Understanding Car Insurance Premium Calculators

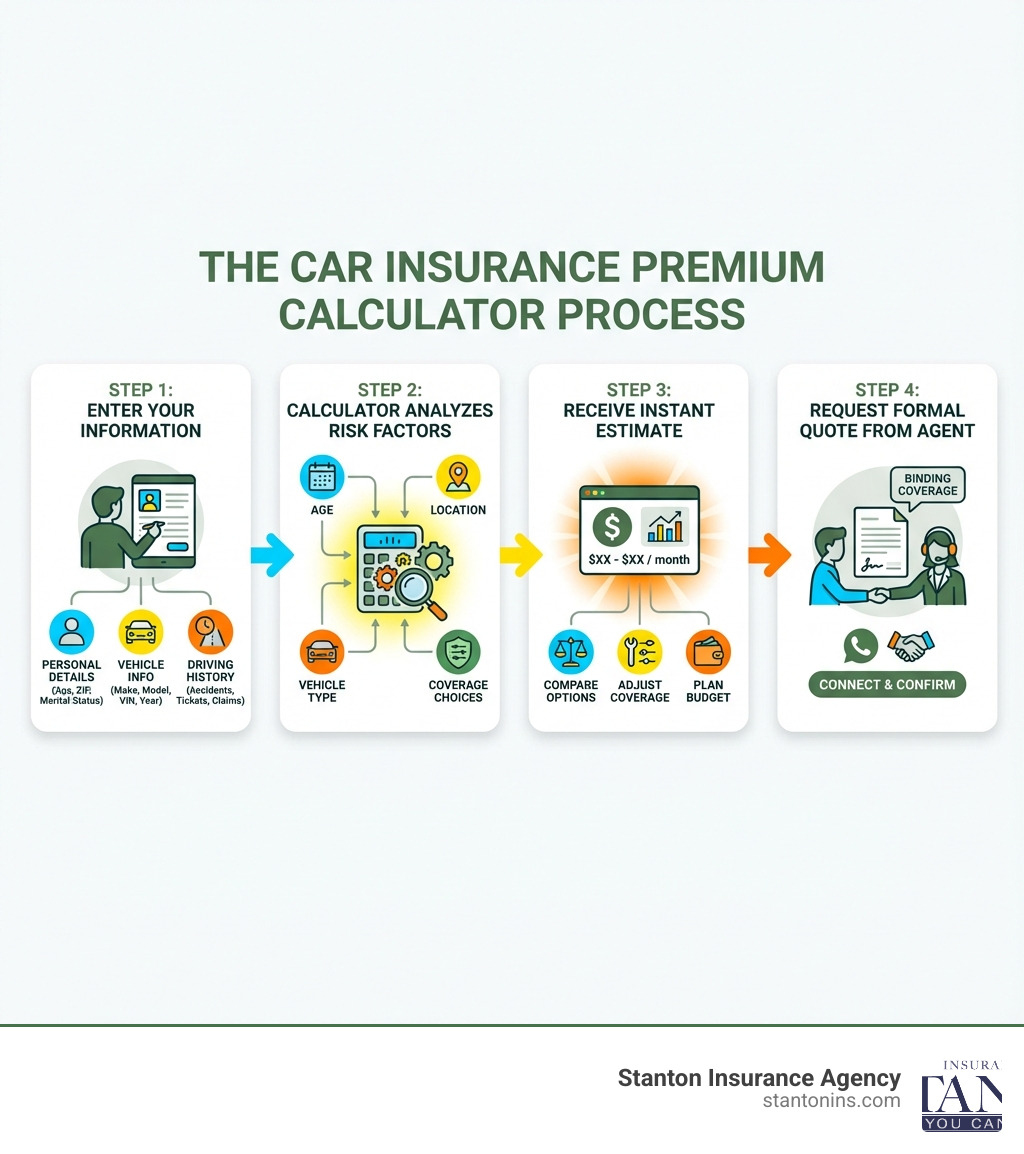

A Car insurance premium calculator is an online tool that instantly estimates how much you’ll pay for auto insurance coverage based on information you provide about yourself, your vehicle, and your desired coverage.

How to Use a Car Insurance Premium Calculator:

- Enter your personal details – Age, ZIP code, gender, marital status

- Provide vehicle information – Year, make, model, and VIN

- Share your driving history – Accidents, tickets, and claims from the past 3-5 years

- Select coverage types – Liability limits, collision, comprehensive, and deductibles

- Review your estimate – Compare costs for different coverage scenarios

Key Benefits:

- Get instant premium estimates in minutes

- Compare coverage options side-by-side

- Budget effectively before speaking to an agent

- Understand how different factors affect your rate

Shopping for car insurance can feel overwhelming, especially when you’re not sure what you’ll actually pay. Your rate could be significantly higher or lower than average depending on dozens of factors—from your age and driving record to your vehicle type and ZIP code.

That’s where a car insurance premium calculator becomes an essential tool. These sophisticated calculators use millions of real insurance quotes to provide you with a ballpark estimate before you commit to anything. Think of it as a test drive for your insurance costs—you can adjust coverage levels, change deductibles, and even compare different vehicles to see how each choice impacts your premium.

As Geoff Stanton, President of Stanton Insurance Agency, I’ve helped countless Massachusetts and New Hampshire residents steer the car insurance landscape using premium calculators as a starting point. Over my 25+ years in the insurance industry, I’ve found that clients who use a Car insurance premium calculator before requesting quotes are better prepared, ask smarter questions, and ultimately make more informed decisions about their coverage.

What is a Car Insurance Premium Calculator and How Does It Work?

A car insurance premium calculator is a digital tool designed to give you a close estimate of what you can expect to pay for an auto insurance policy. Instead of waiting for an agent or filling out lengthy forms, you can get an instant snapshot of your potential premium. The tool works by taking the information you provide and running it through a sophisticated algorithm that references a vast database of current insurance rates. It analyzes your risk profile based on your data and provides a non-binding estimate, empowering you to budget and compare options effectively before committing to a policy.

If you want a deeper dive into how insurers think about risk in general, resources like the Insurance overview on Wikipedia can help you understand the broader principles behind premium calculations.

Information You’ll Need to Get an Estimate

To get the most accurate estimate, you’ll want to have some key pieces of information on hand. The more precise your data, the closer the estimate will be to a real quote.

- Personal Details: Your age, gender, marital status, and the ZIP code where your car is primarily garaged.

- Vehicle Information: The car’s year, make, model, and sometimes the Vehicle Identification Number (VIN). Details about safety features and anti-theft devices can also be helpful.

- Driving History: A record of any at-fault accidents, moving violations (like speeding tickets), or claims you’ve filed in the last 3-5 years.

- Coverage Needs: An idea of the coverage types and limits you want, such as liability, collision, and comprehensive.

The Benefits of Using an Online Calculator

Using a calculator is more than just a way to see a price; it’s a strategic step in the insurance shopping process that offers several advantages.

- Instant Estimates: Get a ballpark figure in minutes without having to speak to an agent.

- Smarter Budgeting: Understand your potential costs, which helps you plan your finances more effectively.

- Easy Comparison: Quickly see how different coverage levels or vehicle choices could impact your premium.

- No-Pressure Environment: Explore your options privately and at your own pace.

- Time-Saving: Skip lengthy phone calls and paperwork.

- Educational Value: Learn how different factors affect your premium.

- Empowerment: Make informed decisions before you buy.

Understanding Your Results: Estimate vs. Quote

The number a calculator provides is an estimate, not a final quote. While these tools are sophisticated, they have limitations and cannot replicate the full underwriting process an insurance company uses to determine your final rate.

How Accurate Are Car Insurance Calculators?

Car insurance calculators are generally quite accurate for providing a preliminary estimate. They are built using millions of real data points from insurance rate filings, offering a solid approximation of what you might pay. However, the final price we receive can differ because an official quote involves a deeper dive into our personal history, including a detailed look at our driving record and, in most states, our credit-based insurance score. This is a key difference between states like New Hampshire, where credit can be a factor, and Massachusetts, which has banned the use of credit scores in setting auto insurance rates. Think of the calculator as a highly educated guess that gets us into the right ballpark. For a more precise figure, we always recommend getting an actual, personalized quote from a trusted local agency like Stanton Insurance Agency.

The Key Difference Between an Insurance Estimate and a Quote

Knowing the distinction between these two terms is key to being a savvy insurance shopper. They are not interchangeable, and understanding why will help us manage our expectations.

| Feature | Insurance Estimate | Insurance Quote |

|---|---|---|

| Purpose | For budgeting and research | Firm offer for a specific policy |

| Binding? | No, non-binding | Yes, binding for a set period (usually 30 days) |

| Based on | General data you provide | Detailed underwriting and verification |

| Validity | Not valid for purchase | Can be used to purchase a policy |

An estimate is a quick calculation based on the information we input, designed to give us an idea of potential costs. A quote, on the other hand, is an actual offer from an insurance company, based on a thorough review of our detailed information, which may include pulling driving records and other reports. This means a quote is legally binding for a set period and can be used to purchase a policy.

The Key Factors That Drive Your Car Insurance Premium

Ever wonder what goes into the price you’re quoted? Insurers use a wide range of data points to assess risk—the likelihood that you’ll file a claim. The higher the perceived risk, the higher the premium. These factors fall into three main categories.

If you’re curious about how auto coverage works more broadly, you can also review the general concepts outlined in Vehicle insurance.

Your Personal Profile

Insurers look at who you are and where you live to predict your risk level.

- Age and Driving Experience: Younger, less experienced drivers typically face higher rates than mature drivers with a long, clean history.

- Driving Record: A history of at-fault accidents or moving violations will significantly increase your premium. Conversely, a clean record can earn you safe-driver discounts.

- Credit History: In most states, including New Hampshire, insurers use a credit-based insurance score as a predictor of future claims. Massachusetts, however, has banned the use of credit scores in setting auto insurance rates.

- Location: Your ZIP code matters. Urban areas with higher rates of traffic, theft, and vandalism generally have higher premiums than rural areas.

Your Vehicle’s Profile

The car you drive is one of the biggest factors in determining your rate.

- Make and Model: Sports cars and luxury vehicles cost more to insure than a standard sedan because their repair costs are higher and they may have a higher theft rate.

- Vehicle Age: Newer cars often have higher premiums because their value is greater. The average price of a new car is a significant factor, as noted by sources like Kelley Blue Book.

- Safety Ratings: Vehicles with high safety ratings and features like automatic emergency braking may qualify for discounts.

- Repair Costs: The cost and availability of parts for your specific model influence how much an insurer might have to pay for a claim.

Your Chosen Coverage and Limits

The amount of protection you buy has a direct impact on your premium.

- Types of Coverage: A policy with only the state-required minimum liability will be much cheaper than a “full coverage” policy that includes collision and comprehensive.

- Coverage Limits: Higher limits (e.g., $100,000 in bodily injury liability vs. $25,000) provide more protection but also cost more.

- Deductibles: This is the amount you pay out-of-pocket on a collision or comprehensive claim. Choosing a higher deductible will lower your premium.

How to Use a Car Insurance Premium Calculator to Save Money

A calculator isn’t just for seeing what you might pay—it’s a dynamic tool for finding ways to pay less. By adjusting different variables, we can see in real-time how our choices affect our estimated premium and identify potential savings.

Customizing Coverage to See the Impact on Your Premium

Start by getting a baseline estimate with your desired coverage. Then, play with the numbers. See how much you could save by adjusting your liability limits (while still ensuring you have adequate protection) or by removing collision and comprehensive coverage on an older, less valuable car. For example, if our car is over 8 years old or worth less than $5,000, removing comprehensive and collision might be a smart move to lower our premium, as the cost of these coverages could outweigh the potential payout. In Massachusetts and New Hampshire, always ensure we at least meet the state’s minimum requirements; beyond that, it’s about tailoring coverage to our personal financial situation and risk tolerance.

The Role of Deductibles and Discounts

One of the quickest ways to see a change in our premium is by adjusting our deductible. Use the Car insurance premium calculator to see the difference in cost between a $500 deductible and a $1,000 deductible. Often, increasing our deductible by a few hundred dollars can lead to significant savings on our premium. Just make sure we can comfortably afford the higher deductible if we ever need to file a claim.

While calculators don’t typically apply discounts directly in their initial estimates, they serve as a fantastic reminder of what to ask for. When we’re ready for a real quote, have a list of potential discounts ready—such as multi-policy bundling (combining car and home insurance), low mileage (if we drive less than the average), good student, or safe driver discounts. Discounts can add up to savings of 40% or more! A local agent at Stanton Insurance Agency can help us identify all the savings we qualify for, ensuring we don’t leave any money on the table.

Comparing Different Scenarios

Are you car shopping? A premium calculator is your best friend. Run estimates for the different models you’re considering to see how much each would cost to insure. We might find that a seemingly minor difference in model or trim level can lead to a notable difference in insurance costs. This insight can be crucial for our overall budget.

We can also compare the long-term cost of a minimum coverage policy versus a full coverage policy to decide if the extra protection is worth the price for our specific vehicle and financial situation. For a new car, full coverage is almost always recommended, as the cost to replace a new vehicle (which can be just under $50,000) far exceeds typical minimum liability limits. However, for a 10-year-old car, the calculation might tilt differently. Using the calculator allows us to visualize these cost differences and make an informed decision custom to our needs in Massachusetts or New Hampshire.

Average Car Insurance Costs and What to Expect

While your rate is highly personalized, it’s helpful to know the local averages to see where you might stand. According to recent data, the average cost for a full coverage policy in Massachusetts is around $140 per month, while the average in New Hampshire is closer to $100 per month. Rates for minimum coverage are lower, but your final premium will depend entirely on your unique profile and selected coverages.

For broader context on how auto insurance fits into the overall insurance landscape, you can review the overview at Insurance, which explains how premiums relate to risk and claims.

How Costs Vary in Massachusetts and New Hampshire

Your location plays a huge role, and rates can differ significantly between neighboring states.

- Massachusetts: As a densely populated state with compulsory insurance laws, rates here tend to be higher than the national average. The state also requires Personal Injury Protection (PIP), which adds to the base cost.

- New Hampshire: The “Live Free or Die” state is unique because it doesn’t mandate auto insurance. However, drivers are still financially responsible for any accidents they cause. This, combined with a more rural landscape, generally leads to lower average premiums compared to Massachusetts.

Frequently Asked Questions about Car Insurance Premium Calculators

How can I get the most accurate car insurance estimate?

To get the most accurate estimate possible, be meticulous with the data you enter. Use your vehicle’s exact model and trim, be honest about your driving history (including any accidents or tickets from the last 3-5 years), and provide the correct ZIP code for where your car is primarily garaged in Massachusetts or New Hampshire. The more precise your inputs, the more reliable the output will be. The calculator is only as good as the information you feed it!

Do car insurance calculators account for discounts?

Most online Car insurance premium calculators do not factor in potential discounts in their initial estimates. They are designed to provide a base premium before any savings are applied. This means the estimate you receive is likely a bit higher than what you might actually pay. You should always ask a licensed agent about discounts you may qualify for, such as multi-policy (bundling home and auto), good student, safe driver, anti-theft device, or even low mileage discounts. The final quoted price is often lower than the initial estimate once all applicable discounts are applied.

What’s the difference between liability, collision, and comprehensive coverage?

These three coverages form the foundation of most auto policies and are crucial for understanding your premium.

- Liability coverage pays for injuries and property damage you cause to others in an at-fault accident. It’s legally required in Massachusetts and highly recommended in New Hampshire, as it protects your assets from potential lawsuits.

- Collision coverage pays to repair or replace your own car after a collision with another object, whether that’s another vehicle, a tree, or a pole. It’s often required if you have a car loan or lease.

- Comprehensive coverage pays for damage to your car from non-collision events like theft, fire, vandalism, falling objects, or hitting an animal. Like collision, it’s frequently required by lenders.

Understanding these distinctions helps us choose the right blend of protection, which directly impacts our overall premium.

Conclusion: From Estimate to Policy

A Car insurance premium calculator is an invaluable first step on our journey to finding the right auto insurance. It empowers us with knowledge, helps us budget effectively, and allows us to explore our options without pressure. By understanding the factors that influence our rate and the difference between an estimate and a formal quote, we can approach the shopping process with confidence. It’s like having a crystal ball that gives us a peek into our potential insurance future, allowing us to tweak variables until we find a scenario that fits our budget and needs.

When you’re ready to move from an estimate to a personalized policy, it’s time to speak with a professional. The experts at Stanton Insurance Agency can take your research to the next level, searching for applicable discounts and providing a firm, accurate quote custom to your unique needs in Massachusetts and New Hampshire. We’re here to exceed your expectations and ensure you have trusted protection for your valuable assets.

Contact a Stanton Insurance Agency agent today to get a personalized quote.