Automobile Diminished Value Claim: Maximize Your 2025 Worth

Understanding the Hidden Cost of Car Accidents

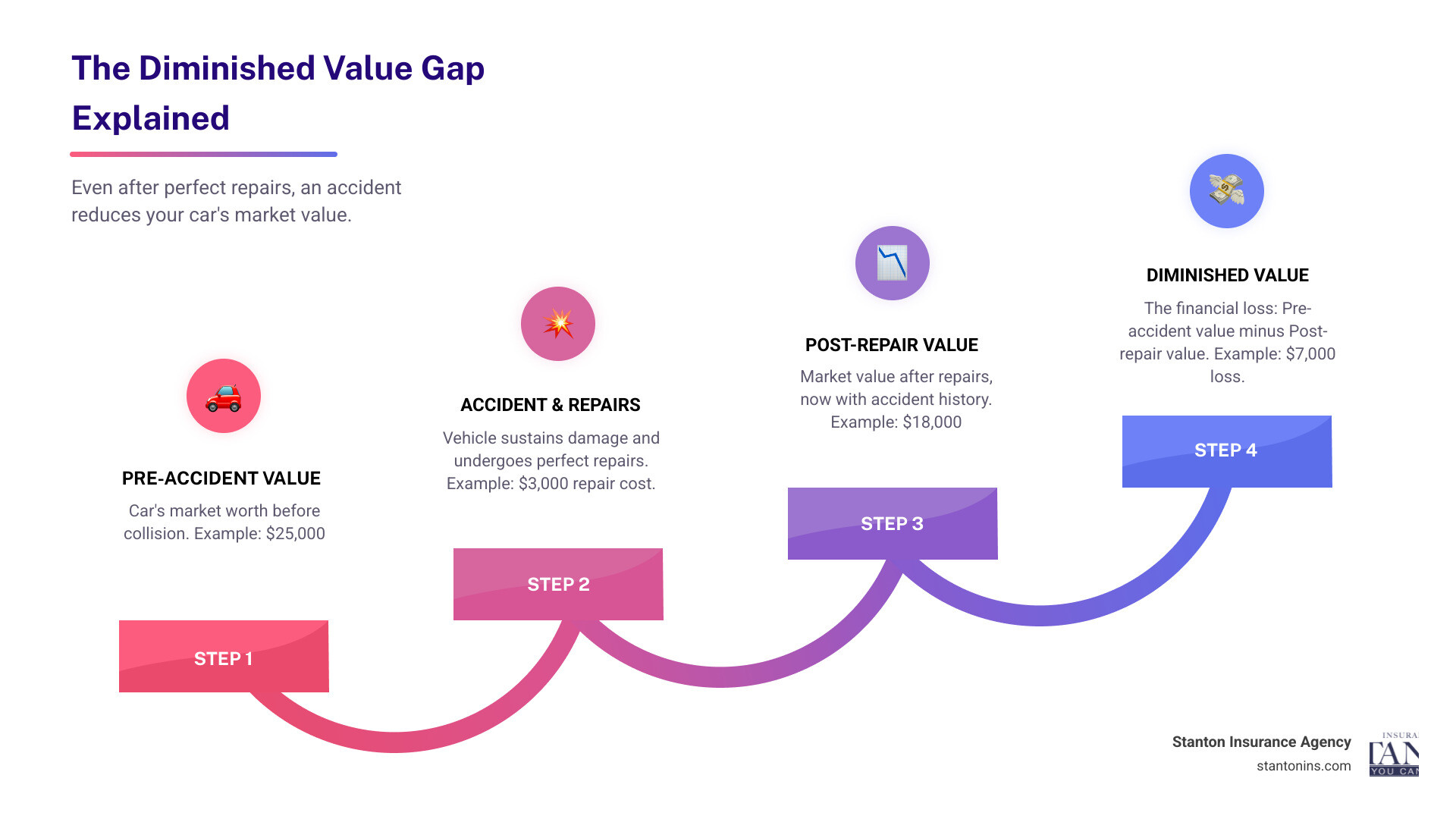

An automobile diminished value claim helps you recover money when your car loses value after an accident – even if it’s perfectly repaired. Here’s what you need to know:

Key Facts About Automobile Diminished Value Claims:

- Your car can lose 5-50% of its value after an accident, even with perfect repairs

- Claims are typically filed against the at-fault driver’s insurance company

- In Massachusetts, you generally cannot claim against your own insurer

- You need professional appraisal and documentation to succeed

- The 17C formula provides a starting point for calculating your loss

When your car gets hit and repaired, something unfortunate happens that most people don’t realize. Even if the body shop does perfect work, your vehicle is now worth less than it was before the accident. This loss in value – called diminished value – can cost you thousands when you sell or trade in your car.

The stigma of an accident history follows your vehicle forever. Buyers see a vehicle history report showing collision damage, and they immediately want to pay less – or they walk away entirely. According to industry data, a vehicle that has been damaged and repaired may be offered up to 50% less by prospective buyers, even if the repair was completed to factory standards.

This guide will walk you through everything you need to know about filing an automobile diminished value claim in Massachusetts and New Hampshire. We’ll explain the legal landscape, calculation methods, and step-by-step process to recover your losses.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve been helping Massachusetts and New Hampshire residents steer complex insurance claims for over two decades. Through my experience in our claims department and working with clients on automobile diminished value claim issues, I’ve seen how this hidden cost can impact families financially.

Understanding Diminished Value and Its Impact on Your Car

Picture this: your car gets rear-ended at a red light. The other driver’s insurance pays for beautiful repairs – you can’t even tell where the damage was. But here’s the frustrating reality: your car is now worth thousands less than it was before that accident happened.

Diminished value is the difference between what your car was worth before the accident and what it’s worth now, even after perfect repairs. It’s a hidden financial hit that catches many car owners off guard when they go to sell or trade in their vehicle.

The numbers can be sobering. A repaired vehicle may be offered for up to 50% less by prospective buyers, regardless of repair quality. That $30,000 sedan you owned? After an accident and repair, potential buyers might only offer $15,000 – even if the bodywork looks flawless.

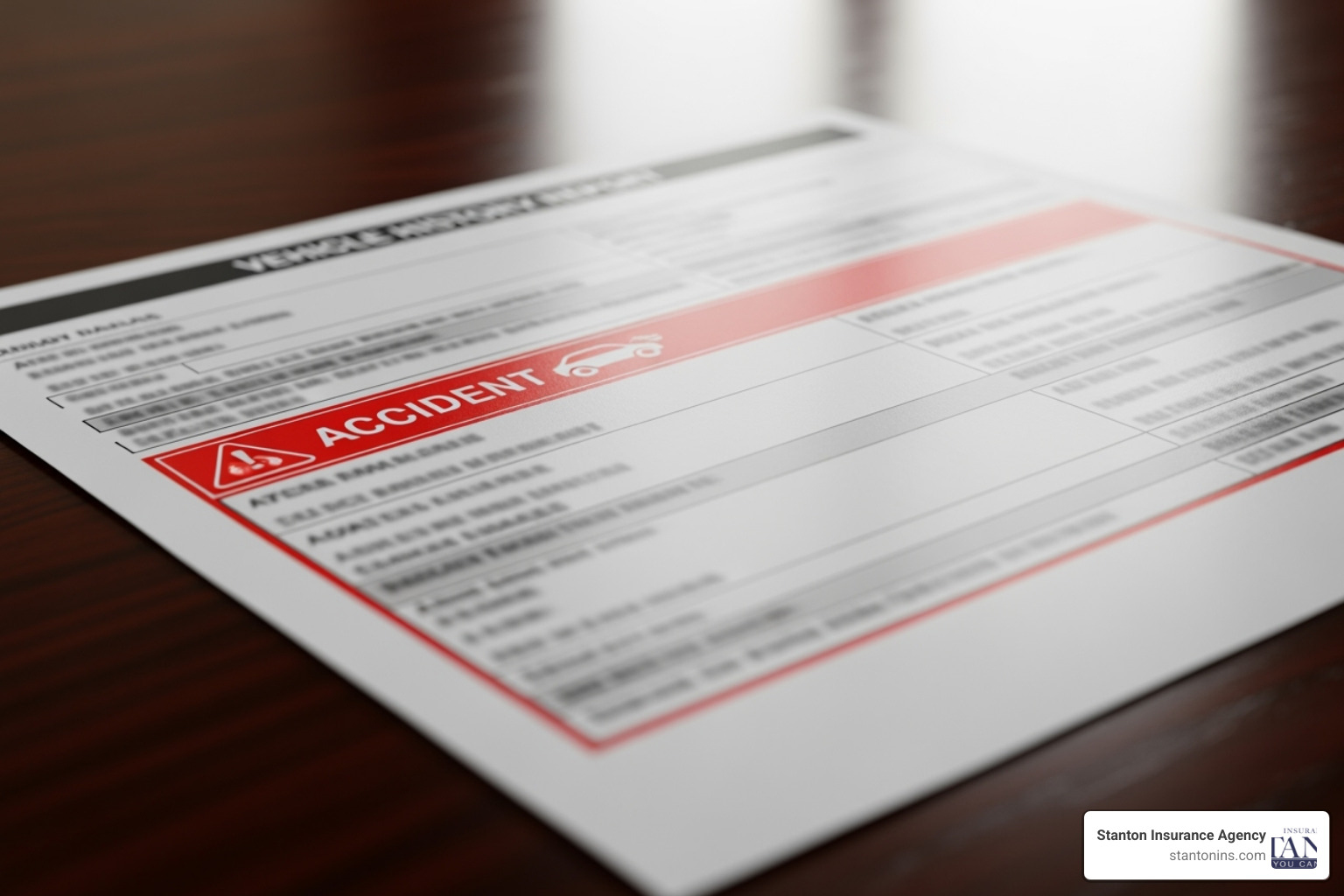

Vehicle history reports are largely to blame for this harsh reality. These reports create a permanent record of your car’s accident history that follows it forever. Smart buyers (and that’s most buyers these days) always check these reports before making a purchase.

When that accident pops up on the screen, buyer perception shifts immediately. They start wondering: Was the frame damaged? Will this car have problems down the road? Is there hidden damage I can’t see? This buyer wariness directly translates into lower offers and a smaller pool of interested purchasers.

For more information on how your policy works, you can explore our resources on car insurance in MA.

The Two Main Types of Diminished Value

Not all diminished value is created equal. Understanding the two main types can help you build a stronger automobile diminished value claim.

Inherent Diminished Value is the most common type you’ll encounter. This happens simply because your car now has an accident history – period. Even if the repairs were absolutely perfect and you can’t find a single flaw, buyers will still pay less because of the collision stigma. It’s the perceived loss of value that exists purely because your vehicle was in a crash.

Repair-Related Diminished Value occurs when the actual repair work itself reduces your car’s value. Maybe the paint doesn’t quite match, or the shop used aftermarket parts instead of original equipment. Perhaps there are lingering mechanical issues that weren’t fully resolved, or the body panels don’t align perfectly. In these cases, the poor quality repairs add insult to injury on top of the inherent loss.

Direct vs. Indirect Loss in Auto Insurance

Here’s where things get tricky with insurance companies, and why filing an automobile diminished value claim can be challenging.

Direct loss is straightforward – it’s the immediate, physical damage to your vehicle. Your insurance policy is designed to cover these direct costs: fixing the dent, replacing the bumper, repainting the scratched panels. For example, what does collision insurance cover? It covers the direct cost of repairing or replacing your car after an impact.

Indirect loss refers to the financial consequences that happen because of the direct damage, but aren’t the actual repair costs themselves. Diminished value falls squarely into this category. It’s not the cost of fixing your car – it’s the loss of future resale value because your car now has an accident history.

Most standard auto insurance policies are designed to restore your vehicle to its pre-accident physical condition, not its market value. Insurance companies often exclude indirect losses like diminished value, arguing their job is to fix your car, not guarantee its resale price. This is why pursuing these claims requires persistence and the right approach.

Calculating Diminished Value: The 17c Formula Explained

When you’re dealing with the financial aftermath of an accident, one of your biggest questions is probably: “How much is my car actually worth now?” While diminished value is absolutely a real financial loss, figuring out the exact dollar amount isn’t always straightforward.

Many insurance companies use what’s called the “17C Diminished Value Formula” as their starting point. Think of it as the insurance industry’s attempt to put a number on something that’s inherently subjective – how much less buyers will pay for your car because it has an accident history.

Here’s the thing though – this formula is not legally binding. It’s simply a common industry starting point that gives you a ballpark estimate. Your insurance company might use it, or they might have their own method entirely. But understanding the 17C formula can help you prepare for your automobile diminished value claim negotiations.

How the 17c Formula Works

The 17C formula breaks down your car’s diminished value into four manageable steps. It’s like following a recipe – each ingredient affects the final result.

First, you need to determine your car’s pre-accident value using reliable industry guides for vehicle valuation. This becomes your baseline – what your car was worth the day before the accident happened.

Next comes the 10% base loss cap. The formula assumes that no matter what, your car can’t lose more than 10% of its pre-accident value due to diminished value alone. So you multiply your pre-accident value by 0.10 to get your maximum possible claim.

Then you apply a damage multiplier based on how severe the accident damage was. Severe structural damage (like frame damage) gets the full 1.0 multiplier, while major damage (significant body panel replacement) gets 0.75. Moderate damage (bumper and fender replacement) receives 0.50, and minor cosmetic damage (dents and scratches) only gets 0.25. If there was no structural damage at all, the multiplier drops to 0.0.

Finally, there’s a mileage multiplier that accounts for your car’s age and wear. Low-mileage vehicles (0-29,999 miles) get the full 1.0 multiplier because they have more value to lose. Higher-mileage cars get progressively lower multipliers – 0.8 for 30,000-64,999 miles, 0.6 for 65,000-94,999 miles, and so on. Once you hit 160,000+ miles, the multiplier becomes 0.0.

Let’s walk through a real example. Say your car was worth $30,000 before the accident, sustained major damage (0.75 multiplier), and had 45,000 miles on it (0.8 multiplier).

Your calculation would be: $30,000 × 0.10 × 0.75 × 0.8 = $1,800

This formula provides a baseline, but your actual diminished value might be higher or lower depending on your specific vehicle, local market conditions, and buyer demand for your particular make and model.

Filing an Automobile Diminished Value Claim in Massachusetts & New Hampshire

When your car gets damaged in an accident that wasn’t your fault, filing an automobile diminished value claim means going after the at-fault driver’s insurance company, not your own. This is what we call a third-party claim, and it’s quite different from the collision or comprehensive claims you might file with your own insurer.

Here’s where things get tricky. Your own insurance policy is designed to fix your car or replace it – that’s the direct loss we talked about earlier. But diminished value? That’s an indirect loss, and most standard policies don’t cover it. So you’ll need to pursue the at-fault party’s insurance company to recover this financial hit.

If the driver who hit you doesn’t have insurance, you’re facing an uphill battle. While your Uninsured Motorist Bodily Injury Liability coverage can help with medical bills, getting money for your car’s lost value from someone with no insurance is incredibly difficult.

The biggest challenge you’ll face is proving your loss. Insurance companies have heard every diminished value claim in the book, and they’ve gotten pretty good at minimizing payouts. Their favorite line? “If the car was properly repaired, there’s no loss in value.” They’ll often start with lowball offers or flat-out deny your claim if your evidence isn’t rock solid.

The Legal Landscape in Massachusetts

Massachusetts doesn’t make automobile diminished value claims easy. If you’re thinking about filing a claim against your own insurance company, you’re probably out of luck. Massachusetts courts, particularly in the case Given v. Commerce Ins. Co., have made it clear that your own insurer generally doesn’t have to pay for inherent diminished value.

The reasoning goes back to that direct versus indirect loss concept. Your insurance company’s job is to fix your car or pay you its actual cash value if it’s totaled. They’re not on the hook for what might happen to its resale value down the road.

But here’s the good news: you can file a third-party automobile diminished value claim against the at-fault driver’s insurance company in Massachusetts. The catch? You’ll need to prove your case with solid evidence. That means getting a professional appraisal and documenting everything carefully.

The burden of proof is entirely on you as the vehicle owner. You’ll need to show exactly how much value your car lost because of its accident history. For more guidance on insurance claims in Massachusetts, check out the state’s Frequently Asked Questions about Auto Insurance Claims. And if you’re wondering about coverage basics, our guide on what is the minimum car insurance coverage in Massachusetts? can help.

Pursuing a Claim in New Hampshire

New Hampshire gives you a better shot at recovering diminished value than Massachusetts does. As a tort state, New Hampshire follows the principle that if someone causes an accident, they’re responsible for all the damages – not just fixing your bumper.

This “make you whole” philosophy works in your favor. If your car is worth less because of an accident someone else caused, that’s part of making you whole again. You can pursue the at-fault driver’s insurance company directly, or even sue the driver personally if needed.

The key to success in New Hampshire is still the same: you need a strong, independent appraisal that clearly shows your car’s lost value. Without that professional documentation, even New Hampshire’s favorable laws won’t help you much.

If you’re curious about insurance requirements in the Live Free or Die state, you can learn more about whether you’re required to have auto insurance in New Hampshire. For a deeper dive into coverage options, check out our comprehensive guide to NH Auto Insurance.

Your Step-by-Step Guide to an Automobile Diminished Value Claim

Navigating an automobile diminished value claim can feel daunting, but being prepared and following a structured approach significantly increases your chances of success. We believe knowledge is power, and being proactive is the best way to protect your vehicle’s worth. Here’s a step-by-step guide to help you through the process:

1. Gather All Documentation

The foundation of any successful claim is comprehensive documentation. You’ll need to compile everything related to the accident and your vehicle’s repairs. This includes:

- Police Report: Essential for establishing fault and documenting the accident details.

- At-Fault Driver’s Information: Their name, insurance company, and policy number.

- Repair Estimates and Final Invoice: Detailed documents from the body shop outlining the repairs performed and their cost.

- Photos: Before-and-after photos of the damage to your vehicle.

- Vehicle History Report: Obtain a vehicle history report. These reports are critical because they show the accident history that potential buyers will see, directly impacting your vehicle’s market value. The role of vehicle history reports in diminished value claims cannot be overstated; they’re often the first piece of evidence a buyer uses to justify a lower offer.

2. Obtain a Credible Appraisal

This is arguably the most crucial step. Since insurance companies will likely dispute your claim, you need an unbiased, professional assessment of your vehicle’s loss in value.

- Hiring a Licensed, Independent Appraiser: Seek out a qualified appraiser who specializes in diminished value. They should be licensed and entirely independent, meaning they have no affiliation with your repair shop or an insurance company.

- Appraiser’s Report as Proof of Loss: The appraiser will conduct a thorough examination of your vehicle, review repair documentation, and research market comparables (similar vehicles without accident history) to determine the difference in market value. Their detailed report serves as your primary proof of loss.

- Comparing Pre-Accident Value to Post-Repair Market Value: A good appraisal will clearly articulate your vehicle’s value before the accident versus its market value after the repairs, accounting for the stigma of the accident history.

- Avoid Using the Dealership for an Appraisal: While dealerships can tell you what they would offer for your car, their appraisal is often not considered impartial for a diminished value claim due to their vested interest in negotiation.

3. Submit a Demand Letter

Once you have your comprehensive documentation and a credible appraisal report, it’s time to formally present your automobile diminished value claim to the at-fault party’s insurance company.

- Formal Letter to the At-Fault Party’s Insurer: Draft a clear, concise demand letter. This letter should state your intention to claim diminished value and the specific amount you are seeking.

- Include All Documentation and the Appraisal Report: Attach copies of everything you’ve gathered – the police report, repair invoices, photos, and especially the independent appraisal report. This comprehensive package demonstrates the legitimacy of your claim.

- Clearly State the Diminished Value Amount You Are Demanding: Be precise with the figure you are seeking, backed by your appraisal.

- Send Via Certified Mail: Always send your demand letter via certified mail with a return receipt requested. This provides legal proof that the insurance company received your claim, which can be invaluable if disputes arise later.

4. Negotiate a Settlement

After submitting your demand letter, expect a response from the insurance company. This is where negotiation comes into play.

- Insurer’s Initial Response: It’s common for insurance companies to initially offer a lowball settlement, or even deny the claim outright, arguing that proper repairs negate any loss in value. Don’t be discouraged by this.

- Using Your Appraisal to Counteroffer: Your independent appraisal is your strongest tool. Use it to counter any low offers, explaining how your documented loss is legitimate and supported by expert opinion. Be firm but polite.

- Potential for Small Claims Court if Negotiations Fail: If you cannot reach a fair settlement through negotiation, you may consider filing a lawsuit in small claims court. The process is designed to be accessible for individuals without lawyers, and your thorough documentation and appraisal will be crucial evidence. Understanding more info on liability insurance can also help you understand the insurer’s position and obligations.

Frequently Asked Questions about Diminished Value

When you’re dealing with an automobile diminished value claim, you probably have questions. As someone who’s helped countless clients steer these claims over the years, I hear the same concerns come up again and again. Let me address the most common ones:

Can I claim diminished value if I was at fault for the accident?

Unfortunately, no – you can’t file an automobile diminished value claim if you caused the accident. These claims are specifically designed to recover losses from the at-fault driver’s insurance company. Think of it this way: if you accidentally damaged something, you wouldn’t expect the other person to pay for your loss in value.

Your own insurance policy covers the direct costs of repairing your vehicle, but diminished value is considered an indirect loss that you’re responsible for when you’re at fault. It’s one of those harsh realities of being in an at-fault accident – the financial consequences can extend well beyond the initial repair costs.

How long do I have to file a diminished value claim?

Time is more important than many people realize. Both Massachusetts and New Hampshire give you three years from the date of the accident to file a property damage claim, including diminished value. That might sound like plenty of time, but don’t wait.

The sooner you start the process after your repairs are completed, the better. Fresh documentation is more convincing, and memories don’t fade. Plus, you’ll want to avoid any last-minute scrambling as that three-year deadline approaches. I’ve seen too many valid claims get complicated simply because someone waited too long to act.

Will filing a diminished value claim raise my insurance rates?

Here’s some good news – filing a claim against the other driver’s insurance company won’t affect your rates with your own insurer. Since you weren’t at fault, this third-party claim shouldn’t impact your premiums at all.

Your insurance rates are typically affected by claims where you’re found at fault, changes to your driving record, or broader risk factors in your area. When you’re the victim pursuing rightful compensation, that’s completely different. You’re simply recovering what you’re owed, not filing a claim that suggests you’re a higher risk driver.

If you’re curious about what factors do influence your premiums, you can learn more about car insurance rates in Massachusetts and how various elements come into play.

Conclusion: Protecting Your Vehicle’s Worth

The reality is clear: automobile diminished value claims represent a genuine financial loss that can hit your wallet hard after an accident. Even when your car is repaired to perfection, that accident history follows it forever. When potential buyers see a vehicle history report, they often walk away or demand a lower price – sometimes thousands less than what your car would be worth without that accident history.

Here’s the thing though – you don’t have to just accept this loss. While insurance companies often try to minimize these claims or deny them altogether, you have options. The key is being prepared and knowing your rights.

Knowledge truly is power when it comes to protecting your vehicle’s worth. Understanding how diminished value works, knowing the 17C formula, and having a solid game plan for filing a claim puts you in a much stronger position. Yes, the process can feel overwhelming, especially when you’re dealing with insurance adjusters who seem determined to pay as little as possible. But remember – a well-documented claim backed by an independent appraisal is your best weapon in this fight.

Being prepared is crucial for a successful claim. Start gathering your documentation immediately after an accident. Don’t wait until you’re ready to sell your car to find you’ve lost thousands in value. The sooner you act, the stronger your case will be.

At Stanton Insurance Agency, we’ve seen how automobile diminished value claims can impact our clients. We understand that your car is more than just transportation – it’s a valuable asset that you’ve worked hard to afford. That’s why we’re committed to helping you understand every aspect of your coverage and your rights.

If you’re dealing with an accident and wondering about diminished value, or if you simply want to understand your policy better, we’re here to help. Our team can walk you through your coverage options and help you prepare for potential claims before they happen. Don’t let insurance companies take advantage of your lack of knowledge about this complex area.

Ready to make sure you’re properly protected? Contact us to review your auto insurance coverage today. We’ll help you understand exactly what your policy covers and what steps you can take to protect your vehicle’s worth. After all, you deserve trusted protection for all your valuable assets – and that includes getting the full value of your car when it matters most.