Car insurance quotes monthly: Best 4 Ways to Save

Why Understanding Monthly Car Insurance Quotes Matters

Car insurance quotes monthly are essential for drivers looking to compare coverage options and find the best value for their protection needs. Here’s what you need to know:

Key Facts About Monthly Car Insurance Quotes:

- Quote Variation: Rates can differ by hundreds of dollars per year between companies for identical coverage.

- Potential Savings: Comparing quotes can save you up to 30% or more annually.

- Best Strategy: Get quotes from at least 3-5 different insurers to ensure competitive pricing.

If you’re among the 45% of drivers who suspect they’re overpaying for car insurance, you’re not alone. The good news? Shopping around for monthly car insurance quotes is one of the simplest ways to cut costs without sacrificing the protection you need.

Your monthly premium isn’t a fixed number handed down from the insurance gods. It’s a calculation based on dozens of factors—some you can control, others you can’t. Where you live, what you drive, your age, your driving history, and in some states, your credit score, all play a role. A 20-year-old driver might pay more than double what a 40-year-old with a clean record pays for the same full coverage policy. Understanding these variables puts you in the driver’s seat when it to finding affordable coverage.

The reality is that insurance companies compete for your business, and their rates for the exact same coverage can vary wildly. One carrier might charge you $150/month while another offers identical protection for $100/month. The only way to know if you’re getting a fair deal is to compare multiple quotes—and that’s exactly what this guide will help you do.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping drivers in Massachusetts and New Hampshire steer car insurance quotes monthly and find coverage that fits their budget and needs. As a Certified Insurance Counselor and 4th generation owner of our agency, I’ve seen how a few minutes of comparison shopping can save families hundreds of dollars a year.

What Determines Your Monthly Car Insurance Cost?

The price you’re quoted for monthly car insurance isn’t arbitrary. Insurers use a complex algorithm to assess your risk profile, weighing dozens of data points. While some factors are beyond your control, understanding all of them empowers you to make smarter decisions. While costs vary widely, your personal rate will be unique.

Coverage Levels: Liability vs. Full Coverage

The single biggest choice you’ll make is your coverage level. State-minimum liability is the cheapest option, but it only covers damages you cause to others. Full coverage, which includes collision and comprehensive, protects your own vehicle.

- Liability-Only: This is the most basic coverage required by law. For example, in Massachusetts, the minimum includes limits like $20,000/$40,000 for bodily injury and $8,000 in Personal Injury Protection (PIP). New Hampshire’s minimums are different, such as $25,000/$50,000 for bodily injury. While these policies are the most affordable, they only cover damages you cause to others and won’t pay for your own car’s repairs in an at-fault accident. We advise our clients in both states to carefully consider if minimum liability is truly enough to protect their assets.

- Full Coverage: This includes liability plus collision (covers your car in an accident) and comprehensive (covers theft, vandalism, weather damage). It’s often required for financed or leased vehicles, as lenders want to protect their investment. While it costs more than a liability-only policy, it provides crucial protection for your vehicle. For more detailed information on various car insurance costs, you can explore our resources on car insurance costs.

Key Personal Factors That Influence Your Rate

Insurers look at your personal details to predict the likelihood of you filing a claim. This is why quotes can vary so much from person to person. Understanding these factors can help you make informed decisions about your coverage.

- Location (ZIP Code): Where you live matters significantly. Densely populated urban areas in Massachusetts like Boston or Worcester, or busy parts of New Hampshire, often have higher premiums than more rural towns. Why? More traffic means a higher chance of accidents, and urban areas typically see higher rates of theft and vandalism.

- Age and Gender: Statistics show that younger, less experienced drivers are involved in more accidents. For instance, a 20-year-old driver can expect to pay significantly more for full coverage than a 40-year-old. As drivers gain experience and maturity, their rates tend to decrease. Gender also plays a role in many states, as male drivers are statistically involved in more fatal crashes, according to the Insurance Institute for Highway Safety. However, some states have moved to ban gender as a rating factor.

- Credit Score: In many states, including New Hampshire, insurers use a credit-based insurance score as a key rating factor. A better credit history often suggests financial responsibility, which can translate to lower rates. Important Note: The use of credit scores for setting auto insurance rates is banned in Massachusetts. This means your credit score won’t impact your car insurance premium if you live in the Bay State, but it’s a consideration for our New Hampshire clients.

- Vehicle Type: The car you drive impacts your rate. A luxury sports car will be more expensive to insure than a standard sedan due to higher values, more expensive parts, and increased theft risk. Conversely, cars with high safety ratings or anti-theft devices might qualify for discounts, helping to offset some costs.

How to Lower Your Monthly Car Insurance Payments

Finding affordable car insurance quotes monthly is about more than just picking the lowest number. It’s about finding the best value. By taking a few proactive steps, you can significantly reduce your premium while maintaining the protection you need. We believe in empowering our clients to make smart choices.

Smart Strategies for Immediate Savings

You have more control over your monthly premium than you might think. Here are proven ways to lower your costs:

- Shop Around and Compare Quotes: This is the single most effective way to save. Rates for the exact same coverage can vary by hundreds of dollars between companies. Don’t just renew your policy automatically—take a few minutes to see what other options are available. We often find that our clients are surprised by the savings they uncover just by getting a few comparison quotes.

- Ask for Discounts: Insurers offer a wide range of discounts. It’s like finding hidden treasure! Common ones include good student, safe driver, multi-policy (bundling your home insurance or renters insurance with your auto policy), and discounts for vehicle safety features like anti-lock brakes or airbags. Don’t be shy; ask about every discount you might qualify for. You might even find discounts for paying your premium in full or enrolling in automatic payments.

- Increase Your Deductible: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. Raising it from $500 to $1,000 can lower your monthly premium for collision and comprehensive coverage. Just be sure you can comfortably afford the higher amount in case of a claim. It’s a trade-off: lower monthly payments now, but a higher out-of-pocket expense if something happens.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is a long-term strategy for keeping your rates low. In Massachusetts, for example, your driving record directly impacts your premium through the Safe Driver Insurance Plan (SDIP), where good drivers earn credits and at-fault accidents or violations add surcharges. A single at-fault accident can increase your annual premium significantly in both states, so safe driving truly pays off.

The Impact of Driving History on Your Monthly Car Insurance Quotes

Your record on the road is a direct reflection of your risk. A clean record is your ticket to the lowest rates, while violations can cause a significant spike. Insurers in both Massachusetts and New Hampshire closely examine your driving history.

- Clean Record: Drivers with no recent accidents or tickets receive the best rates. This demonstrates to insurers that you are a responsible driver, and they reward that with lower premiums. Keep up the good work!

- At-Fault Accident: Expect a major increase. A single at-fault crash can cause your rates to jump substantially. Even a minor fender bender where you’re deemed at fault can impact your rates for several years.

- Speeding Ticket: While less severe than an accident, a speeding ticket will still raise your rates. It indicates a higher propensity for risky driving behavior, even if it didn’t result in a collision. The more tickets you accumulate, the more significant the impact on your monthly car insurance quotes.

- DUI: A DUI is one of the most serious infractions and can cause your premium to double or even triple. Insurers view a DUI as a major red flag, making it one of the most expensive mistakes you can make on the road, both legally and financially. If you find yourself in this situation, we can still help you explore your options.

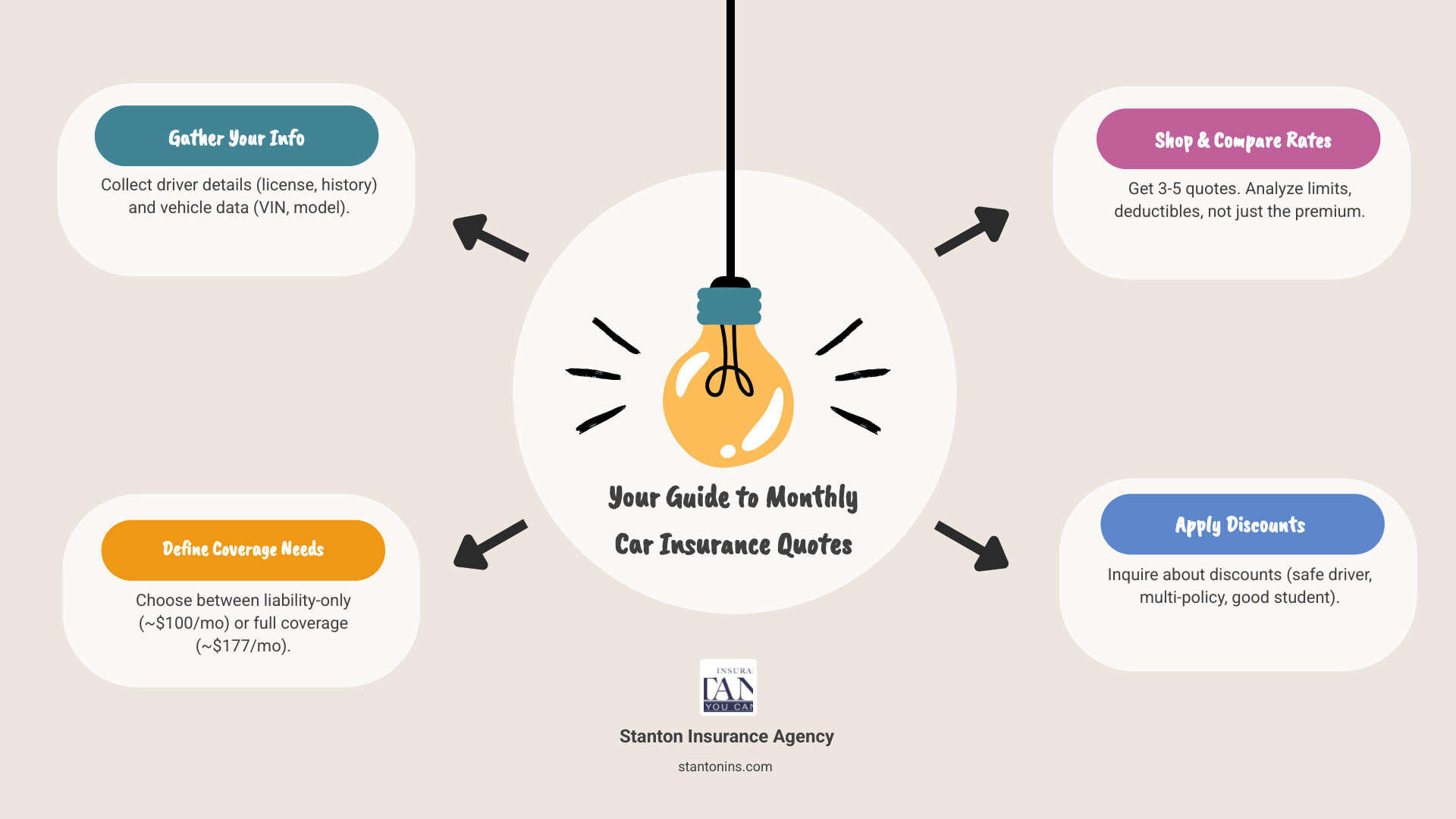

The Process of Getting Car Insurance Quotes Monthly

Getting quotes is a straightforward process. Being prepared with the right information will make it quick and easy, allowing you to accurately compare your options and find the best policy. We’re here to guide you every step of the way.

Information You’ll Need to Get Started

To get an accurate quote, you’ll need to provide some basic information about the drivers and vehicles you want to insure. Having this ready before you start will streamline the process.

- Driver Information: Full name, date of birth, and driver’s license number for everyone on the policy. This helps insurers assess experience and driving history.

- Vehicle Information: The year, make, model, and Vehicle Identification Number (VIN) for each car. This allows them to evaluate the car’s value, safety features, and repair costs.

- Driving History: A record of any accidents, claims, or violations. Be honest here, as insurers will verify this. The lookback period varies; for instance, Massachusetts’ surcharge system can look back up to six years for incidents, while New Hampshire insurers typically focus on the last three to five years.

- Current Policy: Your current coverage limits and premium (if you have one) for a direct comparison. This helps us ensure you’re getting comparable coverage at a better price.

How to Get the Best Car Insurance Quotes Monthly

Once you have your information, you can start shopping. The goal is to compare apples-to-apples coverage to see which insurer offers the best price for your specific needs. This is where we shine as your independent agency.

- Determine Your Coverage Needs: Before you even look at prices, decide what level of protection you require. Do you need basic liability, or does your new car or financial situation warrant full coverage? Consider adding higher liability limits or other protections like umbrella insurance for greater financial security, especially if you have significant assets to protect.

- Use a Comparison Tool or Contact an Agent: Online tools can provide multiple quotes at once, which is convenient. Alternatively, working with an independent insurance agent like us gives you access to expert advice and quotes from several carriers we represent. We do the legwork for you, comparing options from various providers to find the best fit for your unique situation in Massachusetts or New Hampshire.

- Analyze Your Quotes: Don’t just look at the price. Compare the coverage limits, deductibles, and any included perks or exclusions. A slightly more expensive policy might offer significantly better protection or superior customer service. For a deeper dive into what determines insurance prices, the Insurance Information Institute provides excellent resources that can further enlighten you. We’re here to help you understand the fine print.

Frequently Asked Questions about Monthly Car Insurance

We often get these questions from our clients in Massachusetts and New Hampshire. We hope these answers help clarify common concerns about car insurance quotes monthly.

How much should I be paying for car insurance per month?

There’s no single answer, as your cost is highly personalized. A 40-year-old with a clean record in a rural New Hampshire town might pay around $120/month for full coverage, while a 20-year-old driver in Boston could see quotes exceeding $300/month for the same policy. Your specific location, driving record, vehicle, and coverage choices are the biggest factors. The only way to know if you’re paying a fair price is to compare quotes from multiple insurers.

Is it cheaper to pay for car insurance monthly or annually?

Paying your entire premium for six or twelve months upfront is almost always cheaper. Most insurance companies add a small service or installment fee to each monthly payment. These fees can add up over the year. If your budget allows, paying in full can save you money over the policy term. Think of it as a small “thank you” from the insurance company for making their billing process easier!

Can I get car insurance with no down payment?

In both Massachusetts and New Hampshire, policies require the first month’s premium to be paid to activate coverage. This initial payment is what is often meant by a “down payment.” While some carriers may advertise “no down payment,” you will almost always need to pay for at least the first month to start your policy. It’s rare to get a policy started without any upfront cost, as insurers need to cover their immediate risk. We can help clarify the specific initial payment options available from different carriers.

Find Your Best Rate Today

Securing an affordable monthly car insurance quote is about being an informed consumer. By understanding the factors that shape your premium, actively seeking discounts, and consistently comparing your options, you can ensure you’re not overpaying for the vital protection you need on the road. The right policy is a balance of cost and coverage, custom to your life.

As a local independent agency serving Massachusetts and New Hampshire, Stanton Insurance Agency is dedicated to helping you steer this process. We work with multiple top-rated carriers to find you the best coverage at the most competitive price. Let us do the comparison shopping for you, so you can spend less time worrying about insurance and more time enjoying the open road. Our mission is to exceed your expectations and provide you with trusted protection for your valuable assets.

Contact us today to get a personalized quote and see how much you can save on your car insurance!