Builder risk insurance rates: 2025 Essential Guide

Understanding Builder’s Risk Insurance Rates for Your Construction Project

Builder risk insurance rates are typically calculated as 1% to 5% of your total construction project value. For a $500,000 build, you’d pay between $5,000 and $25,000 for coverage during the construction period.

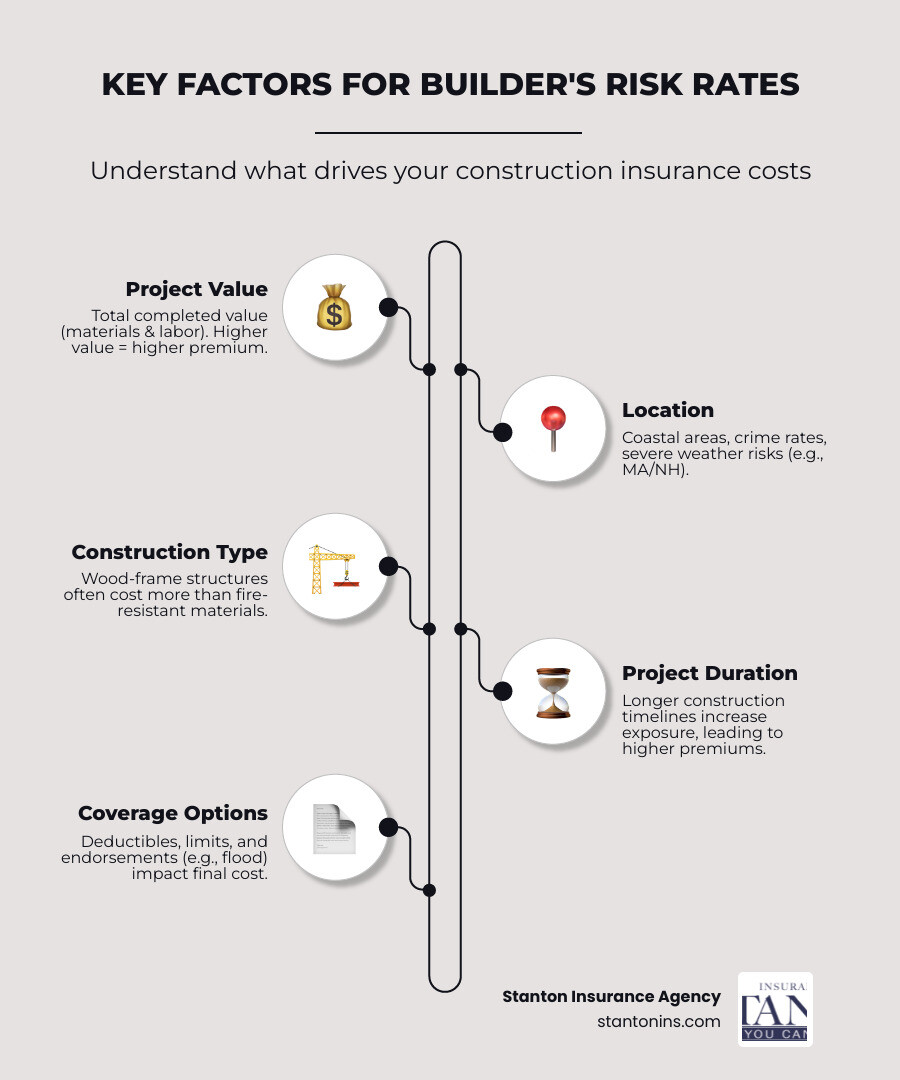

Key factors that determine your rate:

- Project value – The total completed value including materials and labor

- Location – Coastal areas, crime rates, and weather risks

- Construction type – Wood-frame vs. fire-resistant materials

- Project duration – Longer projects = higher premiums

- Coverage options – Deductibles, limits, and endorsements

Average monthly costs: $40–$85 per $100,000 of construction value

For any construction project in Massachusetts or New Hampshire, understanding these rates is key to budgeting accurately. Builder’s risk insurance protects your investment during the vulnerable construction phase when standard property policies won’t cover a new build, renovation, or addition.

The bottom line: Most contractors and property owners find that builder’s risk insurance costs between $1,000 and $7,000 annually, depending on project specifics. Lenders typically require this coverage before releasing construction funds.

I’m Geoff Stanton, President of Stanton Insurance Agency. With over 25 years of experience, I’ve helped countless homeowners and contractors in Massachusetts and New Hampshire steer builder’s risk insurance rates. This guide explains how rates are calculated and how you can manage costs while protecting your project.

What is Builder’s Risk Insurance and What Does It Cover?

Builder’s risk insurance is a temporary property policy designed for construction projects. It protects your building during construction or renovation, filling a critical gap left by standard homeowner’s or commercial property policies. Most property policies exclude structures under construction because a job site has unique risks. A builder’s risk insurance policy protects your investment during this vulnerable phase.

The policy covers the structure’s value and on-site materials, paying for repairs or rebuilding after a covered loss. This protection is essential, as an incident without it could lead to devastating out-of-pocket expenses that halt your project.

What’s Typically Covered?

Most plans offer “all-risk” coverage, protecting against any peril not specifically excluded. While policies vary, common covered events are nearly universal.

Fire damage is a crucial protection, as a fire can destroy months of work and materials in hours. Weather events like wind, hail, and lightning are covered, which is vital in New England. Flood and earthquake damage are usually excluded but can be added via endorsements if your location is at risk.

Theft of valuable building materials, fixtures, and equipment is a common risk. Your policy covers these losses, protecting your budget and timeline. Similarly, vandalism, from graffiti to intentional destruction, is also covered, helping you restore the project without a major financial hit.

The policy also protects against structural collapse from a covered event. Most policies also cover materials in transit or temporarily stored off-site, protecting items like expensive windows or custom fixtures before they are installed.

To learn more, see what builder’s risk covers. This specialized insurance fills a critical gap when your investment is most vulnerable. Understanding the scope of this protection clarifies how builder risk insurance rates are calculated.

Key Factors That Determine Builder’s Risk Insurance Rates

A builder’s risk policy cost is not one-size-fits-all. Insurers perform a detailed risk assessment of your project, considering materials, location, and more. Generally, builder risk insurance rates fall between 1% and 5% of the total construction cost. Understanding the key variables helps you anticipate and manage expenses.

Project Scope and Value

The biggest factor influencing your builder risk insurance rates is the project’s total completed value. This includes all materials, labor, and associated fees.

Hard costs are the direct expenses of construction, including labor, materials, and equipment. A $2 million commercial build will have a higher premium than a $400,000 home renovation because the potential loss is greater.

Soft costs are indirect expenses from a construction delay caused by a covered loss, such as loan interest, legal fees, and taxes. These can add up quickly. Soft cost coverage is not standard but can be added as an endorsement, which is highly recommended for larger projects.

The project type also affects rates. A new build, a gut renovation, or a building addition each has a unique risk profile. Remodeling projects often have higher builder risk insurance rates due to risks with existing structures, like uncovering hidden issues. Shorter installation projects typically have the most affordable premiums.

Construction and Location Details

Where and how you build greatly affects your premium, especially in Massachusetts and New Hampshire, where geography presents unique risks.

Construction type influences your project’s vulnerability. Fire-resistant materials like steel and concrete can lead to lower builder risk insurance rates compared to wood-frame structures. Using materials that better withstand hazards will likely be reflected in your premium.

Location is critical. Building on the Massachusetts or New Hampshire coastlines means higher risks from hurricanes and nor’easters, leading to higher builder risk insurance rates. A partially completed structure is also vulnerable to New England’s heavy snow, ice, and high winds. Local crime rates also affect premiums; higher theft and vandalism risks mean higher costs. Conversely, proximity to a fire department and hydrants can lower your rates.

Regional labor and material costs also influence builder risk insurance rates. For example, recent industry data shows significant reconstruction cost increases in New Hampshire. As rebuilding costs rise, premiums typically follow.

Policy Structure and Your Influence on Builder’s Risk Insurance Rates

The good news is you have some control over your premium. The coverages and limits you choose allow for customization based on your project’s needs and risk tolerance.

Coverage limits should equal the project’s total estimated completed value. A $1 million project needs a $1 million limit. While higher limits mean higher premiums, underinsuring to save money is risky and can lead to significant out-of-pocket expenses after a major loss.

Deductibles are what you pay out-of-pocket before coverage begins. A higher deductible can lower your builder risk insurance rates, but be sure to choose an amount you can comfortably afford if you need to file a claim.

The policy term is temporary, matching your project’s expected duration (e.g., 6, 12, or 18 months). Longer projects mean longer risk exposure and higher costs. Extensions are usually available for delays but will add to your premium.

Finally, optional coverages let you tailor your policy. Adding a builder’s risk endorsement for risks like flood, soft costs, or specialized equipment will increase your premium but provides crucial protection. Weigh the cost of the endorsement against the potential financial impact of an uncovered loss.

Understanding the Average Cost and What’s Not Included

While builder risk insurance rates are always project-specific, industry benchmarks can help you budget. Most policies cost between 1% and 5% of your total project value. For a $500,000 home, that’s roughly $5,000 to $25,000 for the policy term. Monthly costs can range from $40 to $85 per $100,000 of value. A typical six-month new home build might cost $4,000 to $6,000 in total premiums.

These numbers vary based on location, materials, project duration, and selected coverages. For a personalized estimate, our builder’s risk insurance cost calculator can provide a clearer picture.

Typical Exclusions to Be Aware Of

Knowing what is not covered is as critical as knowing what is. Common exclusions include:

- Faulty workmanship, design, or materials: Losses from poor-quality work or defective materials are the contractor’s or designer’s responsibility.

- Employee theft: This is covered under a separate crime insurance policy, not builder’s risk.

- Mechanical breakdown: Equipment failure requires a separate equipment breakdown policy.

- Earthquake and flood: These are almost always excluded but can be added via an endorsement. If your project is in a vulnerable area, you must ask, “Does builder’s risk insurance cover flood?“

- Wear and tear: Gradual deterioration is not covered.

- Contractual penalties for delays and government action like property seizure also fall outside the policy’s scope.

Does Builder’s Risk Cover Liability?

A common misconception is that builder’s risk covers liability. No, it does not.

Builder’s risk is a first-party property policy protecting your assets: the structure, materials, and on-site equipment. It covers direct physical loss to the project, not injuries to others or damage to their property.

For injuries to others or damage to a neighbor’s property, you need Commercial General Liability (CGL) insurance. This is a separate policy that contractors must carry, and property owners should also ensure they have adequate liability coverage.

Without proper liability coverage, a job site accident could be financially devastating. Builder’s risk and liability insurance work hand-in-hand to provide comprehensive protection for your property and your legal responsibilities.

Navigating Your Builder’s Risk Policy

Managing your builder’s risk insurance means knowing who needs coverage, when it starts, and how it fits with other policies. Getting this right prevents coverage gaps and protects everyone involved.

Who Needs a Policy and When Is It Required?

Anyone with a financial stake in a construction project needs protection. This includes:

- Property Owners: A homeowner building a house or a commercial developer has the most to lose.

- General Contractors: They are almost always contractually required to secure a policy to meet owner and lender requirements.

- Subcontractors: They can often be listed as an additional insured on a builder’s risk policy to protect their materials and work.

- Lenders: Financial institutions will not release construction funds without proof of builder’s risk insurance to protect their collateral.

The construction contract should clearly state who pays for builder’s risk insurance, which is usually the property owner or general contractor. Regardless of who pays, everyone benefits from proper coverage.

Understanding Your Policy’s Lifespan and Customization

Builder’s risk insurance is temporary, with a policy term matching your estimated project duration, such as 6, 12, or 18 months. If your project is delayed, you can usually apply for an extension, which will add to your premium. Coverage starts when construction begins and ends when the project is complete and ready for occupancy, at which point your standard property insurance takes over.

A key strength of builder’s risk insurance is its customization. You can adjust limits, choose deductibles, and add endorsements for unique exposures. For example, you can add flood coverage via a builder’s risk endorsement or protect specialized equipment. This flexibility ensures you get the right amount of protection without overpaying.

It’s also vital to distinguish builder’s risk from a contractor’s General Liability policy. General Liability is liability insurance, covering legal responsibility for accidents. Builder’s risk is property insurance, protecting the physical structure and materials from direct damage. They are separate policies covering separate risks, and you need both.

Frequently Asked Questions about Builder’s Risk Insurance Rates

Here are answers to the most common questions we hear about builder risk insurance rates from homeowners and contractors in Massachusetts and New Hampshire:

How is the final cost of builder’s risk insurance calculated?

The final cost is typically 1% to 5% of your project’s total completed value. Insurers adjust this base rate based on project specifics: new build vs. renovation, wood-frame vs. steel construction, and location (e.g., coastal vs. inland). Your chosen coverage options, such as deductibles and endorsements for flood or soft costs, also play a major role. A longer project duration also increases the premium, as it extends the period of risk. Each factor contributes to the final risk assessment.

Can I get a policy for a small renovation project?

Yes, and it’s highly recommended for major renovations and additions. A standard homeowner’s policy may not cover your property during substantial structural changes, leaving a critical gap that a builder’s risk policy is designed to fill. While you don’t need it for minor cosmetic updates, we strongly advise coverage for any project involving structural work, additions, or significant demolition.

What’s the difference between builder’s risk and a standard homeowner’s policy?

A standard homeowner’s policy is for a finished, occupied home and typically excludes or limits coverage during major construction. For example, it likely wouldn’t cover water damage if a storm hits after your roof is removed for an addition. A builder’s risk policy is designed for the “course of construction” phase, covering the structure, on-site materials, and unique job site risks like theft and vandalism. Once the project is complete, your homeowner’s policy takes over. The two policies work in sequence.

Get the Right Protection for Your Project

Construction projects in Massachusetts and New Hampshire are significant investments. Understanding builder’s risk insurance rates is crucial but can feel overwhelming when you’re juggling contractors, permits, and budgets.

The right coverage is a critical part of a successful project, providing a financial safety net against events like severe weather, theft, or accidents. Properly protecting your investment ensures that one unforeseen event doesn’t derail your project or cause catastrophic financial loss.

You don’t have to steer these complexities alone. An experienced insurance professional can assess your project’s risks, explain premium factors, compare quotes, and customize a policy that provides robust protection at a competitive rate. We help you find the right balance of coverage and cost.

For over 25 years, Stanton Insurance Agency has helped homeowners, contractors, and developers in Massachusetts and New Hampshire protect their projects. We understand the unique risks of building in our region, from coastal exposure to harsh winters, and know the local challenges.

Our expert team will guide you through the entire process, from planning to policy issuance and claims support. We’ll ensure your asset is protected from groundbreaking to completion, giving you peace of mind.

Ready to secure your project with the right builder’s risk insurance coverage? We’re here to help. Get a custom quote for your builder’s risk insurance needs today.