Auto insurance accident claim: Crash Course 2025

Why Filing Your Auto Insurance Accident Claim Correctly Matters

Filing an auto insurance accident claim can feel overwhelming amidst vehicle damage, potential injuries, and stress. However, understanding the process and taking the right steps can mean the difference between a smooth resolution and months of frustration.

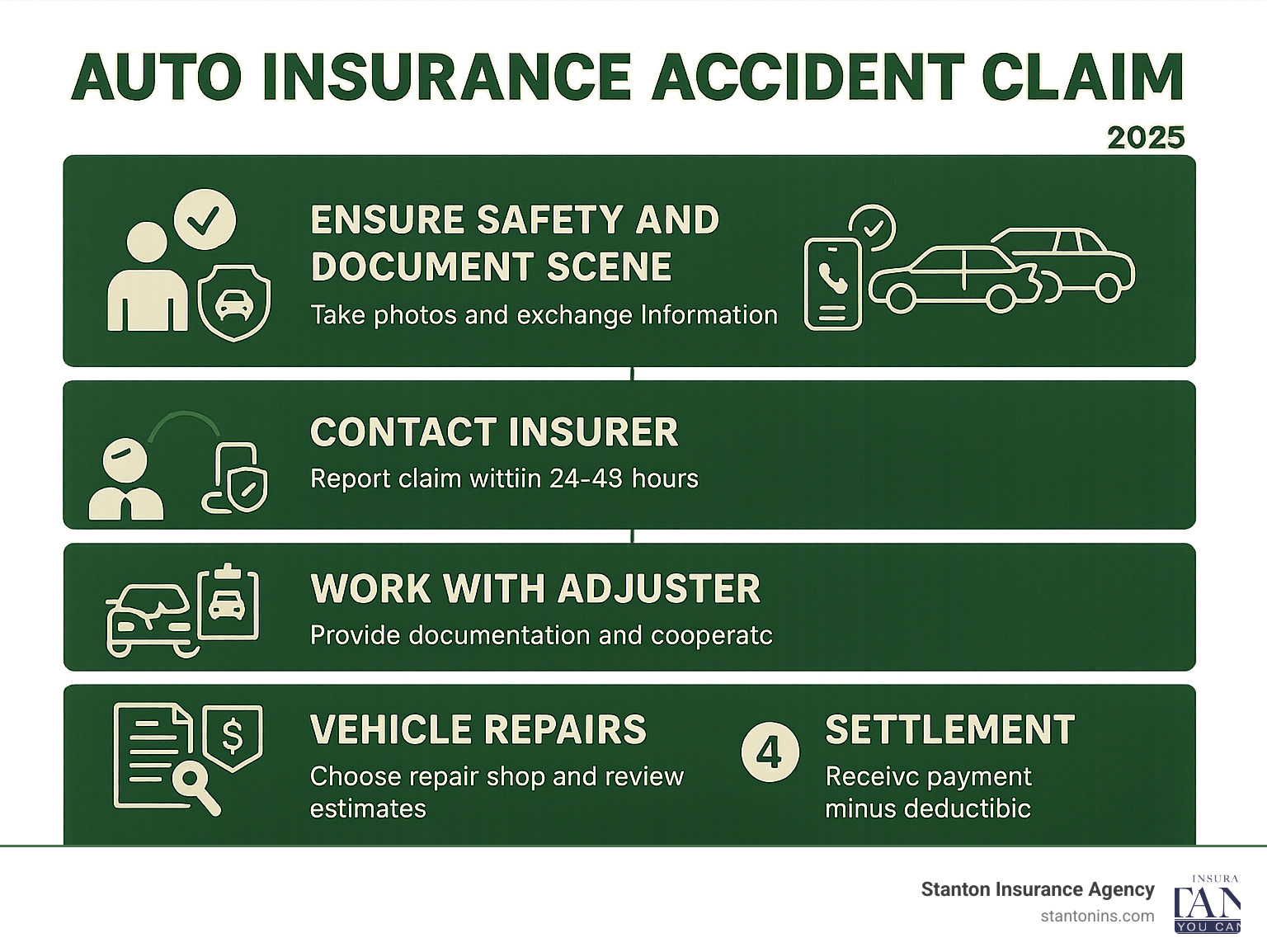

Quick Guide to Auto Insurance Accident Claims:

- Immediate Actions: Ensure safety, call 911 if needed, document the scene

- Contact Your Insurer: Report the claim within 24-48 hours using phone, app, or online

- Work with Adjuster: Provide requested documentation and cooperate with investigation

- Vehicle Repairs: Choose your repair shop and review damage estimates

- Settlement: Receive payment for repairs or total loss value minus deductible

The statistics tell the story: in 2021, there were 6.1 million police-reported crashes in the U.S., with the average property damage claim costing $5,046. With total auto insurance claims reaching $279.4 billion nationwide, knowing how to steer this process protects your financial interests and peace of mind.

Whether it’s a minor fender bender or a serious collision, your actions immediately after an accident and during the claims process directly impact your outcome. From understanding fault in Massachusetts’s no-fault system to knowing your rights when choosing a repair shop in New Hampshire, local knowledge is key.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve been helping families steer auto insurance accident claims for over two decades, starting in our claims department in 1999. My experience shows that preparation and understanding the process are your best tools for a successful claim.

What to Do Immediately After an Accident

The moments after a car accident can feel chaotic. Your actions in these first few minutes and hours are critical for keeping everyone safe and ensuring your auto insurance accident claim goes smoothly. Following a clear plan will help you gather what you need while prioritizing safety.

Prioritize Safety and Call for Help

Safety always comes first. If possible, move your car to the shoulder and turn on your hazard lights. Check yourself and others for injuries.

Call 911 if anyone is hurt. Adrenaline can mask injuries, so it’s always better to be safe. Even for a minor fender bender, getting a police report is one of the smartest things you can do. This official report is valuable evidence, especially if the other driver later changes their story. In Massachusetts and New Hampshire, police reports help establish facts and can speed up the claims process.

For hit-and-run accidents or stolen vehicles, calling the police is essential. Your insurance company will require an official police report to process your claim. No report often means no coverage.

Worried about winter driving? Our Winter Survival Kit for Your Vehicle can help you prepare for New England weather.

Gather Information and Document the Scene

Your smartphone is your best friend here. Don’t rely on memory—document everything. The shock of an accident can make details fuzzy later.

- Other Driver’s Info: Get their full name, address, phone number, and driver’s license number. Snap a photo of their insurance card to capture their insurer and policy number.

- Vehicle Details: Note the make, model, year, color, and license plate number for every car involved. Take photos of the license plates.

- Witnesses: Get names and phone numbers from anyone who saw the accident. Their account could be crucial if fault is disputed.

- Police Information: Get the officer’s name, badge number, and the police report number. Ask how to get a copy.

- Photos: Take many photos. Get wide shots of the scene, close-ups of damage to all vehicles from multiple angles, skid marks, traffic signs, and road conditions. Create a visual record of the incident.

The National Association of Insurance Commissioners offers additional tips for this process.

What Not to Do at the Scene

While being cooperative is important, you must also protect yourself. The biggest mistake is admitting fault, even if you think the accident was your fault.

Liability can be complex. What seems obvious might not be the whole story. Another driver could have been speeding, or a traffic light may have malfunctioned. Stick to the facts when talking to the other driver, witnesses, and police. Describe what happened, but don’t speculate about who was at fault.

Don’t discuss your Car Insurance Liability limits with the other driver. That’s for the insurance companies to handle. Avoid any statements about blame. A simple “I’m sorry this happened” shows empathy; “I’m sorry, this was my fault” could cost you thousands. Let the insurance investigators determine fault—that’s their job.

A Step-by-Step Guide to Filing Your Auto Insurance Accident Claim

Once you are safe and have documented the scene, it’s time to initiate the claims process. Filing your auto insurance accident claim promptly and correctly is key to a smooth resolution. The average property damage claim costs over $5,000, so getting this part right can save you significant stress and money.

Understand Your Policy and Contact Your Insurer

An auto insurance accident claim is simply your formal request asking your insurance company to help pay for damages after your vehicle has been in an accident. Before you make that call, take a moment to understand what you’re working with.

Your insurance policy is like a toolkit, and knowing which tools you have makes all the difference. Collision Insurance covers damage to your car from crashes, while Comprehensive Coverage handles those unexpected events like theft or hail damage. Bodily Injury Liability pays for injuries to others if you’re at fault. Don’t forget about your deductible—that’s the amount you pay out-of-pocket before your insurance steps in to help.

For more details on these coverages, check out our guides on Collision Insurance, Comprehensive Coverage, and Bodily Injury Liability.

Contact your insurance company within 24-48 hours of the accident. I know it feels overwhelming, but the sooner you start, the sooner you can get back to normal. Most insurers make it easy with several filing options.

Calling by phone connects you directly with a claims representative who can walk you through complex situations. Mobile apps have become incredibly user-friendly—you can start your claim, upload photos, check your deductible, and even track progress right from your phone. Online portals on your insurer’s website offer similar convenience with a larger screen.

Working with your local agent often provides the most personal touch. At Stanton Insurance Agency, we guide you through the entire process, help you understand your coverage, and advocate on your behalf. We’re here to make this confusing process as smooth as possible.

Filing an Auto Insurance Accident Claim: At-Fault vs. Not-At-Fault

Here’s where things can get a bit tricky, but don’t worry—understanding these differences will help you know what to expect.

If you’re at fault, you’ll file what’s called a “first-party claim” with your own insurance company. Your liability coverage takes care of the other person’s damages and injuries, while your collision coverage (if you have it) handles fixing your own vehicle. You’ll pay your deductible, and your insurer handles the rest.

If the other driver is at fault, you have choices. You can file a “third-party claim” directly with their insurance company, letting their liability coverage pay for your damages. Alternatively, you can file with your own insurer if you have collision coverage and let them chase down the other company for reimbursement through something called subrogation. This second option often moves faster since your own insurer is working for you.

Living in Massachusetts adds a unique twist. Our state uses a no-fault system primarily for medical expenses. This means you’ll file with your own insurer for medical bills and lost wages under Personal Injury Protection (PIP), regardless of who caused the accident. Property damage still follows fault rules—the at-fault driver’s insurance pays for vehicle repairs. For a deeper dive into how this works, see Is Massachusetts a No-Fault Car Insurance State?.

New Hampshire operates as an at-fault state, meaning the driver who caused the accident is responsible for all damages. You’d typically file with their insurance, though you can also file with your own insurer if you have collision coverage and let them pursue reimbursement.

Here’s a pro tip: always inform your own insurance company about any accident, even if you don’t plan to file a claim with them immediately. This keeps them in the loop and protects you if complications arise later.

After You File: The Adjuster, Repairs, and Settlement

After you report the incident, your insurer assigns an adjuster to your case. This person becomes your main point of contact and plays a central role in determining the outcome of your claim. Think of them as your case manager—they’re there to guide you through the process and ensure everything gets resolved fairly.

Working with the Insurance Adjuster

The insurance adjuster wears many hats during your auto insurance accident claim. Their primary job is to investigate what happened and determine how much your insurer should pay. They’ll dig into all the information you provided—the police report, your photos, witness statements—and cross-reference everything with your policy to confirm you’re covered.

Next comes the vehicle inspection. Your adjuster will assess the damage either by meeting you at a designated location or through a virtual estimate using photos you upload. Many insurers now offer photo estimate tools that can provide initial estimates within 48 hours for straightforward external damage, which can really speed things up.

What happens after the insurance adjuster assesses the damage? They’ll typically provide a repair estimate or, if your car is severely damaged, a total loss valuation. They might also reach out to other people involved in the accident to get their side of the story.

Here’s the key to success: be prepared, honest, and responsive. When your adjuster asks for additional documentation, get it to them quickly. This keeps your claim moving forward instead of sitting in a pile waiting for paperwork. Good communication is often the difference between a claim that wraps up in weeks versus one that drags on for months.

Handling Vehicle Repairs and Total Loss Scenarios

Once your adjuster approves the claim, you can move forward with getting your life back to normal. The path forward depends on how badly your vehicle was damaged.

Choosing a repair shop is entirely up to you in Massachusetts and New Hampshire—that’s your legal right. Your insurer might suggest shops from their preferred network (sometimes called “Select Service” shops), and these can offer perks like guaranteed completion dates or lifetime warranties on repairs. But the final decision is always yours. Getting multiple estimates from different shops is often smart, especially for significant damage.

Some insurers will pay the repair shop directly, while others reimburse you after you pay. Ask your adjuster which process your company uses so you can plan accordingly.

If your car is declared a “total loss,” it means the repair costs exceed your vehicle’s actual cash value (ACV)—basically what your car was worth just before the accident, accounting for depreciation. Your insurer will pay you the ACV minus your deductible, giving you funds to purchase a replacement vehicle. If you’re still making car payments, the settlement typically goes to your lender first to pay off the loan.

When disagreements arise, don’t hesitate to speak up. If you think the adjuster’s damage estimate is too low or their total loss valuation doesn’t reflect your car’s true worth, you can negotiate. Gather your own repair estimates from reputable shops or documentation showing your vehicle’s higher value—recent appraisals or similar vehicle listings work well. Ask for a written explanation of their offer.

If you still can’t reach an agreement, your state’s department of insurance can provide assistance. Most policies also include an appraisal clause that allows for a third-party appraisal process to resolve value disputes. It’s not as scary as it sounds—think of it as getting a neutral referee to settle the disagreement.

For insights on when certain coverage might not be worth keeping, check out our guide on When to Drop Collision Insurance Coverage.

How an Auto Insurance Accident Claim Affects Your Premium

Let’s address the elephant in the room: “Will my rates go up?” Filing an auto insurance accident claim, particularly for an at-fault accident, will likely increase your insurance premium at renewal time. But the impact isn’t the same for everyone.

Several factors influence how much your rates might increase: the severity of the claim, whether you were at fault, your driving history, and your specific insurance company’s policies. If you weren’t at fault, your premium may not increase at all, or the increase might be minimal, depending on your insurer and state regulations.

Some policies include “accident forgiveness,” which can prevent a rate hike after your first at-fault accident. However, the terms vary significantly between companies, so it’s worth reviewing your policy details.

If your rates do jump significantly after filing a claim, it might be time to shop around. Different insurers weigh claim history differently, so you could find better rates elsewhere. Our guide on Comparing Car Insurance Companies: Which One Is Right For You? can help you steer this process.

Maintaining a clean driving record going forward and bundling your policies can help reduce your rates over time. Think of a claim as a temporary setback, not a permanent penalty.

Frequently Asked Questions about the Auto Insurance Claim Process

How long does the claims process typically take?

The timeline for an auto insurance accident claim depends on its complexity. A straightforward claim with clear fault and minor damage might be resolved in a week or two. However, cases involving bodily injuries, disputes over fault, or significant damage can take several weeks or even months. In Massachusetts, insurers generally have about 30 days to investigate and respond, but complex cases can take longer. Regularly check in with your adjuster for updates.

Can I file a claim without a police report?

Yes, you can file an auto insurance accident claim without a police report, especially for single-vehicle incidents like hitting a deer or damage from a storm. However, a police report is strongly recommended for any accident involving another vehicle, significant damage, or injuries. It serves as an official, third-party account that is crucial for determining fault. The NH Division of Motor Vehicles has specific reporting requirements, so it’s always better to have the documentation.

What should I do if I disagree with the insurance settlement offer?

It’s normal to question a settlement offer. Start by asking your adjuster for a detailed written explanation of their calculation. If you believe the offer is too low, gather your own evidence, such as higher repair estimates from other shops or documentation supporting a higher value for your vehicle. Present this information professionally to your adjuster. If you still can’t agree, you can file a complaint with your state’s insurance department or use the appraisal clause in your policy. Massachusetts offers guidance on their Frequently Asked Questions about Auto Insurance Claims.

What are the benefits of using a mobile app to file a claim?

Mobile apps offer significant convenience and speed. You can start your claim at the scene of the accident, upload photos and videos, track your claim’s progress in real-time, and communicate directly with your claims team. Many apps also let you access policy details, request roadside assistance, and find approved repair shops. This puts you in control and can speed up the entire process.

What should I do if my car is damaged by a hit-and-run driver or stolen?

For hit-and-runs or vehicle theft, contact the police immediately to file an official report. This is essential for your insurance claim. Provide police with every detail you can remember, such as a partial license plate number for a hit-and-run or your vehicle’s VIN and unique features if it was stolen. After filing the police report, contact your insurance company to start your claim. Your Comprehensive Coverage typically covers both hit-and-run damage and vehicle theft.

Your Partner Through the Claims Process

Filing an auto insurance accident claim doesn’t have to be a journey you take alone. While it can feel overwhelming, the key to a smooth experience is simple: stay calm, be prepared, and act quickly. By documenting the scene, understanding your policy, and communicating clearly with your insurer, you set yourself up for a fair resolution.

However, having a trusted insurance professional in your corner makes all the difference. When questions arise about coverage, repair estimates, or the claims process itself, that’s where we step in.

At Stanton Insurance Agency, we don’t just sell policies; we build relationships. We are committed to walking with our clients through challenging moments, providing expert advice and dedicated support when it matters most. Whether it’s clarifying a delay or advocating on your behalf, we’re here to ensure you’re treated fairly.

We’ve built our reputation on trusted protection for your valuable assets, which means being there when you need us most. Think of us as your insurance advocates, dedicated to protecting what’s important to you.

Ready to review your coverage or get answers to your insurance questions? Explore our Auto Insurance resources or give us a call. We’re here to provide personalized service that exceeds your expectations.

Meta Title: Crash Course: Filing Your Auto Insurance Accident Claim | Stanton Insurance Agency

Meta Description: Learn how to file an auto insurance accident claim in Massachusetts or New Hampshire. Step-by-step guide from Stanton Insurance Agency to help you steer the process with confidence.

URL: https://stantonins.com/auto-insurance-accident-claim-guide/