Affordable House Insurance: 7 Proven Ways to Save Big in 2025

Finding the Right Balance Between Coverage and Cost

Affordable house insurance doesn’t mean sacrificing protection for your most valuable asset. With home insurance premiums rising an average of 6% nationwide in 2025, Canadian homeowners are paying between $800-$1,200 annually, while Massachusetts and New Hampshire residents face similar increases due to extreme weather events.

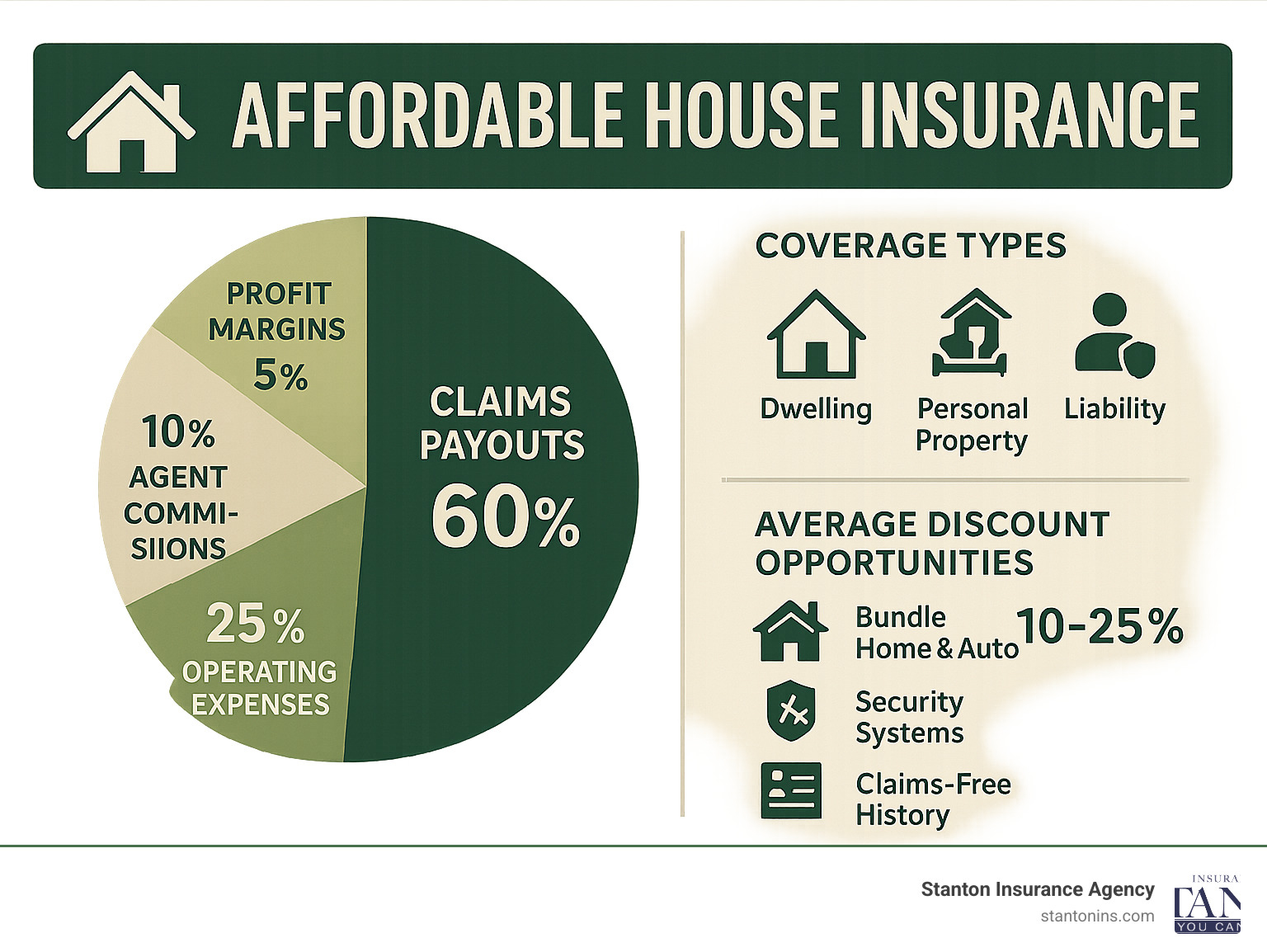

Top ways to secure affordable house insurance:

- Bundle home and auto policies – Save 10-25% on combined premiums

- Increase your deductible – Higher out-of-pocket costs reduce annual premiums

- Install security systems – Monitored alarms and water sensors earn discounts

- Shop around annually – Compare quotes from multiple providers

- Choose the right coverage level – Balance replacement cost vs. actual cash value

- Maintain claims-free history – Clean records qualify for loyalty discounts

The key is understanding what drives your premium costs. Your home’s age, location, construction type, and proximity to fire services all impact rates. Smart homeowners also leverage discounts for newer builds, non-smoker status, and bundling multiple policies.

I’m Geoff Stanton, a 4th generation owner and Certified Insurance Counselor at Stanton Insurance Agency in Waltham, Massachusetts, where I’ve specialized in helping families find affordable house insurance solutions for over two decades.

Affordable house insurance terms simplified:

What Is House Insurance & Why It Matters

Think of house insurance as your family’s financial safety net. When life throws curveballs like fire, theft, or liability claims, your policy protects your bank account.

Affordable house insurance covers four essential areas. Your dwelling coverage protects the actual structure against covered disasters. Personal belongings get protection too, usually covering 50-70% of your dwelling amount. Liability protection handles legal costs if someone gets injured on your property. Additional living expenses coverage pays for hotels and meals while repairs happen.

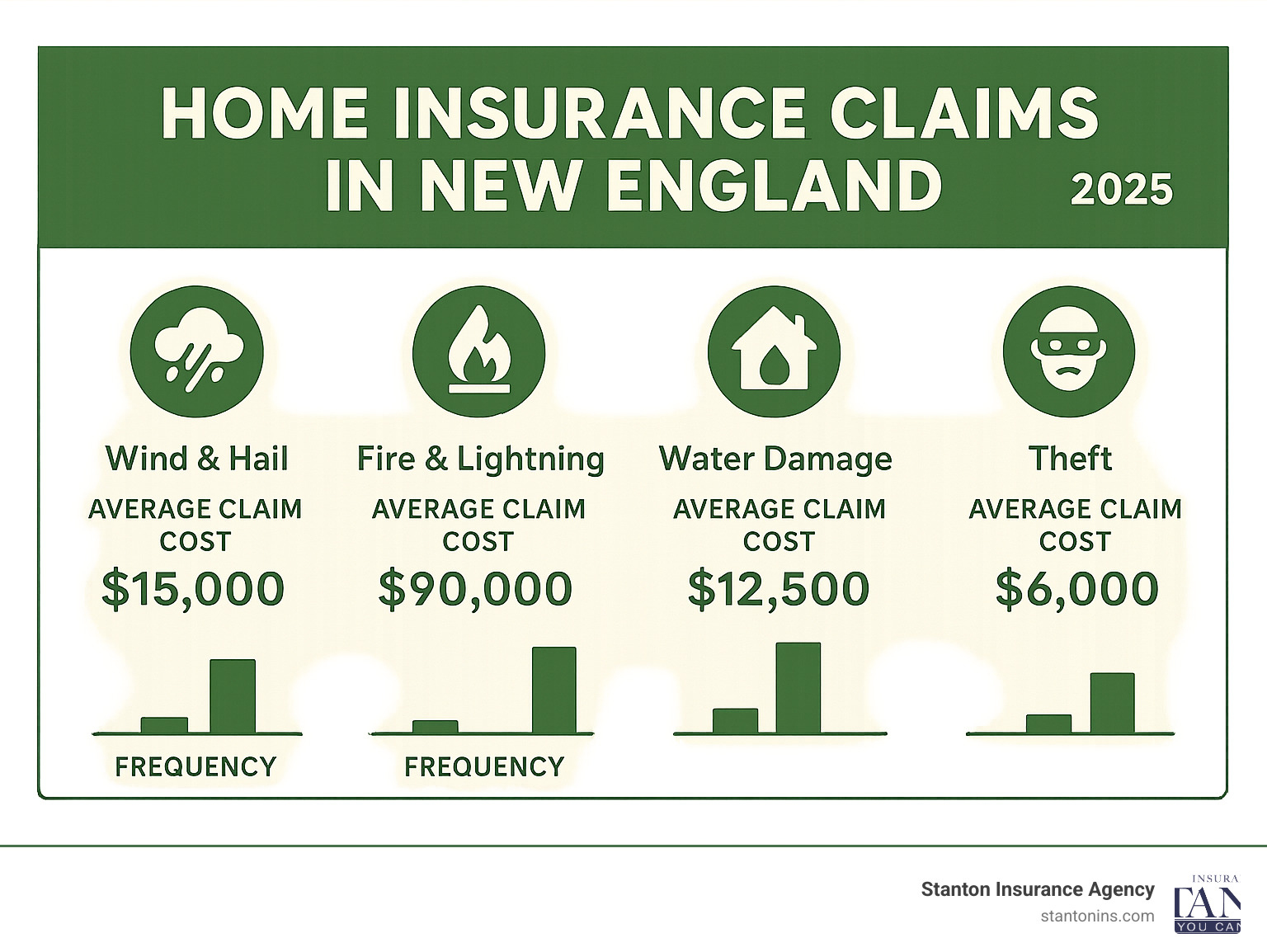

Recent catastrophe trends make this protection more critical than ever. Extreme weather events have boosted insurance claims by over 40% in the past decade. Here in New England, we’ve dealt with devastating ice storms, surprise flooding, and even tornado activity. Even scientific research on earthquake risk shows that areas we’ve never considered earthquake zones now face emerging threats.

Is House Insurance Mandatory in Canada & New England?

Technically, no law forces you to buy homeowners insurance. Practically speaking, if you have a mortgage, you absolutely need it. Mortgage companies in Massachusetts and New Hampshire require dwelling coverage equal to your loan amount or full replacement cost. They’ll also want to be listed as an additional mortgagee on your policy.

Even if you own your home outright, skipping insurance is like playing financial Russian roulette. A single house fire can easily cost $200,000-$500,000 to rebuild.

Replacement Cost vs. Actual Cash Value

Understanding Replacement Cost Value (RCV) versus Actual Cash Value (ACV) can save you thousands when you file a claim.

RCV coverage pays the full cost to rebuild or replace damaged items with brand-new materials. ACV coverage pays the depreciated value after accounting for wear and tear. ACV policies cost about 10-15% less than RCV coverage, but the potential out-of-pocket expenses during a claim often make RCV the smarter long-term investment.

Affordable House Insurance: Cost Drivers & Savings Strategies

Your home insurance premium isn’t random. Insurance companies use sophisticated algorithms considering dozens of factors when calculating your rate.

Location plays the biggest role in determining your premium. Homes near fire stations get better rates. Your home’s age tells its own story – newer homes under 10 years old often qualify for discounts up to 15%. Construction type matters – brick and stone homes cost less to insure than wood frame construction.

Your credit score significantly impacts your premium in states where it’s allowed. Improving your credit score from “fair” to “good” can reduce your premium by 10-20%. Your claims history follows you too – filing multiple claims within 3-5 years can increase your premium by 20-40%.

Proven strategies that actually save money: Installing a monitored security system typically earns 5-15% discounts. Water damage causes more insurance claims than fire, theft, and vandalism combined. Installing water leak detectors with automatic shut-off valves can reduce your premium by 5-10%.

Maintaining a claims-free history is like earning compound interest. Most insurers offer loyalty discounts ranging from 5-25% for homeowners who avoid filing claims for 3-5 years. More info about saving strategies provides detailed guidance.

Bundling Home & Auto for Bigger Discounts

Combining your home and auto insurance typically produces the largest single discount opportunity, ranging from 10-25%. You’ll have a single renewal date, one agent handling all needs, and simpler claims when multiple policies are involved.

Raising or Lowering Your Deductible for Control

Your deductible choice gives you direct control over premium costs. A $500 deductible works well for homeowners with limited emergency savings. Most homeowners find the sweet spot between $1,000-$2,500 deductibles for meaningful premium savings with manageable out-of-pocket costs. Higher deductibles of $5,000 or more work best for homeowners with substantial emergency funds.

Affordable House Insurance vs. High-Value Coverage

Finding affordable house insurance doesn’t mean accepting inadequate protection. Start with a solid foundation of adequate dwelling coverage, sufficient personal property limits, and appropriate liability limits. Consider your actual needs before adding expensive endorsements and balance your coverage with your assets and lifestyle.

Product Roundup: Budget-Friendly Coverage Options & Endorsements

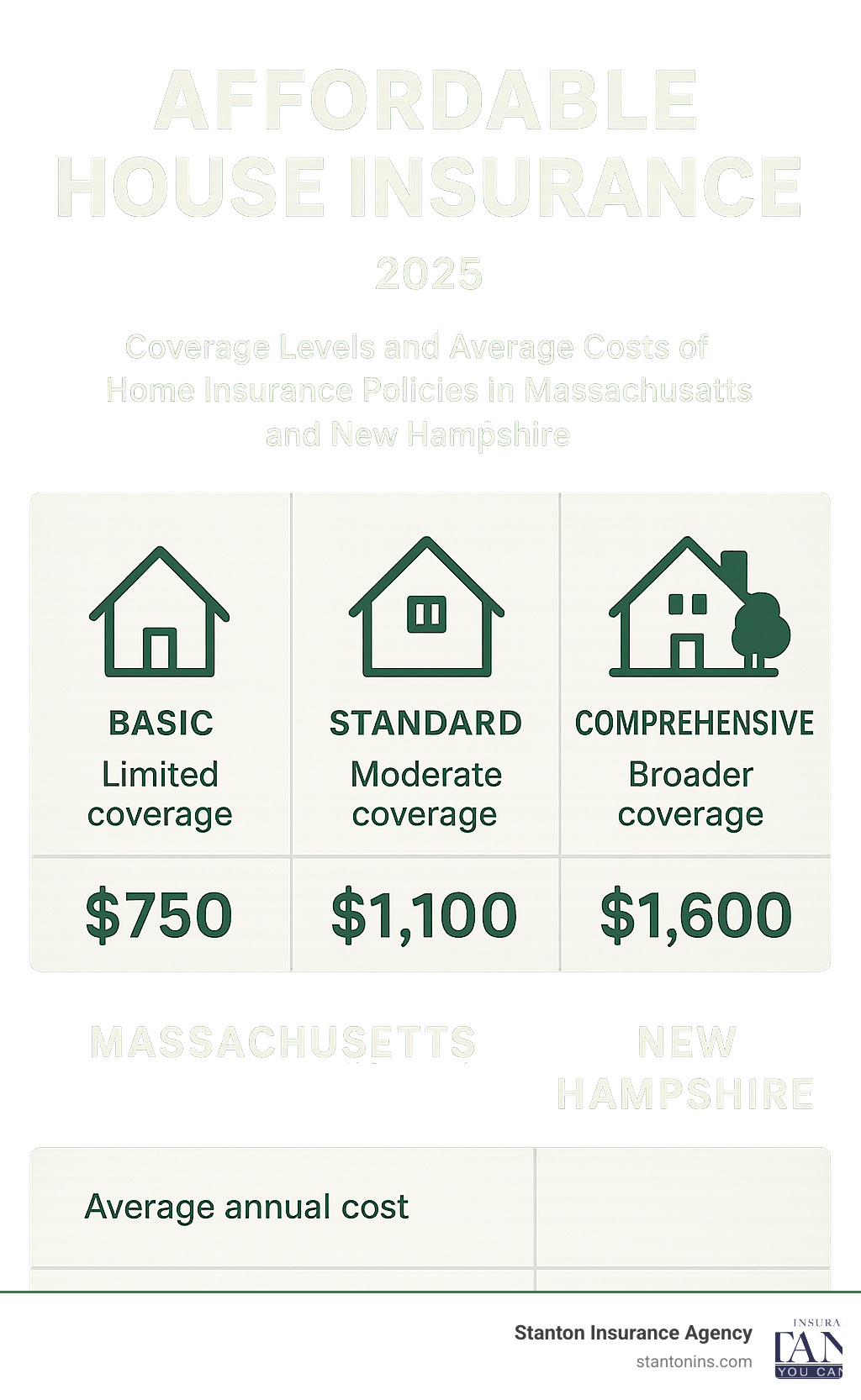

When shopping for affordable house insurance, understanding your policy options helps you choose the right protection level without overpaying.

The HO-3 Comprehensive policy remains the gold standard, offering the best balance of protection and cost. For tighter budgets, the HO-2 Broad Coverage policy covers both your home and belongings against 17 specific perils. The bare-bones HO-1 Named Perils policy is rarely offered today due to limited protection.

Smart endorsement choices provide real money-saving opportunities. Sewer backup coverage costs $50-$100 annually but can save thousands in cleanup costs. Water backup coverage protects against sump pump failures. Service line coverage pays for repairing underground utility lines for just $30-$60 annually.

RCV vs. ACV Payout Scenarios:

| Item | Age | Original Cost | RCV Payout | ACV Payout | Your Cost Difference |

|---|---|---|---|---|---|

| Roof | 10 years | $15,000 | $15,000 | $9,000 | $6,000 |

| HVAC System | 8 years | $8,000 | $8,000 | $4,800 | $3,200 |

| Flooring | 5 years | $12,000 | $12,000 | $8,400 | $3,600 |

Finding Affordable House Insurance for Condos & Tenants

Condo insurance (HO-6 policies) fill gaps left by your association’s master policy. While the building’s insurance covers exterior walls and common areas, you’re responsible for everything inside your unit walls. What Does Condo Insurance Cover? helps steer these coverage boundaries.

Tenant insurance (HO-4 policies) might be the best insurance value available, typically costing just $150-$400 annually. Your tenant policy protects personal property, provides liability coverage, covers additional living expenses, and includes medical payments for injured guests.

Optional Add-Ons Worth Considering

Personal umbrella liability provides additional protection beyond your homeowners policy limits, typically offering $1 million in coverage for just $200-$400 annually. Equipment breakdown coverage protects against mechanical failures of home systems. Extended replacement cost coverage adds a buffer above your dwelling limit to account for construction cost increases after major disasters.

How to Compare Quotes & Switch Without Penalties

Finding affordable house insurance goes beyond comparing premium costs. The cheapest policy isn’t always the best value when you consider coverage gaps and claim service quality.

Smart comparison starts with standardizing your coverage levels across all quotes. Financial strength matters – stick with companies rated A- or higher by A.M. Best. Don’t overlook customer service quality during your research.

Home Insurance Quotes simplifies this process by working with multiple financially strong carriers.

Switching policies requires careful timing to avoid coverage gaps. The ideal approach involves starting your new policy the day after your current policy expires. Always secure your new coverage before cancelling existing policies.

Information You Need for an Accurate Quote

Getting realistic quotes requires complete information upfront. Property specifics like square footage, construction type, and year built form the foundation. System information about electrical, plumbing, and heating systems affects both pricing and coverage. Your claims history over the past five years directly impacts pricing. Safety and security features you’ve installed can reduce premiums substantially.

Affordable House Insurance for Different Home Ages & Locations

Newer homes enjoy the best insurance rates with homes under five years old typically qualifying for new construction discounts up to 15%. Established homes between 6-25 years old represent the insurance sweet spot. Older homes over 25 years face unique challenges but still have coverage options.

Location impacts extend beyond obvious factors. Distance from fire stations significantly affects rates. Urban locations typically offer more coverage options but face higher premiums. Suburban areas generally provide the best balance of coverage availability and pricing. Rural properties present mixed considerations with lower crime rates but limited fire protection.

Frequently Asked Questions about Affordable House Insurance

How much does affordable house insurance cost in Massachusetts or New Hampshire?

Massachusetts homeowners typically invest $1,200-$1,800 annually in coverage, while New Hampshire residents often find rates between $800-$1,400. Location makes a huge difference – coastal properties face higher rates due to hurricane risks, while homes relying on volunteer fire departments pay more than those near professional stations.

Your best opportunities for savings include bundling with auto insurance for 15-25% discounts, installing monitored security systems for 5-15% savings, and maintaining a claims-free history.

How does claims history affect my premium?

Most companies review 3-7 years of claims history when setting rates. Weather-related claims typically have less impact than preventable losses. Multiple claims within a short period trigger the highest rate increases.

The flip side is powerful – maintaining a claims-free record for 3+ years typically earns you 5-15% discounts, while 5+ years can save you 10-25%. Consider paying smaller claims yourself to preserve your claims-free status.

Can I add flood or earthquake coverage later?

Flood insurance remains available year-round but new policies typically include a 30-day waiting period. Earthquake coverage is available as an endorsement and can typically be added at renewal without waiting periods. The golden rule for both coverages is to add them before you need them.

Conclusion

Finding affordable house insurance that truly protects your family doesn’t have to feel overwhelming. The key is understanding that the cheapest policy and the best value are rarely the same thing. Smart homeowners focus on building comprehensive protection while using proven strategies to keep costs manageable.

Your path to savings starts with the fundamentals. Ensure adequate dwelling coverage, optimize your deductible to the highest amount your emergency fund can handle, bundle your home and auto policies for multi-policy discounts, and invest in protective devices that insurance companies reward with premium reductions.

The beauty of this approach is that many money-saving strategies actually make your home safer. Installing water leak detectors, upgrading to monitored security systems, and maintaining your home’s major systems all reduce both your risk of claims and your annual premiums.

Annual quote shopping remains one of your most powerful tools. Insurance markets change constantly, and regular comparisons ensure you’re always getting competitive pricing without sacrificing coverage.

At Stanton Insurance Agency, we’ve spent four generations helping New England families steer these decisions. Our local expertise in Massachusetts, New Hampshire, and Maine markets means we understand the unique risks you face – from nor’easters and ice storms to the quirks of insuring century-old homes.

What sets us apart is our commitment to building relationships, not just selling policies. We take time to understand your family’s specific situation, explain your options clearly, and provide ongoing support when you need to file a claim.

Ready to find what affordable house insurance looks like for your specific situation? Contact us today for a personalized quote comparison that considers your unique needs, budget, and the specific risks of living in New England. Our experienced team will help you build a protection plan that delivers genuine peace of mind without breaking your budget.

Homeowners Insurance – Let’s start building your comprehensive protection plan today.

The goal isn’t just finding cheap coverage – it’s finding the right coverage at the right price. That’s the kind of insurance that lets you sleep soundly, knowing your family’s most valuable assets are properly protected.