How to Cancel Car Insurance in Massachusetts 4 Easy Steps

Understanding Massachusetts’ Unique Car Insurance Cancellation Requirements

How to Cancel Car Insurance in Massachusetts requires a specific process that differs from most other states. Here’s what you need to know:

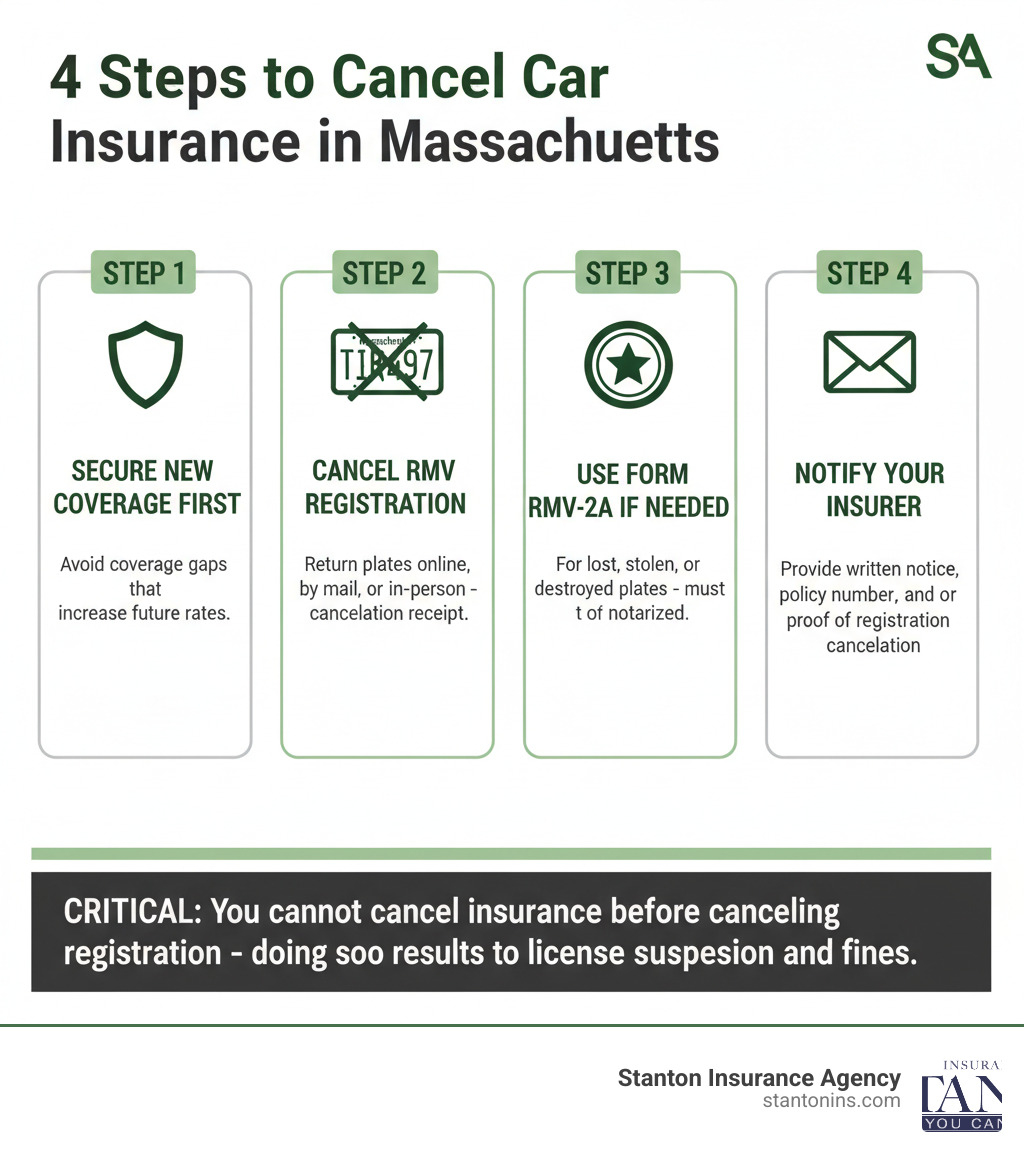

4 Steps to Cancel Car Insurance in Massachusetts:

- Secure new coverage (if continuing to drive) to avoid any coverage gap.

- Cancel your vehicle registration with the RMV and return your license plates (online, by mail, or in-person).

- Complete Form RMV-2A if your plates are lost, stolen, or destroyed (must be notarized).

- Notify your insurance company in writing with your policy number and proof of registration cancellation.

Critical Rule: In Massachusetts, you cannot cancel your insurance until your vehicle’s registration is canceled with the Registry of Motor Vehicles (RMV). Attempting to cancel insurance first will result in license suspension, fines, and registration revocation.

Massachusetts law (M.G.L. Chapter 175, Section 113H) directly ties car insurance to vehicle registration. Your insurer cannot legally process a cancellation without proof that your registration has been canceled—either through a plate return receipt or a stamped RMV-2A Form. This unique requirement catches many drivers off guard, as simply stopping payments or calling your insurer won’t work and can lead to serious consequences.

As insurance experts helping Massachusetts drivers for decades, we’ve seen how the state’s plate-return rule can create confusion. Understanding this process is essential whether you’re selling your car, moving, or switching insurers. Depending on how you cancel, you may receive a pro-rata refund (full unused premium) or a short-rate refund (with a small penalty). Let’s walk through the right way to cancel your policy.

The Golden Rule: Why You Must Cancel Your Registration First

Here’s the most important thing to understand about How to Cancel Car Insurance in Massachusetts: you absolutely cannot cancel your auto insurance policy until your vehicle’s registration is officially canceled with the RMV. This isn’t a suggestion—it’s Massachusetts law, and getting the order wrong is costly.

In Massachusetts, your car insurance and vehicle registration are linked. As long as your car has an active registration, it must have active insurance. The state designed this system to ensure every registered vehicle maintains financial responsibility. According to M.G.L. Chapter 175, Section 113H, your insurance company is legally prohibited from canceling your policy without proof of registration cancellation.

When you cancel your registration, the RMV provides official proof—a plate return receipt or a stamped RMV-2A form. You must present this document to your insurance company before they can legally process your cancellation. Without it, their hands are tied.

Many drivers learn this lesson the hard way. They stop paying premiums, assuming the policy is canceled. The result? The RMV revokes your registration and suspends your driver’s license. You could face fines up to $5,000, potential imprisonment, and a minimum 60-day license suspension for a first offense. You’ll also pay hefty reinstatement fees and get a mark on your driving record.

Furthermore, your insurance company will continue billing you because, from their perspective, you still have a registered vehicle that requires coverage. This creates billing headaches and potential collections issues.

Always cancel your registration first, then your insurance. Understanding this fundamental rule will save you from frustration and expense. If you’re curious about other unique aspects of Massachusetts insurance law, you might want to learn about whether Is Massachusetts a No-Fault Car Insurance State?

How to Cancel Car Insurance in Massachusetts: A 4-Step Guide

Following these steps in the exact order presented is crucial for avoiding penalties and ensuring a smooth cancellation of your car insurance in the Commonwealth.

Step 1: Secure New Coverage (If You’re Switching Insurers)

If you plan to keep driving in Massachusetts, your first move must be to purchase a new policy before canceling your old one. Avoiding a coverage gap is essential. A lapse, even for 24 hours, flags you as a higher-risk driver, resulting in significantly higher premiums. A small mistake can cost you thousands over time.

Once your new policy is active, your new insurance company will automatically notify the RMV. This electronic notification ensures state records show you as continuously insured, protecting you from fines and license suspension. If you’re looking for guidance on finding the right new coverage, our guide on How to Get Car Insurance in Massachusetts can help.

Step 2: Cancel Your Vehicle Registration & Return Your Plates

This is the most critical step in the Massachusetts process. The RMV offers three options for returning your plates:

- Online: The fastest method. You can cancel your plates/vehicle registration online through the Mass.gov RMV portal. You’ll receive a confirmation email that serves as your official Registration Cancellation Receipt. Print a copy for your records.

- By Mail: Send your physical license plates with a completed Registration and Plate Cancellation form to the RMV. Use a trackable mailing service for proof of delivery.

- In-Person: Visit an RMV Service Center to hand your plates to a clerk and receive a printed Registration Cancellation Receipt immediately.

Whichever method you choose, this receipt is the essential proof your insurer needs to cancel your policy.

Step 3: What to Do If You Can’t Physically Return Your Plates

If your license plates are lost, stolen, or destroyed, you must use the Affidavit for Cancellation of Registration for Lost, Stolen, Destroyed, or Canceled Plates, known as Form RMV-2A. This form is a legal substitute for the physical plates.

- Download the official RMV-2A Form from the Mass.gov website.

- Fill out the form completely, explaining why the plates cannot be surrendered (e.g., “Plates stolen from vehicle on March 15, 2024”).

- Have the form notarized. You must sign it in front of a notary public.

- Submit the notarized form to the RMV by mail or in person. The RMV will process and stamp your copy. This stamped form is your official proof of registration cancellation.

Step 4: Officially Notify Your Insurance Company

With your RMV paperwork in hand, it’s time to close the loop with your insurer. Do not simply stop making payments. This leads to a “cancellation for non-payment” on your record, branding you as a high-risk customer and triggering RMV penalties.

Instead, contact your insurer with a written request to cancel. An email or letter creates a paper trail. Your request must include:

- Your full name and policy number.

- Your desired cancellation date (which cannot be before your registration was canceled).

- A copy of your Registration Cancellation Receipt or your stamped RMV-2A Form. This is non-negotiable.

Finally, cancel any automatic payments for the policy. Until the cancellation is complete, you must maintain the What is the Minimum Car Insurance Coverage in Massachusetts? to remain legally insured.

Financial Implications: Refunds and Fees

When you cancel your car insurance, you are generally entitled to a refund for the premium you’ve paid for future coverage. This is called “unearned premium.” In Massachusetts, insurers must deliver this refund within 30 days of your policy’s cancellation date. The type of refund you receive depends on the situation.

-

Pro-rata refunds are the most favorable. You receive a full, proportionate refund of your unearned premium with no penalties. This typically occurs when your insurer cancels the policy, you cancel within the first 30 days of a new policy, or your vehicle is stolen or totaled.

-

Short-rate refunds are more common if you initiate the cancellation after the first 30 days of your policy term. With a short-rate refund, your insurer applies a small administrative penalty to cover their setup costs. You’ll get slightly less back than with a pro-rata refund, but you still receive the bulk of your unused premium.

Your earned premium is the portion the insurance company keeps for the time they covered you. Your unearned premium is the portion you get back. Before canceling, it’s wise to ask your provider what type of refund to expect. For more context on what drives premiums, see our guide on Car Insurance Rates Massachusetts.

Understanding these financial implications helps you make informed decisions as you steer How to Cancel Car Insurance in Massachusetts.

When to Cancel vs. When to Consider Alternatives

Knowing How to Cancel Car Insurance in Massachusetts is one thing, but knowing when to cancel is equally important. Outright cancellation isn’t always the best move. A policy adjustment can often save you money without the hassle and risk of a coverage gap.

Good Reasons for How to Cancel Car Insurance in Massachusetts

There are valid scenarios where canceling your policy is the right move, provided you follow the RMV steps.

- You’ve Sold Your Vehicle: This is the most common reason. Once the title is signed over and the registration is canceled with the RMV, you can cancel the policy. It’s wise to wait until the sale is finalized and you have the RMV cancellation receipt in hand.

- You’re Moving Out of State: To avoid a coverage gap, establish your new insurance and registration in your new state first. Only then should you cancel your Massachusetts registration and your MA insurance policy.

- The Vehicle is Totaled or Stolen: After your insurance claim is settled, you will need to cancel the vehicle’s registration with the RMV. Once that’s done, you can cancel the corresponding insurance policy.

When You Should NOT Cancel Your Policy

Sometimes, what seems like a logical move can create bigger problems. Consider these alternatives first.

- Storing Your Vehicle: A registered vehicle in Massachusetts must be insured, even if it’s not being driven. To legally avoid insurance costs, you must first cancel the registration with the RMV. Otherwise, you are required to maintain coverage.

- Student Away at College: If your child is attending college more than 100 miles away without their car, don’t cancel their insurance. They’ll need coverage when they come home for breaks. Many insurers offer a “student away at school” discount, which can significantly reduce your premium while maintaining continuous coverage.

- Paid Off Your Car Loan: While you no longer need to carry comprehensive and collision coverage for a lender, you shouldn’t cancel your policy entirely. You can save a significant amount by reducing your coverage to liability-only, but you must maintain liability coverage if the car is still registered and driven. Dropping all coverage leaves you financially vulnerable in an accident. For more on coverage specifics, see Does Insurance Follow the Car or Driver in Massachusetts?.

Before you cancel, give us a call. We can often find ways to reduce your premium through discounts or coverage adjustments that meet your goals without the risks of full cancellation.

Understanding Insurer-Initiated Cancellations and Your Rights

While this guide focuses on how you can cancel your policy, it’s important to know that your insurance company can also initiate a cancellation. Understanding your rights and the rules insurers must follow is crucial in this situation.

Insurers have the authority to cancel policies in Massachusetts, but only for specific, valid reasons. The most common are:

- Non-payment of premium

- Fraud or material misrepresentation on your application

- Suspension or revocation of your driver’s license or vehicle registration

- Failure to comply with a vehicle inspection request

By law, an insurer must provide you with a written “Notice of Cancellation” at least 20 days before the effective date. This notice must clearly state the specific reason for the cancellation.

If you believe the cancellation is unfair or incorrect, you have the right to appeal the decision through the Board of Appeal on Motor Vehicle Liability Policies and Bonds. Timing is critical: your “Cancellation Complaint Form” must be filed with the Board of Appeal before your policy’s cancellation date. Filing on time keeps your coverage active during the appeal process, preventing a dangerous gap.

The appeal process is handled virtually via video or telephone, and there is no fee to submit a complaint. You will need to include a copy of the cancellation notice with your form. All necessary forms and instructions can be found on the official Mass.gov website, where you can learn how to appeal an auto insurance cancellation.

Dealing with an insurer-initiated cancellation can be overwhelming. An experienced insurance agent can help you understand your options and guide you through the process if needed.

Frequently Asked Questions about Canceling Car Insurance in Massachusetts

Here are answers to some of the most common questions we receive about car insurance cancellation in Massachusetts.

What are the consequences of driving without insurance in Massachusetts?

The penalties for driving without the state-required minimum insurance are severe. They include:

- Fines: Up to $5,000.

- Imprisonment: Up to one year.

- License Suspension: A minimum of 60 days for a first offense.

- Registration Revocation: Your vehicle’s registration will be revoked.

In addition, you will face significant reinstatement fees with the RMV. A coverage lapse will also flag you as a high-risk driver, leading to much higher insurance premiums for years. Most importantly, if you cause an accident while uninsured, you are personally responsible for all damages and injuries, which can lead to devastating financial liability.

How does Massachusetts’ car insurance cancellation process compare to other states?

Massachusetts has one of the strictest and most unique cancellation processes in the country. In most other states, you simply contact your insurer to cancel. The Bay State’s legal requirement to tie insurance directly to vehicle registration—and to mandate plate return or a notarized RMV-2A Form before cancellation—is a key difference. This system is designed to minimize the number of uninsured drivers on the road, contributing to a more secure driving environment for everyone.

Where can I find official RMV forms like the 2A Form for cancellation purposes?

Always go directly to the source for official forms to ensure you have the most current version. All forms related to registration and insurance cancellation, including the RMV-2A (Affidavit for Cancellation of Registration) and the standard Registration and Plate Cancellation form, can be downloaded from the official Massachusetts government website at Mass.gov. Steer to the Registry of Motor Vehicles (RMV) section to find their forms library.

Navigating Your Next Steps with Confidence

We know that How to Cancel Car Insurance in Massachusetts can seem complex, but once you understand the process, it’s manageable. The golden rule is to always cancel your RMV registration first and get official proof before contacting your insurance company. This single step protects you from fines, license suspension, and other serious headaches.

Following the correct procedure ensures a clean break, whether you’re selling your car, moving, or switching providers. You won’t have any surprise penalties showing up down the road.

The goal of a good insurance professional is to empower you with clear, practical knowledge. They aren’t just there to sell policies—they act as your trusted partner. If you have questions about finding new coverage, understanding your policy options, or navigating the complexities of auto insurance in Massachusetts, an experienced team can help. Trusted agents pride themselves on providing reliable protection and personal service.

Contact a local agent today to explore your options or get a free quote for your MA car insurance needs to make sure you’re well-covered for your next chapter.