Why Getting Car Insurance Quotes Massachusetts Online Matters

Car insurance quotes massachusetts online make it faster and easier than ever to compare coverage options and prices from multiple insurers without leaving your home. Here’s how to get started:

Quick Steps to Get Your MA Car Insurance Quote Online:

- Gather your information – driver’s license, vehicle details (VIN, make, model, year), and current insurance policy

- Visit a trusted insurance website – independent agencies like Stanton Insurance can compare multiple carriers at once

- Enter your details – complete the online form with your driver and vehicle information

- Select your coverages – choose mandatory coverages plus any optional protections you want

- Review your quotes instantly – compare prices, coverage limits, and policy details side-by-side

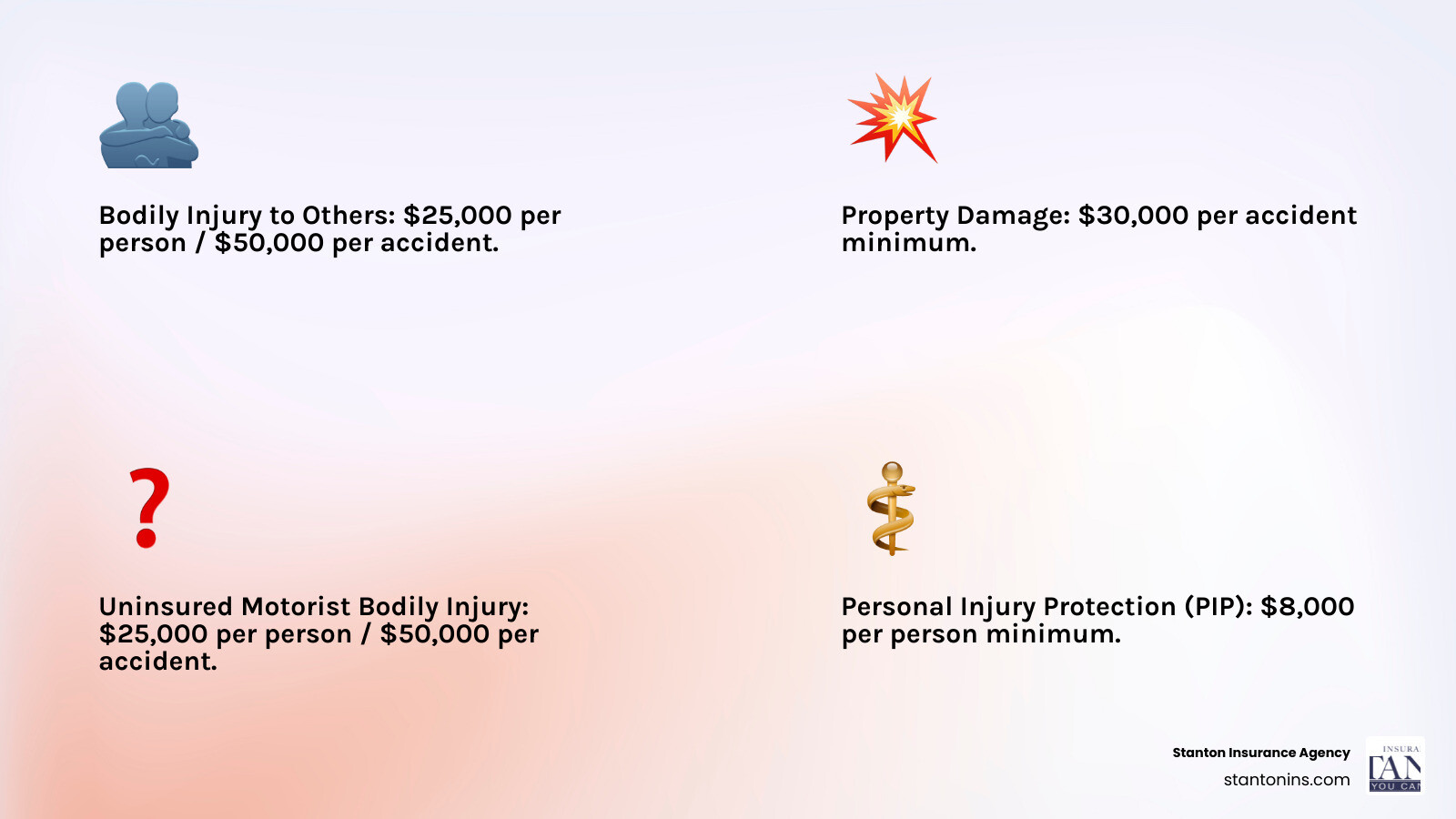

Massachusetts requires four mandatory coverages: Bodily Injury to Others ($25,000/$50,000), Property Damage ($30,000), Uninsured Motorist ($25,000/$50,000), and Personal Injury Protection ($8,000). The average cost for full coverage in Massachusetts is about $138 per month, which is 12% lower than the national average.

Let’s be honest. Insurance can be confusing and time-consuming. But getting quotes online doesn’t have to be. Whether you live in Worcester, Boston, or the Berkshires, you can now compare policies in minutes instead of hours.

As Geoff Stanton, President of Stanton Insurance Agency in Waltham, I’ve helped Massachusetts drivers steer car insurance quotes massachusetts online for over two decades, ensuring families and individuals get the right coverage at competitive rates. My team specializes in making the online quoting process simple and transparent for Bay State residents.

Basic car insurance quotes massachusetts online terms:

Understanding Massachusetts Car Insurance Essentials

Before shopping for car insurance in Massachusetts, it’s crucial to understand the Commonwealth’s unique laws and minimum coverage standards every driver must meet.

Mandatory Coverages and Minimum Limits

Operating a motor vehicle without insurance is illegal in Massachusetts. All drivers must carry four mandatory coverages to protect themselves and others.

Here are the mandatory car insurance coverages and their minimum limits in Massachusetts, as regulated by the state:

- Bodily Injury to Others (BI): This coverage pays for injuries to other people for which you are legally responsible. The minimum required limits are $25,000 per person and $50,000 per accident. This means your policy will pay up to $25,000 for injuries to any one person, with a maximum of $50,000 for all injuries in a single accident.

- Property Damage to Others (PD): This pays for damage to other people’s property (like their car, fence, or house) that you cause. The minimum required limit is $30,000 per accident.

- Uninsured Motorist Bodily Injury (UMBI): This protects you and your passengers if you are injured by a driver who doesn’t have insurance or is a hit-and-run driver. The minimum required limits are $25,000 per person and $50,000 per accident.

- Personal Injury Protection (PIP): This is a “no-fault” coverage that pays for medical expenses and lost wages for you, your household members, and certain passengers, regardless of who caused the accident. The minimum required limit is $8,000 per person, per accident.

While these are the minimums, we advise considering higher liability limits to protect your assets in a serious accident. For more details on liability, check out our guide on car insurance liability. You can also find more information about Massachusetts auto insurance requirements on the official Mass.gov website.

How Massachusetts’ No-Fault Law Affects You

As a “no-fault” state, Massachusetts law dictates that your own Personal Injury Protection (PIP) coverage is the primary source for your medical expenses and lost wages after an accident, regardless of who is at fault.

The system streamlines claims for minor injuries but restricts your right to sue:

- PIP Coverage is Key: As mentioned, PIP covers up to $8,000 for medical treatment, funeral expenses, and lost wages. In some cases, if you have health insurance, your PIP coverage might only cover up to $2,000, with your health insurance covering the rest.

- Restrictions on Lawsuits: In a no-fault state, your right to sue the at-fault driver for pain and suffering is generally restricted unless your injuries meet a certain threshold (e.g., significant disfigurement, fractured bones, or medical expenses exceeding a specific amount). This threshold can vary.

Understanding this system is crucial when considering your coverage options, as it directly impacts how medical costs and lost wages are handled after a collision. To dive deeper into this topic, read our article: Is Massachusetts a no-fault car insurance state?

What If You Can’t Find Insurance?

While we strive to find competitive rates for all drivers, some individuals with high-risk driving records might struggle to find coverage in the “voluntary market” from standard insurance companies. Massachusetts has a solution for this.

If you can’t find car insurance through conventional channels, you’ll be assigned an insurance company through the Massachusetts Auto Insurance Plan (MAIP). This plan acts as an “insurer of last resort,” ensuring that every licensed driver in Massachusetts can obtain the mandatory coverage required by law.

The MAIP is a shared risk pool where all insurance companies authorized to write auto policies in Massachusetts participate. If a driver is deemed high-risk and rejected by multiple insurers, MAIP assigns them to one of these participating companies. This ensures that even those with challenging driving histories can get the necessary coverage to legally operate a vehicle in the Commonwealth.

How to Get Car Insurance Quotes Massachusetts Online: A 4-Step Process

Getting car insurance quotes Massachusetts online is quick and convenient. Follow these four steps to efficiently compare options and find the right policy for your needs and budget.

Step 1: Gather Your Information

Having the necessary information ready before you start will make the online quoting process much smoother and faster.

Here’s what you’ll typically need:

- Driver Information:

- Full Name and Date of Birth for all drivers in your household.

- Driver’s License Number for each driver.

- Social Security Number (SSN) for identification and verification (note: Massachusetts prohibits using credit scores for rating).

- Driving History for each driver, including recent accidents, violations, or claims.

- Occupation and Education Level (some insurers offer discounts based on these).

- Marital Status.

- Current Insurance Provider and Policy Expiration Date (if applicable).

- Address where the vehicle is primarily garaged.

- Vehicle Information:

- Vehicle Identification Number (VIN) for each car you want to insure. This is the most accurate way for insurers to get details about your car.

- Make, Model, and Year of each vehicle.

- Current Odometer Reading (annual mileage impacts rates).

- Safety Features (e.g., anti-lock brakes, airbags) and Anti-Theft Devices (e.g., alarms, tracking systems).

- Lease or Loan Information (lenders often require specific coverages).

Having these details ready will ensure you receive accurate quotes and won’t have to pause your online search to dig for documents.

Step 2: Choose Your Quoting Method

When it comes to getting car insurance quotes Massachusetts online, you have a few options, but we believe one stands out for its comprehensive approach:

- Use a Trusted Independent Insurance Agency’s Website: This is our top recommendation. Websites like ours, Stanton Insurance Agency, allow you to enter your information once and receive quotes from multiple top carriers. This saves you time by avoiding repeated data entry on individual company websites, and it provides a broad comparison of options custom to your needs. As an independent agency, we work for you, not for one specific insurance company. We can compare policies and prices from various insurers to find the best fit and value.

- Contact an Independent Agent Directly: If you prefer a more personal touch or have complex insurance needs, you can always reach out to an independent agent. They can walk you through the process, answer your questions, and still provide comparative quotes from different companies.

- Direct Insurer Websites: You can also visit individual insurance company websites directly to get quotes. However, this means repeating Step 1 and Step 3 for each insurer, which can be time-consuming if you’re trying to compare many options.

For a deeper dive into the overall process of securing coverage in the Bay State, consult our guide on how to get car insurance in Massachusetts.

Step 3: Enter Your Details and Select Coverages

Once you’ve chosen your preferred quoting method (hopefully through an independent agency like ours!), the next step is to accurately input your gathered information into the online form.

- Complete the Online Quote Form: This will involve entering all the driver and vehicle details you prepared in Step 1. Be as precise as possible, as even small inaccuracies can affect your quote.

- Select Required and Optional Coverages: The online tool will typically guide you through selecting the mandatory Massachusetts coverages. Beyond those, you’ll have the opportunity to choose additional protections. Consider what makes sense for your personal situation, your vehicle’s value, and your financial comfort level. We’ll discuss these optional coverages in more detail shortly.

- Set Your Preferred Deductibles: For coverages like collision and comprehensive, you’ll need to select a deductible. This is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible usually means a lower premium, but it also means a larger out-of-pocket expense if you file a claim.

The goal here is to accurately reflect your needs so that the quotes you receive are as precise as possible. You can often adjust coverages and deductibles during the quoting process to see how they impact your premium. If you’re ready to start, you can get an online quote today.

Step 4: Receive and Review Your Quotes

This is often the most exciting part – seeing the numbers! After entering all your details and selecting your desired coverages, the online system will typically generate your quotes instantly.

- Instantly View Price Estimates and Policy Details: You’ll usually see a summary of the premium for each policy, along with a breakdown of the coverages included. Pay close attention to not just the price, but also what each policy covers and for what limits.

- Review the Coverage Options and Quote Validity Period: Ensure that each quote includes the mandatory Massachusetts coverages and any optional ones you requested. Also, note the validity period of the quote; prices can change, so it’s good to know how long your quoted rate is guaranteed.

- Save Your Quotes for Easy Comparison: Most online quoting systems allow you to save or email your quotes. This is incredibly helpful for comparing them side-by-side, which is crucial for making an informed decision. Don’t just look at the bottom-line price; compare the coverage limits, deductibles, and any added benefits or exclusions.

This step allows you to clearly see the differences between various policies and helps you move closer to selecting the best car insurance for your Massachusetts driving needs.

From Quotes to Coverage: Comparing Policies and Making a Choice

Getting quotes is just the first step. Comparing them carefully ensures you get the best value and protection—not just the lowest price.

When reviewing your car insurance quotes Massachusetts online, it’s important to compare apples to apples. Ensure that each quote offers the same types of coverage, with the same limits and deductibles. This allows for a true comparison of prices. For more tips on this, check out our guide on comparing car insurance companies: which one is right for you.

What is ‘Full Coverage’ Car Insurance in Massachusetts?

The term “full coverage” is frequently used but isn’t an official insurance term or a single policy. Instead, it generally refers to a combination of coverages that provide extensive protection for your vehicle and against liabilities.

In Massachusetts, a “full coverage” policy typically includes:

- Liability Coverage: This is your mandatory Bodily Injury to Others and Property Damage to Others coverage, protecting you financially if you’re at fault in an accident.

- Collision Coverage: This pays for damage to your own vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, hail, falling objects, or hitting an animal.

If you have a car loan or lease, your lender will almost certainly require you to carry both collision and comprehensive coverage to protect their investment. Even if your car is paid off, these coverages are highly recommended to protect you from potentially significant out-of-pocket repair or replacement costs. To understand the nuances, read our article on full coverage vs liability car insurance.

Understanding Optional Coverages

Beyond mandatory and full coverage, consider these optional protections to fit your lifestyle and budget:

- Standard vs. Limited Collision Coverage: A Massachusetts-specific choice. Standard Collision pays for repairs regardless of fault. Limited Collision only pays if you are less than 50% at fault, offering a lower premium for less protection.

- Collision Deductible Waiver: Waives your collision deductible if you are not at fault (less than 50%) and the other driver is identified.

- Medical Payments (MedPay): Supplements PIP by covering additional medical and funeral expenses for you and your passengers, regardless of fault. It’s especially useful for motorcyclists.

- Rental Reimbursement: If your car is damaged in a covered accident and needs repairs, this coverage pays for the cost of a rental car while yours is in the shop, up to specified limits.

- Roadside Assistance: This coverage can be a lifesaver for situations like flat tires, dead batteries, lockouts, or towing services.

- Underinsured Motorist Coverage: Similar to Uninsured Motorist coverage, this protects you if you’re hit by a driver whose own insurance limits aren’t high enough to cover your injuries or damages.

After You’re Insured: Registering Your Vehicle

Once you’ve secured your car insurance, the next crucial step is to register your vehicle with the Massachusetts Registry of Motor Vehicles (RMV). This process officially makes your car legal to drive in the Commonwealth.

Here are the general steps:

- Complete the RMV-1 Form with Your Insurance Agent: The RMV-1 form is a critical document for vehicle registration in Massachusetts. Your insurance agent will need to complete and stamp the insurance portion of this form, certifying that you have the mandatory coverage in place. This is why having insurance sorted first is essential.

- Provide Proof of Insurance: When you go to the RMV (or if your dealer handles registration electronically), you’ll need to present the completed RMV-1 form as proof of your insurance.

- Title Application and Sales Tax Payment: If you’ve just purchased a vehicle, you’ll also need to apply for a vehicle title (which your dealer might handle electronically) and pay the applicable sales tax.

- Registration Fees: Be prepared to pay registration fees, which vary by plate type.

If you’re purchasing a car from a dealer, they might offer electronic vehicle registration, which simplifies the process. If purchasing from an individual, you’ll need to handle the RMV-1 and other paperwork yourself. For more information, including specific forms and procedures, you can visit the Massachusetts Registry of Motor Vehicles site. You absolutely need insurance to register a car in Massachusetts! Our article do you need insurance to register a car in massachusetts? has more details.

How to Find Cheaper Car Insurance in Massachusetts

Massachusetts offers competitive rates, but you can save even more by understanding what affects your premium and which discounts you may qualify for.

The average cost of car insurance in Massachusetts was $1,346 in 2021, which is 12% lower than the national average. However, this is just an average, and your specific rate can vary significantly. Finding the cheapest car insurance isn’t just about looking for the lowest number; it’s about finding the best value for your specific needs. Our guide on cheapest car insurance in massachusetts offers further insights.

Factors That Influence Your Insurance Costs

Insurers use many factors to assess risk and set your premium. Understanding them can help you find ways to lower your costs:

- Driving Record: A clean record with no accidents or violations results in lower premiums, while tickets and at-fault accidents increase them.

- Location (ZIP Code): Urban areas with more traffic, theft, and vandalism typically have higher premiums than rural locations.

- Vehicle Type: The make, model, and year of your car influence rates. Expensive, high-performance, or frequently stolen vehicles cost more to insure.

- Annual Mileage: The more you drive, the higher your risk of being in an accident. Drivers with lower annual mileage may qualify for discounts.

- Age and Driving Experience: Younger, inexperienced drivers face higher premiums due to statistical risk. Rates typically decrease with age and experience before potentially rising again for senior drivers.

- Teen Drivers: Adding a teen driver to your policy can significantly increase your premiums due to their inexperience.

- Credit History: Unlike in many states, Massachusetts law prohibits insurers from using your credit history or score to calculate car insurance rates. Your financial history won’t impact your premium.

These factors combine to create your unique risk profile, which is what insurers use to calculate your premium. If you’ve ever wondered why is car insurance so expensive in massachusetts, these factors are often the culprits.

Common Car Insurance Discounts to Ask For

One of the best ways to find cheaper car insurance quotes Massachusetts online is by leveraging available discounts. While you’re comparing quotes, keep an eye out for these common savings opportunities:

- Multi-policy (Bundling Home and Auto): Many insurers offer significant discounts if you purchase multiple policies (like auto and home, or auto and renters insurance) from them. New customers who bundle home and auto can save over 25% on average nationwide.

- Good Student Discount: If you have a teen driver in your household who maintains good grades, they might qualify for a discount.

- Pay-in-Full Discount: Paying your entire premium upfront for the policy term (e.g., six months or a year) can often lead to a discount compared to monthly installments.

- Anti-Theft Devices Discount: If your vehicle is equipped with anti-theft features like alarms, immobilizers, or tracking systems, you could receive a discount.

- Low Mileage Discount: If you don’t drive much, you might qualify for a lower premium. Some insurers offer programs that track your mileage.

- Safe Driver (Telematics Programs) Discount: Telematics programs that track driving habits via an app can reward safe drivers with discounts up to 30%.

- Paperless Billing/Electronic Funds Transfer (EFT) Discount: Opting for paperless statements or setting up automatic payments can sometimes qualify you for a small discount.

- Accident-Free / Claims-Free Discount: Drivers who maintain an accident-free record for several years may be rewarded with lower rates.

- Loyalty Discount: Staying with the same insurer for an extended period can sometimes earn you a discount.

- New Car Discount: Some insurers offer discounts for newer vehicles.

When getting your car insurance quotes massachusetts online, be sure to list all applicable discounts. An independent agent from Stanton Insurance Agency can also help you identify all the discounts you qualify for across various carriers, helping you lower your costs even further.

Frequently Asked Questions about MA Car Insurance

How much is car insurance per month in Massachusetts?

The average cost for full coverage in Massachusetts is about $138 per month ($1,656 annually). However, your specific rate will vary based on your driving record, vehicle, location, and coverage choices. Liability-only policies can average around $64 per month. Your final cost depends on your unique profile.

Does insurance follow the car or the driver in Massachusetts?

In Massachusetts, insurance generally follows the car. If you permit someone to drive your vehicle and they have an accident, your policy is typically the primary coverage. This is why it’s important to be careful about who you lend your car to, as an incident can affect your premiums. While the policy follows the car, the listed drivers’ records still influence the rate. For a comprehensive look, refer to our article: does insurance follow the car or driver in massachusetts.

What are the specific car insurance requirements for teen drivers in Massachusetts?

Teen drivers in Massachusetts must be listed on a parent’s or guardian’s policy. After getting a learner’s permit at 16 and completing supervised driving hours, they can apply for a Junior Operator License (JOL). Key JOL restrictions include:

- Passenger Restrictions: For the first six months, a JOL holder cannot drive passengers under 18 (immediate family members are an exception).

- Nighttime Driving Ban: Driving is prohibited between 12:30 AM and 5:00 AM unless with a parent.

These restrictions are designed to promote safety and have specific expiration conditions as the driver gains experience. You can find more resources for first-time and student drivers on the Massachusetts first-time drivers guide.

Your Trusted Partner for Massachusetts Car Insurance

Finding the right car insurance online is about balancing cost with the right protection. By understanding Massachusetts requirements, gathering your information, and carefully comparing your quotes, you can confidently choose a policy that secures your peace of mind on the road. For personalized advice and help navigating your options, the experts at your local independent insurance agency can compare policies from multiple top carriers for you. Contact Stanton Insurance Agency today to get a comprehensive and competitive car insurance quote.