Car Insurance Liability: Simple 2025 Guide

Your Guide to Car Insurance Liability

Car insurance can feel like a maze, but one concept is essential: car insurance liability. Think of it as your financial shield. If you cause an accident, you are legally “liable”—or responsible—for the costs. This coverage steps in to pay for the other person’s injuries and property damage, protecting your savings and assets from being drained by a lawsuit. It’s the foundational piece of any auto policy and, in nearly every state, it’s the law. This guide will break down everything you need to know, without the jargon.

I’m Geoff Stanton, President at Stanton Insurance. Having started in the claims department in 1999 and now a fourth-generation owner, I’ve seen how crucial understanding car insurance liability is for protecting our clients’ homes, cars, and other valuables.

Car insurance liability terms made easy:

What Liability Insurance Actually Covers (And What It Doesn’t)

Auto Liability Insurance isn’t one single coverage; it’s split into two key parts that protect you when an accident is your fault. Understanding these is key to grasping how your policy protects you.

Bodily Injury Liability (BI): Covering People

Bodily Injury Liability (BI) covers costs when you cause injury or death to another person in an accident. It pays for their medical bills, lost wages, pain and suffering, and in tragic cases, funeral expenses. Crucially, it also covers your legal defense fees if you are sued.

For example, if you cause a minor accident and the other driver and their passenger need to see a doctor, your BI liability would cover their medical visits and any related legal claims, so you aren’t left with a massive bill.

Learn more: Bodily Injury Liability

Property Damage Liability (PD): Covering Stuff

Property Damage Liability (PD) pays for damage you cause to someone else’s property. This most often means the other driver’s car, but it also covers things like buildings, fences, mailboxes, or guardrails. It can even cover the cost of a rental car for the other driver while their vehicle is being repaired.

For instance, if you rear-end a car and also knock over a mailbox, your PD liability would cover the repairs for both the vehicle and the mailbox, ensuring the other party’s property is fixed without cost to you.

Learn more: Property Damage Liability

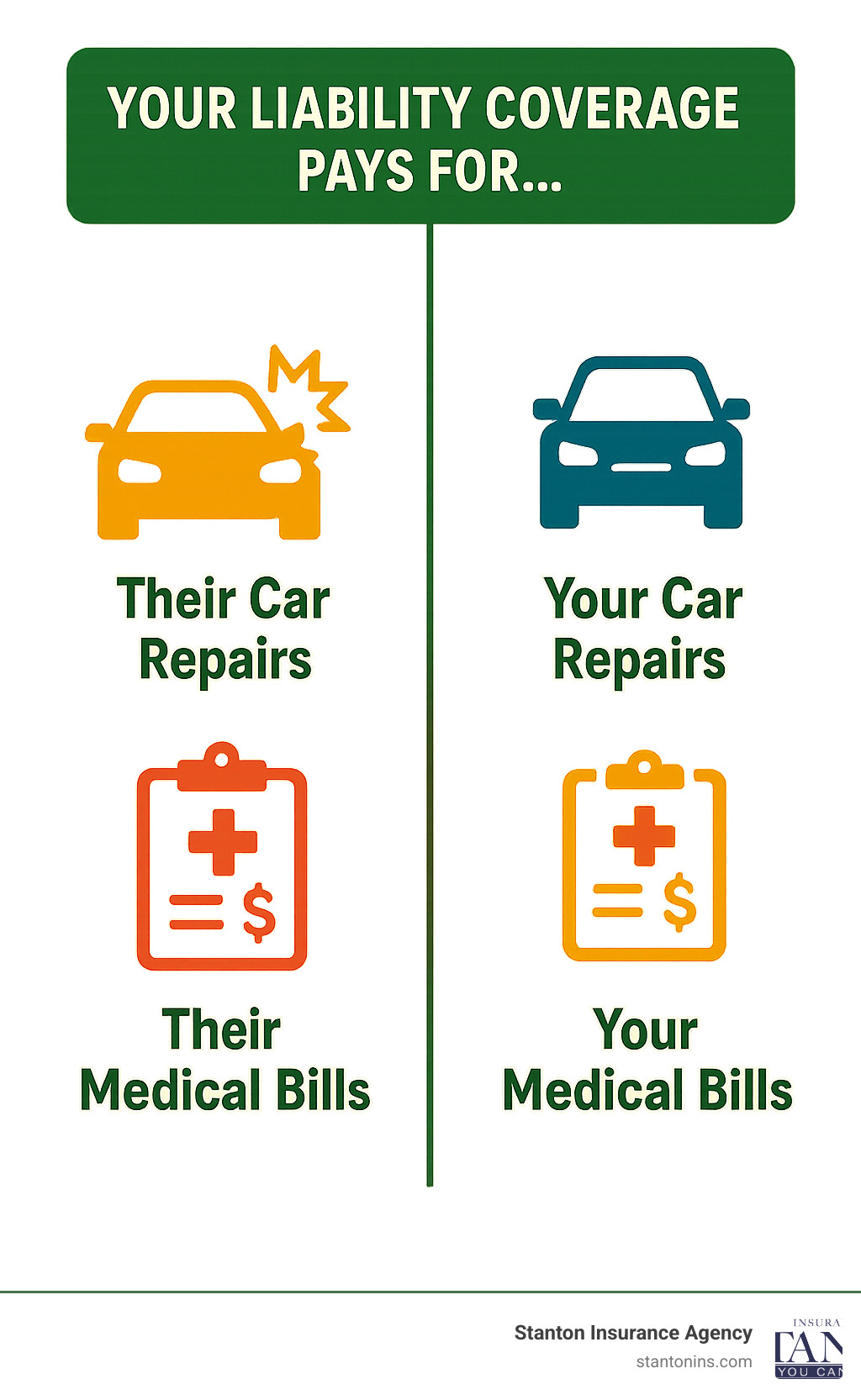

What Car Insurance Liability Does NOT Cover

A crucial point: car insurance liability never pays for your own car or your own injuries if you cause the accident. Your liability coverage is strictly for the other party. To protect yourself and your vehicle, you need other coverages.

Here’s what car insurance liability does not cover:

- Your own car’s damage: For this, you need Collision coverage.

- Your own medical bills: These are covered by your health insurance or optional auto coverages like Personal Injury Protection (PIP) or Medical Payments (MedPay).

- Damage from a hit-and-run: You’d need Collision or Uninsured Motorist Property Damage coverage.

- Theft, vandalism, or weather damage: This is covered by Comprehensive coverage.

- Damage to a rental car you’re driving: Your liability covers the other car, but you’ll need to check if your policy’s collision coverage extends to rentals or purchase a waiver from the rental company.

Find out more: Does Liability Insurance Cover My Car If I Hit Someone?

Understanding Your Liability Limits: Decoding the Numbers

When you get a car insurance quote, you’ll see three numbers like 25/50/25. This isn’t a secret code; it’s a simple formula defining the maximum amount your insurer will pay if you’re at fault in an accident. These are your car insurance liability limits.

Here’s what each number in this “split limits” format means:

- First Number: Bodily Injury (BI) per Person. The maximum your policy will pay for injuries to one individual in an accident you cause (e.g., $25,000).

- Second Number: Bodily Injury (BI) per Accident. The total maximum your policy will pay for injuries to all people combined in a single accident (e.g., $50,000).

- Third Number: Property Damage (PD) per Accident. The maximum your policy will pay for all property damage you cause in one accident (e.g., $25,000).

Let’s use an example with 25/50/25 limits. You cause an accident injuring two people and totaling another car.

- Injuries: Person A has $20,000 in medical bills, and Person B has $35,000. Your policy pays $20,000 for Person A and hits its $25,000 per-person limit for Person B. You are personally responsible for Person B’s remaining $10,000.

- Property Damage: The other car costs $30,000 to replace. Your policy pays its $25,000 limit, leaving you to pay the remaining $5,000.

In this one accident, you’d be out-of-pocket for $15,000 because the damages exceeded your limits.

Some insurers offer a “combined single limit” (CSL), which is one lump sum (e.g., $300,000) that covers both bodily injury and property damage, offering more flexibility.

What Happens If Damages Exceed Your Limits?

If the costs of an accident are higher than your car insurance liability limits, you are personally responsible for paying the difference. This is a very real financial threat, as medical bills and vehicle replacement costs can be extremely high.

If your policy limits are exhausted, the other party can sue you to recover the remaining damages. This could lead to:

- Wage Garnishment: A court could order a portion of your wages to be taken to pay the debt.

- Asset Seizure: Your savings, investments, or other personal property could be taken.

- Liens on Property: A lien could be placed on your home, preventing you from selling it without first paying the debt.

This is why choosing limits higher than the state minimum is crucial. Your car insurance liability coverage is designed to protect your financial future.

How Much Liability Coverage Do You Really Need?

Choosing the right amount of car insurance liability coverage is a balance between what the law requires and what’s smart for your financial security.

State-Mandated Minimums in MA and NH

Is car insurance liability required by law? Yes, in almost every state. These minimums ensure drivers can take at least some financial responsibility for an accident. Here’s what’s required in our area:

-

Massachusetts: As a “no-fault” state, your own policy helps cover your initial medical bills regardless of fault. However, you are still liable for damages you cause to others. MA requires minimum car insurance liability limits of 20/40/5:

- $20,000 for bodily injury per person.

- $40,000 for bodily injury per accident.

- $5,000 for property damage per accident.

You can learn more about Massachusetts minimums here.

-

New Hampshire: The Granite State doesn’t technically require you to buy insurance, but you must prove you have the funds to cover accident costs if you cause one. For this reason, most drivers purchase insurance. If you do, the required minimums are 25/50/25:

- $25,000 for bodily injury per person.

- $50,000 for bodily injury per accident.

- $25,000 for property damage per accident.

Why You Should Have More Than the Minimum

State minimums are often dangerously low and can leave you financially exposed. A serious injury can easily surpass $25,000 in medical bills, and replacing a new car can cost far more than the minimum property damage limit.

Simply put, state minimums are rarely enough to protect your assets in a serious accident. If costs exceed your limits, you are responsible for the rest, which could mean losing your savings or home.

Many financial experts, including the Insurance Information Institute, recommend carrying much higher liability coverage—at least 100/300/50. This means:

- $100,000 for bodily injury per person.

- $300,000 for bodily injury per accident.

- $50,000 for property damage per accident.

A good rule of thumb is to have enough car insurance liability coverage to protect your total net worth. The small premium increase for higher limits is a tiny price for significant financial protection.

Liability-Only vs. Full Coverage: Cost and Considerations

Drivers often face a choice: stick with basic car insurance liability or opt for “full coverage”? The decision balances your budget against your need for protection.

How does liability-only car insurance compare in cost?

Liability-only insurance is significantly cheaper because it only covers damages you cause to others, not to your own car. “Full coverage” isn’t an official policy type; it’s a common term for a policy that bundles car insurance liability with two other key coverages:

- Collision coverage: Pays to repair your car after a crash with another vehicle or object, regardless of fault.

- Comprehensive coverage: Pays for damage to your car from non-collision events like theft, vandalism, fire, or hitting a deer.

While a basic liability policy might average around $619 a year nationally, adding Collision and Comprehensive can increase that cost significantly. The price difference reflects the added protection for your own vehicle.

Learn more: Full Coverage vs Liability Car Insurance

When should I consider liability-only car insurance?

Opting for liability-only makes sense when the cost of full coverage outweighs the value of your car. This often happens as a vehicle gets older.

Consider dropping Collision and Comprehensive if:

- Your car is fully paid off. Lenders require full coverage, but once the loan is paid, the choice is yours.

- Your car’s value is low. A common guideline is if your car is worth less than $5,000 or is over eight years old.

- You have enough in savings to comfortably repair or replace your car out-of-pocket.

- Your annual full coverage premium is over 10% of your car’s value. For example, paying $500 a year for full coverage on a $3,000 car may not be a wise investment.

Even if you choose liability-only, we always recommend higher car insurance liability limits than the state minimum. This coverage protects you from financial disaster if you cause a serious accident.

Find out more: When to Get Liability Only Car Insurance?

Factors Influencing the Cost of Liability Insurance

While the national average for liability coverage is around $64 per month, your exact premium is unique. Insurers assess several risk factors to determine your cost.

Here are the key elements that influence the price of your car insurance liability:

-

Coverage Limits: This is the most direct factor. Higher limits mean more protection for you and more potential payout for the insurer, so the premium is higher. The extra cost for much higher limits is often small compared to the protection they provide.

-

Driving Record: A clean driving record is one of the best ways to keep costs down. At-fault accidents, traffic violations like speeding tickets, and especially DWI/DUI convictions will increase your premiums.

-

Location: Living in a dense urban area with more traffic and higher accident rates typically leads to higher premiums than living in a quiet, rural area.

-

Age and Driving Experience: Younger, less experienced drivers statistically have more accidents, so they generally pay more for car insurance liability. Rates tend to decrease with age and a clean driving record.

-

Vehicle Type: While liability doesn’t cover your car, the type of vehicle you drive can still affect your rates. High-performance or luxury cars may be associated with higher-cost claims.

-

Credit Score: In many states, insurers use credit-based insurance scores to predict the likelihood of claims. A higher score can lead to lower premiums. However, Massachusetts does not allow the use of credit scores in setting car insurance rates.

-

Annual Mileage: The more you drive, the higher your risk of an accident, which can slightly increase your premium.

-

Discounts: Always ask about available discounts. You may qualify for savings through safe driving, bundling policies (auto and home), good student grades, or having anti-theft devices.

Frequently Asked Questions about Car Insurance Liability

Here are answers to some of the most common questions we get about car insurance liability.

What are the consequences of driving without liability insurance?

Driving without the required insurance in Massachusetts or New Hampshire has severe consequences. You could face hefty fines, suspension of your driver’s license and registration, and even potential jail time. Your vehicle could also be impounded. Most importantly, if you cause an accident while uninsured, you are personally responsible for all damages and injuries. This can lead to lawsuits, wage garnishment, and liens on your property, potentially causing financial ruin. The risk is not worth the savings.

Is there a deductible for car insurance liability?

No, there is no deductible for car insurance liability. Deductibles are the out-of-pocket amounts you pay for claims on coverages that protect your vehicle, like Collision and Comprehensive. When your liability coverage pays a claim for another party, the insurer covers the cost up to your policy limits without you paying a deductible.

Does liability insurance cover my car if someone else hits me?

No, your car insurance liability policy never covers your own car or injuries. It is designed to pay for damages you cause to others. If another driver hits you and is at fault, their property damage liability coverage is responsible for your vehicle repairs. If they are uninsured or underinsured, you would need to have Uninsured Motorist Property Damage coverage or Collision coverage on your own policy for your car to be covered.

Protect Your Future with the Right Coverage

Understanding car insurance liability is about building a financial shield around everything you’ve worked for. While states like Massachusetts and New Hampshire set minimum requirements, these are often not enough to protect you in a serious accident. The financial fallout can last a lifetime if you’re not adequately insured.

An accident can happen in a flash, but the consequences can linger for years. At Stanton Insurance Agency, we believe in empowering you to make the best choices for your situation. We’re not just here to sell policies; we’re here to be your trusted guide.

As a local business deeply rooted in the communities of Massachusetts, New Hampshire, and Maine, we understand the unique needs of drivers in our area. We make the complex world of insurance simple and help you tailor a policy that truly protects your world.

Ready to review your liability limits and ensure you’re fully protected? Don’t leave your financial future to chance. Contact us today for a personalized car insurance quote!