Why Finding the Right Independent Insurance Agent Matters

Finding the best independent insurance agent near me is one of the smartest moves you can make when shopping for insurance. Here’s what you need to know right away:

Quick Answer: How to Find the Best Independent Insurance Agent Near You

- Search online using terms like “independent insurance agents near me” and check Google reviews

- Ask for referrals from friends, family, or professionals like real estate agents

- Verify credentials through your state’s insurance department website

- Compare agents by asking how many carriers they represent and how they support clients during claims

- Choose a local agent who understands your community’s specific risks and regulations

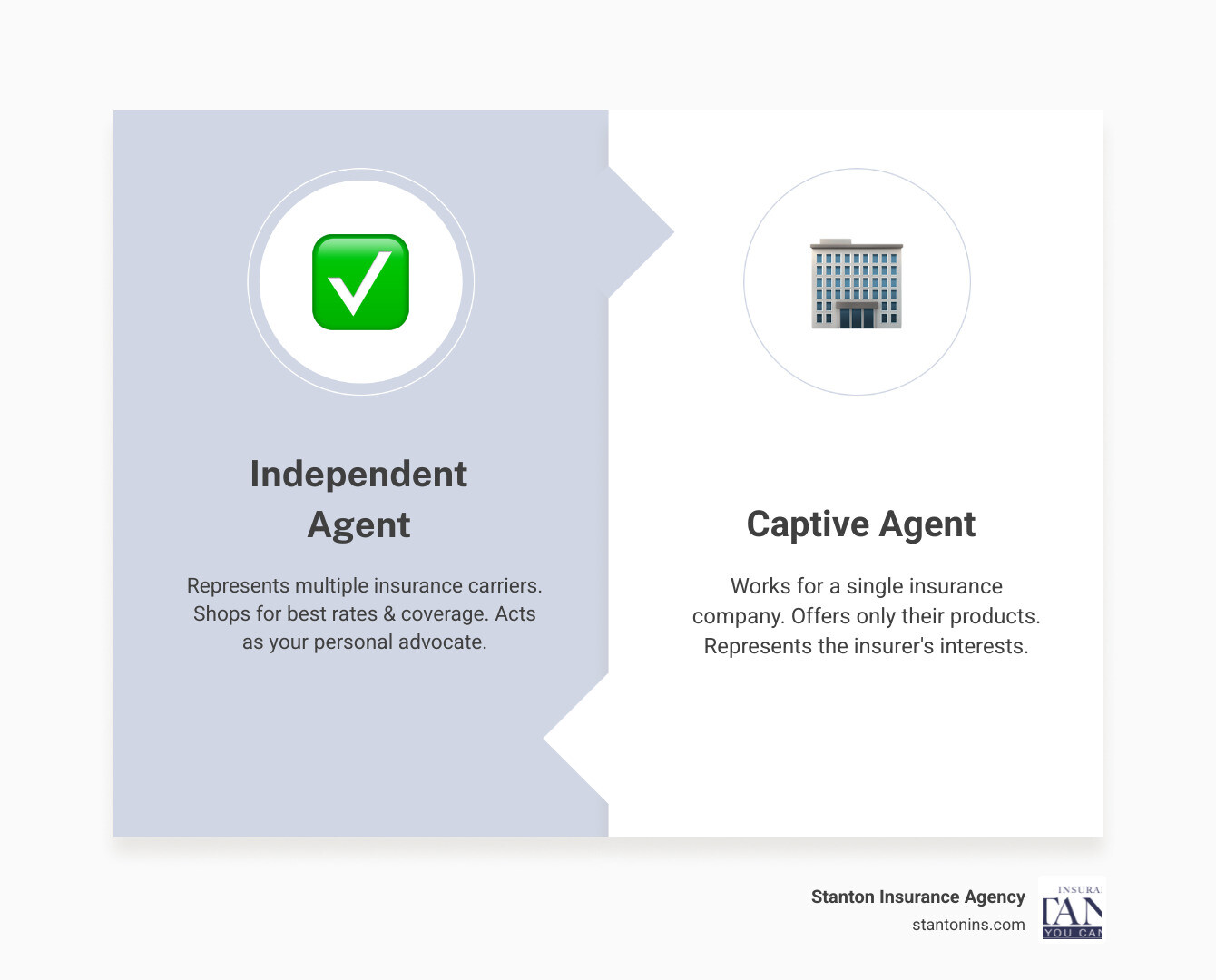

When you’re looking for insurance coverage, you’re not just buying a policy—you’re choosing a partner who will protect your home, your car, and your financial security for years to come. The difference between working with an independent agent versus going directly to an insurance company or using a captive agent can mean hundreds of dollars in savings, better coverage options, and someone in your corner when you need to file a claim.

Independent agents aren’t tied to one insurance company. Instead, they represent multiple carriers, which means they can shop the market on your behalf to find the best combination of price and coverage. For example, some large independent agent networks include hundreds of agents serving over a million clients, while other agencies focus on providing local, accessible service across dozens of locations in a single state.

Why does this matter for you? Because when life throws you a curveball—a car accident, storm damage to your home, or a liability claim—you want an advocate who knows you, understands your needs, and will fight to get you the best outcome. An independent agent provides that personal touch combined with professional expertise.

As Geoff Stanton, President at Stanton Insurance in Waltham, Massachusetts, I’ve spent over two decades helping families and businesses find the best independent insurance agent near me who truly fits their needs. My team and I specialize in working with individuals across Massachusetts and New Hampshire to deliver personalized coverage that protects what matters most.

Basic best independent insurance agent near me vocab:

What is an Independent Insurance Agent?

An Independent Insurance Agent Near Me is a licensed professional who is not tied to a single insurance company. Instead, they represent multiple carriers, allowing them to shop the market on your behalf. Think of them as your personal insurance shopper, sifting through various options to find the policy that best suits your unique situation. This contrasts sharply with captive agents, who work exclusively for one insurance company and can only offer that company’s products.

Independent vs. Captive Agents: A Quick Comparison

When considering your insurance options, understanding the fundamental difference between independent and captive agents is crucial. It’s like deciding between a multi-brand electronics store and a single-brand boutique – both can be good, but one offers a broader selection custom to your specific needs.

| Feature | Independent Agent | Captive Agent |

|---|---|---|

| Number of Carriers | Represents multiple insurance companies (often dozens!). This allows them to compare a wide array of products and pricing. | Represents only one insurance company. They are employees or exclusive contractors of that specific insurer, meaning they can only sell policies from their single employer. |

| Allegiance | Their primary allegiance is to the client. They work to find the best coverage and rates for you, acting as your advocate in the complex world of insurance. | Their primary allegiance is to the insurance company they represent. While they aim to serve clients, their product offerings are limited to what their employer provides. |

| Product Variety | Offers a diverse portfolio of insurance products from various carriers, increasing the likelihood of finding a perfect match for complex or niche needs. They can mix and match policies from different companies to create a comprehensive package. | Limited to the products and services offered by their single company. This might restrict options for specialized coverage or competitive pricing if that company doesn’t offer what you need. |

| Price Shopping Capability | Actively shops the market on your behalf, comparing quotes from multiple insurers to secure the most competitive rates and best value. This can lead to significant savings as they leverage competition between carriers. | Cannot shop around for you. They can only provide quotes for their single company’s products. If their company’s rates aren’t competitive for your specific profile, you’d have to do all the comparison shopping yourself by contacting other captive agents or independent agencies. |

Why This Matters for You

The distinction between independent and captive agents isn’t just industry jargon; it has real, tangible impacts on your insurance experience and your wallet.

First and foremost, it means choice. When you work with an independent agent, you’re not getting a one-size-fits-all solution. Instead, you’re getting options. We can tap into a broad network of reputable insurance providers, both national and regional, to find the policy that perfectly aligns with your needs and budget. This can be especially beneficial in states like Massachusetts and New Hampshire, where local factors and regulations can influence rates.

This expansive choice also translates into unbiased advice. Because independent agents aren’t beholden to a single company, our recommendations are driven by what’s best for you, not by a quota for a specific insurer’s product. We act as consultants, helping you understand your risks and select coverage that truly protects your assets without overpaying. As one agency puts it, “One size does not fit all and that is why you need someone who can shop around for you.”

Finally, it fosters a long-term partnership. Your independent agent is invested in your continued satisfaction. This means your agent stays with you even if your insurance carrier changes. If your current insurer raises rates or your needs evolve, we can simply re-shop the market for you, ensuring you always have the most appropriate and cost-effective coverage. This continuity and dedication are hallmarks of strong Independent Insurance Agencies.

The Top 7 Benefits of Working with an Independent Agent

Working with an Independent Insurance Agency offers significant advantages that go beyond just buying a policy. It’s about securing a relationship that provides value, protection, and peace of mind over the long haul. Here are the top seven reasons why partnering with an independent agent is a smart decision:

1. Best Choice and Comparison Shopping

This is perhaps the most compelling benefit. We have access to multiple insurance companies, allowing us to compare prices and coverage options from a wide array of providers. We do the legwork for you, saving you countless hours of research and phone calls. Instead of you calling individual companies one by one, we present you with a curated selection of policies, ensuring you get the best possible value. As an agency pointed out, independent agents are “value-hunters” who prioritize the client’s pocketbook. We help you find the right insurance, not just an insurance.

2. A Personal Advocate on Your Side

Imagine navigating a complex claims process alone after a stressful event. Not fun, right? This is where your independent agent truly shines. They work for you, not the insurance company. If you ever have a claim, your agent acts as your advocate, guiding you through the process, helping you understand the paperwork, and ensuring a fair and smooth experience. This support is invaluable when you need it most, as one agency highlighted, “They act as your advocate, helping you every step through the claims process.” We’re here to make sure you’re treated fairly and promptly.

3. One-Stop Shopping for All Your Needs

Life is busy enough without managing multiple insurance policies across different companies. Independent agents can handle all your insurance policies in one place. Whether you need coverage for your car, home, or business, we can bundle them efficiently. We offer services for individuals seeking the Best Auto Insurance Agency, families looking for reliable Homeowner Insurance Agencies, and business owners in search of a trusted Massachusetts Business Insurance Agency. This simplifies management, reduces paperwork, and often leads to significant multi-policy discounts.

4. Expert, Custom Advice

Insurance policies can be dense and confusing. Independent agents are licensed professionals with deep industry knowledge. We assess your unique risks and needs, whether you’re a first-time homeowner in New Hampshire or a seasoned business owner in Massachusetts. We don’t just sell policies; we educate. We help you understand complex policy details, coverage limits, and exclusions so you’re never in the dark. This personalized approach ensures your coverage is custom specifically for your lifestyle and assets.

5. Rooted in Your Local Community

We live and work in the same communities as you do. This means we understand the specific risks and regulations unique to our area, whether you’re in Insurance Agency Andover MA or seeking Insurance Companies in Keene NH. We know about local weather patterns that might impact home insurance, regional traffic conditions affecting auto insurance, or specific business regulations that dictate commercial coverage. We’re your neighbors, committed to building long-term relationships and contributing to the local economy. Our commitment is to face-to-face business and treating you like a person, not a number.

6. Long-Term Relationship and Ongoing Service

Your life isn’t static, and neither should your insurance be. Your independent agent periodically reviews your coverage to ensure it keeps up with life changes like buying a new car, moving to a new home, starting a business, or expanding your family. We are a consistent point of contact for all your questions and needs, providing proactive adjustments rather than just reacting to changes. This ongoing service ensures your policies remain relevant and effective as your circumstances evolve.

7. Cost-Effective Solutions

Despite offering a premium service, working with an independent agent is incredibly cost-effective. By comparing multiple carriers, we can consistently find competitive pricing and discounts you might miss on your own. Many agencies have demonstrated their ability to find clients better insurance for a cheaper price. And here’s the best part: there is no extra cost to you for their service, as they are compensated by the insurance carriers. You get expert guidance and access to the best rates without paying a dime more than you would going directly to an insurer. It’s a win-win!

How to Find the Best Independent Insurance Agent Near Me

Finding the right local agent is a straightforward process when you know where to look. With a little strategic searching, you can uncover a gem who will be your trusted insurance partner for years to come.

Start with Online Searches and Directories

The internet is often the first stop for any search. Begin by using specific search terms like “Independent Insurance Agencies Near Me” or “Insurance Agencies Massachusetts“. Pay close attention to agencies with strong local reviews on Google, Yelp, and other platforms. Look for consistent positive feedback regarding their service, responsiveness, and ability to find good rates.

Beyond general search engines, specialized online directories are invaluable. For example, Trusted Choice is an excellent resource that allows you to find vetted independent agents in your state, including Massachusetts and New Hampshire. These directories often provide detailed profiles, customer testimonials, and contact information, making your initial research much easier.

Ask for Referrals

Sometimes the old-fashioned way is the best way. Talk to friends, family, and colleagues in your area who have recently purchased or reviewed their insurance. Personal referrals come with an inherent level of trust and can give you insights into an agent’s working style and reliability.

Additionally, consider asking other professionals you trust for recommendations. Real estate agents, mortgage brokers, or attorneys frequently work with insurance professionals and can often point you toward reputable independent agents who consistently provide excellent service. They have a vested interest in referring competent professionals.

Check with State Associations

Professional organizations are a great resource for finding qualified and ethical agents. For example, the Massachusetts Association of Insurance Agents provides resources and directories for finding qualified agents in the Commonwealth, while the Independent Insurance Agents & Brokers of New Hampshire does the same for the Granite State. These associations often have strict membership requirements and provide continuing education, ensuring their members are up-to-date on industry best practices and adhere to high professional standards.

Choosing Your Agent: Key Factors and Questions to Ask

Once you have a shortlist of Independent Insurance Agents In My Area, it’s time to vet them thoroughly to find the perfect fit. This isn’t just about finding a policy; it’s about finding a long-term partner who understands your needs.

How to find the best independent insurance agent near me by verifying credentials

Before committing to an agent, always verify their credentials. This step is critical for your peace of mind and to ensure you’re working with a legitimate and qualified professional.

First, check their state license status. For agents in Massachusetts, you can typically do this through the Massachusetts Division of Insurance website. For agents in New Hampshire, the New Hampshire Insurance Department website will have similar verification tools. This confirms they are legally authorized to sell insurance in your state.

Next, look for professional designations. While not mandatory, designations like CIC (Certified Insurance Counselor) or CPCU (Chartered Property Casualty Underwriter) indicate an agent’s commitment to advanced education and expertise in the insurance field. These designations signify a higher level of knowledge and professionalism.

Finally, read online reviews and testimonials. While not a credential, they offer valuable insights into an agent’s reputation and customer service. Look for patterns in feedback, particularly regarding responsiveness, helpfulness during claims, and ability to find competitive rates.

Key Questions to Ask a Potential Agent

When you interview potential agents, come prepared with a list of questions that will help you gauge their expertise and fit. Don’t be shy – this is about protecting your future!

Here are some essential questions we recommend asking:

- How many insurance companies do you represent? This will give you a clear idea of the breadth of their market access and their ability to shop for the best rates. The more companies, the more options for you.

- How will you help me during the claims process? Understand their role as your advocate. Will they guide you, intervene if necessary, and explain the steps?

- How often will we review my policies? A good agent should proactively suggest periodic reviews (e.g., annually) to ensure your coverage still meets your evolving needs.

- What is your preferred method of communication? Do they prefer email, phone calls, or in-person meetings? Knowing this upfront ensures smooth communication.

- Can you provide references from clients with needs similar to mine? Hearing from clients who have similar insurance requirements (e.g., small business owners, families with multiple vehicles) can provide valuable insight into an agent’s specific expertise.

What to look for in the best independent insurance agent near me

Beyond the answers to your questions, observe the agent’s demeanor and approach. The best independent insurance agent near me will exhibit several key qualities:

- Responsiveness: Do they return calls and emails promptly? A responsive agent will be there when you need them most, especially during urgent situations.

- A willingness to educate, not just sell: They should patiently explain complex terms and coverage options, ensuring you understand what you’re buying, rather than just pushing a product.

- A clear focus on your needs rather than a specific product: They should listen intently to your situation and tailor solutions, not try to fit you into a pre-determined policy.

- A strong local reputation and community involvement: Agents who are active in their community often have deeper ties and a greater understanding of local needs and risks. They’re not just selling insurance; they’re building relationships.

Frequently Asked Questions about Independent Insurance Agents

We understand that choosing an insurance agent can bring up a lot of questions. Here, we address some of the most common inquiries to help clarify the role and benefits of working with an independent agent.

Are there any costs associated with using an independent insurance agent?

This is a fantastic question, and the answer is reassuring: No, there is no direct fee for the client when using an independent insurance agent. Independent agents are compensated through commissions paid by the insurance companies they partner with, typically after a policy is sold. This commission is already built into the insurance premium, meaning you don’t pay anything extra for their expert guidance, comparison shopping, and ongoing service. You get all the benefits of their expertise and market access without any additional cost to you. It’s truly a service designed to benefit the consumer.

What types of insurance can an independent agent help me with?

Independent agents offer a full, comprehensive range of products to cover virtually every aspect of your life and business. For personal lines, this includes:

- Best Independent Car Insurance

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Motorcycle Insurance

- Boat Insurance

- Flood Insurance

- Personal Umbrella Insurance

- Life Insurance

- Independent Health Insurance Agencies

They also specialize in robust business coverage, such as:

- Independent Commercial Insurance Agent services

- General Liability Insurance

- Workers’ Compensation Insurance

- Commercial Auto Insurance

- Professional Liability (Errors & Omissions)

- Business Property Insurance

- Cyber Liability Insurance

Essentially, if there’s a risk you need to protect against, an independent agent can likely find a solution. Our goal is to be your single point of contact for all your insurance needs.

What is the agent’s role during the claims process?

This is where a great independent agent truly shines and often proves their worth. During the stressful and often confusing claims process, your independent agent acts as your dedicated advocate. We guide you through every step, from the initial reporting of the claim to the final settlement. This includes:

- Helping you report the claim: We assist in gathering necessary information and submitting the claim to the appropriate insurance carrier.

- Explaining what to expect: We explain the process, informing you about timelines, potential outcomes, and what documentation might be required.

- Ensuring fairness and promptness: We act as a liaison between you and the insurance company, working to ensure your claim is handled efficiently and that you receive fair treatment according to your policy terms.

- Intervening on your behalf: If any issues or disputes arise with the insurance carrier, we’re there to represent your interests and help resolve them.

Our role is to make a potentially stressful situation as smooth and straightforward as possible for you, leveraging our knowledge and relationships to protect your interests.

Conclusion: Your Partner for Trusted Protection

Choosing the right insurance is about protecting what matters most – your family, your assets, and your future. An independent agent provides the choice, expertise, and personal advocacy you need to steer the complex world of insurance with confidence. They are a local partner dedicated to finding you the Best Independent Insurance Agency solution for your unique needs. We believe that securing the best independent insurance agent near me means finding someone who truly understands your life in Massachusetts or New Hampshire and is committed to being there for you, come what may.

At Stanton Insurance Agency, our team is committed to being that trusted partner for you. We pride ourselves on personalized service, deep community roots, and the ability to find you comprehensive, cost-effective coverage. If you’re ready to experience the difference that comes with having a dedicated advocate on your side, let’s connect and build a protection plan that’s right for you.

Stanton Insurance Agency

Personalized service

Community focus

Contact Stanton Insurance Agency today for a personalized quote!