yes, they can take your car back.

Repossession doesn’t just leave you without transportation. It severely damages your credit score, sometimes dropping it by 100 points or more. This makes it incredibly difficult to secure financing in the future—not just for cars, but for homes, credit cards, or any other major purchase. You might even face higher insurance rates because of the repossession on your record.

We’ve worked with clients who found themselves in these situations, and trust us, it’s heartbreaking. The good news? It’s completely preventable. Understanding and adhering to the car insurance requirements for financed cars isn’t just about following rules—it’s about protecting yourself from financial catastrophe. A few hundred dollars in monthly premiums is a small price compared to losing your car and damaging your financial future.

Frequently Asked Questions about Insurance for Financed Cars

Can I just get liability insurance on a financed car?

No, unfortunately not. While liability insurance satisfies state law and lets you legally drive on the road, it does absolutely nothing to protect the vehicle itself. Think about it from your lender’s perspective: they’ve loaned you tens of thousands of dollars, and the car is their security. If you only have liability coverage and your car is stolen or totaled, the lender gets nothing back while you still owe the full loan amount.

Because the car is collateral for your loan, your lender will require you to carry both collision and comprehensive coverages to protect their financial interest against physical damage or theft. Skipping these coverages would be a breach of your loan agreement, leading to the serious consequences we discussed earlier—like force-placed insurance or even repossession. For more details on this common question, check out our article on Can I get liability insurance on a financed car?

How does financing a car affect my insurance premiums?

Here’s something that surprises many people: financing itself doesn’t directly increase your insurance rates. Your insurance company doesn’t charge you more simply because you have a loan on your vehicle.

However, here’s the catch: the requirement to carry full coverage—meaning collision and comprehensive along with your liability—will make your policy more expensive than a liability-only policy. Sometimes significantly more expensive. The cost of your insurance is still primarily based on factors like your driving record, the type of car you have (its make, model, safety features, and claims history), your location, and your chosen coverage limits and deductibles.

The good news? Working with an independent agency like Stanton Insurance Agency can help you find the best rates by comparing options from multiple carriers. We shop around so you don’t have to, finding you the coverage you need at a price that fits your budget.

What’s the difference in insurance requirements between leasing and financing a car?

The car insurance requirements for financed cars and leased cars are remarkably similar. In both cases, you are not the outright owner. With a lease, the leasing company (called the lessor) owns the vehicle. With financing, the finance company (the lienholder) has a legal claim to it. Either way, they’re going to require you to carry full coverage to protect their asset.

This includes collision and comprehensive insurance as a baseline. Some leasing companies may even require higher liability limits than the state minimums—sometimes $100,000/$300,000 or even $250,000/$500,000 in bodily injury coverage. They might also require specific additional coverages like a depreciation waiver or lower deductible limits.

Always review your lease or finance agreement carefully for the specific requirements. These contracts are legally binding, and the insurance requirements will be spelled out clearly in the fine print. When in doubt, give us a call at Stanton Insurance Agency, and we can help you decode exactly what your agreement requires.

What are the implications of an accident involving a financed car?

If you’re in an accident with a financed car, the claims process is similar to any other accident, but with one key difference: your lender (as the loss payee) has a direct interest in the claim outcome.

If your car is repairable, the insurance payout will often go to you and the repair shop, or directly to the repair shop to cover the repairs. You’ll pay your deductible, and life goes on. But if your car is totaled, things get more complicated. The insurance company will issue a check that is co-payable to both you and the lender. The lender will then take their portion to cover the outstanding loan balance, and any remainder—if the payout exceeds what you owe—goes to you.

Here’s where things can get tricky: if you owe more on the loan than the car’s actual cash value (which is very common in the first few years of ownership), you’ll be responsible for paying that difference out of pocket. This is exactly where GAP insurance becomes crucial. It covers that gap between what insurance pays and what you still owe, potentially saving you thousands of dollars at the worst possible time.

Conclusion

Understanding the car insurance requirements for financed cars isn’t just about checking boxes on your loan agreement—it’s about protecting yourself from financial disaster. When you maintain the right combination of liability, collision, comprehensive, and GAP coverage, you’re building a safety net that protects both your lender’s investment and your own financial future.

Think about it this way: you’ve just made one of the biggest purchases of your life. The last thing you want is to find yourself making payments on a car that’s sitting in a junkyard or has been stolen. That’s not a hypothetical scenario—it happens more often than you’d think, and without proper coverage, it can be financially devastating.

The requirements might seem strict, but they’re actually designed to protect you. Your lender wants to ensure their investment is safe, yes, but these same coverages prevent you from being stuck with thousands of dollars in debt for a vehicle you can no longer drive. That’s not a burden—that’s peace of mind.

Here at Stanton Insurance Agency, we’ve been helping Massachusetts and New Hampshire drivers steer these requirements since 1999. We know that insurance can feel complicated, especially when you’re already juggling car payments, maintenance costs, and all the other expenses that come with vehicle ownership. That’s why we’re here—to make it simple and ensure you have the protection you need without paying for coverage you don’t.

Whether you’re buying your first financed car or refinancing an existing loan, we can help you find the right policy that meets your lender’s requirements while fitting your budget. Our team takes the time to compare options from multiple carriers, so you get trusted protection at a price that works for you.

Ready to explore your options? Check out our Car Insurance in MA page or get a free quote for Auto Insurance in New Hampshire. Drive with confidence, knowing you’re fully covered and compliant—and that you have a local agency in your corner if you ever need to file a claim or have questions.