Cancel Car Insurance Massachusetts: 4 Easy Steps

Understanding Massachusetts’ Unique Car Insurance Cancellation Requirements

Cancel car insurance massachusetts isn’t as simple as making a phone call like in other states. Massachusetts has unique laws that tie your car insurance directly to your vehicle registration, creating a “plates first” rule that must be followed to avoid penalties.

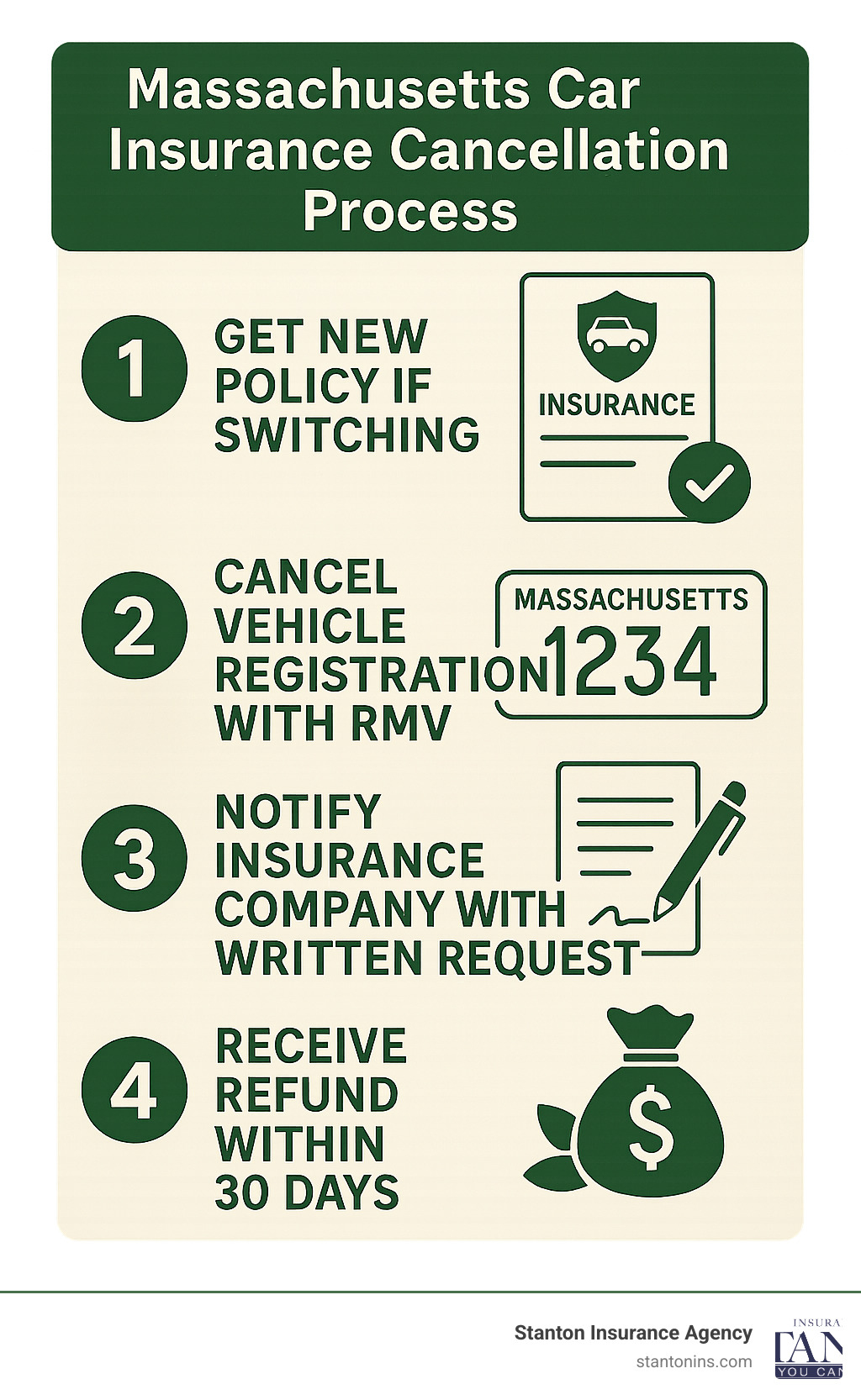

Quick Answer: How to Cancel Car Insurance in Massachusetts

- Secure new coverage (if switching insurers, not selling your car)

- Cancel your vehicle registration and plates with the RMV first

- Notify your insurance company in writing with proof of registration cancellation

- Receive your refund within 30 days

Key Point: You cannot cancel your insurance until your registration is canceled. Insurance companies are legally prohibited from processing cancellations without proof that your plates have been surrendered or canceled with the Registry of Motor Vehicles (RMV).

The consequences of getting this wrong are severe. If you try to cancel your insurance without first handling your registration, the RMV will automatically be notified of an insurance lapse. This triggers immediate penalties including fines up to $500, license suspension, and registration revocation.

As Geoff Stanton, President of Stanton Insurance Agency, I’ve helped hundreds of Massachusetts families steer the specific requirements to cancel car insurance massachusetts policies correctly over my 25+ years in the industry. Understanding these state-specific rules is crucial whether you’re switching providers, selling your vehicle, or moving out of state.

The “Plates First” Rule: Why MA Links Insurance to Registration

Think of your Massachusetts license plate as more than just a metal rectangle on your car. It’s actually a legal promise to the state that says, “This vehicle is both registered and insured.” Unlike most other states where you can simply call your insurer and cancel car insurance massachusetts coverage with a quick phone conversation, the Bay State has created an unbreakable link between your plates and your policy.

This connection exists because Massachusetts law requires continuous insurance coverage for every single registered vehicle. Your license plate serves as visible proof that both your registration and insurance are active and current. As long as those plates are attached to your vehicle and registered with the state, your insurance must remain in force – even if your car is sitting unused in your garage all winter.

The Legal Connection

Here’s where things get interesting from a legal standpoint. Massachusetts General Law creates a direct electronic connection between your insurance company and the Registry of Motor Vehicles (RMV). When you try to cancel car insurance massachusetts coverage, your insurer cannot legally process that request until they receive confirmation from the RMV that your registration is no longer active.

This isn’t just a bureaucratic hurdle – it’s a consumer protection system. The moment your insurance company cancels your policy while your plates are still registered, an automatic notification shoots over to the RMV. This triggers immediate penalties including fines, license suspension, and registration revocation. The system has no mercy and doesn’t care if the cancellation was accidental or intentional.

The continuous coverage requirement means there’s literally no legal way to have registered plates without active insurance in Massachusetts. Your insurance company is bound by law to maintain your coverage until they receive that all-important registration cancellation receipt from the RMV.

If you’re just starting your Massachusetts insurance journey, our guide on Do You Need Insurance to Register a Car in Massachusetts? explains how this unique system works from the very beginning. Understanding this plates-first rule now will save you significant headaches and money down the road.

How to Cancel Car Insurance in Massachusetts: The Official 4-Step Process

Following these steps in order is absolutely essential to avoid fines, a suspended license, and a headache that lasts longer than a typical Boston traffic jam. The most important part is handling your registration and plates before contacting your insurance provider to finalize the cancellation. Trust us, skipping steps here is like trying to put on your shoes before your socks – it just won’t feel right, and the consequences can be messy!

Step 1: Secure New Coverage (If Switching Insurers)

If your goal is to switch car insurance providers in Massachusetts rather than stop driving altogether, this is your very first, crucial step. You absolutely must secure a new car insurance policy before you cancel car insurance massachusetts style. Why? Because a lapse in coverage, even for a single day, has serious consequences in Massachusetts.

Think of continuous coverage like a chain – one broken link and the whole thing falls apart. If you have a gap, you’ll be flagged as a high-risk driver. This red flag can lead to much higher insurance rates for years to come, sometimes significantly more than you were paying before. It’s like having a financial scarlet letter that follows you around!

Your new policy’s effective date should ideally be the same day or a day before your old policy’s cancellation date. This ensures seamless, continuous coverage without any gaps. The good news is, when you purchase a new policy, your new insurer is legally required to notify the RMV electronically that you now have coverage. This automated system works behind the scenes, updating the state’s records without you needing to lift a finger. If you’re looking for better rates while making this switch, check out our insights on Cheapest Car Insurance in Massachusetts.

Step 2: Cancel Your Vehicle Registration to Legally Cancel Car Insurance in Massachusetts

This is the linchpin of the entire process in Massachusetts, and where most people get tripped up. Your insurance company literally cannot legally process a cancellation without proof that the vehicle’s registration has been canceled. It’s not that they don’t want to help you – they’re legally prohibited from doing so until you surrender those plates.

You have several convenient options for canceling your vehicle registration. The online method is often the fastest and most convenient, especially if you’re dealing with a single-owner vehicle. You can cancel your plates/vehicle registration online directly through the Mass.gov RMV portal. You’ll need your vehicle registration number, email address, and either your driver’s license or ID number. Once completed, you’ll receive a Registration Cancellation Receipt – this document is your golden ticket for the next step.

If you prefer the traditional route, you can mail your plates directly to the RMV. Include a letter requesting cancellation of your registration along with your contact information. We strongly recommend sending this via certified mail so you have proof of delivery – it’s worth the extra few dollars for peace of mind.

For those who like face-to-face service, you can visit any RMV service center during business hours. A customer service representative can help you surrender your plates and provide you with an immediate Registration Cancellation Receipt. No waiting, no wondering if your paperwork got lost in the mail.

Whichever method you choose, obtaining that Registration Cancellation Receipt or proof of cancellation is absolutely vital for completing the process.

Step 3: What If My Plates Are Lost, Stolen, or Destroyed?

Life happens, and sometimes those little metal rectangles go missing. Maybe they fell off during a particularly rough pothole encounter, or perhaps they were stolen. Don’t panic – Massachusetts has a process for this situation too.

When your license plates are lost, stolen, or destroyed, you’ll need to obtain and complete an RMV-2A Form, also known as an “Affidavit of Lost or Stolen License Plate(s).” This form serves as your sworn statement that your plates are indeed gone. Here’s the important part: this form must be notarized, so make sure you sign it in front of a notary public, not beforehand.

Once you have the notarized RMV-2A Form, you’ll need to submit it to both your insurance company and the RMV. This form essentially takes the place of physically surrendering your plates, giving your insurer the legal green light to proceed with the cancellation. Keep copies for your records and follow up to ensure both the insurer and the RMV have received and processed the form.

Step 4: Formally Notify Your Insurance Company & Get Your Refund

Now comes the moment you’ve been building up to – you can finally contact your insurance company to cancel car insurance massachusetts style! But even this final step requires some attention to detail.

It’s always best to provide a written cancellation request rather than just calling. This creates a clear paper trail that protects you. Your request should include your full name and policy number, the effective date you want the policy canceled (which should match when your registration was canceled), a clear statement requesting cancellation, and most importantly, a copy of your Registration Cancellation Receipt or the notarized RMV-2A Form.

When it comes to refunds, you’ll likely receive what’s called a “return premium” for any unused coverage you’ve already paid for. The type of refund depends on who initiated the cancellation. If the insurer cancels your policy (perhaps you’re switching companies), you’ll typically receive a pro-rata refund, meaning you get back the full amount of unused premium with no administrative fees. If you cancel the policy yourself, you might receive a short-rate refund, where a small administrative fee may be deducted from your unused premium.

By Massachusetts law, your insurance company must send you any refund within 30 days of the effective cancellation date. So mark your calendar and don’t be shy about following up if that deadline approaches without your refund check appearing in the mailbox.

The Consequences: What Happens if You Get it Wrong?

Failing to follow the “plates first” rule has immediate and costly consequences that no Massachusetts driver wants to face. The state’s automated system ensures the RMV is notified of any insurance lapse on a registered vehicle, leading to swift penalties that can affect your driving privileges and wallet for years to come.

Think of it this way: Massachusetts treats your license plate like a promise that your car is both registered and insured. Break that promise by trying to cancel car insurance massachusetts policies without first handling your registration, and the state will hold you accountable – quickly and expensively.

What Happens if I Don’t Cancel My Plates Before I Cancel Car Insurance in Massachusetts?

Here’s where things get serious fast. The moment you try to cancel your insurance without first canceling your registration, your insurance company is legally required to notify the Registry of Motor Vehicles (RMV) of the coverage lapse. This notification isn’t a friendly heads-up – it’s an automatic trigger that sets a chain of penalties in motion.

The RMV will immediately revoke your vehicle’s registration and suspend your driver’s license. Yes, you read that right. Your license gets suspended not because you were in an accident or got a ticket, but because you didn’t follow the proper sequence when canceling your policy.

But it doesn’t stop there. You’ll face significant reinstatement fees just to get your license and registration back. These fees can add up to hundreds of dollars, turning what should have been a simple insurance cancellation into an expensive lesson about Massachusetts law.

The frustration of finding your license is suspended – perhaps when you’re pulled over for a routine traffic stop – is something every driver wants to avoid. This is precisely why understanding Why Auto Insurance is Important goes beyond just protecting yourself from accidents. It’s about staying legal on Massachusetts roads.

Penalties for Driving Without Insurance in Massachusetts

Even if your insurance lapse was unintentional – maybe you thought you followed the right steps but missed something – Massachusetts law doesn’t make exceptions. Driving without insurance is illegal, period. The penalties are designed to make sure you never forget the importance of continuous coverage.

Fines can reach up to $500 for a first offense. That’s money that could have gone toward your new insurance policy instead of the state’s coffers. Your license and registration can be suspended for up to 60 days, meaning no driving to work, no grocery runs, no exceptions.

Perhaps most costly of all is the long-term impact on your insurance rates. A lapse in coverage, even for just one day, flags you as a high-risk driver. Future insurance companies will see this mark on your record and charge you significantly higher premiums for years to come. What started as trying to cancel car insurance massachusetts coverage can end up costing you thousands in higher rates down the road.

The financial penalty keeps giving long after you’ve paid the initial fines and fees. It’s a reminder that follows you every time you shop for car insurance, making what should be a routine purchase into a more expensive proposition.

When Your Insurer Cancels on You: Your Rights and How to Appeal

Sometimes you’re not the one making the decision to cancel car insurance massachusetts coverage – your insurance company might beat you to it. While this can feel overwhelming, especially when it comes out of nowhere, Massachusetts law actually provides strong protections for policyholders. Insurance companies can’t just decide they don’t like you anymore and drop your coverage. They need a valid, legally-defined reason, and you have the right to fight back if you think they’re wrong.

Valid Reasons an Insurer Can Cancel Your Policy in MA

Your insurance company isn’t allowed to cancel your policy just because they feel like it. Massachusetts law is pretty specific about what constitutes a valid reason for cancellation. The most common reason is non-payment of premium – if you miss payments, your insurer has every right to cancel your policy. It’s like not paying your phone bill; eventually, they’ll cut off service.

Fraud or material misrepresentation is another big one. If you fibbed about your driving record, claimed you lived somewhere you didn’t, or misrepresented how you use your vehicle when you first applied, your insurer can cancel your policy. They don’t take kindly to being misled, and frankly, who can blame them?

If any driver listed on your policy has their driver’s license suspended or revoked, your insurer may also cancel the entire policy. Similarly, if your vehicle registration is revoked (remember our discussion about the plates-first rule?), your insurance policy may follow suit automatically.

In rare cases, the Commissioner of Insurance might determine that continuing a policy would violate the law, giving insurers grounds for cancellation. But this is uncommon and usually involves very specific circumstances.

Here’s the good news: your insurer must send you a written Notice of Cancellation at least 20 days before the effective cancellation date. This notice isn’t just a courtesy – it’s required by law, and it must clearly state the specific reason for cancellation and explain your right to appeal. For the full legal details, you can review the Massachusetts General Laws on Cancellation Appeals.

How to Appeal an Unfair Cancellation

If you believe your insurance company is wrong and your policy shouldn’t be canceled, you don’t have to just accept it. Massachusetts has a Board of Appeal on Motor Vehicle Liability Policies and Bonds that acts as an impartial referee between you and your insurance company. Think of them as the fair-minded friend who settles disputes when both sides think they’re right.

The key to keeping your coverage active during an appeal is timing. You must file your complaint before your policy’s cancellation date. This is absolutely critical – missing this deadline means your policy will be canceled while you wait for a decision, even if you ultimately win your case.

If you file after the cancellation date but within 10 days, your appeal will still be heard, but your coverage won’t continue during the process. It’s like showing up late to court – they’ll still listen to your case, but you’ve lost some important protections in the meantime.

The process involves submitting a “Cancellation Complaint Form” along with a copy of your cancellation notice. The Mass.gov website provides all the necessary forms and step-by-step instructions to appeal an auto insurance cancellation.

All hearings are conducted virtually through video or phone calls, making the process more convenient than having to travel to a government office. There’s no fee to file a complaint, which removes one potential barrier to getting fair treatment. The insurance company will have a representative at the hearing to present their side, and you’ll receive the Board’s decision by mail.

Only the insurance company can request to postpone a hearing – you can’t delay the process once it’s scheduled. This ensures that appeals move forward promptly and don’t drag on indefinitely.

Frequently Asked Questions about Canceling MA Car Insurance

Let’s be honest – navigating Massachusetts car insurance rules can feel like trying to solve a puzzle while blindfolded. After helping countless families through this process over the years, I’ve heard just about every question you can imagine. Here are the ones that come up most often, along with the straight answers you need.

Can I just stop paying my bill to cancel my policy?

Please don’t do this! I can’t stress this enough – stopping your premium payments is absolutely the worst way to cancel car insurance massachusetts policies. It might seem like the path of least resistance, but it’s actually the road to financial headaches.

When you stop paying, your insurer will cancel your policy for “non-payment.” This creates a black mark on your insurance record that follows you around like a bad reputation. Future insurance companies will see this and immediately flag you as a high-risk driver, which means you’ll pay significantly higher premiums for years to come.

But here’s where it gets really painful: the RMV will be automatically notified of your insurance lapse. “Plates first” rule we talked about? Well, when your insurance gets canceled for non-payment while your plates are still active, you’re suddenly driving an uninsured, registered vehicle. This triggers an immediate registration revocation and license suspension, plus hundreds of dollars in reinstatement fees.

Think of it this way – taking five minutes to follow the proper cancellation process can save you years of financial pain and legal headaches.

Do I need to tell the RMV I have new insurance?

Nope! This is one area where Massachusetts actually makes things easier for you. When you purchase a new car insurance policy anywhere in the Bay State, your new insurance company is legally required to notify the RMV electronically within a specific timeframe.

This automated notification system is actually pretty impressive. Your new insurer sends your policy information directly to the RMV’s computer system, updating your records without you having to lift a finger. No phone calls, no paperwork, no standing in line at the RMV office – it all happens behind the scenes.

The system works so well that the RMV typically knows about your new coverage before you even get your new insurance cards in the mail. It’s one of those rare government processes that actually works smoothly!

How long does it take to get a car insurance refund in MA after cancellation?

Massachusetts law is pretty clear on this one, and it’s good news for your wallet. Once your policy is officially canceled, your insurance company has exactly 30 days to send you any refund you’re owed for unused premiums.

This 30-day timeline starts from your policy’s effective cancellation date, not from when you first requested the cancellation. So if you cancel your policy effective March 15th, you should receive your refund check (or direct deposit) by April 14th at the latest.

Most reputable insurance companies actually process refunds much faster than the legal requirement – often within 7 to 14 days. But if you haven’t received your refund within that 30-day window, don’t hesitate to contact your former insurer directly. They’re legally obligated to get that money to you, and a friendly reminder usually does the trick.

Your Trusted Partner in Massachusetts Insurance

Learning how to cancel car insurance massachusetts doesn’t have to feel like solving a Rubik’s cube blindfolded. Yes, the Bay State has its unique quirks and requirements, but once you understand the “plates first” rule, the whole process becomes much more straightforward.

The golden rule bears repeating: always cancel your registration and plates with the RMV before finalizing your insurance cancellation. This single step is your ticket to avoiding fines, license suspensions, and all the headaches that come with them. Think of it as the Massachusetts insurance dance – you just need to know the right steps and the right order.

Whether you’re switching providers to get better rates, selling your car and no longer need coverage, or moving out of state and need different insurance, following this process protects you from costly mistakes. Even if you’re just curious about your current coverage options, having a clear understanding of these rules puts you in control.

At Stanton Insurance Agency, we’ve been guiding families through Massachusetts insurance requirements for generations. We understand that insurance can feel complicated, especially when every state seems to have its own rulebook. That’s why we’re committed to providing the clear, straightforward guidance you need – without the jargon or confusion.

Our local expertise means we know exactly how the RMV systems work, what documents you’ll need, and how to time everything perfectly. We’ve seen what happens when people try to steer this alone, and we’re here to make sure you get it right the first time.

For a complete overview of everything you need to know about coverage in the Bay State, explore our comprehensive Massachusetts Car Insurance Guide. When you’re ready to make a change or just have questions about your policy, trusted protection for your valuable assets is just a conversation away.