Best affordable tenant insurance: Smart Guide 2025

Why Affordable Tenant Insurance Matters for Renters

Best affordable tenant insurance protects your belongings and shields you from liability—often for less than the cost of a few streaming services each month. Here are the top features to prioritize when comparing policies:

- Personal property coverage starting at $25,000-$30,000 to replace your belongings after theft or damage

- Personal liability protection of at least $100,000 to cover accidental injuries or property damage to others

- Additional living expenses to pay for temporary housing if your rental becomes uninhabitable

- Replacement cost coverage instead of actual cash value, so you can buy new items without depreciation deductions

- Bundling discounts when you combine renters insurance with auto insurance, saving up to 25%

Renting your space gives you freedom and flexibility, but what about protecting the life you’ve built inside it? From your laptop and furniture to your clothes and kitchenware, your belongings are valuable. Tenant insurance, also known as renters insurance, is your financial safety net against unexpected events like theft, fire, or liability claims.

The good news? This essential protection is surprisingly affordable. According to industry data, renters insurance costs between $15 to $30 per month on average—less than many people spend on coffee. Yet less than 50% of renters across the U.S. actually have coverage in place, leaving themselves financially vulnerable.

While your landlord’s insurance covers the building structure, it does nothing to protect your personal belongings or shield you from liability if a guest is injured in your home. A comprehensive policy covers your contents, provides liability protection, and even pays for temporary housing if your rental becomes uninhabitable due to a covered event like fire or water damage.

Finding the right policy doesn’t mean sacrificing coverage for cost. By understanding what factors influence premiums and taking advantage of available discounts, you can secure robust protection that fits comfortably within your budget.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve helped countless renters in Massachusetts and New Hampshire find the best affordable tenant insurance to protect their belongings without breaking the bank. With over two decades of experience in the insurance industry, I know how to identify policies that deliver real value—not just the lowest price.

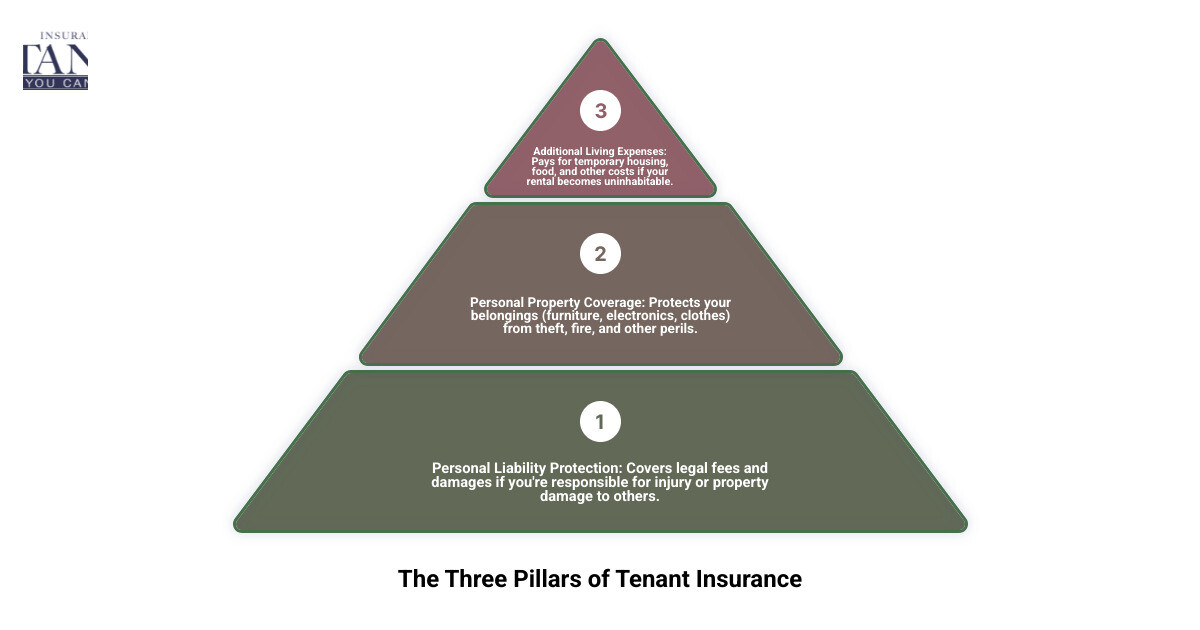

What a Quality Tenant Insurance Policy Covers

Understanding what you’re paying for is the first step toward finding a great policy. While your landlord’s insurance covers the building itself, it does nothing to protect your personal items or shield you from liability. A comprehensive Renters Insurance policy typically includes three core protections.

Personal Property Coverage

Think of this as “your stuff” insurance, also known as contents insurance. It’s designed to cover the cost of replacing your personal belongings if they’re damaged, destroyed, or stolen due to a covered event. This includes everything from your furniture and electronics to your clothes and kitchenware. Common perils covered include:

- Theft: If your laptop disappears or your bike gets swiped, personal property coverage can help you replace it. This even extends to items stolen from your car, not just your rental unit!

- Fire Damage: A devastating fire can destroy everything you own. This coverage helps you rebuild your personal inventory.

- Water Damage: Burst pipes, overflowing bathtubs (sometimes even from an upstairs neighbor!), or other sudden and accidental water incidents can wreak havoc on your belongings.

- Replacement Cost vs. Actual Cash Value: This is a crucial distinction. We always recommend opting for “replacement cost coverage.” This means your insurer pays you the amount it would cost to buy a brand-new version of your damaged or stolen item, without deducting for depreciation. “Actual cash value,” on the other hand, only pays what your item was worth at the time of the loss, which might be significantly less.

- Coverage Away From Home: Your personal property isn’t just protected within your four walls. Many policies extend coverage for items you take with you, whether you’re on vacation or your laptop is stolen from a coffee shop.

Valuable items like jewelry, fine art, or expensive electronics might have special limits under a standard policy. If you have high-value items, you may need to add a specific endorsement or “rider” to your policy to ensure they’re fully covered. For more details on what’s covered, check out our guide on What Does Renters Insurance Cover.

Personal Liability Protection

Imagine a friend slips and falls in your apartment, breaking their arm. Or perhaps your child accidentally breaks a neighbor’s window with a baseball. These are situations where personal liability protection comes to the rescue. This coverage protects you financially if you’re found legally responsible for:

- Accidental Injury to a Guest: If someone is injured on your rented property, your policy can cover their medical expenses and any legal fees if they decide to sue you.

- Damage to Someone Else’s Property: If you accidentally cause damage to someone else’s belongings or property, your policy can help cover the repair or replacement costs.

- Legal Fees: Should you be sued, this protection can cover your legal defense costs, even if the claim is unfounded.

- Medical Payments to Others: This is a smaller coverage that can pay for minor medical expenses for guests injured on your property, regardless of who was at fault, often helping to avoid larger liability claims.

This coverage is vital because lawsuits can happen for all kinds of reasons. For example, if a guest trips on a power cord and hurts themselves badly, personal liability coverage provides a financial safety net. It even covers incidents like a golf ball accidentally hitting a stranger, even if it happens away from your rental unit. To learn more about this crucial aspect of your policy, visit What is Personal Liability Insurance for Renters.

Additional Living Expenses (ALE)

Sometimes called “loss of use” coverage, Additional Living Expenses (ALE) is a lifesaver if your rental unit becomes uninhabitable due to a covered event. Think of it as “You can’t sleep in your home tonight because something happened to it” insurance.

For instance, if a fire or significant water damage (perhaps from that upstairs neighbor’s overflowing sink) forces you out of your apartment, ALE coverage can help pay for:

- Temporary Housing Costs: This includes hotel stays or temporary rental accommodations.

- Restaurant Meals: Since you can’t cook at home, it covers reasonable extra costs for food.

- Laundry Expenses: If you suddenly need to use laundromats.

- Other Necessary Expenses: Any other reasonable and necessary costs incurred because you can’t live in your home.

This coverage is designed to maintain your normal standard of living as much as possible while your home is being repaired or you’re finding a new place. It ensures that an unexpected disaster doesn’t also become a financial crisis for your daily needs.

Decoding the Cost: What Influences Your Premium?

The price of renters insurance is not one-size-is-all. While the national average hovers around $15 to $30 per month, your specific rate depends on several key factors. Insurers assess risk, and understanding what they look at can help you find a more affordable premium. For residents in New England, costs can be very competitive.

Key Factors That Determine Your Rate

When we calculate your premium, we consider a variety of elements that paint a picture of your individual risk profile. Here’s what typically influences your renters insurance cost:

- Location (City vs. Suburb): Your specific address plays a big role. Urban areas with higher crime rates or increased risk of fire might have slightly higher premiums than quieter suburban or rural locations.

- Building Type: Whether you live in a multi-unit apartment building, a duplex, or a single-family home can affect the rate.

- Coverage Limits: The higher the amount of personal property coverage you choose (e.g., $50,000 vs. $25,000) and the higher your liability limit (e.g., $1 million vs. $100,000), the more your policy will cost.

- Deductible Amount: This is the amount you pay out-of-pocket before your insurance kicks in for a claim. Choosing a higher deductible (e.g., $1,000 instead of $500) will lower your monthly premium, but means you’ll pay more upfront if you file a claim.

- Claims History: A history of previous insurance claims, especially for losses like theft or water damage, can lead to higher premiums. Insurers view this as an indicator of future risk.

- Credit-Based Insurance Score: In most states, including Massachusetts and New Hampshire, insurers use a credit-based insurance score (which is different from a regular credit score and does not impact your credit rating). A higher score often indicates a lower risk, potentially leading to lower premiums.

- Protective Devices: Having safety and security features in your rental, such as smoke detectors, fire extinguishers, sprinkler systems, deadbolt locks, or a monitored alarm system, can qualify you for discounts.

Understanding these factors allows us to tailor a policy that fits your specific needs and budget. For a deeper dive into how these elements impact your costs in Massachusetts, visit our page on How Much is Renters Insurance in Massachusetts.

Average Costs in Massachusetts and New Hampshire

While exact rates vary based on the factors above, we find that renters in Massachusetts and New Hampshire can often find policies starting around $15-$25 per month for basic coverage. Some of the most affordable options can even be found for less than $10 a month annually in certain areas.

For example, the average monthly premium for renters insurance in Massachusetts is around $16.16, with some providers offering rates as low as $11.03 per month annually. In New Hampshire, the average monthly premium is even lower at about $11.91, and policies can be found for as little as $5.83 per month annually.

These rates are influenced by local specifics. For instance, policies in cities like Renters Insurance Medford MA or Renters Insurance Malden MA will consider factors like the local crime rates, fire department response times, and general cost of living. Similarly, for those in the Granite State, NH Renters Insurance offers competitive protection with rates influenced by similar local dynamics.

We work with various providers to help you steer these nuances and find a policy that offers the best affordable tenant insurance for your specific situation.

Your Guide to Finding the Best Affordable Tenant Insurance

Finding a policy that balances cost and coverage requires a bit of smart shopping. It’s not just about finding the lowest price, but the best value. By using a few key strategies, you can significantly lower your premium without sacrificing essential protection.

Strategy 1: Maximize Every Available Discount

Insurance providers offer a surprising number of discounts that can significantly reduce your premium. We always help our clients explore every possible saving. Here’s a list of common renters insurance discounts to look for:

- Bundling with Auto Insurance: This is often one of the biggest money-savers. When you purchase both your renters insurance and your auto insurance from the same provider, you can often save anywhere from 10% to 25% on both policies. It’s a win-win!

- Claims-Free Discount: If you haven’t filed a claim for a certain period (e.g., 3-5 years), many insurers will reward you with a discount.

- Loyalty Programs: Some insurers offer discounts for being a long-term customer or for participating in specific loyalty programs.

- Protective Device Credits: Installing safety features like smoke detectors, fire extinguishers, sprinkler systems, deadbolt locks, or a monitored home security system can earn you a discount.

- Good Student Discount: If you’re a student with a good academic record, some insurers offer a discount.

- Paying in Full: If you pay your annual premium upfront instead of in monthly installments, you can often save a small percentage.

- Paperless Billing/Automatic Payments: Opting for electronic statements and setting up automatic payments can also net you a small discount.

Don’t be shy about asking us about every discount you might qualify for. Every little bit helps make your policy more affordable!

Strategy 2: Customize Your Policy to Fit Your Budget

One of the best ways to ensure you’re getting the best affordable tenant insurance is to tailor your policy precisely to your needs. This means not paying for more coverage than you need, but also ensuring you have enough where it counts.

- Choosing Your Deductible: As mentioned earlier, increasing your deductible will lower your premium. However, make sure you choose an amount you’re comfortable paying out-of-pocket if you need to file a claim. A typical deductible is around $500, but options range from $250 to $1,000 or more.

- Setting Appropriate Coverage Limits: Take a thorough inventory of your belongings. You don’t want to over-insure and pay for coverage you don’t need, but you definitely don’t want to be under-insured if a loss occurs.

- Inventorying Your Belongings: This is a critical step! Go through your rental unit room by room and list all your possessions. Take photos or videos. This helps you accurately estimate the total value of your personal property and makes the claims process much smoother if you ever need to file one.

- Understanding Replacement Cost vs. Actual Cash Value: Reiterate that replacement cost coverage is generally preferable, as it allows you to replace items with new ones. While it might be slightly more expensive, the peace of mind and financial benefit during a claim are usually worth it.

- Adding Specific Endorsements for High-Value Items: Instead of raising your overall personal property limit unnecessarily, consider adding specific endorsements for high-value items like jewelry, art, or specialized electronics. This ensures these particular items are fully protected without increasing your entire policy’s cost.

For a comprehensive look at how to structure your coverage, explore our resources on Renters Insurance Coverage.

Strategy 3: How to Compare Quotes for the Best Affordable Tenant Insurance

Comparing quotes is key to finding the best affordable tenant insurance. However, it’s not just about looking at the bottom line. Here’s how we help you compare effectively:

- Comparing Apples-to-Apples Coverage: We ensure that when we present you with different quotes, they reflect the same levels of personal property coverage, liability limits, deductibles, and any specific endorsements you need. This way, you’re genuinely comparing similar policies.

- Looking Beyond the Premium at Customer Service Ratings: A cheap policy is only great if the insurer delivers when you need them most. We consider customer satisfaction scores and complaint trends to ensure you’ll have a smooth experience if you ever need to file a claim.

- Checking Claims Satisfaction Scores: How easily and fairly does an insurer handle claims? This is crucial. We look for companies with a reputation for fair and efficient claims processing.

- Understanding the Benefits of Working with an Independent Agent: As independent agents, we aren’t tied to one specific insurance company. This means we can shop around on your behalf, comparing offerings from multiple providers to find the policy that best fits your needs and budget. We act as your advocate, ensuring you get the right coverage at a competitive price.

- Getting Multiple Quotes: This is where we shine! We can quickly gather and present you with various Renters Insurance Quotes Massachusetts (and New Hampshire) from our network of trusted carriers, making the comparison process simple and transparent for you.

The Modern Renter’s Toolkit: Policy Purchase and Claims

Buying and managing your insurance has never been easier. Many top providers offer a streamlined online experience, from getting a quote to filing a claim, which can be a significant benefit for busy renters.

The Simple Online Purchase Process

Gone are the days of endless paperwork and phone calls. Today, getting your renters insurance can be a remarkably quick and straightforward process:

- Getting a Quote in Minutes: Many online platforms allow you to input your basic information and get a personalized quote almost instantly. You’ll typically answer questions about your rental location, the type of dwelling, and an estimate of your personal belongings’ value.

- Answering Basic Questions About Your Rental: This usually includes your address, whether it’s an apartment or house, and basic details about the building’s construction and safety features.

- Customizing Coverage Online: Once you have a quote, you can often adjust your personal property limits, liability amounts, and deductible online to see how it impacts your premium in real-time. This allows you to fine-tune your policy to hit that sweet spot of protection and affordability.

- Completing the Purchase with a Digital Signature: Once you’re satisfied with your customized policy and price, you can often finalize the purchase digitally, often with just a few clicks.

- Instant Proof of Insurance for Your Landlord: Many online providers can immediately email you, and even your landlord, a copy of your proof of insurance, satisfying any lease requirements without delay.

The convenience of online purchasing means you can secure your protection quickly and efficiently, often within the time it takes to brew a cup of coffee.

What to Expect During the Claims Process

While we hope you never have to file a claim, it’s reassuring to know that the process has also become much more user-friendly:

- Digital Claims Submission: Many insurers allow you to start and manage your entire claim process online, through a web portal or a dedicated app. You can upload photos, videos, and documents directly from your smartphone.

- AI-Powered Processing for Faster Payouts: Some innovative insurers leverage artificial intelligence to review and process simple claims, leading to much faster resolution times and payouts. This means less waiting for you when you need help most.

- Dedicated Claims Adjusters: For more complex claims, you’ll typically be assigned a dedicated claims adjuster who will work with you from start to finish. They’ll guide you through the process, answer your questions, and ensure a fair assessment of your loss.

- Clear Communication: Modern insurers prioritize clear and consistent communication, often providing updates on your claim status via email, text, or through your online account.

- Emergency Response Guarantees: Some providers even guarantee a rapid emergency response for urgent situations, such as a severe water leak or fire, ensuring you get immediate assistance when your home is impacted.

Understanding your policy’s claims-filing procedure before you need it is always a good idea. Knowing what steps to take can reduce stress during an already difficult time.

Frequently Asked Questions about Affordable Tenant Insurance

Is tenant insurance mandatory in Massachusetts or New Hampshire?

No, there is no state law in Massachusetts or New Hampshire that legally mandates renters to carry tenant insurance. However, this is a very important distinction: while the state doesn’t require it, your landlord can absolutely make it a requirement in your lease agreement. According to the Insurance Information Institute, landlords often require proof of liability coverage to protect their own assets, as they could be held responsible for incidents that occur on their property. Even if not required, we strongly recommend it for your own financial protection. It’s a small monthly cost for significant peace of mind.

What are common exclusions in a renters insurance policy?

While tenant insurance offers broad protection, it’s crucial to understand what it typically doesn’t cover. Common exclusions or limitations in standard renters insurance policies include:

- Floods and Earthquakes: Damage from floods (e.g., rising rivers, heavy rainfall) and earthquakes is generally excluded from standard policies. Separate flood insurance or earthquake endorsements can often be purchased if you live in a high-risk area.

- Neglect or Intentional Acts: If damage occurs due to your deliberate actions, gross negligence, or a lack of proper maintenance, it likely won’t be covered.

- War or Terrorism: Acts of war or terrorism are typically excluded.

- Property Acquired Illegally: Any property that was obtained unlawfully will not be covered.

- Home-Based Business Activities: If you run a business from your rental unit, your personal renters insurance usually won’t cover business-related equipment, inventory, or liability. You’ll need a separate commercial policy for that.

- Pests and Vermin: Damage caused by pests like rodents, insects, or bed bugs is generally not covered, though some policies might offer endorsements for specific vermin.

- High-Value Items: While your policy covers personal property, very expensive items like fine jewelry, rare art, or extensive coin collections often have sub-limits (e.g., only $1,000 for jewelry). For full protection, these items usually require a special endorsement or “rider.”

Always review your policy documents carefully to understand all exclusions and limitations. If you’re unsure about anything, we’re here to clarify!

Can I get cheap renters insurance if I have a roommate?

Yes, you can certainly get best affordable tenant insurance if you have a roommate, but there’s a crucial detail: your policy will only cover you and your resident relatives (like a spouse or dependent children). Your roommate is not automatically covered under your policy and needs to purchase their own separate policy.

While some policies might allow you to add a roommate as an “additional insured,” we generally advise against this. If your roommate were to file a claim, it would go on your insurance record, potentially impacting your future rates and claims-free discounts. It’s usually a cleaner and safer approach for each individual to have their own policy, protecting their own belongings and liability separately. This way, any claims they make won’t affect your insurance history or premiums.

Secure Your Peace of Mind Today

Finding the best affordable tenant insurance is about more than just ticking a box for your landlord—it’s about safeguarding your financial well-being. By understanding what a policy covers, what factors influence its cost, and how to shop for discounts, you can secure robust protection that fits comfortably within your budget. Don’t leave your personal belongings and financial future to chance. The team at Stanton Insurance Agency is here to help you steer your options and find a policy that provides true peace of mind.

Ready to protect your world? Explore your renters insurance options and get a personalized quote today!