Average vehicle insurance: Unlock Best Rates 2025

Why Understanding Average Vehicle Insurance Costs Matters

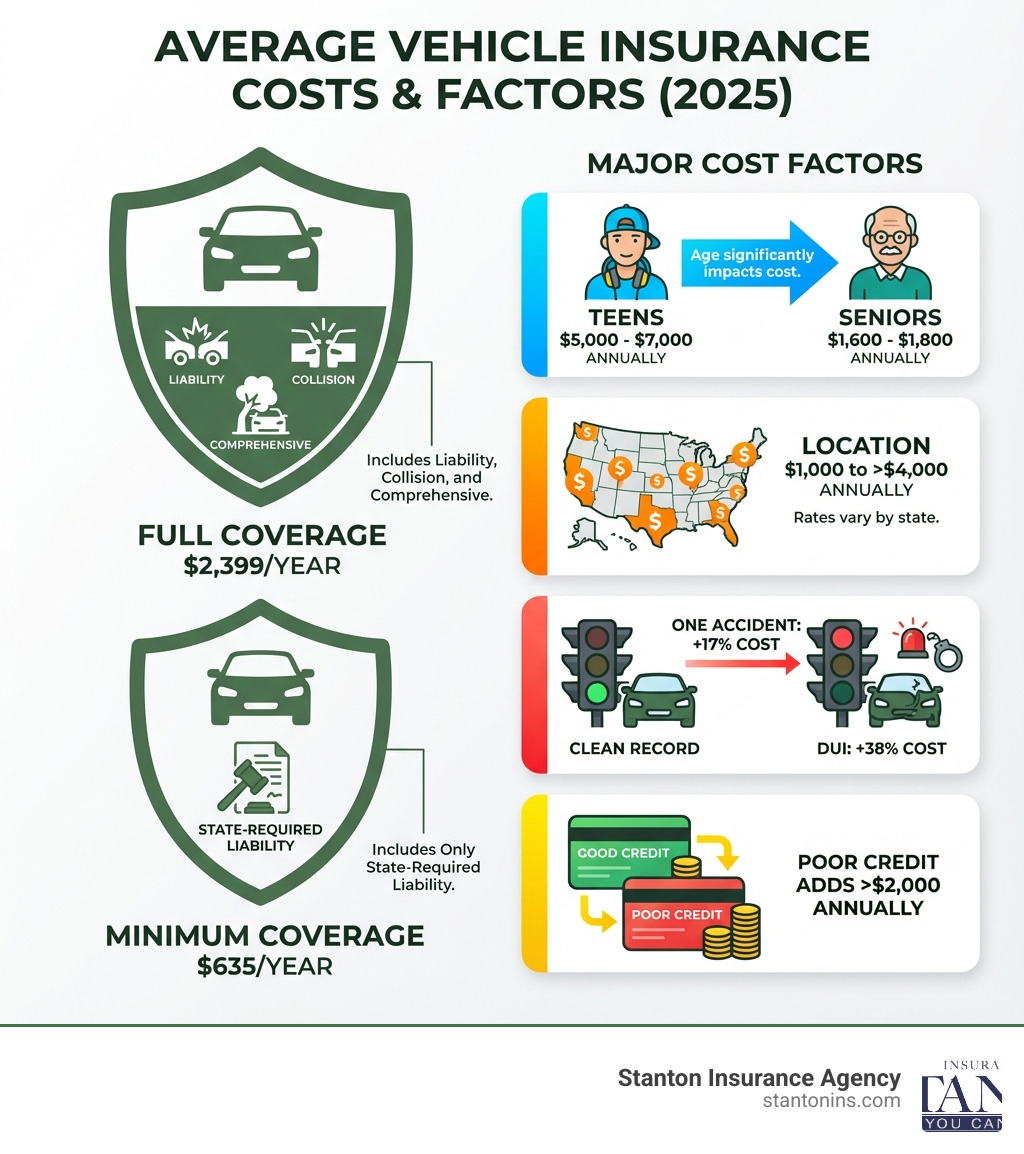

Average vehicle insurance costs in the United States vary widely, but recent data provides clear benchmarks to help you understand what you should expect to pay:

- Full Coverage: National average of $2,399 per year (approximately $200 per month)

- Minimum Liability Coverage: National average of $635 per year (approximately $53 per month)

- Key Cost Drivers: Your location, age, driving record, credit history, and vehicle type all significantly impact your final premium

- Regional Variation: Rates can differ by hundreds or even thousands of dollars depending on your state—New Hampshire averages $1,412 annually for full coverage, while Massachusetts averages $1,801

Car insurance costs average about $172 per month for the everyday driver, but whether you’ll pay more or less than that depends on many variables. Your specific rate is calculated based on a complex combination of factors including where you live, your driving history, the type of vehicle you drive, and even your credit score in most states.

Understanding these averages is crucial because it helps you know if you’re getting a fair rate or if you’re overpaying. With rates rising by 4.7% in the past year alone due to increased repair costs and more severe claims, it’s more important than ever to know what constitutes a competitive premium for your situation.

I’m Geoff Stanton, President at Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over 25 years helping families and individuals steer the complexities of average vehicle insurance costs to find coverage that protects their assets without breaking their budget. Let’s break down what really determines your car insurance rate and how you can ensure you’re getting the best value.

What is the National Average Cost of Car Insurance?

On a national level, the price you pay for car insurance is split between two main categories: minimum liability and full coverage. While averages provide a useful benchmark, your individual quote will be custom to your specific circumstances. It’s important to remember that these are national averages, and your actual costs in Massachusetts or New Hampshire will reflect local conditions and state regulations.

Average Cost for Minimum vs. Full Coverage

Every state, including Massachusetts and New Hampshire, mandates that drivers carry a minimum level of liability insurance. This foundational coverage is designed to protect you financially if you’re at fault in an accident, covering the costs of injuries or property damage to others. The national average for a state-minimum policy is approximately $635 annually, or $53 per month. While this is undeniably the most affordable option, it’s crucial to understand its limitations: it offers absolutely no protection for your own vehicle or your medical expenses if you’re injured.

For more complete peace of mind and financial security, most drivers opt for a full coverage policy. This goes beyond basic liability by adding two critical components:

- Collision coverage: This pays for damages to your own car if it’s involved in an accident, regardless of who is at fault.

- Comprehensive coverage: This protects your vehicle from non-accident-related incidents, such as theft, vandalism, fire, falling objects, or damage from extreme weather like hailstorms.

The national average for a full coverage policy is around $2,399 annually, or about $200 per month. This level of coverage is often required by lenders if you have a car loan or lease, as it protects their investment in your vehicle. For many of our clients in Massachusetts and New Hampshire, choosing full coverage is a wise decision, as it safeguards one of their most valuable assets.

To explore your options and get a personalized quote, we invite you to learn more about our car insurance services: More info about car insurance services

Key Factors That Influence Your Insurance Premium

Insurance companies use a complex algorithm to assess risk and calculate your premium. No single factor tells the whole story; instead, it’s the combination of these elements that creates your final price. Understanding these factors can help you make informed decisions about your coverage.

Your Driver Profile

Your personal details, habits, and history play a major role in determining your rate. It’s a bit like a financial fingerprint that insurers use to predict your likelihood of filing a claim.

-

Driving Record: This is arguably one of the most influential factors. A clean record, free of accidents or violations, will consistently earn you the lowest rates. Insurers love responsible drivers! However, even a single speeding ticket can cause your premium to jump by over 20%. An at-fault accident can be even more impactful, potentially raising your rates by 40% or more, increasing the average annual cost of car insurance to $2,940 after just one incident. For serious offenses like a DUI, the financial penalty is steep, with the national average rate for drivers after a DUI soaring to $3,538 per year. We always encourage our clients in Massachusetts and New Hampshire to drive safely – it’s good for your wallet and everyone on the road.

-

Age and Experience: Youth, unfortunately, often comes with higher insurance premiums. Young, inexperienced drivers, particularly teenagers, face the highest rates. For instance, the average annual rates for teen drivers are some of the highest, reaching $6,410 per year for females and a staggering $7,377 per year for males. These rates gradually decrease as drivers gain experience, with 25-year-old drivers seeing averages of $2,387 for females and $2,526 for males. Rates typically continue to decline into middle age before they might slightly increase again for senior drivers over 75, who still enjoy some of the most affordable national average rates, around $1,756 for female senior drivers and $1,813 for males.

-

Credit History: In most states, including New Hampshire, insurers use a credit-based insurance score to predict your likelihood of filing a claim. The logic is that individuals with a solid financial history tend to be more responsible in other areas of their lives, including driving. This means that drivers with poor credit can pay significantly more – sometimes nearly double – what those with excellent credit pay. The average cost of a policy for a driver with poor credit can be $4,381 per year, compared to $2,095 per year for a driver with good credit. However, it’s important to note that Massachusetts is one of the few states that prohibits the use of credit scores in setting auto insurance rates, offering a different landscape for our clients there.

-

Marital Status: While it might seem odd, being married can also lead to lower rates. Insurers often view married individuals as more stable and less prone to risky driving behaviors, which can translate into a small discount on your average vehicle insurance premium.

Where You Live

Your location, right down to your ZIP code, has a significant impact on your average vehicle insurance costs. It’s not just about the state you live in, but also the specific community.

Densely populated urban areas, like those found around Boston, with more traffic congestion, higher rates of accidents, and increased risks of theft and vandalism, typically have higher premiums. Conversely, more rural areas, common in much of New Hampshire, often enjoy lower rates due to less traffic and lower risk factors.

State regulations also play a crucial role. Each state has its own minimum coverage requirements and specific rules that influence how insurance companies operate and price their policies. Furthermore, the frequency of claims for events like hailstorms, floods, or even deer collisions in certain regions can affect costs.

When we look at our local areas, the differences are clear:

- For example, a full coverage policy in New Hampshire averages around $1,412 per year, well below the national average.

- The same full coverage policy in Massachusetts is closer to $1,801 per year, which is still competitive but higher than its northern neighbor.

These figures highlight why understanding your specific local market is so important.

Your Vehicle

The type of car you drive is another major factor in how much you’ll pay for average vehicle insurance. Insurers consider several characteristics of your vehicle when calculating your premium.

-

Repair Costs: This is a big one. Cars that are expensive to repair will naturally cost more to insure. Luxury and sports cars, with their specialized parts and complex engineering, often have significantly higher repair bills than common sedans or SUVs. If a vehicle’s parts are hard to find or require specialized labor, that cost gets passed on.

-

Safety Features: Modern vehicles are packed with advanced safety features like automatic emergency braking, lane-keeping assist, and multiple airbags. Cars with high safety ratings and these cutting-edge features often earn you a discount because they reduce the likelihood or severity of accidents. Interestingly, newer models may sometimes cost less to insure than slightly older ones due to the rapid evolution of these safety technologies.

-

Theft Likelihood: If your car model is frequently targeted by thieves, its comprehensive insurance costs will likely be higher. Insurers track vehicle theft statistics closely, and certain models consistently appear on “most stolen” lists.

-

Vehicle Age: Insuring a brand-new car isn’t always more expensive than insuring a used one. While a new car’s higher value means higher costs for collision and comprehensive coverage (as it would cost more to replace), its modern safety features can sometimes lead to lower liability premiums. Conversely, an older car might be cheaper to replace, but if it lacks modern safety features, it could be seen as a higher risk in other ways.

Here’s a general idea of how different vehicle types stack up in terms of average monthly premiums, from typically cheapest to most expensive to insure:

- Vans: Around $184 per month

- Minivans: Around $193 per month

- Station Wagons: Around $198 per month

- SUVs: Around $213 per month

- Hybrids: Around $213 per month

- Hatchbacks: Around $222 per month

- Trucks: Around $222 per month

- Luxury SUVs: Around $247 per month

- Sedans: Around $268 per month

- Luxury Cars: Around $291 per month

- Sports Cars: Around $294 per month

- Performance SUVs: Around $299 per month

- Performance Cars: Up to $352 per month

This range illustrates that the vehicle you choose is a significant component of your overall average vehicle insurance cost.

How to Lower Your Car Insurance Premiums

While many rating factors are out of your control, there are several proactive steps you can take to reduce your insurance costs. Taking the time to explore these options can lead to significant savings for our clients in Massachusetts and New Hampshire.

Strategies for Reducing Your Average Vehicle Insurance Cost

We believe everyone deserves fair and affordable insurance. Here are some of our top tips:

-

Shop Around and Compare Quotes: This is, hands down, the single most effective way to ensure you’re not overpaying. Rates for the exact same coverage can vary by hundreds of dollars between different companies. We recommend comparing quotes from several carriers every year or two, or whenever you experience a major life event like buying a new car, moving, or getting married. Don’t assume loyalty automatically means the best price!

-

Bundle Your Policies: Most insurers offer a significant discount if you purchase multiple policies from them. This could mean bundling your auto insurance with your home insurance, renters insurance, or even other types of personal insurance. These multi-policy discounts can often range from 10-25%, making it a smart financial move. We can also help you explore options for multi-family insurance if that applies to your situation.

-

Increase Your Deductible: Your deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in after a claim. By choosing a higher deductible (e.g., $1,000 instead of $500), you signal to the insurer that you’re willing to bear more of the initial risk, which typically results in a lower premium. Just be sure you can comfortably afford the higher amount in case you need to file a claim.

-

Ask About Discounts: Don’t be shy! Insurers offer a wide array of discounts that many people overlook. Be sure to ask us about potential savings for:

- Being a good student (especially for younger drivers)

- Taking a defensive driving course

- Having anti-theft devices installed in your vehicle

- Paying your premium in full upfront rather than in monthly installments

- Driving fewer miles (low-mileage discounts)

- Having multiple vehicles insured on the same policy

- Maintaining a long-standing relationship with the same insurer (though still compare periodically!)

-

Maintain Good Credit (in New Hampshire): As discussed, your credit history can impact your rates in New Hampshire. By working to improve and maintain a strong credit score, you could see a positive effect on your insurance premiums over time.

By proactively implementing these strategies, you can significantly reduce your average vehicle insurance premiums and keep more money in your pocket.

Current Trends Affecting Car Insurance Prices

The auto insurance landscape is constantly evolving, with several recent trends putting upward pressure on rates across the country, including in Massachusetts and New Hampshire. Understanding these industry-wide shifts can provide context for why your premium may have changed, even if your personal driving habits haven’t.

Why the Average Vehicle Insurance Cost is Rising

In recent years, several economic and environmental factors have contributed to rising premiums, making the pursuit of affordable average vehicle insurance more challenging for many.

-

Rising Vehicle Repair Costs: Modern vehicles are marvels of engineering, packed with advanced technology. Features like sensors, cameras, and intricate computer systems embedded in bumpers, windshields, and side mirrors are fantastic for safety, but they make repairs far more complex and expensive. A minor fender bender isn’t just bodywork anymore; it can involve recalibrating sophisticated electronics, driving up the cost of parts and labor. For instance, the U.S. Bureau of Labor Statistics has tracked significant increases in vehicle maintenance and repair expenses, directly impacting what insurers pay out.

-

Increased Claim Severity: While the frequency of accidents might have seen some fluctuations (even dropping during the pandemic lockdowns), the average cost per claim has grown significantly. The Insurance Information Institute (Triple-I) notes that from 2019 to 2024, claim severity — meaning how much each individual claim costs — has substantially increased. This is due to a combination of higher repair costs, more expensive medical treatments for injuries, and larger legal settlements.

-

General Inflation: Like everything else, the cost of providing insurance services is subject to inflation. This includes the operational costs for insurance companies, the cost of materials for repairs, and even the cost of labor. The U.S. Bureau of Labor Statistics reports that the Consumer Price Index for motor vehicle insurance has seen sharp increases, reflecting a significant rise over the past year. This broad economic trend directly affects what insurers need to charge to remain solvent. You can see more details on this trend here: U.S. Consumer Price Index: Motor Vehicle Insurance.

-

Extreme Weather Events: We’ve all seen the news – severe weather events, from intense snowstorms to heavy rainfall and flooding, seem to be more frequent and destructive. These events lead to a surge in comprehensive claims for damaged vehicles, from hail damage to cars submerged in floodwaters. Insurers factor these increasing climate-related risks into their pricing models.

One piece of good news in this trend is that vehicle theft actually saw a significant drop of 17% in 2024, the largest annual decrease in 40 years. This trend, while positive, is somewhat offset by the other rising costs mentioned above.

Combined, these factors mean that insurers are adjusting rates to cover these higher payout costs, which ultimately impacts the premiums our clients in Massachusetts and New Hampshire see.

Frequently Asked Questions about Average Vehicle Insurance

We often hear similar questions from our clients about average vehicle insurance costs. Here are some of the most common ones, along with our expert answers.

Is $200 a month a lot for car insurance?

For a full coverage policy, $200 per month is right around the national average. Whether this is a “good” price for you, however, depends heavily on your unique circumstances, including your location, driving record, age, and the type of vehicle you drive.

For example, a driver in a low-cost state like New Hampshire, with its lower average rates (around $1,412 annually for full coverage), might find $200 a month to be on the higher side. Conversely, a driver in a more densely populated area of Massachusetts, especially if they’ve had a recent accident or a few speeding tickets, might find $200 a month to be a very competitive rate. It’s truly a personal benchmark.

Which vehicle type is cheapest to insure?

Generally, minivans and smaller, family-friendly SUVs are among the cheapest vehicles to insure. Why? Because they are typically driven by safer drivers, have excellent safety ratings, and their repair parts are widely available and affordable. Vehicles like the Toyota RAV4, Honda CR-V, or Subaru Forester often fall into this category.

In contrast, high-performance sports cars, luxury sedans, and certain heavy-duty trucks tend to be the most expensive to insure. This is due to a combination of factors:

- High repair costs: Specialized parts and labor for luxury and performance vehicles are pricey.

- Increased risk of theft: Some high-value vehicles are more attractive targets for thieves.

- Higher statistical likelihood of high-speed accidents: Sports cars, in particular, are often associated with more aggressive driving.

The cost of insuring your vehicle is a factor we always encourage you to consider before making a purchase.

Will my rate go down when I turn 25?

Yes, most drivers see a notable decrease in their car insurance premiums around their 25th birthday. This is a key milestone for insurers because statistical data shows a significant drop in accident risk for drivers once they reach this age. They’re generally considered more mature and experienced behind the wheel.

However, this decrease is not automatic and isn’t guaranteed for everyone. The reduction assumes you have maintained a clean driving record, free of accidents or serious violations. If you’ve accumulated tickets or had at-fault accidents before turning 25, the impact of reaching this age milestone might be less pronounced. Assuming a clean record, your rate will typically continue to gradually decrease into middle age, all other factors remaining equal. It’s definitely something to look forward to!

Find the Right Coverage for Your Needs

Navigating auto insurance can be complex, but understanding the averages and the factors that shape your premium is the first step toward securing the best possible rate. By maintaining a safe driving record, proactively exploring available discounts, and periodically reviewing your coverage with a trusted advisor, you can ensure you have the protection you need without overpaying.

At Stanton Insurance Agency, we are dedicated to helping our clients in Massachusetts and New Hampshire find a policy that fits their life and budget. We’re here to answer your questions, explain the numbers, and provide personalized advice to help you make informed decisions about your average vehicle insurance costs.