Why Buying Bike Insurance Online is the Smart Choice

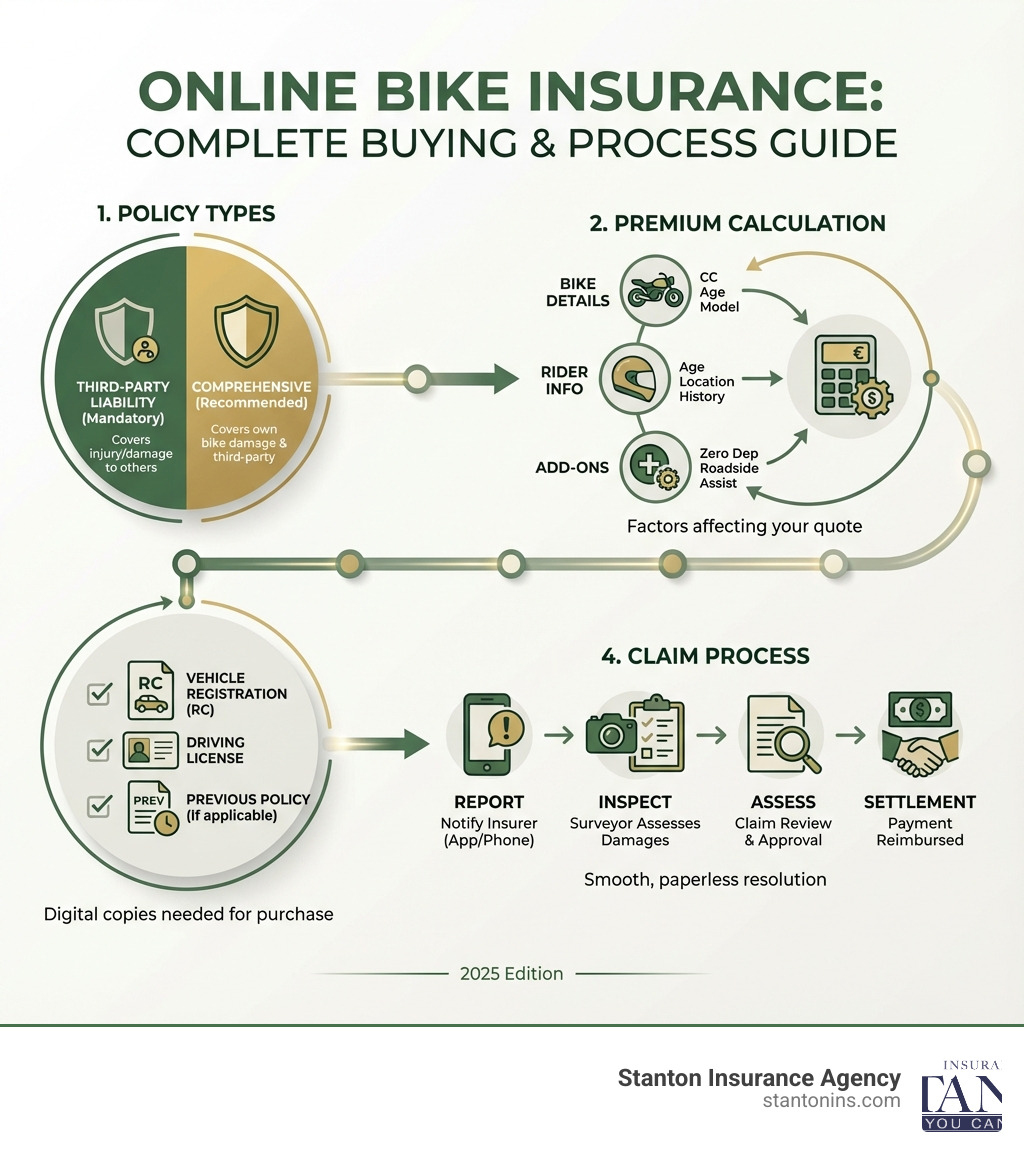

If you’re looking to buy online bike insurance, you’re in the right place. Here’s a quick guide:

Quick Steps to Buy Online Bike Insurance:

- Get a Quote – Enter your bike and rider details.

- Compare Plans – Review third-party vs. comprehensive options.

- Customize Coverage – Select add-ons like zero depreciation.

- Purchase Policy – Complete payment and get instant confirmation.

Motorcycle insurance is mandatory in Massachusetts and New Hampshire, protecting you from financial liability in accidents and ensuring you meet state legal requirements. With thousands of road accidents reported annually, proper insurance is essential for every rider.

Why Buy Online?

- Instant quotes and policy issuance

- Compare multiple plans side-by-side

- Lower premiums without middleman fees

- Convenient, paperless process

- 24/7 access from anywhere

No matter your ride—cruiser, sport bike, or scooter—buying your policy online saves time and money. The secure, transparent process can be completed in minutes, ensuring you get the right protection.

I’m Geoff Stanton, President of Stanton Insurance Agency and a Certified Insurance Counselor with over 25 years of experience helping riders like you buy online bike insurance that fits your needs and budget. Our team specializes in finding the right coverage to protect your motorcycle investment while keeping premiums affordable.

Easy buy online bike insurance glossary:

Understanding Your Motorcycle Insurance Options

Whether you ride a classic cruiser or a high-performance sport bike, understanding your insurance options is key. Massachusetts and New Hampshire have specific requirements—here’s what you need to know to make an informed choice.

What is Bike Insurance and Why is it Mandatory?

Motorcycle insurance is a legal requirement in most states, including Massachusetts and New Hampshire. It protects you from financial liability in case of accidents, injuries, or property damage. Compliance with state laws ensures you’re covered for third-party damages and bodily injury.

At a basic level, bike insurance is a contract between you and an insurer: you pay a premium, and in return the insurer agrees to cover certain losses as described in your policy. Coverage typically focuses on liability for harm you may cause others, plus protection for damage to your own motorcycle if you choose a broader policy.

Learn more about motorcycle insurance

Third-Party Liability vs. Comprehensive Coverage

| Feature | Third-Party Liability | Comprehensive |

|---|---|---|

| Own Damage Cover | No | Yes |

| Third-Party Legal Liability | Yes | Yes |

| Theft/Fire Cover | No | Yes |

| Natural Disasters | No | Yes |

| Mandatory by Law | Yes | No (but recommended) |

| Premium Cost | Lower | Higher |

What Does Each Policy Type Cover?

- Third-Party Coverage: Legal liability for death, injury, or property damage to others.

- Comprehensive Coverage: Includes third-party liability plus protection for your own bike against theft, fire, vandalism, natural disasters, and personal accident cover.

Calculating Your Premium and Finding Discounts

Your insurance premium is based on several risk factors. Understanding these helps you find the most affordable coverage.

How is Your Bike Insurance Premium Calculated?

The cost of your bike insurance is a calculated sum based on factors that assess your risk as a rider and your motorcycle’s value. We consider:

- Insured Declared Value (IDV): A higher IDV (a more valuable bike) results in a higher premium, as the potential payout for theft or total loss is greater.

- Make and Model of Your Bike: A high-performance sport bike generally costs more to insure than a standard commuter bike due to higher accident risk and more expensive parts.

- Age of Your Bike: As a bike ages, its market value (IDV) depreciates, which typically leads to a lower premium. However, very old or classic bikes might see an increase due to the scarcity of parts.

- Cubic Capacity (CC): Bikes with higher CC are associated with higher risk and thus higher premiums.

- No Claim Bonus (NCB): A reward for safe riding. If you haven’t made claims in previous years, you earn a significant discount on your renewal premium.

- Geographical Location: Urban centers in Massachusetts or New Hampshire with high traffic or theft rates typically have higher premiums than rural areas.

- Add-On Covers: Extra protection like zero depreciation or roadside assistance will add to your base premium.

- Voluntary Deductible: Opting for a higher voluntary deductible (the amount you pay out-of-pocket on a claim) can lower your premium.

What is IDV (Insured Declared Value)?

The Insured Declared Value (IDV) is the maximum amount an insurer will pay if your motorcycle is stolen or irreparably damaged. It represents your bike’s current market value.

How is it calculated? IDV is the manufacturer’s selling price minus depreciation for age. For bikes over five years old, the IDV is often mutually agreed upon between you and the insurer.

Why is it important?

- Premium Impact: A higher IDV leads to a higher premium.

- Claim Settlement: The IDV is the maximum payout you’ll receive for a total loss. A realistic IDV ensures you are properly compensated.

- Balancing Act: A low IDV reduces your premium but can leave you underinsured. It’s crucial to balance savings with adequate coverage.

How to Get Cheaper Bike Insurance with Discounts and NCB

When you buy online bike insurance, there are several ways to reduce your premium without compromising essential coverage.

- No Claim Bonus (NCB): Your reward for being a safe rider. For every claim-free year, you earn a discount on your premium, accumulating up to 50% after five consecutive claim-free years. Your NCB is transferable if you switch insurers or buy a new bike.

- Voluntary Deductible: This is a portion of the claim you agree to pay. Opting for a higher voluntary deductible can lead to a lower annual premium.

- Safety Devices: Installing approved anti-theft devices on your motorcycle can earn you a discount, as they reduce the risk of theft claims.

- Rider Safety Course: Completing a certified motorcycle safety course makes you a safer rider and can qualify you for insurance discounts, as insurers view graduates as lower-risk policyholders.

- Bundle Policies: If you have other insurance policies like home or auto, consider bundling them with the same provider for a multi-policy discount.

- Good Driver Discounts: A clean driving record free of accidents and violations can lead to lower premiums.

- Membership Discounts: Being a member of certain motorcycle clubs or associations might also get you a discount.

By leveraging these discounts, you can significantly reduce the cost to buy online bike insurance.

The Complete Guide to Buy Online Bike Insurance

Buying your policy online is quick and straightforward. Here’s how to get started and what to expect.

Key Benefits When You Buy Online Bike Insurance

Choosing to buy online bike insurance with Stanton Insurance Agency offers advantages traditional methods can’t match:

- Convenience: Get a quote, compare plans, and buy your policy 24/7 from anywhere in Massachusetts or New Hampshire.

- Time-Saving: The streamlined process provides instant quotes and immediate policy issuance upon payment. Secure coverage in minutes.

- Paperless Process: All documents are handled digitally, making it eco-friendly and easy to manage.

- Easy Comparison: Review multiple plans side-by-side to compare coverage, premiums, and add-ons, empowering you to make the best choice.

- Transparency: All details, from coverage limits to premium calculations, are clearly presented with no hidden fees.

- Lower Premiums: Online processing cuts administrative costs, often resulting in more competitive premiums.

These benefits make buying bike insurance online a hassle-free, efficient, and cost-effective experience.

How to Compare and Buy Online Bike Insurance

Buying or renewing your bike insurance online with Stanton Insurance Agency is a straightforward process:

- Use Stanton Insurance Agency’s Online Quote Tool: Visit our website to start. Our intuitive online tool will guide you through the initial steps.

- Enter Your Bike and Rider Details: Provide basic information about your motorcycle (make, model, year, VIN) and yourself (driving history, age, location). Accurate information ensures a precise quote.

- Compare IDV and Premium Options: Our system will generate quotes with different Insured Declared Value (IDV) and premium options for third-party vs. comprehensive policies.

- Review Add-Ons and Exclusions: Explore optional add-on covers to improve your protection and understand the policy exclusions so you know what isn’t covered.

- Select Your Plan and Purchase: Choose the policy that offers the right balance of coverage and cost. Complete the payment securely online, and your policy documents will be emailed to you instantly.

Documents Required for Buying or Renewing

Having the right documents ready makes the online process even smoother. You’ll typically need:

- Valid Driver’s License: Proof you’re legally authorized to ride.

- Proof of Address: A utility bill or other document to confirm your residential address.

- Vehicle Registration Certificate (RC): Contains essential details about your motorcycle.

- Previous Policy Number (for renewals): Crucial for transferring your No Claim Bonus (NCB).

- Recent Passport-Size Photograph: Some insurers might require this, though it’s less common for online purchases.

Managing Your Policy: Claims, Add-Ons, and Exclusions

Once insured, it’s important to know how to use your policy—especially when you need it most.

How to Make a Claim on Your Policy

Accidents happen. When they do, our goal at Stanton Insurance Agency is to make the claim process as stress-free as possible:

- Notify Us Immediately: Contact us as soon as an incident occurs. Prompt notification helps expedite the claim.

- File a Police Report: For theft, major accidents, or significant damage, a police report is mandatory and vital for your claim.

- Arrange for a Surveyor Assessment: We may arrange for a surveyor to inspect your bike and estimate repair costs.

- Choose Your Repair Option:

- Cashless Repair: At a network garage, we settle the bill directly (minus your deductible).

- Reimbursement: At a non-network garage, you pay upfront and submit the bills for reimbursement.

- Submit Required Documents: Provide your claim form, policy documents, driver’s license, vehicle registration, and police report (if applicable) to ensure a smooth settlement.

Contact our customer service for assistance if you need to make a claim.

Beneficial Add-On Covers to Improve Protection

Add-on covers let you tailor your policy for improved security. Here are some of the most beneficial options for riders in Massachusetts and New Hampshire:

- Zero Depreciation Cover (Bumper-to-Bumper): Ensures you receive the full cost for replaced parts without a deduction for depreciation. It’s especially valuable for newer bikes.

- 24×7 Roadside Assistance: Provides emergency services like towing, on-the-spot repairs, fuel delivery, and battery jump-starts so you’re never stranded.

- Engine Protector: Standard policies may not cover engine damage from water ingress or oil leakage. This add-on specifically protects this expensive component.

- Consumables Cover: Reimburses you for the cost of items like nuts, bolts, and engine oil used during repairs, which are not covered by a standard policy.

- Return to Invoice (RTI): In case of a total loss, this bridges the gap between your bike’s IDV and its original purchase price, ensuring you get back the full amount you paid.

- Personal Accident Cover for Pillion Rider: Extends death or disability compensation to your passenger in case of an accident.

These add-ons can significantly improve your financial protection and riding experience.

Common Policy Exclusions to Be Aware Of

Understanding what your policy doesn’t cover is just as important as knowing what it does. Common exclusions include:

- Riding Without a Valid License: Your claim will likely be rejected if you’re in an accident without a valid license.

- Riding Under the Influence: Operating your motorcycle while intoxicated is illegal and voids your insurance coverage.

- Consequential Damage: Indirect damage that isn’t a direct result of a covered incident.

- General Wear and Tear: Routine maintenance, depreciation, and damage from natural aging are not covered.

- Mechanical or Electrical Breakdown: Failures are typically excluded unless caused by a covered accident.

- Use Outside Covered Geographical Limits: Damage occurring outside your policy’s specified geographical area won’t be covered.

- Lapsed or Expired Policy: If your policy has expired, you have no coverage. This is illegal and leaves you financially exposed.

Frequently Asked Questions about Buying Bike Insurance Online

How does the age of the bike affect insurance premiums?

A bike’s age significantly impacts insurance premiums:

- Depreciation and IDV: As a bike ages, its Insured Declared Value (IDV) depreciates. A lower IDV, which is the maximum payout for a total loss, generally leads to a lower premium.

- Risk Profile: Insurers may perceive newer, high-performance bikes as higher risk.

- Parts Availability: Premiums for very old or classic bikes can increase if parts are rare and expensive, raising repair costs.

- Technology: Advanced safety features on newer bikes (like ABS) can sometimes earn discounts, offsetting the higher IDV.

In general, your premium will decrease as your bike ages, but it may level off or rise for very old or rare models.

Are there specific insurance requirements for different types of motorcycles?

Yes. While the basic legal requirement for liability insurance applies to all motorcycles in Massachusetts and New Hampshire, the cost and coverage options vary by bike type:

- Sport Bikes: These high-performance machines often have higher premiums due to a statistically higher risk of accidents and expensive repair costs.

- Cruisers and Standard Bikes: These are generally more affordable to insure, as they tend to be ridden more conservatively and have less expensive parts.

- Touring Bikes: These may have moderate insurance costs. They are often ridden by mature riders, but their complex electronics can lead to higher repair costs.

- Scooters and Mopeds: These are typically the cheapest to insure due to their lower power, speed, and value.

- Electric Bikes: As they become more common, specific coverage for expensive battery packs and electrical components is emerging.

- Customized Motorcycles: Heavy customizations must be declared and covered, often through specialized add-ons, which will increase your premium.

When you buy online bike insurance, be sure to accurately describe your motorcycle type.

What is the difference between a compulsory and voluntary deductible?

Deductibles are amounts you pay out-of-pocket before your insurance kicks in. Understanding the two types can help you manage your premium:

- Compulsory Deductible: This is a fixed, non-negotiable amount mandated by the insurer that you must pay on every claim. It’s intended to deter minor claims.

- Voluntary Deductible: This is an additional amount you choose to pay on top of the compulsory deductible. By opting for a higher voluntary deductible, you agree to take on more financial risk. In return, the insurer rewards you with a lower annual premium. This is a great option for cautious riders who want to reduce their upfront insurance costs.

Secure Your Ride with the Right Protection

Choosing the right motorcycle insurance is essential for protecting your investment and ensuring your financial security. By understanding policy types, premium factors, and the convenience of buying online, you can find coverage that fits your needs and budget. Compare quotes, customize your policy with relevant add-ons, and enjoy peace of mind on every ride. The team at Stanton Insurance Agency is here to help you find the perfect policy.