Auto insurance collision coverage limits: Smart 2025 Guide

Explaining Auto Insurance Collision Coverage Limits

Navigating auto insurance can feel complex, with its own language of deductibles, limits, and coverages. However, understanding your policy is the first and most crucial step toward ensuring you have robust financial protection. Collision coverage is a critical component of a full coverage policy, designed specifically to pay for damage to your own vehicle after an accident. The protection it offers isn’t unlimited; it’s defined by its limits—the maximum amount your insurer will pay for a single claim. This guide will break down everything you need to know about auto insurance collision coverage limits, empowering you to make an informed decision for your peace of mind on the road.

What Auto Insurance Collision Coverage Limits Mean for You:

- Maximum Payout is Your Car’s Value: The absolute most your insurance company will pay for a collision claim is your car’s Actual Cash Value (ACV) at the moment of the accident. ACV is not the price you paid for the car; it’s the vehicle’s replacement cost minus depreciation. Factors like age, mileage, wear and tear, and current market conditions all contribute to its ACV. This isn’t a fixed dollar amount you choose when buying your policy; it’s a dynamic value determined by your car’s worth at the time of the loss.

- Your Out-of-Pocket Cost Comes First: Before your insurance pays, you are responsible for your deductible. This is the predetermined amount you agree to pay out-of-pocket for a claim. For example, if you have a $500 deductible and the repairs cost $4,000, you pay the first $500, and your insurer covers the remaining $3,500. If your car is declared a total loss, the insurer will pay you the car’s ACV minus your deductible.

- The Limit is Not a Fixed Dollar Amount: This is a key difference from liability coverage. When you buy liability insurance, you select specific dollar limits (e.g., $100,000 for property damage). With collision coverage, you don’t pick a limit like “$30,000 of coverage.” The limit is inherently tied to the value of the asset it protects—your vehicle. This structure ensures that the coverage adjusts as your car’s value changes over time due to depreciation.

I’m Geoff Stanton, President at Stanton Insurance. My two decades of experience, which began in the claims department, have given me deep insight into how auto insurance collision coverage limits truly impact policyholders during their most stressful moments. I’m here to simplify these complex topics and help you feel confident in your coverage.

What is Collision Insurance and What Does It Cover?

Think of collision insurance as your car’s personal safety net. It’s an optional part of your auto policy that steps up to pay for repairs when your vehicle is damaged in a crash—whether you hit another car, a tree, a guardrail, or even a concrete barrier in a parking garage.

Here’s what makes it fundamentally different from other coverages: Liability insurance is legally required and covers damage you cause to other people’s property and their injuries. Collision coverage, on the other hand, protects your own vehicle. A crucial feature is that it applies regardless of who caused the accident. Even if you were 100% at fault, your collision coverage will still help pay to fix or replace your car, minus your deductible. For most of us, our vehicle is one of our most valuable and essential assets, and collision insurance provides the financial backstop needed to recover from the unexpected.

What’s Covered by Collision Insurance?

Collision insurance is all about physical impacts—when your car makes contact with another object. The scope is broad, but the concept is straightforward: if your car collides with something, you’re protected.

Collisions with other vehicles are the most common type of claim. This includes everything from a low-speed fender bender in a grocery store parking lot to a more serious multi-car accident on a major highway like I-93 or I-495. Your collision coverage helps pay for your vehicle’s repairs, no matter the severity.

Collisions with stationary objects happen more often than we’d like to admit. Maybe you misjudged the distance to a concrete pole in a garage, or you swerved on a wet road and ended up hitting a guardrail. Perhaps you backed into a fence, clipped a mailbox, or slid into a classic New England stone wall on an icy morning. Collision coverage is designed for all of these “oops” moments, covering impacts with trees, buildings, and road barriers.

Single-vehicle rollovers are serious accidents where your car overturns, often due to losing control on a slippery surface, swerving to avoid an obstacle, or a tire blowout. The damage from a rollover can be extensive, and collision insurance is the coverage that responds to pay for these repairs or declare the car a total loss.

Damage from hitting a pothole is a very real concern for anyone driving through New England after a tough winter. Those notorious craters can cause significant damage to your car’s suspension, alignment, tires, or rims. If you hit a pothole and your car sustains damage, it is considered a single-vehicle collision, and your collision coverage can help with the repair costs.

Hit-and-run scenarios are incredibly frustrating. An unknown driver damages your car and flees the scene, leaving you with the bill. In this situation, your collision coverage is essential. It allows you to get your car repaired without having to identify the at-fault party. You’ll pay your deductible, and your insurance will handle the rest.

The simple rule: if your car collides with something, this is the coverage that responds. For a more detailed look at specific situations, check out our guide: What does collision insurance cover?

What’s NOT Covered by Collision Insurance?

Understanding what collision coverage doesn’t cover is just as important as knowing what it does. This clarity helps you ensure you have no gaps in your protection and avoid surprises when filing a claim.

Damage to another person’s vehicle is never covered by your collision insurance. If you are at fault in an accident and damage someone else’s car, your property damage liability coverage is what pays for their repairs. Your collision coverage is exclusively for your own vehicle.

Medical expenses for you or others are handled by different parts of your policy. In Massachusetts, Personal Injury Protection (PIP) is the primary coverage for medical bills, regardless of fault. In New Hampshire, Medical Payments (MedPay) coverage serves a similar purpose. Collision coverage never pays for injuries.

Non-collision events are a major category of exclusions. If your car is stolen, vandalized, damaged by fire, shattered by a hailstorm, or crushed by a falling tree branch during a Nor’easter, you’ll need comprehensive coverage, not collision. These incidents don’t involve your car hitting something, so they fall outside the scope of collision.

Hitting an animal might sound like a collision, but insurance companies classify it differently. If you hit a deer (unfortunately common in New Hampshire and Massachusetts) or another animal, the claim is typically handled under comprehensive coverage. The logic is that an animal’s movement is unpredictable, making the event more akin to a random, non-collision incident like a falling object. Curious about the specifics? We have an article that explains more: Does hitting a deer fall under collision coverage?

Mechanical failure or routine wear and tear are not covered. Insurance is designed to protect against sudden and accidental losses, not predictable events. Engine breakdowns, transmission problems, worn-out brakes, and rust are considered maintenance issues and are the owner’s responsibility.

Collision vs. Comprehensive vs. Liability Coverage

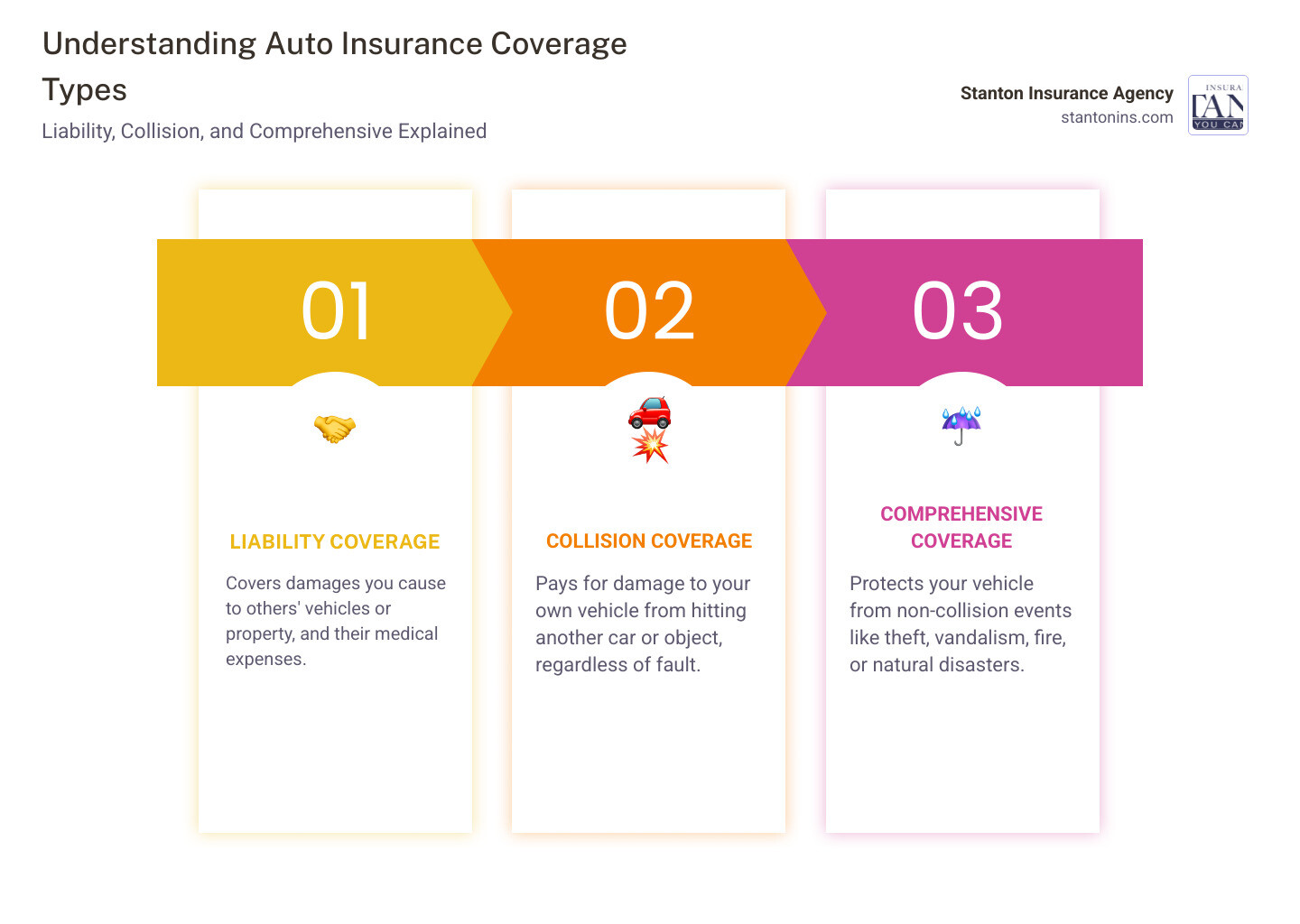

These three coverages are the pillars of a complete auto insurance policy. They work together to provide a broad shield of protection, but each has a distinct and separate role. Understanding how they differ is key to building the right insurance package.

-

Liability Coverage: This is the foundation of your policy and is legally required in Massachusetts. New Hampshire uses a financial responsibility system, but liability coverage is still the primary way drivers protect themselves financially. It protects other people and their property from damage you cause. It has two main parts: Bodily Injury Liability (for their medical bills) and Property Damage Liability (for their car or property repairs). It does nothing to pay for your own car or your own injuries.

-

Collision Coverage: This protects your own car when it is damaged in a crash. It covers impacts with other vehicles or objects, as well as rollovers. It is optional by law but almost always required by a lender if you have a loan or lease on your vehicle. It pays out regardless of who is at fault.

-

Comprehensive Coverage: Often called “other than collision,” this protects your own car from non-crash events. This includes theft, vandalism, fire, flooding, hail, falling objects, and hitting an animal. Like collision, it is optional by law but required by lenders.

To understand the minimum requirements in your state, resources like the official government websites provide a great starting point. For Massachusetts, see Basics of Auto Insurance | Mass.gov, and for New Hampshire, refer to the NH DMV’s page on insurance requirements. When it comes to auto insurance collision coverage limits, remember the maximum payout is your vehicle’s Actual Cash Value at the time of the accident, minus your deductible. This is different from liability coverage, where you actively choose specific dollar limits for your policy.

For a complete comparison that digs into common claim scenarios and helps you decide what coverage you need, take a look at our comprehensive guide: Comprehensive vs. Collision Coverage: Complete Guide