Business insurance policy: Smart Choices 2025

Why a Business Insurance Policy is Your Business’s Best Defense

A business insurance policy is your company’s essential shield against the unexpected. It’s a critical safety net that protects your hard work and financial stability from unforeseen events, ensuring you can keep going even when challenges arise.

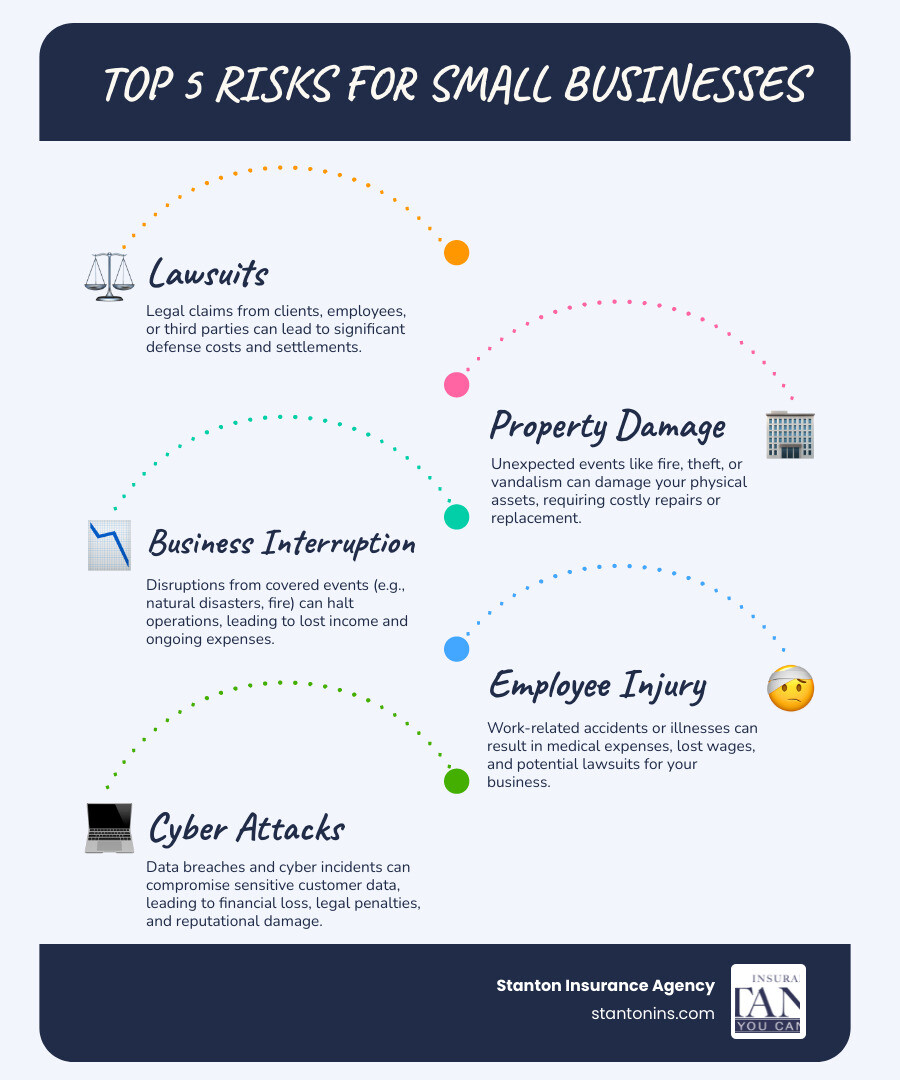

Here’s a quick overview of what a business insurance policy is and why it matters:

- Definition: A policy that bundles various coverages to protect your company from financial losses due to risks like property damage, liability claims, or business interruptions.

- Purpose: It safeguards your assets, helps cover legal costs, and ensures business continuity after a covered event.

- Importance: It prevents potentially devastating financial setbacks, allowing your business to recover and thrive.

- Who Needs It: Nearly all businesses, regardless of size or industry, benefit from custom insurance to manage their unique risks.

In Massachusetts and New Hampshire, businesses face significant risks daily. Without the right protection, a single incident—like a lawsuit or a natural disaster—can threaten your company’s existence. In fact, statistics show that 2 out of 3 companies go out of business after a major loss if they don’t have business interruption insurance. This guide will walk you through everything you need to know to make an informed decision.

I’m Geoff Stanton, President at Stanton Insurance. As a Certified Insurance Counselor (CIC) and fourth-generation owner, I specialize in Commercial Property & Liability, helping businesses in Massachusetts and New Hampshire secure the right business insurance policy for their needs.

Find more about business insurance policy:

- Commercial Property Insurance

- commercial property insurance rates

- is vandalism covered by commercial property insurance

Decoding the Core Types of Business Insurance

Understanding the different types of business insurance policy coverage is key to protecting your business. Each type of coverage serves a specific purpose in shielding your company from different risks.

Commercial General Liability (CGL) Insurance

CGL is the foundation of most business insurance packages, protecting you from everyday operational risks.

- Bodily injury claims: Covers medical bills and potential lawsuits if someone is injured on your property or due to your operations.

- Property damage claims: Pays for damages your business accidentally causes to someone else’s property.

- Advertising injury: Protects against claims of slander, libel, or copyright infringement in your marketing.

- Lawsuits and legal defense costs: Covers legal expenses to defend your business against claims, even if they are frivolous.

Who needs it? Nearly every business benefits from CGL, especially those with physical locations or regular client interactions. For more details, see our guide on business liability insurance.

Commercial Property Insurance

This insurance protects your business’s physical assets from damage or loss.

- Coverage includes: Buildings, equipment, machinery, inventory, and office furniture.

- Protects against: Common perils like fire, theft, and vandalism.

- Common exclusions: Floods and earthquakes typically require separate policies.

To learn more about protecting your physical assets, explore our commercial property insurance page.

Business Owner’s Policy (BOP)

A BOP is a streamlined package that combines General Liability and Property Insurance, often at a lower cost than buying them separately. It simplifies your coverage into a single policy.

Most BOPs also include Business Interruption Insurance, which replaces lost income and covers ongoing expenses like rent and payroll if a covered event forces a temporary closure. This is critical, as statistics show two out of three companies fail after a major loss without it.

BOPs are ideal for small to medium-sized businesses, typically those with fewer than 100 employees and under $5 million in revenue.

For more insights, read about what is a Business Owners Insurance policy and find what does a business owners policy cover.

Other Essential Coverages

Beyond the core policies, specialized coverages address unique modern risks.

- Professional Liability (E&O): Essential for service-based businesses, this protects against claims of negligence, errors, or omissions in your professional services.

- Commercial Auto Insurance: Legally required in Massachusetts for business-owned vehicles and necessary to meet financial responsibility laws in New Hampshire. It covers accidents, theft, and liability claims involving company vehicles. Learn more about commercial auto insurance.

- Workers’ Compensation: Mandatory in both Massachusetts and New Hampshire for businesses with employees. It covers medical costs and lost wages for on-the-job injuries and protects your business from related lawsuits. Find the importance of workers’ compensation insurance.

- Cyber Liability Insurance: Crucial for any business that stores customer data or relies on digital systems. It helps cover costs associated with a data breach, such as notification, credit monitoring, and legal fees. Explore cyber liability insurance for small business to learn more.

How to Choose the Right Business Insurance Policy for Your Company

Selecting the right business insurance policy requires crafting a solution that fits your business perfectly. This section walks you through the key steps to ensure your business gets the protection it truly needs.

Assess Your Unique Business Risks

The first step is to understand your specific vulnerabilities. Consider the following:

- Industry type: A contractor faces different risks (e.g., job site hazards) than a tech firm (e.g., data breaches). Your industry dictates the primary coverages needed, such as Professional Liability or Cyber Liability.

- Location and physical assets: Do you own or lease your building? What is the value of your equipment, inventory, and other physical assets that need protection?

- Number of employees: More employees increase the potential for Workers’ Compensation claims or Employment Practices Liability issues.

- Annual revenue: Your income helps determine appropriate liability limits. Businesses with under $5 million in revenue are often good candidates for a cost-effective Business Owner’s Policy (BOP).

- Daily operations: Do you use heavy machinery, drive company vehicles, or handle sensitive customer data? Each activity introduces specific risks.

- Client contracts: Many contracts, especially in construction or professional services, require specific types and limits of insurance, and may require you to name the client as an “Additional Insured.”

By analyzing these factors, you can identify the most relevant coverages and limits for your business insurance policy.

Understand Legal and State Requirements

In Massachusetts and New Hampshire, certain insurance coverages are legally required.

- Workers’ Compensation: This is mandatory in both MA and NH for businesses with employees. It is non-negotiable.

- Commercial Auto Insurance: In Massachusetts, this is legally required for any business-owned vehicles. New Hampshire requires you to prove you can cover costs if you cause an accident, making commercial auto insurance the most practical way to meet this financial responsibility law.

- Industry-specific regulations: Some professions, like licensed contractors, may need specific liability limits or surety bonds to operate legally.

- Contractual requirements: Your lease or client contracts often mandate specific coverages, such as Commercial General Liability, even if not required by state law.

Failure to meet these requirements can result in fines, legal issues, or a halt to your operations.

Key Factors in Your Business Insurance Policy Cost

The cost of a business insurance policy is calculated based on your unique risk profile. While a basic General Liability policy for a small business in New England can range from $450 to $2,000 per year, and a BOP averages around $1,200 annually, your specific premium is influenced by several factors:

- Coverage limits and deductibles: Higher coverage limits increase premiums, while higher deductibles (your out-of-pocket cost per claim) can lower them.

- Claims history: A history of frequent or large claims will likely lead to higher premiums.

- Industry risk level: High-risk industries like roofing or construction naturally have higher insurance costs than lower-risk office-based businesses.

- Years in business: Established businesses with a clean claims record often earn lower rates than new businesses.

- Employee count and payroll: More employees and a larger payroll increase the exposure for Workers’ Compensation claims, impacting your premium.

For a deeper dive, this external resource is helpful: 13 Types of Insurance a Small Business Owner Should Have.

Reviewing and Updating Your Coverage

Your business is dynamic, and your business insurance policy must adapt with it.

- Annual policy review: At a minimum, review your policy with your agent annually at renewal. This is the time to discuss changes, assess new risks, and ensure your coverage is still adequate.

- Update after significant changes: Don’t wait for your annual review if a major change occurs. Contact your agent immediately after:

- Moving to a new location.

- Hiring new employees.

- Experiencing significant revenue growth.

- Launching new services or products.

- Purchasing major new assets, like equipment or vehicles.

- Ensuring coverage grows with your business: Regularly updating your policy ensures you are not underinsured when a claim occurs, protecting the success you’ve built.

Smart Strategies for Finding the Best Rates

Securing the right business insurance policy at a competitive price is a smart business move. A strategic approach can help you find comprehensive protection without overpaying.

The Role of an Independent Insurance Agent

An independent insurance agent is a key ally in navigating the complexities of a business insurance policy. Unlike agents who work for a single company, independent agents partner with multiple providers, which offers you distinct advantages.

We provide expert guidance, helping you understand policy details and the unique risks facing businesses in Massachusetts and New Hampshire. With access to multiple carriers, we shop the market on your behalf, comparing policies and rates to find the best fit for your needs and budget.

Based on your risk assessment, we offer custom recommendations to ensure your policy is custom to your operations. Our loyalty is to you, our client, not a single insurer. This allows us to provide unbiased advice and prioritize your best interests. To learn more, explore the Benefits of an Independent Commercial Insurance Agent.

How to Reduce Your Insurance Premiums

While you should never compromise on adequate coverage, there are several smart ways to reduce your insurance premiums.

Here’s a quick look at how you can save:

| Strategy | Description | Potential Savings |

|---|---|---|

| Bundling Policies | Combine multiple policies (like a BOP, or commercial property & liability with commercial auto) with one provider. Insurers often offer multi-policy discounts. | 5-15% |

| Risk Management | Implement safety protocols, provide employee training, and install security systems (e.g., alarms, cameras). Proactive risk management signals lower risk to insurers. | Varies by insurer |

| Higher Deductibles | Choose to pay more out-of-pocket per claim. This can lower your premium, but ensure you can afford the deductible if a claim occurs. | Lowers premium |

| Review Annually | Don’t just auto-renew. Get multiple quotes and ensure your coverage matches your current needs, as your business and market rates change. | Up to 35% |

Implementing these strategies can help lower the cost of your business insurance policy while maintaining robust protection.

Comparing Quotes Effectively

When you receive multiple quotes for your business insurance policy, it’s crucial to compare them for value, not just price. A cheap policy may have coverage gaps that leave you exposed.

Here’s how to compare quotes effectively:

- Look beyond price: A low premium could mean insufficient coverage, high deductibles, or critical exclusions. Compare policies on an apples-to-apples basis.

- Compare coverage limits: Ensure the proposed limits for liability and property are high enough to cover a potential worst-case scenario for your business.

- Understand deductibles: A higher deductible lowers your premium, but be sure you can comfortably pay that amount out-of-pocket if you need to file a claim.

- Check for exclusions: Every policy has limitations. Review what is not covered to ensure there are no gaps that leave your business vulnerable.

- Consider the insurer’s reputation: You want an insurer with financial stability (check AM Best ratings) and a good reputation for fair and efficient claims handling.

Frequently Asked Questions about Business Insurance Policies

Navigating a business insurance policy can bring up many questions. Here are straightforward answers to the most common concerns we hear from business owners in Massachusetts and New Hampshire.

How much does a typical business insurance policy cost?

The cost of a business insurance policy varies widely based on your industry, size, location, and chosen coverages. For a small, low-risk business in New England, a basic General Liability policy might range from $450 to $2,000 per year. A Business Owner’s Policy (BOP), which bundles general liability and property insurance, is often more cost-effective, typically averaging around $1,200 per year. Higher-risk industries like construction will have higher premiums.

Is business insurance legally required in Massachusetts and New Hampshire?

While no single law requires every business to have a general business insurance policy, certain coverages are mandatory. In both MA and NH, Workers’ Compensation is required if you have employees. Commercial Auto Insurance is required in MA for business-owned vehicles and is the most practical way to meet NH’s financial responsibility laws. Additionally, commercial leases and client contracts frequently require you to carry General Liability insurance.

How often should I review my business insurance policy?

You should review your business insurance policy at least annually upon renewal. This allows you to adjust coverage for any changes in your operations and shop for competitive rates. It is also critical to review your policy immediately after any significant business change, such as:

- Moving to a new location

- Hiring more employees

- A significant increase in revenue

- Launching new products or services

- Purchasing major equipment or vehicles

Regular reviews ensure your coverage keeps pace with your business’s growth and evolving risks.

Secure Your Business’s Future Today

You’ve poured your passion and dedication into building your business. Protecting that hard work with a solid business insurance policy is not just an expense—it’s a vital investment in your company’s financial stability and future.

A proper business insurance policy provides peace of mind and ensures you’re prepared for the unexpected, allowing your business to thrive for years to come.

Navigating insurance can be complex, but you don’t have to do it alone. The team at Stanton Insurance Agency is here to guide you. We help businesses in Massachusetts, New Hampshire, and Maine understand their risks and craft the custom protection they deserve.

Ready to protect your hard-earned success? Contact us today to discuss your business insurance needs and build a protective shield around your company.