Business Income Insurance: Your #1 Smart Shield

Why Business Income Insurance is Your Financial Safety Net

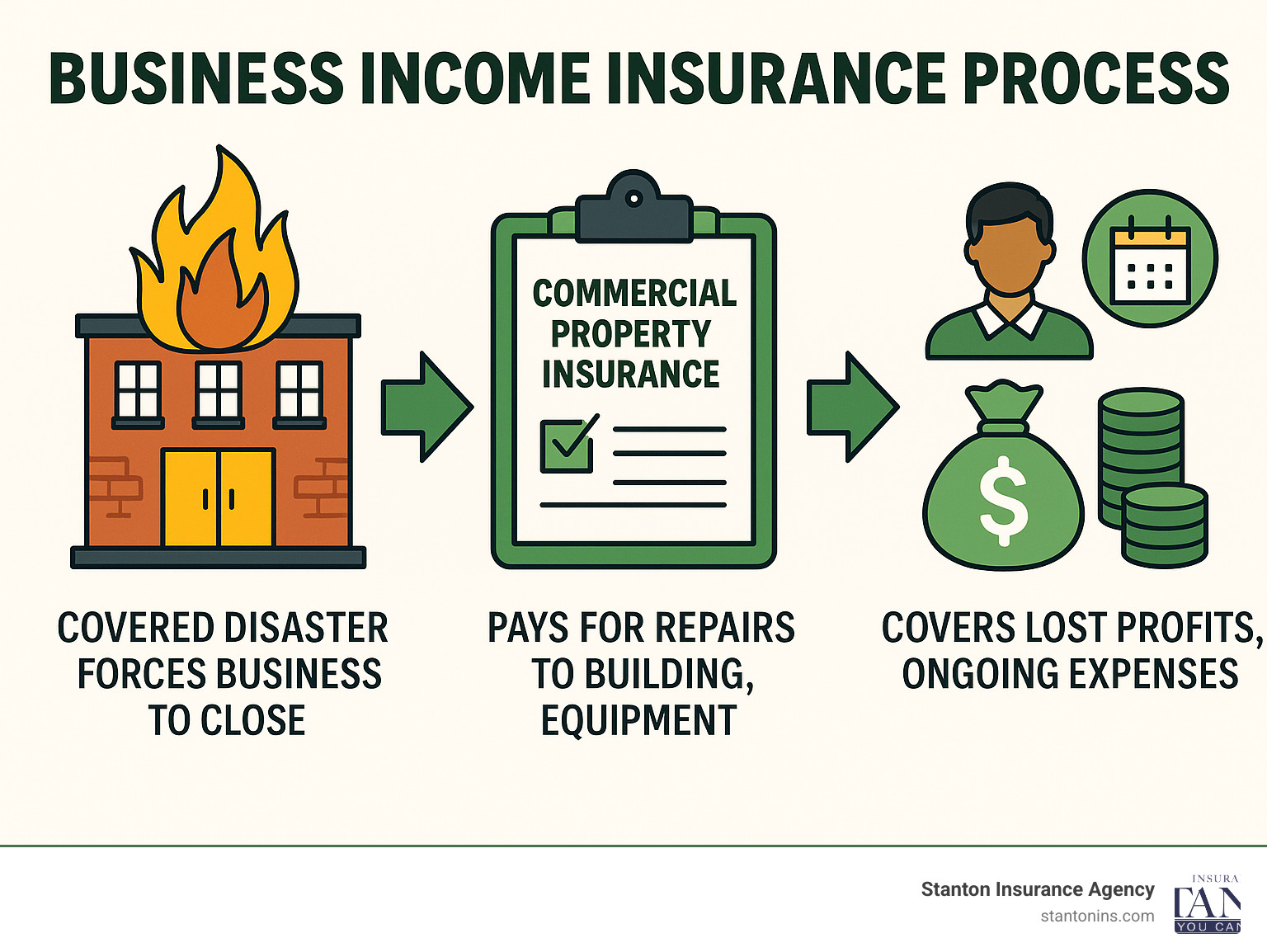

Business income insurance is commercial property coverage that replaces lost profits and pays ongoing expenses when a covered peril—fire, storm damage, or theft—forces you to shut your doors.

Key Coverage Components:

- Lost Net Income – profit you would have earned

- Continuing Operating Expenses – rent, payroll, taxes

- Extra Expenses – costs that speed reopening

- Temporary Relocation – operating from a backup site

Common Exclusions:

- Building repairs (handled by property insurance)

- Undocumented income

- Floods, earthquakes, pandemics without endorsements

- Ordinary economic downturns

Picture a fire in your Main Street shop in Portsmouth. Property insurance rebuilds the structure, but business income insurance keeps cash flowing so you can pay employees and rent until the grand-reopening.

I’m Geoff Stanton, fourth-generation insurance professional and President of Stanton Insurance Agency in Waltham, Massachusetts. After 25+ years helping New England businesses, I know this policy often means the difference between a temporary setback and a permanent closure.

Related business income insurance topics:

Introduction: Keeping Your Doors Open, Even When They’re Closed

Picture this: you’re running a successful bakery in downtown Portsmouth when disaster strikes without warning. Maybe it’s a fire that starts in your ovens during the morning rush. Perhaps it’s storm damage from a powerful nor’easter that sends a tree crashing through your storefront windows. Or it could be theft – vandals who break in and cause extensive damage to your equipment and interior.

Whatever the cause, the harsh reality hits immediately: your doors are closed, your customers can’t get their morning coffee and pastries, and your revenue has suddenly dropped to zero. But here’s what makes this situation truly stressful – your business expenses haven’t stopped. Your rent is still due, your employees still need their paychecks, and your loan payments keep coming.

This is where many business owners find the crucial difference between business interruption insurance and business income insurance. Here’s something that might surprise you: they’re actually the same thing! The insurance industry simply uses both terms interchangeably, though “business income insurance” has become the more modern and precise terminology.

The purpose of coverage is straightforward yet vital: it acts as your financial lifeline during those challenging weeks or months when you’re forced to close for repairs. While your commercial property insurance handles rebuilding your physical space, business income insurance keeps your business financially alive by covering lost profits and ongoing expenses like payroll and rent.

This coverage provides invaluable peace of mind knowing that while you’re dealing with contractors, adjusters, and the stress of getting back on your feet, at least your bills are getting paid. It’s the difference between a temporary setback and a permanent closure.

For more info about Small Business Insurance, our team can help you understand how this essential protection fits into your overall business insurance strategy.

What Your Business Income Insurance Policy Actually Covers (and What It Doesn’t)

Business income insurance protects earnings, not bricks-and-mortar. While Commercial Property Insurance rebuilds your space, this coverage keeps cash coming in so you can pay bills during repairs. It’s often packaged in a Business Owners Insurance Policy (BOP) or purchased on its own.

What’s Typically Covered?

- Lost Net Income – projected profits verified by your books.

- Continuing Operating Expenses – rent, loan payments, key payroll, and taxes.

- Temporary Relocation – extra rent, moving, and setup costs at a short-term site.

- Extra Expenses – reasonable outlays (rented equipment, overtime) that shorten downtime.

- Employee Payroll – lets you keep your team so you reopen fully staffed.

What’s Usually Excluded or Limited?

- Physical Property Damage – the field of your property policy.

- Undocumented Income – only verifiable earnings are covered.

- Certain Perils – flood, earthquake, or pandemic losses unless endorsed.

- Off-Premises Utility Failures – covered only with a Utility Services endorsement.

- Economic Downturn – market slumps aren’t insurable under this form.

Decoding the Jargon: Key Terms You Need to Know

Insurance policies can feel like they’re written in another language – and honestly, sometimes they are! Understanding these key terms will help you know exactly what your protection entails, making it easier to have informed conversations with your agent and make smart decisions about your coverage.

Think of this as your translation guide for the most important business income insurance terms you’ll encounter. Once you understand the language, you’ll feel much more confident about your contract and what it means for your business.

Period of Restoration and Waiting Period

The Period of Restoration is the timeframe during which your policy pays for lost income. It begins shortly after the physical damage occurs (often after a “waiting period”) and ends when your property is, or reasonably should be, repaired and ready for business. The standard period is typically 30 days, but this can be extended to 12 or 24 months depending on your needs.

Here’s where it gets interesting: the period doesn’t necessarily end when repairs are complete. It ends when your property should reasonably be repaired and ready for business. This protects you from contractors who might drag their feet or take longer than necessary.

The Waiting Period – also known as a time deductible – is the amount of time (like 24, 48, or 72 hours) that must pass after the incident before coverage kicks in. Think of it like a regular deductible, but measured in time instead of dollars. Many insurance companies have waiting periods of up to 72 hours, but some insurers offer a zero-hour waiting period, which means coverage begins immediately after the loss.

What is business income insurance with Extra Expense?

Extra Expense Coverage is a critical component that covers necessary expenditures to minimize the business shutdown and continue operations. For example, it could cover the cost of renting a temporary kitchen for your restaurant to fulfill catering orders while your main location is repaired. It helps you get back to generating revenue faster.

There are actually two standard forms for business income insurance: one that includes extra expense coverage and one that doesn’t. Most businesses benefit from the version that includes extra expense coverage because it gives you more flexibility to keep operating and recover faster.

Civil Authority and Dependent Properties

Civil Authority coverage applies if a government or military order – due to a covered peril at a nearby property, not your own – prohibits access to your business. For example, if police close your street due to a fire at a neighboring building, this can cover your lost income. Coverage typically lasts for 14 or 30 consecutive days, often with waiting periods of 24, 48, or 72 hours.

Dependent Property Coverage is your protection when someone else’s disaster becomes your problem. What if your key supplier’s factory burns down, halting your production? This endorsement, also called contingent business interruption, covers your lost income due to physical damage at the location of a key supplier, customer, or “leader” property that attracts customers to your area.

This coverage recognizes that in today’s interconnected business world, you’re not just vulnerable to disasters at your own location. Sometimes the domino effect of someone else’s covered loss can shut you down just as effectively as a fire in your own building.

Who Needs Business Income Insurance and How Much is Enough?

If your business relies on a physical location, equipment, or inventory to generate revenue, you likely need this coverage. A forced closure of even a few weeks can be financially devastating without it. We’ve seen too many New England businesses struggle to recover from disasters simply because they didn’t have adequate business income insurance.

The reality is stark: according to the Federal Emergency Management Agency, 40% of small businesses never reopen after a disaster. Many of these closures aren’t due to the physical damage itself, but because the business couldn’t survive the financial strain of lost income during the recovery period.

Who Needs This Coverage Most?

Restaurants and retail stores face the highest risk because they depend entirely on foot traffic and a physical location to sell goods or services. A fire in your kitchen or storm damage to your storefront can shut you down for weeks or months. Without business income insurance, you’re still paying rent and trying to keep key employees while earning nothing.

Manufacturers have particularly complex exposure because they rely on production facilities, machinery, and raw materials. If your manufacturing equipment is damaged, you can’t produce goods to sell. Even worse, you might have contracts with customers that you can’t fulfill, potentially leading to lawsuits or lost relationships.

Landlords and property managers often overlook this coverage, but they face significant exposure too. If your commercial or residential properties become uninhabitable due to a covered loss, you lose rental income that might be your primary source of revenue.

Even service-based businesses with physical offices should consider this protection. Accounting firms, law offices, and consulting businesses that would need to pay for temporary space to continue serving clients can benefit greatly from coverage. The cost of relocating and setting up a temporary office can be substantial.

How to Calculate Your Needs and What Influences the Cost

Calculating the right amount of coverage is a crucial step that requires careful analysis of your financial situation. You’ll typically work with your agent to complete a business income worksheet, analyzing past financials and projecting future earnings.

The calculation process involves examining your gross receipts or sales, then subtracting your cost of goods sold and operating expenses. After deducting taxes to determine net business income, you’ll need to project future income based on expected changes and estimate the restoration period on a worst-case scenario basis.

This isn’t just about replacing lost profits – you need to consider all the continuing operating expenses that won’t stop during closure. Your rent, key employee salaries, loan payments, and utilities will continue whether your doors are open or not.

Several factors influence your premium costs, and understanding them helps you make informed decisions. Industry risk plays a major role – a restaurant with open flames and hot cooking equipment has a higher risk profile than an accounting office. Generally, low-risk businesses might pay about 1% of revenue for coverage, while high-risk operations could pay 2-3%.

Coverage limits and your chosen period of restoration significantly impact costs. Higher limits and longer coverage periods – choosing 12 months versus 6 months of protection – will increase your premium. You can select monthly limits for 3, 4, or 6 months, with maximum periods of indemnity typically extending 120 days following the date of loss.

Your location matters too, especially here in New England. Businesses in coastal New Hampshire face different risks than those in inland Massachusetts. Properties susceptible to nor’easters, flooding, or other regional hazards may see different rates.

Your business financials form the foundation for determining coverage amounts. Insurers need to understand your annual revenue and operating expenses to calculate appropriate limits. This is another reason why maintaining accurate financial records is so important.

Finally, policy features like endorsements and your chosen waiting period affect the final cost. A 72-hour waiting period will cost less than immediate coverage, but you’ll need to weather those first few days without help. For more information about how this fits into your overall protection strategy, check out our guide on Do I need business interruption insurance?

Tailoring Your Policy: Essential Endorsements and Add-Ons

A standard business income insurance policy provides a great foundation, but endorsements allow you to customize coverage for your specific risks. Think of them as upgrades that fill potential gaps in your protection – like adding snow tires to your car before a New England winter.

After helping hundreds of businesses across Massachusetts and New Hampshire, I’ve learned that one-size-fits-all rarely works in insurance. Your Manchester manufacturing plant faces different risks than a Portsmouth boutique, and your coverage should reflect that reality. For more info about Commercial Insurance, we can help you identify which endorsements make sense for your business.

What additional coverages can be added to a business income policy?

Utility Services Endorsement protects you from income loss due to an interruption of power, water, or communications services caused by damage to the utility provider’s property, not your own. This is particularly important for businesses that rely heavily on electricity or internet connectivity. Picture this: a tree falls on power lines three miles from your office, cutting electricity to your entire neighborhood for five days. Without this endorsement, you’d have no coverage for the income you lose during that outage.

Contingent Business Interruption (CBI) is a vital add-on if you rely heavily on a single supplier or a major customer. It protects your income if their operations are shut down by a covered peril, which in turn disrupts your business. We’ve seen manufacturers in New Hampshire shut down for weeks because their key supplier in another state had a fire. Learn more about Contingent Business Interruption to understand how supply chain disruptions can affect your business.

Ordinance or Law Coverage addresses a common surprise that catches business owners off guard. If your building is damaged, local building codes may require you to make costly upgrades during reconstruction – like installing sprinkler systems or widening doorways for ADA compliance. This endorsement can cover the increased cost and the extra time it takes to comply, extending your period of restoration.

Extended Business Income coverage applies after your property has been repaired and you’ve reopened, but your income hasn’t returned to pre-loss levels. It typically provides coverage for up to 30 days after restoration, though this can be extended. Think of it as a bridge that helps you get back to full speed – customers might be slow to return, or you might need time to rebuild your inventory and staff.

The key is working with an experienced agent who understands both your business and the unique risks we face here in New England. What makes sense for a ski shop in North Conway might be completely different from what a tech startup in Cambridge needs.

Frequently Asked Questions about Business Income Insurance

When it comes to business income insurance, we get a lot of questions from business owners across New England. These are the most common concerns we hear, and I want to give you straight answers that actually help.

Are business income insurance and business interruption insurance the same thing?

Yes, they’re exactly the same thing! You’ll hear both terms used interchangeably in the insurance world. Business income insurance is the more modern and precise term you’ll find in most policy forms today, but plenty of people still call it “business interruption insurance.”

Think of it like how people say “soda” in some places and “pop” in others – different words, same thing. Whether your agent mentions business interruption or business income coverage, they’re talking about the same protection that replaces lost income and covers ongoing expenses after a covered disaster.

How is a business income claim calculated and paid?

Filing a business income insurance claim requires good record-keeping, which is why I always tell clients to maintain detailed financial records. You’ll need to provide past profit and loss statements, sales records, and expense reports to your insurance adjuster.

Here’s how the calculation works: The adjuster uses your historical data to project what income you would have earned during the “period of restoration” if the disaster hadn’t happened. Then they subtract any income you actually managed to earn during the closure (maybe from online sales or a temporary location). The difference is your covered loss.

Business income insurance is defined as your net profit or loss before income taxes that would have been earned, plus continuing normal operating expenses including payroll. The key phrase is “actual loss sustained” – you can’t collect for anticipated profits, only verifiable losses based on your financial history, up to your policy limit.

Does business income insurance cover closures due to a pandemic?

Unfortunately, no. This became a painful lesson for many businesses during COVID-19. Standard business income insurance policies require “direct physical loss or damage” to property to trigger coverage. Business closures due to viruses, bacteria, or government stay-at-home orders typically don’t meet this requirement because there’s no physical damage to your property.

The pandemic highlighted this exclusion for countless New England businesses who thought they had coverage but finded they didn’t. Some insurers now offer specific, limited coverage by endorsement, but it’s not standard and often comes with significant restrictions.

Does business income coverage include payroll?

Yes, and this is often the most valuable part of the coverage! Business income insurance can help pay operating expenses like payroll, which means you can keep your valuable employees on the payroll even when your doors are closed.

This benefit serves two purposes: it provides financial security for your team during a difficult time, and it ensures you have trained staff ready to go when you reopen. Many business owners tell us this payroll protection gave them tremendous peace of mind during their recovery.

Does business income coverage have a deductible?

Business income insurance works differently than other types of coverage. Instead of a monetary deductible, most policies have what’s called a waiting-period deductible. This means you must wait a specified period – typically 24, 48, or 72 hours – before coverage begins.

Think of it as a time deductible rather than a dollar amount. However, some insurers offer zero-hour waiting periods, which means coverage starts immediately after the loss. The waiting period you choose will affect your premium, with shorter waiting periods costing more.

How long does business income coverage last?

Coverage starts when your business shuts down due to covered damage and ends when repairs are complete and operations can reasonably resume. The restoration period for business income insurance typically has a time limit – usually 30 days for basic coverage, but this can be extended to 12 or 24 months depending on your policy and business needs.

The coverage doesn’t automatically end when repairs are finished. It continues until you could reasonably be back in business, which might include time for restocking inventory, rehiring staff, or getting necessary permits. This is why working with an experienced agent to determine the right restoration period is so important for your specific business.

Conclusion: Protecting Your Bottom Line is Our Top Priority

Navigating Business Insurance can be complex, but you don’t have to do it alone. Business income insurance isn’t just another policy – it’s a critical survival tool that ensures a temporary setback doesn’t become a permanent closure. It provides the cash flow to pay your bills, your people, and yourself while you focus on getting back on your feet.

Think about it this way: you’ve poured your heart, soul, and savings into building your business. Whether it’s the family restaurant that’s been serving the community for decades or the innovative tech startup you launched in your garage, your business represents more than just income – it’s your legacy, your passion, and often your family’s future.

When disaster strikes, the last thing you should worry about is whether you can afford to keep your doors open during repairs. That’s exactly what business income insurance takes care of. It’s like having a financial safety net that catches you when the unexpected happens, giving you the breathing room to focus on what really matters: getting back to serving your customers and doing what you love.

At Stanton Insurance Agency, we’ve been helping New England businesses protect what matters most for over 25 years. We understand the unique challenges facing businesses in Massachusetts, New Hampshire, and Maine – from nor’easters that can knock out power for days to the seasonal nature of many local businesses that depend on summer tourism or winter sports.

We’ve seen how business income insurance can make the difference between a quick recovery and a devastating closure. The restaurant owner whose kitchen fire happened right before the busy summer season. The retailer whose storefront was damaged just before the holiday shopping rush. The manufacturer whose equipment failure could have meant laying off dozens of employees. In each case, this coverage provided the financial bridge they needed to rebuild and come back stronger.

Whether you’re a restaurant owner in Boston’s North End, a manufacturer in Manchester, or a retailer on Portsmouth’s historic waterfront, we can help you assess your unique risks and build a policy that truly protects the business you’ve worked so hard to create. Because when disaster strikes, you shouldn’t have to worry about whether you can afford to rebuild – you should be able to focus on getting back to what you do best.

Contact us today to discuss your business income insurance needs. After all, protecting your bottom line is our top priority.