Why Understanding Uninsured Drivers and Insured Cars Matters in Massachusetts and New Hampshire

Can an uninsured driver driving an insured car in massachusetts cause problems for the vehicle owner? The short answer is yes, and understanding this is crucial for your financial protection in both Massachusetts and New Hampshire.

Quick Answer: What You Need to Know

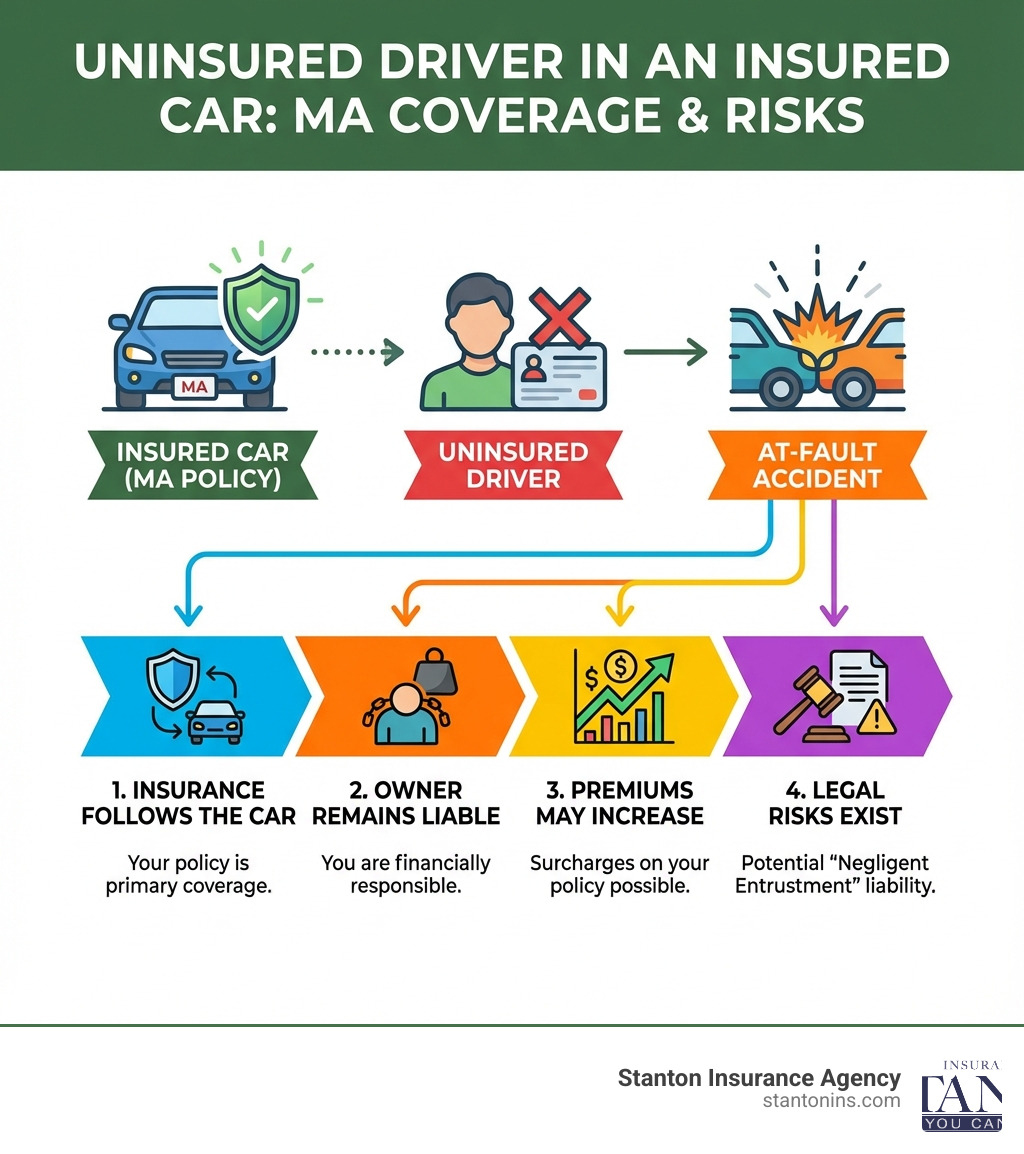

- Insurance follows the car: In both Massachusetts and New Hampshire, if you let someone drive your car, your insurance policy is the primary coverage—even if that driver has no insurance of their own.

- You remain liable: As the vehicle owner, you can be held responsible for damages caused by an uninsured driver you permitted to use your car.

- Your premiums may increase: An at-fault accident involving your vehicle can result in surcharges on your policy, regardless of who was driving.

- Legal risks exist: Under the “negligent entrustment” doctrine, you could face personal liability if you knowingly lent your car to an unfit driver.

Imagine lending your car to a friend or family member for a quick errand, only to get a call that they’ve been in an accident—and they don’t have their own insurance. This scenario is more common than you might think. While Massachusetts has a low rate of uninsured drivers (an estimated 3.5% in 2019), the situation is different in New Hampshire, where insurance is not mandatory and the uninsured driver rate is higher (estimated at 9.9% in 2019). This means thousands of uninsured drivers are on the roads in both states.

Confusion around can an uninsured driver driving an insured car in massachusetts and who’s covered is common. The reality is that while Massachusetts law requires all registered vehicles to carry specific insurance, New Hampshire operates under a financial responsibility law. In either state, when you hand over your keys, you’re also handing over serious responsibility.

I’m Geoff Stanton, President at Stanton Insurance Agency in Waltham. In my years helping Massachusetts and New Hampshire residents with auto insurance, the scenario of can an uninsured driver driving an insured car in massachusetts is one of the most misunderstood. Let me explain how this works, your responsibilities, and how to protect yourself.

Easy can an uninsured driver driving an insured car in massachusetts glossary:

- does insurance follow the car or driver in massachusetts

- is massachusetts a no fault car insurance state

- what is the minimum car insurance coverage in massachusetts

Understanding Massachusetts Mandatory Insurance vs. New Hampshire Financial Responsibility

Massachusetts and New Hampshire have fundamentally different approaches to auto insurance. Massachusetts mandates it for all drivers, while New Hampshire uses a financial responsibility model. Understanding both is key to staying legal and protected on the road.

Auto Insurance in Massachusetts: Mandatory Coverage

To legally register and operate a vehicle in Massachusetts, every owner must carry a minimum amount of auto insurance. This isn’t just a suggestion; it’s the law. The state mandates four specific types of coverage, known as Compulsory Insurance.

- Bodily Injury to Others (Part 1): $20,000 per person / $40,000 per accident.

- Personal Injury Protection (PIP) (Part 2): Up to $8,000 per person, per accident.

- Bodily Injury Caused by an Uninsured Auto (UM) (Part 3): $20,000 per person / $40,000 per accident.

- Damage to Someone Else’s Property (Part 4): $5,000 per accident.

Operating an uninsured vehicle in Massachusetts is a crime under M.G.L. c. 90, § 34J, with penalties including fines from $500 to $5,000, imprisonment for up to one year, and a mandatory 60-day license suspension. For more details, visit our page on What happens if my car insurance is cancelled in Massachusetts.

Auto Insurance in New Hampshire: Financial Responsibility

New Hampshire is unique in that it does not require drivers to purchase auto insurance. However, this does not mean you can drive without consequences. The state operates under a “financial responsibility” law, meaning if you cause an accident, you are legally required to prove you can pay for the damages.

- Minimum Limits (If You Buy Insurance): If you choose to buy insurance in New Hampshire, the policy must meet these minimums:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured Motorist: $25,000 per person / $50,000 per accident

- Medical Payments: $1,000 per person

- Penalties for an At-Fault, Uninsured Accident: If you cause an accident in NH without insurance, you face severe penalties. Your driver’s license and vehicle registration will be suspended until you can pay for the damages or post a bond. You will also be required to file proof of insurance (an SR-22 form) with the DMV for three years, which will significantly increase your future insurance costs.

The Critical Role of Uninsured & Underinsured Motorist Coverage

While Massachusetts has a low rate of uninsured drivers (an estimated 3.5% in 2019), the rate in New Hampshire is significantly higher at 9.9%, largely because insurance is not mandatory. Despite your best efforts, you could still have an accident with someone lacking proper insurance. This is precisely where Uninsured Motorist (UM) coverage becomes your financial shield. UM coverage is required to be included in all auto policies in both Massachusetts and New Hampshire, covering your injuries if you’re hit by an uninsured driver or in a hit-and-run.

How do Uninsured (UM) and Underinsured (UIM) Motorist coverages differ?

It’s common to confuse UM and UIM coverage, but they serve distinct purposes, both vital for your protection:

- Uninsured Motorist (UM) Coverage: This coverage protects you, your passengers, and household members if you’re involved in an accident with a driver who has no auto insurance at all. It also kicks in for hit-and-run accidents where the at-fault driver cannot be identified.

- Underinsured Motorist (UIM) Coverage: This coverage comes into play when the at-fault driver does have insurance, but their liability limits are too low to cover all your damages. For example, if you sustain $50,000 in medical bills and lost wages, but the at-fault driver only has the minimum $25,000 in bodily injury liability, your UIM coverage would help cover the remaining $25,000 (up to your UIM limits). UIM is an optional coverage in both Massachusetts and New Hampshire, but we highly recommend it.

You can explore more about these coverages on our Uninsured motorist coverage vs collision page.

Are the minimum UM limits enough?

The minimum UM coverage required in Massachusetts is $20,000 per person and $40,000 per accident. In New Hampshire, the minimum is slightly higher at $25,000 per person and $50,000 per accident. While this provides some basic protection in either state, we often find that these limits are severely inadequate when serious injuries occur.

Consider this: an emergency room visit, a few days in the hospital, follow-up appointments, physical therapy, and lost income from being unable to work can quickly exhaust these minimums. This leaves you personally responsible for any costs that exceed that limit. That’s why we always recommend increasing your UM/UIM coverage to limits like $100,000/$300,000 or even $250,000/$500,000. The cost difference is often surprisingly small compared to the peace of mind it offers. To assess your needs, visit our guide on How much uninsured motorist coverage do I need.

How do State Systems (No-Fault vs. At-Fault) Interact with UM Claims?

Massachusetts and New Hampshire have different systems for handling accident claims, which affects how your UM coverage is used.

- Massachusetts (A No-Fault State): In a no-fault state, your own Personal Injury Protection (PIP) coverage is the first line of defense, regardless of who was at fault. PIP covers your initial medical expenses and lost wages up to $8,000. Once your PIP benefits are exhausted, or for damages like pain and suffering, you can pursue a claim against the at-fault driver. If that driver is uninsured, your UM coverage steps in to provide compensation for those further bodily injury damages.

- New Hampshire (An At-Fault State): New Hampshire is a traditional “tort” or at-fault state. The person who causes the accident is responsible for the damages from the first dollar. If you are injured by an at-fault, uninsured driver, you would file a claim directly with your own insurance company under your UM coverage. There is no PIP system to go through first (though you may have optional Medical Payments coverage to help with initial bills).

What Happens if an Uninsured Driver is Driving an Insured Car in Massachusetts or New Hampshire?

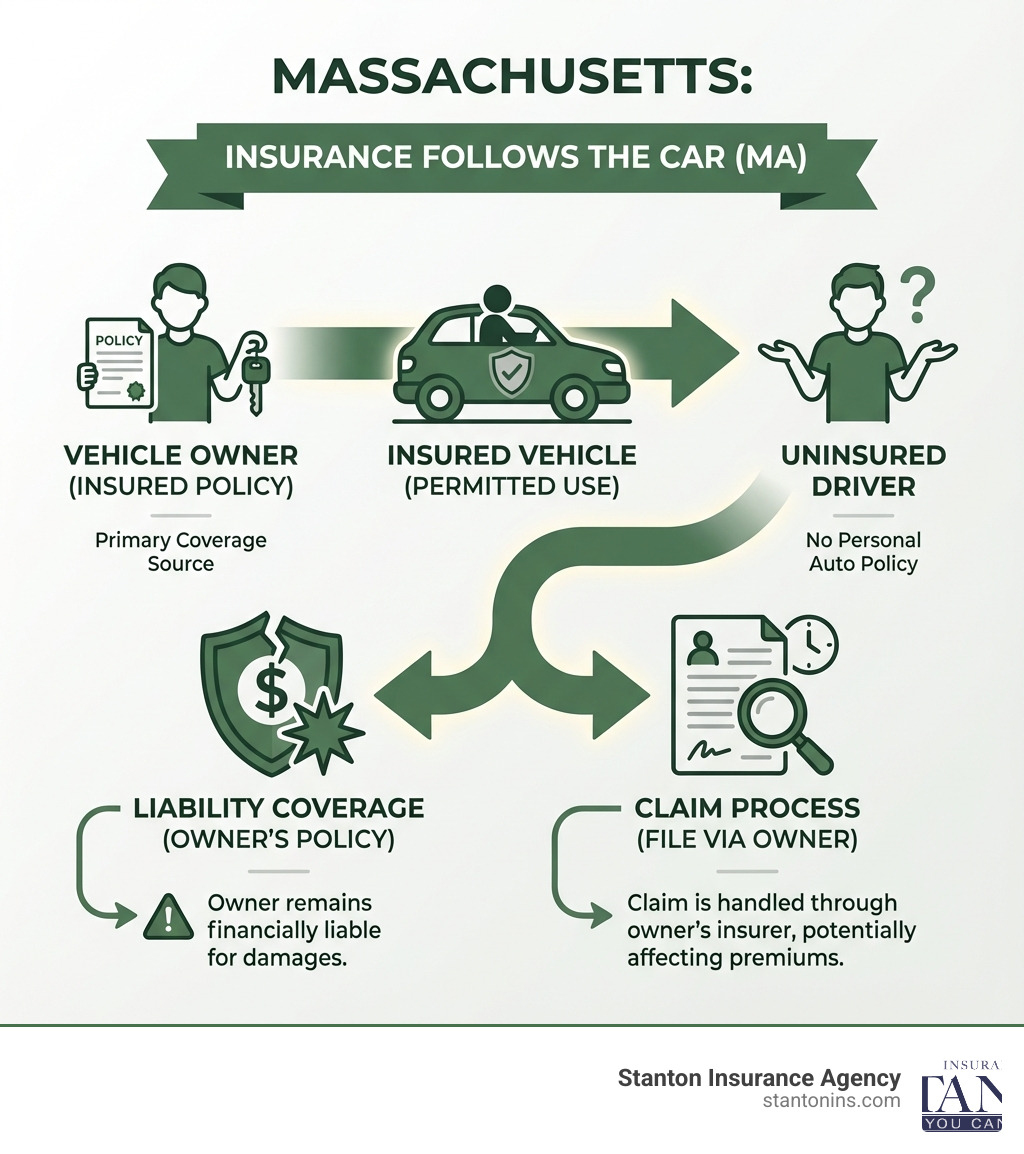

This is the central question for many vehicle owners. If you give someone permission to drive your car, your insurance policy is the primary source of coverage, even if that driver is uninsured. This concept is known as “permissive use.” However, allowing an uninsured individual behind the wheel of your car carries significant risks and legal responsibilities for you, the owner.

What are the implications if an uninsured driver driving an insured car causes an accident?

When an uninsured driver causes an accident while driving your insured car in Massachusetts or New Hampshire, the “permissive use” doctrine comes into play. This means that your auto insurance policy is typically the primary coverage for any damages or injuries they cause.

Here’s what that means for you:

- Your policy’s liability limits apply first: Your Bodily Injury and Property Damage liability coverages will be used to pay for the damages and injuries the uninsured driver caused to others. This means your policy pays for the damages they caused.

- Potential for increased premiums: Even though you weren’t driving, an at-fault accident involving your vehicle can lead to a surcharge or rate increase. This will very likely result in increased insurance premiums for you upon renewal.

- Your vehicle damage: If you have Collision coverage, it would pay for the damage to your own car, minus your deductible. If you don’t have Collision coverage, you might have to pay for your own car repairs out-of-pocket or pursue the uninsured driver directly, which can be challenging.

The bottom line is that when you lend your car, you’re essentially lending your insurance. Our article, Does insurance follow the car or driver in Massachusetts, provides more context on this important principle.

What is the vehicle owner’s liability when an uninsured driver driving an insured car gets into a collision?

Beyond your insurance policy covering the damages, as the vehicle owner, you can face personal legal liability, especially under the doctrine of “negligent entrustment.” This is where things can get particularly stressful and expensive.

- Negligent Entrustment Doctrine: This legal principle holds you, the owner, responsible if you lend your car to someone you knew, or should have known, was unfit or incompetent to drive. This can include:

- Unlicensed Driver: Lending your car to someone without a valid driver’s license.

- History of Reckless Driving: If the person has a known history of drunk driving, speeding tickets, or other reckless behavior, and you still let them drive.

- Impaired Driver: Allowing someone under the influence of alcohol or drugs to drive your car.

A Massachusetts Supreme Judicial Court case, Commerce Ins. Co., Inc. v. Gentile, highlighted this when grandparents explicitly listed their grandson as an excluded driver, but then allowed him to drive their car. The insurance company did not have to pay the optional coverage for bodily injury. This demonstrates the serious consequences of ignoring exclusions or lending to known unfit drivers.

- Your liability can exceed policy limits: If the damages caused by the uninsured driver exceed your insurance policy’s liability limits, you could be personally sued for the remaining amount. This puts your personal assets, such as your savings, home, or future earnings, at risk.

This is a stark reminder that lending your car is not a casual favor. It’s a significant responsibility that can have severe financial and legal repercussions if the driver you entrust it to is uninsured or unfit.

Who is considered an ‘uninsured driver’?

Understanding who qualifies as an “uninsured driver” is key to grasping the full scope of this issue. An uninsured driver is generally defined as:

- Someone with no active auto insurance policy: This is the most straightforward definition—they simply don’t carry the mandatory coverages required by state law (in MA) or lack the financial responsibility to cover an accident (in NH).

- Driving with a suspended or revoked license: While this doesn’t directly mean they lack insurance, often a suspended license is due to prior insurance violations, and even if they had a policy, driving illegally could void their coverage.

- Driving a car without the owner’s permission: If someone steals a car or takes it without permission, they are by definition uninsured for that vehicle, and your UM coverage would likely apply if you were injured by them.

- An excluded driver on a policy: If a specific person is formally excluded from an insurance policy (meaning the insurer explicitly states they will not cover that individual if they drive the car), and that person drives the car and causes an accident, for all practical purposes they are considered uninsured for that incident.

Post-Accident Procedures and Policy Management

Knowing what to do after an accident with an uninsured motorist can make a significant difference in the outcome of your claim. Likewise, understanding how your driving record is managed and how you can control your premiums are essential parts of being an insured driver in Massachusetts and New Hampshire.

What steps should I take after an accident with an uninsured motorist?

Being involved in an accident is stressful enough, but finding the other driver is uninsured adds another layer of complexity. Here are the crucial steps we recommend taking:

- Call 911: Always call emergency services, especially if there are injuries or significant property damage. A police report is vital for your insurance claim.

- Do Not Admit Fault: Never admit fault at the scene of an accident, even if you think you might be partially responsible. Let the investigation determine fault.

- Gather Driver and Witness Information: Collect the uninsured driver’s name, contact information, and license plate number. Also, get contact information for any witnesses.

- Take Photos and Videos: Document the scene extensively. Take pictures of vehicle damage, road conditions, traffic signs, and any visible injuries.

- Notify Your Insurance Company Promptly: Inform us, your insurance provider, as soon as possible. Explain that the other driver was uninsured. Your UM coverage will be your primary recourse for your injuries.

- File a Police Report: Ensure a police report is filed. This documentation is critical for your insurance claim and any potential legal action.

For a comprehensive guide on handling accident claims, please refer to our Auto insurance accident claim complete guide.

How Driving Records Affect Your Premium in MA and NH

Both Massachusetts and New Hampshire have systems for tracking driving history, which directly impacts your auto insurance premiums.

-

In Massachusetts: The Merit Rating Board (MRB): The MRB maintains a database of all licensed drivers’ records, tracking at-fault accidents and traffic violations. When you have an at-fault accident (where your insurer pays out more than $1,000) or certain traffic violations, the MRB assigns “surcharge points” to your driving record. Insurance companies use your MRB record and these points to calculate your premium. Surcharges can affect your premium for up to 6 years. If you receive a notice of an at-fault accident determination, you typically have 30 days to appeal it. For tips on how to appeal, visit our page Simple tips appeal driving surcharge.

-

In New Hampshire: The DMV Point System: The NH Division of Motor Vehicles (DMV) tracks traffic violations and assigns demerit points to your record. Accumulating too many points in a certain period can lead to license suspension. While insurers don’t use a “surcharge point” system like in MA, they review the underlying violations (speeding tickets, at-fault accidents) on your driving record to determine your risk level and set your premiums. A history of violations will lead to higher insurance costs.

How can I lower my auto insurance premiums?

Nobody wants to pay more than they have to for car insurance. Fortunately, there are several strategies we can explore together to help you lower your auto insurance premiums in Massachusetts and New Hampshire:

- Maintain a Clean Driving Record: This is arguably the most impactful factor. Avoiding at-fault accidents and traffic violations keeps your record clean and demonstrates you’re a lower risk to insurers.

- Ask About Discounts: We can help you uncover various discounts you might qualify for, such as:

- Bundling: Combining your auto and home insurance policies with us.

- Good Student: For young drivers with good grades.

- Low Mileage: If you don’t drive many miles annually.

- Multi-Car: Insuring multiple vehicles with the same carrier.

- Safe Driver/Telematics: Some insurers offer discounts for using devices that monitor your driving habits.

- Increase Your Deductibles on Optional Coverages: Raising your deductible for Collision and Comprehensive coverage can significantly lower your premium. Just make sure you can comfortably afford to pay that higher deductible out-of-pocket if you need to file a claim.

- Choose Your Vehicle Wisely: Certain vehicles are more expensive to insure due to factors like repair costs, theft rates, and safety ratings. When purchasing a new car, consider its insurance implications.

- Annually Review Your Coverage Needs: Your life changes, and so should your insurance. Review your policy with us each year to ensure you have the right amount of coverage without overpaying for what you no longer need. For instance, if your car is older and paid off, you might consider dropping Collision or Comprehensive coverage.

By proactively managing these factors, you can often find significant savings on your auto insurance. For more insights on finding affordable coverage, check out our guide on Cheapest car insurance in massachusetts.

Frequently Asked Questions about Uninsured Drivers in Massachusetts and New Hampshire

Does my insurance rate go up if an uninsured person crashes my car?

Yes, it is very likely. Since your insurance policy is primary under permissive use, the claim will be filed against your policy. If the accident is deemed at-fault (meaning the uninsured driver you lent your car to was responsible for the collision), it will be recorded on your driving record. At-fault accidents, regardless of who was driving, typically result in a surcharge or rate increase on your policy upon renewal. This is one of the significant risks you take when allowing someone else to drive your vehicle, especially if they are uninsured.

What’s the difference between an uninsured driver and an excluded driver?

This is a critical distinction!

- An uninsured driver is simply anyone operating a vehicle without a valid, active auto insurance policy. They might not have insurance because they couldn’t afford it, it was canceled, or they never bothered to get it.

- An excluded driver is a person specifically named on your insurance policy whom your insurance company will not cover if they are driving your vehicle. You typically sign a specific form (an “exclusion form”) to remove coverage for this individual, often to lower your premium because they are considered a high-risk driver.

The danger arises if you sign an exclusion form for a household member or frequent driver and then, despite the exclusion, let them drive your car. If they cause an accident, your insurer can legally deny any resulting claim for damages, leaving you personally responsible for all costs.

Can I sue an uninsured driver in Massachusetts or New Hampshire?

Yes, you absolutely can sue an uninsured driver for damages they cause if they are at fault for an accident. However, the legal battle is often the easier part; the real challenge lies in collecting any judgment you might win. If the uninsured driver has no significant assets (like a steady job, savings, or property), you might win the lawsuit but be unable to recover any money from them. This is often referred to as being “judgment proof.” This unfortunate reality is precisely why carrying adequate Uninsured Motorist (UM) coverage and Underinsured Motorist (UIM) coverage on your own policy is so incredibly important. It ensures that you are protected financially, even if the at-fault party cannot pay.

Your Trusted Partner for Massachusetts and New Hampshire Car Insurance

Navigating the rules of the road in Massachusetts and New Hampshire, especially concerning who is and isn’t covered, can be daunting. The key takeaway is that while your car insurance policy generally covers anyone you permit to drive your vehicle, you as the owner retain significant responsibility and potential liability. Ensuring you have the right coverage limits, particularly for Uninsured and Underinsured Motorists, is your best defense against financial loss. If you have questions about your current policy or want to explore your options, the experienced team at Stanton Insurance Agency is here to provide clarity and help you secure the protection you need.