Can you insure an unregistered car in Massachusetts 2025

The Short Answer: Yes, But It’s Not That Simple

Can you insure an unregistered car in massachusetts? Yes, you absolutely can – and in most cases, you must. Massachusetts law requires you to have an active auto insurance policy before you can register your vehicle with the Registry of Motor Vehicles (RMV). However, you can also obtain specific types of insurance for cars you don’t plan on registering for road use.

Quick Answer:

- For registration: You need insurance first, then register within 21-30 days

- For storage: Comprehensive-only coverage protects stored vehicles

- For driving: You must have both insurance AND registration – no exceptions

The relationship between car insurance and vehicle registration in Massachusetts creates what many call a “chicken or the egg” scenario. You need insurance to get registration, but insurance companies expect you to register quickly after getting a policy. This creates unique challenges and opportunities depending on your situation.

Whether you’re buying a new car, storing a classic vehicle for winter, or dealing with an expired registration, understanding these rules can save you from costly mistakes and legal trouble.

As Geoff Stanton, President of Stanton Insurance Agency and a lifelong Waltham resident, I’ve helped countless clients steer the complexities of Massachusetts insurance requirements, including those wondering can you insure an unregistered car in massachusetts. With over 20 years of experience in the insurance industry, I’ll walk you through every scenario to ensure your vehicle is protected and you stay on the right side of the law.

Can you insure an unregistered car in massachusetts terms simplified:

- what is the minimum car insurance coverage in massachusetts

- does insurance follow the car or driver in massachusetts

- is massachusetts a no fault car insurance state

Why Would You Need to Insure an Unregistered Car?

If you’re scratching your head wondering why anyone would need insurance for a car that isn’t registered, you’re not alone. It seems backwards at first, but there are actually several smart reasons why can you insure an unregistered car in massachusetts is such a common question. Let me walk you through the most typical situations where this becomes not just helpful, but absolutely essential.

To Legally Register Your Vehicle

Here’s the big one – and honestly, it trips up a lot of folks. In Massachusetts, you must have insurance before you can register your car. It’s like needing a key to get the key, if that makes sense. The Registry of Motor Vehicles won’t even look at your registration paperwork without proof of insurance first.

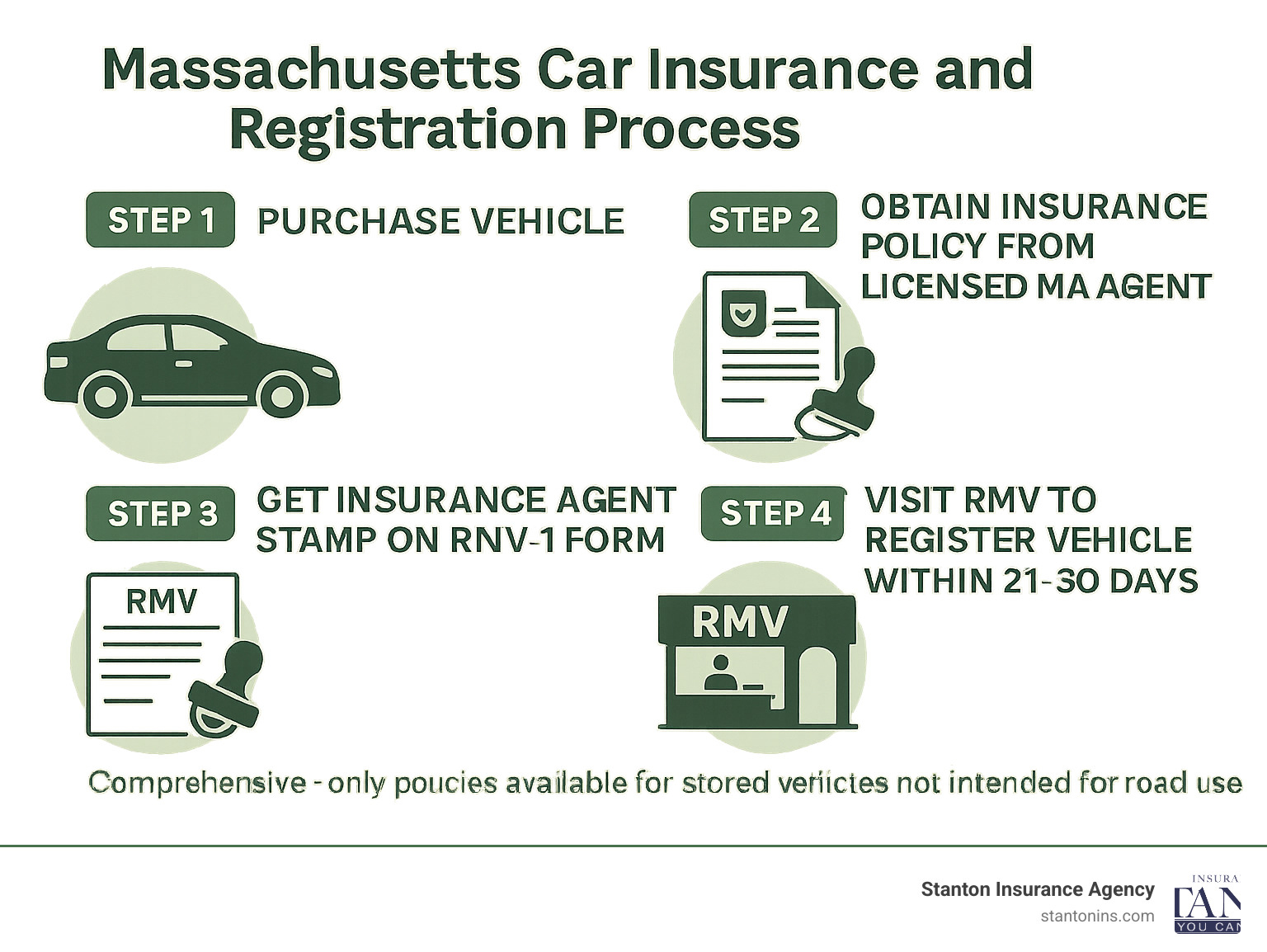

The process works like this: your insurance agent needs to complete and stamp your Registration and Title Application (RMV-1 form) before you head to the RMV. That little stamp is your golden ticket – without it, you’re going home empty-handed. This system ensures every car that hits Massachusetts roads has the required financial protection from day one.

This is where understanding what is the minimum car insurance coverage in Massachusetts becomes crucial. You’ll need to meet all the state’s requirements, including liability coverage, personal injury protection, and uninsured motorist coverage, before that stamp goes on your form.

To Protect a Stored or Seasonal Vehicle

Not every car lives on the road year-round. Maybe you’ve got a classic car that only comes out for weekend drives, or a project car that’s been “almost finished” for the past three years (we’ve all been there!). Perhaps you’re like many New Englanders who store their convertible for the winter or have a vehicle you’re planning to sell.

Just because these cars aren’t registered doesn’t mean they’re safe from trouble. Theft, fire damage, and vandalism don’t care if your car has current plates. A comprehensive-only policy can protect your investment without paying for liability coverage you don’t need. It’s like having a security guard for your garage – you might not need it every day, but you’ll be grateful it’s there if something happens.

During the Purchase and Titling Process

When you buy a car, especially in a private sale, there’s always that nerve-wracking period between handing over your money and getting everything legally sorted out. Massachusetts gives you 10 days to title the vehicle, but a lot can happen in those 10 days.

Picture this: you just bought your dream car from someone’s driveway. You’ve got the bill of sale and you’re working on the title transfer, but it’s sitting in your driveway unregistered. What if someone decides they like your new ride a little too much? What if a tree branch decides to take a dive? Having insurance during this asset protection period means you can sleep soundly while you steer the paperwork.

The peace of mind alone is worth it. Plus, if you’re planning to register the car for road use, you’ll need that insurance anyway. Getting it early just makes the whole process smoother and protects you from the unexpected. For more details on this process, check out our guide on do you need insurance to register a car in Massachusetts.

Can You Insure an Unregistered Car in Massachusetts? The Official Answer

The answer is yes, you can insure an unregistered car in Massachusetts – and in most cases, you absolutely must. The type of policy and its purpose are the key factors that determine how you go about it. The process is straightforward, but it requires understanding the important distinction between insurance for a car you intend to drive versus one you intend to keep safely tucked away off the road.

When people ask can you insure an unregistered car in massachusetts, they’re typically dealing with one of two main scenarios: either they need insurance to complete the registration process, or they want to protect a vehicle that won’t be hitting the roads anytime soon.

What Are the Steps to Insure an Unregistered Car in Massachusetts?

Getting insurance for an unregistered car, especially when your goal is to get it registered for road use, doesn’t have to be complicated. Here’s how we guide our clients through the process to make it as smooth as possible:

First, gather your documents before you even pick up the phone. You’ll need the vehicle’s essential information: the Vehicle Identification Number (VIN), year, make, and model. If you’ve just purchased the car, have the bill of sale and the previous owner’s Certificate of Title ready. Having these documents at hand will significantly speed up the quoting and policy issuance process.

Next, contact an insurance agent – and that’s where we come in! When you call us or visit our office, clearly explain your situation. Are you getting the car insured to register it immediately for daily driving? Or is it a project car that’s going into long-term storage? Your clear explanation helps us determine the precise type of policy you need and ensures you get the right coverage. We’re here to provide expert advice and walk you through Massachusetts auto insurance basics.

Then, choose your coverage based on your specific needs. For a car you will drive on public roads, you’ll need a standard auto policy that meets Massachusetts’ compulsory insurance laws. This includes liability, Personal Injury Protection (PIP), and uninsured motorist coverage. If the car is strictly for storage and won’t be driven, we can help you opt for a “comprehensive-only” policy, which covers non-driving risks like theft or fire without the liability portion.

Get the RMV-1 form stamped if you’re registering the car for road use – this step is absolutely critical. Once you’ve secured your standard auto policy, your agent will provide you with a completed and stamped Registration and Title Application (RMV-1). This physical stamp on the form is your official proof of insurance for the RMV, a mandatory requirement before they will issue plates.

Finally, complete registration promptly – and we can’t stress this enough. Once you have a standard auto policy for a car intended for road use, you must register the car with the RMV within a short timeframe. Insurance companies in Massachusetts monitor the RMV database. If a newly insured vehicle isn’t registered to your name within approximately three weeks (often around 21-30 days), the insurance company will likely issue a cancellation notice for that vehicle’s policy. This happens because the policy was issued on the premise of the car being registered for road use. So, once we’ve helped you secure your Auto Insurance policy, head to the RMV without delay!

What Types of Coverage Are Available?

When considering can you insure an unregistered car in massachusetts, it’s important to understand the different types of coverage that apply depending on your vehicle’s intended use. The two main options serve very different purposes.

| Coverage Type | What It’s For | What It Covers |

|---|---|---|

| Standard Auto Policy | Vehicles intended for road use | Includes state-mandated liability, PIP, and uninsured motorist coverage. Optional collision, comprehensive, etc. |

| Comprehensive-Only | Stored, non-operational vehicles | Protects against non-collision events like theft, fire, vandalism, falling objects, and storm damage. |

A standard auto policy is what you need for any vehicle you plan to drive on public roads. This includes all the state-mandated coverages: liability for bodily injury to others, Personal Injury Protection (PIP), bodily injury caused by uninsured auto, and damage to someone else’s property. You can also add optional coverages like collision, comprehensive, medical payments, substitute transportation, and towing and labor.

A comprehensive-only policy is perfect for stored, non-operational vehicles. It protects against non-collision events like theft, fire, vandalism, falling objects, and storm damage. However, it does not cover damage from a collision or provide liability coverage for incidents while driving, since the vehicle isn’t intended for road use.

Massachusetts requires four compulsory coverages for any standard auto policy. These include coverage for bodily injury to others if you’re at fault in an accident, Personal Injury Protection (PIP) for medical expenses and lost wages regardless of fault, bodily injury caused by uninsured auto to protect you from uninsured drivers, and damage to someone else’s property caused by your vehicle.

You can learn more about Liability Car Insurance Coverage and other essential coverages on our website. The key is matching the right type of coverage to your specific situation – whether that’s getting ready to hit the road or keeping your investment safe while it’s parked.

The Critical Link: Insurance, Registration, and the Law in Massachusetts

Here’s something that trips up many Massachusetts drivers: having insurance doesn’t give you a free pass to drive an unregistered car. Even if you’ve answered “yes” to can you insure an unregistered car in massachusetts and have an active policy, driving that car without valid registration is still completely illegal. The law treats these as two separate requirements that must both be met for any vehicle on public roads.

I’ve seen too many clients learn this lesson the hard way. They assume that because they have insurance, they’re covered legally. Unfortunately, that’s not how Massachusetts law works. Both insurance and registration are mandatory, and failing to have either one carries serious consequences that can turn a simple traffic stop into a very expensive and stressful situation.

What Happens if My Registration Expires?

When your registration expires, your insurance policy doesn’t automatically disappear. As long as you keep paying your premiums, your coverage stays active and will still protect you for things like theft, fire, or even accidents that happen while the car is parked. However, the moment you drive that car on any public road, you’re breaking the law.

If you get pulled over with an expired registration, you’ll face penalties regardless of your insurance status. The officer won’t care that you have great coverage – they’ll still write you a ticket for the registration violation. Even worse, if you get into an accident while driving with expired registration, your insurance company will likely still cover the claim (assuming your policy is current), but you’ll face legal consequences for operating an unregistered vehicle on top of dealing with the accident itself.

This creates a frustrating double whammy where you’re paying for insurance protection but still getting in trouble with the law. It’s why we always remind our clients to keep both their insurance and registration current – they’re a team that needs to work together.

What Are the Legal Consequences of Driving an Unregistered Car?

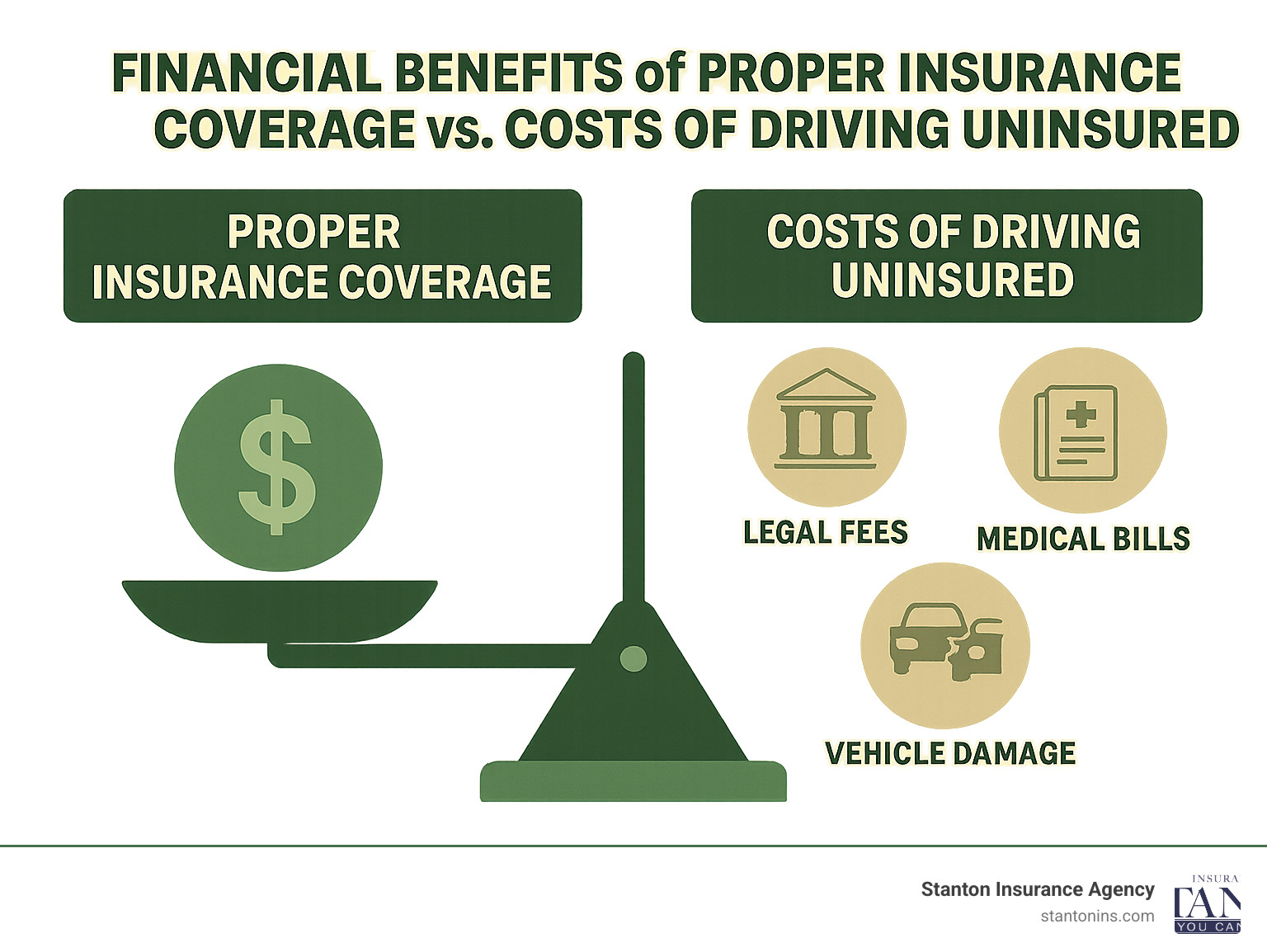

Massachusetts doesn’t mess around when it comes to unregistered vehicles. Operating an unregistered motor vehicle is a misdemeanor offense that can seriously impact your life. The penalties include fines up to $500, potential license suspension, and even vehicle impoundment where you’ll have to pay towing and storage fees to get your car back.

In more serious cases, especially for repeat offenses, you could face jail time. These penalties exist under M.G.L. c. 90, § 34J and are completely separate from any penalties for driving without insurance. If you’re caught doing both – driving an unregistered and uninsured vehicle – you’re looking at a perfect storm of legal trouble.

The financial consequences alone can be devastating. While we’re focusing on can you insure an unregistered car in massachusetts, it’s worth noting that driving without insurance can result in fines up to $5,000, license suspension for up to a year, and even jail time. The cost of proper insurance and registration suddenly seems like a bargain compared to these potential penalties.

What Are the Challenges When You Insure an Unregistered Car in Massachusetts?

The biggest challenge we encounter with clients is the timing pressure. When we set up a standard auto policy for an unregistered vehicle, the insurance company isn’t just taking your word that you’ll register it soon – they’re actively monitoring the situation. Insurance carriers receive regular updates from the RMV database, and they’re watching to see if your newly insured vehicle appears as registered to you.

Here’s where it gets tricky: if your car doesn’t show up as registered within about 21 to 30 days, the insurance company will typically issue a cancellation notice for that vehicle’s policy. This isn’t the insurance company being difficult – it’s because they wrote the policy assuming the car would be legally registered and subject to state oversight.

This creates a real coordination challenge. You need insurance to get registration, but you need to get registration quickly to keep your insurance. It’s like a ticking clock that starts the moment we issue your policy. That’s why we always stress the importance of having all your paperwork ready and scheduling your RMV visit as soon as possible after getting your policy.

The good news is that with proper planning and our guidance, this process runs smoothly. We make sure you have everything you need for your RMV visit, and we’re always available to help if any issues come up during the registration process.

Frequently Asked Questions about Insuring Unregistered Cars in MA

Over the years, we’ve helped countless Massachusetts residents steer the complexities of vehicle insurance and registration. The same questions about can you insure an unregistered car in massachusetts come up again and again, so let’s address the most common concerns we hear from our clients.

Can I get a temporary registration or permit to drive my newly purchased car home?

This is probably the most frequent question we get, especially from folks who’ve moved here from other states. Unfortunately, Massachusetts doesn’t make this easy. Unlike some other states that issue temporary paper plates or transit permits, Massachusetts generally does not provide temporary registration plates for residents to drive a newly purchased vehicle home or to the RMV.

The law is pretty strict about this: you must have the vehicle fully insured and registered before it can be legally driven on public roads. This means if you’re buying a car and can’t complete the insurance and registration process immediately, you’ll need to arrange for the vehicle to be towed to your location, or have the seller deliver it to you.

It’s not the most convenient system, but it’s designed to ensure that every vehicle on Massachusetts roads has proper insurance coverage from day one. We always recommend calling us before you finalize a car purchase so we can have your policy ready to go.

What if I move to Massachusetts with a car registered in another state?

Welcome to the Bay State! If you’re a new resident bringing a vehicle from another state, you do get a bit of breathing room. Massachusetts law generally gives you 30 days to register your vehicle after establishing residency. During that grace period, you can legally drive on your out-of-state plates and registration.

However, there’s an important catch: you must obtain a Massachusetts insurance policy that meets our state’s minimum requirements within that same timeframe. Your out-of-state policy might not provide the specific coverages Massachusetts requires, so it’s crucial to review your policy with a local agent.

We specialize in helping new residents transition their coverage to meet Massachusetts requirements. It’s often easier than people expect, and we can usually help you maintain continuous coverage while ensuring you’re fully compliant with local laws.

If I cancel my registration, what should I do with my insurance?

Life happens, and sometimes you need to take a car off the road. Whether you’re selling it, storing it for the season, or dealing with a vehicle that’s no longer roadworthy, you’ll want to cancel your plate(s) and vehicle registration with the RMV. But what about your insurance?

The answer depends on your situation, and this is where having a good relationship with your insurance agent really pays off. Contact us immediately after canceling your registration, and we’ll help you figure out the best approach.

If you no longer own the car or don’t need any coverage for it, we can cancel the entire policy. You’ll likely receive a partial refund for any unused premium, which is always nice to see.

But if you’re storing the vehicle and want to protect your investment, we can often reduce your policy to comprehensive-only coverage. This protects against theft, fire, vandalism, and storm damage while you’re not driving it. It’s a smart way to save money on premiums while still keeping your asset protected during storage.

The key is communicating with us promptly. We want to make sure you’re not paying for coverage you don’t need, while ensuring your vehicle stays protected if that’s what you want.

Get the Right Coverage for Your Car, Registered or Not

Understanding the rules for insuring and registering a vehicle in Massachusetts doesn’t have to give you a headache. The most important thing to remember is simple: secure the right insurance policy before you take any other steps. This is especially crucial if you plan to drive the vehicle on public roads.

Whether you’re excited about registering your brand-new car, getting ready to tuck your classic convertible away for winter storage, or just want to make sure your current policy matches your vehicle’s registration status, having proper protection is absolutely essential. Think of insurance as your financial safety net – it’s there to catch you when life throws you a curveball.

We know that sorting through different policy types, legal requirements, and deadlines can feel like solving a puzzle with missing pieces. That’s exactly why our team at Stanton Insurance Agency exists. Our local agents live and breathe Massachusetts insurance laws, and we genuinely love helping our neighbors understand their options and find the exact coverage they need.

What makes us different? We’re not just another insurance company trying to sell you the most expensive policy. We’re your neighbors, and we understand that trusted protection for your valuable assets means giving you real peace of mind, whether your car is parked in your driveway or cruising down Route 2.

Don’t leave your vehicle’s protection to chance or hope for the best. We’re here to answer every question you have about can you insure an unregistered car in massachusetts and make sure you’re always on the right side of the law. Our expert advice comes with a personal touch – because that’s how we do business.

Ready to get the protection you deserve? Get a quote for your car insurance today! and find why so many Massachusetts drivers trust us with their most valuable assets.