Auto Liability Insurance Cost: 2025 Smart Savings

Why Auto Liability Insurance Cost Matters for Every Driver

Auto Liability Insurance Cost is a major expense for drivers, but it’s also a crucial financial safeguard. If you cause an accident, this coverage pays for the other person’s medical bills and property damage—not your own. Here’s what you need to know:

Quick Answer: What You’ll Pay

- National average: $500–$800/year for liability-only coverage

- Massachusetts average: Around $1,796/year for full auto insurance ($150/month)

- New Hampshire average: Typically lower than MA due to less urban density

- Factors that affect cost: Location, driving record, age, vehicle type, coverage limits

State Minimums:

- Massachusetts: $20,000/$40,000/$5,000 (BI/BI/PD)

- New Hampshire: $25,000/$50,000/$25,000 (BI/BI/PD)

Understanding why these numbers vary—and how to manage them—can save you hundreds of dollars while ensuring you have enough protection if something goes wrong.

Auto liability insurance is mandatory in nearly every state, including Massachusetts. New Hampshire has a unique “financial responsibility” law, meaning you can technically drive without insurance if you can prove you can pay for damages out of pocket. In practice, almost everyone still buys a policy because proving financial responsibility is difficult and the penalties for causing an uninsured accident are severe.

The cost of this coverage isn’t random. Insurers use a detailed risk assessment to set your premium, factoring in everything from your ZIP code to your driving history. A clean record in a rural New Hampshire town will cost far less than a policy for a young driver in Boston with a recent speeding ticket. The difference can be thousands of dollars per year.

Many drivers simply accept the first quote they receive or stick with the same insurer for years, assuming all companies charge roughly the same rates. That’s rarely true. Shopping around can reveal significant savings—sometimes hundreds of dollars or more annually. Small changes, like bundling policies or raising your coverage limits slightly, can also make a big difference in both cost and protection.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, where I’ve specialized in helping individuals and families steer their Auto Liability Insurance Cost and coverage options for over two decades. My goal is to help you understand what you’re paying for and how to get the best value for your specific needs.

Understanding Auto Liability Insurance and What It Covers

Auto liability insurance is the foundation of any car insurance policy. It’s designed to protect you financially if you’re found legally responsible for an accident that causes injury to another person or damage to their property. Unlike collision or comprehensive coverage, which pays for damage to your own vehicle, liability insurance covers the costs incurred by the other party—the “third party.”

In short, it protects your assets from the financial fallout of an at-fault accident. It’s not about fixing your car; it’s about covering the mess you might cause for someone else. And that matters because the Auto Liability Insurance Cost you pay is directly tied to how much protection you’re buying for exactly these scenarios.

Bodily Injury Liability (BI)

This portion of your policy pays for the medical expenses of people injured in an accident you cause. It can cover everything from initial emergency room visits and hospital stays to ongoing rehabilitation and physical therapy. If the injured person can’t work, it also covers their lost wages. And if you’re sued? It can even cover your legal fees and settlements for pain and suffering.

Policies typically show two limits for BI coverage—something like $25,000/$50,000. The first number represents the maximum payout per person, and the second is the maximum payout per accident, regardless of how many people are hurt. So if you have 25/50 coverage and you injure three people in one crash, your policy would pay up to $25,000 for any one individual and a total of $50,000 for everyone combined. Anything beyond that comes out of your own pocket.

Property Damage Liability (PD)

Property Damage Liability covers the cost to repair or replace another person’s property that you damage in an accident. Most commonly, this is the other driver’s vehicle. But it also applies to other types of property you might hit—like a fence, a mailbox, a storefront, or even a telephone pole.

Imagine accidentally backing into your neighbor’s fence or sliding into a utility pole on an icy morning. PD coverage would help cover the repair bill. This coverage is represented by a single limit, which is the maximum amount your policy will pay for property damage per accident. If you cause $8,000 in damage but only carry $5,000 in PD coverage, you’d be personally responsible for the remaining $3,000.

Key Factors That Determine Your Auto Liability Insurance Cost

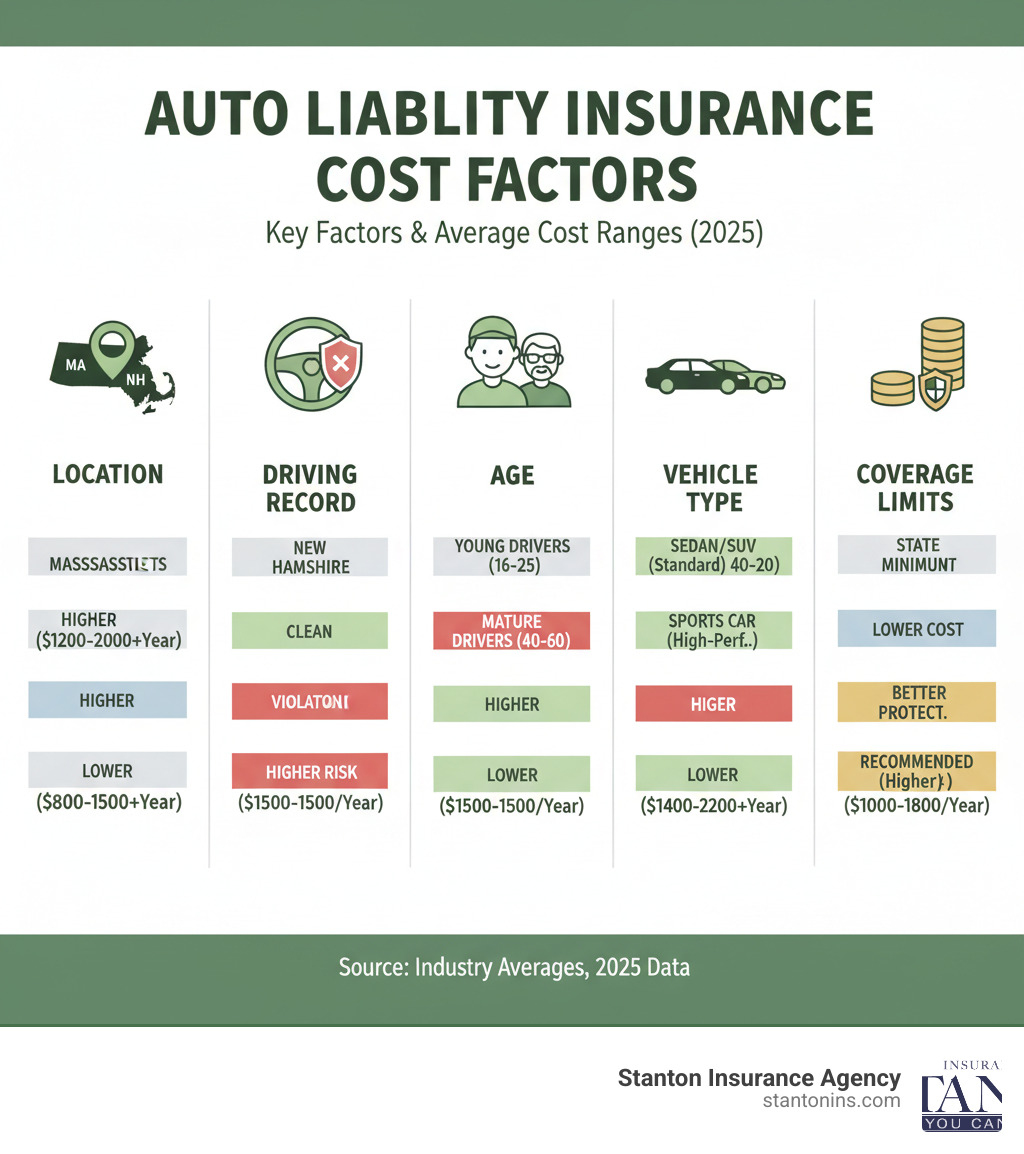

Insurance companies use a complex algorithm to determine your premium, assessing your individual risk profile. While every insurer weighs factors differently, several key elements consistently influence your Auto Liability Insurance Cost. Understanding these can help you identify areas where you might be able to find savings—and just as importantly, help you understand why your rate is what it is.

Your Geographic Location

Where you park your car at night matters more than you might think. Rates vary dramatically not only by state but by ZIP code—sometimes by hundreds of dollars. Densely populated urban areas in Massachusetts, like Boston, typically have higher rates than rural areas in New Hampshire. The reason? More cars mean more accidents. More people mean more theft. And city repairs often cost more than small-town fixes.

Insurers dig deep into local claims data, crime rates, and even the cost of vehicle repairs in your specific area to set prices. A driver in downtown Boston might pay significantly more than someone living in a quiet New Hampshire town, simply because the statistical likelihood of an incident is higher. It’s not personal—it’s just math. To explore how your location can impact your overall auto insurance, visit our car insurance page.

Driving Record and History

This one’s straightforward: if you’ve kept your nose clean on the road, you’ll pay less. A driver with a clean record, free of accidents and traffic violations, will always get better rates than someone with a history of speeding tickets or at-fault collisions. A single at-fault accident can stick around on your record and increase your rates for several years—typically three years in New Hampshire and up to six years in Massachusetts. That’s a long time to pay for one mistake.

More serious violations, such as a DUI, can lead to substantial premium increases and may require you to obtain an SR-22 filing—essentially proof that you’re carrying the state-required insurance after a major violation. Insurers view your driving history as the single best predictor of your future behavior. Keep it clean, and your Auto Liability Insurance Cost will thank you.

Vehicle Type

The car you drive sends a message to your insurance company. While liability insurance doesn’t cover your car’s repairs, insurers have found that certain types of vehicles are involved in more frequent or more severe liability claims. High-performance sports cars, for example, may carry higher liability costs because they’re statistically more likely to be involved in higher-speed accidents. That sleek red convertible might turn heads, but it’ll also turn your premium upward.

On the flip side, vehicles with excellent safety ratings may earn you a small discount. Cars with advanced safety features like automatic braking or lane departure warnings can reduce the severity of injuries to others in an accident. The cost of parts and repairs for popular models in your area also plays a role in how insurers assess risk.

Coverage Limits and Deductibles

The amount of coverage you choose directly impacts your Auto Liability Insurance Cost. Opting for the state minimum will be the cheapest option upfront, but it also offers the least protection. Choosing higher limits—such as $100,000/$300,000 for bodily injury and $100,000 for property damage—will increase your premium but provides a crucial safety net against expensive claims that could otherwise wipe out your savings.

Here’s an important distinction: deductibles typically apply to collision and comprehensive coverage, which cover damage to your vehicle. Liability insurance, which pays for damages to others, doesn’t usually have a deductible. So while increasing your collision or comprehensive deductibles can lower your overall auto insurance premium, it won’t directly reduce the liability portion. However, opting for higher liability limits is one of the smartest financial moves you can make, even if it means paying a bit more each month.

Personal Demographics

Some factors that affect your rate have nothing to do with how well you drive. Statistical data shows that age and driving experience are strong predictors of risk. Young, inexperienced drivers typically face the highest premiums, with rates gradually decreasing after age 25. Drivers aged 16-19 often pay the most, while those in their 40s and 50s with clean records tend to see the lowest rates. Experience matters.

In many states, including Massachusetts and New Hampshire, insurers also consider gender and marital status, as historical data indicates differences in claim frequency between these groups. Married drivers, for example, often receive better rates than single drivers of the same age. While these demographic factors are largely beyond your immediate control, understanding their impact can help you anticipate your costs and plan accordingly.

Navigating Liability Requirements in Massachusetts & New Hampshire

Both Massachusetts and New Hampshire have specific laws regarding mandatory auto insurance. While they’re neighboring states, their requirements and the consequences for non-compliance differ quite a bit. It’s crucial to carry at least the minimum required coverage to drive legally—and to understand what those minimums actually mean for your protection.

Massachusetts Minimum Liability Requirements

In Massachusetts, all drivers are required to carry a policy with specific minimum liability limits. You’ll often hear this referred to as the “20/40/5” rule, which breaks down as follows: $20,000 for Bodily Injury to one person, $40,000 for Bodily Injury to more than one person in a single accident, and $5,000 for Property Damage.

But that’s not all Massachusetts requires. The state also mandates $8,000 in Personal Injury Protection (PIP), which is coverage that pays for your own medical expenses regardless of who caused the accident. You must also carry Uninsured Motorist Coverage matching your Bodily Injury limits (20/40), which protects you if you’re hit by someone who doesn’t have insurance.

Driving without insurance in Massachusetts isn’t just risky—it’s illegal and carries serious penalties. You could face fines ranging from $500 to $5,000, license suspension for up to one year, and even jail time. The state takes this seriously, and frankly, so should you. The financial consequences of an uninsured accident far outweigh the cost of proper coverage.

New Hampshire Minimum Liability Requirements

New Hampshire takes a different approach with its unique “financial responsibility” law. Technically, you’re not required to buy insurance—but before you celebrate, understand what that actually means. You must be able to prove you can pay for damages if you cause an accident. This means demonstrating significant financial resources, which is difficult for most people.

For this reason, nearly all drivers in New Hampshire choose to purchase insurance. If you do, you must carry at least the “25/50/25” rule: $25,000 for Bodily Injury to one person, $50,000 for Bodily Injury to more than one person, and $25,000 for Property Damage. Your policy must also include Medical Payments Coverage and Uninsured Motorist Coverage.

The penalties for causing an uninsured accident in New Hampshire are severe. Your license and registration will be suspended until you pay for all the damages and file proof of future insurance (an SR-22 form) for three years. While you technically have a choice about buying insurance, the responsible choice—and the one that protects your future—is always to carry adequate coverage.

Why Higher Coverage Is Recommended

Here’s the uncomfortable truth: the minimum requirements in both states are relatively low compared to the potential cost of a serious accident. A multi-car collision or an accident causing significant injury can easily exceed a $5,000 property damage limit or a $40,000 bodily injury limit. In fact, according to the Insurance Information Institute, the average auto liability claim for property damage was $6,551, and for bodily injury was $26,501 in 2023. Those figures already exceed the minimums in Massachusetts!

If the costs surpass your coverage, you become personally responsible for the remainder. That could mean wage garnishment, liens on your home, or depleted savings accounts. Everything you’ve worked hard to build could be at risk because of one accident.

This is why experts often recommend carrying limits of at least $100,000/$300,000/$100,000 for adequate protection. Yes, this higher level of coverage will increase your Auto Liability Insurance Cost somewhat, but the increase is typically modest compared to the massive financial safety net it provides. Think of it as protecting not just your car, but your entire financial future. It’s about safeguarding your home, your savings, and your peace of mind—and that’s worth the small difference in premium.

Smart Strategies for Lowering Your Insurance Premiums

While some cost factors are beyond your control, there are many proactive steps you can take to find more affordable auto liability insurance without sacrificing crucial protection. The good news? You don’t have to settle for paying more than necessary. With a bit of effort and some smart strategies, you can often reduce your Auto Liability Insurance Cost significantly while still maintaining the coverage you need.

Shop Around and Compare Quotes

Insurance is not a “set it and forget it” purchase. Rates can change, and a company that was cheapest last year may not be the most competitive this year. Different insurers have different appetites for risk and may offer varying rates based on their own actuarial data. One company might view your profile as low-risk, while another might see it differently. The only way to know who offers you the best deal is to compare.

It’s wise to compare quotes from several different insurers at least once a year or whenever you have a major life change, like moving, buying a new car, or adding a new driver to your policy. Yes, it takes a bit of time, but the potential savings are well worth it. Some drivers find they can save hundreds of dollars simply by switching carriers.

Working with an independent agent, like us at Stanton Insurance Agency, can save you time and effort by comparing quotes from multiple carriers on your behalf. We do the legwork for you, often uncovering significant savings you might not find on your own.

Bundle Your Policies

One of the easiest and most significant discounts available is the multi-policy discount. By purchasing your auto insurance and home insurance, renters, or condo insurance from the same company, you can often save 10-25% on both policies. That’s real money back in your pocket.

It’s a win-win situation: you simplify your insurance management by having all your policies in one place, and you reduce your overall costs at the same time. Instead of dealing with multiple companies, multiple bills, and multiple renewal dates, you have one trusted partner handling everything. We offer comprehensive solutions for your home, renters, and condo insurance needs, making bundling a breeze and helping you maximize your savings.

Ask About Available Discounts

Insurers offer a wide range of discounts that can lower your premium, but they don’t always advertise them loudly. Don’t be shy about asking your agent what you might qualify for! You might be surprised at how many discounts are available that you didn’t even know existed.

For example, if you have a young driver in your household who maintains a Good Student Discount with a “B” average or better, you could see a meaningful reduction in your premium. Completing a Defensive Driving Course can also demonstrate a commitment to safe driving and earn you a discount. If you’ve maintained a Safe Driver/Claims-Free record for a set number of years, insurers will reward that responsible behavior.

Do you work from home or just don’t drive much? A Low Mileage discount might apply, since you’re on the road less, which means less risk. Installing approved Anti-Theft Devices can reduce the risk of theft, potentially lowering your premium. If you can afford to pay your entire annual or semi-annual premium at once, many insurers offer a Pay-in-Full discount, saving them administrative costs and passing those savings on to you.

One of the more modern options is Usage-Based Insurance, also known as telematics programs. These programs monitor your driving habits—things like speed, braking, mileage, and time of day you drive—and reward safe behavior with discounts. If you’re a consistently safe driver, these programs can be a great way to reduce your Auto Liability Insurance Cost. Some drivers save 10-30% or more by participating.

The key is to ask. Every discount you qualify for adds up, and together they can make a significant difference in what you pay each year. We’re here to help you identify every opportunity to save while ensuring you have the protection you need.

Frequently Asked Questions about Auto Liability Insurance Cost

How does a claim work for a third-party liability incident?

If you cause an accident, the other party (the third party) will file a claim against your liability insurance. Your insurance company will assign a claims adjuster to investigate the incident, determine fault, and assess the damages. Think of the adjuster as a detective gathering all the facts—they’ll review the police report, take statements, and look at any photos or evidence from the scene.

If you are deemed responsible, your insurer will negotiate a settlement with the other party and pay for their medical bills and/or property damage up to your policy limits. The good news? You’re not alone in this process. Your insurer handles the negotiations, the paperwork, and the payment. That’s what you’re paying your premium for.

Here’s an important distinction: You are only responsible for paying your deductible if you also file a claim for your own vehicle under your collision coverage. The liability portion of your policy handles the other party’s expenses without a deductible, keeping your personal assets protected. It’s designed to shield you from financial disaster if you accidentally cause harm to someone else.

How much does the average auto liability insurance cost?

The cost varies widely based on the factors we’ve discussed throughout this guide. Nationally, liability-only coverage can average around $736 per year, but that’s just a starting point. Your actual Auto Liability Insurance Cost depends on your unique situation—where you live, your driving record, your age, and the coverage limits you choose.

In Massachusetts, due to its no-fault system, mandatory PIP coverage, and dense urban population, costs tend to run higher than the national average. While the average cost for full auto insurance in Massachusetts is around $1,796 annually, the liability-only portion would represent a segment of that total. New Hampshire’s rates are often lower, thanks to its unique financial responsibility law and generally lower population density outside of its major cities like Manchester and Nashua.

The only way to know your specific cost is to get a personalized quote based on your unique profile and location. Every driver is different, and the numbers can surprise you—sometimes pleasantly! That’s why it’s worth taking the time to compare and explore your options.

What optional coverages best complement third-party liability insurance?

While liability is mandatory, it only covers the other person’s expenses. Several optional coverages provide critical protection for you and your vehicle, filling in the gaps that liability insurance leaves open.

Collision coverage pays for damage to your car from an accident, regardless of who’s at fault. If you hit a tree, another car, or slide into a guardrail on an icy New England morning, collision coverage takes care of your car’s repairs. This is especially valuable if you have a newer or more expensive vehicle.

Comprehensive coverage handles non-collision events like theft, vandalism, fire, hail, or storm damage. Imagine a tree branch falling on your car during a nor’easter—comprehensive coverage would pay for those repairs. It’s the “expect the unexpected” protection.

Uninsured/Underinsured Motorist (UM/UIM) coverage is highly recommended, especially in states like Massachusetts and New Hampshire. This protects you if you’re hit by a driver with no insurance or not enough insurance to cover your medical bills and property damage. Given the relatively low minimum liability limits in both states, it’s entirely possible that an at-fault driver won’t have enough coverage to fully compensate you for a serious accident. UM/UIM coverage steps in to fill that gap, ensuring you’re not left paying out of pocket for someone else’s mistake. It’s one of the smartest additions you can make to your policy.

Get the Right Liability Coverage for Your Needs

Understanding your Auto Liability Insurance Cost is the first step toward making an informed decision about your financial protection. By now, you know what factors influence your rate, what Massachusetts and New Hampshire require, and where to look for discounts. Armed with this knowledge, you’re ready to build a policy that safeguards your assets without breaking the bank.

Here’s the reality: every driver’s situation is unique. A young driver commuting daily into Boston faces different risks than a retired couple in rural New Hampshire. A one-size-fits-all policy rarely provides the best value or the right level of protection. What works for your neighbor might leave you underinsured—or paying for coverage you don’t actually need.

That’s where working with a trusted professional makes all the difference. An experienced agent doesn’t just quote you a price; they take the time to understand your specific circumstances, explain your options in plain language, and help you find the perfect balance of coverage and cost. They can spot gaps in your protection that you might not have considered and identify discounts you didn’t know existed.

The team at Stanton Insurance Agency is dedicated to helping drivers in our community secure the protection they need. We’ve been doing this for over two decades, and we genuinely care about getting it right for you. Whether you’re a first-time driver trying to understand the basics or a seasoned driver looking to optimize your coverage, we’re here to help you steer through your options with confidence.

Ready to see what your personalized Auto Liability Insurance Cost looks like? Get a personalized auto liability insurance quote today. It takes just a few minutes, and there’s no obligation. Let’s make sure you have the right coverage at the right price.