Boat insurance quotes: Save Big in 2025

Why Getting Multiple Boat Insurance Quotes Matters

Boat insurance quotes can vary dramatically between insurers, sometimes by hundreds or even thousands of dollars annually for the same coverage. Smart boat owners in Massachusetts and New Hampshire know that comparing multiple quotes is the key to finding comprehensive protection without overpaying.

Quick Answer for Boat Insurance Quotes:

- Get 3-5 quotes from different insurers for an accurate comparison.

- Expect to pay roughly 1.5% of your boat’s value annually (e.g., $450/year for a $30,000 boat).

- Required information: Boat details (year, make, model, HIN), your boating experience, and intended usage.

- Best savings: Multi-policy discounts (up to 25%), boating safety course completion, and winter lay-up periods.

- Coverage types: Liability, hull/equipment, medical payments, and towing assistance.

Boat insurance costs can range from as little as $100 per year for basic liability on smaller watercraft to several thousand for comprehensive protection on larger vessels. Whether you’re protecting a fishing boat on New Hampshire’s lakes or a yacht cruising Massachusetts’ coastal waters, understanding how to compare quotes effectively can save you significant money while ensuring you have the right protection.

I’m Geoff Stanton, President of Stanton Insurance Agency. With over two decades of experience in both claims and underwriting, I have a unique insight into what boat owners need to protect their investment and enjoy worry-free time on the water.

Boat insurance quotes definitions:

- do i need boat insurance (https://stantonins.com/do-i-need-boat-insurance/)

- boat insurance for older boats (https://stantonins.com/boat-insurance-for-older-boats/)

- boat rental insurance (https://stantonins.com/boat-rental-insurance/)

Understanding Your Boat Insurance Needs

Before comparing boat insurance quotes, you need to know what you’re looking for. A dedicated boat insurance policy is specifically designed for the unique risks of owning a watercraft. While a homeowner’s policy might offer a small endorsement for a low-horsepower boat, it typically has very low limits (e.g., $1,500) and lacks crucial protections like wreck removal, fuel spill liability, or on-water towing. A separate boat policy is the only way to be properly insured.

Key Types of Boat Insurance Coverage

Understanding these components is the first step to getting accurate boat insurance quotes for the protection you need.

Hull and Equipment Coverage: This protects your boat, motor, and permanently attached equipment from physical damage or theft. Policies are typically either “Agreed Value,” which pays a pre-determined amount for a total loss, or “Actual Cash Value,” which pays the boat’s current market value after depreciation. For newer boats, Agreed Value is often preferred.

Liability Coverage: This is vital. It covers bodily injury to others or damage to their property if you’re at fault in an accident. It also helps cover legal defense costs. Many marinas in Massachusetts and New Hampshire require proof of liability coverage, often $1,000,000 or more.

Uninsured/Underinsured Watercraft Coverage: This protects you and your passengers if you’re hit by a boater who has no insurance or not enough to cover the damages.

Medical Payments: This helps pay for medical expenses for you and your passengers after a boating accident, regardless of who was at fault.

Towing and Assistance: This provides on-water towing to shore if your boat is disabled. Some policies include roadside assistance for your trailer, fuel delivery, or jump starts.

Personal Effects: This covers the loss or damage of personal belongings you bring on board, like fishing gear or watersports equipment.

Wreckage Removal and Fuel Spill Cleanup: If your boat sinks or is severely damaged, this helps pay the potentially massive costs of removing the wreckage and cleaning up any environmental pollution.

More info about boat insurance options (https://stantonins.com/personal-insurance/boat-insurance/)

What Types of Boats Can Be Insured?

Virtually every type of recreational watercraft can be insured, though policy details and premiums vary based on the vessel’s size, type, and use.

- Powerboats: This broad category includes runabouts, cruisers, center consoles, and speedboats. Insurance varies based on length, horsepower, and top speed.

- Sailboats: Coverage can be custom for dinghies or large cruising yachts, with special considerations for sails, rigging, and racing risks.

- Pontoon Boats: Popular for family outings, these are generally less expensive to insure.

- Fishing and Bass Boats: These policies often require specialized coverage for expensive equipment like depth finders and trolling motors.

- Yachts: Defined as vessels 27 feet and larger, yachts require specialized policies due to their high value and complex systems.

- Personal Watercraft (PWCs): Jet Skis, Sea-Doos, and Wave Runners can cause significant damage or injury, making dedicated PWC insurance essential.

More info about PWC insurance (https://stantonins.com/personal-watercraft-insurance-and-safety/)

Factors That Influence Your Boat Insurance Quotes

When you request boat insurance quotes, insurers evaluate several factors to determine your premium. Understanding these helps you see why quotes differ and where you might find savings.

Your Boat’s Profile

Your boat itself is a primary factor. A newer, more valuable boat generally costs more to insure due to higher potential repair or replacement costs. For an older boat, an insurer might require a marine survey to confirm it’s in good, seaworthy condition. The boat’s size and type also matter; a small fishing boat costs less to insure than a large, high-performance speedboat. More horsepower often means a higher premium due to increased risk. Interestingly, boats with diesel engines may be cheaper to insure than gasoline-powered ones because diesel is less flammable, reducing fire risk.

Your Boating Habits and Location

Where you boat significantly impacts your boat insurance quotes. Navigating calm inland lakes in New Hampshire typically results in lower premiums than cruising the unpredictable coastal waters of Massachusetts. Extended trips to areas like the Caribbean will require broader, more expensive coverage. How and where you store your boat is also key. A boat kept in a secure marina or locked garage is seen as less risky than one left on a trailer in a driveway. In colder climates like ours, using a winter “lay-up” period—when the boat is stored and not in use—can earn you a significant discount.

The Operator’s Experience

Finally, your experience at the helm is crucial. Insurers favor boaters with years of experience and a history of responsible ownership, which often translates to lower rates. Just like with auto insurance, a clean claims history with no prior boat insurance losses or violations will result in better boat insurance quotes. One of the best ways to earn a discount is by completing a recognized boating safety course from an organization like the U.S. Coast Guard Auxiliary (https://www.cgaux.org/boatinged/). It demonstrates your commitment to safety and can lower your premium.

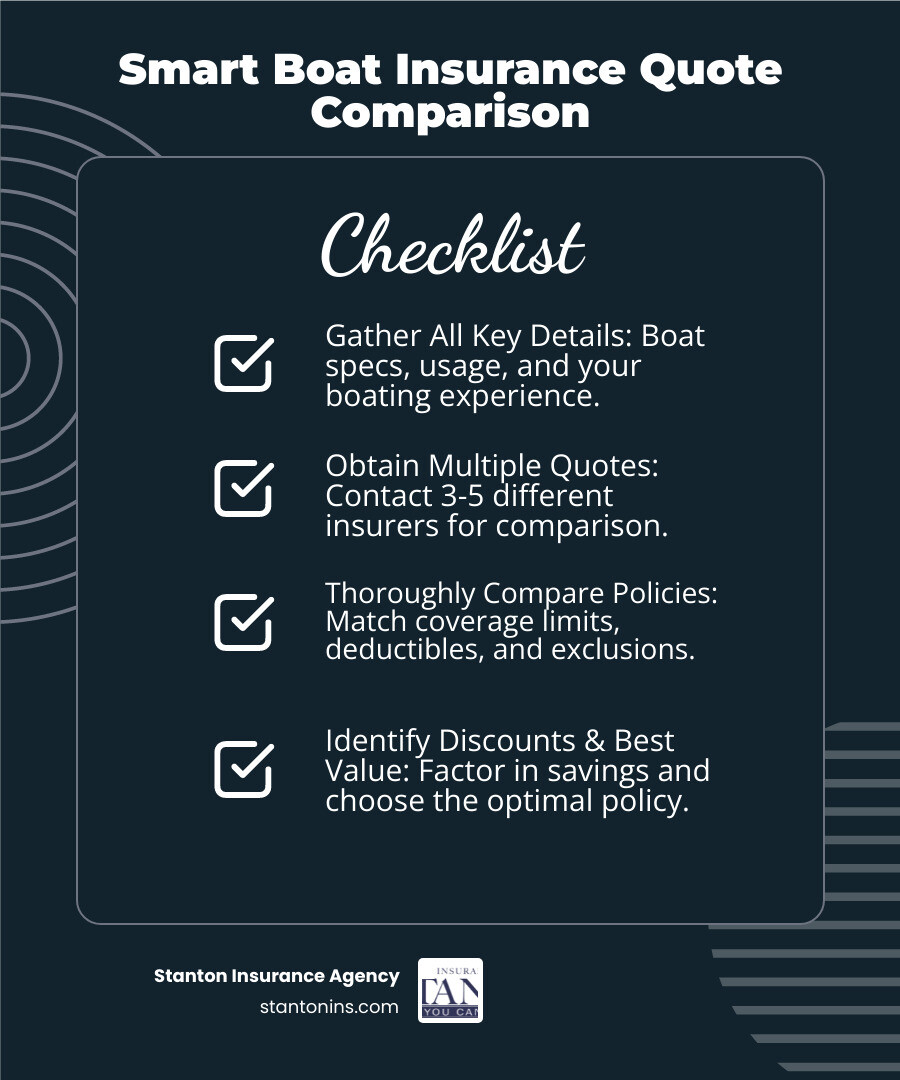

The Smart Way to Get and Compare Boat Insurance Quotes

With a clear understanding of your needs, you’re ready to gather quotes. A systematic approach ensures you’re comparing apples to apples, not just chasing the lowest price.

What Information You’ll Need to Get a Quote

Have this information ready to make the process smooth and receive accurate boat insurance quotes.

- Personal Information: Full name, address, date of birth, and driver’s license number.

- Boat Details: Year, make, model, length, Hull Identification Number (HIN), hull material, propulsion type, and engine details (horsepower, top speed).

- Value & Ownership: The boat’s current market value, purchase price, and date.

- Usage & Experience: Where the vessel will be used (e.g., inland lakes, coastal waters), if you have a winter lay-up period, your years of boating experience, and any boater safety courses completed.

- Claims History: Details of any boat insurance losses in the past 5 years.

Documents for a Quote (Helpful to have on hand):

- Boat Registration or Title

- Driver’s License

- Proof of Boating Safety Course Completion

- Marine Survey (especially for older or high-value boats)

How to Effectively Compare Your Boat Insurance Quotes

Don’t just look at the bottom-line price. A cheap quote might mean you’re underinsured. Focus on making a true side-by-side comparison.

- Match Coverage Limits: This is critical. Ensure liability, uninsured watercraft, and medical payment limits are identical across all quotes.

- Compare Deductibles: Check the deductible for hull coverage. A higher deductible lowers your premium but means you pay more out-of-pocket on a claim. Some policies offer a “diminishing deductible” that decreases each accident-free year.

- Check for Exclusions: Read the fine print. Are watersports covered? Are there navigational limits? Most policies do not cover normal wear and tear.

- Verify Valuation Type: Confirm if the policy is “Agreed Value” or “Actual Cash Value.” For newer boats, Agreed Value is almost always preferred as it removes uncertainty in a total loss claim.

- Review Add-on Coverages: Are essentials like towing, personal effects, or wreckage removal included, or are they optional extras that add to the cost?

- Understand Claims Handling: Research the insurer’s reputation for claims service. You want a provider known for fair and timely claim resolution.

How Much Is Boat Insurance? (https://stantonins.com/how-much-is-boat-insurance/)

Opening Up Savings on Your Policy

Finding the right boat insurance quotes isn’t just about comparing prices; it’s also about smart strategy. You can take proactive steps to lower your premiums without sacrificing essential protection. Insurers reward responsible boaters with a variety of discounts, and at Stanton Insurance Agency, we help you find every available saving.

Common Boat Insurance Discounts

Explore these popular ways to trim your premium. Think of them as rewards for being a savvy and safe boater.

- Bundling Policies: Combining your boat insurance with your auto or home policy is one of the easiest and most significant ways to save.

- Boating Safety Course: Completing a recognized course from the U.S. Coast Guard Auxiliary (https://www.cgaux.org/boatinged/) or a state-approved provider often earns a significant discount.

- Safety Equipment: Installing a fixed fire suppression system, GPS, depth finder, or alarm system can reduce your rate.

- Clean Record: A claims-free history on the water and on the road will result in better pricing.

- Lay-Up Discount: In Massachusetts and New Hampshire, you can get a discount by declaring a period (typically winter) when your boat is stored and not in use.

- Diesel Engine: Boats with diesel engines are often cheaper to insure than gasoline-powered ones due to a lower fire risk.

- Experience and Multi-Unit: Seasoned boaters may qualify for a discount, and insuring more than one watercraft with the same company can also lead to savings.

- Payment Discounts: Paying your policy in full or signing up for automatic payments can often earn a small discount.

- Anti-Theft Devices: Approved anti-theft devices make your boat less of a target and can lower your premium.

Safety on the water is paramount. Check out our Boating Safety Tips (https://stantonins.com/boating-safety-tips/) for more ways to keep your trips smooth and worry-free.

After You’re Insured: Claims and Policy Management

Choosing an insurer goes beyond finding the best boat insurance quotes. It’s about the reliable support you receive if you ever need to file a claim. That’s when your policy truly proves its worth, turning a stressful event into a manageable one.

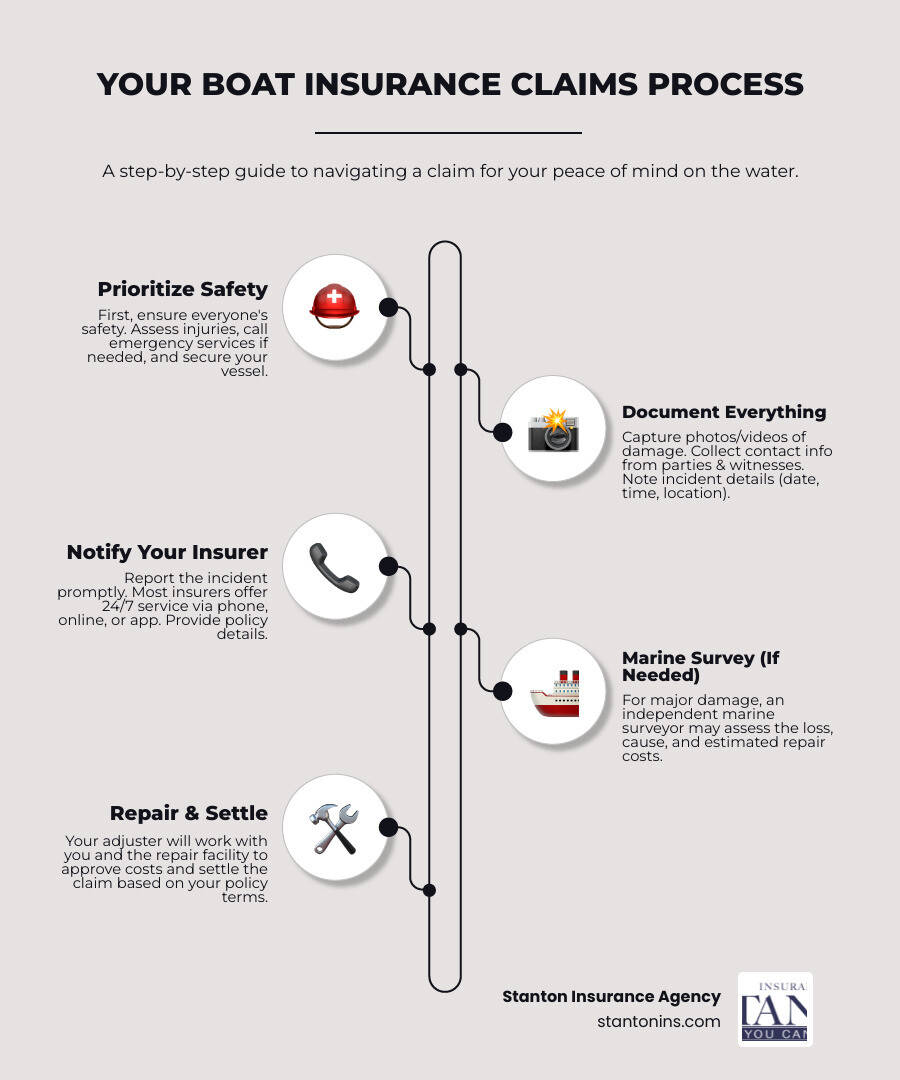

The Claims Process

If an incident occurs, knowing what to do makes all the difference. The claims process generally involves these steps:

- Ensure Safety: Your first priority is the safety of everyone involved. Check for injuries and call for help if needed. Secure your boat to prevent further damage.

- Document the Scene: Take clear photos and videos of the damage and the surrounding area. Collect contact information from other parties and any witnesses.

- Contact Your Insurer: Report the claim as soon as possible. Most insurers have 24/7 claims service. An adjuster will be assigned to guide you through the process.

- Marine Survey (if applicable): For significant damage, your insurer may hire an independent marine surveyor to assess the damage and estimate repair costs. You can find accredited professionals through the Society of Accredited Marine Surveyors (https://www.marinesurvey.org/).

- Repair and Settlement: Your adjuster will work with you and the repair shop to review estimates and determine covered costs. Once approved, the insurer settles the claim based on your coverage and deductible.

The Value of a Specialized Provider

While many companies offer boat insurance, working with a specialized marine insurance agency like Stanton Insurance Agency provides distinct advantages. We understand the nuances of different policies and the unique risks of boating in Massachusetts and New Hampshire. With established relationships with top-rated marine insurers, we can effectively compare boat insurance quotes to find a policy that fits your specific needs, not a one-size-fits-all solution. When things go wrong, you want a partner who speaks the language of boats and understands marine claims.

Frequently Asked Questions about Boat Insurance Quotes

Is boat insurance required in Massachusetts or New Hampshire?

No, neither Massachusetts nor New Hampshire legally requires boat insurance for most recreational boats. However, it is a practical necessity. Most marinas require proof of liability coverage to dock or moor your boat. Furthermore, if you financed your boat, your lender will almost certainly require you to carry comprehensive and collision coverage to protect their investment. Operating without insurance means you are personally responsible for all damages and injuries, which could be financially devastating.

How much does boat insurance typically cost?

The cost of boat insurance varies widely. A general rule of thumb is that annual premiums are around 1.5% of your boat’s insured value. For a $30,000 boat, you might see boat insurance quotes around $450 per year. However, the final price depends on your boat’s type, age, and speed; where you boat and store it; and your personal experience and claims history. Basic liability might cost $20-$30 per month, while a comprehensive policy could be $50-$100 per month.

Can I just add my boat to my homeowner’s insurance policy?

This is a common misconception and a risky move. While some homeowner’s policies offer a limited endorsement for very small, low-horsepower boats, the coverage is almost never sufficient. These endorsements have extremely low limits (e.g., $1,500) and lack the specialized protections essential for boaters. Key coverages like liability for passenger injuries, wreck removal, fuel spill cleanup, and on-water towing are typically excluded. A separate, dedicated boat insurance policy is the only way to ensure you are properly protected on the water.

Get the Right Protection for Your Peace of Mind

Comparing boat insurance quotes is a vital step for any responsible boat owner. By understanding coverage types, cost factors, and how to compare policies, you can make an informed decision that protects your vessel, finances, and enjoyment of the water.

An independent insurance agent is your most valuable resource in this process. We can help you identify discounts, clarify policy language, and find the perfect balance of comprehensive coverage and affordable cost. The team at Stanton Insurance Agency is here to help you find the right policy so you can focus on what matters most—making memories on the water.

Contact us today to get your personalized boat insurance quote! (https://stantonins.com/personal-insurance/boat-insurance/)