Auto Insurance Liability Coverage: Secure Your 2025

Understanding Auto Insurance Liability Coverage Basics

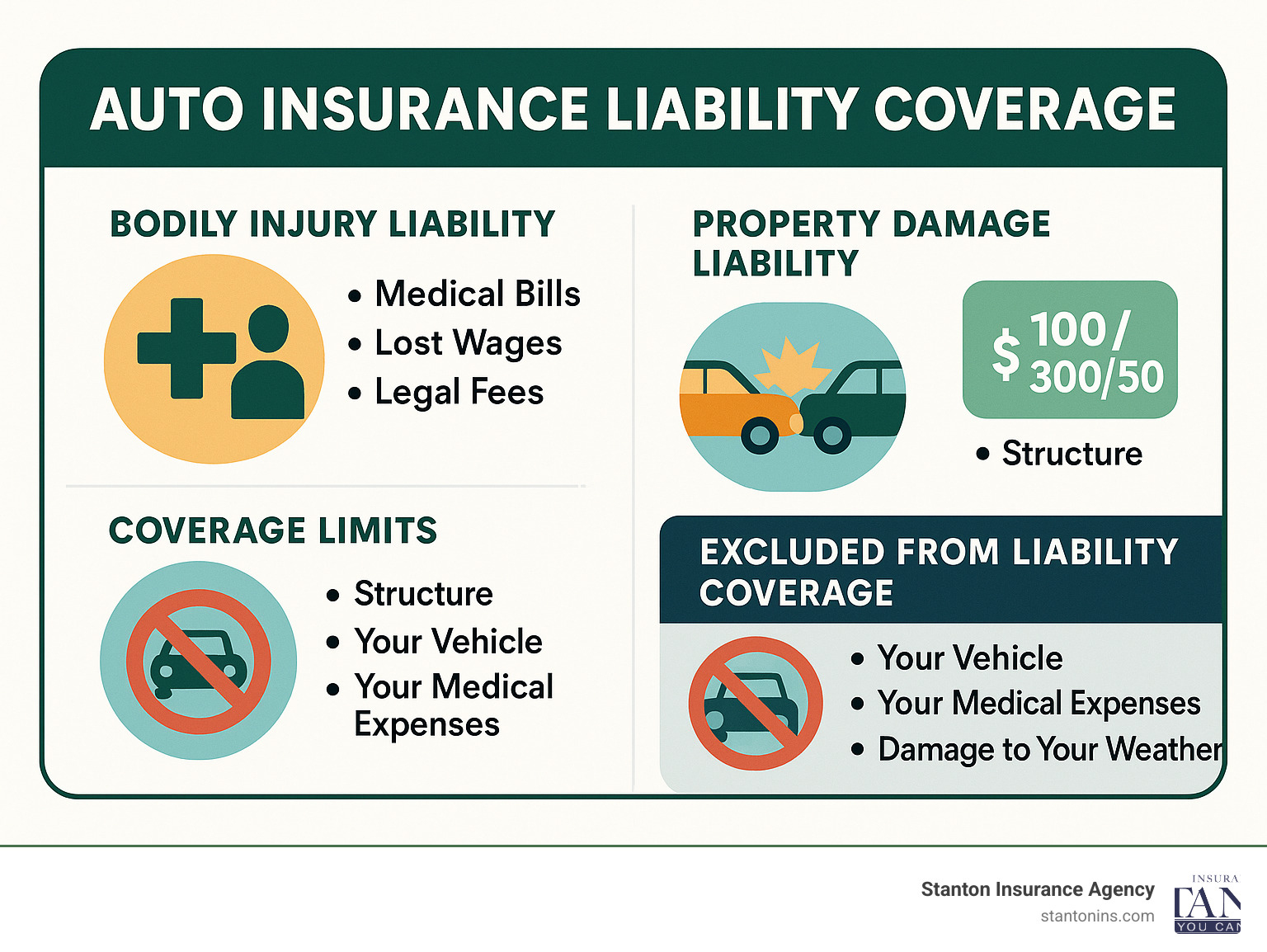

Auto insurance liability coverage is the cornerstone of every car insurance policy, protecting you from financial disaster when you’re at fault in an accident. This mandatory coverage pays for injuries and property damage you cause to others, but it won’t cover your own vehicle or medical bills.

Key Components of Liability Coverage:

- Bodily Injury Liability – Pays medical bills, lost wages, and legal costs for people you injure

- Property Damage Liability – Covers damage to other people’s cars, homes, or property

- Legal Defense – Handles lawsuit costs if you’re sued after an accident

What It Doesn’t Cover:

- Your own vehicle repairs

- Your own medical expenses

- Damage from theft, vandalism, or weather

State Requirements:

- Massachusetts: $20,000/$40,000 bodily injury, $5,000 property damage minimum

- New Hampshire: No mandatory insurance, but financial responsibility required

The reality is stark: a single serious accident can result in damages exceeding $100,000. Many drivers carry only state minimums, leaving them personally liable for costs beyond their policy limits. This can lead to wage garnishment, property liens, and financial ruin.

As Geoff Stanton, President of Stanton Insurance Agency and a Certified Insurance Counselor with over 25 years of experience, I’ve seen how adequate auto insurance liability coverage protects families from devastating financial consequences. My goal is to help you understand what this coverage does—and doesn’t do—so you can make informed decisions to protect your assets.

Auto insurance liability coverage terms made easy:

- do you need uninsured motorist coverage

- uninsured motorist bodily injury liability

- uninsured underinsured motorist bi

What Is Auto Insurance Liability Coverage?

Auto insurance liability coverage is your financial safety net when you’re at fault in an accident. It’s the part of your car insurance that pays for the other party’s expenses—not your own injuries or vehicle damage, but the costs you’re legally responsible for causing to others.

If you accidentally rear-end someone, liability coverage protects you from paying for their medical bills or car repairs out of pocket. Without it, a single moment of distraction could lead to financial devastation. This crucial protection has two main components.

Bodily Injury Liability (BI)

Bodily Injury liability kicks in when you cause an accident that hurts or kills another person. The costs it covers can be staggering and far beyond what most people could pay themselves. This includes:

- Medical bills and hospital care, which can easily reach six figures for serious injuries.

- Lost wages and diminished earning capacity if the injured person can’t work.

- Long-term nursing care for permanent disabilities.

- Pain and suffering compensation.

- Funeral expenses in tragic cases.

- Legal fees if you’re sued as a result of the accident.

A serious injury can generate costs that could financially ruin most families. This coverage exists to handle these overwhelming expenses up to your policy limits.

More info about Bodily Injury Liability

Property Damage Liability (PD)

Property Damage liability protects you when you damage someone else’s property in an accident. While this usually means another vehicle, the coverage extends much further. It handles damage to:

- Buildings like houses or storefronts.

- Fences, mailboxes, and landscaping.

- Guardrails, street signs, and other public property.

- Rental car costs for the other party while their vehicle is repaired.

Totaling a new luxury SUV could easily cost $50,000 or more, and crashing into a storefront could exceed $100,000 in damages. Property Damage liability ensures you’re not left covering these substantial costs from your own savings.

More info about Property Damage Liability

What Liability Coverage Includes (and Excludes)

Understanding the boundaries of your auto insurance liability coverage is critical to avoiding financial surprises after an accident. Knowing what’s left out is just as important as knowing what’s covered.

What specific damages and costs does auto insurance liability coverage cover?

Your liability coverage acts as your financial bodyguard when you’re at fault. It pays for medical expenses and property repair costs for anyone you harm, up to your policy’s limits. A key benefit many people overlook is that it also handles your legal defense costs if you’re sued after an accident. This includes attorney fees, court costs, and settlements that can easily reach tens of thousands of dollars.

What is NOT covered by liability insurance?

This is where many drivers get tripped up. Liability coverage does not pay for:

- Your own vehicle repairs. For this, you need Collision coverage. Liability only pays for damage you cause to others.

- Your own medical bills. These are typically covered by your health insurance or, in Massachusetts, your Personal Injury Protection (PIP) coverage.

- Non-accident damage to your car. For theft, vandalism, fire, or weather damage, you need Comprehensive coverage.

- Hit-and-run accidents. Since the at-fault driver is unknown, your own collision or uninsured motorist coverage would apply.

Other key exclusions include intentional damage, damage to your own household property (e.g., backing into your garage door), and using your personal vehicle for commercial purposes like ridesharing, which requires separate commercial coverage.

Here’s a helpful comparison of what different coverages protect:

| Coverage Type | Protects Others’ Property/Injuries | Protects Your Car in a Crash | Protects Your Car from Theft/Weather |

|---|---|---|---|

| Liability | Yes | No | No |

| Collision | No | Yes | No |

| Comprehensive | No | No | Yes |

The key takeaway? Liability coverage is excellent at what it does—protecting you from claims by others—but it’s not a complete safety net for every possible scenario.

Understanding Your Liability Limits and State Requirements

When you purchase auto insurance liability coverage, you’re not buying unlimited protection. You choose specific dollar amounts—your limits—that represent the maximum your insurer will pay. Think of these limits as the walls of your financial fortress.

Most policies display limits as three numbers, like 50/100/25:

- The first number ($50,000) is the maximum payout for bodily injury per person.

- The second number ($100,000) is the total bodily injury payout per accident for all people combined. If costs exceed this, you’re personally liable for the rest.

- The third number ($25,000) is the property damage coverage limit per accident.

Some insurers offer a Combined Single Limit (CSL), where one larger amount (e.g., $300,000) covers both bodily injury and property damage, offering more flexibility.

State-Mandated Minimums

Nearly every state requires minimum auto insurance liability coverage, though these amounts are often dangerously low for today’s costs.

- Massachusetts requires minimum limits of $20,000/$40,000 for bodily injury and $5,000 for property damage. These amounts fall short in most real accidents. More info on Massachusetts car insurance requirements.

- New Hampshire doesn’t require insurance, but its financial responsibility law means you must prove you can pay for damages if you cause an accident. Most people satisfy this by buying liability insurance with at least $25,000/$50,000 for bodily injury and $25,000 for property damage. More info on New Hampshire auto insurance requirements.

What is a ‘liability-only’ policy?

A liability-only policy includes just the state-required liability coverage (and any other mandatory add-ons like PIP in Massachusetts) without optional collision or comprehensive. This approach offers the cheapest liability only car insurance but leaves your own vehicle unprotected. It may suit drivers with older, low-value cars they could afford to replace out-of-pocket. However, if your vehicle has significant value, is financed, or is leased, you’ll need comprehensive and collision coverage, as most lenders require it.

Why Minimum Coverage Isn’t Enough: Determining Your Needs

While meeting your state’s minimum auto insurance liability coverage keeps you legal, it rarely keeps you financially safe. A single serious accident can create damages that dwarf minimum limits, leaving you personally responsible for devastating costs.

A modern family SUV can cost $40,000 to replace, yet Massachusetts only requires $5,000 in property damage coverage. Medical bills for a serious injury can easily climb into the hundreds of thousands, far exceeding the typical $20,000 per person minimum.

Many major insurers now recommend liability limits of at least $1,000,000—a stark contrast to state minimums. This reflects the real-world costs of accidents today.

What happens if you exceed your liability limits?

When damages from an at-fault accident exceed your coverage, you are personally responsible for the difference. If you have a $25,000 property damage limit and total a $50,000 SUV, you’re on the hook for the remaining $25,000.

The consequences can be life-altering: wage garnishment, property liens on your home, seizure of bank accounts and investments, and even driver’s license suspension.

For a small increase in your premium—often less than $6 per month—you can typically increase your coverage from state minimums to much safer limits like 50/100/50. It’s a small price for significant protection.

When are higher liability limits necessary?

The honest answer is almost always. Higher limits are especially critical if you:

- Own a home or have significant savings, as these assets can be targeted in a lawsuit.

- Have a high income, which can make you a target for larger lawsuits.

- Regularly drive with passengers or carpool, increasing the potential for multiple injuries.

- Frequently drive in heavy traffic, which increases accident risk.

Most insurance professionals, myself included, recommend minimum limits of $100,000/$300,000 for Bodily Injury and $100,000 for Property Damage. For stronger protection, consider $250,000/$500,000 for Bodily Injury with $100,000 or higher Property Damage. If you have substantial assets, an umbrella policy provides an additional layer of liability protection above your auto and home policies.

Liability Coverage in Action: Claims, Costs, and Special Cases

Understanding the theory behind auto insurance liability coverage is one thing, but seeing how it works in real-world situations drives home its importance.

How does a claim work?

Imagine you accidentally run a red light, causing an accident that injures people and totals their car. Here’s how a claim typically works:

- You report the accident to your insurer. This is a crucial first step.

- The other driver files a claim against your liability policy.

- Your insurer investigates to confirm fault and assess the damages.

- Your Bodily Injury liability pays for the other party’s medical bills, lost wages, and pain and suffering, up to your policy limits.

- Your Property Damage liability pays to replace their vehicle and cover other property damage, like a fence or rental car costs.

Crucially, if you are sued, your liability coverage also pays for your legal defense costs, which can save you tens of thousands in attorney fees.

What factors influence the cost of auto insurance liability coverage?

The price you pay for auto insurance liability coverage is a personalized calculation. Your chosen coverage limits play a big role, but upgrading often costs much less than you’d expect for the added protection.

Other key factors include:

- Your driving record: A history of accidents or tickets increases premiums.

- Your location: Urban areas with more traffic typically have higher rates than rural ones.

- The car you drive: Some vehicles have higher claim rates or repair costs.

- Your age and driving experience: Rates generally decrease with a long, clean record.

In Massachusetts, credit scores cannot be used to set car insurance rates, unlike in many other states. For more details, see our guide on liability car insurance cost.

Special Situations: Rentals and Other Drivers

Auto insurance liability coverage often extends beyond just your own vehicle.

- Rental Cars: Your personal liability coverage typically extends to a rental car you drive for personal use, covering damages you cause to others. It does not cover damage to the rental car itself; for that, you need collision coverage or a waiver from the rental company. More info on liability and rental cars.

- Other Drivers: Your liability insurance follows your car. If you lend your car to a friend who causes an accident, your policy is the primary coverage source. This is why all regular household drivers must be listed on your policy. Conversely, when you drive someone else’s car with permission, their insurance is primary, but your policy can act as secondary coverage if their limits are exceeded.

Frequently Asked Questions about Auto Insurance Liability Coverage

After helping Massachusetts and New Hampshire drivers for over 25 years, I’ve heard the same questions countless times. Here are answers to the most common ones about auto insurance liability coverage.

Is there a deductible for liability insurance?

No, there is no deductible for liability coverage. When your liability coverage pays for someone else’s medical bills or property damage, you don’t pay anything out of pocket. Your insurer handles the entire covered amount up to your policy limits. Deductibles only apply to claims for your own vehicle’s repairs through collision or comprehensive coverage.

What is the difference between Bodily Injury and Property Damage liability?

Think of it this way: Bodily Injury liability covers people, while Property Damage liability covers things.

- Bodily Injury liability pays when you hurt someone in an accident. This includes their medical bills, lost wages, pain and suffering, and even funeral expenses.

- Property Damage liability pays for the physical property you damage. Most often, this is someone else’s car, but it could also be a fence, a building, or public property.

Both are essential parts of your auto insurance liability coverage and work as a team to protect you.

Does my liability coverage protect me if I’m driving someone else’s car?

Usually, yes. When you drive someone else’s car with their permission, their insurance policy is the primary coverage. It’s the first line of defense. However, if damages from an accident exceed their policy limits, your own liability coverage can act as secondary, or “excess,” coverage to pay the remaining amount. This is a key reason why carrying higher liability limits is so important, as it provides a crucial safety net whether you’re driving your car or someone else’s.

Secure Your Future with the Right Protection

When you consider everything you’ve worked for—your home, savings, and family’s future—auto insurance liability coverage is more than a monthly bill. It’s your financial lifeline when the unexpected happens.

A single moment of distraction can change everything. The difference between state minimum coverage and adequate protection often determines whether you recover from an accident or face years of financial hardship.

State minimums keep you legal, not financially safe. Massachusetts requires just $5,000 in property damage coverage, while a serious accident can cost hundreds of thousands. The gap between what’s required and what’s needed is vast.

Assessing your personal assets and choosing higher limits is essential for protecting what matters most. Whether you’re a homeowner in Massachusetts or have savings in New Hampshire, your liability limits should reflect what you have to lose.

The insurance world can feel overwhelming, but the right coverage decisions become clear when you work with people who genuinely care about protecting your future.

At Stanton Insurance Agency, we don’t just sell policies—we build relationships. Our team takes the time to understand your unique situation, explain your options in plain English, and help you find the coverage that fits your needs and budget. We’ve been serving families and businesses throughout Massachusetts and New Hampshire because we believe everyone deserves trusted protection for their assets.

Ready to review your coverage? Don’t wait until you need it to find out if your policy is truly protecting you. Explore our Car Insurance options or contact us today for a personalized quote.

You can also learn more about our approach:

Your future self will thank you for making this decision today.