Uninsured vehicle meaning: Crucial Protection 2025

Understanding What Makes a Vehicle “Uninsured”

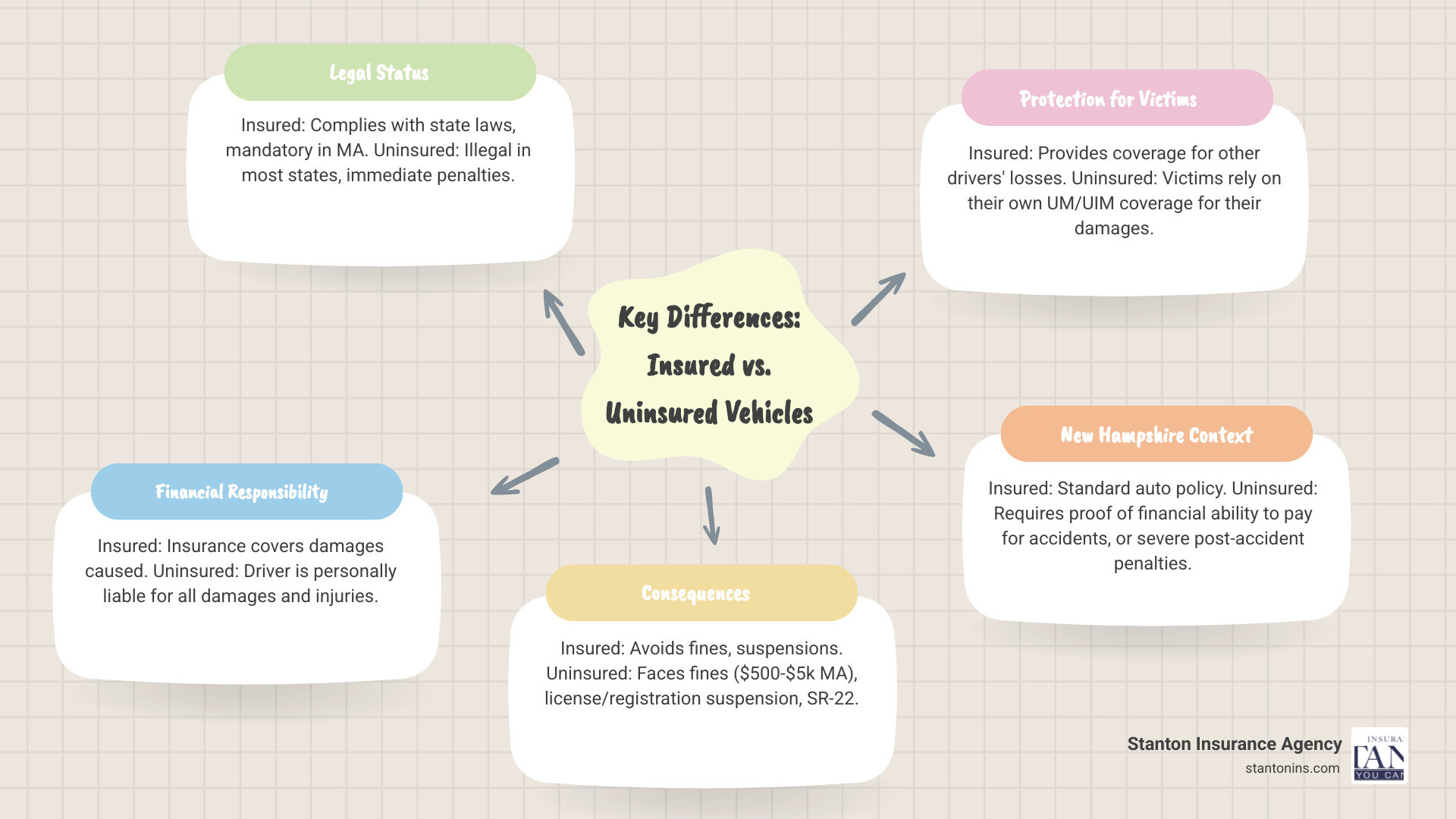

Uninsured vehicle meaning refers to any car, truck, or motorcycle operating on public roads without the legally required minimum liability insurance coverage. In simple terms, it’s a vehicle whose owner has failed to purchase or maintain the auto insurance mandated by state law.

Quick Definition:

- Uninsured Vehicle = A motor vehicle without required liability insurance

- Legal Status = Illegal to drive in most states (including Massachusetts)

- Financial Risk = Driver personally liable for all accident damages

- Your Protection = Uninsured Motorist coverage on your own policy

According to the Insurance Research Council, approximately 4.7% of drivers in Massachusetts and 8.2% in New Hampshire are uninsured. This means that statistically, you’re likely to encounter an uninsured driver on the road at some point.

The consequences of driving uninsured are severe. In Massachusetts, penalties can include fines up to $5,000 and license suspension. In New Hampshire, while insurance isn’t mandatory for all drivers, those who choose to go without coverage must prove they can financially handle accident damages – a risky gamble that often backfires.

More importantly for you as a responsible driver, understanding what an uninsured vehicle means helps you recognize why certain coverages on your own policy exist. When an uninsured driver causes an accident, they typically can’t pay for the damage they cause, leaving you to rely on your own insurance for protection.

I’m Geoff Stanton, President of Stanton Insurance Agency, and I’ve spent over two decades helping Massachusetts and New Hampshire drivers understand complex insurance concepts like uninsured vehicle meaning. Through my experience in both claims and coverage, I’ve seen how proper protection makes all the difference when the unexpected happens.

Similar topics to uninsured vehicle meaning:

The Uninsured Vehicle Meaning and Its Legal Consequences

At its heart, the uninsured vehicle meaning centers on one critical issue: the absence of financial responsibility. When someone drives without insurance, they’re essentially gambling with other people’s lives and their own financial future.

Every state has established rules to ensure drivers can pay for the damage they cause in accidents. It’s not bureaucratic red tape – it’s protection for everyone on the road. When you understand what makes a vehicle “uninsured,” you’re really looking at a driver who has chosen to ignore these fundamental safety nets.

The consequences of this choice extend far beyond the uninsured driver themselves. If they cause an accident, innocent victims may struggle to recover compensation for medical bills, lost wages, and property damage. This is why states take driving without insurance so seriously, with penalties that can dramatically impact your life.

Legal Car Insurance Requirements in MA and NH

Let’s break down what the law actually requires in Massachusetts and New Hampshire, where we help our clients steer these important protections.

Massachusetts takes a no-nonsense approach. All registered vehicles must be insured – period. The Bay State mandates a compulsory insurance policy with four specific coverages that every driver must carry. Bodily Injury to Others covers injuries you cause to other people in an accident, while Personal Injury Protection (PIP) pays for medical expenses and lost wages for you or your passengers, regardless of who was at fault.

The state also requires Bodily Injury Caused by an Uninsured Auto – essentially your personal shield against drivers who ignore the law. Finally, Damage to Someone Else’s Property covers property damage you cause in an accident. You can learn more details on our page about what is the minimum car insurance coverage in Massachusetts.

New Hampshire marches to its own drummer. The Granite State doesn’t require every driver to buy auto insurance, but here’s the catch: if you choose to go without coverage, you must prove you have sufficient funds to meet the state’s financial responsibility requirements after an at-fault accident.

This means having enough money to cover potentially hundreds of thousands of dollars in damages and injuries out of your own pocket. Few people have that kind of liquid cash sitting around. If you can’t prove your financial ability after an accident, you’ll face severe penalties. Our guide on whether you’re required to have auto insurance in New Hampshire explains this unique approach in detail.

Honestly, it’s a gamble we strongly advise against. The cost of insurance premiums pales in comparison to the potential financial devastation of a serious accident.

Penalties for Driving Uninsured

The penalties for driving an uninsured vehicle reflect just how seriously states view this offense. These aren’t just slaps on the wrist – they’re designed to be serious enough to change behavior.

In Massachusetts, getting caught driving without insurance hits hard. You’re looking at fines ranging from $500 to $5,000 for a first offense. More serious cases can result in imprisonment for up to one year, though this is rare for first-time offenders. What’s guaranteed is a 60-day license suspension that can stretch much longer for repeat offenses.

Police also have the authority to seize uninsured vehicles, and in some cases, they can even destroy them. It sends a clear message about how seriously Massachusetts takes financial responsibility on the road.

New Hampshire’s approach focuses on post-accident consequences. While they won’t necessarily penalize you for choosing to go uninsured, if you cause an accident without coverage, the hammer falls hard. Your license and registration get suspended until you either pay for all damages or work out a payment plan with the injured parties.

You’ll also be required to file an SR-22 form for at least three years – a certificate proving you maintain the required coverage. This filing often leads to higher insurance rates and serves as a constant reminder of the consequences of driving without protection.

The bottom line is simple: whether it’s hefty fines, license suspension, or facing unlimited financial liability, the consequences of driving an uninsured vehicle cost far more than maintaining proper insurance coverage. It’s a risk that simply isn’t worth taking when affordable protection is readily available.

For more detailed information about Massachusetts requirements, you can review the official state insurance coverage requirements.

How Insurance Protects You from Uninsured Drivers

Even if you’re a law-abiding driver who carries proper insurance, you can still find yourself in an accident with someone who doesn’t. It’s one of those “life isn’t fair” moments that nobody wants to experience. The good news? Your own auto insurance policy has built-in protections specifically for this situation.

Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverages are your personal safety net. They’re designed to step in when the at-fault driver either can’t pay or doesn’t have enough coverage to handle the damage they’ve caused. Think of them as your insurance against other people’s poor decisions.

Understanding Uninsured vs. Underinsured Motorist Coverage

While these two coverages sound similar, they protect you in different scenarios. Understanding the difference can help you make better decisions about your coverage limits.

Uninsured Motorist (UM) coverage kicks in when you’re hit by a driver who has absolutely no insurance. This is the classic uninsured vehicle meaning scenario – someone driving completely naked (insurance-wise, that is). Your UM coverage essentially replaces the insurance the other driver should have had, paying for your medical bills, lost wages, and other damages.

Underinsured Motorist (UIM) coverage comes into play when the at-fault driver does have insurance, but not nearly enough. Maybe they only bought the bare minimum coverage to satisfy state requirements, but your injuries are severe and expensive. Their small policy gets exhausted quickly, and that’s when your UIM coverage steps in to cover the gap.

| Feature | Uninsured Motorist (UM) Coverage | Underinsured Motorist (UIM) Coverage |

|---|---|---|

| Trigger | At-fault driver has no auto insurance. | At-fault driver has insurance, but not enough to cover your damages. |

| What it Covers | Your medical expenses, lost wages, and other damages. | The difference between your damages and the at-fault driver’s liability limit, up to your own policy limit. |

| Example | An uninsured driver causes $50,000 in medical bills. Your UM coverage pays the $50,000. | A driver with $25,000 in liability coverage causes $50,000 in medical bills. Their policy pays $25,000, and your UIM coverage can pay the remaining $25,000. |

| Mandatory? | UM is mandatory in MA. If you buy auto insurance in NH, UM is also mandatory. | UIM is optional but highly recommended in both states. |

In Massachusetts, UM coverage is mandatory – it’s one of those four required coverages we mentioned earlier. In New Hampshire, if you choose to buy auto insurance (which we strongly recommend), UM coverage is also required. UIM coverage is optional in both states, but we consider it essential protection that’s well worth the relatively small additional cost.

What the Uninsured Vehicle Meaning Implies for Your Insurance Claim

Here’s where understanding uninsured vehicle meaning becomes practically important for your wallet. When an uninsured driver hits you, you can’t file a claim against their insurance company – they don’t have one! Instead, you file the claim with your own insurance company under your UM coverage.

This might feel backwards at first, but it actually works in your favor. You’re dealing with your own insurance company, the one you’ve been paying premiums to and hopefully have a good relationship with. They handle everything, just as if the other driver had proper coverage.

Your UM coverage typically handles bodily injury expenses like medical bills, rehabilitation costs, lost wages, and pain and suffering. This works similarly to how Bodily Injury Liability coverage would pay if the other driver was insured.

For damage to your vehicle, the situation is a bit different. Your primary protection comes from collision coverage, though some policies also include Uninsured Motorist Property Damage coverage. The key difference is that collision coverage usually has a deductible, while UM bodily injury coverage typically doesn’t.

Who’s covered under these protections? Generally, it includes you as the policyholder, any family members living in your household, passengers in your vehicle, and even you or your family members if you’re hit while walking or riding a bicycle. It’s comprehensive protection that follows you beyond just driving your own car.

We always recommend considering higher UM and UIM limits than the state minimums. Medical costs can skyrocket quickly after a serious accident, and the basic required coverage might not be enough. The good news is that increasing these limits is usually quite affordable and provides tremendous value for the additional peace of mind.

What to Do After an Accident with an Uninsured Driver

Being in an accident is already stressful, and finding the other driver doesn’t have insurance can feel like getting hit twice. But here’s the thing – knowing what to do in this situation can make all the difference between a smooth claim process and months of headaches. Let’s walk through exactly what you need to do to protect yourself and your family.

Immediate Steps at the Scene

Your first priority is always safety – yours and everyone else’s. Take a deep breath and focus on these essential steps, even when you’re shaken up.

Check for injuries and call 911 right away if anyone is hurt or if there’s significant damage. Don’t try to be a hero and brush off potential injuries. Adrenaline can mask pain, and what seems minor at the scene might be more serious than you realize.

Always call the police to file a report, even if the accident seems minor. This is absolutely critical when dealing with an uninsured vehicle meaning you’ll need official documentation for your claim. The police report will note the other driver’s lack of insurance, which becomes crucial evidence later. Here’s a pro tip from my years in the business: never accept cash on the spot or promises to “work something out” with an uninsured driver. It might seem tempting to avoid the hassle, but it almost always backfires.

Get the other driver’s information – their name, address, phone number, and license plate number. Even if they admit they don’t have insurance, collect everything you can. Sometimes people think they’re uninsured when they actually do have coverage, or they might have let their policy lapse recently.

Document everything with photos. Your smartphone is your best friend here. Take pictures of both vehicles showing the damage and license plates, the accident scene including road conditions and any traffic signs, and yes, even any visible injuries. If there are witnesses around, get their contact information too. Their testimony can be incredibly valuable, especially since the other driver might change their story later.

Filing Your Claim and Notifying Authorities

Once you’re safe and have gathered the information you need, it’s time to get the official wheels turning.

Contact your insurance company immediately – and I mean as soon as you’re safely able to do so. Don’t wait until Monday if the accident happens on a weekend. Most insurers have 24/7 claim reporting for exactly this reason. Be clear that the other driver is uninsured or that it was a hit-and-run situation. This helps your claims representative understand right away that they’ll be handling this as an Uninsured Motorist claim.

For hit-and-run incidents where the driver flees the scene, you must notify the police within 24 hours. This isn’t just good practice – it’s usually a requirement for your Uninsured Motorist coverage to apply. Your insurance company will need proof that you reported it and that the police investigated.

Your insurance company will guide you through filing your UM claim, but they’ll need documentation from you. This typically includes the police report, photos you took at the scene, witness statements, and details about your injuries and any damage to your vehicle.

When you’re dealing with an uninsured driver, you’re not filing a claim against their insurance company – because they don’t have one. Instead, you’re filing with your own insurer under your Uninsured Motorist coverage. It might feel backwards at first, but this is exactly why you pay for this protection. Your insurance company will then work behind the scenes to recover their costs from the uninsured driver through a process called subrogation, but that’s not your concern.

The key steps to remember:

- Check for injuries and call 911

- Call the police to file a report

- Exchange information with the other driver

- Take photos and get witness information

- Notify your insurance company immediately

The most important thing to remember? Don’t panic. Yes, dealing with an uninsured driver complicates things, but if you have the right coverage and follow these steps, you’ll get through this just fine.

Frequently Asked Questions about Uninsured Vehicles

We know dealing with uninsured vehicle meaning and its implications can feel overwhelming. After helping thousands of clients steer these situations over the years, I’ve found that most people have similar concerns. Let me address the questions I hear most often in my office.

What is the precise uninsured vehicle meaning for a hit-and-run?

This scenario happens more than you’d think, and it’s incredibly frustrating for victims. When a driver hits you and flees the scene, they become what insurance companies call an “unidentified motorist.” Here’s what’s important to understand: for claim purposes, an unidentified motorist is treated exactly the same as an uninsured motorist.

If the hit-and-run driver can’t be found or identified, you can file a claim under your Uninsured Motorist (UM) coverage for your injuries. Your coverage steps in because there’s no identifiable person with insurance to pay for your damages – which is essentially the same problem you’d face with an uninsured vehicle meaning there’s no coverage to tap into.

However, there’s a crucial catch that trips up many people. You must meet strict reporting requirements, which almost always include notifying the police within 24 hours and providing evidence that another vehicle was actually involved. This might include physical damage to your car, debris at the scene, or witness testimony. Unfortunately, your word alone usually isn’t enough for an unidentified motorist claim – insurance companies need proof to prevent fraud.

Will an uninsured motorist claim make my insurance rates go up?

I completely understand this concern – nobody wants their rates to increase when they’re the victim of someone else’s negligence. The good news is that generally, a not-at-fault claim like an Uninsured Motorist claim should not cause your premiums to increase in Massachusetts or New Hampshire.

Think about it this way: you’re using coverage you already paid for to protect yourself from another driver’s irresponsibility. Insurance companies typically distinguish between at-fault accidents (which usually lead to rate increases) and not-at-fault incidents where you’re clearly the victim.

That said, insurance can be complex, and every situation is unique. While one not-at-fault claim shouldn’t directly affect your rates, a pattern of multiple claims over time – even if none are your fault – might sometimes influence how insurers view your risk profile. The best approach is always to discuss your specific situation with your agent. We can look at your exact policy and company guidelines to give you the most accurate picture of any potential impact.

Is there a deductible for uninsured motorist claims?

This depends on which type of coverage is paying for your damages, and it’s an area where many people get confused.

For Uninsured Motorist Bodily Injury (UMBI) coverage—the part that pays for your medical bills, lost wages, and pain and suffering—there is no deductible in Massachusetts or New Hampshire. Your insurance company will cover your eligible expenses up to your policy limits without you paying anything out of pocket first.

However, when it comes to fixing your vehicle, the situation differs by state and your policy choices. In Massachusetts, damage to your car from an uninsured driver is covered under your Collision coverage. You will have to pay your collision deductible, but your policy includes a ‘Waiver of Deductible’ provision. This means your insurer will waive or refund your deductible if the uninsured, at-fault driver can be identified. In New Hampshire, you can purchase optional Uninsured Motorist Property Damage (UMPD) coverage, which typically has a lower deductible than collision coverage. If you don’t have UMPD, you would use your collision coverage and pay that deductible.

The key is knowing what your specific policy includes before you need it. Your policy documents will spell out exactly which deductibles apply, or you can always call us to review your specific situation.

Get the Right Protection for the Road Ahead

Understanding the uninsured vehicle meaning is your first step toward complete road protection, but it shouldn’t be your last. Think of it this way: you wouldn’t leave your house open uped just because your neighbors seem trustworthy, right? The same logic applies to your insurance coverage.

While you can’t control whether that driver texting behind you has proper insurance, you absolutely can control how well-protected you are when they inevitably rear-end you at the next red light. Having adequate Uninsured and Underinsured Motorist coverage isn’t just smart planning—it’s your financial lifeline when someone else’s poor decisions threaten to derail your life.

Here’s what many people don’t realize: the state minimum coverage requirements are just that—minimums. They’re designed to provide basic protection, not comprehensive security. If you’re carrying only the bare minimum UM coverage, you might find yourself in a tough spot if you’re seriously injured by an uninsured driver.

Reviewing your current policy with an experienced agent can reveal gaps you didn’t know existed. Maybe your current limits seemed adequate when you bought your policy five years ago, but medical costs have risen significantly since then. Or perhaps your income has increased, meaning you have more to lose if you can’t work due to injuries from an accident.

At Stanton Insurance Agency, we’ve seen too many good people get caught off guard by inadequate coverage. That’s why we take the time to really understand your situation—your daily commute, your family’s needs, your financial goals. Trusted protection isn’t one-size-fits-all; it’s custom to your specific circumstances.

The peace of mind that comes from knowing you’re properly protected? That’s priceless. But the coverage itself is often more affordable than people expect. Increasing your UM and UIM limits typically costs much less than you’d spend on your morning coffee each month.

Don’t wait until you need to understand the uninsured vehicle meaning from personal experience. Take control of your protection today.

Contact Stanton Insurance Agency to get a personalized car insurance quote today!