Car insurance liability limits: 1 Essential Guide

Why Car Insurance Liability Limits Matter More Than You Think

Car insurance liability limits are the maximum amounts your insurer pays when you cause an accident that injures others or damages their property. Understanding these limits is critical, as they define your financial protection and what you might owe out of pocket.

Quick Answer: Understanding Car Insurance Liability Limits

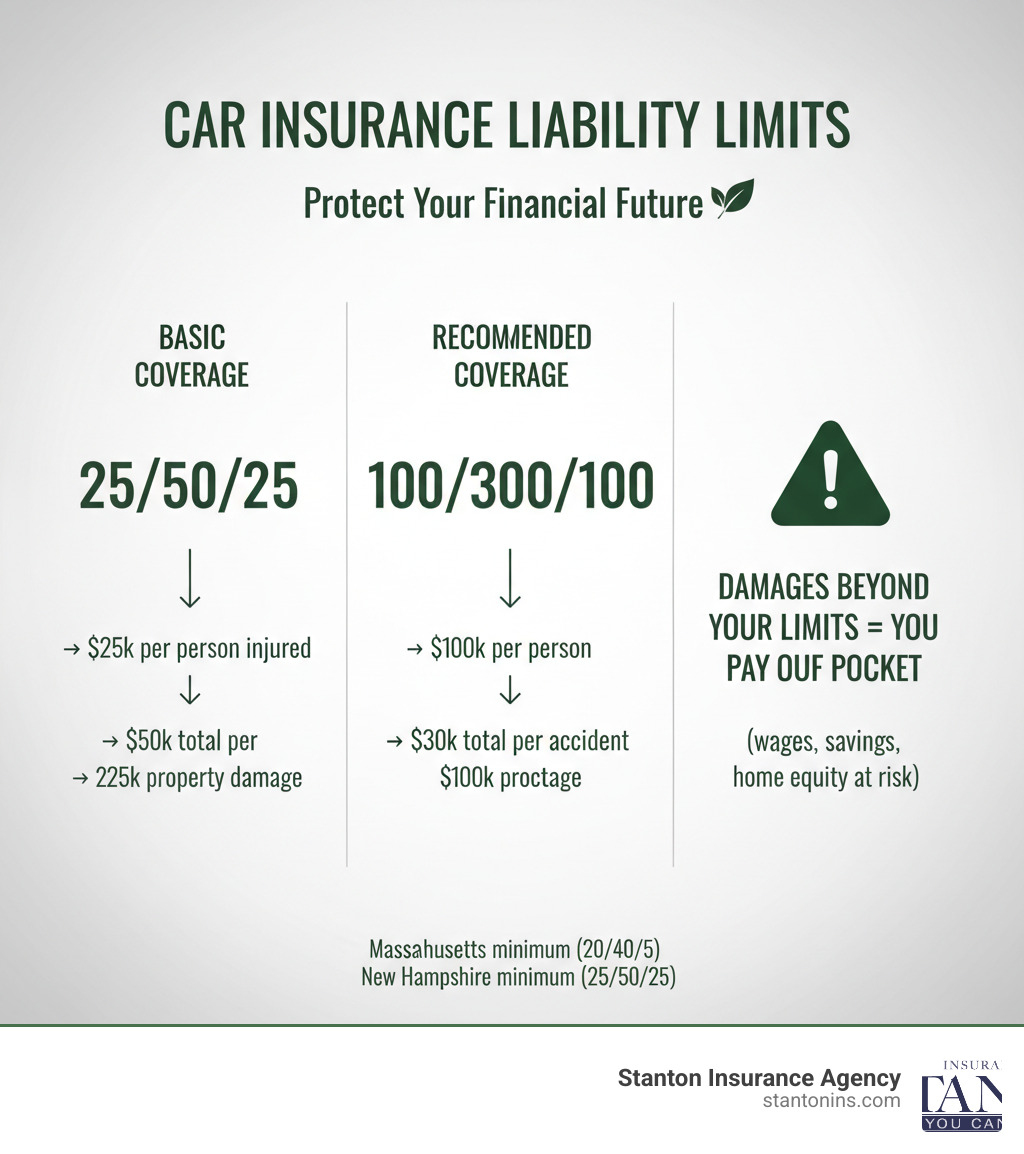

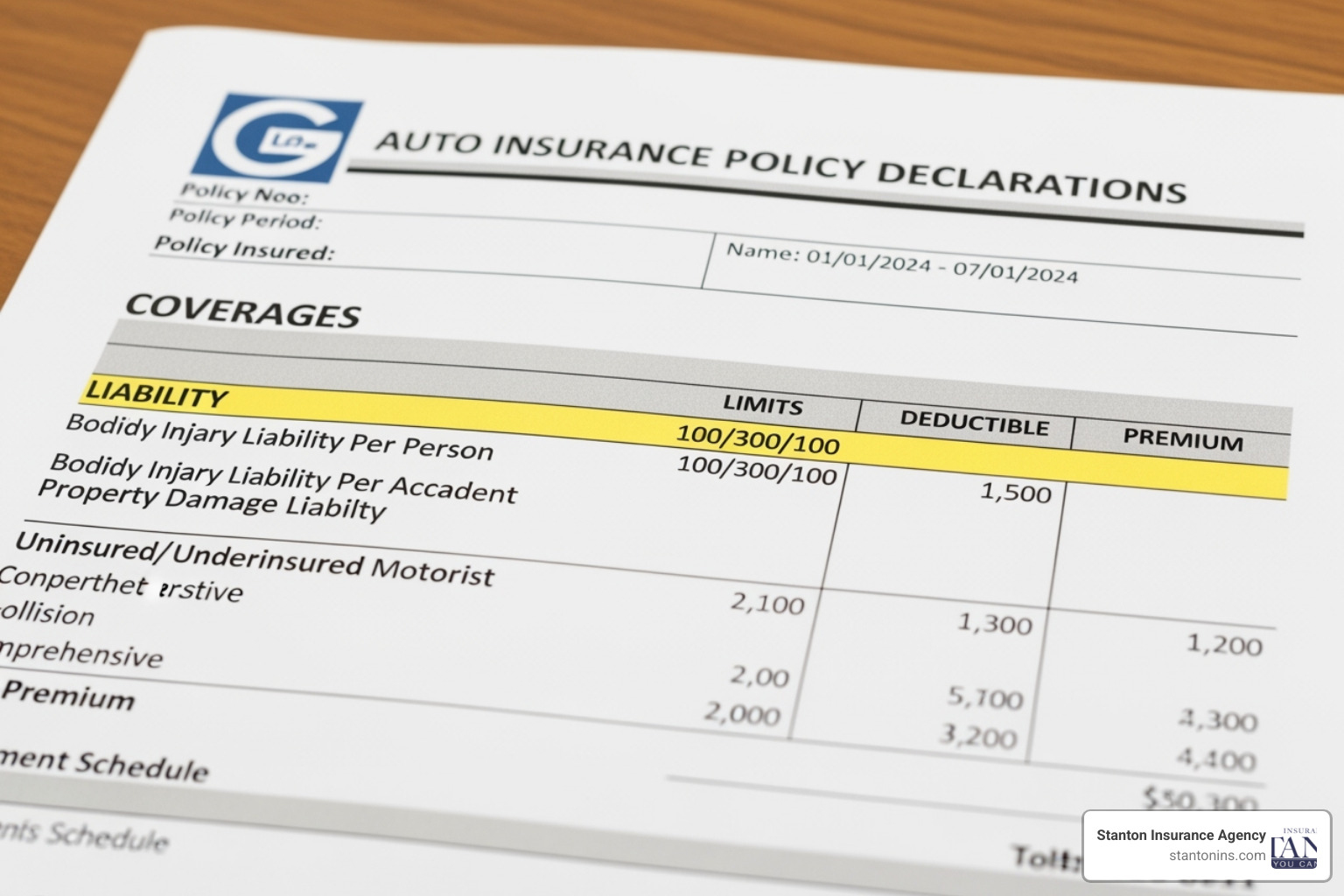

- Format: Three numbers (e.g., 25/50/25 or 100/300/100)

- First Number: Maximum paid per person for bodily injuries.

- Second Number: Total maximum for all bodily injuries per accident.

- Third Number: Maximum for property damage per accident.

- State Minimums: MA requires 20/40/5; NH requires 25/50/25 (if you buy insurance).

- Expert Recommendation: 100/300/100 is a recommended starting point for adequate protection.

If accident costs exceed your liability limits, you are personally responsible for the difference. The injured party can sue you, potentially seizing your savings, home equity, and future wages. Many drivers only carry state minimums, which are often outdated and insufficient for today’s medical and vehicle costs.

For example, a common state minimum for bodily injury is $25,000 per person—an amount a single ER visit can surpass. If you total a $50,000 SUV with Massachusetts’ $5,000 minimum property damage coverage, you’d owe $45,000 out of pocket. These scenarios are common.

I’m Geoff Stanton, President of Stanton Insurance Agency. For over two decades, I’ve helped clients in Waltham, Massachusetts, and beyond choose liability limits that protect their financial futures. As a fourth-generation insurance professional and Certified Insurance Counselor, I’ve seen how the right limits prevent financial devastation.

What is Car Insurance Liability Coverage?

Liability car insurance is your financial protection when you’re at fault in an accident. It covers the other party’s medical bills, lost wages, and property damage, which can quickly escalate into tens or hundreds of thousands of dollars.

Liability coverage is unique because it never pays for your own injuries or vehicle damage. It exists only to cover claims made by others. Your car insurance liability limits are the maximum your insurer will pay on your behalf; anything beyond that comes from your pocket.

Liability coverage is split into two distinct components, each serving a specific purpose.

Bodily Injury Liability (BI)

Bodily injury liability coverage applies when you injure someone in an accident you caused. It covers medical expenses, from ER visits to long-term rehabilitation, and pays for the injured person’s lost wages. If you’re sued, this coverage also pays for your legal defense costs and any settlements or judgments, including pain and suffering. For example, if you cause an accident where the other driver’s medical bills and lost wages total $100,000, you would be personally responsible for any amount exceeding your coverage limits.

Property Damage Liability (PD)

Property damage liability coverage pays for the repair or replacement of property you damage in an at-fault accident. This commonly means the other driver’s vehicle, but also extends to a fence, mailbox, storefront window, or telephone pole. This coverage has a single limit per accident. For instance, if you cause $20,500 in damage but only have Massachusetts’ minimum $5,000 limit, you’d owe $15,500 out of pocket. That’s a harsh lesson that could have been avoided with higher limits.

Decoding Your Liability Limits: What the Numbers Mean

Your policy’s car insurance liability limits, often shown as “25/50/25” or “100/300/100,” are essential to understand. They define how much protection you have and where your personal financial risk begins. These numbers use a “split limit” format, where each number is the maximum your insurer will pay for a specific type of damage in one at-fault accident.

Let’s break down what each number means using a 25/50/25 policy as an example.

The first number is your bodily injury liability limit per person. In a 25/50/25 policy, this is $25,000. It’s the maximum your insurer will pay for one person’s injuries. If their medical bills and other costs total $75,000, your insurance pays $25,000, and you’re personally responsible for the remaining $50,000.

The second number is your bodily injury liability limit per accident. This is the total maximum for all injuries in a single accident. In our 25/50/25 example, that’s $50,000. If you injure three people with combined medical costs of $100,000, your policy pays a maximum of $50,000, leaving you to cover the rest. This limit is also subject to the per-person cap.

The third number is your property damage liability limit per accident. For a 25/50/25 policy, this is $25,000. This covers all property you damage in one accident. If you total a $40,000 SUV, your policy pays $25,000, and you owe the remaining $15,000.

Many state minimums are dangerously outdated. With the average new car costing over $48,000 and a single ER visit easily exceeding $25,000, these low limits are insufficient. That’s why experts and the Insurance Information Institute recommend much higher limits, such as 100/300/100, for adequate protection.

Are State Minimum Car Insurance Liability Limits Enough?

State minimum car insurance liability limits are almost never enough to truly protect you. These legal requirements are often decades old and fail to cover today’s high medical, vehicle, and repair costs. Meeting the state minimum keeps you legal, but it won’t keep you financially safe in a serious accident.

Understanding Minimum Car Insurance Liability Limits in MA and NH

The legal requirements for car insurance liability limits vary between Massachusetts and New Hampshire.

In Massachusetts, you’re required to carry at least 20/40/5. This means $20,000 for bodily injury per person, $40,000 per accident, and just $5,000 for property damage. This property damage minimum is one of the lowest in the country, which is alarming when the average new car costs over $48,000. For complete details, review the Basics of Auto Insurance from Mass.gov.

New Hampshire doesn’t legally require you to buy insurance to register a vehicle. However, if you purchase New Hampshire car insurance, the minimum limits are 25/50/25. If you opt out of insurance, you must still prove you have sufficient funds to meet these requirements after an at-fault accident. Failure to do so results in severe penalties, including license and registration suspension.

The Risk of Carrying Only Minimum Coverage

Let’s illustrate how quickly minimum coverage falls short. Imagine you rear-end a new SUV, causing $45,000 in damage, and the two occupants require medical care totaling $35,000. With Massachusetts’ minimum 20/40/5 coverage, your policy would pay only $5,000 for the vehicle, leaving you to pay the remaining $40,000. While the $35,000 in medical bills would be covered by your $40,000 per-accident limit, what if one person needed surgery? Costs could easily double, exposing you to a lawsuit that puts your home, savings, and future earnings at risk.

Medical costs add up quickly. An ambulance ride can cost over $1,200, an overnight hospital stay averages $2,600, and surgery can exceed $50,000. A $20,000 or $25,000 per-person limit is often exhausted by the initial treatment alone.

When bills exceed your car insurance liability limits, you are personally responsible for the difference. The injured party can sue you, and a court judgment can lead to the seizure of your assets—savings, investments, and home equity. Your future wages can also be garnished, leading to a devastating financial hit that can take decades to overcome.

This risk is real. According to the Insurance Research Council, the rate of uninsured drivers is over 9% in New Hampshire and around 4% in Massachusetts, increasing the chances of an accident with inadequate coverage. Fortunately, many drivers are making smarter choices: over half now choose liability limits higher than their state requires. They understand that state minimums are just a legal baseline, not comprehensive protection. Choosing Massachusetts car insurance limits that match your financial situation is one of the most important decisions you can make as a driver.

How to Choose the Right Car Insurance Liability Limits

Choosing the right car insurance liability limits is about protecting your financial future. Inadequate coverage can put your home, savings, and other assets at risk after a single serious accident. The goal is to select limits that create a safety net to keep your personal assets secure.

Assess Your Net Worth

A good rule of thumb is to carry enough liability coverage to match or exceed your total net worth. To calculate your net worth, add up your assets (home equity, savings, investments) and subtract your debts (mortgage, loans). This ensures your insurance policy, not your personal assets, covers a large lawsuit. For most families in Massachusetts and New Hampshire, the expert-recommended limits of 100/300/100 are an excellent starting point. As the Insurance Information Institute suggests, these limits provide significantly more protection than state minimums. Our guide on how much liability insurance do I need for my car? can help you assess your specific needs.

Consider Lender and Leasing Requirements

If you are financing or leasing your vehicle, your lender has a financial stake and will require higher coverage limits than the state minimum. Your agreement will almost certainly mandate full coverage vs liability car insurance, which includes collision and comprehensive coverage. If you let this coverage lapse, your lender can purchase expensive force-placed insurance and add the cost to your loan, which should be avoided.

What Factors Influence the Cost of Car Insurance Liability Limits?

The cost of liability car insurance depends on your driving history, age, location, vehicle, and chosen limits. The good news is that increasing your liability limits is often surprisingly affordable. Upgrading from state minimums to the recommended 100/300/100 provides dramatically more protection for a modest increase in your premium. Considering what’s at stake, the small additional investment is a wise choice. Increasing your limits after purchase is simple, and we can help adjust your coverage as your needs change.

Advanced Liability Concepts and Related Coverages

As your assets grow, it’s worth exploring advanced options to improve your protection.

Combined Single Limit (CSL)

Instead of split limits like 100/300/100, a Combined Single Limit (CSL) policy offers one large amount—for example, $300,000—that can be used flexibly for bodily injuries and property damage in a single accident. This avoids the per-person or property damage caps of a split-limit policy. If one person is seriously injured, more of the total limit can be applied to their medical bills. A CSL policy offers simpler, more comprehensive car insurance liability limits for those with significant assets.

Umbrella Insurance

A personal umbrella policy provides an extra layer of liability insurance that activates after your auto or homeowners policy limits are exhausted. For example, if you cause an accident with $500,000 in damages and your auto limit is $300,000, an umbrella policy would cover the remaining $200,000. Umbrella policies are remarkably affordable, offering $1 million or more in extra coverage for a modest premium. If your net worth exceeds $500,000, an umbrella policy is strongly recommended. We offer comprehensive umbrella insurance to give you this extra layer of security.

How Liability Differs from Other Coverages

It’s crucial to know what liability doesn’t cover: your own car repairs or medical bills. For that, you need other coverages:

- Collision coverage: Pays for damage to your car from a collision, regardless of fault.

- Comprehensive coverage: Pays for non-collision damage from events like theft, fire, hail, or hitting an animal.

- Uninsured/Underinsured Motorist (UM/UIM): This vital coverage pays for your injuries and damages if you’re hit by a driver with no insurance or not enough. Do you need uninsured motorist coverage? Yes. With uninsured driver rates over 9% in New Hampshire and around 4% in Massachusetts, this protects you from their lack of coverage.

Frequently Asked Questions about Car Insurance Liability Limits

We hear these questions regularly from our clients here in Massachusetts and New Hampshire. Let’s address the most common concerns about car insurance liability limits:

What happens if the damages from an accident exceed my liability coverage limits?

If damages from an at-fault accident exceed your car insurance liability limits, you are personally responsible for the difference. The injured party can sue you, and a court judgment can lead to the seizure of your personal assets (savings, investments, home equity) and garnishment of your future wages. This is why choosing adequate limits is critical to protecting your financial well-being.

Does liability insurance cover rental cars?

Yes, your personal auto policy’s liability coverage typically extends to rental cars for personal use, covering damages you cause to others. However, it does not cover damage to the rental car itself. For that, you need collision and comprehensive coverage on your own policy to extend to the rental, or you must purchase a loss damage waiver (LDW) from the rental company. Always check your policy or call us before renting to confirm your coverage.

Can I have liability-only insurance on a financed car?

No. Lenders and leasing companies require you to protect their financial investment in the vehicle. They mandate that you carry “full coverage,” which includes collision and comprehensive in addition to liability, until the loan is paid off. If you drop these coverages, the lender can buy expensive “force-placed” insurance and add the cost to your loan. To learn more, see our guide on full coverage vs liability car insurance.

Protect Your Future with the Right Liability Coverage

Choosing the right car insurance liability limits is a critical financial decision. State minimums keep you legal but rarely protect your assets—like your home, savings, and retirement accounts—from a serious accident. A minor incident can become a major financial burden due to high medical bills or damage to an expensive vehicle.

The good news is that increasing your protection is affordable and straightforward. By assessing your net worth and choosing higher limits like 100/300/100, or adding an umbrella policy, you create a true safety net. The small monthly cost to increase coverage is a wise investment that can prevent a financial catastrophe.

For over 100 years, our fourth-generation family business at Stanton Insurance Agency has helped Massachusetts and New Hampshire families make these important decisions. We understand it’s about protecting your future and peace of mind.

Ready to ensure you have the right protection? Let’s discuss your needs and build a policy that acts as a true safety net. Explore our auto liability insurance options or give us a call today.