Why Understanding Minimum Coverage for Car Insurance Matters

Minimum coverage for car insurance is the legally required amount of auto insurance you must carry to drive in your state. It typically includes:

- Bodily Injury Liability – Pays for injuries you cause to others (commonly $25,000 per person / $50,000 per accident)

- Property Damage Liability – Pays for damage you cause to other vehicles or property (commonly $25,000 per accident)

- Additional Required Coverage – Some states mandate Personal Injury Protection (PIP) or Uninsured Motorist coverage

Important: Minimum coverage only protects others from your mistakes. It does not cover your own vehicle repairs, your medical bills (in most states), or damages beyond the policy limits.

We often forget that cars are inherently dangerous due to their size, weight, and rate of speed. This is why almost every state in the U.S. requires drivers to have car insurance as a measure of financial responsibility. But here’s the uncomfortable truth: the state minimum is often set shockingly low and hasn’t been adjusted for years, even as medical costs and vehicle prices have soared.

In Massachusetts, for example, the mandatory minimums will increase as of January 1, 2025, to $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. That sounds like a lot until you realize that the average cost to repair a modern vehicle after a serious crash can easily exceed $10,000, and a single night in the hospital can cost tens of thousands of dollars.

The real question isn’t “What’s the legal minimum?” It’s “What level of coverage will actually protect me and my family from financial disaster?”

If you’re exploring your options for minimum coverage for car insurance, you might be trying to save money on premiums. That’s understandable. The average cost of minimum coverage in Massachusetts and New Hampshire is often less than half the price of a full coverage policy. But that savings can evaporate in an instant if you cause an accident that exceeds your policy limits. When that happens, you’re personally responsible for the difference, and creditors can come after your home, your savings, and even your future wages.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts. Over my 25+ years in the industry, I’ve helped countless Massachusetts and New Hampshire drivers steer their options for minimum coverage for car insurance and build policies that truly protect their assets. My goal is to make sure you understand exactly what you’re getting—and what you’re not getting—when you choose the bare minimum.

Basic minimum coverage for car insurance vocab:

- does liability car insurance cover legal costs

- does liability insurance cost more depending on kind of car

Understanding State-Mandated Car Insurance Requirements

State minimum coverage for car insurance is the legal floor, not a recommended level of coverage. It’s designed to protect other people from the financial consequences of an accident you cause. These requirements vary by state but typically revolve around liability coverage, which is broken down into two main parts. Every state has its own specific requirements, and it’s our job at Stanton Insurance Agency to help you steer these often-confusing regulations.

The Core Components of Minimum Coverage

When we talk about minimum coverage for car insurance, we’re primarily discussing liability. This is the cornerstone of any auto insurance policy, as it covers the costs when you’re at fault in an accident.

- Liability Coverage: This is the most fundamental type of car insurance. It steps in to pay for damages and injuries you cause to others in an accident. Without it, you’d be personally responsible for these costs, which can quickly add up to tens or even hundreds of thousands of dollars. We often refer to this as your financial safety net for other people. For more detailed insights into what liability insurance entails, especially regarding legal costs, you can visit our guide on liability insurance.

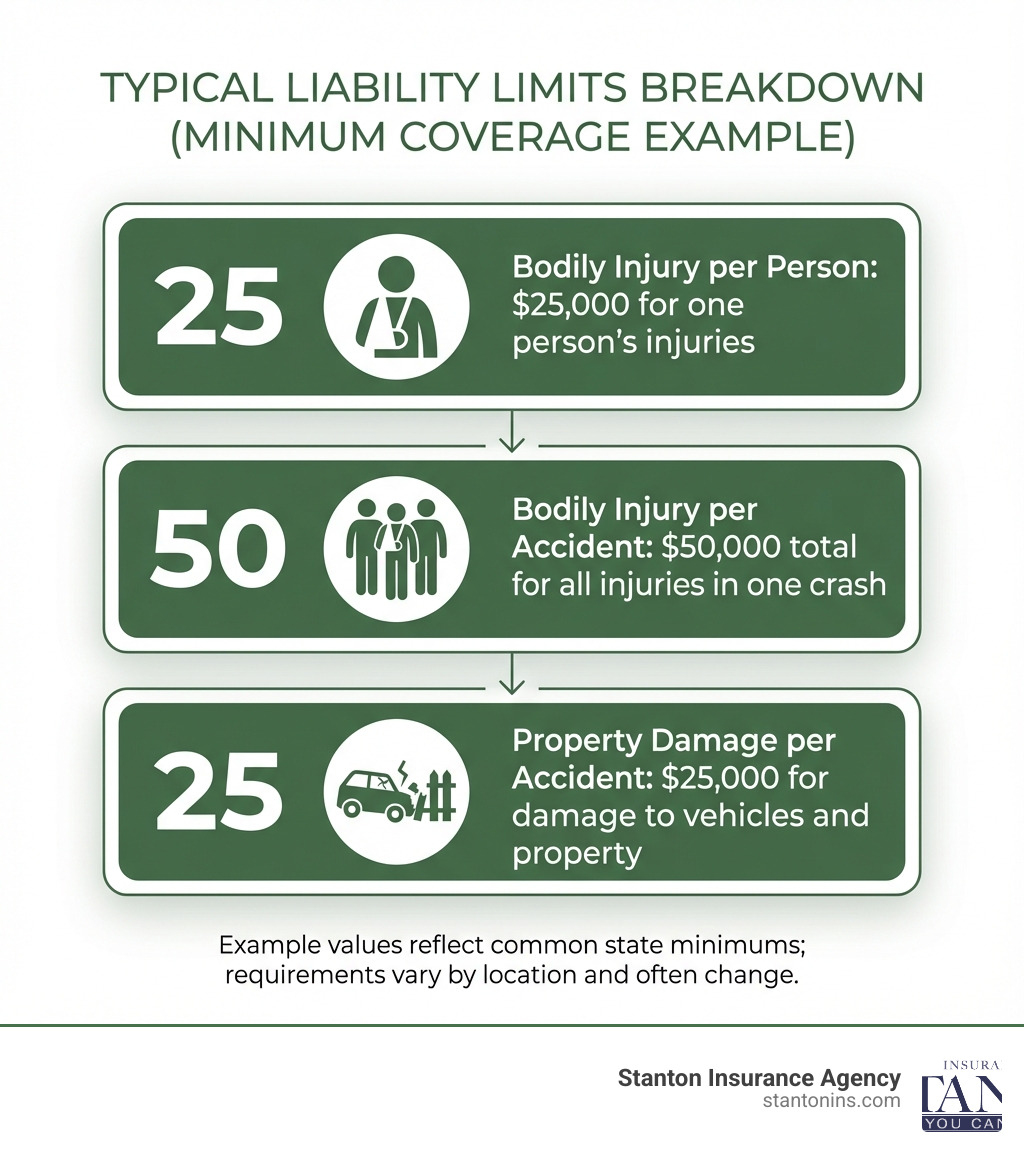

- Bodily Injury Liability (BI): This part of your liability coverage pays for medical expenses, lost wages, and pain and suffering for anyone you injure in an accident where you are deemed at fault. It’s typically expressed as two numbers, like $25,000/$50,000. The first number ($25,000) is the maximum amount your policy will pay for injuries to one person. The second number ($50,000) is the maximum amount your policy will pay for all injuries in a single accident, regardless of how many people were hurt.

- Property Damage Liability (PD): This covers the cost of repairing or replacing property you damage in an accident, such as another vehicle, a fence, a lamppost, or even a building. This is usually expressed as a single number, like $25,000, which is the maximum amount your policy will pay for all property damage in one accident.

- Split Limits: When you see numbers like “25/50/25,” these are called split limits. They represent the BI per person, BI per accident, and PD per accident, respectively. For instance, “25/50/25” means your policy will pay up to $25,000 for one person’s injuries, $50,000 total for all people injured in one accident, and $25,000 for property damage in that same accident.

Beyond basic liability, some states, including Massachusetts, require additional coverages:

- Uninsured/Underinsured Motorist (UM/UIM): This crucial coverage protects you and your passengers if you’re hit by a driver who either doesn’t have insurance (uninsured) or doesn’t have enough insurance (underinsured) to cover your medical bills and property damage. Given the number of uninsured drivers on the road, this coverage can be a lifesaver, ensuring you’re not left paying out of pocket for someone else’s mistake. Many states require this to be offered, but some allow you to opt out in writing.

- Personal Injury Protection (PIP): Often a requirement in “no-fault” states like Massachusetts, PIP covers medical expenses, lost wages, and essential services (like childcare or household help) for you and your passengers, regardless of who caused the accident. This means you file a claim with your own insurance company first, rather than waiting for the at-fault driver’s insurer.

- Medical Payments (MedPay): Similar to PIP, MedPay covers medical expenses for you and your passengers after an accident, regardless of fault. However, it typically doesn’t cover lost wages or other non-medical expenses like PIP does. This coverage can be particularly useful for covering health insurance deductibles or co-pays.

These core components form the backbone of minimum coverage for car insurance. However, the specific types and amounts mandated can vary significantly from one state to another, which brings us to our local requirements in Massachusetts and New Hampshire.

Minimum Coverage for Car Insurance in Massachusetts and New Hampshire

Where you live has the biggest impact on your specific requirements. For drivers in New England, the rules in Massachusetts and New Hampshire are quite different. It’s critical to understand these local laws to stay legal and protected on the road. We at Stanton Insurance Agency pride ourselves on our deep understanding of these regional nuances.

Massachusetts: A “No-Fault” State’s Requirements

Massachusetts operates under a “no-fault” system and requires all drivers to carry four compulsory coverages. This means that, for certain expenses, your own insurance pays regardless of who caused the accident. Effective January 1, 2025, these minimums will be updated to provide more robust protection, reflecting the rising costs of medical care and vehicle repairs. For a comprehensive overview of auto insurance basics in the Commonwealth, you can always refer to the official Basics of Auto Insurance in MA guide.

The required coverages are:

- Bodily Injury to Others ($25,000 per person / $50,000 per accident): This is your liability coverage that pays for injuries to other people if you cause an accident. The minimums mean your policy will pay up to $25,000 for one person’s injuries and a total of $50,000 for all injuries in a single accident. While these limits are mandatory, we often recommend higher amounts to truly protect your assets, as medical costs can easily exceed these figures.

- Personal Injury Protection (PIP) ($8,000): As a no-fault state, Massachusetts requires PIP. This coverage pays for medical expenses, up to 75% of lost wages, and replacement services (like hiring someone to do household chores you can’t do) for you, your household members, passengers, and even pedestrians, regardless of who caused the accident. The $8,000 limit is for combined expenses.

- Bodily Injury Caused by an Uninsured Auto ($25,000 per person / $50,000 per accident): This protects you and your passengers if you’re injured by a driver who doesn’t have any car insurance. It mirrors your Bodily Injury to Others limits, providing up to $25,000 for one person and $50,000 total per accident.

- Damage to Someone Else’s Property ($25,000): This is your property damage liability coverage, paying for damage you cause to other vehicles or property. The minimum is $25,000 per accident. Given the cost of modern vehicles, this amount can quickly be exhausted if you total a newer car.

These four compulsory coverages form the minimum coverage for car insurance you need to legally drive and register a vehicle in Massachusetts. While they meet the legal mandate, our experience shows that they often fall short of providing true financial security. We can help you explore options to improve your personal insurance protection here.

New Hampshire: The “Live Free or Drive” Exception

New Hampshire holds a unique position as the only state that doesn’t mandate auto insurance for all drivers. Their motto, “Live Free or Die,” extends to car insurance, with the state allowing drivers to forgo a traditional policy. However, this doesn’t mean you’re free from responsibility if you cause an accident.

Instead of mandatory insurance, New Hampshire requires drivers to prove Financial Responsibility. This means that if you are involved in an accident and are found at fault, you must be able to demonstrate that you have the financial resources to cover the damages and injuries you caused, up to the state’s minimum limits. If you cannot, you could face severe penalties, including license and registration suspension, and a requirement to file an SR-22 Filing for a period of time. An SR-22 is a certificate of financial responsibility that your insurance company files with the state, proving you have coverage. It’s often required for high-risk drivers or those who’ve had their license suspended.

If you choose to buy insurance (which we strongly recommend, as most drivers do), New Hampshire law requires your policy to meet specific minimums. These are outlined in resources like the NH Auto Insurance Guide:

- Bodily Injury Liability ($25,000 per person / $50,000 per accident): This covers injuries to others if you are at fault.

- Property Damage Liability ($25,000): This covers damage to other people’s property if you are at fault.

- Uninsured Motorist ($25,000 per person / $50,000 per accident): This protects you if you’re injured by a driver who doesn’t have insurance.

- Medical Payments ($1,000): This covers reasonable medical expenses for you and your passengers, regardless of fault.

New Hampshire is an At-Fault State, meaning the driver who causes an accident is legally and financially responsible for the damages and injuries. While the option to drive without insurance might seem appealing for some, the potential financial fallout from an at-fault accident can be catastrophic. Proving financial responsibility after an accident, without an insurance policy, can be a complex and costly endeavor.

The Risks of “Bare Bones” Coverage: Minimum vs. Full Coverage

Opting for only the state minimum is tempting because it’s the cheapest option. In Massachusetts and New Hampshire, a liability-only policy can cost less than half the price of a full coverage policy. However, that low price comes with significant risk, as minimum coverage leaves major gaps that could lead to financial ruin after a serious accident. We’ve seen it happen, and it’s never a pretty picture.

What Does Minimum Coverage for Car Insurance Leave Out?

The most important thing to understand is that minimum coverage for car insurance (liability insurance) does not cover you, your passengers, or your vehicle. It only pays for damages and injuries you cause to others. If you’re at fault, you’ll be on your own to pay for your car repairs and medical bills unless you have additional coverage. This is a critical distinction that many drivers overlook until it’s too late.

Consider this table comparing the basic differences:

| Feature | Minimum Coverage | Full Coverage |

|---|---|---|

| Covers other party’s injuries | Yes | Yes |

| Covers other party’s property damage | Yes | Yes |

| Covers your car’s repairs | No | Yes, with Collision |

| Covers your car from theft/weather | No | Yes, with Comprehensive |

| Covers your medical bills | Only in no-fault states with PIP | Yes, with MedPay/PIP |

The High Cost of a Serious Accident with Low Limits

Let’s get real for a moment. Choosing minimum coverage for car insurance means you’re taking a significant gamble. Imagine you have a policy with a $25,000 property damage limit, and you cause an accident that totals a brand-new SUV worth $60,000. Your insurance will pay its $25,000 limit, and you will be personally sued for the remaining $35,000. Without the assets to pay, you could face wage garnishment and liens against your property for years. This isn’t just a hypothetical scenario; we’ve seen clients go through this painful experience.

The same applies to medical bills. A serious accident can easily result in medical expenses that exceed the common $25,000 or $50,000 bodily injury limits for a single person or an entire accident. A broken bone requiring surgery, extensive physical therapy, or a prolonged hospital stay can quickly climb into the hundreds of thousands of dollars. If your policy limits are exhausted, the injured party can pursue your personal assets to cover the remaining costs. This exposes your home, savings, and future earnings to significant risk.

In New Hampshire, where insurance isn’t mandatory, imagine causing a severe accident and being unable to prove financial responsibility. The legal and financial consequences could be devastating, potentially leading to your assets being seized and your wages garnished for years to come. The initial savings on premiums could quickly be dwarfed by the costs of an underinsured accident.

Making the Right Choice: When to Increase Your Coverage

Choosing the right amount of car insurance is a personal decision based on your financial situation. While the state sets the minimum, your goal should be to protect your assets and future earnings. We believe in helping you build a policy that offers true security, not just legal compliance.

Why You Should Consider More Than the Minimum Coverage for Car insurance

You should carry enough liability insurance to cover your net worth. Think about it: if you cause a major accident and your liability limits are exhausted, you could be personally sued for the remainder. If you own a home, have savings, or have significant future earning potential, a minimum coverage for car insurance policy is simply not enough to shield those assets. Higher liability limits are often surprisingly affordable for drivers with a clean record and offer significantly greater peace of mind.

- Asset Protection: Your home, savings, and investments are valuable assets that could be at risk in a lawsuit if your liability insurance is insufficient. Increasing your limits provides a stronger barrier between your assets and potential claims.

- Net Worth: A good rule of thumb is to have liability coverage that matches or exceeds your net worth. This ensures that in the event of a catastrophic accident, your personal wealth is better protected.

- Loan/Lease Requirements: If you have a loan or lease on your vehicle, your lender will almost certainly require you to carry comprehensive and collision coverage in addition to liability. This protects their investment in your vehicle, ensuring it can be repaired or replaced if damaged or stolen.

- Peace of Mind: Knowing you have robust coverage allows you to drive with confidence, understanding that you’re prepared for unexpected events.

- Umbrella Insurance: For the ultimate protection, an umbrella policy can provide an extra layer of liability coverage above your auto and home policies. This is especially recommended for individuals with significant assets, offering millions in additional protection for a relatively modest premium.

Penalties for Driving Without Any Insurance

If the risk of financial ruin isn’t enough, the legal penalties for driving uninsured are severe. Driving without the legally required minimum coverage for car insurance (or proof of financial responsibility in New Hampshire) can lead to a host of unpleasant consequences:

- Hefty Fines: These can range from hundreds to thousands of dollars, depending on the state and whether it’s a first offense.

- Suspension of Your Driver’s License and Vehicle Registration: This means you can’t legally drive, and your car can’t be on the road.

- Vehicle Impoundment: Your car could be towed and stored at your expense, adding more fees to an already difficult situation.

- SR-22 Filing: In many cases, especially after a license suspension, you’ll be required to obtain an SR-22 form to prove financial responsibility. This is a certificate filed by your insurer with the state and often results in higher insurance premiums for several years.

- Higher Future Insurance Premiums: Having an insurance lapse on your record signals to insurers that you’re a higher risk, leading to significantly higher rates when you do eventually purchase a policy.

These penalties are designed to enforce financial responsibility on the road. We want to help you avoid them entirely by ensuring you have the right coverage from the start.

Frequently Asked Questions about Minimum Car Insurance

We often get questions from drivers in Massachusetts and New Hampshire about the nuances of minimum coverage for car insurance. Here are some of the most common:

What’s the difference between “at-fault” and “no-fault” states?

This is a key distinction, especially for our clients in New England.

- In an “at-fault” state (like New Hampshire), the driver who causes an accident is responsible for paying for the other party’s medical bills and damages through their liability insurance. This means after an accident, there’s typically an investigation to determine who was at fault, and that driver’s insurance then covers the other party’s losses.

- In a “no-fault” state (like Massachusetts), your own Personal Injury Protection (PIP) coverage pays for your initial medical expenses, lost wages, and other related costs for you and your passengers, regardless of who was at fault for the accident. While PIP handles immediate medical costs, you might still pursue a claim against the at-fault driver for severe injuries or other damages that exceed your PIP limits.

Does my minimum coverage policy cover me if I drive in another state?

Yes, your car insurance policy generally travels with you across the U.S. and Canada. This means if you’re driving from Massachusetts to New Hampshire, or vice versa, your policy will still provide coverage. Furthermore, if you drive into a state with higher minimum liability requirements than your own, your policy will automatically adjust up to meet that state’s legal minimums. For example, if your Massachusetts policy has lower limits than what’s required in a state you’re visiting, your policy will temporarily increase to match those higher minimums while you’re driving there. However, if you plan to drive in Mexico, you’ll typically need to purchase a separate policy from a Mexican insurer, as standard U.S. policies usually don’t extend coverage there.

Can my lender require more than the state minimum coverage?

Absolutely. If you have a car loan or lease, the lender is a part-owner of the vehicle and wants to protect their investment. They will almost always require you to carry not only liability coverage but also collision and comprehensive coverage to pay for repairs or replacement of the vehicle itself. This is because minimum coverage for car insurance (liability) only protects others, not your own vehicle. Without collision and comprehensive, if your financed car is totaled or stolen, the lender could lose money. These requirements are standard practice and are usually outlined in your loan or lease agreement.

Find the Right Protection for Your Journey

State minimum coverage for car insurance is the legal starting line, not the finish line. It fulfills your basic legal duty but often fails to protect your own vehicle, your health, and your financial future. As we’ve explored, while the low premium might be attractive, the potential costs of an underinsured accident can be catastrophic, especially for drivers in Massachusetts and New Hampshire who steer distinct state laws.

Evaluating your personal assets and risks is the only way to determine the right level of coverage. Don’t wait for an accident to find out you’re underinsured. The team at Stanton Insurance Agency is here to help you steer your options and build a policy that provides true security, custom specifically to the requirements and nuances of driving in Massachusetts and New Hampshire. We’ll help you understand the difference between legal minimums and actual protection, ensuring you make an informed decision for your peace of mind and financial well-being. Ready to find the right balance of protection and price? Get a personalized car insurance quote and ensure you’re truly covered for the road ahead.