Sr22 insurance nh: Unlock Affordable Rates 2025

What You Need to Know About SR-22 Insurance in New Hampshire

SR22 insurance NH is not a type of insurance policy—it’s a certificate of financial responsibility that your insurance company files with the New Hampshire DMV to prove you carry the state’s minimum required coverage. If you’ve been notified by the DMV that you need an SR-22, here’s what you need to know:

Quick Facts:

- What it is: A form filed by your insurer, not a separate insurance policy

- Who needs it: Drivers with DWI convictions, reckless driving, driving without insurance, or license suspensions

- Cost: $15-$25 filing fee, plus significantly higher premiums (average $1,015-$1,619 annually)

- Duration: Typically 3 years of continuous coverage required

- Minimum coverage: $25,000/$50,000/$25,000 liability, plus uninsured motorist and medical payments

- Types: Owner SR-22 (if you own a vehicle) or Operator SR-22 (non-owner policy)

The most important thing to remember: You must maintain continuous insurance coverage for the entire requirement period. If your policy lapses, the DMV will be notified immediately, your license will be suspended, and your 3-year period may restart.

Getting an SR-22 filing can feel overwhelming, especially when you’re already dealing with the stress of a license suspension or serious driving violation. Many drivers worry about the cost increase and the complexity of the process.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve helped countless Massachusetts and New Hampshire drivers steer SR22 insurance NH requirements and find affordable coverage after license issues. In this guide, I’ll walk you through everything you need to know about the SR-22 process in New Hampshire—from understanding why you need one to getting it removed after your requirement period ends.

What is an SR-22 and Who Needs One in New Hampshire?

Navigating auto insurance in New Hampshire can be challenging, especially if you’re required to file an SR-22. If the New Hampshire DMV has notified you about this requirement, you may have questions about what an SR-22 is, why it’s needed, and how it impacts your insurance. This comprehensive guide from Stanton Insurance Agency will walk you through every aspect of SR22 insurance NH, from filing to removal, so you can get back on the road with confidence.

An SR-22 is not an insurance policy, but a certificate of financial responsibility. Your insurance provider files this form with the New Hampshire Division of Motor Vehicles (DMV) to prove you carry the state’s minimum required liability coverage. It assures the state that you will remain insured for a specified period. Think of it as a guarantee to the state that you are financially responsible enough to cover potential damages if you cause an accident. The state views drivers who need an SR-22 as “high-risk,” and this form is their way of ensuring you maintain continuous coverage.

Who Needs to File for SR22 Insurance in NH?

The state or a court may require you to file an SR-22 if you are considered a high-risk driver. You will receive a written notice from the NH DMV if you must file. This notification is crucial, as your driving and registration privileges cannot be restored or retained until this requirement is met. Common reasons that trigger an SR22 insurance NH requirement include:

- DWI (Driving While Intoxicated) or DUI (Driving Under the Influence) convictions: This is one of the most frequent reasons drivers need an SR-22. Even a first offense can lead to this requirement.

- Leaving the scene of an accident: If you are involved in a crash and fail to remain at the scene, an SR-22 will likely be mandated.

- Second or subsequent offense for Reckless Operation: Repeat instances of driving dangerously can flag you as a high-risk driver.

- Driving without insurance or a valid license: If you’re caught operating a vehicle without proper insurance or a suspended/invalid license, the state will require an SR-22 to ensure future compliance.

- Accumulating excessive points on your driving record: A history of multiple traffic violations can lead to your license being suspended, and an SR-22 will be necessary for reinstatement.

- Failure to pay court-ordered child support: In some cases, non-driving related legal issues, like failing to meet child support obligations, can result in a license suspension and an SR-22 requirement.

- Involvement in an accident without adequate insurance: Even if it’s your first offense, if you cause an accident and lack the proper coverage, an SR-22 may be required.

Essentially, if your driving record indicates that you pose a higher risk on the road, the New Hampshire DMV will require this certificate to ensure you maintain financial responsibility. This requirement is not something you can ignore; it directly impacts your ability to legally drive in the state.

Owner vs. Operator (Non-Owner) SR-22

When the New Hampshire DMV mandates an SR-22, they are looking for proof of financial responsibility. This can manifest in two primary forms, depending on your vehicle ownership status:

-

Owner’s SR-22: This is the most common type. An Owner’s SR-22 is required if you own and register a vehicle. This certificate links the proof of insurance directly to you and your specific vehicle(s). It confirms that any vehicle you own and operate is covered by at least the state’s minimum liability insurance. This type of SR-22 allows you to own, register, and operate your vehicle(s) legally.

-

Operator’s SR-22 (Non-Owner): What if you don’t own a car but still need to fulfill an SR-22 requirement to get your driving privileges back? This is where an Operator’s SR-22, often referred to as a non-owner policy, comes into play. This policy provides liability coverage specifically for you when you operate a non-owned vehicle. It’s designed for individuals who frequently borrow cars, rent vehicles, or drive company vehicles but do not have a car registered in their name. This type of SR22 insurance NH ensures that you, as the driver, are covered for any damages you might cause while driving a vehicle you don’t own. It insures your driver’s license and your privilege to drive, making it a crucial option for those without personal vehicle ownership. You can learn more about this specific coverage in our guide on non-owner car insurance.

Understanding the distinction is vital to ensure you obtain the correct type of SR-22 and remain compliant with New Hampshire’s regulations.

Understanding the Costs and Requirements of SR22 Insurance NH

While the SR-22 itself is not insurance, the requirement will significantly increase your policy cost. Insurers view the underlying violation as a clear sign of increased risk, which unfortunately leads to higher premiums. This is simply because statistics show that drivers who require an SR-22 are more likely to be involved in future accidents or violations.

Let’s look at how the costs compare:

| Coverage Type | Average Annual Cost (Clean Record) | Average Annual Cost (With SR-22) |

|---|---|---|

| Minimum Coverage NH | $540 | $1,015–$1,619 |

As you can see, the jump in premiums is substantial. For minimum coverage, drivers with an SR-22 can pay 121% higher than the state average for clean-record drivers. For full coverage, the increase can be around 112%.

The Financial Impact: Filing Fees and Premium Increases

The direct cost to file the SR-22 form with the New Hampshire DMV is a one-time administrative fee, typically a modest amount ranging between $15 and $25. This fee is paid to your insurance company, which then handles the filing process. However, this small fee is just the tip of the iceberg.

The more significant financial impact comes from the substantial increase in your auto insurance premiums. Because you’re now classified as a “high-risk” driver, insurance companies will charge more to cover you. Research indicates that, on average, New Hampshire drivers with an SR-22 can expect to pay anywhere from $1,015 to $1,619 annually for minimum coverage. This is a dramatic increase compared to standard rates, and it’s a cost you’ll need to budget for the entire duration of your SR-22 requirement. For instance, a first DUI conviction could lead to average annual premiums of over $2,000, while driving without insurance might result in average annual premiums around $1,500 with an SR-22 filing. These figures highlight the importance of understanding the full financial implications.

New Hampshire’s Minimum Coverage Requirements

To satisfy an SR-22 requirement, your auto insurance policy must meet or exceed New Hampshire’s specific minimum liability limits. It’s not enough to just have any insurance; it must comply with state law. For more detailed and official information, you can always refer to the New Hampshire DMV’s Insurance Requirements / SR-22 page.

Here are the minimum coverage amounts mandated in New Hampshire for an SR-22:

- $25,000 for bodily injury liability per person: This covers medical expenses and lost wages for a single person injured in an accident you cause.

- $50,000 for bodily injury liability per accident: This is the maximum amount your insurer will pay for all injuries in an accident you cause, regardless of how many people are hurt.

- $25,000 for property damage liability per accident: This covers damage to another person’s property (like their vehicle or fence) if you are at fault in an accident.

- $25,000/$50,000 for uninsured/underinsured motorist bodily injury: This is crucial coverage that protects you if you’re hit by a driver who either has no insurance or not enough insurance to cover your medical bills.

- $1,000 for Medical Payments (MedPay) coverage: This helps cover medical expenses for you and your passengers, regardless of fault, after an accident.

These are just the minimum requirements. While opting for minimum coverage might seem like a way to reduce your premiums, it could leave you financially vulnerable if you’re involved in a serious accident. We always recommend discussing your options with a trusted insurance professional to understand the benefits of carrying higher limits or additional coverages.

Finding Affordable SR22 Insurance NH

Even with an SR22 insurance NH requirement, finding affordable rates is possible. It requires a bit more effort and strategic planning, but it’s definitely achievable. We understand that every dollar counts, especially when facing increased premiums.

Here are some actionable steps you can take to find more budget-friendly options:

- Compare Quotes from Multiple Providers: This is arguably the most effective strategy. Rates for high-risk drivers can vary dramatically between different auto insurance companies in NH. Some insurers specialize in high-risk policies, while others might offer more competitive rates depending on your specific circumstances. Don’t settle for the first quote you receive. Our agency can help you compare options from various carriers to find the best fit for your needs and budget.

- Ask for All Available Discounts: Even with an SR-22, you might still qualify for a range of discounts. Don’t be shy about asking your agent about every possible saving. Common discounts include:

- Bundling policies: Combining your auto insurance with home or renters insurance.

- Defensive driving courses: Completing an approved defensive driving course can sometimes lead to a discount and demonstrate your commitment to safer driving.

- Vehicle safety features: Cars equipped with anti-lock brakes, airbags, or anti-theft devices can qualify for lower rates.

- Good student discounts: If there’s a young driver on your policy who maintains good grades.

- Paying in full: Some insurers offer a discount if you pay your entire premium upfront instead of in monthly installments.

- Usage-based insurance programs: If you have good driving habits, telematics programs that monitor your driving can sometimes lower your rates.

- Improve Your Driving Record: This is a long-term strategy, but it’s the best way to consistently lower your rates over time. By driving responsibly and avoiding any further violations, you demonstrate to insurers that you are becoming a less risky driver. Over time, as your record cleans up, your premiums will decrease.

- Choose a Higher Deductible: If you have opted for comprehensive and collision coverage (often part of a full coverage vs. liability car insurance policy), selecting a higher deductible can significantly lower your premium. Just make sure you can comfortably afford to pay the deductible out-of-pocket if you need to file a claim. This is a balancing act between lower premiums and managing potential out-of-pocket costs.

- Consider Your Vehicle: The type of car you drive can also impact your insurance rates. More expensive, high-performance, or frequently stolen vehicles typically cost more to insure. If you have the flexibility, insuring a more modest vehicle can help reduce costs.

By diligently exploring these options, you can mitigate the financial burden of SR22 insurance NH and find a policy that fits your budget.

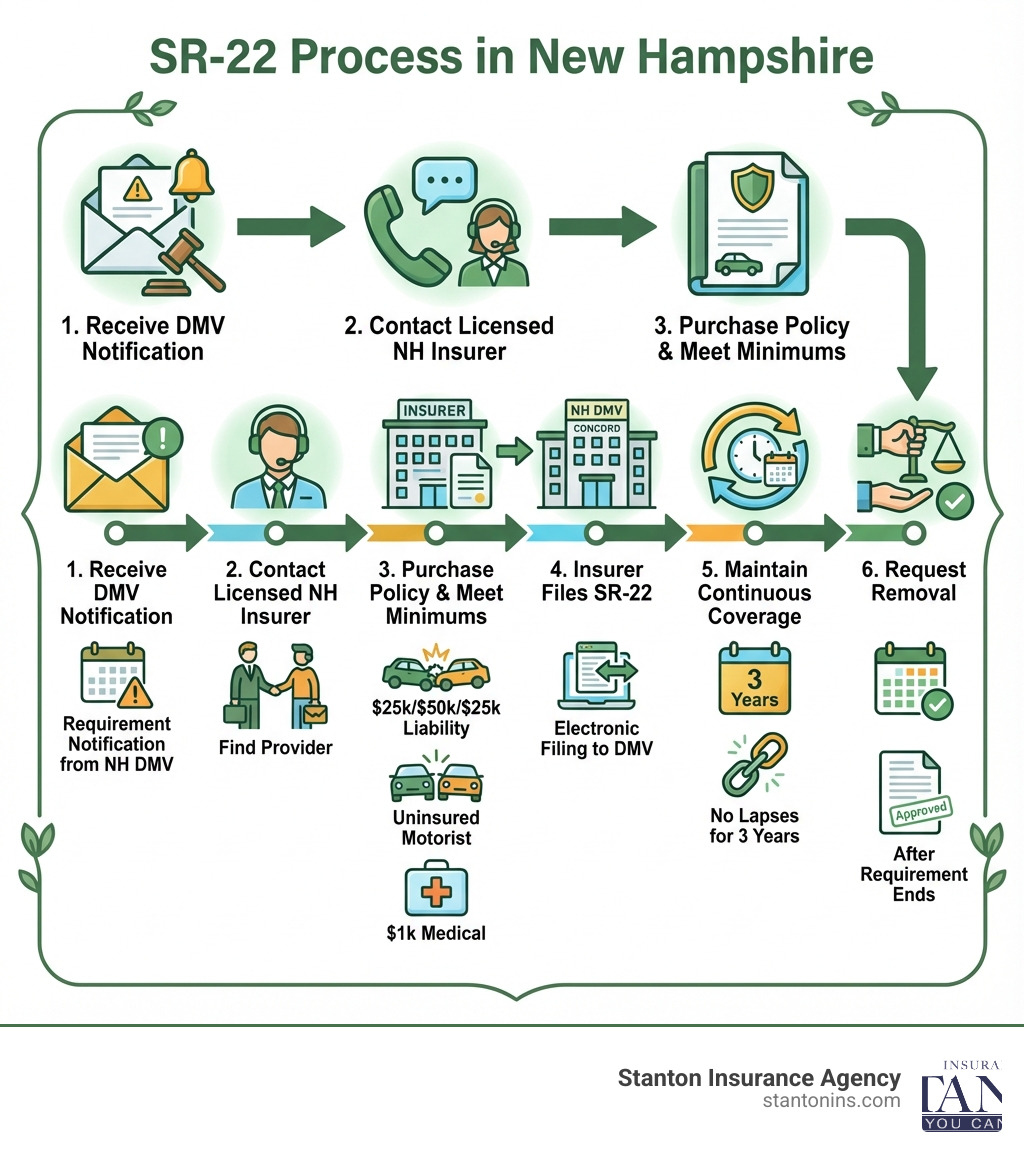

The Step-by-Step Process: Filing, Maintaining, and Removing Your SR-22

Managing an SR-22 involves several key steps, from the initial filing to the final removal. Diligence and continuous attention are required to avoid further penalties and ensure you successfully complete your requirement. It’s a bit like navigating a maze, but with our guidance, we can help you find your way through it.

How to Get and Maintain Your SR-22

The process of obtaining and maintaining your SR22 insurance NH is straightforward once you know the steps. Here’s how we’ll help you steer it:

- Find an Insurer Licensed in New Hampshire: Your first step is to contact an insurance provider that is licensed to do business in New Hampshire and offers SR-22 filings. Not all insurance companies handle SR-22s, so be upfront about your requirement from the very beginning. We work with multiple carriers that can provide this service, making it easier for you to find coverage.

- Purchase a Policy that Meets State Minimums: Once you’ve found an insurer, you’ll need to purchase an auto insurance policy that satisfies New Hampshire’s minimum liability requirements. As we discussed earlier, this means at least $25,000/$50,000/$25,000 for liability, plus uninsured/underinsured motorist bodily injury and medical payments coverage. We’ll help ensure your policy includes all the necessary components.

- Request the Filing: After your policy is active, you’ll ask your insurer to file the SR-22 certificate with the NH DMV on your behalf. This is a critical step. Your insurance company will then send the necessary documentation directly to the DMV in Concord, NH. Some agencies, like ours, can offer express same-day SR-22 certificates, ensuring the DMV receives proof of your financial responsibility quickly. This electronic filing typically expedites the process.

- Maintain Continuous Coverage: This is perhaps the most important aspect of the entire SR-22 process. You must keep your auto insurance policy active and without any lapses for the entire duration of your requirement. In New Hampshire, this period is typically three years from the date of final conviction, crash involvement, or administrative action that triggered the SR-22. If you are convicted of a second DWI offense, the filing period is three years from the date you become eligible for license restoration. Any gap in coverage, even for a single day, can have severe repercussions.

Consequences of a Lapse or Non-Compliance

We cannot stress this enough: maintaining continuous coverage is non-negotiable. If your insurance policy lapses, is canceled for non-payment, or expires without renewal while you have an SR22 insurance NH requirement, your insurer is legally obligated to notify the DMV. They do this by filing an SR-26 form, which signals to the state that you are no longer maintaining the required financial responsibility.

The consequences of this notification are swift and severe:

- Immediate Suspension of Driving Privileges: Your driver’s license and/or vehicle registration will be immediately suspended. This means you legally cannot drive, and if caught, you could face further penalties.

- Restarting the Requirement Period: The worst part? Your three-year SR-22 requirement period may restart from the beginning. All the time and effort you put into maintaining coverage up to that point could be lost, extending the period you’re considered a high-risk driver and prolonging your higher insurance rates.

- Additional Fines and Penalties: Beyond suspension, you could face new fines, court fees, and even vehicle impoundment. In extreme cases, repeated non-compliance could lead to jail time.

For more information on these critical details, we encourage you to review the official Insurance Requirements/SR-22 FAQs provided by the New Hampshire DMV. Being proactive and staying informed is your best defense against these undesirable outcomes.

Switching Providers and Removing the SR-22

Life changes, and so might your insurance needs. We understand that you might want to switch insurance companies even while you have an SR22 insurance NH requirement. The good news is, you absolutely can! However, the key is to avoid any gap in coverage. Here’s how to do it safely:

- Seamless Transition is Key: Before you cancel your current policy, your new insurance provider must file an SR-22 certificate with the New Hampshire DMV. This ensures there’s no lapse in your proof of financial responsibility. We can help coordinate this transition to make sure it’s smooth and compliant.

- Communication is Crucial: Always communicate clearly with both your old and new insurers. Let them know about your SR-22 requirement and your plans to switch. Your new insurer will need to be aware of the SR-22 filing from day one.

Once you have successfully completed your entire three-year filing period, maintaining continuous coverage without any lapses, it’s time to celebrate! But there’s one final step to officially remove the requirement:

- Contact the NH DMV: First, you’ll want to confirm with the New Hampshire DMV that you have fully satisfied your SR-22 requirement. You can submit a written request to the NH Dept. of Safety, DMV – FR SR-22 Processing Section, 23 Hazen Drive, Concord NH 03305, or call their customer service representatives at (603) 227-4010. They will verify your eligibility for removal.

- Instruct Your Insurer: Once the DMV confirms your eligibility, you can then ask your insurance company to remove the SR-22 from your policy. While the SR-22 itself doesn’t directly increase your premium, its removal might signal to your insurer that you are no longer classified as a high-risk driver due to that specific incident, potentially leading to lower rates. It’s a significant step towards getting back to standard insurance costs.

Frequently Asked Questions about SR-22 in New Hampshire

We know that dealing with an SR-22 can generate a lot of questions. Here, we address some of the most common inquiries we receive from drivers in New Hampshire.

What happens if I fail to maintain SR-22 insurance in New Hampshire?

Failing to maintain continuous SR22 insurance NH has serious consequences. As soon as your policy lapses or is canceled, your insurance company is legally required to notify the New Hampshire DMV. This notification triggers an immediate suspension of your driver’s license and/or vehicle registration. You will not be allowed to legally drive.

Furthermore, you could face additional penalties, including significant fines and fees. The most frustrating consequence for many is that your entire three-year SR-22 requirement period may restart from the date of the lapse. This means all the progress you made towards fulfilling the requirement could be undone, prolonging the period you’re considered a high-risk driver and extending the duration of your high insurance premiums. It’s a situation you absolutely want to avoid.

Can I get an SR-22 in New Hampshire if I don’t own a vehicle?

Absolutely, yes! We frequently help individuals who don’t own a car but still need to fulfill an SR-22 requirement. If you need to reinstate your driving privileges but don’t have a vehicle registered in your name, you will purchase what’s known as a non-owner insurance policy.

Once you have this policy, your insurer will file an “Operator’s” SR-22 certificate on your behalf. This certificate insures your driver’s license and your privilege to drive. It provides liability coverage for you when you operate any non-owned vehicle, such as a borrowed car or a rental. This ensures that you meet New Hampshire’s financial responsibility laws without being tied to a specific vehicle you own. It’s a crucial option for many drivers in this unique situation.

How do I get my SR-22 requirement removed in New Hampshire?

The process for removing your SR22 insurance NH requirement involves a few key steps once you’ve completed your mandatory period. The typical duration for an SR-22 in New Hampshire is three years of continuous coverage without any lapses.

Here’s how to proceed:

- Verify with the NH DMV: First, you need to confirm with the New Hampshire Division of Motor Vehicles that you have successfully fulfilled the entire requirement. You can do this by submitting a written request to the NH Dept. of Safety, DMV – FR SR-22 Processing Section, 23 Hazen Drive, Concord NH 03305. Alternatively, you can call and speak with a customer service representative at (603) 227-4010. They will check your record and confirm your eligibility.

- Instruct Your Insurance Company: Once the DMV officially confirms that your SR-22 requirement has been met, you should then contact your insurance company. Inform them that the state no longer requires the SR-22 filing on your policy and ask them to remove it. While the SR-22 filing itself has a minimal fee, its removal can often lead to a reduction in your overall insurance premiums, as you’ll no longer be categorized as needing state-mandated financial responsibility proof for past violations.

Your Partner in Navigating NH Auto Insurance

Dealing with an SR22 insurance NH requirement can feel overwhelming, but it’s a manageable process. The keys to successfully navigating this period are understanding the rules, maintaining continuous insurance coverage without any lapses, and consistently practicing safe driving habits. By following these steps diligently, you can fulfill your state requirements and work steadily towards restoring your standard driver status and, eventually, more affordable insurance rates. We believe that everyone deserves a second chance, and with the right guidance, you can get back on track.

At Stanton Insurance Agency, we pride ourselves on being your trusted partner through every twist and turn of your insurance journey. We understand the complexities of SR22 insurance NH and are here to provide clear, simple answers and practical solutions. Our team is dedicated to helping you find the right coverage that meets state requirements while also fitting your budget. We’ll walk you through the process, answer all your questions, and ensure your filings are handled correctly and promptly.

If you need help finding the right coverage, have more questions about your specific situation, or simply want to explore your options, the experts at Stanton Insurance Agency are here to help. Don’t hesitate to reach out to us. We’re committed to exceeding your expectations and providing the trusted protection you need. For a complete overview of car insurance in the Granite State, explore our New Hampshire Car Insurance Guide.