Why Renters Need Financial Protection Without Overspending

Cheap Tenant Insurance is achievable when you know where to look and what strategies to use. Here’s how to find affordable coverage:

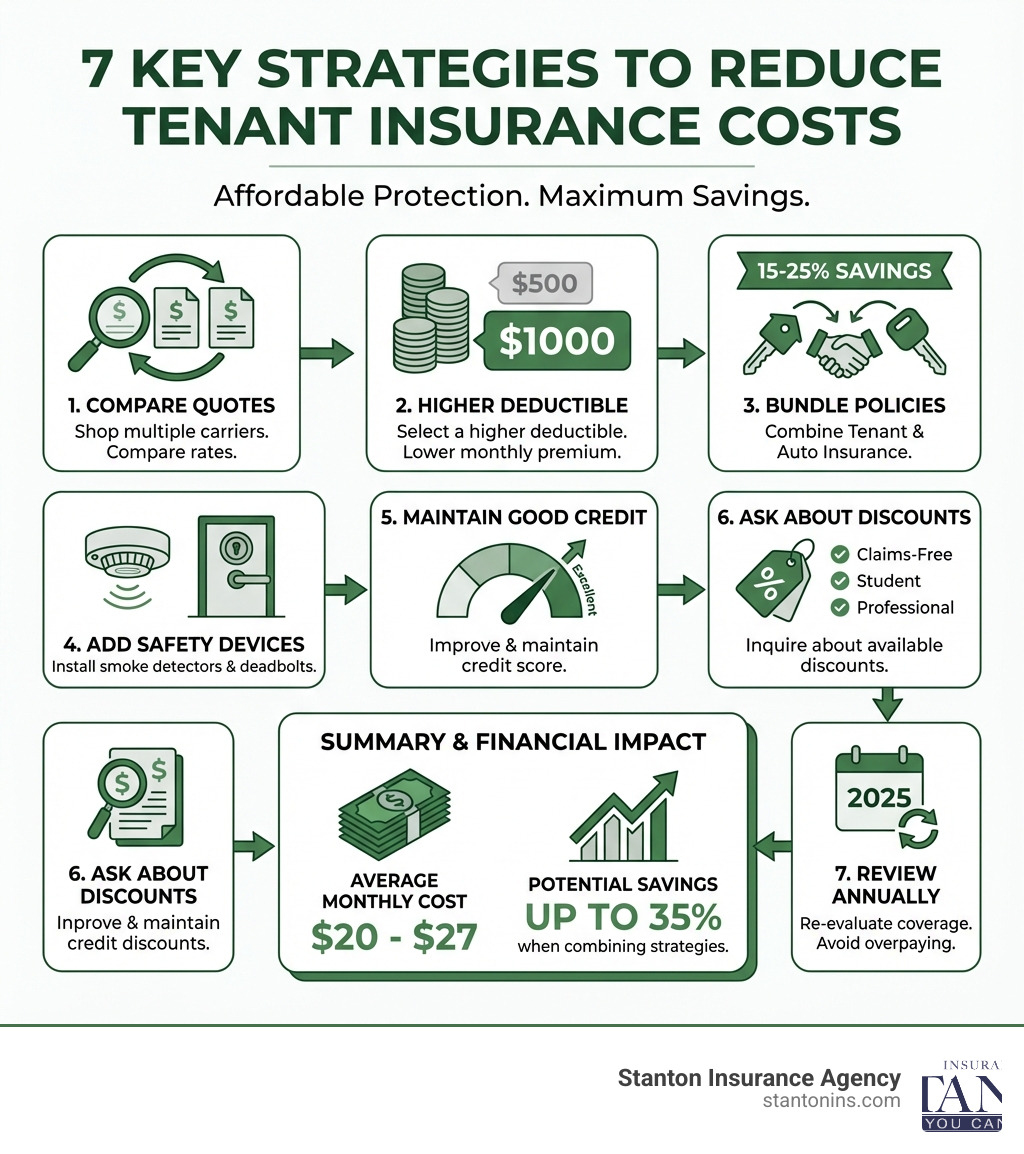

Quick Answer: Finding Cheap Tenant Insurance

- Compare quotes from at least 3-5 different insurance companies

- Choose a higher deductible to lower your monthly premium

- Bundle with auto insurance to save 15-25% on average

- Install safety features like smoke detectors and deadbolts for discounts

- Maintain good credit to qualify for lower rates

- Ask about discounts for being claims-free, a student, or a professional organization member

On average, tenant insurance costs around $20-$27 per month in Massachusetts and New Hampshire, making it more affordable than many people realize.

Renting a home or apartment comes with a false sense of security. Many renters assume their landlord’s insurance will cover their belongings if disaster strikes. It won’t. Your landlord’s policy protects the building structure, not your TV, laptop, furniture, or clothing. If a fire, theft, or water damage destroys everything you own, you’re on your own—unless you have tenant insurance.

The good news? Protecting your belongings doesn’t require a huge budget. Cheap Tenant Insurance is not only possible, it’s easier to find than you might think. With the right approach, you can secure comprehensive coverage for less than the cost of a streaming service subscription each month.

The challenge is understanding what affects your premium and knowing which levers to pull to bring the cost down. Insurance companies consider dozens of factors when setting rates, from your location and credit score to the safety features in your building. Some of these factors you can’t control, but many you can influence to your advantage.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts, and I’ve spent over two decades helping renters across Massachusetts and New Hampshire find affordable, reliable coverage. Throughout my career, I’ve guided countless renters through the process of securing Cheap Tenant Insurance that fits their budget while still providing essential protection. Let me show you exactly how to do the same.

What is Tenant Insurance and Why is it Crucial?

Tenant insurance is a policy designed specifically for renters. It protects your personal belongings from damage or loss and shields you from liability claims. Think of it as a security blanket for everything you own inside your rented space. While the average cost is often less than a few cups of coffee a month (with some policies running about $13 a month for approximately $34,000 in coverage), the protection it offers can be worth tens of thousands of dollars, preventing a financial catastrophe after an unexpected event.

Many renters mistakenly believe their landlord’s insurance policy will cover their personal possessions in the event of a fire, theft, or other disaster. However, a landlord’s policy typically only covers the physical structure of the building itself. Your landlord’s insurance won’t replace your furniture, electronics, clothing, or personal valuables if they’re damaged or stolen. That’s where tenant insurance steps in, offering a vital layer of financial protection for your hard-earned belongings and your peace of mind. Without it, if your apartment becomes uninhabitable or your belongings are destroyed, you could face significant out-of-pocket expenses to replace everything and find temporary housing.

Is Tenant Insurance Required in Massachusetts and New Hampshire?

While no state law in Massachusetts or New Hampshire explicitly mandates renters insurance for tenants, it’s a common requirement imposed by landlords. Many landlords include a clause in their lease agreements stating that tenants must carry a valid renters insurance policy throughout their tenancy. This is not out of malice, but rather a practical measure to minimize their own risk and ensure that tenants can cover the cost of accidental damage they might cause to the property, or protect themselves from liability claims.

Even if your landlord doesn’t require it, securing a policy is one of the smartest financial decisions a renter can make. The minimal monthly cost pales in comparison to the potential financial burden of replacing all your belongings or facing a lawsuit. For more details on local requirements, see our guide on Is Apartment Renters Insurance Policy Required in Massachusetts.

What Your Policy Actually Covers

A standard tenant insurance policy is a package of three essential coverages that protect your finances in different ways. Understanding these components is key to choosing the right policy and ensuring you have adequate protection.

-

Personal Property Coverage: This is the core of your policy. It reimburses you for the loss or damage of your personal items—like furniture, electronics, clothing, kitchenware, and even your treasured book collection—due to covered perils such as fire, theft, vandalism, or certain types of water damage. This coverage extends beyond your rental unit, often protecting your belongings even when they’re temporarily elsewhere, like in a storage unit or stolen from your car. Imagine if you had to buy all of your stuff all over again; your spoons, TV, and everything in between all add up. Personal property coverage ensures you don’t have to foot that entire bill yourself.

-

Personal Liability Coverage: This protects you if you are found legally responsible for injuring someone or damaging their property, whether it occurs inside your rental unit or elsewhere. It covers legal fees and settlement costs up to your policy limit. For example, if a guest slips and falls in your apartment and sustains an injury, or if your dog bites someone at the park, this coverage kicks in to protect you from potentially devastating lawsuits. Many policies offer $100,000 in liability coverage as a good starting point, but we often recommend considering $300,000 or more for improved protection. Learn more about Does Renters Insurance Cover Personal Injury.

-

Additional Living Expenses (ALE): If your rental becomes uninhabitable due to a covered event like a fire, severe water damage, or a natural disaster, ALE coverage helps pay for temporary living costs. This can include hotel bills, restaurant meals, and other necessary expenses you incur while your home is being repaired or rebuilt, or while you’re finding a new permanent residence. This coverage ensures you aren’t left scrambling for a place to stay or facing unexpected financial strain during an already difficult time.

Decoding Your Coverage: Key Terms and Options

When you get a quote for Cheap Tenant Insurance, you’ll encounter terms and options that can be confusing. Let’s break down the most important ones so you can customize your policy confidently and find the best value for your needs.

Actual Cash Value (ACV) vs. Replacement Cost (RC)

This is one of the most critical choices you’ll make, as it determines how you’ll be paid for a claim on your personal belongings. It’s the difference between getting reimbursed for what your items are currently worth versus what it would cost to buy them new today.

| Feature | Actual Cash Value (ACV) | Replacement Cost (RC) |

|---|---|---|

| Payout Basis | Pays for the depreciated value of your item, considering age and wear. | Pays the full cost to buy a new, similar item, without deducting for depreciation. |

| Example | Your 5-year-old laptop is stolen. ACV pays what it was worth today, which is less than its original purchase price. | Your 5-year-old laptop is stolen. RC pays for a brand-new, comparable model, allowing you to replace it without extra cost. |

| Premium Cost | Generally results in a cheaper premium. | Typically leads to a slightly higher premium. |

| Best For | Renters on a very tight budget who prioritize the lowest premium, understanding they might not fully replace older items. | Most renters, as it provides fuller recovery and allows you to replace items with new ones of similar quality. |

We generally recommend Replacement Cost coverage if your budget allows. While it might cost a little more upfront, it offers significantly better protection, ensuring you can truly replace your lost items without dipping into your savings.

Protecting Valuables: Jewelry, Electronics, and More

While your standard tenant insurance policy provides broad coverage for your personal property, it often includes special limits for high-value items like jewelry, fine art, collectibles, and certain electronics. These sub-limits mean the policy will only pay up to a certain amount (often $1,500-$2,500 per item or category) for losses to these specific types of property, regardless of their actual value.

If the value of your specific items exceeds these sub-limits, you should consider adding a “rider” or “endorsement” to your policy. This provides specific, additional coverage for your most prized possessions, ensuring they are fully protected. For instance, if you have an engagement ring valued at $5,000, you’d want an endorsement to cover the difference beyond the standard policy limit. This is a crucial step to avoid underinsurance for your most cherished belongings.

Optional Coverages to Consider

While a basic policy covers a lot, some common risks are excluded from standard tenant insurance. You can add endorsements for improved protection, tailoring your policy to your specific needs and the risks in your area.

- Sewer & Water Backup: Standard policies typically exclude damage caused by sewer backups or sump pump failures. This optional coverage protects your belongings from water damage if a sewer or drain backs up into your rental unit. Given the aging infrastructure in many parts of Massachusetts and New Hampshire, this can be a very valuable addition.

- Flood Insurance: Standard tenant insurance policies, like most property insurance, do not cover flooding from natural disasters (like overflowing rivers or heavy rainfall). This must be purchased separately through the National Flood Insurance Program (NFIP). If you live in a flood-prone area in Massachusetts or New Hampshire, we strongly advise looking into this additional protection.

- Identity Theft Protection: Identity theft is a growing concern. This optional coverage helps cover the costs associated with restoring your identity if it’s stolen. This can include legal fees, lost wages from time taken off work, and expenses for credit monitoring services. It’s a small investment for significant peace of mind.

7 Actionable Strategies for Finding Cheap Tenant Insurance

Protecting your belongings and your financial future doesn’t have to be expensive. With a few smart strategies, you can significantly lower your premiums without sacrificing essential coverage. The goal is to find the sweet spot between affordability and adequate protection, ensuring you get the best value for your insurance dollar.

1. Shop Around and Compare Quotes

Premiums can vary dramatically between insurance companies for the exact same coverage. Relying on a single quote means you might be missing out on significant savings. Don’t just take the first offer you get. Comparing offers from multiple carriers is the single most effective way to find Cheap Tenant Insurance. We can help you do the legwork, comparing rates from various reputable insurers to find the policy that best fits your budget and needs.

2. Choose a Higher Deductible

Your deductible is the amount you agree to pay out-of-pocket on a claim before your insurance coverage kicks in. For example, if you have a $500 deductible and experience a $2,000 loss, your insurer would pay $1,500. Opting for a higher deductible (e.g., $1,000 instead of $500) tells the insurer you’re willing to shoulder more of the initial cost in the event of a claim. This reduces the insurer’s potential payout, and in turn, they reward you with a lower monthly premium. Just make sure you choose a deductible amount you’re comfortable paying if you ever need to file a claim.

3. Bundle Your Insurance Policies

Do you also have a car? Or perhaps another insurance policy like motorcycle or boat insurance? Most insurers offer a significant multi-policy discount—often up to 15-25%—if you bundle your tenant and auto insurance with them. This is one of the easiest ways to achieve substantial savings. It also simplifies your insurance management, as you’re dealing with one provider for multiple policies. Explore our Personal Insurance options to see how bundling can benefit you.

4. Improve Your Home’s Safety and Security

Insurers love reduced risk. The safer your rental unit is, the less likely you are to file a claim, and they often pass those savings on to you. Installing safety devices like smoke detectors, carbon monoxide detectors, fire extinguishers, deadbolt locks, or a monitored security system can often earn you a discount on your premium. Even small improvements can make a difference, so be sure to ask your agent about all available safety-related discounts.

5. Maintain a Good Credit Score

In many states, including Massachusetts and New Hampshire, insurance companies use a credit-based insurance score to help determine premiums. This score is different from your traditional credit score but is derived from information in your credit report. A history of responsible financial management and a good credit score can signal to insurers that you are a lower risk, potentially leading to lower rates. If you’re working on improving your credit, these efforts could pay off in your insurance costs too.

6. Ask About Other Discounts

Don’t be shy about asking your insurance agent for a comprehensive list of available discounts. You might be surprised at what you qualify for! You could save money based on your age (e.g., senior discounts), for having a claims-free history (meaning you haven’t filed a claim in a certain number of years), or for membership in certain professional organizations, alumni groups, or even certain employers. Every little bit helps when you’re looking for Cheap Tenant Insurance.

7. Review Your Coverage Annually

Your needs change over time. You might acquire more valuable possessions, or your financial situation could shift. Don’t just “set it and forget it” when it comes to your tenant insurance. Take 15 minutes each year to review your policy, update your home inventory, and see if you can get a better rate elsewhere. This ensures you’re not overpaying for coverage you no longer need and that your policy still adequately protects your current lifestyle and belongings. For a deeper dive into costs, check out our guide on How Much is Renters Insurance?.

Getting Your Quote: What You’ll Need

Getting a tenant insurance quote is a quick and easy process, usually taking just a few minutes. To ensure you get the most accurate price and the best Cheap Tenant Insurance options, have the following information ready:

- Personal Information: Your full name, date of birth, and the complete address of the rental property you wish to insure.

- Building Details: Be prepared to provide information about the type of building you live in (e.g., apartment in a multi-unit building, single-family home, condo), its construction type (e.g., brick, wood frame), and the approximate year it was built. These factors influence the risk profile.

- Coverage Amounts: An estimate of the total value of your personal belongings. The best way to do this is by creating a simple home inventory. Walk through your home room-by-room and list your possessions and their approximate value. Don’t forget items in closets, drawers, and storage areas. This helps you determine an appropriate coverage limit for your personal property.

- Liability Limit: Decide how much personal liability coverage you want. While many policies start at $100,000, experts often recommend $300,000 or even $500,000 for robust protection against potential lawsuits.

- Claims History: Be prepared to share any insurance claims you’ve filed in the past 3-5 years, regardless of the type of insurance. This information helps insurers assess your risk profile.

Frequently Asked Questions about Cheap Tenant Insurance

Can I add my roommate to my tenant insurance policy?

This is a common question, and the answer depends on your relationship with your roommate and the insurer’s rules. Most tenant insurance policies are designed to cover the policyholder and any resident relatives (e.g., a spouse, children, or other family members who permanently live with you).

A non-related roommate is not automatically covered under your policy. If the insurer allows it, a non-related roommate might be specifically added to your policy as an “additional insured,” which could slightly increase your premium. More commonly, however, each non-related roommate will need to purchase their own separate tenant insurance policy. This ensures everyone’s belongings and liability are properly protected, as one person’s claim won’t affect the other’s policy, and each person has their own liability coverage. It’s always best to clarify this with your insurance provider.

Does tenant insurance cover damage caused by my pets?

This is a nuanced area, and the answer depends on the type of damage.

- Liability Coverage: The personal liability portion of your policy will likely cover you if your pet injures someone (e.g., your dog bites a visitor or another animal). This coverage would help with medical expenses and legal fees if you are sued. However, some policies may have exclusions for specific breeds of dogs or animals with a history of aggression.

- Personal Property Damage: Your tenant insurance policy will not cover damage your own pet causes to your personal belongings (e.g., your cat scratches your couch) or the rental unit itself (e.g., your dog chews the baseboards). These types of damages are generally considered preventable and are excluded. If your pet damages the landlord’s property, your liability coverage might kick in, but your own property damage from your pet is typically not covered.

Always review your policy details and discuss any concerns about pet coverage with your insurance agent.

How do I file a claim?

Filing a tenant insurance claim might seem daunting, but we’re here to help guide you through the process. If you experience a loss covered by your policy, it’s important to act promptly. The process typically involves these steps:

- Ensure Safety: First and foremost, ensure your safety and the safety of anyone else in your home. If there’s a fire or significant damage, contact emergency services if necessary.

- Contact Your Insurance Provider: As soon as it’s safe to do so, contact your insurance agent or company to report the incident. They will open a claim and provide you with a claim number.

- Document the Damage: Take photos or videos of all damaged or lost property. This visual evidence is crucial for your claim. Make a detailed list of all affected items, including descriptions, estimated value, and purchase dates. If you have receipts or previous home inventory records, gather those as well.

- Prevent Further Damage: Take reasonable steps to prevent any further damage to your property (e.g., covering a broken window, turning off a leaking water source). Keep receipts for any temporary repairs you make.

- Filing a Claim Form: Your insurer will provide you with a claim form or guide you through an online portal to detail the incident, the circumstances, and the items lost or damaged. Be as thorough and accurate as possible.

- Investigation: An insurance adjuster will be assigned to your case. They will review your claim, your policy, and the evidence you’ve provided. They may also visit your rental unit to assess the damage firsthand.

- Settlement: Once your claim is approved, the insurer will issue a payment for your loss, minus your deductible. This payment will be based on whether you have Actual Cash Value or Replacement Cost coverage.

We understand that dealing with a loss can be stressful, and our team at Stanton Insurance Agency is always ready to assist you through every step of the claims process.

Secure Your Peace of Mind Today

Finding Cheap Tenant Insurance is about more than just the lowest price; it’s about finding the best value. By understanding what your policy covers, knowing what factors influence your rate, and using smart strategies to shop for coverage, you can secure robust financial protection without breaking the bank. An affordable policy gives you the peace of mind to enjoy your rented home, knowing you’re prepared for whatever life throws your way, whether it’s a burst pipe, a theft, or an unexpected liability claim.

Don’t let the fear of high costs prevent you from protecting your valuable possessions and your financial well-being. The experts at Stanton Insurance Agency are here to help you understand your options and compare quotes from top carriers to find the perfect balance of coverage and cost specifically custom for renters in Massachusetts and New Hampshire. Ready to get started? Explore our Renters Insurance options or Contact Stanton Insurance Agency for a personalized quote today.