Auto-Insurance Companies: 7 Powerful Choices for 2025

Why Choosing the Right Auto Insurance Company Matters

Auto-insurance companies come in many shapes and sizes, but they all serve one critical purpose: protecting you financially when accidents happen. Here’s what you need to know about the top providers:

Leading Auto Insurance Companies:

– National carriers – High customer satisfaction, significant annual savings potential

– Regional providers – Trusted by millions of drivers, top-rated financial strength

– Usage-based insurers – Pricing saves best drivers up to $900/year

– Digital-first companies – AI-powered claims processing, high app ratings

– Local mutuals – Community focus with agents who understand your area

Auto insurance isn’t just about meeting legal requirements (though that’s important too). It’s about peace of mind knowing that a fender-bender won’t drain your savings or that a serious accident won’t leave you facing financial ruin.

The insurance landscape has changed dramatically in recent years. Traditional companies now compete with app-based startups that use your driving data to set rates. Some focus on lightning-fast digital service, while others emphasize local agents who know your neighborhood.

The key is finding a company that matches your priorities – whether that’s rock-bottom rates, white-glove service, or cutting-edge technology.

I’m Geoff Stanton, a fourth-generation insurance professional and Certified Insurance Counselor who has spent over two decades helping Massachusetts and New Hampshire residents steer auto-insurance companies and find the right coverage. My experience in both claims and sales gives me unique insight into what really matters when your policy gets put to the test.

Easy auto-insurance companies glossary:

– average cost of car insurance in ma

– commercial insurance

– auto insurance

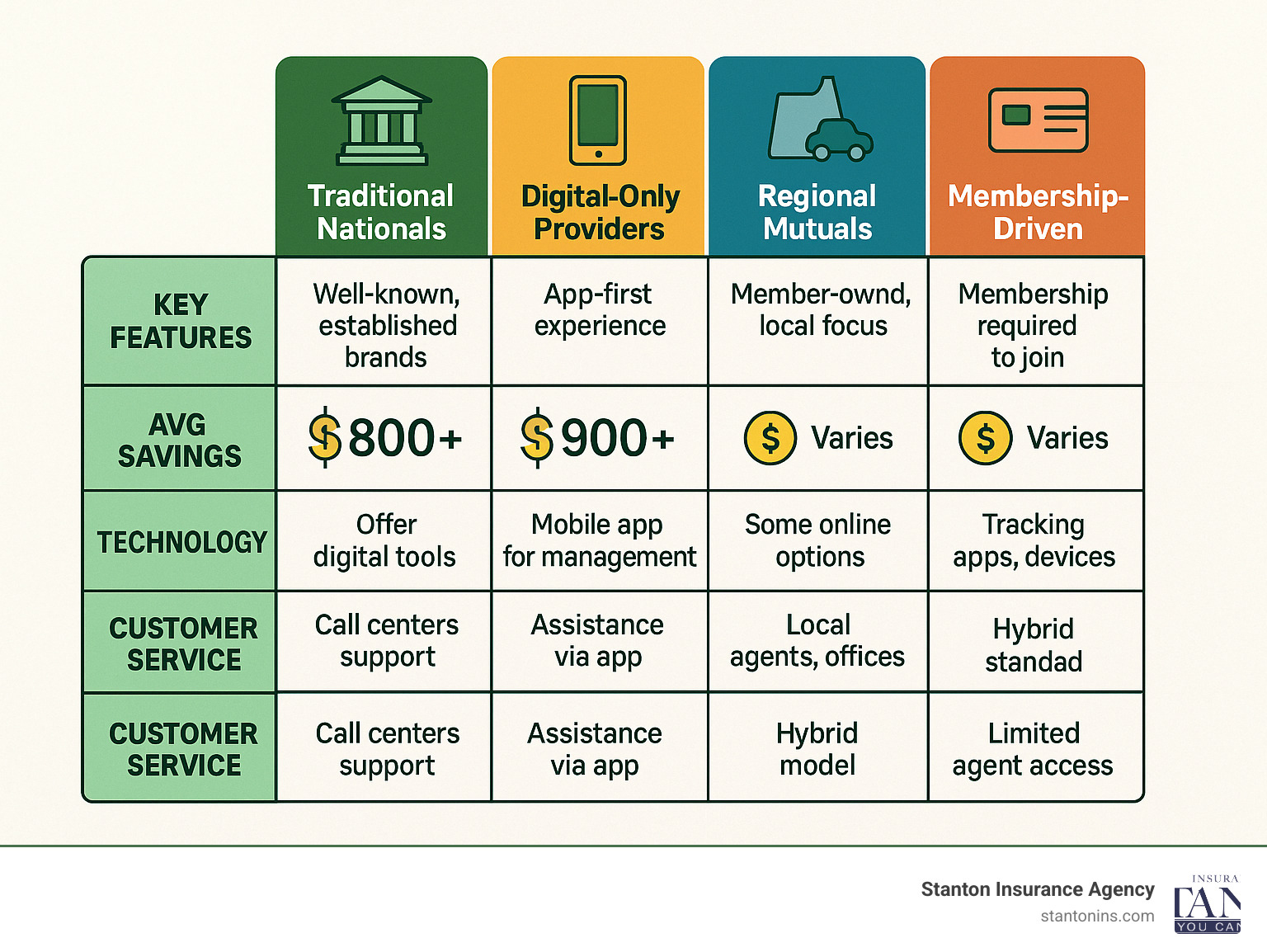

Auto-Insurance Companies: 7 Styles & Which Fits Your Wheelhouse

Think of auto-insurance companies like car dealerships: same core product, wildly different experiences. After two decades helping Massachusetts and New Hampshire drivers sort their options, I’ve found most insurers fall into seven buckets:

- Traditional nationals – decades-old brands with vast claims networks and strong finances.

- Regional mutuals – focus on New England roads, often paying dividends to policyholders.

- Usage-based insurers – price by telematics; safe drivers can save big.

- Digital-only providers – app-driven quotes and AI claims, often in minutes.

- Membership-driven companies – serve specific groups and bundle extra perks.

- High-risk specialists – cover drivers with violations, accidents, or lapses.

- Captive-agent networks – one carrier, deep product knowledge, personal guidance.

| Company Type | Typical Price | Tech Level | Service Style |

|---|---|---|---|

| Traditional Nationals | Moderate | Standard apps | Phone + online |

| Regional Mutuals | Competitive | Basic digital tools | Local agents |

| Usage-Based | Variable | Advanced tracking | App-centric |

| Digital-Only | Low–moderate | AI-powered | Chat + app |

| Membership-Driven | Premium | Standard | Personal touch |

| High-Risk Specialists | Higher | Limited | Phone support |

| Captive Networks | Varies | Carrier-specific | Dedicated agents |

Traditional Nationals vs. Digital-Only Start-Ups

Traditional nationals win on scale and a coast-to-coast repair network. If you like a human guiding you through a multi-car pile-up, they’re hard to beat. Digital-only start-ups trade that depth for speed—90-second quotes and same-day claim payments for simple losses. Complex collisions can still require old-fashioned expertise, so decide whether convenience or seasoned hand-holding matters more to you.

Regional Mutuals vs. Membership-Driven Providers

Regional mutuals know the difference between a Nor’easter and spring black ice. Their local knowledge plus potential policyholder dividends make them popular in New England. Membership-driven companies, by contrast, hook customers with bundle perks—think travel discounts or financial-planning tools—on top of solid coverage. Both models emphasize relationship over transactions.

More info about auto insurance services

Usage-Based & Telematics Programs

Usage-based insurance turns your smartphone into a driving scorecard. Consistently avoid hard braking, rapid acceleration, and late-night speeding? You could chop 10–30% off your bill. Pay-per-mile options go further by charging for the miles you actually drive, perfect for work-from-home lifestyles. Savvy drivers balance privacy with savings—most programs let you quit sharing data anytime (you’ll just forfeit the discount).

Learn more about uninsured motorist coverage

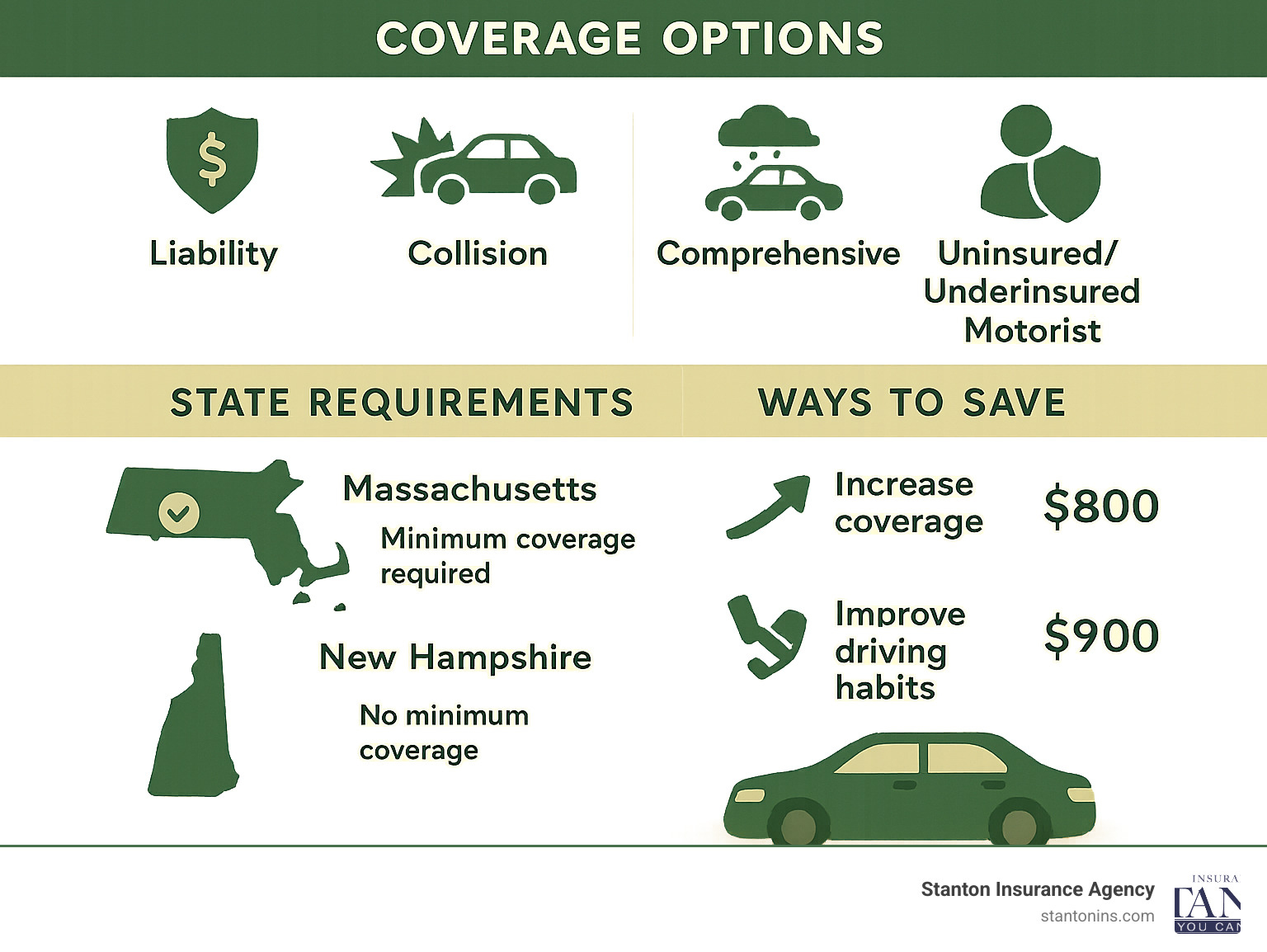

What Your Policy Should Cover (and What It Shouldn’t Skip)

Picture your policy as a safety net: missing strands create real financial pain. Here are the essentials, condensed:

- Liability – Pays for injuries or damage you cause. It’s the legal minimum and the first place to raise limits; lawsuits easily exceed state requirements.

- Collision – Repairs or replaces your car after crashes, minus your deductible.

- Comprehensive – Protects against theft, vandalism, falling trees, deer run-ins—anything that isn’t a crash with another car.

- Uninsured/Underinsured Motorist – Covers you when the at-fault driver has little or no insurance. One in eight motorists drives uninsured, so don’t skip it.

- Medical Payments (MedPay) – Immediate help with ambulance or ER bills, no matter who’s at fault.

- Roadside Assistance & Rental Reimbursement – Small add-ons that keep you mobile when life—or a flat tire—gets messy.

- Gap Coverage – Crucial if you lease or owe more than your car’s market value. It fills the “gap” after a total loss.

Personal vs. Commercial Auto Insurance

Odds are your personal policy already allows light business use (think driving to a meeting). But if you deliver food, haul equipment, or let employees drive your car, you need commercial coverage. Getting it wrong can mean claim denial and out-of-pocket disaster. Commercial premiums are tax-deductible business expenses.

More info about commercial vs. personal auto

Minimums in MA & NH: Know the Law

Massachusetts mandates 20/40/5 liability, $8,000 PIP, and matching uninsured motorist limits. New Hampshire technically doesn’t require insurance, but you must prove financial responsibility; most drivers simply carry coverage to avoid big cash bonds and potential license suspension. Legal minimums are just that—minimums. A serious wreck can rack up six-figure bills fast, so buy as much protection as your budget allows.

What Drives Your Premium Up (or Down)

Ever wonder why your neighbor pays half what you do for car insurance? Auto-insurance companies use a complex recipe of factors to cook up your premium, and understanding these ingredients can help you serve up some serious savings.

Your age tells a story that insurers listen to carefully. Young drivers under 25 face the highest rates because statistics show they’re more likely to have accidents. The good news? Rates typically drop significantly at 25 and again at 65, when experience meets wisdom.

Your driving record is like your insurance report card. A clean record earns you gold stars and lower rates, while tickets and accidents can bump up your premium for three to five years. That speeding ticket might seem minor, but it could cost you an extra 10-15% on your premium.

Credit history plays a bigger role than most people realize. In states where it’s allowed, insurers use credit scores to predict claim likelihood. Better credit often means better rates, though Massachusetts limits how much credit can affect your premium.

The car you drive matters tremendously. Sports cars and luxury vehicles cost more to insure because they’re expensive to repair and attractive to thieves. On the flip side, vehicles with safety features like automatic emergency braking often qualify for discounts.

Where you live and how much you drive both impact your rates. Urban areas with heavy traffic and higher crime rates typically mean higher premiums. Drive fewer than 7,500 miles per year? Many insurers offer low-mileage discounts.

Your coverage choices directly affect cost. Higher deductibles mean lower premiums because you’re taking on more financial responsibility. Choosing higher liability limits increases your premium but provides better protection – and the cost difference is often smaller than you’d expect.

Bundling policies can open up significant savings. Combining your auto insurance with homeowners or renters coverage typically saves 5-25% on both policies. It’s like getting a bulk discount at the insurance store.

Smart Ways to Shrink Your Bill

Nobody enjoys paying more than necessary for car insurance, and the good news is you don’t have to. Smart strategies can trim your premium without sacrificing the protection you need.

Taking a defensive driving course is one of the easiest ways to save money while becoming a better driver. Most insurers offer 5-10% discounts for completing approved courses, and these discounts often last for three years. It’s like getting paid to learn.

Raising your deductible from $500 to $1,000 or $1,500 can slash your collision and comprehensive premiums by 15-30%. Just make sure you can comfortably afford the higher out-of-pocket cost if you need to file a claim.

Paying your premium annually instead of monthly eliminates processing fees that can add $50-100 to your yearly cost. Think of it as getting a discount for paying upfront – because that’s exactly what it is.

Installing usage-tracking devices or apps can lead to substantial savings for safe drivers. These telematics programs monitor your driving habits and reward good behavior with discounts of 10-30%. The best drivers can save hundreds of dollars annually.

Parking in a garage protects your car from weather, theft, and vandalism – and insurers reward this reduced risk with comprehensive coverage discounts. Even a carport can sometimes qualify for savings.

Maintaining continuous coverage is crucial for keeping rates low. Even short gaps in coverage can trigger higher rates for several years, as auto-insurance companies view coverage lapses as a red flag.

Reviewing your coverage annually ensures you’re not paying for protection you no longer need. Paid off your car loan? You might be able to drop comprehensive and collision coverage on an older vehicle. Kids moved out? Remove them from your policy to avoid unnecessary costs.

More info about best auto insurance agents

How to Switch Auto-Insurance Companies Without a Fender-Bender

Switching auto-insurance companies doesn’t have to feel like navigating through a maze blindfolded. With the right approach, you can make the transition smoothly while avoiding the pitfalls that trip up many drivers.

The golden rule of switching insurance is simple: never cancel your old policy until your new one is active. Even a single day without coverage can brand you as high-risk, and those higher rates can follow you for years. Think of it like changing jobs – you wouldn’t quit your current position before signing a new employment contract.

Most auto-insurance companies require 30 days’ written notice for cancellation, but here’s the good news: you can usually cancel immediately when switching to new coverage. You’ll receive a prorated refund for any unused premium, though some companies do charge small cancellation fees.

When you’re ready to make the switch, timing your policy overlap correctly is crucial. A brief overlap between your old and new policies is far preferable to any coverage gap. Plan to cancel your existing policy on the exact day your new coverage begins – this eliminates gaps while minimizing unnecessary overlap costs.

Your paperwork checklist should include your new policy declarations page, updated proof of insurance cards, and cancellation confirmation from your previous insurer. Don’t forget to notify your lender or leasing company about the change, as they need current insurance information on file. Some states also require your new company to file documentation with the DMV, though most insurers handle this automatically.

Timing the Switch Around Renewal

Smart timing can save you money and headaches when switching auto-insurance companies. The easiest time to make the change is right at your renewal period, when your current policy naturally expires.

You’ll typically receive renewal notices 30 to 45 days before your policy expires, giving you plenty of time to shop around and compare options. Switching at renewal eliminates early cancellation fees and simplifies the entire process – no complicated refund calculations or mid-term adjustments to worry about.

While you can switch mid-term if you find significant savings, it’s often more complicated. You might face cancellation fees, and calculating prorated refunds can get messy. However, if you’re looking at substantial savings – say, several hundred dollars annually – these minor inconveniences might be worth it.

Try to align your insurance changes with vehicle registration renewals when possible. This keeps all your automotive paperwork synchronized and reduces the administrative burden of managing multiple renewal dates throughout the year.

One timing tip from experience: avoid switching during peak periods like major holidays or right after severe weather events. Insurance companies get swamped during these times, and you might face longer wait times for customer service or policy processing.

Evaluating Customer Service & Claims Speed

Here’s where the rubber meets the road – literally. When you’re dealing with a fender-bender at 7 PM on a rainy Tuesday, you’ll quickly find whether your auto-insurance company delivers on its promises.

24/7 support availability isn’t just a nice-to-have feature; it’s essential. Accidents don’t wait for business hours, and neither should quality customer service. Look for companies that offer round-the-clock claims reporting and customer support, not just automated phone systems that tell you to call back during business hours.

Modern digital claims processing has revolutionized how quickly you can get back on the road. Many insurers now offer mobile apps that let you photograph damage, upload documents, and track your claim’s progress in real-time. Some companies can process straightforward claims in minutes rather than days, though complex situations still require human expertise.

Consider whether you prefer working with local agents or handling everything digitally. Some people love the convenience of managing their insurance entirely through smartphone apps, while others want to sit down face-to-face with someone who knows their name and understands their specific needs.

Customer satisfaction ratings from independent research organizations tell you how real policyholders feel about their experience. Pay attention to both overall satisfaction scores and specific feedback about claims handling – that’s when customer service matters most.

Claims payment speed varies dramatically between companies. While some digital-first insurers boast about processing simple claims in minutes, complex accidents involving injuries or disputes take time regardless of the company. What matters more is transparent communication throughout the process and fair, prompt resolution when all facts are clear.

Scientific research on customer satisfaction

Frequently Asked Questions about Auto-Insurance Companies

What is “full coverage” and do I really need it?

“Full coverage” isn’t an official insurance term, but it typically refers to policies including liability, collision, comprehensive, and uninsured motorist coverage. This combination protects against most common risks drivers face.

You need comprehensive protection if you’re financing or leasing your vehicle, as lenders require collision and comprehensive coverage. Even with a paid-off vehicle, comprehensive coverage makes financial sense unless your car’s value is very low.

The cost difference between minimum coverage and comprehensive protection is often smaller than expected. Many customers who switch save hundreds of dollars annually while often increasing their coverage levels.

How can I tell if an insurer is financially strong?

Financial strength ratings from independent agencies like A.M. Best, Moody’s, and Standard & Poor’s indicate an insurer’s ability to pay claims. Look for ratings of A- or better from A.M. Best.

Many reputable insurers maintain A+ ratings from A.M. Best, indicating superior financial strength. Companies with lower ratings might offer cheaper premiums but could struggle to pay claims during catastrophic events.

State insurance departments also monitor insurer financial health and can provide information about companies’ complaint ratios and regulatory actions.

Does usage-based insurance raise rates if I brake hard once?

Usage-based insurance programs evaluate overall driving patterns rather than isolated incidents. One hard brake won’t significantly impact your score, especially if your overall driving record demonstrates safe habits.

Most programs consider patterns over several weeks of driving. The best drivers can save hundreds of dollars per year, with rates based primarily on actual driving behavior rather than demographics.

Most programs provide ongoing feedback through smartphone apps, allowing you to monitor your driving score and understand how various behaviors affect your rates.

Conclusion

Choosing the right auto-insurance companies feels overwhelming at first, but it doesn’t have to be. Whether you’re drawn to the lightning-fast claims processing of digital companies or the rock-solid stability of traditional insurers, there’s a perfect match waiting for your specific needs and budget.

The insurance world is changing faster than ever. Companies are rolling out AI-powered apps that can settle claims in minutes, while others are perfecting usage-based programs that reward your actual driving habits instead of making assumptions based on your age or zip code. It’s an exciting time to be shopping for coverage.

Here in Massachusetts and New Hampshire, we face unique challenges that many national companies simply don’t understand. Our brutal winters, stop-and-go Boston traffic, and winding mountain roads in the White Mountains create driving conditions that require local expertise. Auto-insurance companies that truly know our region make all the difference when claims happen.

That’s where Stanton Insurance Agency comes in. We’ve been protecting drivers across Massachusetts and New Hampshire since 1909 – that’s four generations of helping families find the right coverage. We’re not tied to just one company, which means we can shop multiple auto-insurance companies to find you the best combination of price, coverage, and service.

We don’t believe in cookie-cutter solutions because no two drivers are exactly alike. A college student commuting to UMass needs different coverage than a small business owner hauling equipment around the North Shore. A family with teenage drivers faces different challenges than empty nesters planning retirement road trips.

When you work with us, you’re getting more than just an insurance policy. You’re getting a local partner who understands Massachusetts and New Hampshire insurance requirements, knows which companies handle claims fairly, and can explain everything in plain English without the industry jargon.

Ready to find which auto-insurance companies offer the best fit for your situation? Give us a call for a personalized quote that takes into account your actual needs, not just what some algorithm thinks you should buy.

More info about Auto Insurance

Stanton Insurance Agency – protecting Massachusetts & New Hampshire drivers since 1909.